Johnson & Johnson Announces Preliminary Results of Kenvue Inc. Exchange Offer

August 21 2023 - 6:20AM

Business Wire

Johnson & Johnson (NYSE: JNJ) today announced that, based on

preliminary results, its previously announced offer to its

shareholders to exchange their shares of Johnson & Johnson

common stock for shares of Kenvue Inc. (NYSE: KVUE) (“Kenvue”)

common stock owned by Johnson & Johnson was oversubscribed. The

exchange offer expired at 12:00 midnight, New York City time, at

the end of the day on August 18, 2023. Under the terms of the

exchange offer, 8.0324 shares of Kenvue common stock will be

exchanged for each share of Johnson & Johnson common stock

accepted in the exchange offer.

According to the exchange agent, Computershare Trust Company,

N.A., 802,707,331 shares of Johnson & Johnson common stock were

validly tendered and not validly withdrawn, including 250,407,279

shares that were tendered by notice of guaranteed delivery. Johnson

& Johnson intends to accept 190,955,436 of the tendered shares

in exchange for the 1,533,830,450 shares of Kenvue common stock

owned by Johnson & Johnson. Because the exchange offer was

oversubscribed, Johnson & Johnson is accepting only a portion

of the shares of its common stock that were validly tendered and

not validly withdrawn, on a pro rata basis in proportion to the

number of shares tendered. Shareholders who owned fewer than 100

shares of Johnson & Johnson common stock, or an "odd-lot," who

have validly tendered all of their shares, will not be subject to

proration, in accordance with the terms of the exchange offer.

Based on the total number of shares of Johnson & Johnson

common stock reported to be tendered prior to the expiration of the

exchange offer, it is estimated that approximately 23.8% of the

tendered shares of Johnson & Johnson common stock will be

exchanged, assuming all shares tendered by guaranteed delivery

procedures are delivered under the terms of the exchange offer.

This preliminary proration factor is subject to change based on the

number of tendered shares that satisfy the guaranteed delivery

procedures, as well as the number of "odd-lot" shares that were

validly tendered and are not subject to proration. Johnson &

Johnson expects to announce the final proration factor on August

23, 2023, promptly following the expiration of the guaranteed

delivery period. Shares of Johnson & Johnson common stock

tendered but not accepted for exchange will be returned to the

tendering shareholders in book-entry form promptly after the final

proration factor is announced. Following the completion of the

exchange offer, Johnson & Johnson will retain approximately

9.5% of the outstanding shares of Kenvue common stock.

Goldman Sachs & Co. LLC and J.P. Morgan Securities LLC are

the dealer managers for the exchange offer.

About Johnson & Johnson

At Johnson & Johnson, we believe good health is the

foundation of vibrant lives, thriving communities and forward

progress. That’s why for more than 135 years, we have aimed to keep

people well at every age and every stage of life. Today, as the

world’s largest, most diversified healthcare products company, we

are committed to using our reach and size for good. We strive to

improve access and affordability, create healthier communities, and

put a healthy mind, body and environment within reach of everyone,

everywhere. We are blending our heart, science and ingenuity to

profoundly change the trajectory of health for humanity.

Forward Looking Statements

This communication contains certain statements about Johnson

& Johnson and Kenvue that are forward-looking statements.

Forward-looking statements are based on current expectations and

assumptions regarding Johnson & Johnson’s and Kenvue’s

respective businesses, the economy and other future conditions. In

addition, the forward-looking statements contained in this

communication may include statements about the expected effects on

Johnson & Johnson and Kenvue of the exchange offer, the

anticipated timing and benefits of the exchange offer, Johnson

& Johnson’s and Kenvue’s anticipated financial results, and all

other statements in this communication that are not historical

facts.

Because forward-looking statements relate to the future, by

their nature, they are subject to inherent uncertainties, risks and

changes in circumstances that are difficult to predict and are

detailed more fully in Johnson & Johnson’s and Kenvue’s

respective periodic reports filed from time to time with the

Securities and Exchange Commission (the “SEC”), the Registration

Statement referred to below, including the Prospectus forming a

part thereof, the Schedule TO and other exchange offer documents

filed by Johnson & Johnson or Kenvue, as applicable, with the

SEC. Such uncertainties, risks and changes in circumstances could

cause actual results to differ materially from those expressed or

implied in such forward-looking statements. Forward-looking

statements included herein are made as of the date hereof, and

neither Johnson & Johnson nor Kenvue undertakes any obligation

to update publicly such statements to reflect subsequent events or

circumstances, except to the extent required by applicable

securities laws. Investors should not put undue reliance on

forward-looking statements.

Additional Information and Where to Find It

This communication is for informational purposes only and is not

an offer to sell or exchange, a solicitation of an offer to buy or

exchange any securities and a recommendation as to whether

investors should participate in the exchange offer. Kenvue has

filed with the SEC a registration statement on Form S-4 (the

“Registration Statement”), including the Prospectus forming a part

thereof, and Johnson & Johnson has filed with the SEC a

Schedule TO, which more fully describes the terms and conditions of

the exchange offer. INVESTORS AND SECURITY HOLDERS ARE URGED TO

READ THE PROSPECTUS, AND ANY OTHER RELEVANT DOCUMENTS FILED WITH

THE SEC, WHEN THEY BECOME AVAILABLE AND BEFORE MAKING ANY

INVESTMENT DECISION, BECAUSE THEY CONTAIN IMPORTANT INFORMATION.

None of Johnson & Johnson, Kenvue or any of their respective

directors or officers or the dealer managers appointed with respect

to the exchange offer makes any recommendation as to whether you

should participate in the exchange offer.

Holders of Johnson & Johnson common stock may obtain copies

of the Prospectus, the Registration Statement, the Schedule TO and

other related documents, and any other information that Johnson

& Johnson and Kenvue file electronically with the SEC free of

charge at the SEC’s website at http://www.sec.gov. Holders of

Johnson & Johnson common stock will also be able to obtain a

copy of the Prospectus by clicking on the appropriate link on

http://www.JNJSeparation.com.

Johnson & Johnson has retained Georgeson LLC as the

information agent for the exchange offer. To obtain copies of the

exchange offer Prospectus and related documents, or for questions

about the terms of the exchange offer, you may contact the

information agent at 1-866-695-6074 (toll-free for stockholders,

banks and brokers) or +1-781-575-2137 (all others outside the

United States).

View source

version on businesswire.com: https://www.businesswire.com/news/home/20230821033927/en/

Investor Relations: Jessica Moore

investor-relations@its.jnj.com

Media Relations: Jake Sargent

media-relations@its.jnj.com

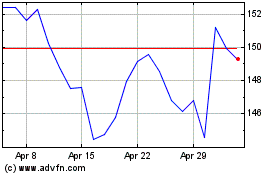

Johnson and Johnson (NYSE:JNJ)

Historical Stock Chart

From Oct 2024 to Nov 2024

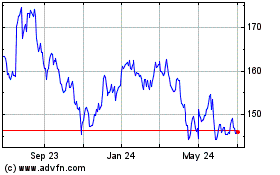

Johnson and Johnson (NYSE:JNJ)

Historical Stock Chart

From Nov 2023 to Nov 2024