0001498710false00014987102024-08-012024-08-01

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (date of earliest event reported): August 1, 2024

SPIRIT AIRLINES, INC.

(Exact name of registrant as specified in its charter)

| | | | | | | | | | | |

| Delaware | 001-35186 | 38-1747023 |

| (State or other jurisdiction of incorporation) | (Commission File Number) | (IRS Employer Identification Number) |

| | | |

| 1731 Radiant Drive | Dania Beach, | Florida | 33004 |

| (Address of Principal Executive) | (Zip Code) |

(954) 447-7920

(Registrant's telephone number, including area code)

N/A

(Former name or former address, if changed since last report.)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions: | | | | | |

| ☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act: | | | | | | | | |

| Class | Trading Symbol(s) | Name of each exchange on which registered |

| Common Stock, $0.0001 par value | SAVE | New York Stock Exchange |

| | |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 2.02. Results of Operations and Financial Condition.

On August 1, 2024 Spirit Airlines, Inc. (the “Company” or “Spirit”) issued a press release announcing its unaudited financial results for the second quarter of 2024. A copy of the press release is attached hereto as Exhibit 99.1 and is incorporated herein by reference (the "Earnings Press Release").

Non-GAAP financial measures that reflect adjustments from historical financial data prepared under GAAP, including adjustments for special items, are included in the Earnings Press Release as supplemental disclosures because the Company believes they are useful indicators of the Company's operating performance for comparative purposes. These non-GAAP financial measures are well recognized performance measurements in the airline industry that are frequently used by investors, securities analysts and other interested parties in comparing the operating performance of companies in the airline industry. The non-GAAP financial measures provided have limitations as an analytical tool. Because of these limitations, non-GAAP financial measures should not be considered in isolation or as a substitute for performance measures calculated in accordance with GAAP. The Company has also provided in the Earnings Press Release reconciliations of these non-GAAP financial measures to the appropriate GAAP financial measures.

Item 7.01. Regulation FD Disclosure.

On August 1, 2024, the Company posted a copy of an investor update (the "Investor Update") providing third quarter and full year 2024 guidance as well a Fleet Plan on its investor relations website at https://ir.spirit.com. A copy of the Investor Update and a copy of the Fleet Plan are furnished pursuant to this Item 7.01 as Exhibit 99.2 and Exhibit 99.3, respectively, to this Current Report on Form 8-K and incorporated by reference herein in its entirety. Investors are encouraged to read the Investor Update and the Fleet Plan in conjunction with the Earnings Press Release. The Company reserves the right to discontinue availability of the Investor Update from its website at any time.

Pursuant to General Instruction B.2. to Form 8-K, the information set forth in this Current Report on Form 8-K, including Exhibits 99.1, 99.2 and 99.3 shall not be deemed "filed" for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the "Exchange Act"), or otherwise subject to the liabilities thereof, nor shall it be incorporated by reference into future filings by the Company under the Exchange Act or under the Securities Act of 1933, as amended, except to the extent specifically provided in any such filing. Additionally, the submission of the information set forth in this Item 7.01 is not deemed an admission as to the materiality of any information in this Current Report on Form 8-K that is required to be disclosed solely by Regulation FD.

Item 9.01. Financial Statements and Exhibits.

(d) Exhibits

The following is furnished as an exhibit to this report and shall not be deemed “filed” for purposes of Section 18 of the Exchange Act:

| | | | | |

| Exhibit No. | Description |

| |

| 99.1 | |

| 99.2 | |

| 99.3 | |

| 104 | Cover Page Interactive Data File (embedded within the Inline XBRL Document) |

| |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, as amended, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | |

| Date: August 1, 2024 | SPIRIT AIRLINES, INC. |

| |

| By: /s/ Thomas Canfield |

| Name: Thomas Canfield |

| Title: Senior Vice President and General Counsel |

| |

| |

| |

| |

| |

EXHIBIT 99.1

Spirit Airlines Reports Second Quarter 2024 Results

Ended the Second Quarter 2024 with $1.14 Billion of Liquidity

DANIA BEACH, Fla., August 1, 2024 - Spirit Airlines, Inc. ("Spirit" or the "Company") (NYSE: SAVE) today reported second quarter 2024 financial results.

Second Quarter 2024 Financial Results | | | | | | | | | | | | | | | |

| |

| (unaudited) |

| As Reported | | | | | | Adjusted1 |

| | | | | | | |

| | |

| | | | | | | |

| Total operating revenues | $1,280.9 million | | | | | | $1,280.9 million |

| Operating income (loss) | $(152.5) million | | | | | | $(166.9) million |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| Operating margin | (11.9)% | | | | | | (13.0)% |

| | | | | | | |

| | | | | | | |

| Net income (loss) | $(192.9) million | | | | | | $(157.9) million |

| Diluted earnings (loss) per share | $(1.76) | | | | | | $(1.44) |

| | | | | | | |

| | | | | | | |

"Summer demand remains robust and load factors have been strong; however, significant industry capacity increases together with ancillary pricing changes in the competitive environment have made it difficult to increase yields, resulting in disappointing revenue results for the second quarter of 2024," said Ted Christie, Spirit's President and Chief Executive Officer. "The continued intense competitive battle for the price-sensitive leisure traveler further reinforces our belief that we are on the right path with our transformation plan to redefine low-fare travel with new, high-value travel options that will allow Guests to choose an elevated experience at an affordable price. I want to thank our entire team for their dedication and patience as we execute on these initiatives intended to drive improvement in overall revenue production and put us on the path to profitability."

