Natural Resource Partners L.P. (NYSE:NRP) today reported

fourth quarter and full year 2018 results as follows:

Three Months Ended Year

Ended December 31, December 31,

(In thousands,

except per unit data) (Unaudited)

2018 2017 2018 2017 Net

income from continuing operations (1) $ 35,092 $ 28,665 $ 122,360 $

82,485 Adjusted EBITDA (2) 72,936 54,280 230,241 211,483 Cash flow

provided by (used in) continuing operations: Operating activities

80,489 42,434 178,282 112,151 Investing activities 2,078 591 7,607

9,807 Financing activities 64,856 (136,465 ) (6,839 ) (134,149 )

Distributable cash flow (2) (3) 280,658 43,025 383,980 121,958 Free

cash flow (2) 80,944 42,833 183,440 121,324

_________________________

(1) Includes $25.0

million from the Hillsboro litigation settlement in the Coal

Royalty and Other Segment for the three months and year ended

December 31, 2018 and $12.7 million from a royalty dispute

settlement in the Soda Ash segment for the year ended December 31,

2018. (2) See "Non-GAAP Financial Measures" and reconciliation

tables at the end of this release. (3) Includes net proceeds from

sale of construction aggregates business which are classified as

investing cash flow from discontinued operations.

"NRP ended the year delivering another robust quarter of

financial results, highlighted by the favorable Hillsboro

settlement and the successful sale of our construction aggregates

business," stated NRP’s President and Chief Operating Officer,

Craig Nunez. “We generated significant amounts of cash from

operations as we continued to see strong demand for our

metallurgical and thermal coal throughout 2018. Additionally, the

sale of our construction aggregates business for $205 million

accelerated the de-levering and de-risking of our capital structure

as we used the net cash proceeds to repay $143 million of debt to

date, and plan to use the remaining proceeds to repay our Opco

notes as they amortize in 2019, all at par value. This has been a

transformative year for NRP and we are focused on continuing to

position the company for a more secure future.”

NRP's liquidity was $306.0 million at December 31, 2018,

consisting of $101.8 million of cash, $104.2 million of cash

restricted for debt repayment ($49 million of which was used to

repay Opco notes in January 2019) and $100.0 million of borrowing

capacity available under its credit facility. NRP's consolidated

Debt-to-Adjusted EBITDA ratio at December 31, 2018 was 3.0x,

down over 15% from 2017 and down over 40% from the high of 5.3x at

year-end 2015.

NRP declared a cash distribution of $0.45 per common unit and a

cash distribution of $7.5 million on NRP’s preferred units for the

fourth quarter of 2018. NRP's distribution coverage ratio over the

last twelve months, excluding proceeds from sale of assets included

in discontinued operations, was 8.4x before taking into account the

$30 million annual distribution on NRP's preferred units, and 7.1x

after taking into account the preferred unit distribution.

Fourth Quarter Segment Results (Unaudited)

Operating Business Segments

Coal Royaltyand Other

Soda Ash

Corporateand Financing

Total

(In

thousands)

Three Months Ended December 31, 2018 Net income (loss) from

continuing operations $ 44,487 $ 13,320 $ (22,715 ) $ 35,092

Adjusted EBITDA (1) 68,850 9,800 (5,714 ) 72,936 Cash flow provided

by (used in) continuing operations: Operating activities 80,272

9,800 (9,583 ) 80,489 Investing activities 2,078 — — 2,078

Financing activities — — 64,856 64,856 Distributable cash flow (1)

(2) 82,350 9,800 (9,583 ) 280,658

Free cash flow (1)

80,727 9,800 (9,583 ) 80,944 Three Months Ended December 31,

2017 Net income (loss) from continuing operations $ 39,642 $ 12,781

$ (23,758 ) $ 28,665 Adjusted EBITDA (1) 46,592 12,250 (4,562 )

54,280 Cash flow provided by (used in) continuing operations:

Operating activities 45,550 12,250 (15,366 ) 42,434 Investing

activities 591 — — 591 Financing activities — — (136,465 ) (136,465

) Distributable cash flow (1) 46,141 12,250 (15,366 ) 43,025

Free cash flow (1)

45,949 12,250 (15,366 ) 42,833

_________________________

(1) See "Non-GAAP

Financial Measures" and reconciliation tables at the end of this

release. (2)

Includes net proceeds from sale of

construction aggregates business which are classified as investing

cash flow from discontinued operations.

Coal Royalty and Other

Total coal production and the average coal royalty revenue per

ton remained stable compared to the prior year quarter as NRP

continued to see strong coal pricing driven by solid export demand

and stable domestic markets for metallurgical and thermal coal.

Approximately 65% of NRP's coal royalty revenues and approximately

45% of its coal royalty production was derived from metallurgical

coal during the three months ended December 31, 2018.

Net income and Adjusted EBITDA increased compared to the prior

year quarter primarily as a result of the $25 million Hillsboro

litigation settlement; Net income was partially offset by a $16.8

million increase in non-cash asset impairments.

Distributable cash flow and Free cash flow increased compared to

the prior year quarter primarily as a result of the $25 million

Hillsboro litigation settlement and increased cash receipts from

higher metallurgical prices and production.

Soda Ash

Soda Ash segment operating performance was consistent with the

prior year quarter as improved international sales pricing during

the fourth quarter of 2018 was partially offset by increased

freight costs.

Adjusted EBITDA, Distributable cash flow and Free cash flow

decreased $2.5 million due to lower fourth quarter cash

distributions received from Ciner Wyoming.

Corporate and Finance

Corporate and Finance segment Net income, Free cash flow and

Distributable cash flow results improved compared to the prior year

quarter primarily due to lower interest as a result of continued

repayment of debt.

Full Year Segment Results (Unaudited)

Operating Business Segments

Coal Royaltyand Other

Soda Ash

Corporateand Financing

Total

(In

thousands)

Year Ended December 31, 2018 Net income (loss) from continuing

operations $ 160,728 $ 48,306 $ (86,674 ) $ 122,360 Adjusted EBITDA

(1) 200,187 46,550 (16,496 ) 230,241 Cash flow provided by (used

in) continuing operations: Operating activities 212,394 44,453

(78,565 ) 178,282 Investing activities 5,510 2,097 — 7,607

Financing activities — — (6,839 ) (6,839 ) Distributable cash flow

(1) (2) 217,904 46,550 (78,565 ) 383,980

Free cash flow (1)

215,455 46,550 (78,565 ) 183,440 Year Ended December 31,

2017 Net income (loss) from continuing operations $ 154,604 $

40,457 $ (112,576 ) $ 82,485 Adjusted EBITDA (1) 180,985 49,000

(18,502 ) 211,483 Cash flow provided by (used in) continuing

operations: Operating activities 166,138 43,354 (97,341 ) 112,151

Investing activities 4,161 5,646 — 9,807 Financing activities 517 —

(134,666 ) (134,149 ) Distributable cash flow (1) 170,299 49,000

(97,341 ) 121,958

Free cash flow (1)

169,665 49,000 (97,341 ) 121,324

_________________________

(1) See "Non-GAAP

Financial Measures" and reconciliation tables at the end of this

release. (2)

Includes net proceeds from sale of

construction aggregates business which are classified as investing

cash flow from discontinued operations.

