0000049071false00000490712024-07-312024-07-31

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the

Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): July 31, 2024 (July 31, 2024)

Humana Inc.

| | |

| (Exact name of registrant as specified in its charter) |

|

| | | | | | | | |

| Delaware | 1-5975 | 61-0647538 |

| (State or other jurisdiction of incorporation) | (Commission File Number) | (IRS Employer Identification No.) |

500 West Main Street Louisville, KY 40202

(Address of principal executive offices, including zip code)

502-580-1000

(Registrant’s telephone number, including area code)

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

| | | | | |

| ☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| | | | | |

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| | | | | |

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| | | | | |

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | |

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered |

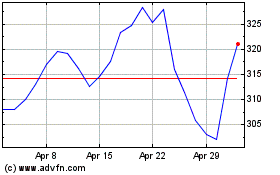

| Common Stock | HUM | New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in as defined in Rule 405 of the Securities Act of 1933 (17 CFR §230.405) or Rule 12b-2 of the Securities Exchange Act of 1934 (17 CFR §240.12b-2).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 2.02 Results of Operations and Financial Condition.

Item 7.01 Regulation FD Disclosure.

Humana Inc. (the "Company") issued a press release this morning reporting financial results for the quarter ended June 30, 2024, and posted a detailed earnings release related to the same period to the Investor Relations portion of the Company’s website at www.humana.com. A copy of each release is attached hereto as Exhibit 99.1 and Exhibit 99.2, respectively, and each release is incorporated herein by reference. Additionally, a copy of management's prepared remarks on the Company's financial results for the quarter ended June 30, 2024 and expectations for future earnings, as well as a letter from CEO, Jim Rechtin, are attached hereto as Exhibit 99.3 and Exhibit 99.4, respectively, and incorporated herein by reference.

Item 9.01 Financial Statements and Exhibits.

(d)Exhibits:

| | | | | | | | | | | |

| Exhibit No. | Description |

| | | |

| 99.1 | | | |

| 99.2 | | | |

| 99.3 | | | |

| 99.4 | | | |

| 104 | Cover Page Interactive Data File (embedded within the Inline XBRL document) | |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this Report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | |

| HUMANA INC. |

| |

| BY: | /s/ John-Paul W. Felter |

| John-Paul W. Felter |

| Senior Vice President, Chief Accounting Officer & Controller |

| (Principal Accounting Officer) |

Dated: July 31, 2024

| | | | | |

n e w s r e l e a s e | Exhibit 99.1 Humana Inc. 500 West Main Street P.O. Box 1438 Louisville, KY 40202 http://www.humana.com |

FOR MORE INFORMATION CONTACT:

| | | | | |

Lisa Stoner

Humana Investor Relations

(502) 580-2652

e-mail: LStamper@humana.com | |

Mark Taylor

Humana Corporate Communications

(317) 753-0345

e-mail: MTaylor108@humana.com

Humana Reports Second Quarter 2024 Financial Results;

Affirms Full Year Adjusted 2024 Financial Guidance

•Reports 2Q24 earnings per share (EPS) of $5.62 on a GAAP basis, Adjusted EPS of $6.96; reports YTD 2024 EPS of $11.74 on a GAAP basis, $14.19 on an Adjusted basis

•Revises FY 2024 EPS guidance to 'approximately $12.81' (previously 'approximately $13.93') on a GAAP basis, while affirming Adjusted EPS of 'approximately $16.00'; affirms FY 2024 Insurance segment benefit ratio of approximately 90 percent

•Raises 2024 individual Medicare Advantage annual membership growth by 75,000 to now anticipate annual growth of approximately 225,000, or 4.2 percent

•Publishes Letter from the CEO and prepared management remarks to Investor Relations page of www.humana.com ahead of this morning's 9:00 a.m. ET question and answer session to discuss its financial results for the quarter and expectations for future earnings

LOUISVILLE, KY (July 31, 2024) – Humana Inc. (NYSE: HUM) today reported consolidated pretax results and diluted earnings per share (EPS) for the quarter ended June 30, 2024 (2Q24) versus the quarter ended June 30, 2023 (2Q23) and for the six months ended June 30, 2024 (YTD 2024) versus the six months ended June 30, 2023 (YTD 2023) as noted in the tables below.

| | | | | | | | | | | | | | |

Consolidated income before income taxes and equity in net earnings (pretax results) In millions | 2Q24 (a) | 2Q23 (a) | YTD 2024 (a) | YTD 2023 (a) |

| Generally Accepted Accounting Principles (GAAP) | $918 | | $1,262 | | $1,932 | | $2,876 | |

| Amortization associated with identifiable intangibles | 15 | | 16 | | 31 | | 34 | |

| Put/call valuation adjustments associated with the company's non-consolidating minority interest investments | 68 | | 53 | | 199 | | 107 | |

| Impact of exit of employer group commercial medical products business | 59 | | 45 | | 60 | | (37) | |

| Value creation initiatives | 68 | | — | | 97 | | — | |

| Transaction and integration costs | — | | 4 | | — | (48) | |

| Accrued charge related to certain anticipated litigation expenses | — | | 90 | | — | | 90 | |

| Change in fair market value of publicly-traded equity securities | — | | — | | — | (1) | |

| | | | |

| | | | |

| | | | |

| Adjusted (non-GAAP) | $1,128 | | $1,470 | | $2,319 | | $3,021 | |

| | | | |

| | | | | | | | | | | | | | |

| Diluted earnings per share (EPS) | 2Q24 (a) | 2Q23 (a) | YTD 2024 (a) | YTD 2023 (a) |

| GAAP | $5.62 | | $7.66 | | $11.74 | | $17.54 | |

| Amortization associated with identifiable intangibles | 0.13 | | 0.13 | | 0.25 | | 0.27 | |

| Put/call valuation adjustments associated with the company's non-consolidating minority interest investments | 0.57 | | 0.43 | | 1.65 | | 0.85 | |

| Impact of exit of employer group commercial medical products business | 0.49 | | 0.35 | | 0.50 | | (0.30) | |

| Value creation initiatives | 0.56 | | — | | 0.80 | | — | |

| Transaction and integration costs | — | | 0.03 | | — | | (0.38) | |

| Accrued charge related to certain anticipated litigation expenses | — | | 0.72 | | — | | 0.72 | |

| Change in fair market value of publicly-traded equity securities | — | | — | | — | | (0.01) | |

| | | | |

| | | | |

| Cumulative net tax impact of non-GAAP adjustments | (0.41) | | (0.38) | | (0.75) | | (0.37) | |

| Adjusted (non-GAAP) | $6.96 | | $8.94 | | $14.19 | | $18.32 | |

| | | | |

Refer to the "Footnotes" section included herein for further explanation of disclosures for Adjusted (non-GAAP) financial measures, as well as additional reconciliations.

Please refer to the tables above, as well as the consolidated and segment highlight sections in the detailed earnings release for additional discussion of the factors impacting the year-over-comparisons.

In addition, a summary of key consolidated and segment statistics comparing 2Q24 to 2Q23 and YTD 2024 to YTD 2023 follows.

| | | | | | | | | | | | | | |

Humana Inc. Summary of Results

($ in millions, except per share amounts) | 2Q24 (a) | 2Q23 (a) | YTD 2024 (a) | YTD 2023 (a) |

| CONSOLIDATED | | | | |

| Revenues | $29,540 | $26,747 | $59,151 | $53,489 |

| Revenues - Adjusted (non-GAAP) | $29,380 | $25,733 | $58,711 | $51,385 |

| Pretax results | $918 | $1,262 | $1,932 | $2,876 |

| Pretax results - Adjusted (non-GAAP) | $1,128 | $1,470 | $2,319 | $3,021 |

| EPS | $5.62 | $7.66 | $11.74 | $17.54 |

| EPS - Adjusted (non-GAAP) | $6.96 | $8.94 | $14.19 | $18.32 |

| Benefits expense ratio | 89.0 | % | 86.3 | % | 88.9 | % | 85.9 | % |

| Benefits expense ratio - Adjusted (non-GAAP) | 88.9 | % | 86.1 | % | 88.9 | % | 86.0 | % |

| Operating cost ratio | 10.8 | % | 11.8 | % | 10.6 | % | 11.5 | % |

| Operating cost ratio - Adjusted (non-GAAP) | 10.5 | % | 11.2 | % | 10.4 | % | 11.0 | % |

| Operating cash flows | | | $1,636 | $9,863 |

| Operating cash flows - Adjusted (non-GAAP) (b) | | | $1,636 | $2,861 |

| Parent company cash and short term investments | | | $1,256 | $1,109 |

| Debt-to-total capitalization | | | 43.6 | % | 41.0 | % |

| Days in Claims Payable (DCP) | 41.6 | 42.6 | | |

| | | | |

| INSURANCE SEGMENT | | | | |

| Revenues | $28,525 | $25,875 | $57,224 | $51,778 |

| Revenues - Adjusted (non-GAAP) | $28,365 | $24,861 | $56,784 | $49,675 |

| Benefits expense ratio | 89.5 | % | 86.8 | % | 89.4 | % | 86.4 | % |

| Benefits expense ratio - Adjusted (non-GAAP) | 89.4 | % | 86.6 | % | 89.4 | % | 86.5 | % |

| Operating cost ratio | 8.4 | % | 9.9 | % | 8.4 | % | 9.6 | % |

| Operating cost ratio - Adjusted (non-GAAP) | 8.4 | % | 9.2 | % | 8.3 | % | 9.1 | % |

| Income from operations | $763 | $1,031 | $1,661 | $2,358 |

| Income from operations - Adjusted (non-GAAP) | $826 | $1,172 | $1,730 | $2,422 |

| | | | |

| CENTERWELL SEGMENT | | | | |

| Revenues | $4,947 | $4,530 | $9,765 | $9,035 |

| Operating cost ratio | 92.0 | % | 92.6 | % | 92.5 | % | 92.1 | % |

| Income from operations | $338 | $287 | $620 | $617 |

| Income from operations - Adjusted (non-GAAP) (c) | $394 | $337 | $729 | $716 |

Refer to the "Footnotes" section included herein for further explanation of disclosures for Adjusted (non-GAAP) financial measures, as well as reconciliations.