Transforming our Guest Experience

During the second quarter, Spirit began to execute on its transformation plan to better align its business model with the current market dynamics. On July 30, 2024, Spirit announced the next phase of its go forward strategy. The Company is introducing new offerings, including brand new premium selections, as part of a significant transformation that delivers an even friendlier, more comfortable, and cost-effective travel experience. The new premium selections and experience will range from elevated to economical to meet the needs of all travelers. Spirit will begin offering the new travel options for booking on Aug. 16 and launch the newly transformed Guest experience by August 27, 2024.To date, announced changes include:

•Four travel options: Go Big, Go Comfy, Go Savvy and Go

•Designated priority check-in at more than 20 airports for Guests who purchase the Go Big fare option or are Free Spirit® Gold members or Free Spirit World Elite Mastercard holders

•Enhanced boarding experience aimed to reduce boarding time and enhance operational performance

•Expanded Guest-friendly policies:

◦All four travel options include the flexibility of no change or cancel fees

◦Increased checked bag weight allowance up to 50 pounds

◦Extended Future Travel Vouchers expiration to 12 months (for vouchers issued on or after June 3, 2024)

Delivering on Cost Saving Initiatives and Network Changes

•On track to achieve $100 million of annual run-rate cost savings with approximately $75 million expected to be achieved by year-end 2024

•Initiatives include:

•Temporarily suspending the recruitment of pilots and flight attendants and related training costs

•Offering voluntary unpaid leaves of absences to flight attendants

•Right-sizing overhead and non-crew operational positions

•Reducing discretionary capital spend

•Furloughing approximately 240 pilots and downgrading approximately 100 captains

•Realigning the network

•Compared to the third quarter 2023, in the third quarter 2024 the Company will have exited 42 markets and added 77 new ones

•Offering more day of week routes which allows for route expansion at a lower risk profile

•Aggressively managing capacity to better match seasonal and daily demand variances

•Aligning capacity to markets where the supply/demand trends are more in balance

•In addition to other liquidity-enhancing initiatives, the Company deferred all aircraft on order with Airbus that were scheduled to be delivered in the second quarter of 2025 through the end of 2026 to 2030-2031

Second Quarter 2024 Operations

•System completion factor of 98.5 percent

•System controllable completion factor2 of 99.8 percent

•Capacity increase of 1.7 percent year over year

•Load factor of 83.2 percent, an increase of 0.3 pts year over year

•Aircraft utilization of 10.6 hours, down 6.2 percent compared to the second quarter last year of 11.3 hours, primarily due to aircraft unavailable for operational service due to PW1100G-JM geared turbo fan engine availability issues (“AOG”)

Second Quarter 2024 Revenues

Elevated domestic industry capacity restrained the Company's ability to drive increased ticket yields, pressuring fare revenue per passenger flight segment ("segment") during the second quarter of 2024. The Company also experienced downward pressure on non-ticket revenue per segment, primarily due to the elimination of charging for change and cancellation fees and competitive price reductions of ancillary items.

•Total operating revenues of $1,280.9 million, a decrease of 10.6 percent year over year

•Total revenue per ASM ("TRASM") of 9.05 cents, a decrease of 12.1 percent year over year on 1.7 percent more capacity

•Total revenue per segment of $108.46, a decrease of 15.3 percent year over year

•Fare revenue per segment of $45.02, a decrease of 22.2 percent year over year

•Non-ticket revenue per segment of $63.44,1 a decrease of 9.6 percent year over year

As the Company executes on its transformation strategy, it anticipates that over time it will be able to drive improvement in total revenue per segment.

Second Quarter 2024 Cost Performance

•Total operating expense of $1,433.4 million and adjusted operating expenses of $1,447.8 million1

•Adjusted non-fuel cost of $1,040.5 million1

•Average fuel price per gallon of $2.78

•Total non-operating expense of $37.1 million

Second Quarter 2024 Liquidity and Capital Deployment

•Ended the quarter with unrestricted cash and cash equivalents, short-term investment securities and liquidity available under the Company's revolving credit facility of $1.1 billion

•Extended the final maturity of its $300 million revolving credit facility to September 30, 2026, subject to certain conditions

•Recorded pre-delivery deposit refunds, net of pre-delivery payments of $162.2 million for the six months ending June 30, 2024, partially offset by $60.6 million spent on the purchase of property and equipment

•Recognized $57.1 million1 of AOG credits on the Company's condensed consolidated statements of Cash Flows, bringing the year-to-date benefit recognized to $75.0 million1

•Estimates AOG credits to be issued in 2024 by Pratt & Whitney for AOG aircraft will benefit full year 2024 liquidity by approximately $150 million to $200 million

"The Spirit management team is focused on returning to profitability, and we believe the transformation plan we recently announced places us on the path to improved financial performance," said Fred Cromer, Spirit’s Chief Financial Officer. “We will continue to aggressively manage our costs to maintain our position as a low-cost leader in the industry and to make every effort to maintain adequate liquidity. Earlier this week, we closed on a Direct Lease and Pre-Delivery Payment Transaction that raised, in the aggregate, approximately $186 million. We expect to end the year 2024 with over $1.0 billion of liquidity, including unrestricted cash and cash equivalents, short-term investment securities, liquidity available under our revolving credit facility and additional liquidity initiatives, assuming that we are able to close those initiatives that are currently in process. Meanwhile, we remain in active discussions with the advisors to the noteholders to address the upcoming debt maturities and will provide updates on our progress when appropriate."

Second Quarter 2024 Fleet and NEO Engine Update

•Took delivery of four new A320neo aircraft and four new A321neo aircraft

•Retired five A319ceo aircraft

•Ended the quarter with a fleet of 210 aircraft

•Secured $37.2 million of AOG credits to be issued by Pratt & Whitney based on AOG days during the quarter

•Recorded $7.1 million of AOG credits within the Company’s condensed consolidated statements of operations, of which $3.6 million was recorded as a credit within maintenance, materials and repairs, $2.0 million was recorded as credit within aircraft rent and $1.5 million was recorded as a credit to depreciation and amortization

•Estimates that it will average about 20 AOG aircraft for the full year 2024

•Spirit intends to discuss appropriate arrangements with Pratt & Whitney in due course for any Spirit AOG aircraft after December 31, 2024

Conference Call/Webcast Detail

Spirit will conduct a conference call to discuss these results today at 10:00 a.m. Eastern U.S. Time. A live audio webcast of the conference call will be available to the public on a listen-only basis at

https://ir.spirit.com. An archive of the webcast will be available under "Events & Presentations" for 60 days.

