Form DEFA14A - Additional definitive proxy soliciting materials and Rule 14(a)(12) material

September 19 2023 - 11:15AM

Edgar (US Regulatory)

|

| UNITED STATES |

| SECURITIES AND EXCHANGE COMMISSION |

| WASHINGTON, DC 20549 |

| |

| SCHEDULE 14A |

| (RULE 14A-101) |

| |

| INFORMATION REQUIRED IN PROXY STATEMENT |

| |

| SCHEDULE 14A INFORMATION |

| |

| Proxy Statement Pursuant to Section 14(a) |

| of the Securities Exchange Act of 1934 |

| |

| Filed by the Registrant / X / |

| |

| Filed by a Party other than the Registrant / / |

|

|

| Check the appropriate box: |

| |

| / / |

Preliminary Proxy Statement. |

| / / |

Confidential, for use of the Commission Only (as permitted by Rule 14a-6(e) (2)). |

| / / |

Definitive Proxy Statement. |

| / X / |

Definitive Additional Materials. |

| / / |

Soliciting Material under § 240.14a-12. |

|

| PUTNAM MANAGED MUNICIPAL INCOME TRUST |

| PUTNAM MUNICIPAL OPPORTUNITIES TRUST |

| |

| (Name of Registrant as Specified in its Charter) |

| |

| (Name of Person(s) Filing Proxy Statement, |

| if Other Than the Registrant) |

|

|

| Payment of Filing Fee (Check the appropriate box): |

|

|

| / X / |

No fee required. |

|

|

| / / |

Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

|

(1) Title of each class of securities to which transaction applies: |

|

(2) Aggregate number of securities to which transaction applies: |

|

(3) Per unit price or other underlying value of transaction computed pursuant to Exchange |

|

Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how |

|

it was determined): |

|

(4) Proposed maximum aggregate value of transaction: |

|

|

|

(5) Total fee paid: |

|

|

| / / |

Fee paid previously with preliminary materials. |

|

|

| / / |

Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and |

|

identify the filing for which the offsetting fee was paid previously. Identify the previous |

|

filing by registration statement number, or the Form or Schedule and the date of its filing. |

|

(1) Amount Previously Paid: |

|

(2) Form, Schedule or Registration Statement No.: |

|

(3) Filing Party: |

|

(4) Date Filed: |

ISS-Putnam Discussion of Putnam

Municipal Closed-End Funds

(PMO and PMM)

► Meeting Date: October 6, 2023

► Meeting Location: 100 Federal St., Boston, MA 02110

► Meeting Time: 11am EST

► Background:

|

▪ On May 31, 2023, Great-West Lifeco Inc., the parent company of Putnam U.S. Holdings I, LLC (“Putnam Holdings”), entered into a definitive purchase agreement with Franklin Resources, Inc. (“FRI” and, together with its subsidiaries, “Franklin Templeton”) and a subsidiary of FRI for the subsidiary to acquire Putnam Holdings from Great-West Lifeco Inc. (the “Transaction”) |

|

▪ The Transaction will cause the funds’ current management and sub-advisory contracts to terminate in accordance with applicable law and the terms of each contract |

|

▪ One condition of Transaction completion is that shareholders of a substantial number of Putnam funds approve new management contracts |

|

▪ Each fund’s Board of Trustees has approved the new contracts |

► Proposals:

|

▪ Approving a new management contract: shareholders of each fund are being asked to approve a new management contract with Putnam Investment Management, LLC (“Putnam Management”) |

|

▪ Approving a new sub-advisory contract: shareholders of each fund are being asked to approve a new sub-advisory contract with Putnam Investments Limited (“PIL”) |

The Board of Trustees of the Putnam Funds unanimously recommends that shareholders vote FOR the proposed new contracts.

► Rationale for the Board of Trustees’ recommendations:

|

▪ Investment team continuity: Franklin Templeton does not intend to make any material change in Putnam Management’s senior investment professionals (other than certain changes related to reporting structure and organization of personnel), including the portfolio managers of the funds, or to the firm’s operating locations as a result of the Transaction. Franklin Templeton intends to include the fixed income investment professionals at Putnam Management and its affiliate Putnam Investments Limited in Franklin Templeton’s fixed income group, with the group reporting to Franklin Templeton’s Head of Public Markets. |

|

▪ Investment philosophy continuity: Franklin Templeton’s expectation is that there will not be any changes in the investment objectives, strategies, or portfolio holdings of the funds as a result of the Transaction. |

|

▪ Fee continuity: Neither Franklin Templeton nor Putnam Management have any current plans to propose changes to the funds’ existing management or sub-advisory fees. |

|

▪ Management contract: the proposed new management contract is identical to the current management contract except for the effective date and initial term. There will be no change in the services under the proposed new management contract. Note: Putnam’s management fees were ranked in the cheapest quartile vs. peers in the Board’s most recent 15(c) contract renewal process. |

|

▪ Sub-advisory contract: the proposed new sub-advisory contract is identical to the current sub-advisory contract, except for the effective date, initial term, and other non-substantive changes. There will be no change in the services under the applicable proposed new sub-advisory contract. |