Coal Royalty and Other

Full year 2018 total coal production remained stable and the

average coal royalty revenue per ton increased as a result of

higher metallurgical and thermal coal prices and higher

metallurgical coal production driven by solid export demand and

stable domestic markets for metallurgical and thermal coal,

partially offset by lower thermal coal production as a result of

capital constraints and declining overall demand for certain of our

lessees, as well as temporary relocation of certain production off

of NRP's coal reserves in the Illinois Basin. Approximately 65% of

NRP's coal royalty revenues and approximately 55% of its coal

royalty production was derived from metallurgical coal during the

year ended December 31, 2018.

Net income and Adjusted EBITDA increased compared to the prior

year primarily as a result of the $25 million Hillsboro litigation

settlement; Net income was partially offset by a $15.3 million

increase in non-cash asset impairments.

Distributable cash flow and Free cash flow increased compared to

the prior year primarily as a result of the $25 million Hillsboro

litigation settlement in addition to increased cash receipts from

higher metallurgical prices and production and increased cash from

other revenues.

Soda Ash

Soda Ash segment operating performance increased compared to the

prior year primarily as a result of Ciner Wyoming's litigation

settlement of a royalty dispute that resulted in $12.7 million of

income. This increase was partially offset by a $4.9 million

decrease in income primarily due to lower production and sales

resulting from unexpected repairs during scheduled outages and ore

grade degradation.

Adjusted EBITDA, Distributable cash flow and Free cash flow

decreased $2.5 million compared to the prior year as a result of

lower cash distributions received from Ciner Wyoming in the fourth

quarter of 2018.

Corporate and Finance

Corporate and Finance segment results improved compared to the

prior year primarily due to lower interest as a result of continued

repayment of debt and lower employee-related costs.

Conference Call

A conference call will be held today at 10:00 a.m. ET. To join

the conference call, dial (844) 379-6938 and provide the conference

code 55454891. Investors may also listen to the call via the

Investor Relations section of the NRP website at www.nrplp.com. To

access the replay, please visit the Investor Relations section of

NRP’s website.

Company Profile

Natural Resource Partners L.P., a master limited

partnership headquartered in Houston, TX, is a

diversified natural resource company that owns, manages and leases

a diversified portfolio of mineral properties in the United States

including interests in coal, industrial minerals and other natural

resources. A large percentage of NRP's revenues are generated

from royalties and other passive income. In addition, NRP owns

an equity investment in Ciner Wyoming, a trona/soda ash

operation.

For additional information, please contact Tiffany Sammis at

713-751-7515 or tsammis@nrplp.com. Further information about NRP is

available on the partnership’s website at http://www.nrplp.com.

Forward-Looking Statements

This press release includes “forward-looking statements” as

defined by the Securities and Exchange Commission. All statements,

other than statements of historical facts, included in this press

release that address activities, events or developments that the

partnership expects, believes or anticipates will or may occur in

the future are forward-looking statements. These statements are

based on certain assumptions made by the partnership based on its

experience and perception of historical trends, current conditions,

expected future developments and other factors it believes are

appropriate in the circumstances. Such statements are subject to a

number of assumptions, risks and uncertainties, many of which are

beyond the control of the partnership. These risks include, but are

not limited to, commodity prices; decreases in demand for coal,

aggregates and industrial minerals, including trona/soda ash;

changes in operating conditions and costs; production cuts by our

lessees; unanticipated geologic problems; our liquidity, leverage

and access to capital and financing sources; changes in the

legislative or regulatory environment, litigation risk, and other

factors detailed in Natural Resource Partners’ Securities and

Exchange Commission filings. Natural Resource Partners L.P. has no

obligation to publicly update or revise any forward-looking

statement, whether as a result of new information, future events or

otherwise.

Non-GAAP Financial Measures

"Adjusted EBITDA" is a non-GAAP financial measure that we

define as net income (loss) from continuing operations less equity

earnings from unconsolidated investment, net income attributable to

non-controlling interest and gain on reserve swap; plus total

distributions from unconsolidated investment, interest expense,

net, debt modification expense, loss on extinguishment of debt,

depreciation, depletion and amortization and asset impairments.

Adjusted EBITDA should not be considered an alternative to, or more

meaningful than, net income or loss, net income or loss

attributable to partners, operating income, cash flows from

operating activities or any other measure of financial performance

presented in accordance with GAAP as measures of operating

performance, liquidity or ability to service debt obligations.

There are significant limitations to using Adjusted EBITDA as a

measure of performance, including the inability to analyze the

effect of certain recurring items that materially affect our net

income (loss), the lack of comparability of results of operations

of different companies and the different methods of calculating

Adjusted EBITDA reported by different companies. In addition,

Adjusted EBITDA presented below is not calculated or presented on

the same basis as Consolidated EBITDA as defined in our partnership

agreement or Consolidated EBITDDA as defined in Opco's debt

agreements. Adjusted EBITDA is a supplemental performance measure

used by our management and by external users of our financial

statements, such as investors, commercial banks, research analysts

and others to assess the financial performance of our assets

without regard to financing methods, capital structure or

historical cost basis.

“Distributable cash flow” or "DCF" is a non-GAAP

financial measure that we define as net cash provided by (used in)

operating activities of continuing operations plus distributions

from unconsolidated investment in excess of cumulative earnings,

proceeds from sales of assets, including sales of discontinued

operations, and return of long-term contract receivables (including

affiliate); less maintenance capital expenditures and distributions

to non-controlling interest. DCF is not a measure of financial

performance under GAAP and should not be considered as an

alternative to cash flows from operating, investing or financing

activities. DCF may not be calculated the same for us as for other

companies. In addition, Distributable cash flow is not calculated

or presented on the same basis as distributable cash flow as

defined in our partnership agreement, which is used as a metric to

determine whether we are able to increase quarterly distributions

to our common unitholders. Distributable cash flow is a

supplemental liquidity measure used by our management and by

external users of our financial statements, such as investors,

commercial banks, research analysts and others to assess our

ability to make cash distributions and repay debt.

