- Packaging System placement up 0.4% year over year to

approximately 141.2 thousand machines at June 30, 2024

- Net revenue for the second quarter increased 5.5% year over

year to $86.4 million and increased 5.9% year over year on a

constant currency basis to $89.6 million

- Net income for the second quarter of $5.5 million compared

to net loss of $2.1 million for the prior year period

- Constant Currency Adjusted EBITDA (“AEBITDA”) for the second

quarter of $20.4 million up 7.4%, or $1.4 million, year over

year

Ranpak Holdings Corp. (NYSE: PACK) (“Ranpak” or “the Company”),

a leading provider of environmentally sustainable, systems-based,

product protection and end-of-line automation solutions for

e-Commerce and industrial supply chains, today reported its second

quarter 2024 financial results.

Omar Asali, Chairman and Chief Executive Officer, commented, “We

are pleased to build on our momentum to start the year and deliver

a solid performance in the second quarter that included growth in

volumes, sales, Adjusted EBITDA and an increase in our cash

position. Sales for the quarter increased 5.5% year over year, or

5.9% on a constant currency basis, driven by an 8.8% volume

increase fueled by a meaningful uptick in strategic account

activity in North America and a 3.2% volume growth rate in the

quarter in Europe and APAC. The input cost environment remained

roughly inline with the first quarter and resulted in gross profit

growth of 5.0% or 5.4% on a constant currency basis, implying a

gross margin of 36.7%. The improved volume growth and gross profit

drove a 7.4% increase in Adjusted EBITDA for the quarter continuing

our steady progress on deleveraging, achieving a 4.2x net debt to

LTM Adjusted EBITDA ratio on a constant currency basis as of the

end of the second quarter. In addition to driving volume growth,

deleveraging to 3.0x or below and generating cash remain our key

priorities at Ranpak.”

“We were pleased to execute on our strategic account activity

plan in the second quarter and see the beginnings of large

e-commerce players in North America making the plastic to paper

shift while publicly citing the benefits of paper versus air

pillows. Although activity levels at many of the consumer and

industrial customers we serve remain constrained due to persistent

interest rate and inflationary pressures, we believe we are well

positioned to benefit from continued volume growth for the year as

our strategic account initiatives began to bear fruit and build

from here. We believe this is only the beginning as these sites

ramp up and our additional actions begin to be layered in later

this year, which we expect will provide us with solid momentum

going into 2025.

In addition to the sustainability momentum, our Automation and

data capabilities are increasingly becoming a key differentiator in

discussions with large accounts. Our value-added solutions provide

customers with insights into their business as well as cost savings

opportunities, enabling us to have much deeper and broader

relationships across these organizations. I truly believe we have

changed the game at Ranpak, and the world is beginning to see

Ranpak brings a lot more to the table than it did a few years

ago.”

Second Quarter 2024 Highlights

- Packaging systems placement increased 0.4% year over year, to

approximately 141.2 thousand machines as of June 30, 2024

- Net revenue increased 5.5% and increased 5.9% adjusting for

constant currency

- Net income of $5.5 million compared to net loss of $2.1 million

for the prior year period

- Constant currency AEBITDA1 of $20.4 million for the three

months ended June 30, 2024 is up 7.4%

Net revenue for the second quarter of 2024 was $86.4 million

compared to $81.9 million in the second quarter of 2023, an

increase of $4.5 million or 5.5% year over year. Net revenue was

positively impacted by an increase in void-fill, partially offset

by a decrease in cushioning and other net revenue. Other net

revenue includes automated box sizing equipment and non-paper

revenue from packaging systems installed in the field, such as

systems accessories. Cushioning decreased $1.6 million, or 4.4%, to

$35.0 million from $36.6 million; void-fill increased $6.6 million,

or 21.2%, to $37.7 million from $31.1 million; wrapping remained

constant at $8.4 million; and other sales decreased $0.5 million,

or 8.6%, to $5.3 million from $5.8 million for the second quarter

of 2024 compared to the second quarter of 2023. The increase in net

revenue is quantified by an increase in the volume of sales of our

paper consumable products of approximately 8.8%, partially offset

by a 2.5% decrease in the price or mix of our paper consumable

products and a 0.4% decrease in sales of automated box sizing

equipment. Constant currency net revenue was $89.6 million for the

second quarter of 2024, a 5.9% increase from $84.6 million from the

second quarter of 2023.

Net revenue in North America for the second quarter of 2024

totaled $37.7 million compared to $32.2 million in the second

quarter of 2023. The increase of $5.5 million, or 17.1%, was

primarily attributable to an increase in void-fill sales, partially

offset by decreases in wrapping and other sales.