About Spirit Airlines

Spirit Airlines (NYSE: SAVE) is a leading low-fare carrier committed to delivering the best value in the sky by offering an enhanced travel experience with flexible, affordable options. Spirit serves destinations throughout the United States, Latin America and the Caribbean with its Fit Fleet®, one of the youngest and most fuel-efficient fleets in the U.S. Spirit is committed to inspiring positive change in the communities it serves through the Spirit Charitable Foundation. Discover elevated travel options with exceptional value at spirit.com.

Investor inquiries:

Spirit Investor Relations

investorrelations@spirit.com

Media inquiries:

Spirit Media Relations

Media_Relations@spirit.com

Forward Looking Guidance

The forward-looking guidance items provided in this release are based on the Company's current estimates and are not a guarantee of future performance. There could be significant risks and uncertainties that could cause actual results to differ materially, including the risk factors discussed in the Company's reports on file with the Securities and Exchange Commission. Spirit undertakes no duty to update any forward-looking statements or estimates.

Investors are encouraged to read this press release in conjunction with the company's Investor Update which provides additional information about the company's forward-looking estimates for certain financial metrics and is included along with this press release in the Current Report on Form 8-K furnished to the U.S. Securities and Exchange Commission. The Investor Update is also available at https://ir.spirit.com. Management will also discuss certain business outlook items during the quarterly earnings conference call.

Investors are also encouraged to read the Company's periodic and current reports filed with or furnished to the Securities and Exchange Commission, including its Annual Report on Form 10-K, Quarterly Reports on Form 10-Q and Current Reports on Form 8-K, for additional information regarding the Company.

End Notes

(1) See "Reconciliation of Reported Amounts to Adjusted (Non-GAAP) Items" tables below for more details.

(2) Excludes the following events, which are outside of the Company's control, from the calculation of completion factor: weather, air traffic and uncontrolled airport/runway closures, which may include acts of nature, disabled aircraft incidents on the runway, political/civil unrest and disturbances preventing normal operations within airline control, among others, and any city/state closures as declared by local authorities and asserted by our Security department.

Cautionary Statement Regarding Forward Looking Statements

Forward-Looking Statements in this release and certain oral statements made from time to time by representatives of the Company contain various forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended (the "Securities Act"), and Section 21E of the Securities Exchange Act of 1934, as amended (the "Exchange Act") which are subject to the “safe harbor” created by those sections. Forward-looking statements are based on our management’s beliefs and assumptions and on information currently available to our management. All statements other than statements of historical facts are “forward-looking statements” for purposes of these provisions. In some cases, you can identify forward-looking statements by terms such as “may,” “will,” “should,” “could,” “would,” “expect,” “plan,” “anticipate,” “believe,” “estimate,” “project,” “predict,” “potential,” and similar expressions intended to identify forward-looking statements. Forward-looking statements include, without limitation, guidance for 2024 and statements regarding the Company's intentions and expectations regarding revenues, cash levels, capacity and passenger demand, additional financing, capital spending, operating costs and expenses, pre-tax income, pre-tax margin, taxes, hiring and furloughs, aircraft deliveries, stakeholders, negotiations and settlement with Pratt & Whitney regarding neo engine availability issues, resolving outstanding indebtedness, vendors and government support. Such forward-looking statements are subject to risks, uncertainties and other important factors that could cause actual results and the timing of certain events to differ materially from future results expressed or implied by such forward-looking statements. Factors include, among others, results of operations and financial condition, the competitive environment in our industry, our ability to keep costs low and the impact of worldwide economic conditions, including the impact of economic cycles or downturns on customer travel behavior and other factors, as described in the Company’s filings with the Securities and Exchange Commission, including the detailed factors discussed under the heading “Risk Factors” in the Company’s Annual Report on Form 10-K for the fiscal

year ended December 31, 2023, as supplemented in the Company's Quarterly Report on Form 10-Q for the fiscal quarters ended March 31, 2024 and June 30, 2024. Furthermore, such forward-looking statements speak only as of the date of this release. Except as required by law, we undertake no obligation to update any forward-looking statements to reflect events or circumstances after the date of such statements. Risks or uncertainties (i) that are not currently known to us, (ii) that we currently deem to be immaterial, or (iii) that could apply to any company, could also materially adversely affect our business, financial condition, or future results. Additional information concerning certain factors is contained in the Company's Securities and Exchange Commission filings, including but not limited to the Company's Annual Report on Form 10-K, Quarterly Reports on Form 10-Q, and Current Reports on Form 8-K.

SPIRIT AIRLINES, INC.

Condensed Consolidated Statements of Operations

(unaudited, in thousands, except per-share amounts)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Three Months Ended | | | Six Months Ended | |

| June 30, | Percent | | June 30, | Percent |

| 2024 | | 2023 | | Change | | 2024 | | 2023 | Change |

| Operating revenues: | | | | | | | | | | |

| Passenger | $ | 1,253,803 | | | $ | 1,410,061 | | | (11.1) | | | $ | 2,493,113 | | | $ | 2,737,534 | | (8.9) | |

| Other | 27,086 | | | 22,411 | | | 20.9 | | | 53,313 | | | 44,712 | | 19.2 | |

| Total operating revenues | 1,280,889 | | | 1,432,472 | | | (10.6) | | | 2,546,426 | | | 2,782,246 | | (8.5) | |

| | | | | | | | | | |

| Operating expenses: | | | | | | | | | | |

| Aircraft fuel | 407,296 | | | 391,032 | | | 4.2 | | | 813,647 | | | 878,743 | | (7.4) | |

