0001862068

false

0001862068

2023-08-08

2023-08-08

0001862068

rbt:ClassCommonStockParValue0.0001PerShareMember

2023-08-08

2023-08-08

0001862068

rbt:WarrantsEachExercisableForOneShareOfClassCommonStockAtExercisePriceOf11.50PerShareMember

2023-08-08

2023-08-08

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM 8-K

CURRENT

REPORT

PURSUANT

TO SECTION 13 OR 15(d)

OF

THE SECURITIES EXCHANGE ACT OF 1934

Date

of Report (Date of earliest event reported): August 8, 2023

Rubicon Technologies, Inc.

(Exact

name of registrant as specified in its charter)

| Delaware |

|

001-40910 |

|

88-3703651 |

(State or other jurisdiction

of incorporation) |

|

(Commission

File Number) |

|

(IRS Employer

Identification No.) |

335 Madison Ave, Floor Four

New York, NY |

|

10017 |

| (Address of principal

executive offices) |

|

(Zip Code) |

(844)

479-1507

(Registrant’s

telephone number, including area code)

Not

Applicable

(Former

name or former address, if changed since last report)

Check

the appropriate box below if the Form 8-K is intended to simultaneously satisfy the filing obligation of the registrant under any

of the following provisions:

| ☐ |

Written communications

pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

|

| ☐ |

Soliciting material pursuant

to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

|

| ☐ |

Pre-commencement communications

pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

|

| ☐ |

Pre-commencement communications

pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities

registered pursuant to Section 12(b) of the Act:

| Title

of each class |

|

Trading

Symbol(s) |

|

Name

of each exchange on which registered |

| Class

A common stock, par value $0.0001 per share |

|

RBT |

|

New York Stock Exchange |

| Warrants,

each exercisable for one share of Class A common stock at an exercise price of $11.50 per share |

|

RBT

WS |

|

New York Stock Exchange |

Indicate

by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405

of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging

growth company ☒

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act.

Item 2.02.

Results of Operations and Financial Condition.

On

August 8, 2023, Rubicon Technologies, Inc. issued a press release that announced earnings results for the fiscal quarter ended June 30,

2023. The press release is attached hereto as Exhibit 99.1.

The

information in Item 2.02 of this report and the exhibit attached hereto is being furnished and shall not be deemed “filed”

for purposes of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), nor shall it be deemed incorporated

by reference into any registration statement or other filing under the Securities Act of 1933, as amended, or the Exchange Act, except

as shall be expressly set forth by specific reference to such filing.

Item 9.01.

Financial Statements and Exhibits.

(d)

Exhibits.

SIGNATURES

Pursuant

to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by

the undersigned hereunto duly authorized.

| Rubicon Technologies,

Inc. |

|

| |

|

| By: |

/s/

Philip Rodoni |

|

| |

Name: |

Philip Rodoni |

|

| |

Title: |

Chief Executive Officer |

|

Date:

August 8, 2023

Exhibit

99.1

Rubicon

Reports Second Quarter 2023 Financial Results

Rubicon

achieves second consecutive quarter of record Gross Profit at approximately $12 million, more than double Gross Profit in the second

quarter of 2022. The Company remains on track to achieve positive Adjusted EBITDA for Q4 2023.

New

York, NY – August 8, 2023 – Rubicon Technologies, Inc. (“Rubicon” or the “Company”) (NYSE:

RBT), a leading provider of software-based waste, recycling, and fleet operations products for businesses and governments worldwide,

today reported financial and operational results for the second quarter of 2023.

Second

Quarter 2023 Financial Highlights

| ● | Revenue

was approximately $174.6 million, an increase of $10.0 million or 6.0% compared to $164.6

million in the second quarter of 2022. |

| ● | Gross

profit was $11.8 million, an increase of $6.3 million or 116.1% compared to $5.5 million

in the second quarter of 2022. |

| ● | Adjusted

Gross Profit was approximately $17.9 million, an increase of $5.3 million or 41.4% compared

to $12.7 million in the second quarter of 2022. |

| ● | Gross

Profit Margin was 6.8%, an increase of 340 bps compared to 3.3% in the second quarter of

2022. |

| ● | Adjusted

Gross Profit Margin was 10.3%, an increase of 260 bps compared to 7.7% in the second quarter

of 2022. |

| ● | Net

loss was $(22.8) million, an improvement of $5.0 million compared to $(27.8) million in the

second quarter of 2022. |

| ● | Adjusted

EBITDA was a negative $(9.7) million, an improvement of $9.2 million compared to $(18.9)

million in the second quarter of 2022. |

Operational

and Business Highlights

| ● | Rubicon

announced a new, 3-year partnership with Denver, Colorado in June. RUBICONSmartCity™

technology is now powering the City and County of Denver’s entire solid waste and recycling

fleet of more than 150 vehicles, digitizing operations and enabling greater efficiency. |

| ● | The

Company also announced that RUBICONSmartCity has been successfully deployed in more than

100 cities, including eight of the top 20 U.S. cities by population. This milestone was achieved

in just 6 years, with city adoption doubling year-over-year over the last few years. |

| ● | RUBICONConnect™

continues to expand with the addition of, among others, True Food Kitchen and Artisent Floors

to the platform. Both companies will experience the full benefits of Rubicon’s digital

platform for scalable waste and recycling services which supports their efforts to reduce

environmental impact while providing exceptional value and service to their own customers. |

| ● | The

Company also secured some notable customer renewals, including a new 5-year extension with

Gap, Inc. RUBICONConnect has been deployed at more than 2,000 Gap retail stores across the

United States and Canada, including at all of Gap’s lifestyle brands and Gap Outlet

and Banana Republic Factory locations. Additionally, Goodyear Tires renewed their contract

with Rubicon for a further two years. RUBICONConnect is deployed at more than 800 Goodyear

retail and commercial locations across the United States. |

“We

are excited to announce our second quarter 2023 results, which include a second consecutive quarter of record Adjusted Gross Profit.

