UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant

to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): February 10, 2015

SUBURBAN PROPANE PARTNERS, L.P.

(Exact name of registrant as specified in its charter)

|

|

|

|

|

| Delaware |

|

1-14222 |

|

22-3410353 |

| (State or other jurisdiction

of incorporation) |

|

(Commission

File Number) |

|

(IRS Employer

Identification No.) |

|

|

|

| 240 Route 10 West

Whippany, NJ |

|

07981 |

| (Address of principal executive offices) |

|

(Zip Code) |

Registrant’s telephone number, including area code (973) 887-5300

(Former name or former address, if changed since last report.)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the

following provisions (see General Instruction A.2. below):

| ¨ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ¨ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ¨ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ¨ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

| Item 7.01 |

Regulation FD Disclosure. |

On February 10, 2015, Suburban Propane Partners, L.P.

(“Suburban”) issued a press release announcing that it, together with Suburban Energy Finance Corp., a wholly-owned subsidiary (together with Suburban, the “Issuers”), had commenced a cash tender offer for any and all of the

$250,000,000 aggregate principal amount of their unsecured 7 -3/8 % senior notes due 2020 (the “Notes”). In connection with the tender offer, the Issuers are soliciting consents to effect certain proposed amendments to the indenture

governing the Notes to eliminate most of the restrictive covenants, shorten the minimum notice period for redemption of the Notes to three business days and amend certain other provisions.

A copy of the press release is furnished as Exhibit 99.1 hereto and is incorporated herein by reference.

On February 10, 2015, Suburban issued a press release announcing the commencement of its public offering of $250,000,000 aggregate principal

amount of senior notes due 2025.

A copy of the press release is furnished as Exhibit 99.2 hereto and is incorporated herein by

reference.

| Item 9.01 |

Financial Statements and Exhibits |

|

|

|

|

|

|

|

99.1 |

|

Press release of Suburban Propane Partners, L.P. dated February 10, 2015, announcing the commencement of a cash tender offer for any and all of the $250,000,000 aggregate principal amount of the unsecured 7 -3/8 % senior notes due

2020 of Suburban Propane Partners, L.P. and Suburban Energy Finance Corp. and a related solicitation of consents to certain proposed amendments to the indenture in respect of such notes. |

|

|

|

|

|

99.2 |

|

Press release of Suburban Propane Partners, L.P. dated February 10, 2015, announcing the commencement of its public offering of senior notes due 2025. |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by

the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

|

|

|

|

SUBURBAN PROPANE PARTNERS, L.P. |

|

|

|

|

| Date: February 10, 2015 |

|

|

|

By: |

|

/s/ MICHAEL A. KUGLIN |

|

|

|

|

Name: |

|

Michael A. Kuglin |

|

|

|

|

Title: |

|

Chief Financial Officer and Chief Accounting Officer |

EXHIBIT INDEX

|

|

|

| Exhibit |

|

|

|

|

| 99.1 |

|

Press release of Suburban Propane Partners, L.P. dated February 10, 2015, announcing the commencement of a cash tender offer for any and all of the $250,000,000 aggregate principal amount of the unsecured 7 -3/8 % senior notes due

2020 of Suburban Propane Partners, L.P. and Suburban Energy Finance Corp. and a related solicitation of consents to certain proposed amendments to the indenture in respect of such notes. |

|

|

| 99.2 |

|

Press release of Suburban Propane Partners, L.P. dated February 10, 2015, announcing the commencement of its public offering of senior notes due 2025. |

Exhibit 99.1

|

|

|

|

|

News Release |

|

Contact: Michael A. Kuglin |

|

Chief Financial Officer & Chief Accounting Officer |

|

P.O. Box 206, Whippany, NJ 07981-0206 |

|

Phone: 973-503-9252 |

FOR IMMEDIATE RELEASE

Suburban Propane Partners, L.P.

Announces Tender for Any and All of its $250,000,000 Aggregate Principal Amount of 7 -3/8 % Senior Notes

and Related Solicitation of Consents

Whippany, New Jersey, February 10, 2015 — Suburban Propane Partners, L.P. (NYSE:SPH) (“Suburban Propane”), a nationwide

distributor of propane, fuel oil and related products and services, as well as a marketer of natural gas and electricity, announced today that Suburban Energy Finance Corp. and Suburban Propane (collectively “Suburban”), have commenced a

cash tender offer for any and all of the $250,000,000 aggregate principal amount of their 7 -3/8 % Senior Notes due 2020 with CUSIP number 864486AC9 (the “Notes”) and a related solicitation of consents (together, the

“Offer”) to certain proposed amendments to the indenture governing the Notes (the “Consents”).