Salaries, wages and benefits

| 418,378 | | | 407,705 | | | 2.6 | | | 849,861 | | | 796,890 | | 6.6 | |

| Landing fees and other rents | 116,064 | | | 106,487 | | | 9.0 | | | 222,782 | | | 203,832 | | 9.3 | |

| Aircraft rent | 125,339 | | | 92,101 | | | 36.1 | | | 240,545 | | | 177,368 | | 35.6 | |

| Depreciation and amortization | 84,486 | | | 80,542 | | | 4.9 | | | 165,832 | | | 158,533 | | 4.6 | |

| Maintenance, materials and repairs | 52,453 | | | 56,825 | | | (7.7) | | | 107,368 | | | 111,239 | | (3.5) | |

| Distribution | 45,923 | | | 50,701 | | | (9.4) | | | 91,099 | | | 98,718 | | (7.7) | |

| Special charges (credits) | (381) | | | 19,972 | | | (101.9) | | | 35,877 | | | 33,955 | | 5.7 | |

| Loss (gain) on disposal of assets | (14,047) | | | 802 | | | NM | | (17,076) | | | 7,902 | | NM |

| Other operating | 197,890 | | | 206,094 | | | (4.0) | | | 396,340 | | | 407,250 | | (2.7) | |

| Total operating expenses | 1,433,401 | | | 1,412,261 | | | 1.5 | | | 2,906,275 | | | 2,874,430 | | 1.1 | |

| | | | | | | | | | |

| Operating income (loss) | (152,512) | | | 20,211 | | | NM | | (359,849) | | | (92,184) | | NM |

| | | | | | | | | | |

| Other (income) expense: | | | | | | | | | | |

| Interest expense | 54,307 | | | 28,880 | | | 88.0 | | | 109,116 | | | 80,673 | | 35.3 | |

| Loss (gain) on extinguishment of debt | — | | | — | | | NM | | (14,996) | | | — | | NM |

| Capitalized interest | (5,689) | | | (8,445) | | | (32.6) | | | (15,692) | | | (16,093) | | (2.5) | |

| Interest income | (12,169) | | | (15,962) | | | (23.8) | | | (25,759) | | | (31,396) | | (18.0) | |

| Other (income) expense | 665 | | | 766 | | | NM | | (65,825) | | | 1,308 | | NM |

| | | | | | | | | | |

| Total other (income) expense | 37,114 | | | 5,239 | | | NM | | (13,156) | | | 34,492 | | NM |

| | | | | | | | | | |

| Income (loss) before income taxes | (189,626) | | | 14,972 | | | NM | | (346,693) | | | (126,676) | | NM |

| Provision (benefit) for income taxes | 3,301 | | | 17,321 | | | (80.9) | | | (11,131) | | | (20,416) | | (45.5) | |

| | | | | | | | | | |

| Net income (loss) | $ | (192,927) | | | $ | (2,349) | | | NM | | $ | (335,562) | | | $ | (106,260) | | NM |

| Basic earnings (loss) per share | $ | (1.76) | | | $ | (0.02) | | | NM | | $ | (3.07) | | | $ | (0.97) | | NM |

| Diluted earnings (loss) per share | $ | (1.76) | | | $ | (0.02) | | | NM | | $ | (3.07) | | | $ | (0.97) | | NM |

| | | | | | | | | | |

| Weighted-average shares, basic | 109,506 | | | 109,161 | | | 0.3 | | | 109,468 | | | 109,136 | | 0.3 | |

| Weighted-average shares, diluted | 109,506 | | | 109,161 | | | 0.3 | | | 109,468 | | | 109,136 | | 0.3 | |

NM: "Not Meaningful"

SPIRIT AIRLINES, INC.

Selected Operating Statistics

(unaudited)

| | | | | | | | | | | | | | | | | |

| | Three Months Ended June 30, | | Change |

| Operating Statistics | 2024 | | 2023 | |

| Available seat miles (ASMs) (thousands) | 14,146,192 | | | 13,908,113 | | | 1.7 | % |

| Revenue passenger miles (RPMs) (thousands) | 11,766,847 | | | 11,532,450 | | | 2.0 | % |

| Load factor (%) | 83.2 | | | 82.9 | | | 0.3 | pts |

| Passenger flight segments (thousands) | 11,810 | | | 11,189 | | | 5.6 | % |

| | | | | |

| Departures | 75,925 | | | 74,787 | | | 1.5 | % |

| Total operating revenue per ASM (TRASM) (cents) | 9.05 | | | 10.30 | | | (12.1) | % |

| Average yield (cents) | 10.89 | | | 12.42 | | | (12.3) | % |

| Fare revenue per passenger flight segment ($) | 45.02 | | | 57.86 | | | (22.2) | % |

| Non-ticket revenue per passenger flight segment ($) | 63.44 | | | 70.17 | | | (9.6) | % |

| Total revenue per passenger flight segment ($) | 108.46 | | | 128.03 | | | (15.3) | % |

| CASM (cents) | 10.13 | | | 10.15 | | | (0.2) | % |

| Adjusted CASM (cents) (1) | 10.23 | | | 9.96 | | | 2.7 | % |

| Adjusted CASM ex-fuel (cents) (1)(2) | 7.36 | | | 7.15 | | | 2.9 | % |

| Fuel gallons consumed (thousands) | 146,686 | | | 149,513 | | | (1.9) | % |

| Average fuel cost per gallon ($) | 2.78 | | | 2.62 | | | 6.1 | % |

| Aircraft at end of period | 210 | | | 198 | | | 6.1 | % |

| Average daily aircraft utilization (hours) | 10.6 | | | 11.3 | | | (6.2) | % |

| Average stage length (miles) | 981 | | | 1,016 | | | (3.8) | % |

| | | | | |

| | | | | | | | | | | | | | | | | |

| | | | | | |

| | Six Months Ended June 30, | | Change |

| Operating Statistics | 2024 | | 2023 | |

| Available seat miles (ASMs) (thousands) | 27,635,211 | | | 27,117,249 | | | 1.9 | % |

| Revenue passenger miles (RPMs) (thousands) | 22,649,463 | | | 22,207,330 | | | 2.0 | % |

| Load factor (%) | 82.0 | | | 81.9 | | | 0.1 | pts |

| Passenger flight segments (thousands) | 22,624 | | | 21,787 | | | 3.8 | % |

| | | | | |

| Departures | 147,846 | | | 147,536 | | | 0.2 | % |

| Total operating revenue per ASM (TRASM) (cents) | 9.21 | | | 10.26 | | | (10.2) | % |