This outstanding performance is the result of our team’s diligent execution of our Bridge to Profitability plan, and I am pleased

to report that we remain on target to achieve positive Adjusted EBITDA for the fourth quarter of this year,” said Phil Rodoni,

Chief Executive Officer of Rubicon. “With a solid foundation in place, we are now focused on growth and driving even greater results

for the Company and our valued customers.”

Second

Quarter Review

Total Revenue in the second quarter of 2023 was approximately $174.6 million, an increase of $10.0 million or 6.0%, compared

to the second quarter of 2022. This growth was driven primarily by strength in the RUBICONConnect business, as well as continued growth

of the SaaS business.

Gross

profit for the second quarter of 2023 was $11.8 million, an increase of $6.3 million or 116.1% compared to $5.5 million in the second quarter

of 2022. The growth in gross profit was supported by an increase in the RUBICONConnect business and growth of the SaaS business.

Adjusted

Gross Profit in the second quarter of 2023 was approximately $17.9 million, an increase of $5.3 million or 41.4% compared to the second

quarter of 2022. The increase in Adjusted Gross Profit was primarily due to positive impacts from actions taken to enhance margins in

the RUBICONConnect business and growth in SaaS products.

Net

Loss in the second quarter of 2023 was $(22.8) million, an improvement of $5.0 million compared to a Net Loss of $(27.8) million in the

second quarter of 2022.

Adjusted

EBITDA for the second quarter of 2023 was negative $(9.7) million, an improvement of approximately $9.2 million or a reduction of approximately

half of the loss of $(18.9) million in the second quarter of 2022.

Strategic

Progress

Moving forward, the Company will remain focused on reaching profitability, making improvements in its leading digital platform

and suite of products, and executing its strategic plan in order to achieve its next phase of growth. Having accomplished its initial

foundational objectives, Rubicon can now focus on driving profitable growth through customer wallet share expansion, new product offerings,

and improved operational efficiency. The Company will provide updates on these efforts in the coming quarters.

Webcast

Information

The Rubicon Technologies management team will host a conference call to discuss its second quarter 2023 financial results

this afternoon, Tuesday, August 8, 2023, at 5:00 p.m. ET. The call can be accessed via telephone by dialing (929) 203-2112, or toll

free at (888) 660-6863, and referencing Rubicon Technologies. A live webcast of the conference will also be available on the Events and

Presentations page on the Investor Relations section of Rubicon’s website (https://investors.rubicon.com/events-presentations/default.aspx).

Please log in to the webcast or dial in to the call at least 10 minutes prior to the start of the event.

About

Rubicon

Rubicon Technologies, Inc. (NYSE: RBT) is a leading provider of software-based waste, recycling, and fleet operations products

for businesses and governments worldwide. Striving to create a new industry standard by using technology to drive environmental innovation,

the Company helps turn businesses into more sustainable enterprises, and neighborhoods into greener and smarter places to live and work.

Rubicon’s mission is to end waste. It helps its partners find economic value in their waste streams and confidently execute on

their sustainability goals. To learn more, visit rubicon.com.

Non-GAAP

Financial Measures

This earnings release contains “non-GAAP financial measures,” including Adjusted Gross Profit, Adjusted

Gross Profit Margin and Adjusted EBITDA, which are supplemental financial measures that are not calculated or presented in accordance

with generally accepted accounting principles (GAAP). Such non-GAAP financial measures should not be considered superior to, as a substitute

for or alternative to, and should be considered in conjunction with, the GAAP financial measures presented in this earnings release.

The non-GAAP financial measures in this earnings release may differ from similarly titled measures used by other companies. Definitions

of these non-GAAP financial measures, including explanations of the ways in which Rubicon’s management uses these non-GAAP measures

to evaluate its business, the substantive reasons why Rubicon’s management believes that these non-GAAP measures provide useful

information to investors and limitations associated with the use of these non-GAAP measures, are included under “Use of Non-GAAP

Financial Measures” after the tables below. In addition, reconciliations of these non-GAAP financial measures to the most directly

comparable GAAP financial measures are included under “Reconciliations of Non-GAAP Financial Measures” after the tables below.

