1Q24 Net Income of $42.1 million and Diluted

Earnings Per Share (EPS) of $0.38

- Utility Continues to Operate Efficiently While Advancing

Wildfire Mitigation and Resilience Efforts

- One ‘Ohana Initiative Progressing, With 43 Decedent and 15

Physical Injury Registrants to Date

- Bank’s Strategic Balance Sheet Repositioning Executed in the

Previous Quarter Contributed to Improved Profitability and Net

Interest Margin

- Bank’s Release of Maui Wildfire-Related Reserves Reflects

Better Outlook for Maui Economy

Hawaiian Electric Industries, Inc. (NYSE:

HE) (HEI) today reported consolidated net income for common

stock for the first quarter of 2024 of $42.1 million and EPS of

$0.38 compared to $54.7 million and EPS of $0.50 for the first

quarter of 2023. Core net income and EPS1 for the first quarter

were $49.3 million and $0.45, respectively.

“We continue to work in earnest with key stakeholders to help

our community recover from the devastating impacts of the Maui

wildfires. The State’s One ‘Ohana fund has seen steady uptake and

the Governor recently extended the registration deadline, and

mediation discussions are underway with those impacted by the

fires. Hawaii’s legislative session recently concluded, and

although we are disappointed that we ran out of time to pass

legislation this session, our governor and legislature are highly

engaged in determining how to design legislation that best makes

sense for Hawaii, our customers and our company. Our utility is

committed to making the investments needed to mitigate wildfire

risk and advance important safety and resilience work,” said Scott

Seu, HEI president and CEO.

“American Savings Bank executed well in the first quarter,

generating higher net income as net interest margin and

profitability benefited from the strategic balance sheet

repositioning executed last quarter. The bank also released

reserves initially taken following the wildfires on Maui,

reflecting Maui’s resilient economy and stronger-than-expected

outlook.”

HAWAIIAN ELECTRIC COMPANY (HAWAIIAN ELECTRIC)

EARNINGS2

Hawaiian Electric’s net income for the first quarter of 2024 was

$39.2 million compared to $47.0 million in the first quarter of

2023, with the decrease primarily driven by the following after-tax

items:

- $12 million in higher operations and maintenance (O&M)

expenses, including $7 million of costs associated with the Maui

windstorm and wildfire event. These costs include the settlement of

indemnification claims asserted by the state and wildfire

mitigation expenses. The remaining increase in O&M included

higher insurance costs and higher vegetation management costs;

and

- $3 million impact from worse heat rate performance.

These items were partially offset by the following after-tax

items:

- $5 million higher revenues, including $4 million from the

annual revenue adjustment mechanism and $1 million from the major

project interim recovery mechanism;

- $1 million in higher interest income; and

- $1 million higher allowance for funds used during construction

related to increased capital expenditures.

Excluding incremental after-tax Maui windstorm and

wildfire-related expenses net of insurance recoveries, Hawaiian

Electric’s core net income3 for the quarter was $44.2 million. The

incremental after-tax Maui windstorm and wildfire-related expenses

of $5 million were composed of $18 million of expenses, net of $7

million of insurance-related recoveries and $6 million of costs

deferred pursuant to the Public Utilities Commission’s decision

allowing Hawaiian Electric to defer these costs.

Utility Dividend Declaration

On May 8, 2024 Hawaiian Electric’s Board of Directors declared a

$13 million quarterly cash dividend to its sole common stockholder,

HEI.

AMERICAN SAVINGS BANK EARNINGS

ASB’s first quarter 2024 net income was $20.9 million, compared

to $3.2 million in the fourth quarter of 2023 and $18.6 million in

the first quarter of 2023. Net income for the quarter reflected the

release of $1.5 million of Maui wildfire-related reserves and the

recovery of $0.4 million in cash lost or damaged during the

wildfires, partially offset by Maui wildfire-related expenses of

$1.8 million. Excluding the after-tax impacts of these items, core

net income for the first quarter was also $20.9 million.4

Total earning assets as of March 31, 2024 were $8.9 billion,

down approximately 2.7% from December 31, 2023.

Total loans were $6.1 billion as of March 31, 2024, down 1.1%

from December 31, 2023, primarily reflecting the payoff and sale of

loans in the commercial markets portfolio and a decrease in the

HELOC portfolio.

Total deposits were $8.0 billion as of March 31, 2024, down 1.7%

from December 31, 2023. Core deposits declined 1.2% from December

31, 2023, while certificates of deposit decreased 5.3% primarily

due to the paydown of $166 million in public time deposits. As of

March 31, 2024, 86% of deposits were F.D.I.C. insured or fully

collateralized, consistent with December 31, 2023. Approximately

82% of deposits were F.D.I.C. insured, up slightly from 80% as of

December 31, 2023. For the first quarter of 2024, the average cost

of funds was 117 basis points, down slightly from 118 basis points

in the linked quarter and up from 66 basis points in the prior year

quarter.