| Average yield (cents) | 11.24 | | | 12.53 | | | (10.3) | % |

| Fare revenue per passenger flight segment ($) | 46.48 | | | 57.66 | | | (19.4) | % |

| Non-ticket revenue per passenger flight segment ($) | 66.07 | | | 70.04 | | | (5.7) | % |

| Total revenue per passenger flight segment ($) | 112.55 | | | 127.70 | | | (11.9) | % |

| CASM (cents) | 10.52 | | | 10.60 | | | (0.8) | % |

| Adjusted CASM (cents) (1) | 10.45 | | | 10.42 | | | 0.3 | % |

| Adjusted CASM ex-fuel (cents) (1)(2) | 7.51 | | | 7.18 | | | 4.6 | % |

| Fuel gallons consumed (thousands) | 286,826 | | | 291,855 | | | (1.7) | % |

| Average fuel cost per gallon ($) | 2.84 | | | 3.01 | | | (5.6) | % |

| Aircraft at end of period | 210 | | | 198 | | | 6.1 | % |

| Average daily aircraft utilization (hours) | 10.5 | | | 11.3 | | | (7.1) | % |

| Average stage length (miles) | 988 | | | 1,004 | | | (2.0) | % |

| | | | | |

(1)Excludes operating special items.

(2)Excludes fuel expense and operating special items.

Non-GAAP Financial Measures

The Company evaluates its financial performance utilizing various accounting principles generally accepted in the United States of America (“GAAP”) and non-GAAP financial measures, including Adjusted operating expenses, Adjusted operating income (loss), Adjusted operating margin, Adjusted operating margin adjusted for AOG credits, Adjusted income (loss) before income taxes, Adjusted pre-tax margin, Adjusted net income (loss), Adjusted provision (benefit) for income taxes, Adjusted net income (loss) per share, diluted, Adjusted CASM and Adjusted CASM ex-fuel. These non-GAAP financial measures are provided as supplemental information to the financial information presented in this press release that is calculated and presented in accordance with GAAP and these non-GAAP financial measures are presented because management believes that they supplement or enhance management’s, analysts’ and investors’ overall understanding of the Company’s underlying financial performance and trends and facilitate comparisons among current, past and future periods.

Because the non-GAAP financial measures are not calculated in accordance with GAAP, they should not be considered superior to and are not intended to be considered in isolation or as a substitute for the related GAAP financial measures presented in the press release and may not be the same as or comparable to similarly titled measures presented by other companies due to possible differences in the method of calculation and in the items being adjusted. We encourage investors to review our financial statements and other filings with the Securities and Exchange Commission in their entirety and not to rely on any single financial measure.

The information below provides an explanation of certain adjustments reflected in the non-GAAP financial measures and shows a reconciliation of non-GAAP financial measures reported in this press release (other than forward-looking non-GAAP financial measures) to the most directly comparable GAAP financial measures. Within the financial tables presented, certain columns and rows may not add due to the use of rounded numbers. Per unit amounts presented are calculated from the underlying amounts.

The Company believes that adjusting for a litigation loss contingency (recorded within other operating expenses within the Company's condensed consolidated statements of operations), loss (gain) on disposal of assets and special charges (credits) is useful to investors because these items are not indicative of the Company’s ongoing performance and the adjustments are similar to those made by our peers and allow for enhanced comparability to other airlines.

Operating expenses per available seat mile (“CASM”) is a common metric used in the airline industry to measure an airline’s cost structure and efficiency. We exclude aircraft fuel and related taxes and special items from operating expenses to determine Adjusted CASM ex-fuel. We also believe that excluding fuel costs from certain measures is useful to investors because it provides an additional measure of management’s performance excluding the effects of a significant cost item over which management has limited influence and increases comparability with other airlines that also provide a similar metric.

| | | | | | | | | | | | | | | |

| Reconciliation of Reported Amounts to Adjusted (Non-GAAP) Items | | | | | | |

| (See Note Regarding Use of Non-GAAP Financial Measures) | | | |

| Within the tables presented, certain amounts may not add due to the use of rounded numbers |

| (in thousands, except per share or per unit amounts) (unaudited) | | | |

| | | | | | | |

| | Three Months Ended | | |

| June 30, | | |

| 2024 | | 2023 | | | | |

| Operating revenues | | | | | | | |

| Fare | $ | 531,652 | | | $ | 647,344 | | | | | |

| Non-fare | 722,151 | | | 762,717 | | | | | |

| Total passenger revenues | 1,253,803 | | | 1,410,061 | | | | | |

| Other revenues | 27,086 | | | 22,411 | | | | | |

| Total operating revenues | $ | 1,280,889 | | | $ | 1,432,472 | | | | | |

| | | | | | | |

| Non-ticket revenues (1) | $ | 749,237 | | | $ | 785,128 | | | | | |

| | | | | | | |

| Passenger segments | 11,810 | | | 11,189 | | | | | |

| | | | | | | |

| Non-ticket revenue per passenger flight segment ($) | $ | 63.44 | | | $ | 70.17 | | | | | |

| | | | | | | |

| Special Items (2) | | | | | | | |

| Operating special items include the following: | | | | | | | |

| Litigation loss contingency (3) | $ | — | | | $ | 6,000 | | | | | |

| Loss (gain) on disposal of assets (4) | (14,047) | | | 802 | | | | | |

| Operating special charges (credits) (5) | (381) | | | 19,972 | | | | | |

| Total operating special items | $ | (14,428) | | | $ | 26,774 | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| Total operating expenses, as reported | $ | 1,433,401 | | | $ | 1,412,261 | | | | | |

| Less: Operating special items | (14,428) | | | 26,774 | | | | | |

| Adj. Operating expenses, non-GAAP (6) | $ | 1,447,829 | | | $ | 1,385,487 | | | | | |

| Less: Aircraft fuel expense | 407,296 | | | 391,032 | | | | | |

| Adj. Operating expenses excluding fuel, non-GAAP (7) | $ | 1,040,533 | | | $ | 994,455 | | | | | |

