UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number

811-05120

Nuveen Municipal Value Fund, Inc.

(Exact name of registrant as specified

in charter)

Nuveen Investments

333 West Wacker Drive

Chicago,

Illinois 60606

(Address of

principal executive offices) (Zip code)

Mark L. Winget

Vice President and Secretary

333

West Wacker Drive

Chicago, Illinois 60606

(Name and address of agent for service)

Registrant’s telephone number, including area code: (800) 257-8787

Date of fiscal year end: October 31

Date of reporting period: October 31, 2024

| Item 1. |

Reports to Stockholders. |

|

|

|

|

|

|

|

|

|

|

|

|

|

Closed-End Funds |

|

|

|

October 31,

2024 |

Nuveen Municipal

Closed-End Funds

|

|

|

| |

|

| Nuveen Municipal Value Fund, Inc. |

|

NUV |

| |

|

| Nuveen AMT-Free Municipal Value Fund |

|

NUW |

| |

|

| Nuveen Municipal Income Fund, Inc. |

|

NMI |

Annual

Report

Table

of Contents

2

Important Notices

NMI- Portfolio Manager Update: Effective April 1, 2024, Christopher Drahn retired from Nuveen Asset Management, LLC

and no longer serves as a portfolio manager of the Fund.

Management fees: As of May 1, 2024, each Fund’s overall complex-level fee begins at

a maximum rate of 0.1600% of the Fund’s average daily net assets, with breakpoints for eligible complex-level assets above $124.3 billion.

Changes in

Independent Registered Public Accounting Firm

(a) Previous independent registered public accounting firm: On October 24, 2024, the

Funds’ Board of Trustees (the “Board”), upon recommendation from the Audit Committee, notified KPMG LLP (“KPMG”) that it would be dismissed as the independent registered public accounting firm for the Funds effective upon

(i) completion of KPMG’s audit of the Funds’ financial statements to be included in the Funds’ Annual Report on Form N-CSR (the “2024 Annual Report”) for the fiscal year ended

October 31, 2024 and (ii) the issuance of KPMG’s report on the same. KPMG’s dismissal as the Funds’ independent registered public accounting firm was effective on December 26, 2024, which is the date on which KPMG

issued their report on their audit of the Funds’ financial statements to be included in the 2024 Annual Report. KPMG’s audit reports on the Funds’ financial statements as of and for the fiscal years ended October 31, 2024 and

October 31, 2023 contained no adverse opinion or disclaimer of opinion nor were they qualified or modified as to uncertainty, audit scope or accounting principles. During the Funds’ fiscal years ended October 31, 2024 and

October 31, 2023, and for the subsequent interim period through December 26, 2024, there were no disagreements with KPMG on any matter of accounting principles or practices, financial statement disclosure or auditing scope or procedures,

which disagreements if not resolved to the satisfaction of KPMG would have caused them to make reference in connection with their reports opinion to the subject matter of the disagreement. During the Funds’ fiscal years ended October 31,

2024 and October 31, 2023 and for the subsequent interim period through December 26, 2024, there were no reportable events (as defined in Regulation S-K Item 304(a)(1)(v)).

The Funds provided KPMG with a copy of the foregoing disclosures and requested that KPMG furnish the Funds with a letter addressed to the U.S. Securities and Exchange

Commission stating whether KPMG agrees with the above statements.

(b) New independent registered public accounting firm: On October 24, 2024, the

Board, upon recommendation from the Audit Committee, appointed PricewaterhouseCoopers LLP (“PwC”) as the new independent registered public accounting firm for the Funds for the fiscal year ended October 31, 2025 audit. During the

Funds’ fiscal years ended October 31, 2024 and October 31, 2023 and for the subsequent interim period through December 26, 2024, the Funds have not consulted with PwC regarding any of the matters described in Regulation S-K Item 304 (“S-K 304”), S-K 304(a)(2)(i) or S-K 304(a)(2)(ii) disclosure.

3

Discussion of Fund Performance

Nuveen Municipal Value Fund, Inc. (NUV)

Nuveen AMT-Free Municipal Value Fund (NUW)

Nuveen Municipal Income Fund, Inc. (NMI)

Nuveen Asset Management, LLC (NAM), an affiliate of Nuveen Fund Advisors, LLC, is the investment adviser for the Nuveen Municipal Value Fund, Inc. (NUV), Nuveen AMT-Free Municipal Value Fund (NUW) and Nuveen Municipal Income Fund, Inc. (NMI).

The portfolio managers for NUV and NUW

are Daniel Close, CFA, and Kristen DeJong, CFA. The portfolio managers for NMI are Kristen DeJong, CFA and Scott Romans, PhD.

Below is a discussion of Fund

performance and the factors that contributed and detracted during the 12-month reporting period ended October 31, 2024. For more information on Fund investment objectives and policies, please refer to the

Shareholder Update section at the end of the report.

Nuveen Municipal Value Fund, Inc. (NUV)

What factors affected markets during the reporting period?

| |

• |

|

The Fund’s trading activity remained focused on pursuing its investment objectives. There were no material changes to

the Fund’s positioning. |

| |

• |

|

Credit fundamentals remained strong, with default activity at low levels. Although supply has increased in 2024 year-to-date, demand for municipal debt remained solid. |

What key

strategies were used to manage the Fund during the reporting period?

| |

• |

|

The Fund’s credit selection focused on identifying issuers where fundamental credit risk was mispriced by the market,

while avoiding names that could have issues in this higher-for-longer financing environment. |

| |

• |

|

The Fund continued to invest primarily in intermediate- and long-duration bonds across a diverse group of sectors, issuers

and credit qualities. The Fund actively participated in the new issue market, where issuance was elevated and pricing was attractive, selling down low book yield positions when needed to reinvest the proceeds in new opportunities.

|

How did the Fund perform and what factors affected relative performance?

For the 12-month reporting period ended October 31, 2024, NUV returned 11.12%. The Fund outperformed the returns of the

S&P Municipal Bond Index, which returned 10.08%.

Top contributors to relative performance

| |

• |

|

The Fund’s use of leverage through inverse floating rate securities. |

| |

• |

|

Duration and yield curve positioning, particularly the overweight to bonds in the longest duration range and underweight to

bonds in the shortest duration range. |

| |

• |

|

Credit quality positioning, specifically the underweight to the highest grade

(AAA-rated and AA-rated) bonds and overweight to A-rated and BBB-rated bonds.

|

Top detractors from relative performance

| |

• |

|

Sector allocation, driven by exposure to long-maturity tobacco bonds and an underweight to the industrial development

revenue sector. |

| |

• |

|

The Fund’s out-of-benchmark allocation

to high yield corporate bonds. In particular, the Fund’s exposure to bonds within the consumer discretionary sector, which were volatile during the reporting period. |

Nuveen AMT-Free Municipal Value (NUW)

What factors affected markets during the reporting period?

| |

• |

|

Municipal bond yields ended the reporting period lower than where they started, although the path was not a straight

|

4

| |

line given uncertainties about the Federal Reserve’s plan for monetary easing and the U.S. election. |

| |

• |

|

Credit fundamentals remained strong, with default activity at low levels. Although supply has increased in 2024 year-to- date, demand for municipal debt remained solid. |

What key

strategies were used to manage the Fund during the reporting period?

| |

• |

|

The Fund’s trading activity remained focused on pursuing its investment objectives. There were no material changes to

the Fund’s positioning. |

| |

• |

|

The Fund continued to invest primarily in intermediate- and long-duration bonds across a diverse group of sectors, issuers

and credit qualities. The Fund actively participated in the new issue market, where issuance was elevated and pricing was attractive, selling down low book yield positions when needed to reinvest the proceeds in new opportunities.

|

How did the Fund perform and what factors affected relative performance?

