Regulatory News:

1. The Pierre & Vacances-Center Parcs Group

(Paris:VAC) recorded a 31% increase in adjusted

EBITDA1 for the first half of 2024 (+€14 million)

excluding the impact of non-recurring income recognised in the

first half of the year2, or +54% (+€25 million) on an unadjusted

basis.

2. The Group's robust first-half operating performance

enables it to raise full-year 2024 guidance, to now expect

adjusted EBITDA of at least €160 million excluding the impact

of non-recurring items, or €170 million on an unadjusted basis, vs.

€145/150 million announced previously3, a year ahead of the

business plan drawn up in March 2022.

3. On the strength of these results, which follow the

healthy performances recorded over the past two years, the

Group:

a) confirms the relevance of the strategic

directions of the ReInvention plan and is stepping up growth

momentum around five value-creating pillars:

- Acting for positive impact local tourism.

- Investing in an immersive customer experience, based on

innovative technology and an enhanced service culture.

- Developing the network with a dominant asset-light share

(management and franchise contracts).

- Reducing our cost structure.

- Making our brands autonomous and responsible growth

pillars.

b) obtains, on 29 May 2024, approval from

its lenders to refinance its corporate debt (early redemption

of €328 million and implementation of an RCF4 of €205 million

planned for the second half of the year), thus definitively

turning the page on its financial restructuring, finalised in

September 2022.

c) upgrades its five-year targets5

with:

- A Group revenue target of €2 billion for 2026 (of which

€1,960 million for the tourism businesses) and of €2,180 million

for 2028 (of which €2,130 million for the tourism

businesses).

- A Group adjusted EBITDA target of €200 million for 2026 and

€220 million for 2028, generating an operating margin of

10%.

- An investment forecast of more than €750 million

(excluding new developments), of which €550 million in capex

financed by the Group and more than €200 million by owner lessors

and other third-party partners.

- A target operating cash flow6/adjusted EBITDA ratio

of 40% on average over 2024-2028.

Franck Gervais, CEO of the Pierre & Vacances-Center Parcs

Group, stated:

"Thanks to its unique positioning as a leader in local tourism

and underpinned by the strength of its four brands, the Pierre

& Vacances-Center Parcs Group is consolidating its earnings

growth with higher performances for the fifth consecutive half-year

period. With our EBITDA forecast revised upwards to €170 million

for the full year 2024, we are exceeding the targets set out in our

ReInvention plan a year ahead of schedule, and our goal is to

achieve record operating profitability of 10% on revenue of €2

billion by 2026. The successful implementation of our new financing

structure, less than two years after the completion of our

restructuring operations, also testifies to the confidence of our

banking partners in our business model and strategic directions. On

the strength of these achievements and the commitment of our teams,

we have all the cards in hand to go beyond our initial objectives

and offer our guests a reinvented tourism that is more sustainable,

100% experiential, modern and value-creating".

I. Main events

Refinancing of corporate debt

Less than two years after the completion of the Group's

Restructuring Transactions on 16 September 2022, and buoyed by the

strong operating performances recorded since then, on 29 May 2024,

the Group obtained approvals from its lenders to refinance its

corporate debt:

- During the second half of the year, the

Group is set to voluntarily redeem its reinstalled debt ahead of

schedule with a principal amount of €303 million, as well as its

state-guaranteed loan with a principal amount of €25 million, using

available cash. The main benefits of this repayment will be the

lifting of the security trust granted as part of the Restructuring

Transactions of 16 September 2022, as well as the easing of certain

covenants and financial undertakings.