Net revenue in Europe/Asia for the second quarter of 2024

totaled $48.7 million compared to $49.7 million in the second

quarter of 2023. The decrease of $1.0 million, or 2.0%, was driven

by decreases in void-fill and cushioning, partially offset by

increases in wrapping and other sales. Constant currency net

revenue in Europe/Asia was $51.9 million for the second quarter of

2024, a $0.5 million, or 1.0%, decrease from $52.4 million for the

second quarter of 2023.

_________________________

1 Please refer to “Non-GAAP Financial

Data” in this press release for an explanation and related

reconciliation of the Company’s non-GAAP financial measures and

further discussion related to certain other non-GAAP metrics

included in this press release.

Year-to-Date 2024 Highlights

- Net revenue increased 5.3% and increased 5.1% adjusting for

constant currency

- Net loss of $2.6 million compared to net loss of $14.5 million

for the prior year period

- Constant currency AEBITDA of $40.6 million for the six months

ended June 30, 2024 is up 19.1%

Balance Sheet and Liquidity

Ranpak completed the second quarter of 2024 with a strong

liquidity position, including a cash balance of $65.1 million and

no borrowings on its $45 million Revolving Credit Facility, which

matures in June 2025. As of June 30, 2024, the Company had $250.0

million of USD-denominated term loans and €133.4 million of

euro-denominated term loans outstanding under its First Lien Term

Loan facilities, resulting in an Adjusted EBITDA net leverage ratio

of 4.2x based on results on a constant currency basis through the

second quarter of 2024. The First Lien Term Loan facilities mature

in June 2026.

The following table presents Ranpak’s installed base of

protective packaging systems by product line as of June 30, 2024

and 2023:

June 30, 2024

June 30, 2023

Change

% Change

PPS Systems

(in thousands)

Cushioning machines

34.9

35.0

(0.1

)

(0.3

)

Void-Fill machines

83.9

83.3

0.6

0.7

Wrapping machines

22.4

22.4

—

—

Total

141.2

140.7

0.5

0.4

Conference Call Information

The Company will host a conference call and webcast at 8:30 a.m.

(ET) on Thursday, August 1, 2024. The conference call and earnings

presentation will be webcast live at the following link:

https://events.q4inc.com/attendee/405040634. Investors who cannot

access the webcast may listen to the conference call live via

telephone by dialing (800) 715-9871 and use the Conference ID:

5813434.

A telephonic replay of the webcast also will be available

starting at 11:30 a.m. (ET) on Thursday, August 1, 2024 and ending

at 11:59 p.m. (ET) on Thursday, August 8, 2024. To listen to the

replay, please dial (800) 770-2030 and use the passcode:

5813434.

Note Regarding Forward-Looking Statements

This news release contains “forward-looking statements” within

the meaning of Section 21E of the Securities Exchange Act of 1934,

as amended (the “Exchange Act”). Statements that are not historical

facts are forward-looking statements. Our forward-looking

statements include, but are not limited to, statements regarding

our or our management team’s expectations, hopes, beliefs,

intentions or strategies regarding the future. In addition, any

statements that refer to estimates, projections, forecasts or other

characterizations of future events or circumstances, including any

underlying assumptions, are forward-looking statements. The words

“anticipate,” “believe,” “continue,” “could,” “estimate,” “expect,”

“forecast,” “intend,” “may,” “might,” “plan,” “possible,”

“potential,” “predict,” “project,” “should,” “would” and similar

expressions may identify forward-looking statements, but the

absence of these words does not mean that a statement is not

forward- looking. Forward-looking statements in this news release

include, for example, statements about our expectations around the

future performance of the business, including our forward-looking

guidance.

The forward-looking statements contained in this news release

are based on our current expectations and beliefs concerning future

developments and their potential effects on us taking into account

information currently available to us. There can be no assurance

that future developments affecting us will be those that we have

anticipated. These forward-looking statements involve a number of

risks, uncertainties (some of which are beyond our control) or

other assumptions that may cause actual results or performance to

be materially different from those expressed or implied by these

forward-looking statements. These risks include, but are not

limited to: (i) our inability to secure a sufficient supply of

paper to meet our production requirements; (ii) the impact of

rising prices on production inputs, including labor, energy, and

freight on our results of operations; (iii) the impact of the price

of kraft paper on our results of operations; (iv) our reliance on

third party suppliers; (v) geopolitical conflicts and other social

and political unrest or change; (vi) the high degree of competition

and continued consolidation in the markets in which we operate;

(vii) consumer sensitivity to increases in the prices of our

products, changes in consumer preferences with respect to paper

products generally or customer inventory rebalancing; (viii)

economic, competitive and market conditions generally, including

macroeconomic uncertainty, the impact of inflation, and variability

in energy, freight, labor and other input costs; (ix) the loss of

certain customers; (x) our failure to develop new products that

meet our sales or margin expectations or the failure of those

products to achieve market acceptance; (xi) our ability to achieve

our environmental, social and governance (“ESG”) goals and maintain

the sustainable nature of our product portfolio and fulfill our

obligations under evolving ESG standards; (xii) our ability to

fulfill our obligations under new disclosure regimes relating to

ESG matters, such as the European Sustainability Disclosure

Standards recently adopted by the European Union (“EU”) under the

EU’s Corporate Sustainability Reporting Directive (“CSRD”); (xiii)

our future operating results fluctuating, failing to match

performance or to meet expectations; (xiv) our ability to fulfill

our public company obligations; and (xv) other risks and

uncertainties indicated from time to time in filings made with the

SEC.