For the 12-month reporting period ended October 31, 2024, NUW returned 10.72%. The Fund outperformed the returns of the

S&P Municipal Bond Index, which returned 10.08%.

Top contributors to relative performance

| |

• |

|

The Fund’s use of leverage through inverse floating rate securities. |

| |

• |

|

Duration and yield curve positioning, particularly the overweight to bonds in the longest duration range and underweight to

bonds in the shortest duration range. |

| |

• |

|

Credit quality positioning, specifically the underweight to the highest grade

(AAA-rated and AA-rated) bonds and overweight to A-rated and BBB-rated bonds.

|

Top detractors from relative performance

| |

• |

|

Sector allocation, driven by exposure to long-maturity tobacco bonds and an underweight to the industrial development

revenue sector. |

| |

• |

|

The Individual credit selection, as bonds bought at the low point in interest rates during this reporting period generally

underperformed. |

Nuveen Municipal Income Fund, Inc. (NMI)

What factors affected markets during the reporting period?

| |

• |

|

Municipal bond yields ended the reporting period lower than where they started, although the path was not a straight line

given uncertainties about the Federal Reserve’s plan for monetary easing and the U.S. election. |

| |

• |

|

Credit fundamentals remained strong, with default activity at low levels. Although supply has increased in 2024 year-to- date, demand for municipal debt remained solid. |

What key

strategies were used to manage the Fund during the reporting period?

| |

• |

|

The Fund’s trading activity remained focused on pursuing its investment objectives. There were no material changes to

the Fund’s positioning. |

| |

• |

|

The portfolio management worked to transition the portfolio to be more in line with the Fund’s new focus on high yield

investments, as well as took advantage of periods of market softness to buy bonds at attractive valuations and continued to carefully manage the Fund’s income sustainability via tactical trading. |

How did the Fund perform and what factors affected relative performance?

For

the 12-month reporting period ended October 31, 2024, NMI returned 15.13%. The Fund underperformed the returns of the NMI Linked Benchmark, which returned 16.94%. The NMI Linked Benchmark represents the

linked returns between the S&P Municipal Bond Index (through September 29, 2023) and the S&P Municipal Yield Index (subsequent to September 29, 2023).

Top contributors to relative performance

| |

• |

|

Duration and yield curve positioning, particularly an overweight to durations over 12 years and an underweight to

|

5

(continued)

| |

durations of zero to four years. |

| |

• |

|

Credit quality positioning, specifically an overweight to non-rated bonds and an

underweight to high-grade (AAA-rated and AA-rated) bonds. |

| |

• |

|

Individual credit selection. |

Top detractors from relative performance

| |

• |

|

Sector allocations, driven by exposure to the industrial development revenue and life care sectors. |

| |

• |

|

Although security selection overall contributed, selection among bonds with durations longer than 12 years detracted.

|

This material is not intended to be a recommendation or

investment advice, does not constitute a solicitation to buy, sell or hold a security or an investment strategy, and is not provided in a fiduciary capacity. The information provided does not take into account the specific objectives or

circumstances of any particular investor, or suggest any specific course of action. Investment decisions should be made based on an investor’s objectives and circumstances and in consultation with his or her advisors.

Certain statements in this report are forward-looking statements. Discussions of specific investments are for illustration only and are not intended as recommendations

of individual investments. The forward-looking statements and other views expressed herein are those of the portfolio managers as of the date of this report. Actual future results or occurrences may differ significantly from those anticipated in any

forward-looking statements, and the views expressed herein are subject to change at any time, due to numerous market and other factors. The Funds disclaim any obligation to update publicly or revise any forward-looking statements or views expressed

herein.

For financial reporting purposes, the ratings disclosed are the highest rating given by one of the following national rating agencies: Standard

& Poor’s Group (S&P), Moody’s Investors Service, Inc. (Moody’s) or Fitch, Inc. (Fitch). This treatment of split-rated securities may

differ from that used for other purposes, such as for Fund investment policies. Credit ratings are subject to change. AAA, AA, A and BBB are investment grade ratings, while BB, B, CCC, CC, C and D are below investment grade ratings. Holdings

designated N/R are not rated by these national rating agencies.

Bond insurance guarantees only the payment of principal and interest on the bond when due, and

not the value of the bonds themselves, which will fluctuate with the bond market and the financial success of the issuer and the insurer. Insurance relates specifically to the bonds in the portfolio and not to the share prices of a Fund. No

representation is made as to the insurers’ ability to meet their commitments.

Refer to the Glossary of Terms Used in this Report for further definition

of the terms used within this section.

6

Common Share Information

COMMON SHARE DISTRIBUTION INFORMATION

The following information

regarding the Funds’ distributions is current as of October 31, 2024. Each Fund’s distribution levels may vary over time based on each Fund’s investment activity and portfolio investment value changes.

During the current reporting period, each Fund’s distributions to common shareholders were as shown in the accompanying table.

|

|

|

|

|

|

|

| |

|

Per Common Share Amounts |

| Monthly Distributions (Ex-Dividend Date) |

|

NUV |

|

NUW |

|

NMI |

|

|

|

|

| November |

|

$0.0290 |

|

$0.0425 |

|

$0.0315 |

| December |

|

0.0290 |

|

0.0425 |

|

0.0340 |

| January |

|

0.0290 |

|

0.0425 |

|

0.0340 |

| February |

|

0.0290 |

|

0.0425 |

|

0.0340 |

| March |

|

0.0290 |

|

0.0425 |

|

0.0360 |

| April |

|

0.0290 |

|

0.0425 |

|

0.0360 |

| May |

|

0.0290 |

|

0.0425 |

|

0.0360 |

| June |

|

0.0290 |

|

0.0425 |

|

0.0360 |

| July |

|

0.0290 |

|

0.0425 |

|

0.0360 |

| August |

|

0.0290 |

|

0.0425 |

|

0.0360 |

| September |

|

0.0310 |

|

0.0465 |

|

0.0380 |

| October |

|

0.0310 |

|

0.0465 |

|

0.0380 |

| Total Distributions from Net

Investment Income |

|

$0.3520 |

|

$0.5180 |

|

$0.4255 |

|

|

|

|

| Yields |

|

NUV |

|

NUW |

|

NMI |

| Market Yield1 |

|

4.18% |

|

4.02% |

|

4.71% |

| Taxable-Equivalent

Yield1 |

|

7.05% |

|

6.79% |

|

7.96% |

| 1 |

Market Yield is based on the Fund’s current annualized monthly dividend divided by the Fund’s current market

price as of the end of the reporting period. Taxable-Equivalent Yield represents the yield that must be earned on a fully taxable investment in order to equal the yield of the Fund on an after-tax basis. It is

based on a federal income tax rate of 40.8%. Your actual federal income tax rate may differ from the assumed rate. The Taxable-Equivalent Yield also takes into account the percentage of the Fund’s income generated and paid by the Fund (based on

payments made during the previous calendar year) that was not exempt from federal income tax. Separately, if the comparison were instead to investments that generate qualified dividend income, which is taxable at a rate lower than an

individual’s ordinary graduated tax rate, the fund’s Taxable-Equivalent Yield would be lower. |

Each Fund’s distribution policy,

which may be changed by the Board, is to make regular monthly cash distributions to holders of its common shares (stated in terms of a fixed cents per common share dividend distribution rate which may be set from time to time). The Fund intends to

distribute all or substantially all of its net investment income each year through its regular monthly distribution and to distribute realized capital gains at least annually. In addition, in any monthly period, to maintain its declared per common

share distribution amount, the Fund may distribute more or less than its net investment income during the period. In the event the Fund distributes more than its net investment income during any yearly period, such distributions may also include

realized gains and/or a return of capital. To the extent that a distribution includes a return of capital the NAV per share may erode. If the Fund’s distribution includes anything other than net investment income, the Fund will provide a notice

to shareholders of its best estimate of the distribution sources at that the time of the distribution. These estimates may not match the final tax characterization (for the full year’s distributions) contained in shareholders’ 1099-DIV forms after the end of the year.