- To maintain the Group's flexibility in

meeting its seasonal cash requirements, part of this debt will be

refinanced in the form of a revolving credit facility (RCF) of €205

million, maturing in 2029, from its historical lenders, BNP

Paribas, CACIB and Natixis as bookrunners and mandated arrangers,

and CIC, BNP Paribas Fortis, La Banque Postale, LCL and SG as

mandated arrangers. The facility will bear interest at 3-month

EURIBOR plus a margin of 3.25% p.a. (which may be revised downwards

depending on compliance with financial ratios). The RCF will be

secured by a pledge on 100% of CP Europe NV shares and shares of

the main subsidiaries of CP Holding and CP Europe NV, as well as by

a pledge on the receivables of PV SA in respect of the intra-group

loans that will be granted to its subsidiaries using the RCF.

German government aid

During the first half of 2023/2024, the Group finalised its

application for government aid from the German authorities, leading

it to record a subsidy in respect of the Covid-19 pandemic for an

amount net of ancillary costs of €10.9 million.

Disposal of Seniorales lease operation activities

On 28 December 2023, the Group completed the disposal of its

loss-making businesses operated by lease for 29 Seniorales

residences to the ACAPACE Group, which owns the Jardins d’Arcadie

(residences for the elderly) and Sandaya (open-air hotels). ACAPACE

has taken over this scope with effect from 1 January 2024.

II. First-half 2023/2024 results (1 October 2023 - 31 March

2024) according to operational reporting

To reflect the operational reality of the Group's businesses

and the readability of their performance, the Group's financial

communication, in line with operational reporting as monitored by

management, continues to include the results of joint ventures on a

proportional basis and does not include the application of IFRS

16.

The Group’s results are also presented according to the

following operational sectors defined in compliance with the IFRS 8

standard7, i.e.:

- Center Parcs covering operation of

the Domains marketed under the Center Parcs, Sunparks and Villages

Nature brands, and the building/renovation activities for tourism

assets and property marketing.

- Pierre & Vacances covering the

tourism businesses operated in France and Spain under the Pierre

& Vacances brand, the property development business in Spain

and the Asset Management business line (responsible notably for

relations with individual and institutional lessors).

- maeva.com (included in the Pierre

& Vacances8 business line until 30 September 2023), a

distribution and services platform, operating the maeva.com,

Campings maeva, maeva Home and La France du Nord au Sud brands on

the French market and the Vacansoleil brand on European

markets.

- Adagio, covering operation of the

city residences leased by the Pierre & Vacances-Center Parcs

Group and entrusted to the Adagio SAS joint venture under

management mandates, as well as operation of the sites directly

leased by the joint venture.

- an operational sector covering the Major

Projects business line responsible for construction and

development of new assets on behalf of the Group in France, and

Senioriales, the subsidiary specialised in property

development and operation of non-medicalised residences for

independent elderly people.

- the Corporate operational segment

housing primarily the holding company activities.

The Group’s operational reporting is presented in Note 3 -

Information by operational segment in the Appendix to the

consolidated half-year financial statements. A reconciliation table

with the primary financial statements is presented hereafter.

2.1. Consolidated revenue according to operational

reporting

€m

H1 2024 Operational

reporting

H1 2023 Operational

reporting

Change

Center Parcs

494.9

494.9

+0.0%

of which: Revenue from tourism

businesses

479.0

436.7

+9.7%

o/w accommodation revenue

372.2

340.5

+9.3%

Pierre & Vacances

158.8

148.1*

+7.2%

of which: Revenue from tourism

businesses

158.8

148.1

+7.2%

o/w accommodation revenue

130.5

119.9

+8.8%

Adagio

105.8

99.2

+6.6%

of which: Revenue from tourism

businesses

105.8

99.2

+6.6%

o/w accommodation revenue

94.7

89.6

+5.7%

maeva.com

23.9

20.7

+15.3%

of which: Revenue from tourism

businesses

23.9

20.7

+15.3%

Major Projects & Senioriales

38.2

44.9

-14.9%

Corporate

0.6

1.0

-38.8%

Total

822.2

808.8

+1.7%

Revenue from tourism businesses

767.5

704.7

+8.9%

Accommodation revenue

597.4

550.1

+8.6%

Supplementary income

170.2

154.7

+10.0%

Other revenue

54.7

104.1

-47.4%

*Restated for the externalisation of the maeva.com operating

segment

Revenue from the tourism

businesses

Following a 5.9% rise in revenue in the first quarter of

2023/2024, the Group stepped up the pace of growth in the second

quarter, with an 11.8% increase in revenue, bringing total tourism

revenue for the first half to €767.5 million (up 8.9%).

