- Expands Owens Corning’s leadership position in branded

residential products with a complementary line of innovative

interior and exterior doors and door systems

- Creates a scalable new growth platform leveraging combined

commercial, operational, and innovation capabilities

- Enhances Owens Corning’s attractive financial profile

- Generates strong free cash flow to support consistent capital

allocation strategy

- Names Chris Ball President of Doors business

Owens Corning (NYSE: OC) today announced it has completed its

acquisition of Masonite International Corporation (“Masonite”), a

leading global provider of interior and exterior doors and door

systems. All outstanding Masonite common shares have been acquired

by Owens Corning for $133.00 per share, with an implied transaction

value of approximately $3.9 billion.

“The addition of Masonite to Owens Corning marks a significant

milestone for our company, as we further strengthen our position as

a market leader in building and construction materials,” said Brian

Chambers, Chair and Chief Executive Officer of Owens Corning. “Over

the past several years, Owens Corning has been on a journey to

transform and grow our company through strategic choices and strong

execution. The completion of this acquisition represents the start

of an exciting next chapter that allows us to leverage our proven

commercial, operational, and innovation capabilities to increase

our offering of highly valued branded building materials for our

customers. We are excited about expanding into this new growth

platform and for the opportunities ahead.”

Founded in 1925, Masonite is a leading global provider of

interior and exterior doors and door systems serving both repair

and remodel and new construction demand. Masonite operates 64

manufacturing and distribution facilities, primarily in North

America, and has over 10,000 employees globally.

With the completion of the acquisition, Owens Corning’s annual

revenue grows to $12.5 billion, with adjusted EBITDA of $2.9

billion on a synergized basis1 and reduced ongoing capital

intensity. Owens Corning expects to achieve approximately $125

million of run-rate cost synergies. The acquisition drives

meaningful shareholder value creation with ROIC exceeding Owens

Corning’s cost of capital by the end of Year 3 post-close.

Masonite shareholders voted to approve the transaction at the

Special Meeting of Shareholders held on April 25, 2024. With the

completion of the acquisition, Masonite’s common shares will cease

trading on the New York Stock Exchange and will be delisted.

Doors Business President Named

Owens Corning has named Chris Ball as President of its Doors

business. Ball previously served as President of Masonite’s Global

Residential business. He will report directly to Chair and Chief

Executive Officer Brian Chambers and serve as a member of the

company’s Executive Committee.

“We are pleased to welcome Chris to the Owens Corning executive

team. His proven track record of growing businesses and developing

talent, as well as his strong commercial execution, operational

knowledge, and customer focus, will be instrumental as he leads

this business into the future,” said Chambers. “Today we are

combining two highly talented teams with a shared focus on keeping

each other safe, helping our customers win and grow in the market,

and delivering value for our shareholders. We look forward to

working together with Chris and all of our new colleagues from

Masonite.”

Ball joined Masonite as President of its Global Residential

business in September 2021. Previously he held leadership roles at

several Fortune 500 companies. He was President of the Americas for

Cooper Tire & Rubber Company, where he led the North America,

Latin America, and Global Commercial Truck Tire business units. He

joined Cooper Tire from Whirlpool Corporation, where he served in

various roles including Global Vice President for the company’s

KitchenAid small appliance business and General Manager of the

North America Laundry unit, Whirlpool’s largest business. He has

also worked in sales leadership roles for General Mills, Inc.

He holds a bachelor’s degree from Indiana University’s Kelley

School of Business and a Master of Business Administration from the

executive master’s program at Northwestern University’s Kellogg

School of Management.

About Owens Corning

Owens Corning is a global building and construction materials

leader committed to building a sustainable future through material

innovation. Our four integrated businesses – Roofing, Insulation,

Doors, and Composites – provide durable, sustainable,

energy-efficient solutions that leverage our unique material

science, manufacturing, and market knowledge to help our customers

win and grow. We are global in scope, human in scale with more than

25,000 employees in 31 countries dedicated to generating value for

our customers and shareholders, and making a difference in the

communities where we work and live. Founded in 1938 and based in

Toledo, Ohio, USA, Owens Corning posted 2023 sales of $9.7 billion.