Should one or more of these risks or uncertainties materialize,

they could cause our actual results to differ materially from the

forward-looking statements. We are not undertaking any obligation

to update or revise any forward-looking statements whether as a

result of new information, future events or otherwise. You should

not take any statement regarding past trends or activities as a

representation that the trends or activities will continue in the

future. Accordingly, you should not put undue reliance on these

statements.

Ranpak Holdings Corp.

Unaudited Condensed

Consolidated Statements of Operations and Comprehensive Income

(Loss)

(in millions, except share and

per share data)

Three Months Ended June

30,

Six Months Ended June

30,

2024

2023

2024

2023

Paper revenue

$

67.5

$

63.3

$

133.7

$

127.6

Machine lease revenue

13.6

12.7

26.4

25.5

Other revenue

5.3

5.9

11.6

10.0

Net revenue

86.4

81.9

171.7

163.1

Cost of goods sold

54.7

51.7

107.7

105.4

Gross profit

31.7

30.2

64.0

57.7

Selling, general and

administrative expenses

27.3

16.3

55.2

43.5

Depreciation and amortization

expense

8.3

8.1

16.7

16.1

Other operating expense, net

1.3

1.4

2.1

2.6

Income (loss) from

operations

(5.2

)

4.4

(10.0

)

(4.5

)

Interest expense

5.3

5.9

11.5

11.6

Foreign currency (gain) loss

0.1

0.7

(1.3

)

0.9

Other non-operating income,

net

(17.9

)

(0.4

)

(17.9

)

(0.7

)

Income (loss) before income tax expense

(benefit)

7.3

(1.8

)

(2.3

)

(16.3

)

Income tax expense (benefit)

1.8

0.3

0.3

(1.8

)

Net income (loss)

$

5.5

$

(2.1

)

$

(2.6

)

$

(14.5

)

Two-class method

Basic and diluted income (loss)

per share

$

0.07

$

(0.03

)

$

(0.03

)

$

(0.18

)

Class A – basic and diluted income (loss)

per share

$

0.07

$

(0.03

)

$

(0.03

)

$

(0.18

)

Class C – basic and diluted income (loss)

per share

$

0.07

$

(0.03

)

$

(0.03

)

$

(0.17

)

Weighted average number of shares

outstanding – Class A and C – basic

83,071,520

82,432,158

82,876,914

82,285,291

Weighted average number of shares

outstanding – Class A and C – diluted

83,123,636

82,432,158

82,876,914

82,285,291

Other comprehensive income

(loss), before tax

Foreign currency translation

adjustments

$

(0.1

)

$

(1.2

)

$

(2.2

)

$

0.9

Interest rate swap

adjustments

(0.8

)

(1.0

)

(3.4

)

(3.1

)

Total other comprehensive

loss, before tax

(0.9

)

(2.2

)

(5.6

)

(2.2

)

Benefit for income taxes related

to other comprehensive income (loss)

(0.1

)

(0.4

)

—

(1.2

)

Total other comprehensive

loss, net of tax

(0.8

)

(1.8

)

(5.6

)

(1.0

)

Comprehensive income (loss), net of

tax

$

4.7

$

(3.9

)

$

(8.2

)

$

(15.5

)

Ranpak Holdings Corp.

Unaudited Condensed

Consolidated Balance Sheets

(in millions, except share

data)

June 30, 2024

December 31, 2023

Assets

Current assets

Cash and cash equivalents

$

65.1

$

62.0

Accounts receivable, net

36.5

31.6

Inventories, net

26.0

17.3

Income tax receivable

7.5

0.9

Prepaid expenses and other

current assets

12.4

13.1

Total current assets

147.5

124.9

Property, plant and equipment,

net

139.1

142.1

Operating lease right-of-use

assets, net

22.2

23.7

Goodwill

446.8

450.1

Intangible assets, net

328.7

345.4

Deferred tax assets

0.1

0.1

Other assets

35.6

36.4

Total assets

$

1,120.0

$

1,122.7

Liabilities and Shareholders'