“Free cash flow” or "FCF" is a non-GAAP financial measure

that we define as net cash provided by (used in) operating

activities of continuing operations plus distributions from

unconsolidated investment in excess of cumulative earnings and

return of long-term contract receivables (including affiliate);

less maintenance and expansion capital expenditures, cash flow used

in acquisition costs classified as financing activities and

distributions to non-controlling interest. FCF is calculated before

mandatory debt repayments. Free cash flow is not a measure of

financial performance under GAAP and should not be considered as an

alternative to cash flows from operating, investing or financing

activities. Free cash flow may not be calculated the same for us as

for other companies. Free cash flow is a supplemental liquidity

measure used by our management and by external users of our

financial statements, such as investors, commercial banks, research

analysts and others to assess our ability to make cash

distributions and repay debt.

“Free cash flow excluding discontinued operations and

one-time beneficial items” is a non-GAAP financial measure that

we define as Free cash flow excluding discontinued operations and

one-time beneficial items. Free cash flow excluding discontinued

operations and one-time beneficial items is not a measure of

financial performance under GAAP and should not be considered as an

alternative to cash flows from operating, investing or financing

activities. Free cash flow excluding discontinued operations and

one-time beneficial items may not be calculated the same for us as

for other companies. Free cash flow excluding discontinued

operations and one-time beneficial items is a supplemental

liquidity measure used by our management to assess our ability

to make cash distributions and repay debt.

"Cash flow cushion" is a non-GAAP financial measure that

we define as Free cash flow excluding discontinued operations and

one-time beneficial items less mandatory Opco debt amortization

payments, preferred unit distributions and common unit

distributions. Cash flow cushion is not a measure of financial

performance under GAAP and should not be considered as an

alternative to cash flows from operating, investing or financing

activities. Cash flow cushion is a supplemental liquidity measure

used by our management to assess the Partnership's ability to make

or raise cash distributions to our common and preferred unitholders

and our general partner and repay debt or redeem preferred

units.

“Net income attributable to common unitholders excluding

discontinued operations and one-time beneficial items” is a

non-GAAP financial measure that we define as Net income

attributable to NRP less gain on litigation settlements, income

from discontinued operations, income attributable to preferred

unitholders and Net income attributable to the general partner

excluding discontinued operations and one-time beneficial items.

Net income attributable to common unitholders excluding

discontinued operations and one-time beneficial items should not be

considered in isolation or as a substitute for operating income

(loss), net income (loss), cash flows provided by operating,

investing and financial activities, or other income or cash flow

statement data prepared in accordance with GAAP. Our management

team believes Net income attributable to common unitholders

excluding discontinued operations and one-time beneficial items is

useful in evaluating our financial performance because litigation

settlements are one-time charges, gains on asset sales are not

related to the operations of our business and income attributable

to preferred unitholders and the general partner are unrelated to

common unitholders. Excluding these from net income allows us to

better compare results from ongoing operations attributable to

common unitholders period-over-period.

"Return on capital employed" or "ROCE" is a non-GAAP

financial measure that we define as Net income from continuing

operations plus interest expense divided by the sum of equity

excluding equity of discontinued operations, and debt. Return on

capital employed should not be considered an alternative to, or

more meaningful than, net income or loss, net income or loss

attributable to partners, operating income, cash flows from

operating activities or any other measure of financial performance

presented in accordance with GAAP as measures of operating

performance, liquidity or ability to service debt obligations.

Return on capital employed is a supplemental performance measure

used by our management team that measures our profitability and

efficiency with which our capital is employed. The measure provides

an indication of operating performance before the impact of

leverage in the capital structure.

"Return on capital employed excluding discontinued operations

and one-time beneficial items" is a non-GAAP financial measure

that we define as Return on capital employed excluding one-time

beneficial items. Return on capital employed excluding discontinued

operations and one-time beneficial items should not be considered

an alternative to, or more meaningful than, net income or loss, net

income or loss attributable to partners, operating income, cash

flows from operating activities or any other measure of financial

performance presented in accordance with GAAP as measures of

operating performance, liquidity or ability to service debt

obligations. Return on capital employed excluding discontinued

operations and one-time beneficial items is a supplemental

performance measure used by our management team that measures our

profitability and efficiency with which our capital is employed

excluding the impact of one-time beneficial items. The measure

provides an indication of operating performance before the impact

of leverage in the capital structure and excluding the impact of

one-time beneficial items.

-Financial Tables, Reconciliation of

Non-GAAP Measures and Recap of Metrics Follow-

Natural Resource Partners L.P.

Financial Tables

(Unaudited)

Consolidated Statements of Comprehensive Income

Three Months Ended

Year Ended December 31, September 30,

December 31,

(In thousands,

except per unit data)