Forward-Looking

Statements

This press release includes “forward-looking statements” within the meaning of the “safe harbor”

provisions of the United States Private Securities Litigation Reform Act of 1995 and within the meaning of Section 27A of the Securities

Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. All statements, other than statements

of present or historical fact included in this press release, are forward-looking statements. When used in this press release, the words

“could,” “should,” “will,” “may,” “believe,” “anticipate,” “intend,”

“estimate,” “expect,” “project,” the negative of such terms and other similar expressions are intended

to identify forward-looking statements, although not all forward-looking statements contain such identifying words. Such forward-looking

statements are subject to risks, uncertainties, and other factors which could cause actual results to differ materially from those expressed

or implied by such forward-looking statements. These forward-looking statements are based upon current expectations, estimates, projections,

and assumptions that, while considered reasonable by Rubicon and its management, are inherently uncertain; factors that may cause actual

results to differ materially from current expectations include, but are not limited to: 1) the outcome of any legal proceedings that

may be instituted against Rubicon or others following the closing of the business combination; 2) Rubicon’s ability to meet the

New York Stock Exchange’s listing standards following the consummation of the business combination; 3) the risk that the business

combination disrupts current plans and operations of Rubicon as a result of consummation of the business combination; 4) the ability

to recognize the anticipated benefits of the business combination, which may be affected by, among other things, the ability of the combined

company to grow and manage growth profitably, maintain relationships with customers and suppliers and retain its management and key employees;

5) costs related to the business combination; 6) changes in applicable laws or regulations; 7) the possibility that Rubicon may be adversely

affected by other economic, business and/or competitive factors, including the impacts of the COVID-19 pandemic, geopolitical conflicts,

such as the conflict between Russia and Ukraine, the effects of inflation and potential recessionary conditions; 8) Rubicon’s execution

of anticipated operational efficiency initiatives, cost reduction measures and financing arrangements; and 9) other risks and uncertainties

set forth in the sections entitled “Risk Factors” and “Cautionary Note Regarding Forward-Looking Statements”

in the Company’s Annual Report on Form 10-K, Registration Statement on Form S-1, as amended, filed with the SEC, and other

documents Rubicon has filed with the SEC. Although Rubicon believes the expectations reflected in the forward-looking statements are

reasonable, nothing in this press release should be regarded as a representation by any person that the forward-looking statements set

forth herein will be achieved or that any of the contemplated results of such forward looking statements will be achieved. There may

be additional risks that Rubicon presently does not know of or that Rubicon currently believes are immaterial that could also cause actual

results to differ from those contained in the forward-looking statements, many of which are beyond Rubicon’s control. You should

not place undue reliance on forward-looking statements, which speak only as of the date they are made. Rubicon does not undertake, and

expressly disclaims, any duty to update these forward-looking statements, except as otherwise required by applicable law.

RUBICON

TECHNOLOGIES, INC. AND SUBSIDIARIES

CONDENSED

CONSOLIDATED STATEMENTS OF OPERATIONS (UNAUDITED)

(in

thousands, except per share data)