ASB’s return on average equity was 15.6%, compared to 2.7% in

the linked quarter and 15.5% in the first quarter of 2023. Return

on average assets was 0.88% for the first quarter of 2024, compared

to 0.13% in the linked quarter and 0.78% in the prior year

quarter.

In the first quarter of 2024, ASB did not pay a dividend to HEI,

supporting ASB’s healthy capital levels. ASB had a Tier 1 leverage

ratio of 8.0% as of March 31, 2024.

Please refer to ASB’s news release issued on April 30, 2024 for

additional information on ASB.

HOLDING AND OTHER COMPANIES

The holding and other companies’ net loss was $18.0 million in

the first quarter of 2024 compared to $10.9 million in the first

quarter of 2023. The higher net loss compared to the prior year

quarter was primarily due to wildfire-related expenses and lower

Pacific Current net income. Core net loss for the first quarter of

2024 was $15.8 million5.

EARNINGS RELEASE, WEBCAST AND CONFERENCE CALL TO DISCUSS

EARNINGS

HEI will conduct a webcast and conference call to review its

first quarter 2024 consolidated financial results today at 10:30

a.m. Hawaii time (4:30 p.m. Eastern).

To listen to the conference call, dial 1-888-660-6377 (U.S.) or

1-929-203-0797 (international) and enter passcode 2393042. Parties

may also access presentation materials (which include

reconciliation of non-GAAP measures) and/or listen to the

conference call by visiting the conference call link on HEI’s

website at www.hei.com under “Investor Relations,” sub-heading

“News and Events — Events and Presentations.”

A replay will be available online and via phone. The online

replay will be available on HEI’s website about two hours after the

event. The audio replay will also be available about two hours

after the event through May 24, 2024. To access the audio replay,

dial 1-800-770-2030 (U.S.) or 1-647-362-9199 (international) and

enter passcode 2393042.

HEI and Hawaiian Electric Company, Inc. (Hawaiian Electric)

intend to continue to use HEI’s website, www.hei.com, as a means of

disclosing additional information; such disclosures will be

included in the Investor Relations section of the website.

Accordingly, investors should routinely monitor the Investor

Relations section of HEI’s website, in addition to following HEI’s,

Hawaiian Electric’s and ASB’s press releases, HEI’s and Hawaiian

Electric’s Securities and Exchange Commission (SEC) filings and

HEI’s public conference calls and webcasts. Investors may sign up

to receive e-mail alerts via the “Investor Relations” section of

the website. The information on HEI’s website is not incorporated

by reference into this document or into HEI’s and Hawaiian

Electric’s SEC filings unless, and except to the extent,

specifically incorporated by reference.

Investors may also wish to refer to the Public Utilities

Commission of the State of Hawaii (PUC) website at

https://hpuc.my.site.com/cdms/s/ to review documents filed with,

and issued by, the PUC. No information on the PUC website is

incorporated by reference into this document or into HEI’s and

Hawaiian Electric’s SEC filings.

________________________

1 See “Explanation of HEI’s Use of Certain Unaudited Non-GAAP

Measures” and the related GAAP reconciliations at the end of this

release. 2 Utility amounts indicated as after-tax in this earnings

release are based upon adjusting items using a current year

composite statutory tax rate of 25.75%. 3 Refer to footnote 1. 4

Refer to footnote 1. 5 Refer to footnote 1.

ABOUT HEI

The HEI family of companies provides the energy and financial

services that empower much of the economic and community activity

of Hawaii. HEI’s electric utility, Hawaiian Electric, supplies

power to approximately 95% of Hawaii’s population and is

undertaking an ambitious effort to decarbonize its operations and

the broader state economy. Its banking subsidiary, ASB, is one of

Hawaii’s largest financial institutions, providing a wide array of

banking and other financial services and working to advance

economic growth, affordability and financial fitness. HEI also

helps advance Hawaii’s sustainability goals through investments by

its non-regulated subsidiary, Pacific Current. For more

information, visit www.hei.com.

NON-GAAP MEASURES

Core net income is a non-GAAP measure which excludes Maui

wildfire-related after-tax costs. See “Explanation of HEI’s Use of

Certain Unaudited Non-GAAP Measures” and the related GAAP

reconciliations at the end of this release.

FORWARD-LOOKING STATEMENTS

This release may contain “forward-looking statements,” which

include statements that are predictive in nature, depend upon or

refer to future events or conditions, and usually include words

such as “will,” “expects,” “anticipates,” “intends,” “plans,”

“believes,” “predicts,” “estimates” or similar expressions. In

addition, any statements concerning future financial performance,

ongoing business strategies or prospects or possible future actions

are also forward-looking statements. Forward-looking statements are

based on current expectations and projections about future events

and are subject to risks, uncertainties and the accuracy of

assumptions concerning HEI and its subsidiaries, the performance of

the industries in which they do business and economic, political

and market factors, among other things. These forward-looking

statements are not guarantees of future performance.