2018 2017 2018 2018

2017 Revenues and other income Coal royalty and other $

43,966 $ 47,130 $ 42,459 $ 178,394 $ 158,399 Coal royalty and

other—affiliates — 223 59 484 23,402 Transportation and processing

services 6,649 4,793 6,853 23,887 14,510 Transportation and

processing services—affiliates — — — — 6,012 Equity in earnings of

Ciner Wyoming 13,320 12,781 8,836 48,306 40,457 Gain on litigation

settlement 25,000 — — 25,000 — Gain on asset sales, net 1,622

178 — 2,441 3,545 Total revenues

and other income $ 90,557 $ 65,105 $ 58,207 $ 278,512 $ 246,325

Operating expenses Operating and maintenance expenses $ 4,941 $

3,479 $ 4,650 $ 17,894 $ 16,771 Operating and maintenance

expenses—affiliates 3,446 2,253 2,140 11,615 8,112 Depreciation,

depletion and amortization 6,325 5,761 4,888 21,689 22,406

Amortization expense—affiliate — — — — 1,008 General and

administrative 4,770 2,756 2,249 12,838 13,513 General and

administrative—affiliates 944 1,806 934 3,658 4,989 Asset

impairments 18,038 1,189 — 18,280 2,967

Total operating expenses $ 38,464 $ 17,244 $ 14,861 $ 85,974

$ 69,766 Income from operations $ 52,093 $ 47,861 $ 43,346 $

192,538 $ 176,559 Other expense, net Interest expense, net $

(17,001 ) $ (19,196 ) $ (17,493 ) $ (70,178 ) $ (82,028 ) Debt

modification expense — — — — (7,939 ) Loss on extinguishment of

debt — — — — (4,107 ) Total other

expense, net $ (17,001 ) $ (19,196 ) $ (17,493 ) $ (70,178 ) $

(94,074 ) Net income from continuing operations $ 35,092 $ 28,665 $

25,853 $ 122,360 $ 82,485 Income from discontinued operations

13,966 2,042 2,688 17,687 6,182

Net income $ 49,058 $ 30,707 $ 28,541 $ 140,047 $ 88,667 Net loss

(income) attributable to non-controlling interest — —

359 (510 ) — Net income attributable to NRP $ 49,058

$ 30,707 $ 28,900 $ 139,537 $ 88,667 Less: income attributable to

preferred unitholders (7,500 ) (7,765 ) (7,500 ) (30,000 ) (25,453

) Net income attributable to common unitholders and general partner

$ 41,558 $ 22,942 $ 21,400 $ 109,537 $ 63,214 Net income

attributable to common unitholders $ 40,727 $ 22,483 $ 20,972 $

107,346 $ 61,950 Net income attributable to the general partner $

831 $ 459 $ 428 $ 2,191 $ 1,264 Income from continuing operations

per common unit Basic $ 2.21 $ 1.67 $ 1.50 $ 7.35 $ 4.57 Diluted $

1.69 $ 1.18 $ 1.18 $ 5.90 $ 3.68 Net income per common unit Basic $

3.33 $ 1.84 $ 1.71 $ 8.77 $ 5.06 Diluted $ 2.36 $ 1.26 $ 1.30 $

6.76 $ 3.96 Net income $ 49,058 $ 30,707 $ 28,541 $ 140,047

$ 88,667 Comprehensive income (loss) from unconsolidated investment

and other 619 (234 ) 791 (149 ) (1,647 )

Comprehensive income $ 49,677 $ 30,473 $ 29,332 $ 139,898 $ 87,020

Comprehensive loss (income) attributable to non-controlling

interest — — 359 (510 ) — Comprehensive

income attributable to NRP $ 49,677 $ 30,473 $ 29,691

$ 139,388 $ 87,020

Natural Resource Partners L.P.

Financial Tables

(Unaudited)

Consolidated Statements of Cash Flows

Three Months Ended Year Ended

December 31, September 30, December 31,

(In

thousands)

2018 2017 2018 2018

2017 Cash flows from operating activities Net income $

49,058 $ 30,707 $ 28,541 $ 140,047 $ 88,667 Adjustments to

reconcile net income to net cash provided by operating activities

of continuing operations: Depreciation, depletion and amortization

6,325 5,761 4,887 21,689 22,406 Amortization expense—affiliates — —

— — 1,008 Distributions from unconsolidated investment 9,800 12,250

12,250 44,453 43,354 Equity earnings from unconsolidated investment

(13,320 ) (12,781 ) (8,836 ) (48,306 ) (40,457 ) Gain on asset

sales, net (1,622 ) (178 ) — (2,441 ) (3,545 ) Debt modification

expense — — — — 7,939 Loss on extinguishment of debt — — — — 4,107

Income (loss) from discontinued operations (13,966 ) (2,251 )

(2,803 ) (17,687 ) (6,182 ) Asset impairments 18,038 1,189 — 18,280

2,967 Unit-based compensation expense 290 103 8 1,434 18

Amortization of debt issuance costs and other 4,757 2,156 (229 )

7,334 9,077 Other—affiliates (1,645 ) 2,181 1,635 (201 ) 1,207

Change in operating assets and liabilities: Accounts receivable 171

1,838 645 (6,251 ) 5,905 Accounts receivable—affiliates (12 ) 82

118 127 367 Accounts payable (220 ) 282 39 (238 ) (185 ) Accounts

payable—affiliates 1,268 (107 ) (812 ) 1,376 1 Accrued liabilities

2,812 (788 ) 157 134 (8,478 ) Accrued liabilities—affiliates 400

515 — (115 ) 515 Accrued interest 8,806 5,217 (9,069 ) (1,138 )

(105 ) Deferred revenue 10,265 (5,786 ) 193 19,465 (5,791 )

Deferred revenue—affiliates — — — — (10,166 ) Other items, net (716

) 2,044 (238 ) 320 (478 ) Net cash provided by

operating activities of continuing operations $ 80,489 $ 42,434 $

26,486 $ 178,282 $ 112,151 Net cash provided by operating

activities of discontinued operations 886 3,918 6,919

10,641 14,988 Net cash provided by operating

activities $ 81,375 $ 46,352 $ 33,405 $ 188,923 $ 127,139 Cash

flows from investing activities Distributions from unconsolidated

investment in excess of cumulative earnings $ — $ — $ — $ 2,097 $

5,646 Proceeds from sale of assets 1,623 192 — 2,449 1,151 Return

of long-term contract receivables 455 399 1,590 3,061 2,206 Return

of long-term contract receivables—affiliate — — — — 804 Acquisition

of plant and equipment and other — — — —

— Net cash provided by investing activities of

continuing operations $ 2,078 $ 591 $ 1,590 $ 7,607 $ 9,807 Net

cash provided by (used in) investing activities of discontinued

operations 192,364 (694 ) (3,571 ) 183,021 (6,264 )

Net cash provided by (used in) investing activities $ 194,442 $

(103 ) $ (1,981 ) $ 190,628 $ 3,543

Consolidated

Statements of Cash Flows—Continued Three

Months Ended Year Ended December 31, September

30, December 31,

(In

thousands)

2018 2017 2018 2018 2017 Cash

flows from financing activities Proceeds from issuance of preferred

units and warrants, net $ — $ — $ — $ — $ 242,100 Proceeds from

issuance of 2022 Senior Notes, net — — — — 103,688 Borrowings on

credit facility — 8,000 — 35,000 77,000 Repayments of loans

(119,986 ) (136,027 ) (7,648 ) (175,706 ) (492,319 ) Redemption of

preferred units paid-in-kind — — — (8,844 ) — Distributions to

common unitholders and general partner (5,623 ) (5,617 ) (5,623 )

(22,486 ) (22,467 ) Distributions to preferred unitholders (7,500 )

(3,825 ) (7,500 ) (30,265 ) (8,844 ) Contributions from (to)

discontinued operations 197,965 1,004 (25 ) 195,690 5,784 Debt

issuance costs and other — — (2 ) (228 )

(39,091 ) Net cash provided by (used in) financing activities of

continuing operations $ 64,856 $ (136,465 ) $ (20,798 ) $ (6,839 )

$ (134,149 ) Net cash used in financing activities of discontinued

operations (198,030 ) (1,201 ) (214 ) (196,509 ) (7,077 )

Net cash used in financing activities $ (133,174 ) $ (137,666 ) $

(21,012 ) $ (203,348 ) $ (141,226 ) Net increase (decrease)

in cash, cash equivalents and restricted cash $ 142,643 $ (91,417 )

$ 10,412 $ 176,203 $ (10,544 ) Cash, cash equivalents and

restricted cash of continuing operations at beginning of period $

58,607 $ 120,420 $ 51,329 $ 26,980 $ 39,171 Cash, cash equivalents

and restricted cash of discontinued operations at beginning of

period 4,780 824 1,646

2,847 1,200 Cash, cash equivalents and restricted

cash at beginning of period 63,387 121,244 52,975 29,827 40,371

Cash, cash equivalents and restricted cash at end of period

$ 206,030 $ 29,827 $ 63,387 $ 206,030 $ 29,827 Less: cash, cash

equivalents and restricted cash of discontinued operations at end

of period — 2,847 4,780 — 2,847

Cash, cash equivalents and restricted cash of continuing operations

at end of period $ 206,030 $ 26,980 $ 58,607 $ 206,030 $ 26,980

Supplemental cash flow information: Cash paid during the

period for interest from continuing operations $ 6,838 $ 10,993 $

24,998 $ 64,991 $ 72,850 Non-cash investing and financing

activities: Issuance of 2022 Senior Notes in exchange for 2018

Senior Notes $ — $ — $ — $ — $ 240,638

Natural Resource Partners L.P.