Equity

Current liabilities

Accounts payable

$

26.2

$

17.6

Accrued liabilities and other

23.5

22.1

Current portion of long-term

debt

2.6

2.5

Operating lease liabilities,

current

3.9

3.8

Deferred revenue

2.4

2.0

Total current liabilities

58.6

48.0

Long-term debt

393.5

397.8

Deferred tax liabilities

72.4

71.6

Derivative instruments

4.3

6.3

Operating lease liabilities,

non-current

22.5

24.7

Other liabilities

2.5

2.3

Total liabilities

553.8

550.7

Commitments and contingencies – Note

13

Shareholders' equity

Class A common stock, $0.0001 par,

200,000,000 shares authorized at June 30, 2024 and December 31,

2023; shares issued and outstanding: 80,289,912 and 79,684,170 at

June 30, 2024 and December 31, 2023, respectively

—

—

Convertible Class C common stock, $0.0001

par, 200,000,000 shares authorized at June 30, 2024 and December

31, 2023; shares issued and outstanding: 2,921,099 at June 30, 2024

and December 31, 2023

—

—

Additional paid-in capital

696.1

693.7

Accumulated deficit

(126.4

)

(123.8

)

Accumulated other comprehensive

income (loss)

(3.5

)

2.1

Total shareholders' equity

566.2

572.0

Total liabilities and

shareholders' equity

$

1,120.0

$

1,122.7

Ranpak Holdings Corp.

Unaudited Condensed

Consolidated Statements of Cash Flows (in millions)

Six Months Ended June

30,

2024

2023

Cash Flows from Operating

Activities

Net loss

$

(2.6

)

$

(14.5

)

Adjustments to reconcile net loss

to net cash provided by operating activities:

Depreciation and amortization

35.5

33.0

Amortization of deferred

financing costs

1.4

0.9

Loss on disposal of property and

equipment

0.6

0.8

Gain on sale of patents

(5.4

)

—

Deferred income taxes

3.7

(0.3

)

Amortization of initial value of

interest rate swap

(1.2

)

(0.9

)

Currency (gain) loss on foreign

denominated debt and notes payable

(1.3

)

0.8

Stock-based compensation

expense

2.8

(6.7

)

Amortization of cloud-based

software implementation costs

1.8

1.5

Unrealized loss on strategic

investments

3.5

—

Changes in operating assets and

liabilities:

(Increase) decrease in

receivables, net

(5.6

)

(1.5

)

(Increase) decrease in

inventory

(8.8

)

2.8

(Increase) decrease in income tax

receivable

(6.6

)

(2.0

)

(Increase) decrease in prepaid

expenses and other assets

(2.6

)

(3.5

)

Increase (decrease) in accounts

payable

9.5

1.5

Increase (decrease) in accrued

liabilities

3.4

2.3

Change in other assets and

liabilities

(3.3

)

2.4

Net cash provided by operating

activities

24.8

16.6

Cash Flows from Investing

Activities

Purchases of converter

equipment

(15.3

)

(11.0

)

Purchases of other property,

plant, and equipment

(4.4

)

(14.2

)

Proceeds from sale of patents

5.4

—

Cash paid for strategic

investments

(4.8

)

—

Net cash used in investing

activities

(19.1

)

(25.2

)

Cash Flows from Financing

Activities

Principal payments on term

loans

(0.8

)

(1.1

)

Financing costs of debt

facilities

—

(0.2

)

Proceeds from equipment

financing

0.7

1.9

Payments on equipment

financing

(0.5

)

—

Payments on finance lease

liabilities

(0.6

)

(0.8

)

Tax payments for withholdings on

stock-based awards distributed

(0.4

)

(0.5

)

Net cash used in financing

activities

(1.6

)

(0.7

)

Effect of Exchange Rate

Changes on Cash

(1.0

)

0.4

Net Increase (Decrease) in

Cash and Cash Equivalents

3.1

(8.9

)

Cash and Cash Equivalents,

beginning of period

62.0

62.8

Cash and Cash Equivalents, end of

period

$

65.1

$

53.9

Non-GAAP Financial Data

In this press release, we present Earnings Before Interest,

Taxes, Depreciation and Amortization (“EBITDA”) and constant

currency EBITDA and constant currency adjusted EBITDA (“Constant

currency AEBITDA”), which are non-GAAP financial measures. We have

included EBITDA, constant currency EBITDA and Constant Currency

AEBITDA because they are key measures used by our management and

board of directors to understand and evaluate our operating

performance and trends, to prepare and approve our annual budget

and to develop short- and long-term operational plans. In

particular, the exclusion of certain expenses in calculating EBITDA

and Constant Currency AEBITDA can provide a useful measure for

period-to-period comparisons of our primary business operations.