NUVEEN CLOSED-END FUND DISTRIBUTION AMOUNTS

The Nuveen Closed-End Funds’ monthly and quarterly periodic distributions to shareholders are posted on

www.nuveen.com and can be found on Nuveen’s enhanced closed-end fund resource page, which is at

https://www.nuveen.com/resource-center-closed-end-funds, along with other Nuveen closed-end fund product updates. To ensure

timely access to the latest information, shareholders may use a subscribe function, which can be activated at this web page (https://www.nuveen.com/subscriptions).

7

Common Share Information (continued)

COMMON SHARE EQUITY SHELF PROGRAM

During the current reporting

period, NMI was authorized by the Securities and Exchange Commission to issue additional common shares through an equity shelf program (Shelf Offering). Under these programs, NMI, subject to market conditions, may raise additional capital

from time to time in varying amounts and offering methods at a net price at or above the Fund’s NAV per common share. The maximum aggregate offering under these Shelf Offerings are as shown in the accompanying table.

|

|

|

| |

|

NMI |

| Maximum aggregate offering |

|

2,000,000* |

*For the period May 2, 2024 through October 31, 2024. For the period November 1, 2023 through March 20, 2024 the

maximum aggregate offering was 2,200,000.

During the current reporting period, NMI did not sell any common shares through its Shelf Offering.

Refer to the Notes to Financial Statements for further details on Shelf Offerings and the Fund’s transactions.

COMMON SHARE REPURCHASES

The Funds’ Board of Directors/Trustees

reauthorized an open-market share repurchase program, allowing each Fund to repurchase and retire an aggregate of up to approximately 10% of its outstanding common shares.

During the current reporting period, the Funds did not repurchase any of their outstanding common shares. As of October 31, 2024, (and since the inception of the

Funds’ repurchase programs), each Fund has cumulatively repurchased and retired its outstanding common shares as shown in the accompanying table.

|

|

|

|

|

|

|

| |

|

NUV |

|

NUW |

|

NMI |

|

|

|

|

| Common shares cumulatively repurchased and retired |

|

0 |

|

0 |

|

0 |

| Common shares authorized for repurchase |

|

20,750,000 |

|

1,795,000 |

|

1,005,000 |

8

About the Funds’ Benchmarks

S&P Municipal Bond Index: An index designed to measure the performance of the tax-exempt U.S. municipal bond market. Index returns assume reinvestment of distributions, but do not reflect any applicable sales charges or management fees.

S&P Municipal Yield Index: An index that is structured so that 70% of the index consists of bonds that are either not rated or are rated below investment

grade, 20% are rated BBB/Baa, and 10% are rated single A. Index returns assume reinvestment of distributions, but do not reflect any applicable sales charges or management fees.

9

Fund Performance and Holdings

The Fund Performance and Holding Summaries for each Fund are shown below within this section of

the report.

Fund Performance

Performance data shown represents past

performance and does not predict or guarantee future results. Current performance may be higher or lower than the data shown. Returns do not reflect the deduction of taxes that shareholders may have to pay on Fund distributions or upon the sale of

Fund shares. Returns at NAV are net of Fund expenses, and assume reinvestment of distributions. Comparative index return information is provided for the Fund’s shares at NAV only. Indexes are not available for direct investment.

Total returns for a period of less than one year are not annualized (i.e. cumulative returns). Since inception returns are shown for share classes that have less than 10-years of performance. For performance, current to the most recent month-end visit Nuveen.com or call (800) 257-8787.

Holding Summaries

The Holdings Summaries data relates to the securities held

in each Fund’s portfolio of investments as of the end of this reporting period. It should not be construed as a measure of performance for the Fund itself. Holdings are subject to change. Refer to the Fund’s Portfolio of Investments for

individual security information.

For financial reporting purposes, the ratings disclosed are the highest rating given by one of the following national rating

agencies: Standard & Poor’s Group, Moody’s Investors Service, Inc. or Fitch, Inc. This treatment of split-rated securities may differ from that used for other purposes, such as for Fund investment policies. Credit ratings are

subject to change. AAA, AA, A and BBB are investment grade ratings; BB, B, CCC, CC, C and D are below-investment grade ratings. Holdings designated N/R are not rated by these national rating agencies.

10

|

|

|

| NUV |

|

Nuveen Municipal Value Fund, Inc.

Fund Performance and Holdings October 31, 2024 |

Refer to the Glossary of Terms Used in this Report for further definition of the terms used within this section.

Performance*

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

Total Returns as of

October 31, 2024 |

|

| |

|

|

|

|

Average Annual |

|

| |

|

Inception

Date |

|

|

1-Year |

|

|

5-Year |

|

|

10-Year |

|

| |

|

| NUV at Common Share NAV |

|

|

6/17/87 |

|

|

|

11.12% |

|

|

|

1.00% |

|

|

|

2.78% |

|

| |

|

| NUV at Common Share Price |

|

|

6/17/87 |

|

|

|

16.10% |

|

|

|

0.53% |

|

|

|

3.06% |

|

| |

|

| S&P Municipal Bond Index |

|

|

– |

|

|

|

10.08% |

|

|

|

1.22% |

|

|

|

2.38% |

|

| |

|

*For purposes of Fund performance, relative results are measured against the S&P Municipal Bond Index.

Daily Common Share NAV and Share Price

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Common

Share

NAV |

|

|

Common

Share Price |

|

|

Premium/(Discount)

to NAV |

|

|

Average

Premium/(Discount)

to NAV |

|

| |

$9.30 |

|

|

|

$8.91 |

|

|

|

(4.19)% |

|

|

|

(6.96)% |

|

Growth of an Assumed $10,000 Investment as of October 31, 2024 - Common Share Price

11

Performance Overview and Holdings October 31, 2024 (continued)