Financial Tables

(Unaudited)

Consolidated Balance Sheets

December 31, 2018 2017

(In thousands,

except unit data)

ASSETS Current assets Cash and cash equivalents $ 101,839 $ 26,980

Restricted cash 104,191 — Accounts receivable, net 32,024 24,050

Accounts receivable—affiliates 34 161 Prepaid expenses and other

3,462 3,782 Current assets of discontinued operations 993

36,423 Total current assets 242,543 91,396 Land 24,008

24,008 Plant and equipment, net 984 1,348 Mineral rights, net

743,112 778,419 Intangible assets, net 42,513 46,820 Equity in

unconsolidated investment 247,051 245,433 Long-term contracts

receivable 38,945 40,776 Long-term assets of discontinued

operations — 155,942 Other assets 2,491 4,866 Other

assets—affiliate — 156 Total assets $ 1,341,647

$ 1,389,164 LIABILITIES AND CAPITAL Current

liabilities Accounts payable $ 548 $ 1,010 Accounts

payable—affiliates 1,866 490 Accrued liabilities 12,347 11,542

Accrued liabilities—affiliates — 515 Accrued interest 14,345 15,484

Current portion of deferred revenue 3,509 — Current portion of

long-term debt, net 115,184 79,740 Current liabilities of

discontinued operations 947 11,768 Total current

liabilities 148,746 120,549 Deferred revenue 49,044 100,605

Long-term debt, net 557,574 729,608 Long-term liabilities of

discontinued operations — 2,220 Other non-current liabilities 1,150

588 Other non-current liabilities—affiliate — 346

Total liabilities 756,514 953,916 Commitments and

contingencies Class A Convertible Preferred Units (250,000 and

258,844 units issued and outstanding at December 31, 2018 and 2017,

respectively, at $1,000 par value per unit; liquidation preference

of $1,500 per unit) 164,587 173,431 Partners’ capital: Common

unitholders’ interest (12,249,469 and 12,232,006 units issued and

outstanding at December 31, 2018 and 2017, respectively) 355,113

199,851 General partner’s interest 5,014 1,857 Warrant holders'

interest 66,816 66,816 Accumulated other comprehensive loss (3,462

) (3,313 ) Total partners’ capital 423,481 265,211 Non-controlling

interest (2,935 ) (3,394 ) Total capital 420,546 261,817

Total liabilities and capital $ 1,341,647 $ 1,389,164

Natural Resource Partners L.P.

Financial Tables

(Unaudited)

Consolidated Statement of Partners' Capital

Common Unitholders

GeneralPartner

WarrantHolders

AccumulatedOtherComprehensiveLoss

Partners'CapitalExcluding

Non-ControllingInterest

Non-ControllingInterest

TotalCapital

(In

thousands)

Units Amounts Balance at December 31, 2017

12,232 $ 199,851 $ 1,857 $ 66,816 $ (3,313 ) $ 265,211 $ (3,394 ) $

261,817 Cumulative effect of adoption of accounting standard —

69,057 1,409 — — 70,466 — 70,466 Net income (1) — 136,746 2,791 — —

139,537 510 140,047 Distributions to common unitholders and general

partner — (22,036 ) (450 ) — — (22,486 ) — (22,486 ) Distributions

to preferred unitholders — (29,660 ) (605 ) — — (30,265 ) — (30,265

) Issuance of unit-based awards 17 546 — — — 546 — 546 Unit-based

awards amortization and vesting — 560 — — — 560 — 560 Comprehensive

income (loss) from unconsolidated investment and other — 49

12 — (149 ) (88 ) (51 ) (139 ) Balance at

December 31, 2018 12,249 $ 355,113 $ 5,014 $

66,816 $ (3,462 ) $ 423,481 $ (2,935 ) $ 420,546

_________________________

(1) Net income includes

$30.0 million attributable to Preferred Unitholders that

accumulated during the period, of which $29.4 million is allocated

to the common unitholders and $0.6 million is allocated to the

general partner.

Natural Resource Partners L.P.

Financial Tables

(Unaudited)

The tables below presents NRP's unaudited

business results by segment for the three months ended December 31,

2018 and

2017 and September 30, 2018 and the years

ended December 31, 2018 and 2017:

Operating Business Segments

Coal Royaltyand Other

Corporate andFinancing

(In

thousands)

Soda Ash Total Three Months Ended December 31, 2018

Revenues $ 50,615 $ 13,320 $ — $ 63,935 Gain on litigation

settlement 25,000 — — 25,000 Gains on asset sales, net 1,622

— — 1,622 Total revenues and other income $

77,237 $ 13,320 $ — $ 90,557 Asset impairments $ 18,038 $ — $ — $

18,038 Net income (loss) from continuing operations $ 44,487 $

13,320 $ (22,715 ) $ 35,092 Adjusted EBITDA (1) $ 68,850 $ 9,800 $

(5,714 ) $ 72,936 Distributable cash flow (1) (2) $ 82,350 $ 9,800

$ (9,583 ) $ 280,658

Free cash flow (1)

$ 80,727 $ 9,800 $ (9,583 ) $ 80,944 Three Months Ended

December 31, 2017 Revenues $ 52,146 $ 12,781 $ — $ 64,927 Gains on

asset sales, net 178 — — 178 Total

revenues and other income $ 52,324 $ 12,781 $ — $ 65,105 Asset

impairments $ 1,189 $ — $ — $ 1,189 Net income (loss) from

continuing operations $ 39,642 $ 12,781 $ (23,758 ) $ 28,665

Adjusted EBITDA (1) $ 46,592 $ 12,250 $ (4,562 ) $ 54,280

Distributable cash flow (1) $ 46,141 $ 12,250 $ (15,366 ) $ 43,025

Free cash flow (1)

$ 45,949 $ 12,250 $ (15,366 ) $ 42,833 Three Months Ended

September 30, 2018 Revenues $ 49,371 $ 8,836 $ — $ 58,207 Gains on

asset sales, net — — — — Total revenues

and other income $ 49,371 $ 8,836 $ — $ 58,207 Asset impairments $

— $ — $ — $ — Net income (loss) from continuing operations $ 37,693

$ 8,836 $ (20,676 ) $ 25,853 Adjusted EBITDA (1) $ 42,940 $ 12,250

$ (3,183 ) $ 52,007 Cash flow provided by (used in) continuing

operations: Operating activities $ 41,604 $ 12,250 $ (27,368 ) $

26,486 Investing activities $ 1,590 $ — $ — $ 1,590 Financing

activities $ — $ — $ (20,798 ) $ (20,798 ) Distributable cash flow

(1) $ 43,194 $ 12,250 $ (27,368 ) $ 28,076 Free cash flow (1) $

43,194 $ 12,250 $ (27,368 ) $ 28,076

_________________________

(1) See "Non-GAAP

Financial Measures" and reconciliation tables at the end of this

release. (2)

Includes net proceeds from sale of

construction aggregates business which are classified as investing

cash flow from discontinued operations.