The Offer will expire

at 11:59 P.M., New York City time, on March 10, 2015, unless extended (such date and time, as the same may be extended, the “Expiration Date”). Holders who validly tender their Notes and provide their Consents prior to 5:00 p.m., New York

City time, on February 24, 2015, unless such date is extended or earlier terminated (the “Consent Payment Deadline”), will be entitled to receive the total consideration of $1,041.68, payable in cash for each $1,000 principal amount of

Notes accepted for payment, which includes a consent payment of $30.00 per $1,000 principal amount of Notes accepted for payment. The Offer contemplates an early settlement option, so that holders whose Notes are validly tendered prior to the

Consent Payment Deadline and accepted for purchase could receive payment as early as February 25, 2015 (the “Initial Payment Date”). Holders who validly tender their Notes after the Consent Payment Deadline, but on or prior to the

Expiration Date will receive $1,011.68 for each $1,000 principal amount of Notes accepted for purchase, which amount is equal to the total consideration less the consent payment. Accrued and unpaid interest, up to, but not including, the applicable

settlement date will be paid in cash on all validly tendered and accepted Notes. The settlement date with respect to all Notes not settled at the Initial Settlement Date is expected to be March 11, 2015, or promptly thereafter.

Holders tendering their Notes will be deemed to have delivered their Consent to certain proposed amendments to the indenture governing the

Notes, which will eliminate certain covenants with respect to the Notes and certain events of default, shorten the minimum notice period for redemption of the Notes to three business days and amend certain other provisions with respect to the Notes.

Following receipt of Consents of at least a majority in aggregate principal amount of the outstanding Notes, Suburban will execute a supplemental indenture effecting the proposed amendments.

The closing of the Offer will be subject to a number conditions that are set forth in the Offer to Purchase and Consent Solicitation Statement

dated February 10, 2015 (the “Offer to Purchase”), including, (i) the receipt of the required Consents to amend and supplement the indenture governing the Notes and the execution by the applicable parties of the supplemental indenture

effecting such amendments and (ii) the successful completion by Suburban of a new senior debt offering. Notes validly tendered and Consents validly delivered may not be withdrawn on or following the date of the execution of the supplemental

indenture except as may be required by law.

The terms and conditions of the Offer, including Suburban’s obligation to accept the

Notes tendered and pay the purchase price therefor, are set forth in the Offer to Purchase. Suburban may amend, extend or, subject to certain conditions, terminate the Offer.

In connection with the Offer, Suburban has retained Wells Fargo Securities, LLC as the dealer

manager. Questions regarding the Offer may be directed to Wells Fargo Securities, LLC, at (866) 309-6316 (toll-free) and (704) 410-4760 (collect). Copies of the Offer to Purchase can be obtained from the information agent, D.F.

King & Co., Inc. at (866) 745-0273 (toll-free) and (212) 269-5550 (collect) or at sph@dfking.com. For questions concerning delivery by means of the Automated Tender Offer Program please contact D.F. King & Co., Inc., the

Tender Agent for the Offer, at (866) 745-0273 (toll-free) and (212) 269-5550 (collect) or at sph@dfking.com.

About Suburban

Propane Partners, L.P.

Suburban Propane Partners, L.P. is a publicly-traded master limited partnership listed on the New York Stock

Exchange. Headquartered in Whippany, New Jersey, Suburban has been in the customer service business since 1928. Suburban serves the energy needs of approximately 1.2 million residential, commercial, industrial and agricultural customers through

more than 710 locations in 41 states.

About Suburban Energy Finance Corp.

Suburban Energy Finance Corp. is a Delaware corporation and a wholly-owned subsidiary of Suburban Propane formed for the sole purpose of

acting as the co-issuer of the Notes and other senior notes of Suburban Propane. It has nominal assets and does not and will not conduct any operations or have any employees.

Forward-Looking Statements

This press release includes forward-looking statements. All statements, other than statements of historical facts, included in this press

release that address activities, events or developments that Suburban expects, believes or anticipates will or may occur in the future are forward-looking statements, including statements regarding actions taken by the holders of the Notes or by

Suburban with respect to the offer and whether the conditions to the offer will be satisfied. These statements reflect Suburban’s expectations or forecasts based on assumptions made by the partnership. These statements are subject to risks

including those relating to market conditions, financial performance and results, prices and demand for natural gas and oil and other important factors that could cause actual results to differ materially from our forward looking statements. These

risks are further described in Suburban’s reports filed with the Securities and Exchange Commission.