FY 2024 Earnings Guidance

Humana revised its GAAP EPS guidance for the year ending December 31, 2024 (FY 2024) to approximately $12.81 from approximately $13.93, while affirming its Adjusted EPS guidance of approximately $16.00.

| | | | | |

Diluted earnings per share | FY 2024

Guidance |

| GAAP | approximately $12.81 |

| Amortization of identifiable intangibles | 0.50 | |

| Put/call valuation adjustments associated with the company's non-consolidating minority interest investments (d) | 1.65 | |

| Impact of exit of employer group commercial medical products business | 1.21 | |

| Value creation initiatives (d) | 0.80 | |

| Cumulative net tax impact of non-GAAP adjustments | (0.97) | |

| Adjusted (non-GAAP) – FY 2024 projected | approximately $16.00 |

Refer to the "Footnotes" section included herein for further explanation of disclosures for Adjusted (non-GAAP) financial measures, as well

as additional reconciliations.

Detailed Press Release

Humana’s full earnings press release, including the statistical pages, has been posted to the company’s Investor Relations site and may be accessed at https://humana.gcs-web.com/ or via a current report on Form 8-K filed by the company with the Securities and Exchange Commission this morning (available at www.sec.gov or on the company’s website).

Conference Call

Humana will host a live question and answer session for analysts at 9:00 a.m. Eastern time today to discuss its financial results for the quarter and the company’s expectations for future earnings. In advance of the question and answer session, Humana will post a Letter from the CEO and prepared management remarks to the Quarterly Results section of its Investor Relations page (https://humana.gcs-web.com/financial-information/quarterly-results).

To participate via phone, please register in advance at this link - https://register.vevent.com/register/BI4837b56336d1453fb10a8fdaada5e1c0.

Upon registration, telephone participants will receive a confirmation email detailing how to join the conference call, including the dial-in number and a unique registrant ID that can be used to access the call.

A webcast of the 2Q24 earnings call may also be accessed via Humana’s Investor Relations page at humana.com. The company suggests participants for both the conference call and those listening via the web dial in or sign on at least 15 minutes in advance of the call.

For those unable to participate in the live event, the archive will be available in the Historical Webcasts and Presentations section of the Investor Relations page (https://humana.gcs-web.com/events-and-presentations), approximately two hours following the live webcast.

Footnotes

The company has included financial measures throughout this earnings release that are not in accordance with GAAP. Management believes that these measures, when presented in conjunction with the corresponding GAAP measures, provide a comprehensive perspective to more accurately compare and analyze the company’s core operating performance over time. Consequently, management uses these non-GAAP (Adjusted) financial measures as consistent and uniform indicators of the company’s core business operations from period to period, as well as for planning and decision-making purposes and in determination of incentive compensation. Non-GAAP (Adjusted) financial measures should be considered in addition to, but not as a substitute for, or superior to, financial measures prepared in accordance with GAAP. All financial measures in this earnings release are in accordance with

GAAP unless otherwise indicated. Please refer to the footnotes for a detailed description of each item adjusted out of GAAP financial measures to arrive at non-GAAP (Adjusted) financial measures.

(a) For the periods covered in this earnings press release, the following items are excluded from the non-GAAP financial

measures described above, as applicable:

•Amortization associated with identifiable intangibles - Since amortization varies based on the size and timing of acquisition activity, management believes this exclusion provides a more consistent and uniform indicator of performance from period to period. For all periods shown within this earnings release, GAAP measures affected include consolidated pretax results, EPS, and Insurance and CenterWell segments income from operations. The table below discloses respective period amortization expense for each segment:

| | | | | | | | | | | | | | |

| 2Q24 | 2Q23 | YTD 2024 | YTD 2023 |

| Insurance segment | $4 | $6 | $9 | $11 |

| CenterWell segment | $11 | $10 | $22 | $23 |

•Put/call valuation adjustments associated with the company’s non-consolidating minority interest investments - These amounts are the result of fair value measurements associated with the company's Primary Care Organization strategic partnership and are unrelated to the company's core business operations. For all periods shown within this earnings release, GAAP measures affected include consolidated pretax results and EPS.

•Impact of exit of employer group commercial medical products business - These amounts relate to activity from the exit of the employer group commercial medical products business as announced by Humana on February 23, 2023. For all periods shown within this earnings release, GAAP measures affected include consolidated pretax results, EPS, consolidated revenues, consolidated benefit ratio, consolidated operating cost ratio, Insurance segment revenues, Insurance segment benefit ratio, Insurance segment operating cost ratio, and Insurance segment income from operations.

•Value creation initiatives - These charges relate to the company's ongoing initiative to drive additional value for the enterprise through cost saving, productivity initiatives, and value creation from previous investments, and primarily consist of asset impairment and severance charges. For 2Q24 and YTD 2024, GAAP measures affected in this release include consolidated pretax results, EPS, and the consolidated operating cost ratio.

•Transaction and integration costs - The transaction and integration costs primarily relate to the acquisition of Kindred at Home in 2021 and the subsequent divestiture of Gentiva (formerly Kindred) Hospice in 2022. For 2Q23 and YTD 2023, GAAP measures affected include consolidated pretax results, EPS, and the consolidated operating cost ratio.

•Accrued charge related to certain anticipated litigation expenses - This charge relates to certain anticipated expenses the company has accrued in connection with a legal matter. For 2Q23 and YTD 2023, GAAP measures affected include consolidated pretax results, EPS, the consolidated and Insurance segment operating cost ratios, and Insurance segment income from operations.

•Change in fair market value of publicly-traded equity securities - These gains and losses are a result of market and economic conditions that are unrelated to the company's core business operations. For YTD 2023, GAAP measures affected include consolidated pretax results, EPS, and consolidated revenues (specifically investment income).

•Cumulative net tax impact of non-GAAP adjustments - This adjustment represents the cumulative net impact of the corresponding tax benefit or expense related to the aforementioned items excluded from the applicable GAAP measures. For all periods presented in this earnings release, EPS is the sole GAAP measure affected.

In addition to the reconciliations shown on page 2 of this release, the following are reconciliations of GAAP to Adjusted (non-GAAP) measures described above and disclosed within this earnings release:

Revenues

| | | | | | | | | | | | | | |

Revenues - CONSOLIDATED

(in millions) | 2Q24 | 2Q23 | YTD 2024 | YTD 2023 |

| GAAP | $29,540 | $26,747 | $59,151 | $53,489 |

| Change in fair market value of publicly-traded equity securities | — | | — | | — | | (1) | |

| Impact of exit of employer group commercial medical products business | (160) | | (1,014) | | (440) | | (2,103) | |

| Adjusted (non-GAAP) | $29,380 | $25,733 | $58,711 | $51,385 |

| | | | | | | | | | | | | | |

Revenues - INSURANCE SEGMENT

(in millions) | 2Q24 | 2Q23 | YTD 2024 | YTD 2023 |

| GAAP | $28,525 | $25,875 | $57,224 | $51,778 |

| Impact of exit of employer group commercial medical products business | (160) | | (1,014) | | (440) | | (2,103) | |

| Adjusted (non-GAAP) | $28,365 | $24,861 | $56,784 | $49,675 |

Benefit Ratio

| | | | | | | | | | | | | | |

| Benefit ratio - CONSOLIDATED | 2Q24 | 2Q23 | YTD 2024 | YTD 2023 |

| GAAP | 89.0 | % | 86.3 | % | 88.9 | % | 85.9 | % |

| Impact of exit of employer group commercial medical products business | (0.1) | % | (0.2) | % | — | % | 0.1 | % |