| | | | | | | |

| Available seat miles | 14,146,192 | | | 13,908,113 | | | | | |

| | | | | | | |

| CASM (cents) | 10.13 | | | 10.15 | | | | | |

| Adj. CASM (cents) (6) | 10.23 | | | 9.96 | | | | | |

| Adj. CASM ex-fuel (cents) (7) | 7.36 | | | 7.15 | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | | | | | | | | | |

| Reconciliation of Reported Amounts to Adjusted (Non-GAAP) Items | | | | | | |

| (See Note Regarding Use of Non-GAAP Financial Measures) | | | |

| Within the tables presented, certain amounts may not add due to the use of rounded numbers |

| (in thousands, except per share or per unit amounts) (unaudited) | | | |

| | | | | | | |

| | Three Months Ended | | |

| June 30, | | |

| 2024 | | 2023 | | | | |

| Operating income (loss), as reported | $ | (152,512) | | | $ | 20,211 | | | | | |

| Operating margin | (11.9) | % | | 1.4 | % | | | | |

| Add: Operating special items expense | (14,428) | | | 26,774 | | | | | |

| Adj. Operating income (loss), non-GAAP (6) | $ | (166,940) | | | $ | 46,985 | | | | | |

| Adj. Operating margin, non-GAAP (6) | (13.0)% | | 3.3 | % | | | | |

| | | | | | | |

| Add: Adj. for AOG credit | $ | 30,128 | | | $ | — | | | | | |

| Adj. Operating income (loss), non-GAAP (8) | $ | (136,812) | | | $ | — | | | | | |

| Adj. Operating margin adj. for AOG credits (8) | (10.7)% | | — | % | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| Income (loss) before income taxes, as reported | $ | (189,626) | | | $ | 14,972 | | | | | |

| Pre-tax margin | (14.8)% | | 1.0 | % | | | | |

| Less: Operating special items expense | (14,428) | | | 26,774 | | | | | |

| | | | | | | |

| Adj. Income (loss) before income taxes, non-GAAP (9) | $ | (204,054) | | | $ | 41,746 | | | | | |

| Adj. Pre-tax margin, non-GAAP (9) | (15.9)% | | 2.9% | | | | |

| | | | | | | |

| Provision (benefit) for income taxes, as reported | $ | 3,301 | | | $ | 17,321 | | | | | |

| Less: Net income (loss) tax impact of special items | 49,417 | | | 7,886 | | | | | |

| Adj. Provision (benefit) for income taxes, non-GAAP (10) | $ | (46,116) | | | $ | 9,435 | | | | | |

| | | | | | | |

| Net income (loss), as reported | $ | (192,927) | | | $ | (2,349) | | | | | |

| Less: Operating special items expense | (14,428) | | | 26,774 | | | | | |

| | | | | | | |

| Less: Net income (loss) tax impact of special items | 49,417 | | | 7,886 | | | | | |

| Adj. Net income (loss), non-GAAP (9) | $ | (157,938) | | | $ | 32,311 | | | | | |

| | | | | | | |

| Weighted-average shares, diluted | 109,506 | | | 111,711 | | | | | |

| Net income (loss) per share, diluted, as reported | $ | (1.76) | | | $ | (0.02) | | | | | |

| Add: Impact of special items | (0.13) | | | 0.25 | | | | | |

| Add: Tax impact of special items (11) | 0.45 | | | 0.07 | | | | | |

| Adj. Net income (loss) per share, diluted, non-GAAP (2) | $ | (1.44) | | | $ | 0.29 | | | | | |

| | | | | | | |

| | | | | | | |

(1)Non-ticket revenues equal the sum of non-fare passenger revenues and other revenues.

(2)Refer to the section "Non-GAAP Financial Measures" for additional information.

(3)2023 includes a $6 million litigation loss contingency (recorded within other operating expenses within the Company's condensed consolidated statements of

operations).

(4)2024 includes gains on four aircraft sale-leaseback transactions and net gains on the sale of five A319 airframes and nine engines. 2023 includes losses related to the write-off of obsolete assets and other adjustments, partially offset by gains on three aircraft sale-leaseback transactions and net gains on the sale of three A319 airframes and four A319 engines.

(5)2023 includes legal, advisory, retention award program and other fees related to the former Agreement and Plan of Merger with JetBlue and Sundown Acquisition Corp.

(6)Excludes operating special items. Refer to the section "Non-GAAP Financial Measures" for additional information.

(7)Excludes operating special items and aircraft fuel expense. Refer to the section "Non-GAAP Financial Measures" for additional information.

(8)Excludes special items and adjusts for the difference between the AOG credits to be received related to the AOG aircraft in the second quarter 2024 and the AOG credits recognized in the Company’s condensed consolidated statements of operations for the second quarter 2024.

(9)Excludes total special items. Refer to the section "Non-GAAP Financial Measures" for additional information.

(10)The Company determined the Adjusted Provision (benefit) for income taxes using its statutory tax rate.

(11)Reflects the difference between the Company's GAAP Provision (benefit) for income taxes and Adjusted Provision (benefit) for income taxes as presented on a per share basis.

The following supplemental information is provided to illustrate how the AOG credits earned during the three and six months ended June 30, 2024 were recognized on the Company's condensed consolidated statements of cash flows.

| | | | | | | | | | | |

| | |

| AOG credits were recognized on the Company's condensed consolidated statements of cash flows as follows: |

| | Three Months Ended | | Six Months Ended |

| (in millions) | June 30, 2024 | | June 30, 2024 |

| Net income (loss): | $ | 7.1 | | | $ | 8.7 | |

| | | |

| Less: | | | |

| Adjustments to reconcile net income (loss) to net cash provided by (used in) operations: | | | |

| Depreciation and amortization | 1.5 | | | 1.5 | |

| Add: | | | |

| Changes in operating assets and liabilities: | | | |

| Deferred heavy maintenance | 35.8 | | | 43.9 | |

| Net cash provided (used in) operating activities | $ | 41.4 | | | $ | 51.1 | |

| | | |

| Investing activities: | | | |

| Purchase of property and equipment | $ | 15.8 | | | $ | 23.9 | |

| Net cash provided by (used in) investing activities | $ | 15.8 | | | $ | 23.9 | |

| | | |

| Net increase (decrease) in cash, cash equivalents and restricted cash related to AOG credits recognized | $ | 57.1 | | | $ | 75.0 | |

| | | |

For the full year 2024 the Company estimates AOG credits to be issued by Pratt & Whitney in 2024 will benefit 2024 liquidity by approximately $150 million to $200 million. Through June 30, 2024, Pratt & Whitney has agreed to issue the Company $93.9 million in AOG credits, of which the Company has recognized $75.0 million. The difference remaining between the amount of credits Pratt & Whitney has agreed to issue and the amount the Company has recognized will be recognized in the future as reductions in the cost basis of goods and services purchased from Pratt & Whitney.