Holdings

|

|

|

|

|

| Fund Allocation |

|

|

|

| (% of net assets) |

|

|

|

| |

|

| Municipal Bonds |

|

|

101.8% |

|

| |

|

| Short-Term Municipal Bonds |

|

|

0.6% |

|

| |

|

| Other Assets & Liabilities, Net |

|

|

(0.5)% |

|

| |

|

| Floating Rate Obligations |

|

|

(1.9)% |

|

| |

|

| Net Assets |

|

|

100% |

|

| |

|

|

|

| Bond Credit Quality |

|

|

|

| (% of total investments) |

|

|

|

| |

|

| U.S. Guaranteed |

|

|

3.8% |

|

| |

|

| AAA |

|

|

9.2% |

|

| |

|

| AA |

|

|

40.7% |

|

| |

|

| A |

|

|

27.7% |

|

| |

|

| BBB |

|

|

10.0% |

|

| |

|

| BB or Lower |

|

|

2.6% |

|

| |

|

| N/R (not rated) |

|

|

6.0% |

|

| |

|

| Total |

|

|

100% |

|

| |

|

|

|

|

|

|

| Portfolio Composition |

|

|

|

| (% of total investments) |

|

|

|

| |

|

| Tax Obligation/Limited |

|

|

28.3% |

|

| |

|

| Transportation |

|

|

20.8% |

|

| |

|

| Utilities |

|

|

16.6% |

|

| |

|

| Tax Obligation/General |

|

|

13.4% |

|

| |

|

| Health Care |

|

|

9.2% |

|

| |

|

| U.S. Guaranteed |

|

|

3.8% |

|

| |

|

| Consumer Staples |

|

|

2.9% |

|

| |

|

| Other |

|

|

5.0% |

|

| |

|

| Total |

|

|

100% |

|

| |

|

|

|

|

|

|

| States and Territories1 |

|

|

|

| (% of total municipal bonds) |

|

|

|

| |

|

| Texas |

|

|

14.6% |

|

| |

|

| New York |

|

|

11.5% |

|

| |

|

| Illinois |

|

|

10.7% |

|

| |

|

| California |

|

|

6.0% |

|

| |

|

| Florida |

|

|

5.4% |

|

| |

|

| Colorado |

|

|

5.3% |

|

| |

|

| New Jersey |

|

|

4.6% |

|

| |

|

| Washington |

|

|

3.9% |

|

| |

|

| Ohio |

|

|

3.8% |

|

| |

|

| Michigan |

|

|

3.1% |

|

| |

|

| Georgia |

|

|

3.0% |

|

| |

|

| South Carolina |

|

|

2.7% |

|

| |

|

| Pennsylvania |

|

|

2.0% |

|

| |

|

| Nevada |

|

|

2.0% |

|

| |

|

| Puerto Rico |

|

|

1.8% |

|

| |

|

| Kentucky |

|

|

1.6% |

|

| |

|

| District of Columbia |

|

|

1.6% |

|

| |

|

| Arizona |

|

|

1.6% |

|

| |

|

| Maryland |

|

|

1.3% |

|

| |

|

| Tennessee |

|

|

1.3% |

|

| |

|

| Other |

|

|

12.2% |

|

| |

|

| Total |

|

|

100% |

|

| |

|

| 1 |

See the Portfolio of Investments for the remaining states comprising “Other” and not listed in the table above.

|

12

|

|

|

| NUW |

|

Nuveen AMT-Free Municipal Value Fund

Fund Performance and Holdings October 31, 2024 |

Refer to the Glossary of Terms Used in this Report for further definition of the terms used within this section.

Performance*

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

Total Returns as of

October 31, 2024 |

|

| |

|

|

|

|

Average Annual |

|

| |

|

Inception

Date |

|

|

1-Year |

|

|

5-Year |

|

|

10-Year |

|

| |

|

| NUW at Common Share NAV |

|

|

2/25/09 |

|

|

|

10.72% |

|

|

|

1.13% |

|

|

|

2.76% |

|

| |

|

| NUW at Common Share Price |

|

|

2/25/09 |

|

|

|

14.46% |

|

|

|

(0.38)% |

|

|

|

2.17% |

|

| |

|

| S&P Municipal Bond Index |

|

|

– |

|

|

|

10.08% |

|

|

|

1.22% |

|

|

|

2.38% |

|

| |

|

*For purposes of Fund performance, relative results are measured against the S&P Municipal Bond Index.

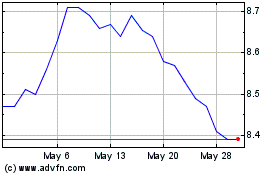

Daily Common Share NAV and Share Price

|

|

|

|

|

|

|

|

|

|

|

|

|

| Common

Share

NAV |

|

Common

Share Price |

|

|

Premium/(Discount)

to NAV |

|

|

Average

Premium/(Discount)

to NAV |

|

| $15.20 |

|

|

$13.89 |

|

|

|

(8.62)% |

|

|

|

(10.12)% |

|

Growth of an Assumed $10,000 Investment as of October 31, 2024 - Common Share

Price

13

Fund Performance and Holdings October 31, 2024 (continued)

Holdings

|

|

|

|

|

| Fund Allocation |

|

|

|

| (% of net assets) |

|

|

|

| |

|

| Municipal Bonds |

|

|

98.7% |

|

| |

|

| Variable Rate Senior Loan Interests |

|

|

0.0% |

|

| |

|

| Short-Term Municipal Bonds |

|

|

4.2% |

|

| |

|

| Other Assets & Liabilities, Net |

|

|

(2.2)% |

|

| |

|

| Floating Rate Obligations |

|

|

(0.7)% |

|

| |

|

| Net Assets |

|

|

100% |

|

| |

|

|

|

| Bond Credit Quality |

|

|

|

| (% of total investments) |

|

|

|

| |

|

| U.S. Guaranteed |

|

|

1.0% |

|

| |

|

| AAA |

|

|

14.0% |

|

| |

|

| AA |

|

|

39.7% |

|

| |

|

| A |

|

|

28.4% |

|

| |

|

| BBB |

|

|

8.7% |

|

| |

|

| BB or Lower |

|

|

1.9% |

|

| |

|

| N/R (not rated) |

|

|

6.3% |

|

| |

|

| Total |

|

|

100% |

|

| |

|

|

|

|

|

|

| Portfolio Composition |

|

|

|

| (% of total investments) |

|

|

|

| |

|

| Tax Obligation/Limited |

|

|

23.5% |

|

| |

|

| Utilities |

|

|

21.5% |

|

| |

|

| Tax Obligation/General |

|

|

17.0% |

|

| |

|

| Health Care |

|

|

12.3% |

|

| |

|

| Transportation |

|

|

8.3% |

|

| |

|

| Education and Civic Organizations |

|

|

7.0% |

|

| |

|

| Consumer Staples |

|

|

3.3% |

|

| |

|

| Other |

|

|

7.1% |

|

| |

|

| Variable Rate Senior Loan Interests |

|

|

0.0% |

|

| |

|

| Total |

|

|

100% |

|

| |

|

|

|

|

|

|

| States and Territories1 |

|

|

|

| (% of total municipal bonds) |

|

|

|

| |

|

| Texas |

|

|

11.4% |

|

| |

|

| California |

|

|

11.1% |

|

| |

|

| New York |

|

|

11.0% |

|

| |

|

| Illinois |

|

|

7.6% |

|

| |

|

| New Jersey |

|

|

6.2% |

|

| |

|

| Ohio |

|

|

5.1% |

|

| |

|

| Pennsylvania |

|

|

5.0% |

|

| |

|

| Colorado |

|

|

4.2% |

|

| |

|

| Florida |

|

|

3.5% |

|

| |

|

| Maryland |

|

|

3.4% |

|

| |

|

| Nevada |

|

|

3.4% |

|

| |

|

| Tennessee |

|

|

3.4% |

|

| |

|

| Puerto Rico |

|

|

3.0% |

|

| |

|

| South Carolina |

|

|

3.0% |

|

| |

|

| Kentucky |

|

|

2.8% |

|

| |

|

| Washington |

|

|

2.7% |

|

| |

|

| Georgia |

|

|

2.2% |

|

| |

|

| Arizona |

|

|

1.5% |

|

| |

|

| Michigan |

|

|

1.4% |

|

| |

|

| Virginia |

|

|

1.3% |

|

| |

|

| Other |

|

|

6.8% |

|

| |

|

| Total |

|

|

100% |

|

| |

|

| 1 |

See the Portfolio of Investments for the remaining states comprising “Other” and not listed in the table above.

|

14

|

|

|

| NMI |

|

Nuveen Municipal Income Fund, Inc. |

| |

Fund Performance and Holdings October 31, 2024 |

Refer to the Glossary of Terms Used in this Report for further definition of the terms used within this section.