Adjusting AEBITDA for comparability for constant currency also

assists in this comparison as it allows a better insight into the

performance of our businesses that operate in currencies other than

our reporting currency. Before consolidation, our Europe/Asia

financial data is derived in Euros. To calculate the adjustment

that we apply to present AEBITDA on a constant currency basis, we

multiply this Euro-derived data by 1.15 to reflect an exchange rate

of 1 Euro to 1.15 USD, which we believe is a reasonable exchange

rate to use to give a stable depiction of the business without

currency fluctuations between periods, to calculate Europe/Asia

data in constant currency USD. An exchange rate of 1.15

approximates the average exchange rate of the Euro to USD over the

past five years. We also present non-GAAP constant currency net

revenue and derive it in the same manner.

However, EBITDA, constant currency EBITDA and Constant Currency

AEBITDA have limitations as analytical tools, and you should not

consider them in isolation or as substitutes for analysis of our

results as reported under GAAP. In particular, EBITDA, constant

currency EBITDA and Constant Currency AEBITDA should not be viewed

as substitutes for, or superior to, net income (loss) prepared in

accordance with GAAP as a measure of profitability or liquidity.

Some of these limitations are:

- although depreciation and amortization are non-cash charges,

the assets being depreciated and amortized may have to be replaced

in the future, and EBITDA, constant currency EBITDA and constant

currency AEBITDA do not reflect all cash capital expenditure

requirements for such replacements or for new capital expenditure

requirements;

- EBITDA, constant currency EBITDA and constant currency AEBITDA

do not reflect changes in, or cash requirements for, our working

capital needs;

- constant currency AEBITDA does not consider the potentially

dilutive impact of equity-based compensation;

- EBITDA, constant currency EBITDA and constant currency AEBITDA

do not reflect the impact of the recording or release of valuation

allowances or tax payments that may represent a reduction in cash

available to us;

- constant currency AEBITDA does not take into account any

restructuring and integration costs;

- constant currency EBITDA and constant currency AEBITDA are

presented on a constant currency basis and give effect to the

impact of currency fluctuations; and

- other companies, including companies in our industry, may

calculate EBITDA, constant currency EBITDA and constant currency

AEBITDA differently, which reduces their usefulness as comparative

measures.

EBITDA — EBITDA is a non-GAAP financial measure that we

calculate as net income (loss), adjusted to exclude: benefit from

(provision for) income taxes; interest expense; and depreciation

and amortization.

Constant currency EBITDA — Constant currency EBITDA is a

non-GAAP financial measure that we present on a constant currency

basis and we calculate as net income (loss), adjusted to exclude:

benefit from (provision for) income taxes; interest expense; and

depreciation and amortization.

Constant Currency AEBITDA — Constant Currency AEBITDA is

a non-GAAP financial measure that we present on a constant currency

basis and calculate as net income (loss), adjusted to exclude:

benefit from (provision for) income taxes; interest expense;

depreciation and amortization; stock-based compensation expense;

and, in certain periods, certain other income and expense items; as

further adjusted to reflect the performance of the business on a

constant currency basis.

We present constant currency EBITDA and Constant Currency

AEBITDA on a constant currency basis because it allows a better

insight into the performance of our businesses that operate in

currencies other than our reporting currency. Before consolidation,

our Europe/Asia financial data is derived in Euros. To calculate

the adjustment that we apply to present constant currency EBITDA

and Constant Currency AEBITDA on a constant currency basis, we

multiply this Euro-derived data by 1.15 to reflect an exchange rate

of 1 Euro to 1.15 U.S. dollars (“USD”), which we believe is a

reasonable exchange rate to use to give a stable depiction of the

business without currency fluctuations between periods, to

calculate Europe/ Asia data in constant currency USD. We believe

that using an exchange rate of 1.15 is reasonable because it

approximates the average exchange rate of the Euro to USD over the

past five years. In addition, we include certain other unaudited,

non- GAAP constant currency data for the three and six months ended

June 30, 2024 and 2023.

This data is based on our historical financial statements,

adjusted (where applicable) to reflect a constant currency

presentation between periods for the convenience of readers. We

reconcile this data to our GAAP data for the same period for the

three and six months ended June 30, 2024 and 2023. Dollar amounts

are presented in millions. “NM” represents “not meaningful.”

Ranpak Holdings Corp.