Any forward-looking statement

speaks only as of the date on which such statement is made and Suburban undertakes no obligation to correct or update any forward-looking statement, whether as a result of new information, future events or otherwise.

* * *

Exhibit 99.2

|

|

|

|

|

News Release |

|

Contact: Michael A. Kuglin |

|

Chief Financial Officer & Chief Accounting Officer |

|

P.O. Box 206, Whippany, NJ 07981-0206 |

|

Phone: 973.503.9252 |

FOR IMMEDIATE RELEASE

Suburban Propane Partners, L.P.

Announces Public Offering of Senior Notes

Whippany, New Jersey, February 10, 2015 — Suburban Propane Partners, L.P. (NYSE:SPH) (“Suburban”), a nationwide

distributor of propane, fuel oil and related products and services, as well as a marketer of natural gas and electricity, announced today that it intends, subject to market conditions, to publicly offer $250,000,000 aggregate principal amount of

senior notes due 2025 (the “2025 Senior Notes”). Suburban Energy Finance Corp., a wholly-owned direct subsidiary of Suburban, will serve as the co-issuer of the notes.

Suburban intends to use the net proceeds from the offering, along with cash on hand to the extent necessary, to fund a cash tender offer for

any and all of its $250,000,000 of outstanding indebtedness under its 7 -3/8 % senior notes due 2020 (the “2020 Senior Notes”), including fees and expenses associated with the cash tender offer. Simultaneously with the launch of this

offering of 2025 Senior Notes, Suburban launched a cash tender offer for its 2020 Senior Notes.

Wells Fargo Securities, LLC is acting as

representative of the underwriters for the offering. A copy of the preliminary prospectus supplement and the accompanying base prospectus, which is filed as part of Suburban’s effective shelf registration statement on Form S-3, may be obtained

from:

Wells Fargo Securities, LLC

Attn: Client Support

608 2nd

Avenue

South Minneapolis, MN 55402

Telephone: (800) 645-3751 Opt 5

Email: wfscustomerservice@wellsfargo.com

An electronic copy of the preliminary prospectus supplement and the accompanying base prospectus may also be obtained at no charge at the

Securities and Exchange Commission’s website at www.sec.gov.

The 2025 Senior Notes are being offered pursuant to an effective

registration statement that Suburban previously filed with the Securities and Exchange Commission. This press release does not constitute an offer to sell or a solicitation of an offer to buy the securities described herein, nor shall there be any

sale of these securities in any state or jurisdiction in which such offer, solicitation or sale would be unlawful prior to registration or qualification under the laws of such jurisdiction. The offering of the 2025 Senior Notes will be made only by

means of a preliminary prospectus supplement and the accompanying base prospectus, which is filed as part of Suburban’s effective shelf registration statement on Form S-3.

About Suburban Propane Partners, L.P.

Suburban Propane Partners, L.P. is a publicly-traded master limited partnership listed on the New York Stock Exchange. Headquartered in

Whippany, New Jersey, Suburban has been in the customer service business since 1928. Suburban serves the energy needs of approximately 1.2 million residential, commercial, industrial and agricultural customers through more than 710 locations in

41 states.

Forward-Looking Statements

This press release includes forward-looking statements. All statements, other than statements of historical facts, included in this press

release that address activities, events or developments that Suburban expects, believes or

anticipates will or may occur in the future are forward-looking statements, including statements regarding closing of the offering and the use of proceeds of the offering. These statements

reflect Suburban’s expectations or forecasts based on assumptions made by the partnership. These statements are subject to risks including those relating to market conditions, financial performance and results, prices and demand for natural gas

and oil and other important factors that could cause actual results to differ materially from our forward looking statements. These risks are further described in Suburban’s reports filed with the Securities and Exchange Commission.

Any forward-looking statement speaks only as of the date on which such statement is made and Suburban undertakes no obligation to correct or

update any forward-looking statement, whether as a result of new information, future events or otherwise.

* * *

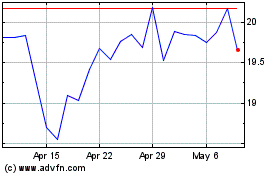

Suburban Propane (NYSE:SPH)

Historical Stock Chart

From Oct 2024 to Nov 2024

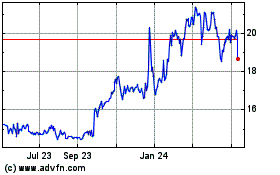

Suburban Propane (NYSE:SPH)

Historical Stock Chart

From Nov 2023 to Nov 2024