Performance*

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

Total Returns as of

October 31, 2024 |

|

| |

|

|

|

|

Average Annual |

|

| |

|

Inception

Date |

|

|

1-Year |

|

|

5-Year |

|

|

10-Year |

|

| |

|

| NMI at Common Share NAV |

|

|

4/20/88 |

|

|

|

15.13% |

|

|

|

1.44% |

|

|

|

2.75% |

|

| |

|

| NMI at Common Share Price |

|

|

4/20/88 |

|

|

|

21.21% |

|

|

|

0.65% |

|

|

|

2.57% |

|

| |

|

| S&P Municipal Bond Index |

|

|

– |

|

|

|

10.08% |

|

|

|

1.22% |

|

|

|

2.38% |

|

| |

|

| S&P Municipal Yield Index |

|

|

– |

|

|

|

16.94% |

|

|

|

2.53% |

|

|

|

4.20% |

|

| |

|

| NMI Linked Benchmark |

|

|

– |

|

|

|

16.94% |

|

|

|

2.23% |

|

|

|

2.89% |

|

| |

|

*For purposes of Fund performance, relative results are measured against the linked returns between the S&P Municipal Bond Index

(through September 29, 2023) and the S&P Municipal Yield Index (subsequent to September 29, 2023).

Daily Common Share NAV and Share Price

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Common

Share

NAV |

|

|

Common

Share Price |

|

|

Premium/(Discount)

to NAV |

|

|

Average

Premium/(Discount)

to NAV |

|

| |

$10.10 |

|

|

|

$9.68 |

|

|

|

(4.16)% |

|

|

|

(5.16)% |

|

Growth of an Assumed $10,000 Investment as of October 31, 2024 - Common Share

Price

15

16

Holdings

|

|

|

|

|

| Fund Allocation |

|

|

|

| (% of net assets) |

|

|

|

| |

|

| Municipal Bonds |

|

|

98.8% |

|

| |

|

| Other Assets & Liabilities, Net |

|

|

1.2% |

|

| |

|

| Net Assets |

|

|

100% |

|

| |

|

|

|

| Bond Credit Quality |

|

|

|

| (% of total investments) |

|

|

|

| |

|

| U.S. Guaranteed |

|

|

1.4% |

|

| |

|

| AA |

|

|

11.1% |

|

| |

|

| A |

|

|

19.1% |

|

| |

|

| BBB |

|

|

19.4% |

|

| |

|

| BB or Lower |

|

|

9.7% |

|

| |

|

| N/R (not rated) |

|

|

39.3% |

|

| |

|

| Total |

|

|

100% |

|

| |

|

|

|

|

|

|

| Portfolio Composition |

|

|

|

| (% of total investments) |

|

|

|

| |

|

| Tax Obligation/Limited |

|

|

26.5% |

|

| |

|

| Transportation |

|

|

19.8% |

|

| |

|

| Education and Civic Organizations |

|

|

15.1% |

|

| |

|

| Health Care |

|

|

13.2% |

|

| |

|

| Utilities |

|

|

5.2% |

|

| |

|

| Long-Term Care |

|

|

5.1% |

|

| |

|

| Tax Obligation/General |

|

|

4.5% |

|

| |

|

| Other |

|

|

10.6% |

|

| |

|

| Total |

|

|

100% |

|

| |

|

|

|

|

|

|

| States and Territories1 |

|

|

|

| (% of total municipal bonds) |

|

|

|

| |

|

| Florida |

|

|

11.3% |

|

| |

|

| Colorado |

|

|

10.9% |

|

| |

|

| Illinois |

|

|

10.2% |

|

| |

|

| New York |

|

|

7.9% |

|

| |

|

| Texas |

|

|

6.8% |

|

| |

|

| California |

|

|

5.0% |

|

| |

|

| Arizona |

|

|

4.9% |

|

| |

|

| Wisconsin |

|

|

3.8% |

|

| |

|

| Pennsylvania |

|

|

3.7% |

|

| |

|

| Indiana |

|

|

3.6% |

|

| |

|

| Missouri |

|

|

2.8% |

|

| |

|

| North Carolina |

|

|

2.7% |

|

| |

|

| Georgia |

|

|

2.5% |

|

| |

|

| Alabama |

|

|

2.5% |

|

| |

|

| Ohio |

|

|

2.4% |

|

| |

|

| Virginia |

|

|

2.3% |

|

| |

|

| Puerto Rico |

|

|

2.1% |

|

| |

|

| Louisiana |

|

|

2.0% |

|

| |

|

| Minnesota |

|

|

1.9% |

|

| |

|

| Washington |

|

|

1.6% |

|

| |

|

| Other |

|

|

9.1% |

|

| |

|

| Total |

|

|

100% |

|

| |

|

| 1 |

See the Portfolio of Investments for the remaining states comprising “Other” and not listed in the table above.

|

17

Report of Independent Registered

Public Accounting Firm

To the

Shareholders and Board of Directors/Trustees

Nuveen Municipal Value Fund, Inc., Nuveen AMT-Free Municipal Value Fund,

and Nuveen Municipal Income Fund, Inc.:

Opinion on the Financial Statements

We have audited the accompanying statements of assets and liabilities of Nuveen Municipal Value Fund, Inc., Nuveen AMT-Free

Municipal Value Fund, and Nuveen Municipal Income Fund, Inc. (the Funds), including the portfolios of investments, as of October 31, 2024, the related statements of operations for the year then ended, the statements of changes in net assets for

each of the years in the two-year period then ended, and the related notes (collectively, the financial statements) and the financial highlights for each of the years in the

five-year period then ended. In our opinion, the financial statements and financial highlights present fairly, in all material respects, the financial position of the Funds as of October 31, 2024, the

results of their operations for the year then ended, the changes in their net assets for each of the years in the two-year period then ended, and the financial highlights for each of the years in the five-year period then ended, in conformity with U.S. generally accepted accounting principles.

Basis for Opinion

These financial statements and financial highlights are the responsibility of the Funds’ management. Our responsibility is to express an opinion on these financial

statements and financial highlights based on our audits. We are a public accounting firm registered with the Public Company Accounting Oversight Board (United States) (PCAOB) and are required to be independent with respect to the Funds in accordance

with the U.S. federal securities laws and the applicable rules and regulations of the Securities and Exchange Commission and the PCAOB.

We conducted our audits in

accordance with the standards of the PCAOB. Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements and financial highlights are free of material misstatement, whether due to

error or fraud. Our audits included performing procedures to assess the risks of material misstatement of the financial statements and financial highlights, whether due to error or fraud, and performing procedures that respond to those risks. Such

procedures included examining, on a test basis, evidence regarding the amounts and disclosures in the financial statements and financial highlights. Such procedures also included confirmation of securities owned as of October 31, 2024, by

correspondence with custodians and brokers; when replies were not received from brokers, we performed other auditing procedures. Our audits also included evaluating the accounting principles used and significant estimates made by management, as well

as evaluating the overall presentation of the financial statements and financial highlights. We believe that our audits provide a reasonable basis for our opinion.

/s/ KPMG LLP

We have served as the auditor of one or more Nuveen

investment companies since 2014.

