Current Report Filing (8-k)

August 11 2022 - 4:22PM

Edgar (US Regulatory)

false000117148600011714862022-08-092022-08-09

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

______________________________________________________

FORM 8-K

______________________________________________________

CURRENT REPORT PURSUANT TO SECTION 13 OR 15(D)

OF THE SECURITIES EXCHANGE ACT OF 1934

Date of report (Date of earliest event reported): August 9, 2022

______________________________________________________

NATURAL RESOURCE PARTNERS LP

(Exact Name of Registrant as Specified in Charter)

______________________________________________________

| | | | | | | | | | | | | | |

Delaware | 001-31465 | 35-2164875 |

(State or other jurisdiction of incorporation or organization) | (Commission File Number) | (I.R.S. Employer Identification No.) |

| 1415 Louisiana St., Suite 2400 | |

| Houston, | Texas | 77002 | |

| (Address of principal executive office) (Zip Code) | |

| (713) | 751-7507 | |

| (Registrant's telephone number, including area code) | |

______________________________________________________

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | | | | | | | |

| Title of each class | | Trading Symbol(s) | | Name of each exchange on which registered |

| Common Units representing limited partner interests | | NRP | | New York Stock Exchange |

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| | | | | |

| ☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| | | | | |

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| | | | | |

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| | | | | |

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act ¨

| | | | | |

| Item 1.01. | Entry Into a Material Definitive Agreement |

The information under Item 2.03 below is incorporated herein by reference.

| | | | | |

| Item 2.03. | Creation of a Direct Financial Obligation or an Obligation under an Off-Balance Sheet Arrangement of a Registrant |

On August 9, 2022, NRP (Operating) LLC (“Opco”) entered into that certain Master Assignment Agreement and Fifth Amendment to the Third Amended and Restated Credit Agreement (the “Fifth Amendment”) by and among Opco, the lenders party thereto and Zions Bancorporation, N.A. dba Amegy Bank, as administrative agent (in such capacity, the “Administrative Agent”) and collateral agent.

The Fifth Amendment amends and modifies that certain Third Amended and Restated Credit Agreement, dated as of June 16, 2015 (as amended, restated, amended and restated, supplemented or otherwise modified from time to time, the “Credit Facility”) among Opco, the lenders party thereto and the Administrative Agent. The Fifth Amendment provides for changes and modifications to the Credit Facility as set forth therein, which include, among other things, the extension of the term of the Credit Facility from April 3, 2023 to August 9, 2027 (the “Maturity Date”); provided, however, that if the 9.125% Senior Notes issued by Natural Resource Partners L.P. and NRP Finance Corporation due in 2025 (the “Parent Notes”), remain outstanding and have a stated maturity date that will not occur later than 180 days after the Maturity Date, then the Maturity Date shall be 180 days prior to the stated maturity date of the Parent Notes then outstanding. The Fifth Amendment also provides for, among other things, (i) modifications to Opco’s ability to declare and make certain restricted payments, (ii) the transition from the London Interbank Offered Rate (“LIBOR”) to the Secured Overnight Financing Rate, as administered by the Federal Reserve Bank of New York (“SOFR”), (iii) the replacement of Citibank, N.A., as administrative agent and collateral agent, with the successor Administrative Agent. Borrowings under the Credit Facility bear interest at a variable rate of either (a) SOFR plus the Applicable Rate (as defined in the Fifth Amendment) or (b) the Alternate Base Rate (as defined in the Fifth Amendment) plus the Applicable Rate and (iv) the increase in commitments from $100 million to $102.5 million, with the ability to expand such commitments to $132.5 million with the addition of future commitments.

The Credit Facility contains financial covenants requiring Opco to maintain:

•a leverage ratio of Consolidated Indebtedness to Consolidated EBITDDA (in each case as defined in the Credit Facility) not to exceed 3.0 to 1.0; and

•an interest coverage ratio of Consolidated EBITDDA to the sum of Consolidated Interest Expense and Consolidated Lease Expense (in each case as defined in the Credit Facility) of not less than 3.5 to 1.0.

The Fifth Amendment is filed as Exhibit 10.1 to this Current Report on Form 8-K.

| | | | | |

| Item 9.01. | Financial Statements and Exhibits |

| | | | | |

| (d) | Exhibits. |

| |

| |

| 104 | Cover Page Interactive Data File (embedded within the Inline XBRL document). |

| |

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, as amended, the Registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | | | | |

| NATURAL RESOURCE PARTNERS L.P. |

| (Registrant) |

| | | |

| By: | | NRP (GP) LP |

| | | its General Partner |

| | | |

| By: | | GP Natural Resource Partners LLC |

| | | its General Partner |

| | | |

Date: August 11, 2022 | | | /s/ Philip T. Warman |

| | | Philip T. Warman |

| | | General Counsel |

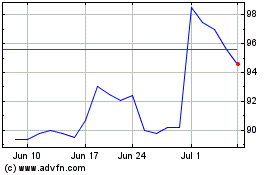

Natural Resource Partners (NYSE:NRP)

Historical Stock Chart

From Jul 2024 to Jul 2024

Natural Resource Partners (NYSE:NRP)

Historical Stock Chart

From Jul 2023 to Jul 2024