| | |

Three Months Ended

June 30, | | |

Six Months Ended

June 30, | |

| | |

2023 | | |

2022 | | |

2023 | | |

2022 | |

| Revenue: | |

| | | |

| | | |

| | | |

| | |

| Service | |

$ | 160,641 | | |

$ | 140,268 | | |

$ | 327,006 | | |

$ | 274,966 | |

| Recyclable commodity | |

| 13,923 | | |

| 24,338 | | |

| 28,656 | | |

| 49,446 | |

| Total revenue | |

| 174,564 | | |

| 164,606 | | |

| 355,662 | | |

| 324,412 | |

| Costs and Expenses: | |

| | | |

| | | |

| | | |

| | |

| Cost of revenue exclusive of amortization and depreciation: | |

| | | |

| | | |

| | | |

| | |

| Service | |

| 150,194 | | |

| 136,185 | | |

| 308,195 | | |

| 265,878 | |

| Recyclable commodity | |

| 11,968 | | |

| 22,386 | | |

| 25,155 | | |

| 45,622 | |

| Total cost of revenue exclusive of amortization and depreciation | |

| 162,162 | | |

| 158,571 | | |

| 333,350 | | |

| 311,500 | |

| Sales and marketing | |

| 2,747 | | |

| 4,546 | | |

| 6,021 | | |

| 8,496 | |

| Product development | |

| 7,224 | | |

| 9,315 | | |

| 15,316 | | |

| 18,533 | |

| General and administrative | |

| 13,932 | | |

| 13,253 | | |

| 32,079 | | |

| 25,880 | |

| Gain on settlement of incentive compensation | |

| - | | |

| - | | |

| (18,622 | ) | |

| - | |

| Amortization and depreciation | |

| 1,344 | | |

| 1,402 | | |

| 2,705 | | |

| 2,892 | |

| Total Costs and Expenses | |

| 187,409 | | |

| 187,087 | | |

| 370,849 | | |

| 367,301 | |

| Loss from Operations | |

| (12,845 | ) | |

| (22,481 | ) | |

| (15,187 | ) | |

| (42,889 | ) |

| | |

| | | |

| | | |

| | | |

| | |

| Other Income Expense: | |

| | | |

| | | |

| | | |

| | |

| Interest earned | |

| 5 | | |

| - | | |

| 6 | | |

| - | |

| Loss on change in fair value of warrant liabilities | |

| (414 | ) | |

| (232 | ) | |

| (469 | ) | |

| (510 | ) |

| Gain on change in fair value of earnout liabilities | |

| 470 | | |

| - | | |

| 5,290 | | |

| - | |

| Loss on change in fair value of derivatives | |

| (335 | ) | |

| - | | |

| (2,533 | ) | |

| - | |

| | |

| | | |

| | | |

| | | |

| | |

| Excess fair value over the consideration received for SAFE | |

| - | | |

| (800 | ) | |

| - | | |

| (800 | ) |

| Gain on service fee settlements in connection with the Mergers | |

| 6,364 | | |

| - | | |

| 6,996 | | |

| - | |

| Loss on extinguishment of debt obligations | |

| (6,783 | ) | |

| - | | |

| (8,886 | ) | |

| - | |

| Interest expense | |

| (8,119 | ) | |

| (3,911 | ) | |

| (15,295 | ) | |

| (7,686 | ) |

| Related party interest expense | |

| (661 | ) | |

| - | | |

| (1,254 | ) | |

| - | |

| Other expense | |

| (482 | ) | |

| (357 | ) | |

| (903 | ) | |

| (687 | ) |

| Total Other Income Expense | |

| (9,955 | ) | |

| (5,300 | ) | |

| (17,048 | ) | |

| (9,683 | ) |

| Loss Before Income Taxes | |

| (22,800 | ) | |

| (27,781 | ) | |

| (32,235 | ) | |

| (52,572 | ) |

| | |

| | | |

| | | |

| | | |

| | |

| Income tax expense benefit | |

| 17 | | |

| 13 | | |

| 33 | | |

| 41 | |

| Net Loss | |

$ | (22,817 | ) | |

$ | (27,794 | ) | |

$ | (32,268 | ) | |

$ | (52,613 | ) |

| | |

| | | |

| | | |

| | | |

| | |

| Net loss attributable to Holdings LLC unitholders prior to the Mergers | |

| - | | |

| (27,794 | ) | |

| - | | |

| (52,613 | ) |

| Net loss attributable to noncontrolling interests | |

| (9,615 | ) | |

| - | | |

| (15,937 | ) | |

| - | |

| Net Loss Attributable to Class A Common Stockholders | |

$ | (13,202 | ) | |

| - | | |

$ | (16,331 | ) | |

| - | |

| | |

| | | |

| | | |

| | | |

| | |

| Loss per share - for the three months ended June 30, 2023: | |

| | | |

| | | |

| | | |

| | |

| Net loss per Class A Common share – basic and diluted | |

| | | |

| | | |

| | | |

| (0.12 | ) |

| Weighted average shares outstanding, basic and diluted | |

| | | |

| | | |

| | | |

| 106,211,259 | |

| | |

| | | |

| | | |

| | | |

| | |

| Loss per share - for the six months ended June 30, 2023: | |

| | | |

| | | |

| | | |

| | |

| Net loss per Class A Common share – basic and diluted | |

| | | |

| | | |

| | | |

| (0.20 | ) |

| Weighted average shares outstanding, basic and diluted | |

| | | |

| | | |

| | | |

| 82,943,357 | |

As

a result of the Mergers with Founder SPAC consummated on August 15, 2022 (the “Closing Date”), the capital structure

has changed and loss per share information is only presented for the period after the Closing Date of the Mergers.

RUBICON

TECHNOLOGIES, INC. AND SUBSIDIARIES

CONDENSED

CONSOLIDATED BALANCE SHEETS (UNAUDITED)

(in

thousands)

