Current Report Filing (8-k)

April 26 2021 - 11:20AM

Edgar (US Regulatory)

0001691421FALSE00016914212021-04-212021-04-21

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of report (Date of earliest event reported): April 21, 2021

LEMONADE, INC.

(Exact name of registrant as specified in its charter)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Delaware

|

|

001-39367

|

|

32-0469673

|

|

(State or other jurisdiction of incorporation)

|

|

(Commission File Number)

|

|

(I.R.S. Employer Identification No.)

|

5 Crosby Street, 3rd Floor

New York, NY 10013

(Address of principal executive offices) (Zip Code)

(844) 733-8666

(Registrant’s telephone number, include area code)

N/A

(Former Name or Former Address, if Changed Since Last Report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

|

|

|

|

|

|

|

|

☐

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

|

|

|

|

|

|

|

☐

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

|

|

|

|

|

|

|

|

☐

|

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

|

|

|

|

|

|

|

|

☐

|

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Title of each class

|

|

Trading Symbol(s)

|

|

Name of each exchange on which registered

|

|

Common Stock, $0.00001 par value per share

|

|

LMND

|

|

New York Stock Exchange

|

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☒

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

|

|

|

|

|

|

|

|

Item 5.02.

|

Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers.

|

On April 21, 2021, G. Thompson Hutton and Haim Sadger each tendered his resignation as a director of Lemonade, Inc. (the “Company”), effective immediately. Mr. Hutton had served as a Class III director and Mr. Sadger had served as a Class II director.

On April 21, 2021, the Board, upon the recommendation of its Nominating and Corporate Governance Committee, appointed each of Silvija Martincevic and Irina Novoselsky to the Board to fill Mr. Hutton’s and Mr. Sadger’s newly vacant seats, respectively, effective immediately (together, the “New Directors”). Ms. Martincevic will serve as a Class III director for a term expiring at the Company’s annual meeting of stockholders to be held in 2023 and Ms. Novoselsky will serve as a Class II director for a term expiring at the Company’s annual meeting of stockholders to be held in 2022, in each case until her successor is duly elected and qualified or her earlier death, disqualification, resignation or removal. In connection with the appointment of Ms. Martincevic to the Board, she was appointed to serve on the Compensation Committee, effective immediately, to replace Mr. Sadger, and as a member of the Nominating and Corporate Governance Committee, effective immediately, to replace Mr. Hutton. In connection with the appointment of Ms. Novoselsky to the Board, she was appointed to serve on the Audit Committee, effective immediately, to replace Mr. Hutton. The Board also appointed Ms. Novoselsky as Chair of the Audit Committee.

Each of the New Directors is eligible to participate in the Company’s Non-Employee Director Compensation Policy, which provides for: (i) an annual cash retainer of $30,000 for serving on the Board, earned on a quarterly basis; (ii) in the case of Ms. Martincevic, an annual cash retainer of $5,000 for serving as a member of the Compensation Committee, earned on a quarterly basis; (iii) in the case of Ms. Novoselsky, an annual cash retainer of $20,000 for serving as Chair of the Audit Committee, earned on a quarterly basis; (iv) an initial equity-based award of restricted stock units (the “Initial Award”) in an amount equal to $175,000 that vests in substantially equal annual installments over three years following the grant date, subject to such New Director’s continued service on the Board through each such vesting date; and (v) following each annual meeting of the Company’s stockholders, an annual equity-based award of restricted stock units in an amount of $150,000 that vests on the first anniversary of the date of grant, subject to such New Director’s continued service on the Board through such vesting date. On April 21, 2021, each of the New Directors was granted an Initial Award in an amount equal to $175,000. Each of the New Directors is also eligible to participate in the Company's Deferred Compensation Plan, which provides for the option to elect the date on which their restricted stock unit awards under the Company's Non-Employee Director Compensation Policy will be settled and paid, including any deferral thereon (in addition to any vesting schedules set forth in the restricted stock unit award grant agreement) and to establish the terms for such elections and deferrals. Each of the New Directors has entered into the Company’s standard indemnification agreement for directors and officers.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Exhibit No.

|

|

Description

|

|

|

|

|

104

|

|

Cover Page Interactive Data File (embedded within the Inline XBRL document)

|

|

|

|

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

LEMONADE, INC.

|

|

|

|

|

|

Date: April 26, 2021

|

|

By:

|

|

/s/ Tim Bixby

|

|

|

|

|

|

Tim Bixby

|

|

|

|

|

|

Chief Financial Officer

|

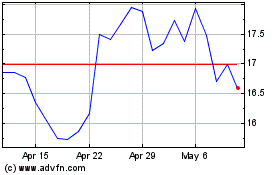

Lemonade (NYSE:LMND)

Historical Stock Chart

From Jun 2024 to Jul 2024

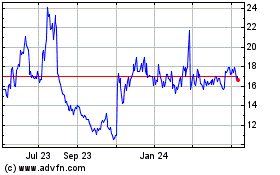

Lemonade (NYSE:LMND)

Historical Stock Chart

From Jul 2023 to Jul 2024