Accommodation revenue

Change in operational KPIs

RevPar

Average letting rates

(by night, for accommodation)

Number of nights sold

Occupancy rate

€ (excl. tax)

Chg. % N-1

€ (excl. tax)

Chg. % N-1

Units

Chg. % N-1

Chg. Pts N-1

Chg. N-1

Center Parcs

117.8

+6.4%

165.5

+7.5%

2,248 981

+1.6%

71.2%

-0.8 pt

Pierre & Vacances

80.1

+11.4%

134.9

-0.3%

966,911

+9.1%

67.4%

+6.2 pts

Adagio

72.6

+3.0%

103.3

+6.5%

917,263

-0.8%

70.8%

-2.6 pts

H1 2023/24

98.0

+7.2%

144.5

+5.7%

4,133 155

+2.7%

70.1%

+0.8 pt

Accommodation revenue totalled €597.4 million during the

first half of 2023/2024, up 8.6% relative to the year-earlier

period.

Growth in revenue was driven by the rise in average letting

rates (+5.7%) and the number of nights sold (+2.7%).

The occupancy rate was up by 0.8 points to 70.1% over the period

(vs. 69.3% in H1 2022/2023).

RevPar9 was up 7.2% compared with H1 2022/2023.

All brands contributed to the increase in revenue:

- Center Parcs: +9.3%

Growth was driven by the Domains in the BNG10 region and was

boosted by a rise in average selling prices (+7.5%) thanks to the

premiumisation strategy and park renovation works, and by a rise in

the number of nights sold (+1.6%).

Business at the French Domains was penalised by the partial

unavailability of cottages at Domaine des Hauts de Bruyères and

Domaine des Bois Francs, which were being renovated during the

first half.

The occupancy rate was down by 0.8 points to 71.2% over the

period.

RevPar was up 6.4%.

- Pierre & Vacances: +8.8%

Revenue at the brand was higher in both France and Spain.

- Revenue from the residences in

France increased by 5.7%, despite a reduction11 in the stock

operated by lease (-5.4% of nights offered relative to H1 of the

previous period). On a constant stock basis, revenue was up (RevPar

up 11.7%). Average price rose by 2.8% and occupancy rates by 5.1%

to 71.2%.

- Revenue from the residences in Spain

was up sharply (+41.4%), driven by both average letting rates

(+7.1%) and a higher occupancy rate (+10.8 points). RevPar was up

33.0%.

All destinations combined, the P&V brand recorded

growth in the occupancy rate of 6.2 points to 67.4%.

Average selling prices were stable over H1 (-0.3%), due to a

less favourable mix effect (strong growth in revenue from seaside

destinations (+15.1%), with lower average prices than mountain

sites).

RevPar was up 11.4%.

- Adagio: +5.7%

Aparthotel revenue rose by 5.7% in the first half, driven by a

6.5% increase in average selling prices.

The occupancy rate fell by 2.6 points to 70.8% (significant base

effect with an occupancy rate up 8 points in the first half of

2022/2023 following the rebound in post-Covid activity).

RevPar was up 3.0%.

Supplementary income12:

H1 supplementary income totalled €170.2 million, up 10.0%

relative to H1 of the previous year, driven by higher onsite

sales (+13.0%) reflecting our strategy to round out the offer and

growth in the maeva.com management and distribution business

(+15.3% over the half-year period).

Other revenue:

H1 2023/2024 revenue from other businesses totalled €54.7

million compared with €104.1 million in H1 2022/2023 (decline with

no significant impact on EBITDA), primarily made up of:

- Renovation operations at Center Parcs

Domains on behalf of owner-lessors, for 15,9 million (compared with

58.2 million in H1 2022/2023).