For more information, visit www.owenscorning.com.

Use of Non-GAAP Measures

Owens Corning uses non-GAAP measures that are intended to

supplement investors' understanding of the company's financial

information. These non-GAAP measures include adjusted EBITDA. A

reconciliation for adjusted EBITDA to the corresponding GAAP

measures are included in the financial tables of this press

release. For purposes of internal review of Owens Corning's

year-over-year operational performance, management excludes from

net earnings attributable to Owens Corning certain items it

believes are not representative of ongoing operations. The non-GAAP

financial measures resulting from these adjustments (including

adjusted EBITDA) are used internally by Owens Corning for various

purposes, including reporting results of operations to the Board of

Directors, analysis of performance, and related employee

compensation measures. Management believes that these adjustments

result in a measure that provides a useful representation of its

operational performance; however, the adjusted measures should not

be considered in isolation or as a substitute for net earnings

attributable to Owens Corning as prepared in accordance with

GAAP.

Forward-Looking

Statements

This news release contains forward-looking statements within the

meaning of Section 27A of the Securities Act of 1933 and Section

21E of the Securities Exchange Act of 1934. These forward-looking

statements are subject to risks, uncertainties and other factors

and actual results may differ materially from any results projected

in the statements. These risks, uncertainties and other factors

include, without limitation: levels of residential and commercial

or industrial construction activity; demand for our products;

industry and economic conditions including, but not limited to,

supply chain disruptions, recessionary conditions, inflationary

pressures, interest rate and financial markets volatility, and the

viability of banks and other financial institutions; availability

and cost of energy and raw materials; levels of global industrial

production; competitive and pricing factors; relationships with key

customers and customer concentration in certain areas; issues

related to acquisitions, divestitures and joint ventures or

expansions; climate change, weather conditions and storm activity;

legislation and related regulations or interpretations, in the

United States or elsewhere; domestic and international economic and

political conditions, policies or other governmental actions, as

well as war and civil disturbance; changes to tariff, trade or

investment policies or laws; uninsured losses, including those from

natural disasters, catastrophes, pandemics, theft or sabotage;

environmental, product-related or other legal and regulatory

liabilities, proceedings or actions; research and development

activities and intellectual property protection; issues involving

implementation and protection of information technology systems;

foreign exchange and commodity price fluctuations; our level of

indebtedness; our liquidity and the availability and cost of

credit; our ability to achieve expected synergies, cost reductions

and/or productivity improvements; the level of fixed costs required

to run our business; levels of goodwill or other indefinite-lived

intangible assets; price volatility in certain wind energy markets

in the U.S.; loss of key employees and labor disputes or shortages;

our ability to successfully integrate Masonite; any material

adverse changes in the business of Masonite; our ability to achieve

the strategic and other objectives relating to the Masonite

acquisition, including any expected synergies; the strategic review

of our Glass Reinforcements business; defined benefit plan funding

obligations; and factors detailed from time to time in the

company’s Securities and Exchange Commission filings. The

information in this news release speaks as of May 15, 2024, and is

subject to change. The company does not undertake any duty to

update or revise forward-looking statements except as required by

federal securities laws. Any distribution of this news release

after that date is not intended and should not be construed as

updating or confirming such information.

1Based on 2023 actual results plus $125mm run-rate synergies and

excludes costs to achieve synergies.

