Growing Solutions signs agreement with AMP

Holdings Group for specialty water soluble fertilizers

ICL (NYSE: ICL) (TASE: ICL), a leading global specialty

minerals company, today announced it has signed a five-year

agreement with AMP Holdings Group Co. Ltd., one of China's top

agricultural distribution companies. The agreement, valued at

approximately $170 million, will run until 2028 and advances ICL’s

stated goal to expand its Growing Solutions product offerings and

to position the business for further growth in major

end-markets.

The agreement is for specialty water soluble fertilizers, which

are used in drip irrigation and designed for cash-crops, such as

apples, watermelons, vegetables, strawberries, ginger and grapes.

It includes a minimum purchase commitment, with certain exclusivity

conditions based on brand and region.

The rising demand for specialty fertilizers in China has

mirrored the growth of high-value crops there, which is driven by

the promising return on investment these crops offer. China has

also seen significant shifts in agricultural practices, in recent

years, due to extreme weather fluctuations, varied crop types, and

a shrinking agricultural workforce. As a result, there has been a

substantial increase in the adoption of drip irrigation, which is

driving demand for specialty soluble fertilizers and making China

the world's largest market for fertigation.

ICL is committed to continuous innovation and to bringing new

ideas and products to partners like AMP. This includes offerings

such as the company’s recent introduction of a unique phosphate and

potassium specialty suspension solution that was designed

specifically for drone application, which is a booming agricultural

sector in China.

AMP Holdings pioneered the distribution of irrigation-based

specialty products in China and has been a leader in this area for

more than a decade. They were among the first in China to recognize

the value of specialty water soluble fertilizers and to establish a

dedicated team of agronomists and sales professionals. AMP Holdings

has been a strategic specialty fertilizer partner for ICL for

several years and boasts significant distribution capabilities that

outpace other companies in the Chinese market.

"Our soluble fertilizer products are recognized as market

leaders in China – a key region for us – and this agreement with

AMP Holdings will further strengthen ICL’s position in the premium

part of China's specialty fertilizer market,” said Elad Aharonson,

president of ICL Growing Solutions. “We are gratified that AMP

continues to select ICL as a partner, and we value our relationship

with them and appreciate the endorsement of our expertise in

specialty soluble fertilizers from one of the leading agricultural

distribution companies in China."

“We are pleased to expand our relationship with ICL Group and to

partner together to bring innovative specialty solutions to the

Chinese market,” said Ye Hong, general manager of AMP Holdings.

“Together, we are helping farmers maximize their investments and

their yields, through the use of specialty irrigation-based

fertilizers.”

This partnership marks another step forward for ICL, in

expanding its footprint in the Chinese market and underscores the

company's commitment to delivering innovative agricultural

solutions in response to evolving regional market needs.

About ICL

ICL Group is a leading global specialty minerals company, which

creates impactful solutions for humanity's sustainability

challenges in the food, agriculture and industrial markets. ICL

leverages its unique bromine, potash and phosphate resources, its

global professional workforce, and its sustainability focused

R&D and technological innovation capabilities, to drive the

company's growth across its end markets. ICL shares are dual listed

on the New York Stock Exchange and the Tel Aviv Stock Exchange

(NYSE and TASE: ICL). The company employs more than 12,000 people

worldwide, and its 2023 revenues totaled approximately $7.5

billion.

For more information, visit ICL's website at icl-group.com. To

access ICL's interactive CSR report, visit

icl-group-sustainability.com. You can also learn more about ICL on

Facebook, LinkedIn, YouTube, X and Instagram.

About AMP Holdings Group Co., LTD

AMP Holdings Group Co., LTD was established in 2003. Relying on

the rapid development of the original imported fertilizer business

base of ZJAMP GROUP, the registered capital is 550 million yuan.

Based on domestic and foreign markets, the company has set up

dozens of subsidiaries or offices in major ports and ports across

the country, and the business scope covers more than 20 provinces

and regions. The annual sales scale of the company exceeds ~13

billion yuan, and the sales performance ranks among the forefront

in the field of agricultural materials circulation.

Forward Looking Statements

This announcement contains statements that constitute

forward‑looking statements, many of which can be identified by the

use of forward‑looking words such as “anticipate,” “believe,”

“could,” “expect,” “should,” “plan,” “intend,” “estimate” and

“potential,” among others.

Forward-looking statements appear in this press release and

include, but are not limited to, statements regarding the company’s

intent, belief or current expectations. Forward-looking statements

are based on management’s beliefs and assumptions and on

information currently available to management. Such statements are

subject to risks and uncertainties, and actual results may differ

materially from those expressed or implied in the forward-looking

statements due to various factors, including, but not limited to:

estimates, forecasts and statements as to management's expectations

with respect to, among other things, business and financial

prospects, financial multiples and accretion estimates, future

trends, plans, strategies, positioning, objectives and

expectations, general economic, market and business conditions,

supply chain and logistics disruptions, energy storage and electric

vehicle growth, the potential for new COVID-19 variants, global

unrest and conflict, governmental and regulatory requirements and

actions by governmental authorities, including changes in

government policy, changes in environmental, tax and other laws or

regulations and the interpretation thereof, and war or acts of

terror and/or political, economic and military instability in

Israel and its region, including the current state of war declared

in Israel and any resulting disruptions to our supply and

production chains. As a result of the foregoing, readers should not

place undue reliance on the forward‐looking statements contained in

this press release concerning the timing of the transaction, or

other more specific risks and uncertainties facing ICL, such as

those set forth in the “Risk Factors” section of its Annual Report

on Form 20-F filed on March 14, 2024, as such risk factors may be

updated from time to time in its Current Reports on Form 6-K and

other filings ICL makes with the U.S. Securities and Exchange

Commission from time to time.

Forward-looking statements refer only to the date they are made,

and the company does not undertake any obligation to update them in

light of new information or future developments or to publicly

release any revisions to these statements in order to reflect later

events or circumstances or to reflect the occurrence of

unanticipated events.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240827639659/en/

Investor and Press Contact – Global Peggy Reilly Tharp

VP, Global Investor Relations +1-314-983-7665

Peggy.ReillyTharp@icl-group.com

Investor and Press Contact - Israel Adi Bajayo ICL

Spokesperson +972-3-6844459 Adi.Bajayo@icl-group.com

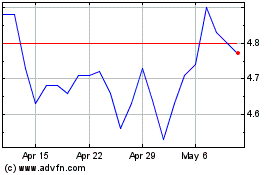

ICL (NYSE:ICL)

Historical Stock Chart

From Oct 2024 to Nov 2024

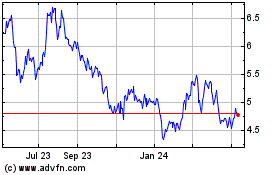

ICL (NYSE:ICL)

Historical Stock Chart

From Nov 2023 to Nov 2024