Non-GAAP Financial Data

Reconciliation and Comparison of GAAP

Statement of Income Data to Non-GAAP EBITDA and Constant Currency

AEBITDA For the Second Quarter of 2024 and 2023 (in

millions)

Please refer to our discussion and

definitions of Non-GAAP financial measures

Three Months Ended June

30,

2024

2023

$ Change

% Change

Net revenue

$

86.4

$

81.9

$

4.5

5.5

Cost of goods sold

54.7

51.7

3.0

5.8

Gross profit

31.7

30.2

1.5

5.0

Selling, general and

administrative expenses

27.3

16.3

11.0

67.5

Depreciation and amortization

expense

8.3

8.1

0.2

2.5

Other operating expense, net

1.3

1.4

(0.1

)

(7.1

)

Income (loss) from

operations

(5.2

)

4.4

(9.6

)

(218.2

)

Interest expense

5.3

5.9

(0.6

)

(10.2

)

Foreign currency loss

0.1

0.7

(0.6

)

(85.7

)

Other non-operating income,

net

(17.9

)

(0.4

)

(17.5

)

NM

Income (loss) before income

tax expense

7.3

(1.8

)

9.1

(505.6

)

Income tax expense

1.8

0.3

1.5

500.0

Net income (loss)

5.5

(2.1

)

7.6

(361.9

)

Depreciation and amortization

expense – COS

8.4

8.6

(0.2

)

—

Depreciation and amortization

expense – D&A

8.3

8.1

0.2

2.5

Interest expense

5.3

5.9

(0.6

)

(10.2

)

Income tax expense

1.8

0.3

1.5

500.0

EBITDA(1)

29.3

20.8

8.5

40.9

Adjustments(2):

Foreign currency loss

0.1

0.6

(0.5

)

(83.3

)

Non-cash impairment losses

0.2

0.5

(0.3

)

(60.0

)

M&A, restructuring,

severance

1.5

1.3

0.2

15.4

Stock-based compensation

expense

1.5

(9.5

)

11.0

(115.8

)

Amortization of cloud-based software

implementation costs(3)

0.9

0.8

0.1

—

Cloud-based software

implementation costs

0.7

1.2

(0.5

)

(41.7

)

SOX remediation costs

2.4

2.4

—

—

Gain on sale of patents

(5.4

)

—

(5.4

)

NM

Patent litigation settlement

(16.1

)

—

(16.1

)

NM

Unrealized loss on strategic

investments

3.5

—

3.5

NM

Other adjustments

1.0

0.1

0.9

900.0

Constant currency

0.8

0.8

—

—

Constant Currency

AEBITDA(1)

$

20.4

$

19.0

$

1.4

7.4

Ranpak Holdings Corp.

Non-GAAP Financial Data

Reconciliation and Comparison of GAAP

Statement of Income Data to Non-GAAP EBITDA and Constant Currency

AEBITDA For the Six Months Ended June 30, 2024 and 2023 (in

millions)

Please refer to our discussion and

definitions of Non-GAAP financial measures

Six Months Ended June

30,

2024

2023

$ Change

% Change

Net revenue

$

171.7

$

163.1

$

8.6

5.3

Cost of goods sold

107.7

105.4

2.3

2.2

Gross profit

64.0

57.7

6.3

10.9

Selling, general and

administrative expenses

55.2

43.5

11.7

26.9

Depreciation and amortization

expense

16.7

16.1

0.6

3.7

Other operating expense, net

2.1

2.6

(0.5

)

(19.2

)

Loss from operations

(10.0

)

(4.5

)

(5.5

)

122.2

Interest expense

11.5

11.6

(0.1

)

(0.9

)

Foreign currency (gain) loss

(1.3

)

0.9

(2.2

)

(244.4

)

Other non-operating income,

net

(17.9

)

(0.7

)

(17.2

)

NM

Loss before income tax expense

(benefit)

(2.3

)

(16.3

)

14.0

(85.9

)

Income tax expense (benefit)

0.3

(1.8

)

2.1

(116.7

)

Net loss

(2.6

)

(14.5

)

11.9

(82.1

)

Depreciation and amortization

expense – COS

18.8

16.9

1.9

—

Depreciation and amortization

expense – D&A

16.7

16.1

0.6

3.7

Interest expense

11.5

11.6

(0.1

)

(0.9

)

Income tax expense (benefit)

0.3

(1.8

)

2.1

(116.7

)

EBITDA(1)

44.7

28.3

16.4

58.0

Adjustments(2):

Foreign currency (gain) loss

(1.3

)

0.8

(2.1

)

(262.5

)

Non-cash impairment losses

0.6

0.9

(0.3

)

(33.3

)

M&A, restructuring,

severance

2.4

1.5

0.9

60.0

Stock-based compensation

expense

2.8

(6.7

)

9.5

(141.8

)

Amortization of cloud-based

software implementation costs(3)

1.8

1.5

0.3

—

Cloud-based software

implementation costs

1.2

2.4

(1.2

)

(50.0

)

SOX remediation costs

3.2

2.4

0.8

33.3

Gain on sale of patents

(5.4

)

—

(5.4

)

NM

Patent litigation settlement

(16.1

)

—

(16.1

)

NM

Unrealized loss on strategic

investments

3.5

—

3.5

NM

Other adjustments

1.4

1.4

—

—

Constant currency

1.8

1.6

0.2

12.5

Constant Currency

AEBITDA(1)

$

40.6

$

34.1

$

6.5

19.1

Ranpak Holdings Corp.