| | |

June 30, | | |

December 31, | |

| | |

2023 | | |

2022 | |

| ASSETS | |

| | | |

| | |

| Current Assets: | |

| | | |

| | |

| Cash and cash equivalents | |

$ | 23,516 | | |

$ | 10,079 | |

| Accounts receivable, net | |

| 66,323 | | |

| 65,923 | |

| Contract assets | |

| 51,321 | | |

| 55,184 | |

| Prepaid expenses | |

| 15,624 | | |

| 10,466 | |

| Other current assets | |

| 1,970 | | |

| 2,109 | |

| Related-party notes receivable | |

| - | | |

| 7,020 | |

| Total Current Assets | |

| 158,754 | | |

| 150,781 | |

| | |

| | | |

| | |

| Property and equipment, net | |

| 2,569 | | |

| 2,644 | |

| Operating right-of-use assets | |

| 2,205 | | |

| 2,827 | |

| Other noncurrent assets | |

| 2,505 | | |

| 4,764 | |

| Goodwill | |

| 32,132 | | |

| 32,132 | |

| Intangible assets, net | |

| 9,270 | | |

| 10,881 | |

| Total Assets | |

$ | 207,435 | | |

$ | 204,029 | |

| | |

| | | |

| | |

| LIABILITIES AND MEMBERS’ (DEFICIT) EQUITY | |

| | | |

| | |

| Current Liabilities: | |

| | | |

| | |

| Accounts payable | |

$ | 72,032 | | |

$ | 75,113 | |

| Line of credit | |

| 46,198 | | |

| 51,823 | |

| Accrued expenses | |

| 66,047 | | |

| 108,002 | |

| Deferred compensation | |

| - | | |

| - | |

| Contract liabilities | |

| 7,397 | | |

| 5,888 | |

| Operating lease liabilities, current | |

| 1,871 | | |

| 1,880 | |

| Warrant liabilities | |

| 29,795 | | |

| 20,890 | |

| Derivative liabilities, current | |

| 7,915 | | |

| - | |

| Debt obligations, net of debt issuance costs | |

| 9,456 | | |

| 3,771 | |

| Total Current Liabilities | |

| 240,711 | | |

| 267,367 | |

| | |

| | | |

| | |

| Long-Term Liabilities: | |

| | | |

| | |

| Deferred income taxes | |

| 235 | | |

| 217 | |

| Operating lease liabilities, noncurrent | |

| 903 | | |

| 1,826 | |

| Debt obligations, net of debt issuance costs | |

| 70,820 | | |

| 69,458 | |

| Related-party debt obligations, net of debt issuance costs | |

| 16,161 | | |

| 10,597 | |

| Derivative liabilities, noncurrent | |

| 7,133 | | |

| 826 | |

| Earn-out liabilities | |

| 310 | | |

| 5,600 | |

| Other long-term liabilities | |

| - | | |

| 2,590 | |

| Total Long-Term Liabilities | |

| 95,562 | | |

| 91,114 | |

| Total Liabilities | |

| 336,273 | | |

| 358,481 | |

| | |

| | | |

| | |

| Commitments and Contingencies | |

| | | |

| | |

| | |

| | | |

| | |

| Stockholders’ (Deficit) Equity: | |

| | | |

| | |

| Common stock – Class A, par value of $0.0001 per share, 690,000,000 shares authorized, 229,818,370 and 55,886,692 shares issued and outstanding as of June 30, 2023 and December 31, 2022, respectively | |

| 23 | | |

| 6 | |

| Common stock – Class V, par value of $0.0001 per share, 275,000,000 shares authorized, 35,402,821 and 115,463,646 shares issued and outstanding as of June 30, 2023 and December 31, 2022, respectively | |

| 4 | | |

| 12 | |

| Preferred stock – par value of $0.0001 per share, 10,000,000 shares authorized, 0 issued and outstanding as of June 30, 2023 and December 31, 2022, respectively | |

| - | | |

| - | |

| Additional paid-in capital | |

| 92,532 | | |

| 34,658 | |

| Accumulated deficit | |

| (354,207 | ) | |

| (337,875 | ) |

| Total stockholders’ deficit attributable to Rubicon Technologies, Inc. | |

| (261,648 | ) | |

| (303,199 | ) |

| Noncontrolling interests | |

| 132,810 | | |

| 148,747 | |

| Total Stockholders’ Deficit | |

| (128,838 | ) | |

| (154,452 | ) |

| Total Liabilities and Stockholders’ (Deficit) Equity | |

$ | 207,435 | | |

$ | 204,029 | |

RUBICON

TECHNOLOGIES, INC. AND SUBSIDIARIES

CONDENSED

CONSOLIDATED STATEMENTS OF CASH FLOWS (UNAUDITED)

(in

thousands)

| | |

Six Months Ended | |

| | |

June 30, | |

| | |

2023 | | |

2022 | |

| Cash flows from operating activities: | |

| | | |

| | |

| Net loss | |

$ | (32,268 | ) | |

$ | (52,613 | ) |

| Adjustments to reconcile net loss to net cash flows from operating activities: | |

| | | |

| | |

| Loss on disposal of property and equipment | |

| 13 | | |

| 21 | |

| Amortization and depreciation | |

| 2,705 | | |

| 2,899 | |

| Amortization of debt issuance costs | |

| 3,338 | | |

| 1,663 | |

| Amortization of related party debt issuance costs | |

| 504 | | |

| - | |

| Paid-in-kind interest capitalized to principal of debt obligations | |

| 3,473 | | |

| - | |

| Paid-in-kind interest capitalized to principal of related party debt obligations | |