Natural Resource Partners L.P.

Financial Tables

(Unaudited)

Operating Business Segments

Coal Royaltyand Other

Soda Ash

Corporate andFinancing

Total

(In

thousands)

Year Ended December 31, 2018 Revenues $ 202,765 $ 48,306 $ — $

251,071 Gain on litigation settlement 25,000 — — 25,000 Gains on

asset sales, net 2,441 — — 2,441 Total revenues and other

income $ 230,206 $ 48,306 $ — $ 278,512 Asset impairments $ 18,280

$ — $ — $ 18,280 Net income (loss) from continuing operations $

160,728 $ 48,306 $ (86,674 ) $ 122,360 Adjusted EBITDA (1) $

200,187 $ 46,550 $ (16,496 ) $ 230,241 Distributable cash flow (1)

(2) $ 217,904 $ 46,550 $ (78,565 ) $ 383,980 Free cash flow (1) $

215,455 $ 46,550 $ (78,565 ) $ 183,440 Cash flow cushion (1) N/A

N/A N/A $ 16,080 Year Ended December 31, 2017 Revenues $

202,323 $ 40,457 $ — $ 242,780 Gains on asset sales, net 3,545 — —

3,545 Total revenues and other income $ 205,868 $ 40,457 $ —

$ 246,325 Asset impairments $ 2,967 $ — $ — $ 2,967 Net income

(loss) from continuing operations $ 154,604 $ 40,457 $ (112,576 ) $

82,485 Adjusted EBITDA (1) $ 180,985 $ 49,000 $ (18,502 ) $ 211,483

Distributable cash flow (1) $ 170,299 $ 49,000 $ (97,341 ) $

121,958 Free cash flow (1) $ 169,665 $ 49,000 $ (97,341 ) $ 121,324

Cash flow cushion (1) N/A N/A N/A $ 9,248

_________________________

(1) See "Non-GAAP

Financial Measures" and reconciliation tables at the end of this

release. (2)

Includes net proceeds from sale of

construction aggregates business which are classified as investing

cash flow from discontinued operations.

Natural Resource Partners L.P.

Financial Tables

(Unaudited)

Operating Statistics - Coal Royalty and Other

Three Months Ended Year Ended

December 31, September 30, December 31,

(In thousands,

except per ton data)

2018 2017 2018 2018

2017 Coal production (tons) Appalachia Northern 1,697 464

349 3,187 2,136 Central 3,415 3,542 3,873 14,997 14,735 Southern

422 535 346 1,710 2,256 Total

Appalachia 5,534 4,541 4,568 19,894 19,127 Illinois Basin 648 828

609 2,739 4,373 Northern Powder River Basin 1,417 1,678

855 4,313 4,386 Total coal production 7,599

7,047 6,032 26,946 27,886 Coal

royalty revenue per ton Appalachia Northern $ 1.78 $ 2.14 $ 4.01 $

2.74 $ 1.53 Central 5.79 5.21 5.37 5.62 5.12 Southern 7.89 5.90

6.82 7.20 5.94 Illinois Basin 4.84 4.75 4.89 4.63 3.88 Northern

Powder River Basin 2.56 2.27 3.79 2.65 2.65 Combined average coal

royalty revenue per ton 4.33 4.31 5.10 4.80 4.33 Coal

royalty revenues Appalachia Northern $ 3,021 $ 992 $ 1,402 $ 8,719

$ 3,271 Central 19,764 18,462 20,786 84,302 75,489 Southern 3,327

3,157 2,359 12,312 13,399 Total

Appalachia 26,112 22,611 24,547 105,333 92,159 Illinois Basin 3,140

3,934 2,973 12,673 16,989 Northern Powder River Basin 3,628

3,815 3,237 11,445 11,642 Unadjusted coal

royalty revenue 32,880 30,360 30,757 $ 129,451 $ 120,790 Coal

royalty adjustment for minimum leases (12 ) — (48 ) (110 ) —

Total coal royalty revenue $ 32,868 $ 30,360 $ 30,709

$ 129,341 $ 120,790 Other revenues Production

lease minimum revenue $ 1,897 $ 8,266 $ 1,769 $ 8,207 $ 30,822

Minimum lease straight line revenue 623 — 567 2,362 — Property tax

revenue 1,454 813 1,263 5,422 5,124 Wheelage 1,329 1,224 1,572

6,484 4,734 Coal overriding royalty revenue 3,386 4,067 3,918

13,878 9,836 Lease modification fees — — — — 1,000 Aggregates

royalty revenue 1,188 728 888 4,739 4,241 Oil and gas royalty

revenues 929 1,693 1,427 6,608 4,225 Other 292 202

405 1,837 1,029 Total other revenues $ 11,098

$ 16,993 $ 11,809 $ 49,537 $ 61,011 Total Coal

Royalty and Other revenues $ 43,966 $ 47,353 $ 42,518 $ 178,878 $

181,801 Transportation and processing services 6,649 4,793

6,853 23,887 20,522 Total Coal Royalty and

Other segment revenues $ 50,615 $ 52,146 $ 49,371 $ 202,765 $

202,323 Gain on litigation settlement 25,000 — — 25,000 — Gain on

asset sales, net 1,622 178 — 2,441

3,545 Total coal royalty and other segment revenues and other

income $ 77,237 $ 52,324 $ 49,371 $ 230,206

$ 205,868

Natural Resource Partners L.P.