| Adjusted (non-GAAP) | 88.9 | % | 86.1 | % | 88.9 | % | 86.0 | % |

| | | | | | | | | | | | | | |

| Benefit ratio - INSURANCE SEGMENT | 2Q24 | 2Q23 | YTD 2024 | YTD 2023 |

| GAAP | 89.5 | % | 86.8 | % | 89.4 | % | 86.4 | % |

| Impact of exit of employer group commercial medical products business | (0.1) | % | (0.2) | % | — | % | 0.1 | % |

| Adjusted (non-GAAP) | 89.4 | % | 86.6 | % | 89.4 | % | 86.5 | % |

Operating Cost Ratio

| | | | | | | | | | | | | | |

| Operating cost ratio - CONSOLIDATED | 2Q24 | 2Q23 | YTD 2024 | YTD 2023 |

| GAAP | 10.8 | % | 11.8 | % | 10.6 | % | 11.5 | % |

| | | | |

| Impact of exit of employer group commercial medical products business | (0.1) | % | (0.2) | % | (0.1) | % | (0.3) | % |

| | | | |

| Value creation initiatives | (0.2) | % | — | % | (0.1) | % | — | % |

| Accrued charge related to certain anticipated litigation expenses | — | % | (0.4) | % | — | % | (0.2) | % |

| Adjusted (non-GAAP) | 10.5 | % | 11.2 | % | 10.4 | % | 11.0 | % |

| | | | | | | | | | | | | | |

| Operating cost ratio - INSURANCE SEGMENT | 2Q24 | 2Q23 | YTD 2024 | YTD 2023 |

| GAAP | 8.4 | % | 9.9 | % | 8.4 | % | 9.6 | % |

| Impact of exit of employer group commercial medical products business | — | % | (0.3) | % | (0.1) | % | (0.3) | % |

| Accrued charge related to certain anticipated litigation expenses | — | % | (0.4) | % | — | % | (0.2) | % |

| Adjusted (non-GAAP) | 8.4 | % | 9.2 | % | 8.3 | % | 9.1 | % |

Income from Operations

| | | | | | | | | | | | | | | | |

| Income from operations - INSURANCE SEGMENT | 2Q24 | 2Q23 | YTD 2024 | YTD 2023 | | |

| GAAP | $763 | $1,031 | $1,661 | $2,358 | | |

| Amortization associated with identifiable intangibles | 4 | 6 | 9 | 11 | | |

| Impact of exit of employer group commercial medical products business | 59 | 45 | 60 | (37) | | |

| Accrued charge related to certain anticipated litigation expenses | — | 90 | — | 90 | | |

| Adjusted (non-GAAP) | $826 | $1,172 | $1,730 | $2,422 | | |

(b) Generally, when the first day of a month falls on a weekend or holiday, with the exception of January 1 (New Year's Day), the

company receives its monthly Medicare premium payment from CMS on the last business day of the previous month. On a GAAP

basis, this can result in certain quarterly cash flows from operations including more or less than three monthly payments. Consequently, when this occurs, the company reports Adjusted cash flows from operations to reflect three payments in each quarter to match the related expenses.

| | | | | | | | | | |

Net cash from operating activities (in millions) | | | YTD 2024 | YTD 2023 |

| GAAP | | | $1,636 | $9,863 |

| Timing of premium payment from CMS | | | — | | (7,002) | |

| Adjusted (non-GAAP) | | | $1,636 | $2,861 |

(c) The CenterWell segment Adjusted income from operations includes an adjustment to add back depreciation and amortization expense to the segment's GAAP income from operations since such an adjustment is commonly utilized for valuation purposes within the healthcare delivery industry.

| | | | | | | | | | | | | | | | |

Income from operations - CENTERWELL SEGMENT

(in millions) | 2Q24 | 2Q23 | YTD 2024 | YTD 2023 | | |

| GAAP | $338 | $287 | $620 | $617 | | |

| Depreciation and amortization expense | 56 | | 50 | | 109 | | 99 | | | |

| Adjusted (non-GAAP) | $394 | | $337 | | $729 | | $716 | | | |

(d) FY 2024 projected Adjusted results exclude the future impact of items that cannot be estimated at this time; YTD 2024 amounts shown.

Cautionary Statement

This news release includes forward-looking statements regarding Humana within the meaning of the Private Securities Litigation Reform Act of 1995. When used in investor presentations, press releases, Securities and Exchange Commission (SEC) filings, and in oral statements made by or with the approval of one of Humana’s executive officers, the words or phrases like “expects,” “believes,” “anticipates,” “assumes,” “intends,” “likely will result,” “estimates,” “projects” or variations of such words and similar expressions are intended to identify such forward-looking statements.

These forward-looking statements are not guarantees of future performance and are subject to risks, uncertainties, and assumptions, including, among other things, information set forth in the “Risk Factors” section of the company’s SEC filings, a summary of which includes but is not limited to the following:

•If Humana does not design and price its products properly and competitively, if the premiums Humana receives are insufficient to cover the cost of healthcare services delivered to its members, if the company is unable to implement clinical initiatives to provide a better healthcare experience for its members, lower costs and appropriately document the risk profile of its members, or if its estimates of benefits expense are inadequate, Humana’s profitability could be materially adversely affected. Humana estimates the costs of its benefit expense payments, and designs and prices its products accordingly, using actuarial methods and assumptions based upon, among other relevant factors, claim payment patterns, medical cost inflation, and historical developments such as claim inventory levels and claim receipt patterns. The company continually reviews estimates of future payments relating to benefit expenses for services incurred in the current and prior periods and makes necessary adjustments to its reserves, including premium deficiency reserves, where appropriate. These estimates involve extensive judgment, and have considerable inherent variability because they are extremely sensitive to changes in claim payment patterns and medical cost trends. Accordingly, Humana's reserves may be insufficient.

•If Humana fails to effectively implement its operational and strategic initiatives, including its Medicare initiatives, which are of particular importance given the concentration of the company's revenues in these products, state-based contract strategy, the growth of its CenterWell business, and its integrated care delivery model, the company’s business may be materially adversely affected. In addition, there can be no assurances that the company will be successful in maintaining or improving its Star ratings in future years.

•If Humana, or the third-party service providers on which it relies, fails to properly maintain the integrity of its data, to strategically maintain existing or implement new information systems, to protect Humana’s proprietary rights to its systems, or to defend against cyber-security attacks, contain such attacks when they occur, or prevent other privacy or data security incidents that result in security breaches that disrupt the company's operations or in the unintentional dissemination of sensitive personal information or proprietary or confidential information, the company’s business may be materially adversely affected.

•Humana is involved in various legal actions, or disputes that could lead to legal actions (such as, among other things, provider contract disputes and qui tam litigation brought by individuals on behalf of the

government), governmental and internal investigations, and routine internal review of business processes any of which, if resolved unfavorably to the company, could result in substantial monetary damages or changes in its business practices. Increased litigation and negative publicity could also increase the company’s cost of doing business.

•As a government contractor, Humana is exposed to risks that may materially adversely affect its business or its willingness or ability to participate in government healthcare programs including, among other things, loss of material government contracts; governmental audits and investigations; potential inadequacy of government determined payment rates; potential restrictions on profitability, including by comparison of profitability of the company’s Medicare Advantage business to non-Medicare Advantage business; or other changes in the governmental programs in which Humana participates. Changes to the risk-adjustment model utilized by CMS to adjust premiums paid to Medicare Advantage plans or retrospective recovery by CMS of previously paid premiums as a result of the final rule related to the risk adjustment data validation audit methodology published by CMS on January 30, 2023 (Final RADV Rule), which Humana believes fails to address adequately the statutory requirement of actuarial equivalence and violates the Administrative Procedure Act due to its failure to include a "Fee for Service Adjuster" could have a material adverse effect on the company's operating results, financial position and cash flows.

•Humana's business activities are subject to substantial government regulation. New laws or regulations, or legislative, judicial, or regulatory changes in existing laws or regulations or their manner of application could increase the company's cost of doing business and have a material adverse effect on Humana’s results of operations (including restricting revenue, enrollment and premium growth in certain products and market segments, restricting the company’s ability to expand into new markets, increasing the company’s medical and operating costs by, among other things, requiring a minimum benefit ratio on insured products, lowering the company’s Medicare payment rates and increasing the company’s expenses associated with a non-deductible health insurance industry fee and other assessments); the company’s financial position (including the company’s ability to maintain the value of its goodwill); and the company’s cash flows.

•Humana’s failure to manage acquisitions, divestitures and other significant transactions successfully may have a material adverse effect on the company’s results of operations, financial position, and cash flows.

•If Humana fails to develop and maintain satisfactory relationships with the providers of care to its members, the company’s business may be adversely affected.

•Humana faces significant competition in attracting and retaining talented employees. Further, managing succession for, and retention of, key executives is critical to the Company’s success, and its failure to do so could adversely affect the Company’s businesses, operating results and/or future performance.