| 641 | | |

| - | |

| Bad debt reserve | |

| 1,398 | | |

| (2,467 | ) |

| Loss on change in fair value of warrants | |

| 469 | | |

| 510 | |

| Loss on change in fair value of derivatives | |

| 2,533 | | |

| - | |

| Gain on change in fair value of earn-out liabilities | |

| (5,290 | ) | |

| - | |

| Loss on extinguishment of debt obligations | |

| 8,886 | | |

| - | |

| Excess fair value over the consideration received for SAFE | |

| - | | |

| 800 | |

| Equity-based compensation | |

| 11,106 | | |

| 184 | |

| Phantom unit expense | |

| - | | |

| 4,570 | |

| Settlement of accrued incentive compensation | |

| (26,826 | ) | |

| - | |

| Service fees settled in common stock | |

| 3,808 | | |

| - | |

| Gain on service fee settlement in connection with the Mergers | |

| (6,996 | ) | |

| - | |

| Deferred income taxes | |

| 18 | | |

| 40 | |

| Change in operating assets and liabilities: | |

| | | |

| | |

| Accounts receivable | |

| (1,798 | ) | |

| (2,471 | ) |

| Contract assets | |

| 3,863 | | |

| (5,159 | ) |

| Prepaid expenses | |

| (2,668 | ) | |

| 225 | |

| Other current assets | |

| 95 | | |

| (204 | ) |

| Operating right-of-use assets | |

| 622 | | |

| 522 | |

| Other noncurrent assets | |

| (163 | ) | |

| 46 | |

| Accounts payable | |

| (3,081 | ) | |

| 21,476 | |

| Accrued expenses | |

| (588 | ) | |

| 14,510 | |

| Contract liabilities | |

| 1,509 | | |

| 87 | |

| Operating lease liabilities | |

| (932 | ) | |

| (1,011 | ) |

| Other liabilities | |

| (1,680 | ) | |

| 100 | |

| Net cash flows from operating activities | |

| (37,309 | ) | |

| (16,272 | ) |

| | |

| | | |

| | |

| Cash flows from investing activities: | |

| | | |

| | |

| Property and equipment purchases | |

| (628 | ) | |

| (685 | ) |

| Net cash flows from investing activities | |

| (628 | ) | |

| (685 | ) |

| | |

| | | |

| | |

| Cash flows from financing activities: | |

| | | |

| | |

| Net (payments) borrowings on line of credit | |

| (5,625 | ) | |

| 11,510 | |

| Proceeds from debt obligations | |

| 86,226 | | |

| - | |

| Repayments of debt obligations | |

| (53,500 | ) | |

| (3,000 | ) |

| Proceeds from related party debt obligations | |

| 14,520 | | |

| - | |

| Financing costs paid | |

| (13,916 | ) | |

| (2,000 | ) |

| Proceeds from issuance of common stock | |

| 24,767 | | |

| - | |

| Proceeds from SAFE | |

| - | | |

| 8,000 | |

| Payments of deferred offering costs | |

| - | | |

| (1,288 | ) |

| Equity issuance costs | |

| (31 | ) | |

| - | |

| RSUs withheld to pay taxes | |

| (1,067 | ) | |

| - | |

| Net cash flows from financing activities | |

| 51,374 | | |

| 13,222 | |

| | |

| | | |

| | |

| Net change in cash and cash equivalents | |

| 13,437 | | |

| (3,735 | ) |

| Cash, beginning of period | |

| 10,079 | | |

| 10,617 | |

| Cash, end of period | |

$ | 23,516 | | |

$ | 6,882 | |

| | |

| | | |

| | |

| Supplemental disclosure of cash flow information: | |

| | | |

| | |

| Cash paid for interest | |

$ | 7,010 | | |

$ | 5,940 | |

| Deferred offering costs recognized in accounts payable | |

$ | - | | |

$ | 1,837 | |

| | |

| | | |

| | |

| Supplemental disclosures of non-cash investing and financing activities: | |

| | | |

| | |

| Exchange of warrant liabilities for common stock | |

$ | 1,050 | | |

$ | - | |

| Fair value of derivatives issued as debt discount | |

$ | 475 | | |

$ | - | |

| Fair value of derivatives issued as debt issuance cost | |

$ | 12,264 | | |

$ | - | |

| Conversions of debt obligations to common stock | |

$ | 5,500 | | |

$ | - | |

| Conversions of related-party debt obligations to common stock | |

| 3,080 | | |

| - | |

| Equity issuance costs waived | |

$ | 6,364 | | |

$ | - | |

| Equity issuance costs settled with common stock | |

$ | 7,069 | | |

$ | - | |

| Loan commitment asset reclassed to debt discount | |

$ | 2,062 | | |

$ | - | |

Use

of Non-GAAP Financial Measures

Adjusted

Gross Profit and Adjusted Gross Profit Margin

Adjusted

Gross Profit and Adjusted Gross Profit Margin are considered non-GAAP financial measures under the rules of the U.S. Securities and Exchange

Commission (the “SEC”) because they exclude, respectively, certain amounts included in Gross Profit and Gross Profit Margin

calculated in accordance with GAAP. Specifically, the Company calculates Adjusted Gross Profit by adding back amortization and depreciation

for revenue generating activities and platform support costs to GAAP Gross Profit, the most comparable GAAP measure. Adjusted Gross Profit

Margin is calculated as Adjusted Gross Profit divided by total GAAP revenue. The Company believes presenting Adjusted Gross Profit and

Adjusted Gross Profit Margin is useful to investors because they show the progress in scaling Rubicon’s digital platform by quantifying

the markup and margin the Company charges its customers that are incremental to its marketplace vendor costs. These measures demonstrate

this progress because changes in these measures are driven primarily by the Company’s ability to optimize services for its customers,

improve its hauling and recycling partners’ efficiency and achieve economies of scale on both sides of the marketplace. Rubicon’s

management team uses these non-GAAP measures as one of the means to evaluate the profitability of the Company’s customer accounts,

exclusive of certain costs that are generally fixed in nature, and to assess how successful the Company is in achieving its pricing strategies.

However, it is important to note that other companies, including companies in our industry, may calculate and use these measures differently

or not at all, which may reduce their usefulness as a comparative measure. Further, these measures should not be read in isolation from

or without reference to our results prepared in accordance with GAAP.

Adjusted

EBITDA

Adjusted

EBITDA is considered a non-GAAP financial measure under the rules of the SEC because it excludes certain amounts included in net loss

calculated in accordance with GAAP. Specifically, the Company calculates Adjusted EBITDA by GAAP net loss adjusted to exclude interest

expense and income, income tax expense and benefit, amortization and depreciation, gain or loss on extinguishment of debt obligations,

equity-based compensation, phantom unit expense, gain or loss on change in fair value of warrant liabilities, gain or loss on change

in fair value of earn-out liabilities, gain or loss on change in fair value of derivatives, executive severance charges, gain or loss

on settlement of the Management Rollover Bonuses, gain or loss on service fee settlements in connection with the Mergers, other non-operating

income and expenses, and unique non-recurring income and expenses.