Reconciliation of Non-GAAP

Measures

(Unaudited)

Adjusted EBITDA

Coal Royaltyand Other

Corporate andFinancing

(In

thousands)

Soda Ash Total Three Months Ended December 31,

2018 Net income (loss) from continuing operations $ 44,487 $

13,320 $ (22,715 ) $ 35,092 Less: equity earnings from

unconsolidated investment — (13,320 ) — (13,320 ) Add: total

distributions from unconsolidated investment — 9,800 — 9,800 Add:

interest expense, net — — 17,001 17,001 Add: depreciation,

depletion and amortization 6,325 — — 6,325 Add: asset impairments

18,038 — — 18,038 Adjusted EBITDA $

68,850 $ 9,800 $ (5,714 ) $ 72,936

Three Months Ended December 31, 2017 Net income (loss) from

continuing operations $ 39,642 $ 12,781 $ (23,758 ) $ 28,665 Less:

equity earnings from unconsolidated investment — (12,781 ) —

(12,781 ) Add: total distributions from unconsolidated investment —

12,250 — 12,250 Add: interest expense, net — — 19,196 19,196 Add:

depreciation, depletion and amortization 5,761 — — 5,761 Add: asset

impairments 1,189 — — 1,189 Adjusted

EBITDA $ 46,592 $ 12,250 $ (4,562 ) $ 54,280

Three Months Ended September 30, 2018 Net income

(loss) from continuing operations $ 37,693 $ 8,836 $ (20,676 ) $

25,853 Less: equity earnings from unconsolidated investment —

(8,836 ) — (8,836 ) Less: net income attributable to

non-controlling interest 359 — — 359 Add: total distributions from

unconsolidated investment — 12,250 — 12,250 Add: interest expense,

net — — 17,493 17,493 Add: depreciation, depletion and amortization

4,888 — — 4,888 Adjusted EBITDA $

42,940 $ 12,250 $ (3,183 ) $ 52,007

Natural Resource Partners L.P.

Reconciliation of Non-GAAP

Measures

(Unaudited)

Adjusted EBITDA

Coal Royalty and Other

Corporate and Financing

(In

thousands)

Soda Ash Total Year Ended December 31, 2018

Net income (loss) from continuing operations 160,728 $ 48,306 $

(86,674 ) $ 122,360 Less: equity earnings from unconsolidated

investment — (48,306 ) — (48,306 ) Less: net income attributable to

non-controlling interest (510 ) — — (510 ) Add: total distributions

from unconsolidated investment — 46,550 — 46,550 Add: interest

expense, net — — 70,178 70,178 Add: depreciation, depletion and

amortization 21,689 — — 21,689 Add: asset impairments 18,280

— — 18,280 Adjusted EBITDA $ 200,187 $

46,550 $ (16,496 ) $ 230,241

Year Ended

December 31, 2017 Net income (loss) from continuing operations

$ 154,604 $ 40,457 $ (112,576 ) $ 82,485 Less: equity earnings from

unconsolidated investment — (40,457 ) — (40,457 ) Add: total

distributions from unconsolidated investment — 49,000 — 49,000 Add:

interest expense, net — — 82,028 82,028 Add: debt modification

expense — — 7,939 7,939 Add: loss on extinguishment of debt — —

4,107 4,107 Add: depreciation, depletion and amortization 23,414 —

— 23,414 Add: asset impairments 2,967 — —

2,967 Adjusted EBITDA $ 180,985 $ 49,000 $

(18,502 ) $ 211,483

Leverage Ratio

(In

thousands)

Year Ended December 31,

2018

Adjusted EBITDA $ 230,241 Debt—at December 31, 2018 $ 687,138

Leverage Ratio (1) 3.0 x

_________________________

(1)

Leverage Ratio is calculated as last

twelve months' Adjusted EBITDA divided by the outstanding principal

of our debt as of December 31, 2018.

Natural Resource Partners L.P.

Reconciliation of Non-GAAP

Measures

(Unaudited)

Distributable Cash Flow and Free Cash Flow

Coal Royalty and Other

Corporate and Financing

(In

thousands)

Soda Ash Total Three Months Ended December 31,

2018 Net cash provided by (used in) operating activities of

continuing operations $ 80,272 $ 9,800 $ (9,583 ) $ 80,489 Add:

proceeds from sale of assets 1,623 — — 1,623 Add: proceeds from

sale of discontinued operations — — — 198,091 Add: return of

long-term contract receivables 455 — — 455

Distributable cash flow $ 82,350 $ 9,800 $

(9,583 ) $ 280,658 Less: proceeds from sale of assets (1,623

) — — (1,623 ) Less: proceeds from sale of discontinued operations

— — — (198,091 ) Free cash flow $ 80,727

$ 9,800 $ (9,583 ) $ 80,944

Three

Months Ended December 31, 2017 Net cash provided by (used in)

operating activities of continuing operations $ 45,550 $ 12,250 $

(15,366 ) $ 42,434 Add: proceeds from sale of assets 192 — — 192

Add: return of long-term contract receivables 399 — —

399 Distributable cash flow $ 46,141 $ 12,250

$ (15,366 ) $ 43,025 Less: proceeds from sale of

assets (192 ) — — (192 ) Free cash flow $ 45,949

$ 12,250 $ (15,366 ) $ 42,833

Three

Months Ended September 30, 2018 Net cash provided by (used in)

operating activities of continuing operations $ 41,604 $ 12,250 $

(27,368 ) $ 26,486 Add: proceeds from sale of assets — — — — Add:

return of long-term contract receivables 1,590 — —

1,590 Distributable cash flow $ 43,194 $

12,250 $ (27,368 ) $ 28,076 Less: proceeds from sale

of assets — — — — Free cash flow $

43,194 $ 12,250 $ (27,368 ) $ 28,076

Distributable Cash Flow and Free Cash Flow

Coal Royalty and Other

Corporate and Financing

(In

thousands)

Soda Ash Total Year Ended December 31, 2018

Net cash provided by (used in) operating activities of continuing

operations $ 212,394 $ 44,453 $ (78,565 ) $ 178,282 Add:

distributions from unconsolidated investment in excess of

cumulative earnings — 2,097 — 2,097 Add: proceeds from sale of

assets 2,449 — — 2,449 Add: proceeds from sale of discontinued

operations — — — 198,091 Add: return of long-term contract

receivables 3,061 — — 3,061

Distributable cash flow $ 217,904 $ 46,550 $ (78,565

) $ 383,980 Less: proceeds from sale of assets (2,449 ) — —

(2,449 ) Less: proceeds from sale of discontinued operations —

— — (198,091 ) Free cash flow $ 215,455

$ 46,550 $ (78,565 ) $ 183,440

Natural Resource Partners L.P.

Reconciliation of Non-GAAP

Measures

(Unaudited)

Free Cash Flow Excluding Discontinued Operations and

One-Time Beneficial Items and Cash Flow Cushion

(In

thousands)

Total Year Ended December 31, 2018 Free cash flow $

183,440 Add: free cash flow used by discontinued operations (540 )

Free cash flow including discontinued operations $ 182,900

Less: free cash flow used by discontinued operations 540 Less: cash

flow from one-time Hillsboro litigation settlement (25,000 ) Free

cash flow excluding discontinued operations and one-time beneficial

items $ 158,440 Less: mandatory Opco debt amortizations

(80,765 ) Less: preferred unit distributions and redemption of PIK

units (39,109 ) Less: common unit distributions (22,486 ) Cash flow

cushion $ 16,080

Natural Resource Partners L.P.