•Humana’s pharmacy business is highly competitive and subjects it to regulations and supply chain risks in addition to those the company faces with its core health benefits businesses.

•Changes in the prescription drug industry pricing benchmarks may adversely affect Humana’s financial performance.

•Humana’s ability to obtain funds from certain of its licensed subsidiaries is restricted by state insurance regulations.

•Downgrades in Humana’s debt ratings, should they occur, may adversely affect its business, results of operations, and financial condition.

•Volatility or disruption in the securities and credit markets may significantly and adversely affect the value of our investment portfolio and the investment income that we derive from this portfolio.

In making forward-looking statements, Humana is not undertaking to address or update them in future filings or communications regarding its business or results. In light of these risks, uncertainties, and assumptions, the forward-looking events discussed herein may or may not occur. There also may be other risks that the company is unable to predict at this time. Any of these risks and uncertainties may cause actual results to differ materially from the results discussed in the forward-looking statements.

Humana advises investors to read the following documents as filed by the company with the SEC for further discussion both of the risks it faces and its historical performance:

•Form 10-K for the year ended December 31, 2023;

•Form 10-Q for the quarter ended March 31, 2024; and

•Form 8-Ks filed during 2024.

About Humana

Humana Inc. is committed to putting health first – for our teammates, our customers, and our company. Through our Humana insurance services, and our CenterWell health care services, we make it easier for the millions of people we serve to achieve their best health – delivering the care and service they need, when they need it. These efforts are leading to a better quality of life for people with Medicare, Medicaid, families, individuals, military service personnel, and communities at large. Learn more about what we offer at Humana.com and at CenterWell.com.

| | |

Humana Inc. 500 West Main Street P.O. Box 1438 Louisville, KY 40202 http://www.humana.com |

FOR MORE INFORMATION CONTACT:

| | | | | |

Lisa Stoner

Humana Investor Relations

(502) 580-2652

e-mail: LStamper@humana.com | |

Mark Taylor

Humana Corporate Communications

(317) 753-0345

e-mail: MTaylor108@humana.com

Humana Reports Second Quarter 2024 Financial Results;

Affirms Full Year Adjusted 2024 Financial Guidance

•Reports 2Q24 earnings per share (EPS) of $5.62 on a GAAP basis, Adjusted EPS of $6.96; reports YTD 2024 EPS of $11.74 on a GAAP basis, $14.19 on an Adjusted basis

•Revises FY 2024 EPS guidance to 'approximately $12.81' (previously 'approximately $13.93') on a GAAP basis, while affirming Adjusted EPS of 'approximately $16.00'; affirms FY 2024 Insurance segment benefit ratio of approximately 90 percent

•Raises 2024 individual Medicare Advantage annual membership growth by 75,000 to now anticipate annual growth of approximately 225,000, or 4.2 percent

•Publishes Letter from the CEO and prepared management remarks to Investor Relations page of www.humana.com ahead of this morning's 9:00 a.m. ET question and answer session to discuss its financial results for the quarter and expectations for future earnings

LOUISVILLE, KY (July 31, 2024) – Humana Inc. (NYSE: HUM) today reported consolidated pretax results and diluted earnings per share (EPS) for the quarter ended June 30, 2024 (2Q24) versus the quarter ended June 30, 2023 (2Q23) and for the six months ended June 30, 2024 (YTD 2024) versus the six months ended June 30, 2023 (YTD 2023) as noted in the tables below.

| | | | | | | | | | | | | | |

Consolidated income before income taxes and equity in net earnings (pretax results) In millions | 2Q24 (a) | 2Q23 (a) | YTD 2024 (a) | YTD 2023 (a) |

| Generally Accepted Accounting Principles (GAAP) | $918 | | $1,262 | | $1,932 | | $2,876 | |

| Amortization associated with identifiable intangibles | 15 | | 16 | | 31 | | 34 | |

| Put/call valuation adjustments associated with the company's non-consolidating minority interest investments | 68 | | 53 | | 199 | | 107 | |

| Impact of exit of employer group commercial medical products business | 59 | | 45 | | 60 | | (37) | |

| Value creation initiatives | 68 | | — | | 97 | | — | |

| Transaction and integration costs | — | | 4 | | — | (48) | |

| Accrued charge related to certain anticipated litigation expenses | — | | 90 | | — | | 90 | |

| Change in fair market value of publicly-traded equity securities | — | | — | | — | (1) | |

| | | | |

| | | | |

| | | | |

| Adjusted (non-GAAP) | $1,128 | | $1,470 | | $2,319 | | $3,021 | |

| | | | |

| | | | | | | | | | | | | | |

| Diluted earnings per share (EPS) | 2Q24 (a) | 2Q23 (a) | YTD 2024 (a) | YTD 2023 (a) |

| GAAP | $5.62 | | $7.66 | | $11.74 | | $17.54 | |

| Amortization associated with identifiable intangibles | 0.13 | | 0.13 | | 0.25 | | 0.27 | |

| Put/call valuation adjustments associated with the company's non-consolidating minority interest investments | 0.57 | | 0.43 | | 1.65 | | 0.85 | |

| Impact of exit of employer group commercial medical products business | 0.49 | | 0.35 | | 0.50 | | (0.30) | |

| Value creation initiatives | 0.56 | | — | | 0.80 | | — | |

| Transaction and integration costs | — | | 0.03 | | — | | (0.38) | |

| Accrued charge related to certain anticipated litigation expenses | — | | 0.72 | | — | | 0.72 | |

| Change in fair market value of publicly-traded equity securities | — | | — | | — | | (0.01) | |

| | | | |

| | | | |

| Cumulative net tax impact of non-GAAP adjustments | (0.41) | | (0.38) | | (0.75) | | (0.37) | |

| Adjusted (non-GAAP) | $6.96 | | $8.94 | | $14.19 | | $18.32 | |

| | | | |

Refer to the "Footnotes" section included herein for further explanation of disclosures for Adjusted (non-GAAP) financial measures, as well as additional reconciliations.

Please refer to the tables above, as well as the consolidated and segment highlight sections that follow for additional discussion of the factors impacting the year-over-year comparisons.

In addition, a summary of key consolidated and segment statistics comparing 2Q24 to 2Q23 and YTD 2024 to YTD 2023 follows.

| | | | | | | | | | | | | | |

Humana Inc. Summary of Results

($ in millions, except per share amounts) | 2Q24 (a) | 2Q23 (a) | YTD 2024 (a) | YTD 2023 (a) |

| CONSOLIDATED | | | | |

| Revenues | $29,540 | $26,747 | $59,151 | $53,489 |

| Revenues - Adjusted (non-GAAP) | $29,380 | $25,733 | $58,711 | $51,385 |

| Pretax results | $918 | $1,262 | $1,932 | $2,876 |

| Pretax results - Adjusted (non-GAAP) | $1,128 | $1,470 | $2,319 | $3,021 |

| EPS | $5.62 | $7.66 | $11.74 | $17.54 |

| EPS - Adjusted (non-GAAP) | $6.96 | $8.94 | $14.19 | $18.32 |

| Benefits expense ratio | 89.0 | % | 86.3 | % | 88.9 | % | 85.9 | % |

| Benefits expense ratio - Adjusted (non-GAAP) | 88.9 | % | 86.1 | % | 88.9 | % | 86.0 | % |

| Operating cost ratio | 10.8 | % | 11.8 | % | 10.6 | % | 11.5 | % |

| Operating cost ratio - Adjusted (non-GAAP) | 10.5 | % | 11.2 | % | 10.4 | % | 11.0 | % |

| Operating cash flows | | | $1,636 | $9,863 |

| Operating cash flows - Adjusted (non-GAAP) (b) | | | $1,636 | $2,861 |

| Parent company cash and short term investments | | | $1,256 | $1,109 |

| Debt-to-total capitalization | | | 43.6 | % | 41.0 | % |

| Days in Claims Payable (DCP) | 41.6 | 42.6 | | |

| | | | |

| INSURANCE SEGMENT | | | | |

| Revenues | $28,525 | $25,875 | $57,224 | $51,778 |

| Revenues - Adjusted (non-GAAP) | $28,365 | $24,861 | $56,784 | $49,675 |

| Benefits expense ratio | 89.5 | % | 86.8 | % | 89.4 | % | 86.4 | % |

| Benefits expense ratio - Adjusted (non-GAAP) | 89.4 | % | 86.6 | % | 89.4 | % | 86.5 | % |

| Operating cost ratio | 8.4 | % | 9.9 | % | 8.4 | % | 9.6 | % |

| Operating cost ratio - Adjusted (non-GAAP) | 8.4 | % | 9.2 | % | 8.3 | % | 9.1 | % |

| Income from operations | $763 | $1,031 | $1,661 | $2,358 |

| Income from operations - Adjusted (non-GAAP) | $826 | $1,172 | $1,730 | $2,422 |

| | | | |

| CENTERWELL SEGMENT | | | | |

| Revenues | $4,947 | $4,530 | $9,765 | $9,035 |

| Operating cost ratio | 92.0 | % | 92.6 | % | 92.5 | % | 92.1 | % |

| Income from operations | $338 | $287 | $620 | $617 |

| Income from operations - Adjusted (non-GAAP) (c) | $394 | $337 | $729 | $716 |

Refer to the "Footnotes" section included herein for further explanation of disclosures for Adjusted (non-GAAP) financial measures, as well as reconciliations.