- Les Seniorales for 20.8 million (vs. 33.3

million in H1 2022/2023).

- the Major Projects business line: €17.4

million (of which €15.7 million related to the extension of the

Villages Nature Paris domain) (vs. €11.6 million in H1

2022/2023).

2.2 Results according to operational reporting

NB: The seasonal nature of the Group’s business in the first

half of the year and the linear accounting of expenses lead to a

structural operating loss during the period.

€ millions

H1 2024

Operational reporting

H1 2023

Operational reporting

Revenue

822.2

808.8

Adjusted EBITDA

-21.4

-46.8

H1 2024 adjusted EBITDA

excluding non-recurring items13

-32.3

Center Parcs

1.1

-4.6

Pierre & Vacances

-5.0

-14.7

maeva

-2.8

-2.6

Adagio

2.6

0.5

Major Projects &

Senioriales

-12.2

-22.6

Corporate

-5.2

-2.8

Current operating profit (loss)

-53.4

-70.4

Financial income and expense

-4.2

-14.0

Other operating income and expense

-14.9

-8.7

Share of profit (loss) of equity-accounted

investments

-

-0.1

Taxes

-9.9

-0.1

Net Profit (loss)

-82.4

-93.1

Adjusted EBITDA for the first half of 2023/2024 stood at

-€21.4 million, improving by €25.4m (+54%) relative to the first

half of 2022/2023 (loss reduced by more than half).

The Group benefited from growth in its tourism businesses (+€63

million in revenue compared with the first half of the previous

year), as well as its ongoing savings plan, with a target of €50

million in savings over the full-year 2024 (compared with €38

million in 2023), 95% of which has already been validated or

committed to date.

Adjusted EBITDA of -€21.4 million for the first half of 2024

also included non-recurring income of €10.9 million corresponding

to additional German government aid for the Covid-19 pandemic.

Adjusted for the impact of these non-recurring items, Group

adjusted EBITDA in the first half of 2024 was up by €14.5 million

(+31%) relative to H1 2023.

Net financial expenses amounted to €4.2 million in the

first half of 2023/2024, down €9.8 million compared with the first

half of 2022/2023 in view of income from financial investments,

which more than offset the rise in interest rates on gross

debt.

Other net operational expenses represented €14.9 million

in H1 2023/2024, primarily including:

- costs incurred (mainly fees and staff

costs) under the framework of the Group’s transformation projects

and the closure of certain sites for €9.8 million.

- a €3.7 million expense related to the

booking under IFRS2 of bonus share allocation plans implemented at

the same time as the Group’s Restructuring operations.

Tax expenses amounted to €9.9 million, stemming primarily

from a tax expense due in Germany and the Netherlands.

The Group’s net loss totalled €82.4 million, an 11.5%

improvement relative to the net loss seen in H1 2023.

2.3. Balance sheet items and net financial debt according to

operational reporting

Simplified balance sheet

€ millions

31 March 2024

Operational reporting

30 Sept. 2023

Operational reporting

Change

Goodwill

142.5

140.1

2.4

Net fixed assets

484.2

504.7

-20.5

Lease assets

95.7

70.2

25.5

TOTAL USES

722.3

714.9

7.4

Share capital

141.2

212.7

-71.5

Provisions for risks and charges

50.3

71.0

-20.7

Net financial debt

44.6

-79.0

123.6

Debt related to lease assets

obligations

115.5

116.8

-1.3

WCR and others

370.7

393.4

-22.7

TOTAL RESOURCES

722.3

714.9

7.4

Net financial debt

€ millions

31 March 2024

30 Sept. 2023

Change

Gross financial liabilities

389.9

389.8

0.1

Cash

-345.3

-468.8

123.5

Net financial debt

44.6

-79.0

123.6

The seasonal nature of the tourism businesses causes structural

cash burn during the first half of the year.

