2nd UPDATE: Frac Sand Miner U.S. Silica Trades Down Post-IPO

February 01 2012 - 4:52PM

Dow Jones News

The sand used in oil and gas well fract7uring didn't cause much

excitement among investors Wednesday, with shares of U.S. Silica

Holdings Inc. (SLCA) declining on their first day of trading.

The company's stock closed at $16 on the New York Stock

Exchange, down 5.9% from its initial-public-offering price of $17.

A total of 11.8 million shares were sold at the midpoint of its

$16-to-$18 price range.

Two other offerings expected to begin trading Wednesday,

biopharmaceutical developer Merrimack Pharmaceuticals Inc. and oil

and gas production company Dynamic Offshore Resources Inc., were

postponed after failing to price Tuesday night.

U.S. Silica specializes in commercial silica--essentially,

sand--that is used in a variety of industries, the most prominent

being oil and gas. The company's "frac sand" is used to stimulate

oil and gas wells that are in shale formations, and it claims to be

one of the few commercial producers capable of rail delivery of

large quantities of the material to each of the major U.S. shale

basins.

Strong demand for frac sand has led U.S. Silica to invest in

expanding its production by 75% over 2010 levels and to build a new

facility that makes resin-coated sand, another area of market

growth. The company plans to use a portion of its IPO process to

help build the facility and to fund future capital spending at the

firm.

Demand for the company's IPO was said to be strong ahead of the

launch, and company President and Chief Executive Bryan A. Shinn

said the offering was well oversubscribed, with an enthusiastic

reception from attendees at road shows.

"We think a lot of (the stock's initial trading performance) has

to do with technical trading issues," said Shinn during a telephone

interview with Dow Jones. "We believe it was well-priced in the

middle of the range. The stock is not something we are going to

watch on a minute-by-minute basis."

U.S. Silica is the second-largest domestic producer of

commercial silica, and while frac sand accounts for nearly half of

its business, the company also makes silica for glassmaking,

chemical manufacturing, solar panels, wind turbines, specialty

coatings and geothermal energy systems.

U.S. Silica says it has a low-cost operating structure because

it owns most of its sand reserves and locates its processing

facilities close to its mines. It expects demand to rise for its

frac sand as more horizontal wells are drilled using fracturing

techniques, well length increases due to advances in drill

technology, and more frac sand is used per foot.

Silica prices increased at an average annual rate of 9% between

2000 and 2009; if demand for frac sand continues to rise, and if

the general economic recovery continues to result in increased

demand from other industries, U.S. Silica expects prices to go even

higher.

In the first nine months of 2011, sales increased 14% to $212

million, and profit more than doubled to $20 million.

The company's growth through frac sand isn't without its risks.

If oil prices contract, high-tech hydraulic methods to drill wells

in shale may prove too expensive, and demand for frac sand would

fall. Other methods that use different materials to stimulate wells

could replace frac sand.

Three-quarters of U.S. Silica's IPO shares were sold by previous

owners, so the company won't receive those proceeds. The major

seller was private equity firm Golden Gate Capital.

Morgan Stanley (MS), Bank of America Merrill Lynch and Jefferies

Group Inc. (JEF) were joint bookrunners on U.S. Silica's

offering.

-By Lynn Cowan, Dow Jones Newswires; 301-270-0323;

lynn.cowan@dowjones.com

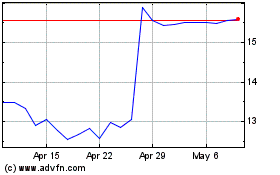

Silica (NYSE:SLCA)

Historical Stock Chart

From Jun 2024 to Jul 2024

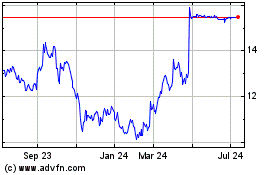

Silica (NYSE:SLCA)

Historical Stock Chart

From Jul 2023 to Jul 2024