Putnam believes the Board of Trustees rationale for approval aligns with ISS’s previous approval recommendations due to continuity of fees, investment objective, portfolio managers, and the terms of the contracts.

► Putnam Municipal Opportunities Trust (PMO):

|

▪ Strong performance vs. Bloomberg Municipal Bond Index, with PMO generating excess returns 82% (3-YR) and 93% (5-YR) of the time |

|

▪ On 3- and 5-YR basis vs. Lipper category, PMO was above median 100% of the time and top-quartile 87% (3-YR) and 58% (5-YR) of the time |

|

▪ Premia/discounts have generally been above median, and more recently top-quartile, vs. Lipper peers |

► Putnam Managed Municipal Income Trust (PMM):

|

▪ Strong performance vs. Bloomberg Municipal Bond Index, with PMM generating excess returns 73% (3-YR) and 78% (5-YR) of the time |

|

▪ On 3- and 5-YR basis vs. Lipper category, PMM was above median 87% of the time and top-quartile 22% (3-YR) and 30% (5-YR) of the time |

|

▪ Premia/discounts have generally been above median, with some recent month end discounts in the top third vs. Lipper peers |

Carlo N. Forcione, CFA

Head of Product and Strategy

Putnam Investments

Mr. Forcione is Head of Product and Strategy. He is responsible for all aspects of Putnam’s product shelf, including strategy, development, pricing, and execution for the firm’s retail, institutional, and retirement distribution channels. Mr. Forcione also oversees the firm’s competitive intelligence and business intelligence functions and engages in strategic planning and exploration of business development opportunities.

Mr. Forcione is a member of Putnam’s Operating Committee and the ESG Leadership Committee. He has been in the investment industry since he joined Putnam in 2007.

Previously at Putnam, Mr. Forcione served as Director of Product Strategy & Development. Prior to this role, he practiced corporate and securities law for 12 years, serving in in-house and law firm settings, where he specialized in legal and regulatory matters related to the investment management industry.

Paul M. Drury, CFA

Portfolio Manager

Investment Management

Mr. Drury is a Portfolio Manager in the Tax Exempt Fixed Income group. He manages Putnam's open- and closed-end municipal bond portfolios. His responsibilities include security selection and sector rotation, ratings allocation, and duration/term structure management. In addition, Mr. Drury manages Putnam's Municipal Portfolio team, credit research analysts, and traders. He has been in the investment industry since he joined Putnam in 1989.

Previously at Putnam, Mr. Drury spent a decade as Head of Trading, Municipal Bonds, where he worked closely with portfolio managers to execute trades in various sectors of the municipal market.

Mr. Drury earned a B.S. from Suffolk University.

Garrett L. Hamilton, CFA

Portfolio Manager

Investment Management

Mr. Hamilton is a Portfolio Manager in the Tax Exempt Fixed Income group. He is responsible for managing Putnam's tax-exempt strategies, including short- and intermediate-term municipal income strategies. He joined Putnam in 2016 and has been in the investment industry since 2006.

Prior to joining Putnam, Mr. Hamilton was a Portfolio Manager at BNY Mellon from 2010 to 2016, a Vice President and Trader at TDAM USA from 2008 to 2010, and a Trading and Sales Assistant from 2007 to 2008 and a Municipal Analyst from 2006 to 2007 at First Southwest Company Investment Bank.

Mr. Hamilton earned an M.S. in Investment Management from Questrom School of Business at Boston University and a B.S. in International Business Administration from Southern New Hampshire University.

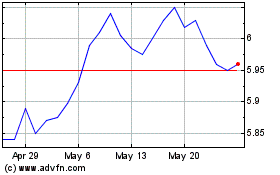

Putnam Managed Muni Income (NYSE:PMM)

Historical Stock Chart

From Jun 2024 to Jul 2024

Putnam Managed Muni Income (NYSE:PMM)

Historical Stock Chart

From Jul 2023 to Jul 2024