Chicago, Illinois

December 26, 2024

18

Portfolio of Investments October 31, 2024

NUV

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| PRINCIPAL |

|

|

|

|

DESCRIPTION |

|

RATE |

|

|

MATURITY |

|

|

VALUE |

|

|

|

|

|

|

|

LONG-TERM INVESTMENTS - 101.8% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

MUNICIPAL BONDS - 101.8% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

ALABAMA - 0.5% |

|

|

|

|

|

|

|

|

|

|

|

|

| $ |

4,640,000 |

|

|

|

|

Black Belt Energy Gas District, Alabama, Gas Project Revenue Bonds, Series 2024C, (Mandatory Put 7/01/31) |

|

|

5.000% |

|

|

|

05/01/55 |

|

|

$ |

4,956,126 |

|

| |

2,455,000 |

|

|

|

|

Jefferson County, Alabama, Sewer Revenue Warrants, Series 2024 |

|

|

5.500 |

|

|

|

10/01/53 |

|

|

|

2,659,831 |

|

| |

2,000,000 |

|

|

|

|

Mobile County Industrial Development Authority, Alabama, Solid Waste Disposal Revenue Bonds, AM/NS Calvert LLC Project, Series 2024A, (AMT) |

|

|

5.000 |

|

|

|

06/01/54 |

|

|

|

2,044,398 |

|

|

|

|

|

|

|

TOTAL ALABAMA |

|

|

|

|

|

|

|

|

|

|

9,660,355 |

|

|

|

|

|

|

|

ALASKA - 0.5% |

|

|

|

|

|

|

|

|

|

|

|

|

| |

9,750,000 |

|

|

|

|

Anchorage, Alaska, Solid Waste Services Revenue Bonds, Refunding Series 2022A |

|

|

4.000 |

|

|

|

11/01/52 |

|

|

|

9,304,963 |

|

|

|

|

|

|

|

TOTAL ALASKA |

|

|

|

|

|

|

|

|

|

|

9,304,963 |

|

|

|

|

|

|

|

ARIZONA - 1.6% |

|

|

|

|

|

|

|

|

|

|

|

|

| |

1,420,000 |

|

|

|

|

Chandler Industrial Development Authority, Arizona, Industrial Development Revenue Bonds, Intel Corporation Project, Series 2019, (AMT), (Mandatory Put 6/01/29) |

|

|

4.000 |

|

|

|

06/01/49 |

|

|

|

1,421,158 |

|

| |

21,745,000 |

|

|

|

|

Salt River Project Agricultural Improvement and Power District, Arizona, Electric System Revenue Bonds, Series 2023B |

|

|

5.250 |

|

|

|

01/01/53 |

|

|

|

23,864,981 |

|

| |

5,600,000 |

|

|

|

|

Salt Verde Financial Corporation, Arizona, Senior Gas Revenue Bonds, Citigroup Energy Inc Prepay Contract Obligations, Series 2007 |

|

|

5.000 |

|

|

|

12/01/37 |

|

|

|

6,077,546 |

|

|

|

|

|

|

|

TOTAL ARIZONA |

|

|

|

|

|

|

|

|

|

|

31,363,685 |

|

|

|

|

|

|

|

CALIFORNIA - 6.2% |

|

|

|

|

|

|

|

|

|

|

|

|

| |

1,955,000 |

|

|

|

|

Burbank-Glendale-Pasadena Airport Authority, California, Airport Revenue Bonds, Senior Series 2024B, (AMT) |

|

|

5.250 |

|

|

|

07/01/49 |

|

|

|

2,087,964 |

|

| |

10,000,000 |

|

|

|

|

California County Tobacco Securitization Agency, Tobacco Settlement Asset-Backed Bonds, Los Angeles County Securitization Corporation, Series 2020B-2 |

|

|

0.000 |

|

|

|

06/01/55 |

|

|

|

1,922,514 |

|

| |

4,080,000 |

|

|

(a) |

|

California Health Facilities Financing Authority, California, Revenue Bonds, Sutter Health, Refunding Series 2016B, (Pre-refunded 11/15/26) |

|

|

5.000 |

|

|

|

11/15/46 |

|

|

|

4,264,506 |

|

| |

5,920,000 |

|

|

|

|

California Health Facilities Financing Authority, California, Revenue Bonds, Sutter Health, Series 2018A |

|

|

5.000 |

|

|

|

11/15/48 |

|

|

|

6,071,820 |

|

| |

1,830,000 |

|

|

|

|

California Health Facilities Financing Authority, Revenue Bonds, Adventist Health System/West, Series 2024A |

|

|

5.250 |

|

|

|

12/01/43 |

|

|

|

1,982,631 |

|

| |

2,850,000 |

|

|

|

|

California Health Facilities Financing Authority, Revenue Bonds, Adventist Health System/West, Series 2024A |

|

|

5.250 |

|

|

|

12/01/44 |

|

|

|

3,078,031 |

|

| |

1,650,000 |

|

|

|

|

California Health Facilities Financing Authority, Revenue Bonds, Children’s Hospital Los Angeles, Series 2017A |

|

|

5.000 |

|

|

|

08/15/35 |

|

|

|

1,697,721 |

|

| |

1,635,000 |

|

|

|

|

California Municipal Finance Authority, Revenue Bonds, Linxs APM Project, Senior Lien Series 2018A, (AMT) |

|

|

5.000 |

|

|

|

12/31/43 |

|

|

|

1,652,648 |

|

| |

3,495,000 |

|

|

|

|

California Municipal Finance Authority, Revenue Bonds, Linxs APM Project, Senior Lien Series 2018A, (AMT) |

|

|

5.000 |

|

|

|

12/31/47 |

|

|

|

3,525,084 |

|

| |

1,000,000 |

|

|

|

|

California Municipal Finance Authority, Revenue Bonds, Linxs APM Project, Senior Lien Series 2018B, (AMT) |

|

|

5.000 |

|

|

|

06/01/48 |

|

|

|

1,007,384 |

|

| |

2,290,000 |

|

|

(b) |

|

California Pollution Control Financing Authority, Water Furnishing Revenue Bonds, San Diego County Water Authoriity Desalination Project Pipeline, Refunding Series 2019 |

|

|

5.000 |

|

|

|

07/01/39 |

|

|

|

2,372,517 |

|

| |

3,500,000 |

|

|

(b) |

|

California Statewide Communities Development Authority, California, Revenue Bonds, Loma Linda University Medical Center, Series 2016A |

|

|

5.000 |

|

|

|

12/01/46 |

|

|

|

3,526,262 |

|

| |

4,505,000 |

|

|

|

|

Covina-Valley Unified School District, Los Angeles County, California, General Obligation Bonds, Series 2003B - FGIC Insured |

|

|

0.010 |

|

|

|

06/01/28 |

|

|

|

4,018,788 |

|

| |

2,180,000 |

|

|

|

|

Foothill/Eastern Transportation Corridor Agency, California, Toll Road Revenue Bonds, Refunding Series 2013A |

|

|

6.850 |

|

|

|

01/15/42 |

|

|

|

2,574,545 |

|

| |

1,000,000 |

|

|

|

|

Fresno, California, Airport Revenue Bonds, Series 2023A - BAM Insured, (AMT) |

|

|

5.000 |

|

|

|

07/01/48 |

|

|

|

1,047,038 |

|

| |

1,000,000 |

|

|

|

|

Fresno, California, Airport Revenue Bonds, Series 2023A - BAM Insured, (AMT) |

|

|

5.000 |

|

|

|

07/01/53 |

|

|

|

1,041,321 |

|

19

Portfolio of Investments October 31, 2024 (continued)

NUV

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| PRINCIPAL |

|

|

|

|

DESCRIPTION |

|

RATE |

|

|

MATURITY |

|

|

VALUE |

|

|

|

|

|

|

|

CALIFORNIA (continued) |

|

|

|

|

|

|

|

|

|

|

|

|

| $ |

34,020,000 |

|

|

|

|

Golden State Tobacco Securitization Corporation, California, Tobacco Settlement Asset-Backed Bonds, Capital Appreciation Series 2021B-2 |

|

|

0.010% |

|

|

|

06/01/66 |

|

|

$ |

3,696,181 |

|

| |

345,000 |

|

|

|

|

Golden State Tobacco Securitization Corporation, California, Tobacco Settlement Asset-Backed Revenue Bonds, Series 2022A-1 |

|

|

5.000 |

|

|

|

06/01/51 |

|

|

|

362,826 |

|

| |

2,780,000 |

|

|

|

|

Los Angeles Department of Airports, California, Revenue Bonds, Los Angeles International Airport, Refunding Subordinate Series 2022I |

|

|

5.000 |

|

|

|

05/15/48 |

|

|

|

3,014,287 |

|

| |

2,725,000 |

|

|

|

|

Los Angeles Department of Water and Power, California, Water System Revenue Bonds, Series 2023A |