Table 1

The reconciliation from Net earnings attributable to Owens

Corning to EBITDA and Adjusted EBITDA for 2023 is shown in the

table below (in millions):

Year Ended

December 31, 2023

NET EARNINGS ATTRIBUTABLE TO OWENS

CORNING

$

1,196

Net loss attributable to non-redeemable

and redeemable non-controlling interests

(3

)

NET EARNINGS

1,193

Equity in net earnings of affiliates

3

Income tax expense

401

EARNINGS BEFORE TAXES

1,591

Interest expense, net

76

EARNINGS BEFORE INTEREST AND TAXES

1,667

Depreciation and amortization

609

EARNINGS BEFORE INTEREST, TAXES,

DEPRECIATION AND AMORTIZATION (EBITDA)

2,276

Less: Adjusting items (below)

(138

)

Accelerated depreciation and amortization

included in restructuring

(101

)

ADJUSTED EBITDA

$

2,313

ADJUSTING ITEMS TO EBITDA

Restructuring costs

$

(169

)

Pension settlement losses

(145

)

Paroc marine recall

(15

)

Gains on asset sales

191

TOTAL ADJUSTING ITEMS (a)

$

(138

)

(a) Please refer to the 2023 10-K filing

in the "Adjusted Earnings Before Interest and Taxes ("Adjusted

EBIT") paragraph of Management's Discussion and Analysis for

additional information on these adjusting items.

Source: Owens Corning SEC Filings; Annual

Report on Form 10-K for the year ended December 31, 2023 filed on

February 14, 2024.

Table 2

The reconciliation from Net income attributable to Masonite

International Corporation ("Masonite") to adjusted EBITDA (in

thousands):

Year Ended

December 31, 2023

Net income attributable to Masonite

$

118,227

Plus:

Depreciation

91,145

Amortization

32,976

Share based compensation expense

23,638

Loss on disposal of property, plant and

equipment

4,434

Restructuring costs

10,130

Asset impairment

33,063

Interest expense, net

50,822

Other income, net

(2,087

)

Income tax expense

40,941

Other items (a)

12,311

Net income attributable to non-controlling

interest

3,042

Adjusted EBITDA

$

418,642

(a) In 2023, other items include $12,311

in acquisition and due diligence related costs and legal costs

related to the settlement of Canada class action litigation in the

twelve months ended December 31, 2023, and were recorded in

selling, general and administration expenses within the

consolidated statements of income and comprehensive income.

Source: Masonite SEC Filings; Annual

Report on Form 10-K for the year ended December 31, 2023 filed on

February 29, 2024.

Table 3

The following table combines Owens Corning and Masonite EBITDA;

inclusive of projected synergies (in millions):

Year Ended

December 31, 2023

Owens Corning

+

Masonite

+

Synergies (a)

=

Combined

Net Sales

$9,677

$2,831

—

$12,508

Adjusted EBITDA

$2,313

$419

$125

$2,857

(a) Owens Corning projects to achieve

approximately $125 million of run-rate cost synergies.

Please see Table 1 for the reconciliation

from Net earnings attributable to Owens Corning to EBITDA and

Adjusted EBITDA and Table 2 for the reconciliation from Net income

attributable to Masonite to Adjusted EBITDA.

Source: Owens Corning SEC Filings; Annual

Report on Form 10-K for the years ended December 31, 2023 filed on

February 14, 2024; Masonite SEC Filings; Annual Report on Form 10-K

for the year ended December 31, 2023 filed on February 29,

2024.

Owens Corning Company News / Owens Corning Investor Relations

News

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240514879383/en/

Owens Corning

Megan James Media Relations megan.james@owenscorning.com

419.348.0768

Amber Wohlfarth Investor Relations

amber.wohlfarth@owenscorning.com 419.248.5639

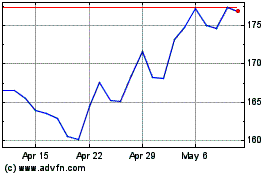

Owens Corning (NYSE:OC)

Historical Stock Chart

From Oct 2024 to Nov 2024

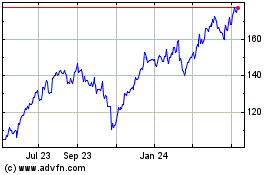

Owens Corning (NYSE:OC)

Historical Stock Chart

From Nov 2023 to Nov 2024