Non-GAAP Financial Data

Reconciliation of GAAP Statement of

Income Data to Non-GAAP Constant Currency Statement of Income Data,

Constant Currency EBITDA, and Constant Currency AEBITDA (in

millions)

For the Second Quarter of 2024

Please refer to our discussion and

definitions of Non-GAAP financial measures, including Non-GAAP

Constant Currency

Three Months Ended June 30,

2024

As reported

Constant Currency(4)

Non-GAAP

Net revenue

$

86.4

$

3.2

$

89.6

Cost of goods sold

54.7

1.9

56.6

Gross profit

31.7

1.3

33.0

Selling, general and

administrative expenses

27.3

1.0

28.3

Depreciation and amortization

expense

8.3

0.1

8.4

Other operating expense, net

1.3

0.1

1.4

Loss from operations

(5.2

)

0.1

(5.1

)

Interest expense

5.3

—

5.3

Foreign currency loss

0.1

—

0.1

Other non-operating income,

net

(17.9

)

(1.0

)

(18.9

)

Income before income tax

expense

7.3

1.1

8.4

Income tax expense

1.8

0.3

2.1

Net income

$

5.5

$

0.8

$

6.3

Constant currency-effected

add(1):

Depreciation and amortization

expense – COS

$

8.7

Depreciation and amortization

expense – D&A

8.4

Interest expense

5.3

Income tax expense

2.1

Constant currency

EBITDA

30.8

Constant currency-effected

adjustments(2):

Foreign currency loss

0.1

Non-cash impairment losses

0.1

M&A, restructuring, severance

1.5

Stock-based compensation expense

1.6

Amortization of cloud-based software

implementation costs(3)

0.9

Cloud-based software implementation

costs

0.7

SOX remediation

2.4

Gain on sale of patents

(5.4

)

Patent litigation settlement

(17.2

)

Unrealized loss on strategic

investments

3.5

Other adjustments

1.4

Constant currency AEBITDA

$

20.4

Ranpak Holdings Corp.

Non-GAAP Financial Data

Reconciliation of GAAP Statement of

Income Data to Non-GAAP Constant Currency Statement of Income Data,

Constant Currency EBITDA, and Constant Currency AEBITDA (in

millions)

For the Second Quarter of 2023

Please refer to our discussion and

definitions of Non-GAAP financial measures, including Non-GAAP

Constant Currency

Three Months Ended June 30,

2023

As reported

Constant Currency(4)

Non-GAAP

Net revenue

$

81.9

$

2.7

$

84.6

Cost of goods sold

51.7

1.6

53.3

Gross profit

30.2

1.1

31.3

Selling, general and

administrative expenses

16.3

0.5

16.8

Depreciation and amortization

expense

8.1

0.1

8.2

Other operating expense, net

1.4

—

1.4

Income from operations

4.4

0.5

4.9

Interest expense

5.9

0.1

6.0

Foreign currency loss

0.7

—

0.7

Other non-operating income,

net

(0.4

)

0.4

—

Loss before income tax

expense

(1.8

)

—

(1.8

)

Income tax expense

0.3

(0.3

)

—

Net loss

$

(2.1

)

$

0.3

$

(1.8

)

Constant currency-effected

add(1):

Depreciation and amortization

expense – COS

$

8.8

Depreciation and amortization

expense – D&A

8.2

Interest expense

6.0

Income tax expense

—

Constant currency

EBITDA

21.2

Constant currency-effected

adjustments(2):

Foreign currency loss

0.7

Non-cash impairment losses

0.5

M&A, restructuring, severance

1.5

Stock-based compensation expense

(9.6

)

Amortization of cloud-based software

implementation costs(3)

0.8

Cloud-based software implementation

costs

1.3

SOX remediation

2.4

Other adjustments

0.2

Constant currency AEBITDA

$

19.0

Ranpak Holdings Corp.