|

|

5.250 |

|

|

|

07/01/53 |

|

|

|

3,033,445 |

|

| |

2,365,000 |

|

|

|

|

Montebello Unified School District, Los Angeles County, California, General Obligation Bonds, Election 1998 Series 2004 - FGIC Insured |

|

|

0.010 |

|

|

|

08/01/27 |

|

|

|

2,156,877 |

|

| |

3,060,000 |

|

|

|

|

Mount San Antonio Community College District, Los Angeles County, California, General Obligation Bonds, Election of 2008, Series 2013A |

|

|

5.875 |

|

|

|

08/01/28 |

|

|

|

3,358,996 |

|

| |

2,315,000 |

|

|

|

|

Mount San Antonio Community College District, Los Angeles County, California, General Obligation Bonds, Election of 2008, Series 2013A |

|

|

0.000 |

|

|

|

08/01/43 |

|

|

|

2,279,242 |

|

| |

3,550,000 |

|

|

|

|

M-S-R Energy Authority, California, Gas Revenue Bonds, Citigroup Prepay Contracts, Series 2009C |

|

|

6.500 |

|

|

|

11/01/39 |

|

|

|

4,527,068 |

|

| |

10,150,000 |

|

|

|

|

Placer Union High School District, Placer County, California, General Obligation Bonds, Series 2004C - AGM Insured |

|

|

0.000 |

|

|

|

08/01/33 |

|

|

|

7,521,890 |

|

| |

2,660,000 |

|

|

|

|

San Bruno Park School District, San Mateo County, California, General Obligation Bonds, Series 2000B - FGIC Insured |

|

|

0.010 |

|

|

|

08/01/25 |

|

|

|

2,589,763 |

|

| |

185,000 |

|

|

|

|

San Diego Tobacco Settlement Revenue Funding Corporation, California, Tobacco Settlement Bonds, Subordinate Series 2018C |

|

|

4.000 |

|

|

|

06/01/32 |

|

|

|

187,233 |

|

| |

2,825,000 |

|

|

|

|

San Francisco Airport Commission, California, Revenue Bonds, San Francisco International Airport, Refunding Second Series 2024A, (AMT) |

|

|

5.250 |

|

|

|

05/01/44 |

|

|

|

3,051,833 |

|

| |

2,175,000 |

|

|

|

|

San Francisco Airport Commission, California, Revenue Bonds, San Francisco International Airport, Refunding Second Series 2024A, (AMT) |

|

|

5.250 |

|

|

|

05/01/49 |

|

|

|

2,321,001 |

|

| |

6,000,000 |

|

|

|

|

San Francisco Airports Commission, California, Revenue Bonds, San Francisco International Airport, Refunding Second Series 2019D |

|

|

5.000 |

|

|

|

05/01/36 |

|

|

|

6,470,879 |

|

| |

4,000,000 |

|

|

|

|

San Francisco Airports Commission, California, Revenue Bonds, San Francisco International Airport, Refunding Second Series 2019D |

|

|

5.000 |

|

|

|

05/01/39 |

|

|

|

4,284,614 |

|

| |

500,000 |

|

|

|

|

San Joaquin Hills Transportation Corridor Agency, Orange County, California, Refunding Senior Lien Toll Road Revenue Bonds, Series 2021A |

|

|

4.000 |

|

|

|

01/15/42 |

|

|

|

503,678 |

|

| |

12,095,000 |

|

|

|

|

San Joaquin Hills Transportation Corridor Agency, Orange County, California, Toll Road Revenue Bonds, Refunding Series 1997A - NPFG Insured |

|

|

0.000 |

|

|

|

01/15/25 |

|

|

|

12,000,418 |

|

| |

13,220,000 |

|

|

|

|

San Mateo County Community College District, California, General Obligation Bonds, Series 2006A - NPFG Insured |

|

|

0.010 |

|

|

|

09/01/28 |

|

|

|

11,831,140 |

|

| |

5,815,000 |

|

|

|

|

San Ysidro School District, San Diego County, California, General Obligation Bonds, Refunding Series 2015 |

|

|

0.010 |

|

|

|

08/01/48 |

|

|

|

1,637,988 |

|

| |

2,075,000 |

|

|

|

|

Southern California Public Power Authority, California, Revenue Bonds, Clean Energy Project Revenue Bonds, Series 2024A, (Mandatory Put 9/01/30) |

|

|

5.000 |

|

|

|

04/01/55 |

|

|

|

2,206,616 |

|

|

|

|

|

|

|

TOTAL CALIFORNIA |

|

|

|

|

|

|

|

|

|

|

118,906,749 |

|

|

|

|

|

|

|

COLORADO - 5.4% |

|

|

|

|

|

|

|

|

|

|

|

|

| |

1,265,000 |

|

|

|

|

Adams and Weld Counties School District 27J, Brighton, Colorado, General Obligation Bonds, Series 2024A |

|

|

5.000 |

|

|

|

12/01/47 |

|

|

|

1,373,525 |

|

| |

1,750,000 |

|

|

|

|

Adams and Weld Counties School District 27J, Brighton, Colorado, General Obligation Bonds, Series 2024A |

|

|

5.000 |

|

|

|

12/01/48 |

|

|

|

1,896,691 |

|

| |

2,135,000 |

|

|

|

|

Centennial Water and Sanitation District, Douglas County, Colorado, Water and Wastewater Revenue Bonds, Series 2019 |

|

|

5.250 |

|

|

|

12/01/48 |

|

|

|

2,239,109 |

|

| |

1,000,000 |

|

|

|

|

Colorado Health Facilities Authority, Colorado, Revenue Bonds, AdventHealth Obligated Group, Series 2024A, (Mandatory Put 11/15/29) |

|

|

5.000 |

|

|

|

11/15/59 |

|

|

|

1,083,788 |

|

20

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| PRINCIPAL |

|

|

|

|

DESCRIPTION |

|

RATE |

|

|

MATURITY |

|

|

VALUE |

|

|

|

|

|

|

|

COLORADO (continued) |

|

|

|

|

|

|

|

|

|

|

|

|

| $ |

1,575,000 |

|

|

|

|

Colorado Health Facilities Authority, Colorado, Revenue Bonds, AdventHealth Obligated Group, Series 2024A, (Mandatory Put 11/15/31) |

|

|

5.000% |

|

|

|

11/15/59 |

|

|

$ |

1,739,853 |

|

| |

4,155,000 |

|

|

|

|

Colorado Health Facilities Authority, Colorado, Revenue Bonds, CommonSpirit Health, Series 2019A-2 |

|

|

4.000 |

|

|

|

08/01/49 |

|

|

|

3,814,804 |

|

| |

1,255,000 |

|

|

|

|

Colorado High Performance Transportation Enterprise, C-470 Express Lanes Revenue Bonds, Senior Lien Series 2017 |

|

|

5.000 |

|

|

|

12/31/56 |

|

|

|

1,254,949 |

|

| |

4,500,000 |

|

|

|

|

Colorado State, Building Excellent Schools Today, Certificates of Participation, Series 2018N |

|

|

5.000 |

|

|

|

03/15/37 |

|

|

|

4,702,098 |

|

| |

1,000,000 |

|

|

|

|

Colorado State, Building Excellent Schools Today, Certificates of Participation, Series 2020R |

|

|

4.000 |

|

|

|

03/15/45 |

|

|

|

986,136 |

|

| |

620,000 |

|

|

|

|

Colorado State, Certificates of Participation, Lease Purchase Financing Program, National Western Center, Series 2018A |