FY 2024 Earnings Guidance

Humana revised its GAAP EPS guidance for the year ending December 31, 2024 (FY 2024) to approximately $12.81 from approximately $13.93, while affirming its Adjusted EPS guidance of approximately $16.00.

Additional FY 2024 guidance points are included on page 15 of this earnings release.

| | | | | |

Diluted earnings per share | FY 2024

Guidance |

| GAAP | approximately $12.81 |

| Amortization of identifiable intangibles | 0.50 | |

| Put/call valuation adjustments associated with the company's non-consolidating minority interest investments (d) | 1.65 | |

| Impact of exit of employer group commercial medical products business | 1.21 | |

| Value creation initiatives (d) | 0.80 | |

| Cumulative net tax impact of non-GAAP adjustments | (0.97) | |

| Adjusted (non-GAAP) – FY 2024 projected | approximately $16.00 |

Refer to the "Footnotes" section included herein for further explanation of disclosures for Adjusted (non-GAAP) financial measures, as well

as additional reconciliations.

Humana Consolidated Highlights

| | | | | | | | | | | | | | |

Humana Inc. Summary of Results

($ in millions, except per share amounts) | 2Q24 (a) | 2Q23 (a) | YTD 2024 (a) | YTD 2023 (a) |

| CONSOLIDATED | | | | |

| Revenues | $29,540 | $26,747 | $59,151 | $53,489 |

| Revenues - Adjusted (non-GAAP) | $29,380 | $25,733 | $58,711 | $51,385 |

| Pretax results | $918 | $1,262 | $1,932 | $2,876 |

| Pretax results - Adjusted (non-GAAP) | $1,128 | $1,470 | $2,319 | $3,021 |

| EPS | $5.62 | $7.66 | $11.74 | $17.54 |

| EPS - Adjusted (non-GAAP) | $6.96 | $8.94 | $14.19 | $18.32 |

| Benefits expense ratio | 89.0 | % | 86.3 | % | 88.9 | % | 85.9 | % |

| Benefits expense ratio - Adjusted (non-GAAP) | 88.9 | % | 86.1 | % | 88.9 | % | 86.0 | % |

| Operating cost ratio | 10.8 | % | 11.8 | % | 10.6 | % | 11.5 | % |

| Operating cost ratio - Adjusted (non-GAAP) | 10.5 | % | 11.2 | % | 10.4 | % | 11.0 | % |

| Operating cash flows | | | $1,636 | $9,863 |

| Operating cash flows - Adjusted (non-GAAP) (b) | | | $1,636 | $2,861 |

| Parent company cash and short term investments | | | $1,256 | $1,109 |

| Debt-to-total capitalization | | | 43.6 | % | 41.0 | % |

| Days in Claims Payable (DCP) | 41.6 | 42.6 | | |

Refer to the "Footnotes" section included herein for further explanation of disclosures for Adjusted (non-GAAP) financial measures, as well as reconciliations.

Consolidated Revenues

The favorable year-over-year quarter and YTD GAAP consolidated revenues comparisons were primarily driven by the following factors:

•higher per member Medicare premiums, and

•Medicare Advantage and state-based contracts membership growth.

These factors were partially offset by the continued decline in the company's group commercial medical and stand-alone PDP membership.

Refer to the "Footnotes" section included herein for a reconciliation of GAAP to Adjusted (non-GAAP) consolidated revenues for the respective periods.

Consolidated Benefit Ratio

The year-over-year quarterly and YTD increases in the GAAP consolidated ratio primarily reflected the following:

•the continued impact of elevated Medicare Advantage medical cost trends in 2Q24 and YTD 2024, and

•a lesser favorable impact from prior period medical claims reserve development (prior period development) in 2024.

These factors were partially offset by the impact of the pricing and benefit design of the company's 2024 Medicare Advantage products, which included a reduction in benefits in response to the net impact of the 2024 final rate notice and the initial emergence of increased medical cost trends in 2023.

Furthermore, the year-over-year comparison continues to reflect a shift in line of business mix, with growth in Medicare Advantage and state-based contracts and other membership, which can carry a higher benefit ratio.

Refer to the "Footnotes" section included herein for a reconciliation of GAAP to Adjusted (non-GAAP) consolidated benefit ratios for the respective periods.

Prior Period Medical Claims Reserve Development (Prior Period Development) | | | | | | | | | | | | | | | | | |

Consolidated Favorable Prior Period Development $ in millions Basis points (bps) | First

Quarter | Second

Quarter | YTD |

Prior Period Development from prior years recognized in 2024 (e) | $535 | $134 | $669 |

| Decrease to GAAP benefit ratio | (190 bps) | (50 bps) | (120 bps) |

Prior Period Development from prior years recognized in 2023 (e) | $522 | $232 | $754 |

| Decrease to GAAP benefit ratio | (200 bps) | (90 bps) | (150 bps) |

Consolidated Operating Cost Ratio

The year-over-year quarterly and YTD decreases in the GAAP consolidated operating cost ratio from the respective 2023 periods primarily related to the following:

•scale efficiencies associated with growth in the company's Medicare Advantage membership,

•administrative cost efficiencies resulting from the company's value creation initiatives,

•lower commission expense for brokers in 2024 compared to 2023 as a result of the significant individual Medicare Advantage membership growth in 2023, and

•the impact of the accrued charge related to certain anticipated litigation expenses included in 2Q23 and YTD 2023 results.

These factors were partially offset by the impact of charges related to value creation initiatives in 2Q24 and YTD 2024. These charges were recorded at the corporate level and not allocated to the segments.

Refer to the "Footnotes" section included herein for a reconciliation of GAAP to Adjusted (non-GAAP) consolidated operating cost ratios for the respective periods.

Balance sheet

•Days in claims payable (DCP) of 41.6 days at June 30, 2024 represented a decrease of 0.9 day from 42.5 days at March 31, 2024, and a decrease of 1.0 day from 42.6 days at June 30, 2023.

The 0.9 day sequential decrease was primarily driven by a return to more normalized claims submission patterns following the Change Healthcare disruption in February 2024.

The 1.0 day year-over-year decrease was primarily driven by lower reserve requirements in provider-capitation accruals due to lower performance-based payment expectations.

•Humana's debt-to-total capitalization at June 30, 2024 decreased 150 basis points to 43.6 percent from 45.1 percent at March 31, 2024 primarily driven by 2Q24 net earnings and the net repayment of commercial paper balances.

Operating cash flows

The year-over-year decline in GAAP operating cash flows primarily reflected the significant impact of the early receipt of the $7.00 billion July 2023 premium payment from CMS in June 2023(b), resulting in seven payments being received in YTD 2023 compared to only six received in YTD 2024. Further, YTD 2023 operating cash flows included the CMS mid-year settlement of $2.2 billion received in June 2023, whereas the 2024 settlement was not received until July.

Share repurchases

| | | | | |

| YTD 2024 |

| Total number of shares repurchased | 1,948,690 |

| Average price paid per share | $ | 384.65 | |

| Remaining repurchase authorization as of July 30, 2024 | $2.93 billion |

Humana’s Insurance Segment

This segment is comprised of insurance products serving Medicare and state-based contract beneficiaries, as well as individuals and employers. The segment also includes the company's Pharmacy Benefit Manager, or PBM, business.

| | | | | | | | | | | | | | |

Insurance Segment Results

($ in millions) | 2Q24 (a) | 2Q23 (a) | YTD 2024 (a) | YTD 2023 (a) |

| Revenues | $28,525 | $25,875 | $57,224 | $51,778 |

| Revenues - Adjusted (non-GAAP) | $28,365 | $24,861 | $56,784 | $49,675 |

| Benefits expense ratio | 89.5 | % | 86.8 | % | 89.4 | % | 86.4 | % |

| Benefits expense ratio - Adjusted (non-GAAP) | 89.4 | % | 86.6 | % | 89.4 | % | 86.5 | % |

| Operating cost ratio | 8.4 | % | 9.9 | % | 8.4 | % | 9.6 | % |

| Operating cost ratio - Adjusted (non-GAAP) | 8.4 | % | 9.2 | % | 8.3 | % | 9.1 | % |

| Income from operations | $763 | $1,031 | $1,661 | $2,358 |

| Income from operations - Adjusted (non-GAAP) | $826 | $1,172 | $1,730 | $2,422 |

Refer to the "Footnotes" section included herein for further explanation of disclosures for Adjusted (non-GAAP) financial measures, as well as recalculations.

