0000074303false00000743032024-08-282024-08-28

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): August 28, 2024

OLIN CORPORATION

(Exact name of registrant as specified in its charter)

| | | | | | | | |

| Virginia | 1-1070 | 13-1872319 |

| (State or Other Jurisdiction of Incorporation) | (Commission File Number) | (IRS Employer Identification No.) |

| | | | | | | | | | | | | | |

| 190 Carondelet Plaza, | Suite 1530 | Clayton, | MO | 63105 |

| (Address of principal executive offices) | (Zip Code) |

(314) 480-1400

(Registrant’s telephone number, including area code)

(Former name or former address, if changed since last report)

| | | | | | | | | | | | | | | | | |

| Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below): |

| | | | | |

| ☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| | | | | |

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| | | | | |

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| | | | | |

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

| | | | | |

| Securities registered pursuant to Section 12(b) of the Act: |

| Title of each class | Trading Symbol | Name of each exchange on which registered |

| Common Stock, $1.00 par value per share | OLN | New York Stock Exchange |

| | | | | |

| Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter). |

| | | | | |

| ☐ | Emerging growth company |

| | | | | |

| ☐ | If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. |

On August 28, 2024, Olin Corporation issued a press release announcing the lifting of its systemwide force majeure on chlor-alkali products declared on July 10, 2024 due to the temporary disruption of its Freeport, Texas operations caused by Hurricane Beryl. A copy of the press release is attached hereto as Exhibit 99.1 and is incorporated herein by reference.

| | | | | |

| Item 9.01. | Financial Statements and Exhibits. |

| |

(d) Exhibit No. | Exhibit |

| 99.1 | |

| 104 | Cover Page Interactive Data File (embedded within the Inline XBRL document) |

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | | | | |

| OLIN CORPORATION |

| By: | /s/ Inchan Hwang |

| | Name: | Inchan Hwang |

| | Title: | Vice President, Deputy General Counsel and Corporate Secretary |

Date: August 28, 2024

Exhibit 99.1

Investor Contact: Steve Keenan

(314) 719-1755

InvestorRelations@Olin.com

News

NewsOlin Corporation, 190 Carondelet Plaza, Suite 1530, Clayton, MO 63105

Olin Corporation Lifts Systemwide Force Majeure for Chlor-Alkali Products

Clayton, MO, August 28, 2024 – Olin Corporation (NYSE: OLN), a leading global manufacturer of chemical products and ammunition, announced today that it has lifted its systemwide force majeure on chlor-alkali products declared on July 10, 2024. Chlor-alkali and derivative production has been returned to operation. A temporary disruption of its Freeport, Texas operations had occurred as a result of Hurricane Beryl. Olin’s Epoxy business is in the process of restarting its Aromatics assets which remain under Force Majeure. Olin remains committed to the safe and reliable operation of its assets.

COMPANY DESCRIPTION

Olin Corporation is a leading vertically integrated global manufacturer and distributor of chemical products and a leading U.S. manufacturer of ammunition. The chemical products produced include chlorine and caustic soda, vinyls, epoxies, chlorinated organics, bleach, hydrogen, and hydrochloric acid. Winchester’s principal manufacturing facilities produce and distribute sporting ammunition, law enforcement ammunition, reloading components, small caliber military ammunition and components, industrial cartridges, and clay targets.

Visit www.olin.com for more information on Olin.

FORWARD-LOOKING STATEMENTS

This communication includes forward-looking statements. These statements relate to analyses and other information that are based on management's beliefs, certain assumptions made by management, forecasts of future results, and current expectations, estimates and projections about the markets and economy in which we and our various segments operate. The statements contained in this communication that are not statements of historical fact may include forward-looking statements that involve a number of risks and uncertainties.

We have used the words "anticipate," "intend," "may," "expect," "believe," "should," "plan," "outlook," "project," "estimate," "forecast," "optimistic," “target,” and variations of such words and similar expressions in this communication to identify such forward-looking statements. These forward-looking statements include, but are not limited to, statements regarding the Company’s intent to repurchase, from time to time, the Company’s common stock. These statements are not guarantees of future performance and involve certain risks, uncertainties, and assumptions, which are difficult to predict and many of which are beyond our control. Therefore, actual outcomes and results may differ materially from those matters expressed or implied in such forward-looking statements. We undertake no obligation to update publicly any forward-looking statements, whether as a result of future events, new information or otherwise. The payment of cash dividends is subject to the discretion of our board of directors and will be determined in light of then-current conditions, including our earnings, our operations, our financial conditions, our capital requirements, and other factors deemed relevant by our board of directors. In the future, our board of directors may change our dividend policy, including the frequency or amount of any dividend, in light of then-existing conditions.