Gross financial debt on 31 March 2024 (€389.9 million)

therefore corresponded mainly to:

- the debt reinstalled on 16 September 2022 for a total amount of

€302.5 million (maturing in September 2027) corresponding to:

- a term loan for a nominal amount of €174.0

million, bearing interest at the 3-month Euribor rate plus a margin

of 3.75%.

- a term loan for a nominal amount of €123.8

million, bearing interest at the 3-month Euribor rate plus a margin

of 2.50%.

- a bond loan in the form of a Euro PP

private placement, unlisted for a nominal amount of €1.8 million,

bearing interest at the 3-month Euribor rate plus a margin of

4.25%.

- a bond loan in the form of a Euro PP

private placement, unlisted for a nominal amount of €2.9 million,

bearing interest at the 3-month Euribor rate plus a margin of

3.90%.

- the remainder of the state-guaranteed loan for €25.0

million.

- loans taken out by the Group as part of its financing of

property development programmes destined to be sold off for €59

million (of which €44.5 million for the Center Parcs programme in

the Lot-et-Garonne and €12.5 million for the Avoriaz

programme).

- sundry bank loans for €1.7 million.

- accrued interest for €0.9 million.

- deposits and guarantees for €0.7 million.

Bank ratios

The debt covenants reinstated as part of the Group's

Restructuring and Refinancing operations require compliance with

three financial ratios: the first compares the Group's net debt

with consolidated adjusted EBITDA every six months, the second

verifies a minimum cash position at the end of the half-year period

and the last verifies a maximum annual CAPEX. As of 31 March 2024,

these covenants were respected.

III. Outlook

Upward revision to financial forecasts for 2023/2024

In a market context more in line with conditions prevailing

before the Covid crisis (end to "revenge travel" phenomenon), with

a rise in last-minute bookings in particular, the Group expects

business to return to normal in the second half of the year. The

portfolio of tourism reservations to date represents almost 70% of

the budgeted revenue target for the second half of 2023/2024, an

achievement rate comparable to the year-earlier period.

Underpinned by sales momentum in the first half of the year and

the extent to which cost savings have been secured, the Group has

raised its guidance for 2023/2024, to expect adjusted

EBITDA of at least €160 million excluding the impact of

non-recurring items (or €170 million on an unadjusted basis), vs.

€145/150 million announced previously14, a year ahead of the

business plan drawn up in March 2022.

Targets for 2028 revised upwards

On the strength of these first-half results, which follow the

healthy performances recorded over the past two years, the Group

has raised its five-year targets to expect:

- A Group revenue target of €2 billion in

2026 (of which €1,960 million for the tourism businesses) and

€2,180 million in 2028 (of which €2,130 million for its tourism

businesses),

- A Group adjusted EBITDA target of €200

million in 2026 and €220 million in 2028, generating an operating

margin of 10%,

- An investment forecast of more than €750

million (excluding new developments), of which €550 million in

capex financed by the Group and more than €200 million by owner

lessors and other third-party partners,

- A target operating cash flow/adjusted

EBITDA ratio of 40% on average over 2024-2028.

These new targets, and the growth drivers behind them, will be

discussed at the Group's Capital Markets Day on 30 May 2024.

IV. Appendix: Reconciliation table

The Group’s financial communication is in line with operational

reporting, which is more representative of the performances and

economic reality of the contribution of each of the Group’s

businesses i.e.:

- excluding the impact of IFRS 16 application

for all financial statements. Indeed, in the Group’s internal

financial reporting, rental expenses are recognised as an operating

expense. In contrast, under IFRS 16, rental expenses are replaced

by financial interest and the straight-line depreciation expense

over the lease term of the right of use. The rental savings

obtained from the lessors are not recognised in the income

statement but are deducted from the value of the right of use and

the rental obligation, thus reducing the depreciation and financial

costs to be recognised over the remaining term of the leases.