EXHIBIT 99.2

EXHIBIT 99.2

Investor Update as of August 1, 2024

The third quarter and full year 2024 estimates provided below are based on the current estimates of Spirit Airlines, Inc. ("Spirit" or the "Company") and are not a guarantee of future performance. There are significant risks and uncertainties that could cause actual results to differ materially, including the risk factors discussed in the Company's reports on file with the Securities and Exchange Commission. Spirit undertakes no duty to update any forward-looking statements or estimates.

The Company estimates its total revenue for the third quarter will range between $1,155 and $1,175 million. Significant industry capacity increases together with ancillary pricing changes in the competitive environment are making it difficult to drive increased yields. In addition, the Company has eliminated charging for change and cancellation fees which is expected to be a headwind to revenue per passenger segment on a year over year basis for at least the remainder of 2024.

As the Company executes on its transformation strategy, including the addition of premium leisure selections, it anticipates that over time it will be able to drive improvement in total revenue per segment.

On July 19, 2024, the Company canceled 470 flights as a result of the Crowdstrike IT outage.

The Company estimates the negative impact to third quarter operating income related to this operational disruption was $7.2 million, primarily due to lost revenue.

Based on the estimated number of cumulative days aircraft will be unavailable for operational service due to PW100G-JM geared turbo fan engine availability issues (“AOG”) during the third quarter 2024, the Company estimates it will earn credits of approximately $25.7 million and recognize approximately $8.6 million in its condensed consolidated statement of operations for the third quarter 2024.

Third quarter Adjusted Operating margin is estimated to range between negative 29.0 percent and negative 26.0 percent, which includes only the $8.6 million estimated AOG credits to be recognized in the condensed consolidated statement of operations for the third quarter 2024. Adjusting for the difference between AOG credits estimated to be earned and the estimated

AOG credit to be recognized through earnings, Adjusted operating margin adjusted for AOG credits for the third quarter 2024 is estimated to range between negative 27.5 percent to negative 24.5 percent.

The Company estimates it will end the year 2024 with over $1.0 billion of liquidity, including unrestricted cash and cash equivalents, short-term investment securities, liquidity available under its revolving credit facility and additional liquidity initiatives, assuming that we are able to close those initiatives that are currently in process.

| | | | | | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| 3Q24E | | | | | | | |

| Total revenues ($millions) | $1,155 to $1,175 | | | | | | | |

| | | | | | | | |

Adjusted Operating income (loss), non-GAAP ($millions)(1) | $(335) to $(305) | | | | | | | |

Adjusted Operating margin (%)(1) | (29.0)% to (26.0)% | | | | | | | |

| Add: Adj. for AOG credit ($millions) | $17.1 | | | | | | | |

Adj. Operating income (loss) adj. for AOG credits, non-GAAP ($millions)(2) | $(318) to $(288) | | | | | | | |

Adj. Operating margin adj. for AOG credits(2) | (27.5)% to (24.5)% | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

Fuel cost per gallon ($)(3) | $2.65 | | | | | | | |

| Fuel gallons (millions) | 145 | | | | | | | |

Total other (income) expense ($millions)(4) | $40.6 | | | | | | | |

Tax rate for adjusted income(5) | 22.6% | | | | | | | |

| Weighted average diluted share count (millions) | 109.5 | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| Capital expenditures ($millions) | Full Year 2024E |

| Pre-delivery deposits (refunds), net (6) | $ | (175) | | |

| Purchase of property and equipment | 155 | | |

Total capital expenditures ($millions)(7) | $ | (20) | | |

| | | | | | | | | | | | | | | | |

| | | 3Q24E | | FY24E | |

| Available seat miles % change vs. 2023 | | | (0.3)% | | flat to down low-single digits | |

|

Footnotes(1)Excludes special items, which may include loss on disposal of assets, special charges and credits and other items which are not estimable at this time.

(2)Excludes special items and adjusts for the difference between the AOG credits estimated to be received related to the AOG aircraft in the third quarter 2024 and the AOG credits estimated to be recognized in the Company’s operating statement for the third quarter 2024.

(3)Includes fuel taxes and into-plane fuel cost.

(4)Includes interest expense, capitalized interest, interest income and other income and expense.

(5)Based on the Company’s statutory tax rate.

(6)Excludes the impact of the July 30, 2024 Direct Lease and Pre-Delivery Payment transaction subject to evaluation of accounting presentation.

(7)Total capital expenditures assumes all new aircraft deliveries are either delivered under direct leases or financed through sale-leaseback transactions.