The risks, uncertainties and assumptions involved in our forward-looking statements, many of which are discussed in more detail in our filings with the SEC, including without limitation the "Risk Factors" section of our Annual Report on Form 10-K for the year ended December 31, 2023, and our Quarterly Reports on Form 10-Q and other reports furnished or filed with the SEC, include, but are not limited to, the following:

Business, Industry and Operational Risks

•sensitivity to economic, business and market conditions in the United States and overseas, including economic instability or a downturn in the sectors served by us;

•declines in average selling prices for our products and the supply/demand balance for our products, including the impact of excess industry capacity or an imbalance in demand for our chlor alkali products;

•unsuccessful execution of our strategic operating model, which prioritizes Electrochemical Unit (ECU) margins over sales volumes;

•failure to identify, attract, develop, retain, and motivate qualified employees throughout the organization and ability to manage executive officer and other key senior management transitions;

•failure to control costs and inflation impacts or failure to achieve targeted cost reductions;

•our reliance on a limited number of suppliers for specified feedstock and services and our reliance on third-party transportation;

•the occurrence of unexpected manufacturing interruptions and outages, including those occurring as a result of labor disruptions and production hazards;

•exposure to physical risks associated with climate-related events or increased severity and frequency of severe weather events;

•availability of and/or higher-than-expected costs of raw material, energy, transportation, and/or logistics;

•the failure or an interruption, including cyber-attacks, of our information technology systems;

•our inability to complete future acquisitions or joint venture transactions or successfully integrate them into our business;

•risks associated with our international sales and operations, including economic, political, or regulatory changes;

•our indebtedness and debt service obligations;

•weak industry conditions affecting our ability to comply with the financial maintenance covenants in our senior credit facility;

•adverse conditions in the credit and capital markets, limiting or preventing our ability to borrow or raise capital;

•the effects of any declines in global equity markets on asset values and any declines in interest rates or other significant assumptions used to value the liabilities in, and funding of, our pension plans;

•our long-range plan assumptions not being realized, causing a non-cash impairment charge of long-lived assets;

Legal, Environmental and Regulatory Risks

•changes in, or failure to comply with, legislation or government regulations or policies, including changes regarding our ability to manufacture or use certain products and changes within the international markets in which we operate;

•new regulations or public policy changes regarding the transportation of hazardous chemicals and the security of chemical manufacturing facilities;

•unexpected outcomes from legal or regulatory claims and proceedings;

•costs and other expenditures in excess of those projected for environmental investigation and remediation or other legal proceedings;

•various risks associated with our Lake City U.S. Army Ammunition Plant contract and performance under other governmental contracts; and

•failure to effectively manage environmental, social and governance (ESG) issues and related regulations, including climate change and sustainability.

All of our forward-looking statements should be considered in light of these factors. In addition, other risks and uncertainties not presently known to us or that we consider immaterial could affect the accuracy of our forward-looking statements.

2024-13

v3.24.2.u1

Document and Entity Information

|

Aug. 28, 2024 |

| Cover [Abstract] |

|

| Entity Registrant Name |

OLIN CORPORATION

|

| Entity Central Index Key |

0000074303

|

| Document Type |

8-K

|

| Amendment Flag |

false

|

| Document Period End Date |

Aug. 28, 2024

|

| Entity Incorporation, State or Country Code |

VA

|

| Entity File Number |

1-1070

|

| Entity Tax Identification Number |

13-1872319

|

| Entity Address, Address Line One |

190 Carondelet Plaza,

|

| Entity Address, Address Line Two |

Suite 1530

|

| Entity Address, City or Town |

Clayton,

|

| Entity Address, State or Province |

MO

|

| Entity Address, Postal Zip Code |

63105

|

| City Area Code |

314

|

| Local Phone Number |

480-1400

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Common Stock, $1.00 par value per share

|

| Trading Symbol |

OLN

|

| Security Exchange Name |

NYSE

|

| Entity Emerging Growth Company |

false

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

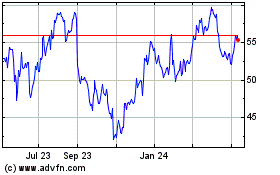

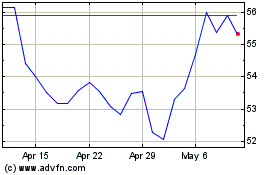

Olin (NYSE:OLN)

Historical Stock Chart

From Oct 2024 to Nov 2024

Olin (NYSE:OLN)

Historical Stock Chart

From Nov 2023 to Nov 2024