- with the presentation of joint undertakings

according to the proportional consolidation method (i.e. excluding

application of IFRS 11) for profit and loss items.

The Group's operational reporting as monitored by management, in

accordance with IFRS 8, is presented in Note 3 - Information by

operating segment to the consolidated financial statements as at 31

March 2024.

The reconciliation table with the primary financial statements

are therefore set out below.

Income statement

(€ millions)

H1 2024

Operational reporting

IFRS 11 adjustments

Impact of IFRS 16

H1 2024

IFRS

Revenue

822.2

-32.5

-11.2

778.6

External purchases and

services

-594.5

+21.7

+208.5

-364.3

of which cost of sales of

property assets

-29.8

-

+11.2

-18.7

of which owner rents

-221.2

+3.6

+197.6

-20.0

Staff costs

-238.7

+8.0

-0.3

-231.0

Other operating income and

expense

8.5

-0.8

+1.1

+8.8

Depreciation, amortisation and

impairment

-50.9

+1.2

-118.5

-168.3

Current operating profit

(loss)

-53.4

-2.4

+79.6

23.7

Adjusted EBITDA

-21.4

-3.0

198.0

173.6

Other operating income and

expense

-14.9

+0.5

-0.4

-14.8

Financial income and expense

-4.2

-0.1

-96.1

-100.5

Equity associates

-

+0.1

+0.2

+0.3

Income tax

-9.9

+1.0

+1.4

-7.4

Profit (loss)

-82.4

-0.8

-15.4

-98.7

(€ millions)

H1 2023

Operational reporting

IFRS 11 adjustments

Impact of IFRS 16

H1 2023

IFRS

Revenue

808.8

-41.4

-25.6

741.8

External purchases and

services

-609.8

+28.4

+227.1

-354.3

of which cost of sales of

property assets

-57.7

+25.6

32.1

of which owner rents

-217.0

+2.6

+197.9

16.4

Staff costs

-212.8

+7.5

-

-205.3

Other operating income and

expense

-10.0

-

-1.0

-11.1

Depreciation, amortisation and

impairment

-46.5

+1.0

-102.2

-147.7

Current operating profit

(loss)

-70.4

-4.5

+98.3

23.4

Adjusted EBITDA

-46.8

-5.0

+200.5

148.7

Other operating income and

expense

-8.7

-

-

-8.7

Financial income and expense

-14.0

+0.8

-107.8

-121.0

Equity associates

-0.1

-1.2

+0.1

-1.2

Income tax

-0.1

+1.2

+1.9

3.0

Profit (loss)

-93.1

-3.7

-7.6

-104.4

Group revenue under IFRS accounting totalled €778. 6 million, up

5% compared with the year-earlier period. Revenue was up across all

brands with a rise in average letting rates and higher occupancy

rates.

The Group net loss amounted to €98.7 million euros, an

improvement of €5.7 million compared to the first half of the

previous financial year, including, in addition to EBITDA of €173.6

million, net depreciation and provisions of €168.3 million and

financial expenses of €100.5 million.

Balance sheet

(€ millions)

H1 2024

Operational reporting

Impact of IFRS 16

H1 2024

IFRS

Goodwill

142.5

-

142.5

Net fixed assets

484.2

-3.9

480.3

Lease/right of use assets

95.7

+2,426.3

2,522.0

Uses

722.3

+2,422.4

3,144.7

Share capital

141.2

-654.5

-513.3

Provisions for risks and

charges

50.3

-0.1

50.2

Net financial debt

44.6

-

44.6

Debt related to lease

assets/liabilities

115.5

+ 3,148.8

3,264.3

WCR and others

370.7

-71.8

298.9

Resources

722.3

+2,422.4

3,144.7

(€ millions)