|

|

5.000 |

|

|

|

09/01/33 |

|

|

|

653,026 |

|

| |

3,790,000 |

|

|

|

|

Colorado State, Certificates of Participation, Rural Series 2018A |

|

|

5.000 |

|

|

|

12/15/37 |

|

|

|

4,004,766 |

|

| |

3,400,000 |

|

|

|

|

Denver City and County, Colorado, Airport System Revenue Bonds, Series 2022B |

|

|

5.250 |

|

|

|

11/15/53 |

|

|

|

3,694,513 |

|

| |

2,000,000 |

|

|

|

|

Denver Convention Center Hotel Authority, Colorado, Revenue Bonds, Convention Center Hotel, Refunding Senior Lien Series 2016 |

|

|

5.000 |

|

|

|

12/01/35 |

|

|

|

2,026,432 |

|

| |

9,660,000 |

|

|

|

|

E-470 Public Highway Authority, Colorado, Senior Revenue Bonds, Series 2000B - NPFG Insured |

|

|

0.000 |

|

|

|

09/01/29 |

|

|

|

8,172,988 |

|

| |

24,200,000 |

|

|

|

|

E-470 Public Highway Authority, Colorado, Senior Revenue Bonds, Series 2000B - NPFG Insured |

|

|

0.010 |

|

|

|

09/01/31 |

|

|

|

18,788,689 |

|

| |

17,000,000 |

|

|

|

|

E-470 Public Highway Authority, Colorado, Senior Revenue Bonds, Series 2000B - NPFG Insured |

|

|

0.000 |

|

|

|

09/01/32 |

|

|

|

12,625,108 |

|

| |

7,600,000 |

|

|

|

|

E-470 Public Highway Authority, Colorado, Toll Revenue Bonds, Refunding Series 2006B - NPFG Insured |

|

|

0.000 |

|

|

|

09/01/39 |

|

|

|

3,655,650 |

|

| |

600,000 |

|

|

|

|

Hunters Overlook Metropolitan District 5, Severance, Weld County, Colorado, Limited Tax General Obligation Bonds, Refunding Series 2024 |

|

|

5.000 |

|

|

|

12/01/44 |

|

|

|

642,904 |

|

| |

575,000 |

|

|

|

|

Hunters Overlook Metropolitan District 5, Severance, Weld County, Colorado, Limited Tax General Obligation Bonds, Refunding Series 2024 |

|

|

5.000 |

|

|

|

12/01/49 |

|

|

|

607,695 |

|

| |

8,000,000 |

|

|

|

|

Public Authority for Colorado Energy, Natural Gas Purchase Revenue Bonds, Colorado Springs Utilities, Series 2008 |

|

|

6.500 |

|

|

|

11/15/38 |

|

|

|

9,637,754 |

|

| |

1,400,000 |

|

|

|

|

Regional Transportation District, Colorado, Private Activity Bonds, Denver Transit Partners Eagle P3 Project, Series 2020A |

|

|

4.000 |

|

|

|

07/15/34 |

|

|

|

1,410,141 |

|

| |

4,945,000 |

|

|

|

|

Regional Transportation District, Colorado, Sales Tax Revenue Bonds, Fastracks Project, Series 2017A |

|

|

5.000 |

|

|

|

11/01/40 |

|

|

|

5,073,134 |

|

| |

5,355,000 |

|

|

|

|

State of Colorado, Rural Colorado, Certificates of Participation, Series 2022 |

|

|

6.000 |

|

|

|

12/15/38 |

|

|

|

6,348,462 |

|

| |

3,000,000 |

|

|

|

|

State of Colorado, Rural Colorado, Certificates of Participation, Series 2022 |

|

|

6.000 |

|

|

|

12/15/41 |

|

|

|

3,522,360 |

|

| |

4,250,000 |

|

|

(a) |

|

University of Colorado, Enterprise System Revenue Bonds, Series 2018B, (Pre-refunded 6/01/28) |

|

|

5.000 |

|

|

|

06/01/43 |

|

|

|

4,580,532 |

|

|

|

|

|

|

|

TOTAL COLORADO |

|

|

|

|

|

|

|

|

|

|

104,535,107 |

|

|

|

|

|

|

|

CONNECTICUT - 0.4% |

|

|

|

|

|

|

|

|

|

|

|

|

| |

1,000,000 |

|

|

|

|

Connecticut Airport Authority, Connecticut, Customer Facility Charge Revenue Bonds, Ground Transportation Center Project, Series 2019A, (AMT) |

|

|

5.000 |

|

|

|

07/01/49 |

|

|

|

1,011,179 |

|

| |

2,125,000 |

|

|

|

|

Connecticut Health and Educational Facilities Authority, Revenue Bonds, Connecticut Children?s Medical Center and Subsidiaries, Series 2023E |

|

|

5.250 |

|

|

|

07/15/48 |

|

|

|

2,288,686 |

|

| |

5,000,000 |

|

|

|

|

Connecticut State, General Obligation Bonds, Series 2015F |

|

|

5.000 |

|

|

|

11/15/33 |

|

|

|

5,066,105 |

|

|

|

|

|

|

|

TOTAL CONNECTICUT |

|

|

|

|

|

|

|

|

|

|

8,365,970 |

|

|

|

|

|

|

|

DISTRICT OF COLUMBIA - 1.6% |

|

|

|

|

|

|

|

|

|

|

|

|

| |

15,000,000 |

|

|

|

|

District of Columbia Tobacco Settlement Corporation, Tobacco Settlement Asset-Backed Bonds, Series 2006A |

|

|

0.000 |

|

|

|

06/15/46 |

|

|

|

3,777,829 |

|

| |

5,260,000 |

|

|

|

|

District of Columbia Water and Sewer Authority, Public Utility Revenue Bonds, Senior Lien Series 2018B |

|

|

5.000 |

|

|

|

10/01/43 |

|

|

|

5,467,160 |

|

| |

10,000,000 |

|

|

|

|

Metropolitan Washington Airports Authority, Virginia, Dulles Toll Road Revenue Bonds, Dulles Metrorail Capital Appreciation, Second Senior Lien Series 2010B |

|

|

6.500 |

|

|

|

10/01/44 |

|

|

|

10,952,431 |

|

21

Portfolio of Investments October 31, 2024 (continued)

NUV

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| PRINCIPAL |

|

|

|

|

DESCRIPTION |

|

RATE |

|

|

MATURITY |

|

|

VALUE |

|

|

|

|

|

|

|

DISTRICT OF COLUMBIA (continued) |

|

|

|

|

|

|

|

|

|

|

|

|

| $ |

2,300,000 |

|

|

|

|

Metropolitan Washington D.C. Airports Authority, Airport System Revenue Bonds, Refunding Series 2024A, (AMT) |

|

|

5.250% |

|

|

|

10/01/49 |

|

|

$ |

2,446,541 |

|

| |

4,435,000 |

|

|

|

|

Metropolitan Washington D.C. Airports Authority, Airport System Revenue Bonds, Refunding Series 2024A, (AMT) |

|

|

5.500 |

|

|

|

10/01/54 |

|

|

|

4,812,336 |

|

| |

1,060,000 |

|

|

|

|

Washington Convention and Sports Authority, Washington D.C., Dedicated Tax Revenue Bonds, Refunding Senior Lien Series 2021A |

|

|

4.000 |

|

|

|

10/01/38 |

|

|

|

1,057,021 |

|

| |

1,265,000 |

|

|

|

|

Washington Convention and Sports Authority, Washington D.C., Dedicated Tax Revenue Bonds, Refunding Senior Lien Series 2021A |

|

|

4.000 |

|

|

|

10/01/39 |

|

|

|

1,252,209 |

|

| |

1,775,000 |

|

|

|

|

Washington Metropolitan Area Transit Authority, District of Columbia, Dedicated Revenue Bonds, Series 2020A |

|

|

5.000 |

|

|

|

07/15/45 |

|

|