Insurance Segment Revenues

The year-over-year quarter and YTD increases in GAAP segment revenues from the respective 2023 periods primarily reflected the following items:

•higher per member Medicare premiums, and

•Medicare Advantage and state-based contracts membership growth.

These factors were partially offset by the continued decline in the company's group commercial medical and stand-alone PDP membership.

Refer to the "Footnotes" section included herein for a reconciliation of GAAP to Adjusted (non-GAAP) Insurance segment revenues for the respective periods.

Insurance Segment Benefit Ratio

The year-over-year quarter and YTD increases in the GAAP segment ratio primarily reflected the following:

•the continued impact of elevated Medicare Advantage medical cost trends in 2Q24 and YTD 2024, and

•a lesser favorable impact from prior period development in 2024.

These factors were partially offset by the impact of the pricing and benefit design of the company's 2024 Medicare Advantage products, which included a reduction in benefits in response to the net impact of the 2024 final rate notice and the initial emergence of increased medical cost trends in 2023.

Furthermore, the year-over-year comparison continues to reflect a shift in line of business mix, with growth in Medicare Advantage and state-based contracts and other membership, which can carry a higher benefit ratio.

Refer to the "Footnotes" section included herein for a reconciliation of GAAP to Adjusted (non-GAAP) Insurance segment benefit ratios for the respective periods.

Insurance Segment Operating Cost Ratio

The year-over-year quarter and YTD decreases in the GAAP segment operating cost ratio from the respective 2023 periods primarily related to the following:

•scale efficiencies associated with growth in the company's individual Medicare Advantage membership,

•administrative cost efficiencies resulting from the company's value creation initiatives,

•lower commission expense for brokers in 2024 compared to 2023 as a result of the significant individual Medicare Advantage membership growth in 2023, and

•the impact of the accrued charge related to certain anticipated litigation expenses included in 2Q23 and YTD 2023 results.

Refer to the "Footnotes" section included herein for a reconciliation of GAAP to Adjusted (non-GAAP) Insurance segment operating cost ratios for the respective periods.

Humana’s CenterWell Segment

This segment includes pharmacy (excluding the PBM operations), primary care, and home solutions. The segment also includes the impact of non-consolidating minority interest investments related to the company's strategic partnerships with Welsh, Carson, Anderson & Stowe (WCAS) to develop and operate senior-focused, payor-agnostic, primary care centers, as well as the Gentiva (formerly Kindred) Hospice operations. Services offered by this segment are designed to enhance the overall healthcare experience. These services may lead to lower utilization associated with improved member health and/or lower drug costs.

| | | | | | | | | | | | | | |

CenterWell Segment Results

($ in millions) | 2Q24 | 2Q23 | YTD 2024 | YTD 2023 |

| Revenues | $4,947 | $4,530 | $9,765 | $9,035 |

| Operating cost ratio | 92.0 | % | 92.6 | % | 92.5 | % | 92.1 | % |

| Income from operations | $338 | $287 | $620 | $617 |

| Income from operations - Adjusted (non-GAAP) (c) | $394 | $337 | $729 | $716 |

Refer to the "Footnotes" section included herein for further explanation of disclosures for Adjusted (non-GAAP) financial measures, as well as reconciliations.

CenterWell Segment Revenues

The favorable year-over-year quarter and YTD CenterWell segment revenues comparisons were primarily impacted by the following factors:

•greater intersegment revenues associated with the Home Solutions business in 2Q24 and YTD 2024 as compared to respective periods in 2023 as a result of the expansion of the value-based home care model, and

•higher revenues associated with growth in the company's Primary Care business, partially offset by the impact of the v28 risk model revision.

CenterWell Segment Operating Cost Ratio

The year-over-year quarterly decrease in the segment's operating cost ratio from 2Q23 was favorably impacted by the following factors:

•administrative cost efficiencies resulting from the company's value creation initiatives, and

•positive prior period development within the Primary Care Organization, partially offset by the unfavorable impact of the v28 risk model revision.

The year-over-year increase in the YTD 2024 segment operating cost ratio primarily resulted from the unfavorable impact of the v28 risk model revision to the company's Primary Care business.

See additional operational metrics for the CenterWell segment on pages S-14 through S-16 of the statistical supplement included in this earnings release.

Conference Call

Humana will host a live question and answer session for analysts at 9:00 a.m. Eastern time today to discuss its financial results for the quarter and the company’s expectations for future earnings. In advance of the question and answer session, Humana will post a Letter from the CEO and prepared management remarks to the Quarterly Results section of its Investor Relations page (https://humana.gcs-web.com/financial-information/quarterly-results).

To participate via phone, please register in advance at this link - https://register.vevent.com/register/BI4837b56336d1453fb10a8fdaada5e1c0.

Upon registration, telephone participants will receive a confirmation email detailing how to join the conference call, including the dial-in number and a unique registrant ID that can be used to access the call.

A webcast of the 2Q24 earnings call may also be accessed via Humana’s Investor Relations page at humana.com. The company suggests participants for both the conference call and those listening via the web dial in or sign on at least 15 minutes in advance of the call.

For those unable to participate in the live event, the archive will be available in the Historical Webcasts and Presentations section of the Investor Relations page (https://humana.gcs-web.com/events-and-presentations), approximately two hours following the live webcast.

Footnotes

The company has included financial measures throughout this earnings release that are not in accordance with GAAP. Management believes that these measures, when presented in conjunction with the corresponding GAAP measures, provide a comprehensive perspective to more accurately compare and analyze the company’s core operating performance over time. Consequently, management uses these non-GAAP (Adjusted) financial measures as consistent and uniform indicators of the company’s core business operations from period to period, as well as for planning and decision-making purposes and in determination of incentive compensation. Non-GAAP (Adjusted) financial measures should be considered in addition to, but not as a substitute for, or superior to, financial measures prepared in accordance with GAAP. All financial measures in this earnings release are in accordance with GAAP unless otherwise indicated. Please refer to the footnotes for a detailed description of each item adjusted out of GAAP financial measures to arrive at non-GAAP (Adjusted) financial measures.

(a) For the periods covered in this earnings press release, the following items are excluded from the non-GAAP financial

measures described above, as applicable:

•Amortization associated with identifiable intangibles - Since amortization varies based on the size and timing of acquisition activity, management believes this exclusion provides a more consistent and uniform indicator of performance from period to period. For all periods shown within this earnings release, GAAP measures affected include consolidated pretax results, EPS, and Insurance and CenterWell segments income from operations. The table below discloses respective period amortization expense for each segment:

| | | | | | | | | | | | | | |

| 2Q24 | 2Q23 | YTD 2024 | YTD 2023 |

| Insurance segment | $4 | $6 | $9 | $11 |

| CenterWell segment | $11 | $10 | $22 | $23 |

•Put/call valuation adjustments associated with the company’s non-consolidating minority interest investments - These amounts are the result of fair value measurements associated with the company's Primary Care Organization strategic partnership and are unrelated to the company's core business operations. For all periods shown within this earnings release, GAAP measures affected include consolidated pretax results and EPS.

•Impact of exit of employer group commercial medical products business - These amounts relate to activity from the exit of the employer group commercial medical products business as announced by Humana on February 23, 2023. For all periods shown within this earnings release, GAAP measures affected include consolidated pretax results, EPS, consolidated revenues, consolidated benefit ratio, consolidated operating cost ratio, Insurance segment revenues, Insurance segment benefit ratio, Insurance segment operating cost ratio, and Insurance segment income from operations.

•Value creation initiatives - These charges relate to the company's ongoing initiative to drive additional value for the enterprise through cost saving, productivity initiatives, and value creation from previous investments, and primarily consist of asset impairment and severance charges. For 2Q24 and YTD 2024, GAAP measures affected in this release include consolidated pretax results, EPS, and the consolidated operating cost ratio.

•Transaction and integration costs - The transaction and integration costs primarily relate to the acquisition of Kindred at Home in 2021 and the subsequent divestiture of Gentiva (formerly Kindred) Hospice in 2022. For 2Q23 and YTD 2023, GAAP measures affected include consolidated pretax results, EPS, and the consolidated operating cost ratio.

•Accrued charge related to certain anticipated litigation expenses - This charge relates to certain anticipated expenses the company has accrued in connection with a legal matter. For 2Q23 and YTD 2023, GAAP measures affected include consolidated pretax results, EPS, the consolidated and Insurance segment operating cost ratios, and Insurance segment income from operations.

•Change in fair market value of publicly-traded equity securities - These gains and losses are a result of market and economic conditions that are unrelated to the company's core business operations. For YTD 2023, GAAP measures affected include consolidated pretax results, EPS, and consolidated revenues (specifically investment income).

•Cumulative net tax impact of non-GAAP adjustments - This adjustment represents the cumulative net impact of the corresponding tax benefit or expense related to the aforementioned items excluded from the applicable GAAP measures. For all periods presented in this earnings release, EPS is the sole GAAP measure affected.