Forward Looking Statements

Forward-Looking Statements in this investor update and certain oral statements made from time to time by representatives of the Company contain various forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended (the "Securities Act"), and Section 21E of the Securities Exchange Act of 1934, as amended (the "Exchange Act") which are subject to the “safe harbor” created by those sections. Forward-looking statements are based on our management’s beliefs and assumptions and on information currently available to our management. All statements other than statements of historical facts are “forward-looking statements” for purposes of these provisions. In some cases, you can identify forward-looking statements by terms such as “may,” “will,” “should,” “could,” “would,” “expect,” “plan,” “anticipate,” “believe,” “estimate,” “project,” “predict,” “potential,” and similar expressions intended to identify forward-looking statements. Forward-looking statements include, without limitation, guidance for 2024 and statements regarding the Company's intentions and expectations regarding revenues, cash levels, capacity and passenger demand, additional financing, capital spending, operating costs and expenses, pre-tax income, pre-tax margin, taxes, hiring and furloughs, aircraft deliveries and stakeholders, negotiations and settlement with Pratt & Whitney regarding neo engine availability issues, resolving outstanding indebtedness, vendors and government support. Such forward-looking statements are subject to risks, uncertainties and other important factors that could cause actual results and the timing of certain events to differ materially from future results expressed or implied by such forward-looking statements. Factors include, among others, results of operations and financial condition, the competitive environment in our industry, our ability to keep costs low and the impact of worldwide economic conditions, including the impact of economic cycles or downturns on customer travel behavior and other factors, as described in the Company’s filings with the Securities and Exchange Commission, including the detailed factors discussed under the heading “Risk Factors” in the Company’s Annual Report on Form 10-K for the fiscal year ended December 31, 2023, as supplemented in the Company's Quarterly Report on Form 10-Q for the fiscal quarter ended March 31, 2024. Furthermore, such forward-looking statements speak only as of the date of this investor update. Except as required by law, we undertake no obligation to update any forward-looking statements to reflect events or circumstances after the date of such statements. Risks or uncertainties (i) that are not currently known to us, (ii) that we currently deem to be immaterial, or (iii) that could apply to any company, could also materially adversely affect our business, financial condition, or future results. Additional information concerning certain factors is contained in the Company's Securities and Exchange Commission filings, including but not limited to the Company's Annual Report on Form 10-K, Quarterly Reports on Form 10-Q, and Current Reports on Form 8-K.

Non-GAAP Financial Measures

The Company evaluates its financial performance utilizing various accounting principles generally accepted in the United States of America (“GAAP”) and non-GAAP financial measures, including Adjusted operating income (loss) and Adjusted operating margin. These non-GAAP financial measures are provided as supplemental information to the financial information presented in this investor update that is calculated and presented in accordance with GAAP and these non-GAAP financial measures are presented because management believes that they supplement or enhance management’s, analysts’ and investors’ overall understanding of the Company’s underlying financial performance and trends and facilitate comparisons among current, past and future periods.

Adjusted operating expenses and adjusted operating margin are non-GAAP financial measures, which are provided on a forward-looking basis. The Company does not provide a reconciliation of non-GAAP measures on a forward-looking basis where the Company believes such reconciliation would imply a degree of precision and certainty that could be confusing to investors and is unable to reasonably predict certain items included in/excluded from the GAAP financial measures without unreasonable efforts. This is due to the inherent difficulty of forecasting the timing or amount of various items that have not yet occurred and are out of the Company’s control or cannot be reasonably predicted. For the same reasons, the Company is unable to address the probable significance of the unavailable information. Forward-looking non-GAAP measures provided without the most directly comparable GAAP financial measures may vary materially from the corresponding GAAP financial measures. Investors are encouraged to read this investor update in conjunction with the Company's Earnings Release which provides additional information about the Company's non-GAAP financial measures and is included along with this investor update in the Current Report on Form 8-K furnished to the U.S. Securities and Exchange Commission. The Earnings Release is also available at https://ir.spirit.com.

EXHIBIT 99.3 A319 CEO A320 CEO A320 NEO A321 CEO A321 NEO Total 19 64 84 30 8 205 1Q24 (5) — 3 — 4 2 2Q24 (5) — 4 — 4 3 3Q24 (1) — — — 7 6 4Q24 (6) — — — 5 (1) 2 64 91 30 28 215 1Q25 — — — — 4 4 2Q25 (2) — — — 1 (1) 3Q25 — — — — 1 1 4Q25 — — — — — — — 64 91 30 34 219 — 64 91 30 34 219 Note: (1) Seat Configurations Seats 145 182/182 228/235 Spirit Airlines, Inc. Fleet Plan as of August 1, 2024 A321 CEO/NEO Total Aircraft Year-end 2023 (1) Total Aircraft Year-end 2024 (1) Aircraft Type A319 CEO Total Aircraft Year-end 2025 (1) A320 CEO/NEO Includes the exit of A319ceo aircraft. Does not include A320/A321 aircraft lease expirations. Total Aircraft Year-end 2026 (1)

v3.24.2.u1

Cover Page

|

Aug. 01, 2024 |

| Cover page. [Abstract] |

|

| Document Type |

8-K

|

| Document Period End Date |

Aug. 01, 2024

|

| Entity Registrant Name |

SPIRIT AIRLINES, INC.

|

| Entity Incorporation, State or Country Code |

DE

|

| Entity File Number |

001-35186

|

| Entity Tax Identification Number |

38-1747023

|

| Entity Address, Address Line One |

1731 Radiant Drive

|

| Entity Address, City or Town |

Dania Beach,

|

| Entity Address, State or Province |

FL

|

| Entity Address, Postal Zip Code |

33004

|

| City Area Code |

954

|

| Local Phone Number |

447-7920

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Common Stock, $0.0001 par value

|

| Trading Symbol |

SAVE

|

| Security Exchange Name |

NYSE

|

| Entity Emerging Growth Company |

false

|

| Entity Central Index Key |

0001498710

|

| Amendment Flag |

false

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

save_Coverpage.Abstract |

| Namespace Prefix: |

save_ |

| Data Type: |

xbrli:stringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

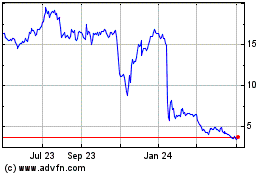

Spirit Airlines (NYSE:SAVE)

Historical Stock Chart

From Nov 2024 to Dec 2024

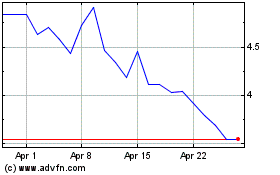

Spirit Airlines (NYSE:SAVE)

Historical Stock Chart

From Dec 2023 to Dec 2024