The

Company has included Adjusted EBITDA because it is a key measure used by Rubicon’s management team to evaluate its operating performance,

generate future operating plans, and make strategic decisions, including those relating to operating expenses. Further, the Company believes

Adjusted EBITDA is helpful in highlighting trends in Rubicon’s operating results because it allows for more consistent comparisons

of financial performance between periods by excluding gains and losses that are non-operational in nature or outside the control of management,

as well as items that may differ significantly depending on long-term strategic decisions regarding capital structure, the tax jurisdictions

in which Rubicon operates and capital investments. Adjusted EBITDA is also often used by analysts, investors and other interested parties

in evaluating and comparing Rubicon’s results to other companies within the industry. Accordingly, the Company believes that Adjusted

EBITDA provides useful information to investors and others in understanding and evaluating its operating results in the same manner as

Rubicon’s management team and board of directors.

Adjusted

EBITDA has limitations as an analytical tool, and it should not be considered in isolation or as a substitute for analysis of net loss

or other results as reported under GAAP. Some of these limitations are:

| |

● |

Adjusted EBITDA does not

reflect the Company’s cash expenditures, future requirements for capital expenditures, or contractual commitments; |

| |

|

|

| |

● |

Adjusted EBITDA does not

reflect changes in, or cash requirements for, the Company’s working capital needs; |

| |

|

|

| |

● |

Adjusted EBITDA does not

reflect the Company’s tax expense or the cash requirements to pay taxes; |

| |

● |

although amortization and

depreciation are non-cash charges, the assets being amortized and depreciated will often have to be replaced in the future and Adjusted

EBITDA does not reflect any cash requirements for such replacements; |

| |

|

|

| |

● |

Adjusted EBITDA should

not be construed as an inference that the Company’s future results will be unaffected by unusual or non-recurring items for

which the Company may make adjustments in historical periods; and |

| |

|

|

| |

● |

other companies in the

industry may calculate Adjusted EBITDA differently than the Company does, limiting its usefulness as a comparative measure. |

Reconciliations

of Non-GAAP Financial Measures

Adjusted

Gross Profit and Adjusted Gross Profit Margin

The

following table presents reconciliations of Adjusted Gross Profit and Adjusted Gross Margin to the most directly comparable GAAP financial

measures for each of the periods indicated.

| | |

Three Months Ended June 30, | | |

Six Months Ended June 30, | |

| | |

2023 | | |

2022 | | |

2022 | | |

2021 | |

| | |

(in thousands, except percentages) | |

| Total revenue | |

$ | 174,564 | | |

$ | 164,606 | | |

$ | 355,662 | | |

$ | 324,412 | |

| Less: total cost of revenue (exclusive of amortization and depreciation) | |

| 162,162 | | |

| 158,571 | | |

| 333,350 | | |

| 311,500 | |

| Less: amortization and depreciation for revenue generating activities | |

| 614 | | |

| 579 | | |

| 1,188 | | |

| 1,229 | |

| Gross profit | |

$ | 11,788 | | |

$ | 5,456 | | |

$ | 21,124 | | |

$ | 11,683 | |

| Gross profit margin | |

| 6.8 | % | |

| 3.3 | % | |

| 5.9 | % | |

| 3.6 | % |

| | |

| | | |

| | | |

| | | |

| | |

| Gross profit | |

$ | 11,788 | | |

$ | 5,456 | | |

$ | 21,124 | | |

$ | 11,683 | |

| Add: amortization and depreciation for revenue generating activities | |

| 614 | | |

| 579 | | |

| 1,188 | | |

| 1,229 | |

| Add: platform support costs | |

| 5,541 | | |

| 6,657 | | |

| 11,777 | | |

| 12,877 | |

| Adjusted gross profit | |

$ | 17,943 | | |

$ | 12,692 | | |

$ | 34,089 | | |

$ | 25,789 | |

| Adjusted gross profit margin | |

| 10.3 | % | |

| 7.7 | % | |

| 9.6 | % | |

| 7.9 | % |

| | |

| | | |

| | | |

| | | |

| | |

| Amortization and depreciation for revenue generating activities | |

$ | 614 | | |

$ | 579 | | |

$ | 1,188 | | |

$ | 1,229 | |

| Amortization and depreciation for sales, marketing, general and administrative activities | |

| 730 | | |

| 823 | | |

| 1,517 | | |

| 1,663 | |

| Total amortization and depreciation | |

$ | 1,344 | | |

$ | 1,402 | | |

$ | 2,705 | | |

$ | 2,892 | |

| | |

| | | |

| | | |

| | | |

| | |

| Platform support costs(1) | |

$ | 5,541 | | |

$ | 6,657 | | |

$ | 11,777 | | |

$ | 12,877 | |

| Marketplace vendor costs(2) | |

| 156,621 | | |

| 151,914 | | |

| 321,573 | | |

| 298,623 | |

| Total cost of revenue (exclusive of amortization and depreciation) | |

$ | 162,162 | | |

$ | 158,571 | | |

$ | 333,350 | | |

$ | 311,500 | |

| (1) | Platform

support costs are defined as costs to operate the Company’s revenue generating platforms that do not directly correlate with volume

of sales transactions procured through Rubicon’s digital marketplace. Such costs include employee costs, data costs, platform hosting

costs and other overhead costs. |

| (2) | Marketplace

vendor costs are defined as direct costs charged by the Company’s hauling and recycling partners for services procured through