30 September 2023

Operational reporting

Impact of IFRS 16

30 September 2023

IFRS

Goodwill

140.1

-

140.1

Net fixed assets

504.7

-29.9

474.8

Lease/right of use assets

70.2

+2,492.2

2,562.4

Uses

714.9

+2,462.3

3,177.2

Share capital

212.7

-638.5

-425.8

Provisions for risks and

charges

71.0

-24.3

46.7

Net financial debt

-79.0

-

-79.0

Debt related to lease

assets/liabilities

116.8

+ 3,176.9

3,293.7

WCR and others

393.4

-51.8

341.6

Resources

714.9

+2,462.3

3,177.2

The Group’s balance sheet under IFRS reflected the

following:

- a decrease in shareholders' equity of €87.5 million, taking

into account the first-half net result, which is structurally

loss-making due to the seasonal nature of the Group's activities.

equity remained negative at 31 March 2024 due to the impact of IFRS

16, which has been applied retrospectively.

- a decline in net debt of €123.6 million, due to the structural

cash requirement generated in the first half of the year.

___________________________________________ 1Adjusted EBITDA =

current operating profit stemming from operational reporting

(consolidated operating income before other non-current operating

income and expense, excluding the impact of IFRS 11 and IFRS 16

accounting rules) adjusted for provisions and depreciation and

amortisation of fixed operating assets. Adjusted EBITDA therefore

includes the benefit of rental savings generated by the Villages

Nature project following the agreements signed in December 2022

(€10.9 million for 2023, €14.5 million for 2024, €12.4 million for

2025 and €4.0 million for 2026). 2 Recognition in the first half of

the 2023/2024 financial year of additional German government aid of

€10.9 million for the Covid-19 pandemic. 3 Forecast announced in a

press release on 1 December 2023. 4 Revolving Credit Facility 5

Data according to operational reporting. These targets are based on

data, assumptions and estimates considered reasonable by the Group

at the date they were established. These data, assumptions and

estimates are likely to change or be modified as a result of

uncertainties linked to the health, economic or financial

environment. The occurrence of one or more of the risks described

in chapter 2 "Risk factors" of the Universal Registration Document

could have an impact on the Group's businesses, financial position,

results or outlook, and therefore call into question its ability to

deliver its targets and forecasts. The Group therefore makes no

commitment and provides no guarantee as to the achievement of the

targets presented. 6 Operating cash flows after capex and before

non-recurring items and flows related to financing activities. 7

See page 186 of the Universal Registration Document, filed with the

AMF on 21 December 2023 and available on the www.groupepvcp.com 8

The Group has externalised the maeva.com operating segment in order

to improve the readability of the performance of this business line

and has consequently restated the historical comparative

information presented in this press release. 9 RevPar

=accommodation revenue divided by the number of nights offered 10

Belgium, Netherlands, Germany 11 Decrease in inventory due to

non-renewal of leases 12 Revenue from onsite activities (catering,

animation, stores, services etc.), co-ownership and multi-owner

fees and management mandates, marketing margins and revenue

generated by the maeva.com business line. 13 Restated for the

impact of additional income from German government aid for the

Covid-19 pandemic, recorded in the first half of 2023/24 for an

amount of €10.9 million. 14 Forecast announced in a press release

on 1 December 2023.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240529259040/en/

For further information:

Investor Relations and Strategic Operations Emeline Lauté

+33 (0) 1 58 21 54 76 info.fin@groupepvcp.com

Press Relations Valérie Lauthier +33 (0) 1 58 21 54 61

valerie.lauthier@groupepvcp.com

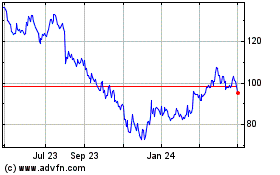

Marriott Vacations World... (NYSE:VAC)

Historical Stock Chart

From Nov 2024 to Dec 2024

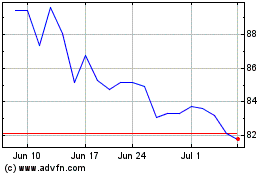

Marriott Vacations World... (NYSE:VAC)

Historical Stock Chart

From Dec 2023 to Dec 2024