Reconciliation of Non-GAAP

Measures

(Unaudited)

Distributable Cash Flow and Free Cash Flow

Coal Royalty and Other

Corporate and Financing

(In

thousands)

Soda Ash Total Year Ended December 31, 2017

Net cash provided by (used in) operating activities of continuing

operations $ 166,138 $ 43,354 $ (97,341 ) $ 112,151 Add:

distributions from unconsolidated investment in excess of

cumulative earnings — 5,646 — 5,646 Add: proceeds from sale of

assets 1,151 — — 1,151 Add: return of long-term contract

receivables (including affiliates) 3,010 — —

3,010 Distributable cash flow $ 170,299 $ 49,000

$ (97,341 ) $ 121,958 Less: proceeds from sale of

assets (1,151 ) — — (1,151 ) Less: acquisition costs classified as

financing activities 517 — — 517 Free

cash flow $ 169,665 $ 49,000 $ (97,341 ) $ 121,324

Free Cash Flow Excluding Discontinued

Operations and One-Time Beneficial Items and Cash Flow Cushion

(In

thousands)

Total Year Ended December 31, 2017 Free cash flow $

121,324 Add: free cash flow provided by discontinued operations

6,394 Free cash flow including discontinued operations $

127,718 Less: free cash flow provided by discontinued

operations (6,394 ) Free cash flow excluding discontinued

operations and one-time beneficial items $ 121,324 Less:

mandatory Opco debt amortizations (80,765 ) Less: preferred unit

distributions (8,844 ) Less: common unit distributions (22,467 )

Cash flow cushion $ 9,248

Natural Resource Partners L.P.

Reconciliation of Non-GAAP

Measures

(Unaudited)

Net Income Attributable to Common Unitholders Excluding

Discontinued Operations and One-Time Beneficial Items

Year Ended

(In

thousands)

December 31, 2018 Net income attributable to NRP $ 139,537

Less: Hillsboro litigation settlement (25,000 ) Less: income from

discontinued operations (17,687 ) Less: income from Ciner Wyoming's

royalty dispute settlement (12,678 ) Net income attributable to NRP

excluding discontinued operations and one-time beneficial items $

84,172 Less: income attributed to preferred unitholders

(30,000 ) Net income attributable to common unitholders and general

partner excluding discontinued operations and one-time beneficial

items $ 54,172 Less: Net income attributable to the general

partner excluding discontinued operations and one-time beneficial

items (1,083 ) Net income attributable to common unitholders

excluding discontinued operations and one-time beneficial items $

53,089

Distribution Coverage Ratio

Year Ended

(In

thousands)

December 31, 2018 Net cash provided by operating activities

of continuing operations $ 178,282 Add: distributions from

unconsolidated investment in excess of cumulative earnings 2,097

Add: proceeds from sale of assets 2,449 Add: return on long-term

contract receivables 3,061 Add: proceeds from sale of discontinued

operations 198,091 Distributable cash flow $ 383,980

Less: proceeds from sale of discontinued operations (198,091 )

Distributable cash flow excluding sale of discontinued operations $

185,889 Common unit distribution $ 1.80

Distribution Coverage Ratio excluding sale of discontinued

operations (1) 8.4 x Less: Preferred distributions $ (30,000

) Distributable cash flow excluding sale of discontinued

operations and after Preferred distributions $ 155,889

Distribution Coverage Ratio excluding sale of discontinued

operations and after Preferred distributions (2) 7.1 x

_________________________

(1) Calculated as last

twelve months' distributable cash flow excluding sale of

discontinued operations divided by annual common unit distributions

times number of common units and general partner units outstanding.

(2) Calculated as last twelve months' distributable cash

flow excluding sale of discontinued operations and less preferred

distributions divided by annual common unit distributions times

number of common units and general partner units outstanding.

Natural Resource Partners L.P.

Reconciliation of Non-GAAP

Measures

(Unaudited)

Return on Capital Employed ("ROCE")

Coal Royalty and Other

Corporate and Financing

(In

thousands)

Soda Ash Total Year Ended December 31, 2018

Net income (loss) from continuing operations $ 160,728 $ 48,306 $

(86,674 ) $ 122,360 Interest expense — — 70,816

70,816 Return $ 160,728 $ 48,306 $

(15,858 ) $ 193,176

As of December 31, 2017

Total assets of continuing operations 945,237 245,433 6,129

1,196,799 Less: total current liabilities excluding current debt

(9,467 ) — (19,574 ) (29,041 ) Less: total long-term liabilities

excluding long-term debt (100,804 ) — (735 ) (101,539 ) Add:

non-controlling interest 3,394 — — 3,394

Capital employed excluding discontinued operations $ 838,360

$ 245,433 $ (14,180 ) $ 1,069,613 Total

Partners' Capital (1) $ 838,360 $ 245,433 $ (996,959 ) $ 265,211

Less: Partners' Capital from discontinued operations — —

— (178,377 ) Total Partners' Capital excluding

discontinued operations $ 838,360 $ 245,433 $ (996,959 ) $ 86,834

Class A Convertible Preferred Units — — 173,431 173,431 Debt —

— 809,348 809,348 Capital employed

excluding discontinued operations $ 838,360 $ 245,433

$ (14,180 ) $ 1,069,613 ROCE

excluding discontinued operations 19.2% 19.7% N/A 18.1%

Excluding one-time beneficial items: Return $ 160,728 $ 48,306 $

(15,858 ) $ 193,176 Less: income from Hillsboro litigation

settlement (25,000 ) — (25,000 ) Less: income from Ciner Wyoming's

royalty dispute settlement — (12,678 ) (12,678

) Return excluding discontinued operations and one-time

beneficial items $ 135,728 $ 35,628 $ (15,858 ) $

155,498 ROCE excluding

discontinued operations and one-time beneficial items 16.2% 14.5%

N/A 14.5%

_________________________

(1) Total Partners'

Capital includes $178.4 million from discontinued operations.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20190307005076/en/

Tiffany Sammis, 713-751-7515tsammis@nrplp.com

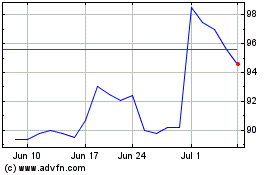

Natural Resource Partners (NYSE:NRP)

Historical Stock Chart

From Jul 2024 to Jul 2024

Natural Resource Partners (NYSE:NRP)

Historical Stock Chart

From Jul 2023 to Jul 2024