In addition to the reconciliations shown on page 2 of this release, the following are reconciliations of GAAP to Adjusted (non-GAAP) measures described above and disclosed within this earnings release:

Revenues

| | | | | | | | | | | | | | |

Revenues - CONSOLIDATED (in millions) | 2Q24 | 2Q23 | YTD 2024 | YTD 2023 |

| GAAP | $29,540 | $26,747 | $59,151 | $53,489 |

| Change in fair market value of publicly-traded equity securities | — | | — | | — | | (1) | |

| Impact of exit of employer group commercial medical products business | (160) | | (1,014) | | (440) | | (2,103) | |

| Adjusted (non-GAAP) | $29,380 | $25,733 | $58,711 | $51,385 |

| | | | | | | | | | | | | | |

Revenues - INSURANCE SEGMENT (in millions) | 2Q24 | 2Q23 | YTD 2024 | YTD 2023 |

| GAAP | $28,525 | $25,875 | $57,224 | $51,778 |

| Impact of exit of employer group commercial medical products business | (160) | | (1,014) | | (440) | | (2,103) | |

| Adjusted (non-GAAP) | $28,365 | $24,861 | $56,784 | $49,675 |

Benefit Ratio

| | | | | | | | | | | | | | | | |

| Benefit ratio - CONSOLIDATED | 2Q24 | 2Q23 | YTD 2024 | YTD 2023 | | |

| GAAP | 89.0 | % | 86.3 | % | 88.9 | % | 85.9 | % | | |

| Impact of exit of employer group commercial medical products business | (0.1) | % | (0.2) | % | — | % | 0.1 | % | | |

| Adjusted (non-GAAP) | 88.9 | % | 86.1 | % | 88.9 | % | 86.0 | % | | |

| | | | | | | | | | | | | | | | |

| Benefit ratio - INSURANCE SEGMENT | 2Q24 | 2Q23 | YTD 2024 | YTD 2023 | | |

| GAAP | 89.5 | % | 86.8 | % | 89.4 | % | 86.4 | % | | |

| Impact of exit of employer group commercial medical products business | (0.1) | % | (0.2) | % | — | % | 0.1 | % | | |

| Adjusted (non-GAAP) | 89.4 | % | 86.6 | % | 89.4 | % | 86.5 | % | | |

| | | | | | |

Operating Cost Ratio

| | | | | | | | | | | | | | | | |

| Operating cost ratio - CONSOLIDATED | 2Q24 | 2Q23 | YTD 2024 | YTD 2023 | | |

| GAAP | 10.8 | % | 11.8 | % | 10.6 | % | 11.5 | % | | |

| | | | | | |

| Impact of exit of employer group commercial medical products business | (0.1) | % | (0.2) | % | (0.1) | % | (0.3) | % | | |

| | | | | | |

| Value creation initiatives | (0.2) | % | — | % | (0.1) | % | — | % | | |

| Accrued charge related to certain anticipated litigation expenses | — | % | (0.4) | % | — | % | (0.2) | % | | |

| Adjusted (non-GAAP) | 10.5 | % | 11.2 | % | 10.4 | % | 11.0 | % | | |

| | | | | | | | | | | | | | | | |

| Operating cost ratio - INSURANCE SEGMENT | 2Q24 | 2Q23 | YTD 2024 | YTD 2023 | | |

| GAAP | 8.4 | % | 9.9 | % | 8.4 | % | 9.6 | % | | |

| Impact of exit of employer group commercial medical products business | — | % | (0.3) | % | (0.1) | % | (0.3) | % | | |

| Accrued charge related to certain anticipated litigation expenses | — | % | (0.4) | % | — | % | (0.2) | % | | |

| Adjusted (non-GAAP) | 8.4 | % | 9.2 | % | 8.3 | % | 9.1 | % | | |

Income from Operations

| | | | | | | | | | | | | | | | |

| Income from operations - INSURANCE SEGMENT | 2Q24 | 2Q23 | YTD 2024 | YTD 2023 | | |

| GAAP | $763 | $1,031 | $1,661 | $2,358 | | |

| Amortization associated with identifiable intangibles | 4 | 6 | 9 | 11 | | |

| Impact of exit of employer group commercial medical products business | 59 | 45 | 60 | (37) | | |

| Accrued charge related to certain anticipated litigation expenses | — | 90 | — | 90 | | |

| Adjusted (non-GAAP) | $826 | $1,172 | $1,730 | $2,422 | | |

(b) Generally, when the first day of a month falls on a weekend or holiday, with the exception of January 1 (New Year's Day), the

company receives its monthly Medicare premium payment from CMS on the last business day of the previous month. On a GAAP

basis, this can result in certain quarterly cash flows from operations including more or less than three monthly payments. Consequently, when this occurs, the company reports Adjusted cash flows from operations to reflect three payments in each quarter to match the related expenses.

| | | | | | | | | | |

Net cash from operating activities (in millions) | | | YTD 2024 | YTD 2023 |

| GAAP | | | $1,636 | $9,863 |

| Timing of premium payment from CMS | | | — | | (7,002) | |

Adjusted (non-GAAP) | | | $1,636 | $2,861 |

(c) The CenterWell segment Adjusted income from operations includes an adjustment to add back depreciation and amortization expense to the segment's GAAP income from operations since such an adjustment is commonly utilized for valuation purposes within the healthcare delivery industry.

| | | | | | | | | | | | | | | | |

Income from operations - CENTERWELL SEGMENT (in millions) | 2Q24 | 2Q23 | YTD 2024 | YTD 2023 | | |

| GAAP | $338 | $287 | $620 | $617 | | |

| Depreciation and amortization expense | 56 | | 50 | | 109 | | 99 | | | |

| Adjusted (non-GAAP) | $394 | | $337 | | $729 | | $716 | | | |

(d) FY 2024 projected Adjusted results exclude the future impact of items that cannot be estimated at this time; YTD 2024 amounts shown.

(e) Prior Period Development related to the employer group commercial medical products business:

| | | | | | | | | | | | |

| Favorable (Unfavorable) Prior Period Development | First Quarter | Second

Quarter | | | | |

Prior Period Development from prior years recognized in 2024 | $34 | ($9) | | | | |

Prior Period Development from prior years recognized in 2023 | $23 | ($20) | | | | |

Cautionary Statement

This news release includes forward-looking statements regarding Humana within the meaning of the Private Securities Litigation Reform Act of 1995. When used in investor presentations, press releases, Securities and Exchange Commission (SEC) filings, and in oral statements made by or with the approval of one of Humana’s executive officers, the words or phrases like “expects,” “believes,” “anticipates,” “assumes,” “intends,” “likely will result,” “estimates,” “projects” or variations of such words and similar expressions are intended to identify such forward-looking statements.

These forward-looking statements are not guarantees of future performance and are subject to risks, uncertainties, and assumptions, including, among other things, information set forth in the “Risk Factors” section of the company’s SEC filings, a summary of which includes but is not limited to the following:

•If Humana does not design and price its products properly and competitively, if the premiums Humana receives are insufficient to cover the cost of healthcare services delivered to its members, if the company is unable to implement clinical initiatives to provide a better healthcare experience for its members, lower costs and appropriately document the risk profile of its members, or if its estimates of benefits expense are inadequate, Humana’s profitability could be materially adversely affected. Humana estimates the costs of its benefit expense payments, and designs and prices its products accordingly, using actuarial methods and assumptions based upon, among other relevant factors, claim payment patterns, medical cost inflation, and historical developments such as claim inventory levels and claim receipt patterns. The company continually reviews estimates of future payments relating to benefit expenses for services incurred in the current and prior periods and makes necessary adjustments to its reserves, including premium deficiency reserves, where appropriate. These estimates involve extensive judgment, and have considerable inherent variability because they are extremely sensitive to changes in claim payment patterns and medical cost trends. Accordingly, Humana's reserves may be insufficient.

•If Humana fails to effectively implement its operational and strategic initiatives, including its Medicare initiatives, which are of particular importance given the concentration of the company's revenues in these products, state-based contract strategy, the growth of its CenterWell business, and its integrated care delivery model, the company’s business may be materially adversely affected. In addition, there can be no assurances that the company will be successful in maintaining or improving its Star ratings in future years.

•If Humana, or the third-party service providers on which it relies, fails to properly maintain the integrity of its data, to strategically maintain existing or implement new information systems, to protect Humana’s proprietary rights to its systems, or to defend against cyber-security attacks, contain such attacks when they occur, or prevent other privacy or data security incidents that result in security breaches that disrupt the company's operations or in the unintentional dissemination of sensitive personal information or proprietary or confidential information, the company’s business may be materially adversely affected.

•Humana is involved in various legal actions, or disputes that could lead to legal actions (such as, among other things, provider contract disputes and qui tam litigation brought by individuals on behalf of the government), governmental and internal investigations, and routine internal review of business processes any of which, if resolved unfavorably to the company, could result in substantial monetary damages or changes in its business practices. Increased litigation and negative publicity could also increase the company’s cost of doing business.