Rubicon’s digital marketplace. |

Adjusted

EBITDA

The

following table presents reconciliations of Adjusted EBITDA to the most directly comparable GAAP financial measure for each of the periods

indicated.

| | |

Three Months Ended June 30, | | |

Six Months Ended

June 30, | |

| | |

2023 | | |

2022 | | |

2023 | | |

2022 | |

| | |

(in thousands) | |

| Net loss | |

$ | (22,817 | ) | |

$ | (27,794 | ) | |

$ | (32,268 | ) | |

$ | (52,613 | ) |

| Adjustments: | |

| | | |

| | | |

| | | |

| | |

| Interest expense | |

| 8,119 | | |

| 3,911 | | |

| 15,295 | | |

| 7,686 | |

| Related party interest expense | |

| 661 | | |

| - | | |

| 1,254 | | |

| - | |

| Interest earned | |

| (5 | ) | |

| - | | |

| (6 | ) | |

| - | |

| Income tax expense | |

| 17 | | |

| 13 | | |

| 33 | | |

| 41 | |

| Amortization and depreciation | |

| 1,344 | | |

| 1,402 | | |

| 2,705 | | |

| 2,892 | |

| Loss on extinguishment of debt obligations | |

| 6,783 | | |

| - | | |

| 8,886 | | |

| - | |

| Equity-based compensation | |

| 1,804 | | |

| 126 | | |

| 11,106 | | |

| 184 | |

| Phantom unit expense | |

| - | | |

| 2,021 | | |

| - | | |

| 4,570 | |

| Loss on change in fair value of warrant liabilities | |

| 414 | | |

| 232 | | |

| 469 | | |

| 510 | |

| Gain on change in fair value of earn-out liabilities | |

| (470 | ) | |

| - | | |

| (5,290 | ) | |

| - | |

| Loss on change in fair value of derivatives | |

| 335 | | |

| - | | |

| 2,533 | | |

| - | |

| Executive severance charges | |

| - | | |

| - | | |

| 4,553 | | |

| - | |

| Gain on settlement of Management Rollover Bonuses | |

| - | | |

| - | | |

| (26,826 | ) | |

| - | |

| Excess fair value over the consideration received for SAFE | |

| - | | |

| 800 | | |

| - | | |

| 800 | |

| Gain on service fee settlements in connection with the Mergers | |

| (6,364 | ) | |

| - | | |

| (6,996 | ) | |

| - | |

| Other expenses(3) | |

| 482 | | |

| 357 | | |

| 903 | | |

| 687 | |

| Adjusted EBITDA | |

$ | (9,697 | ) | |

$ | (18,932 | ) | |

$ | (23,649 | ) | |

$ | (35,243 | ) |

| (3) | Other

expenses primarily consist of foreign currency exchange gains and losses, taxes, penalties, fees for certain financing arrangements,

and gains and losses on sale of property and equipment. |

Investor

Contact:

Alexandra Clark

Director of Finance & Investor Relations

alexandra.clark@rubicon.com

Media

Contact:

Dan Sampson

Chief Marketing & Corporate Communications Officer

dan.sampson@rubicon.com

v3.23.2

Cover

|

Aug. 08, 2023 |

| Document Type |

8-K

|

| Amendment Flag |

false

|

| Document Period End Date |

Aug. 08, 2023

|

| Entity File Number |

001-40910

|

| Entity Registrant Name |

Rubicon Technologies, Inc.

|

| Entity Central Index Key |

0001862068

|

| Entity Tax Identification Number |

88-3703651

|

| Entity Incorporation, State or Country Code |

DE

|

| Entity Address, Address Line One |

335 Madison Ave

|

| Entity Address, Address Line Two |

Floor Four

|

| Entity Address, City or Town |

New York

|

| Entity Address, State or Province |

NY

|

| Entity Address, Postal Zip Code |

10017

|

| City Area Code |

(844)

|

| Local Phone Number |

479-1507

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Entity Emerging Growth Company |

true

|

| Elected Not To Use the Extended Transition Period |

false

|

| Class A common stock, par value $0.0001 per share |

|

| Title of 12(b) Security |

Class

A common stock, par value $0.0001 per share

|

| Trading Symbol |

RBT

|

| Security Exchange Name |

NYSE

|

| Warrants, each exercisable for one share of Class A common stock at an exercise price of $11.50 per share |

|

| Title of 12(b) Security |

Warrants,

each exercisable for one share of Class A common stock at an exercise price of $11.50 per share

|

| Trading Symbol |

RBT

WS

|

| Security Exchange Name |

NYSE

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=rbt_ClassCommonStockParValue0.0001PerShareMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=rbt_WarrantsEachExercisableForOneShareOfClassCommonStockAtExercisePriceOf11.50PerShareMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

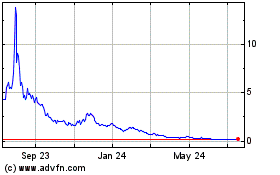

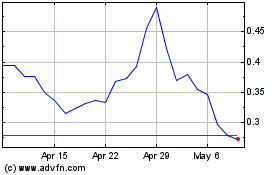

Rubicon Technologies (NYSE:RBT)

Historical Stock Chart

From Jun 2024 to Jul 2024

Rubicon Technologies (NYSE:RBT)

Historical Stock Chart

From Jul 2023 to Jul 2024