Non-GAAP Financial Data

Reconciliation of GAAP Statement of

Income Data to Non-GAAP Constant Currency Statement of Income Data,

Constant Currency EBITDA, and Constant Currency AEBITDA (in

millions)

For the Six Months Ended June 30,

2024

Please refer to our discussion and

definitions of Non-GAAP financial measures, including Non-GAAP

Constant Currency

Six Months Ended June 30,

2024

As reported

Constant Currency(4)

Non-GAAP

Net revenue

$

171.7

$

6.4

$

178.1

Cost of goods sold

107.7

3.8

111.5

Gross profit

64.0

2.6

66.6

Selling, general and

administrative expenses

55.2

1.7

56.9

Depreciation and amortization

expense

16.7

0.3

17.0

Other operating expense, net

2.1

—

2.1

Loss from operations

(10.0

)

0.6

(9.4

)

Interest expense

11.5

0.1

11.6

Foreign currency gain

(1.3

)

(0.1

)

(1.4

)

Other non-operating income,

net

(17.9

)

(0.7

)

(18.6

)

Loss before income tax

benefit

(2.3

)

1.3

(1.0

)

Income tax expense

0.3

0.2

0.5

Net loss

$

(2.6

)

$

1.1

$

(1.5

)

Constant currency-effected

add(1):

Depreciation and amortization expense –

COS

$

19.5

Depreciation and amortization expense –

D&A

17.0

Interest expense

11.6

Income tax expense

0.5

Constant currency

EBITDA

47.1

Constant currency-effected

adjustments(2):

Foreign currency gain

(1.4

)

Non-cash impairment losses

0.6

M&A, restructuring, severance

2.5

Stock-based compensation expense

2.9

Amortization of cloud-based software

implementation costs(3)

1.8

Cloud-based software implementation

costs

1.2

SOX remediation

3.2

Gain on sale of patents

(5.4

)

Patent litigation settlement

(17.2

)

Unrealized loss on strategic

investments

3.5

Other adjustments

1.8

Constant currency AEBITDA

$

40.6

Ranpak Holdings Corp.

Non-GAAP Financial Data

Reconciliation of GAAP Statement of

Income Data to Non-GAAP Constant Currency Statement of Income Data,

Constant Currency EBITDA, and Constant Currency AEBITDA (in

millions)

For the Six Months Ended June 30,

2023

Please refer to our discussion and

definitions of Non-GAAP financial measures, including Non-GAAP

Constant Currency

Six Months Ended June

30, 2023

As reported

Constant Currency(4)

Non-GAAP

Net revenue

$

163.1

$

6.3

$

169.4

Cost of goods sold

105.4

3.9

109.3

Gross profit

57.7

2.4

60.1

Selling, general and

administrative expenses

43.5

1.4

44.9

Depreciation and amortization

expense

16.1

0.3

16.4

Other operating expense, net

2.6

—

2.6

Loss from operations

(4.5

)

0.7

(3.8

)

Interest expense

11.6

0.2

11.8

Foreign currency loss

0.9

—

0.9

Other non-operating (income)

expense, net

(0.7

)

0.9

0.2

Loss before income tax

benefit

(16.3

)

(0.4

)

(16.7

)

Income tax benefit

(1.8

)

(0.3

)

(2.1

)

Net loss

$

(14.5

)

$

(0.1

)

$

(14.6

)

Constant currency-effected

add(1):

Depreciation and amortization

expense – COS

$

17.4

Depreciation and amortization

expense – D&A

16.4

Interest expense

11.8

Income tax benefit

(2.1

)

Constant currency

EBITDA

28.9

Constant currency-effected

adjustments(2):

Foreign currency loss

0.9

Non-cash impairment losses

1.0

M&A, restructuring, severance

1.7

Stock-based compensation expense

(6.7

)

Amortization of cloud-based software

implementation costs(3)

1.6

Cloud-based software implementation

costs

2.4

SOX remediation

2.4

Other adjustments

1.9

Constant currency AEBITDA

$

34.1

_________________________

(1)

Reconciliations of EBITDA and constant

currency AEBITDA for each period presented are to net (loss)

income, the nearest GAAP equivalent.

(2)

Adjustments are related to non-cash

unusual or infrequent costs such as: effects of non-cash foreign

currency remeasurement or adjustment; impairment of returned

machines; costs associated with the evaluation of acquisitions;

costs associated with executive severance; costs associated with

restructuring actions such as plant rationalization or realignment,

reorganization, and reductions in force; costs associated with the

implementation of the global ERP system; and other items deemed by

management to be unusual, infrequent, or non-recurring.

(3)

Represents amortization of capitalized

costs related to the implementation of the global ERP system, which

are included in SG&A.

(4)

Effect of Euro constant currency

adjustment to a rate of €1.00 to $1.15 on each line item.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240801832641/en/

Investors: IR@Ranpak.com

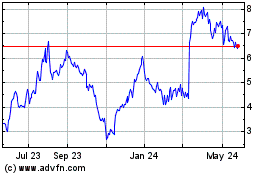

Ranpak (NYSE:PACK)

Historical Stock Chart

From Nov 2024 to Dec 2024

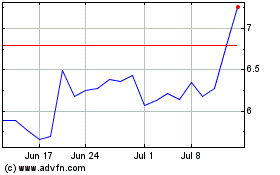

Ranpak (NYSE:PACK)

Historical Stock Chart

From Dec 2023 to Dec 2024