•As a government contractor, Humana is exposed to risks that may materially adversely affect its business or its willingness or ability to participate in government healthcare programs including, among other things, loss of material government contracts; governmental audits and investigations; potential inadequacy of government determined payment rates; potential restrictions on profitability, including by comparison of profitability of the company’s Medicare Advantage business to non-Medicare Advantage business; or other changes in the governmental programs in which Humana participates. Changes to the risk-adjustment model utilized by CMS to adjust premiums paid to Medicare Advantage plans or retrospective recovery by CMS of previously paid premiums as a result of the final rule related to the risk adjustment data validation audit methodology published by CMS on January 30, 2023 (Final RADV Rule), which Humana believes fails to address adequately the statutory requirement of actuarial equivalence and violates the Administrative Procedure Act due to its failure to include a "Fee for Service Adjuster" could have a material adverse effect on the company's operating results, financial position and cash flows.

•Humana's business activities are subject to substantial government regulation. New laws or regulations, or legislative, judicial, or regulatory changes in existing laws or regulations or their manner of application could increase the company's cost of doing business and have a material adverse effect on Humana’s results of operations (including restricting revenue, enrollment and premium growth in certain products and market segments, restricting the company’s ability to expand into new markets, increasing the company’s medical and operating costs by, among other things, requiring a minimum benefit ratio on insured products, lowering the company’s Medicare payment rates and increasing the company’s expenses associated with a non-deductible health insurance industry fee and other assessments); the company’s financial position (including the company’s ability to maintain the value of its goodwill); and the company’s cash flows.

•Humana’s failure to manage acquisitions, divestitures and other significant transactions successfully may have a material adverse effect on the company’s results of operations, financial position, and cash flows.

•If Humana fails to develop and maintain satisfactory relationships with the providers of care to its members, the company’s business may be adversely affected.

•Humana faces significant competition in attracting and retaining talented employees. Further, managing succession for, and retention of, key executives is critical to the Company’s success, and its failure to do so could adversely affect the Company’s businesses, operating results and/or future performance.

•Humana’s pharmacy business is highly competitive and subjects it to regulations and supply chain risks in addition to those the company faces with its core health benefits businesses.

•Changes in the prescription drug industry pricing benchmarks may adversely affect Humana’s financial performance.

•Humana’s ability to obtain funds from certain of its licensed subsidiaries is restricted by state insurance regulations.

•Downgrades in Humana’s debt ratings, should they occur, may adversely affect its business, results of operations, and financial condition.

•Volatility or disruption in the securities and credit markets may significantly and adversely affect the value of our investment portfolio and the investment income that we derive from this portfolio.

In making forward-looking statements, Humana is not undertaking to address or update them in future filings or communications regarding its business or results. In light of these risks, uncertainties, and assumptions, the forward-looking events discussed herein may or may not occur. There also may be other risks that the company is unable to predict at this time. Any of these risks and uncertainties may cause actual results to differ materially from the results discussed in the forward-looking statements.

Humana advises investors to read the following documents as filed by the company with the SEC for further discussion both of the risks it faces and its historical performance:

•Form 10-K for the year ended December 31, 2023;

•Form 10-Q for the quarter ended March 31, 2024; and

•Form 8-Ks filed during 2024.

About Humana

Humana Inc. is committed to putting health first – for our teammates, our customers, and our company. Through our Humana insurance services, and our CenterWell health care services, we make it easier for the millions of people we serve to achieve their best health – delivering the care and service they need, when they need it. These efforts are leading to a better quality of life for people with Medicare, Medicaid, families, individuals, military service personnel, and communities at large. Learn more about what we offer at Humana.com and at CenterWell.com.

| | | | | | | | | | | |

Humana Inc. Full Year 2024 Projections - As of July 31, 2024 in accordance with GAAP unless otherwise noted |

| Current Guidance | Prior Guidance | |

| Diluted earnings per common share |

| GAAP: approximately $12.81 | GAAP: approximately $13.93 | |

| no change | Non-GAAP: approximately $16.00 |

| | | |

| Total Revenues |

| Consolidated | GAAP: approximately $116 billion | GAAP: approximately $113 billion | Consolidated and segment level revenue projections include expected investment income.

Segment level revenues include amounts that eliminate in consolidation. |

| Insurance segment | GAAP: approximately $112 billion | GAAP: approximately $110 billion |

| CenterWell segment | no change | GAAP: approximately $19 billion |

| | | |

| Change in year-end medical membership from prior year-end |

| Individual Medicare Advantage | Growth of approximately 225,000 | Growth of approximately 150,000 | |

| Group Medicare Advantage | no change | Growth of approximately 45,000 | |

| Medicare stand-alone PDP | Decline of approximately 600,000 | Decline of approximately 650,000 | |

| State-based contracts | no change | Growth of approximately 250,000 | State-based contracts guidance includes membership in Florida, Illinois, Indiana, Kentucky, Louisiana, Ohio, Oklahoma, South Carolina, and Wisconsin. |

| | | |

Benefit Ratio Insurance segment | no change | GAAP: approximately 90.0% | Ratio calculation: benefits expense as a percent of premiums revenues. |

| | | |

|

Operating Cost Ratio Consolidated | no change | GAAP: approximately 11.4% | Ratio calculation: operating costs excluding depreciation and amortization as a percent of revenues excluding investment income. |

| | | |

| | | |

| Segment Results |

| Insurance segment income from operations | no change | GAAP: approximately $1.1 billion Non-GAAP: approximately $1.2 billion | Insurance segment Non-GAAP income from operations excludes the projected impact of the exit of employer group commercial medical products business and segment amortization.

Centerwell segment Non-GAAP income from operations excludes the projected impact of segment depreciation and amortization. |

| CenterWell segment income from operations | no change | GAAP: approximately $1.2 billion Non-GAAP: approximately $1.4 billion |

| | | |

| Effective Tax Rate | no change | GAAP: approximately 25.2% Non-GAAP: approximately 25.0% | |

| Weighted Avg. Share Count for Diluted EPS | no change | approximately 121 million | |

| Cash flows from operations | no change | GAAP: approximately $2 billion | |

| Capital expenditures | no change | GAAP: approximately $800 million | |

Humana Inc.

Statistical Schedules

and

Supplementary Information

2Q24 Earnings Release

| | | | | |

Humana Inc.

Statistical Schedules and Supplementary Information

2Q24 Earnings Release |

|

| (S-3) - (S-4) | Consolidated Statements of Income - Quarter and YTD |

| (S-5) | Consolidated Balance Sheets |

| (S-6) | Consolidated Statements of Cash Flows -YTD |

| (S-7) - (S-8) | Consolidating Statements of Income - Quarter |

| (S-9) - (S-10) | Consolidating Statements of Income - YTD |

| (S-11) | Membership Detail |

| (S-12) - (S-13) | Premiums and Services Revenue Detail |

| (S-14) - (S-16) | CenterWell Segment - Pharmacy Solutions, Primary Care, & Home Solutions |

| (S-17) | Footnotes |

Humana Inc.

Consolidated Statements of Income (Unaudited)

Dollars in millions, except per common share results

| | | | | | | | | | | | | |

| | For the three months ended June 30, | | | |

| | | | | |

| | 2024 | 2023 | | | |

| Revenues: | | | | | |

| Premiums | $ | 28,142 | | $ | 25,495 | | | | |

| Services | 1,100 | | 978 | | | | |

| Investment income | 298 | | 274 | | | | |

| Total revenues | 29,540 | | 26,747 | | | | |

| Operating expenses: | | | | | |

| Benefits | 25,039 | | 22,009 | | | | |

| Operating costs | 3,148 | | 3,111 | | | | |

| Depreciation and amortization | 212 | | 191 | | | | |

| Total operating expenses | 28,399 | | 25,311 | | | | |

| Income from operations | 1,141 | | 1,436 | | | | |

| | | | | |

| Interest expense | 168 | | 120 | | | | |

| Other expense, net | 55 | | 54 | | | | |

| Income before income taxes and equity in net earnings | 918 | | 1,262 | | | | |

| Provision from income taxes | 223 | | 296 | | | | |

| Equity in net losses (A) | (17) | | (10) | | | | |

| Net income | 678 | | 956 | | | | |

| Net loss attributable to noncontrolling interests | 1 | | 3 | | | | |

| Net income attributable to Humana | $ | 679 | | $ | 959 | | | | |

| Basic earnings per common share | $ | 5.63 | | $ | 7.70 | | | | |

| Diluted earnings per common share | $ | 5.62 | | $ | 7.66 | | | | |

| Shares used in computing basic earnings per common share (000’s) | 120,445 | | 124,574 | | | | |

| Shares used in computing diluted earnings per common share (000’s) | 120,665 | | 125,109 | | | | |

Humana Inc.

Consolidated Statements of Income (Unaudited)

Dollars in millions, except per common share results

| | | | | | | | | | | | | |