Forward-looking statements in this release should be read in

conjunction with the “Cautionary Note Regarding Forward-Looking

Statements” and “Risk Factors” discussions (which are incorporated

by reference herein) set forth in HEI’s Annual Report on Form 10-K

for the year ended December 31, 2023 and HEI’s other periodic

reports that discuss important factors that could cause HEI’s

results to differ materially from those anticipated in such

statements. These forward-looking statements speak only as of the

date of the report, presentation or filing in which they are made.

Except to the extent required by the federal securities laws, HEI,

Hawaiian Electric, ASB and their subsidiaries undertake no

obligation to publicly update or revise any forward-looking

statements, whether as a result of new information, future events

or otherwise.

Hawaiian Electric Industries, Inc. (HEI)

and Subsidiaries

CONSOLIDATED STATEMENTS OF INCOME DATA

(Unaudited)

Three months ended March

31

(in thousands, except per share

amounts)

2024

2023

Revenues

Electric utility

$

788,578

$

830,361

Bank

105,144

93,857

Other

3,436

4,019

Total revenues

897,158

928,237

Expenses

Electric utility

725,223

754,486

Bank

79,612

70,337

Other

15,904

9,896

Total expenses

820,739

834,719

Operating income (loss)

Electric utility

63,355

75,875

Bank

25,532

23,520

Other

(12,468

)

(5,877

)

Total operating income

76,419

93,518

Retirement defined benefits credit—other

than service costs

1,282

1,152

Interest expense, net—other than on

deposit liabilities and other bank borrowings

(31,591

)

(28,798

)

Allowance for borrowed funds used during

construction

1,386

1,131

Allowance for equity funds used during

construction

3,640

3,301

Interest income

3,133

—

Income before income taxes

54,269

70,304

Income taxes

11,674

15,110

Net income

42,595

55,194

Preferred stock dividends of

subsidiaries

473

473

Net income for common stock

$

42,122

$

54,721

Basic earnings per common share

$

0.38

$

0.50

Diluted earnings per common

share

$

0.38

$

0.50

Dividends declared per common

share

$

—

$

0.36

Weighted-average number of common

shares outstanding

110,218

109,514

Weighted-average shares assuming

dilution

110,476

109,825

Net income (loss) for common stock by

segment

Electric utility

$

39,221

$

47,009

Bank

20,934

18,562

Other

(18,033

)

(10,850

)

Net income for common stock

$

42,122

$

54,721

Comprehensive income attributable to

HEI

$

32,321

$

75,209

Return on average common equity (%)

(twelve months ended)

8.1

10.0

This information should be read in conjunction with the

consolidated financial statements and the notes thereto in HEI

filings with the SEC. Results of operations for interim periods are

not necessarily indicative of results to be expected for future

interim periods or the full year.

Hawaiian Electric Company, Inc. (Hawaiian

Electric) and Subsidiaries

CONSOLIDATED STATEMENTS OF INCOME DATA

(Unaudited)

Three months ended March

31

($ in thousands, except per barrel

amounts)

2024

2023

Revenues

$

788,578

$

830,361

Expenses

Fuel oil

284,296

334,097

Purchased power

159,817

152,761

Other operation and maintenance

143,890

128,316

Depreciation

62,812

60,927

Taxes, other than income taxes

74,408

78,385

Total expenses

725,223

754,486

Operating income

63,355

75,875

Allowance for equity funds used during

construction

3,640

3,301

Retirement defined benefits credit—other

than service costs

1,072

1,047

Interest expense and other charges,

net

(19,985

)

(20,246

)

Allowance for borrowed funds used during

construction

1,386

1,131

Interest income

1,432

—

Income before income taxes

50,900

61,108

Income taxes

11,180

13,600

Net income

39,720

47,508

Preferred stock dividends of

subsidiaries

229

229

Net income attributable to Hawaiian

Electric

39,491

47,279

Preferred stock dividends of Hawaiian

Electric

270

270

Net income for common stock

$

39,221

$

47,009

Comprehensive income attributable to

Hawaiian Electric

$

39,172

$

46,964

OTHER ELECTRIC UTILITY INFORMATION

Kilowatthour sales (millions)

Hawaiian Electric

1,412

1,430

Hawaii Electric Light

254

251

Maui Electric

240

255

1,906

1,936

Average fuel oil cost per barrel

$

121.84

$

139.88

Return on average common equity (%)

(twelve months ended)1

7.8

8.2

1

Simple average.

This information should be read in conjunction with the

consolidated financial statements and the notes thereto in Hawaiian

Electric filings with the SEC. Results of operations for interim

periods are not necessarily indicative of results to be expected

for future interim periods or the full year.

American Savings Bank, F.S.B.

STATEMENTS OF INCOME DATA

(Unaudited)

Three months ended

(in thousands)

March 31, 2024

December 31, 2023

March 31, 2023

Interest and dividend income

Interest and fees on loans

$

72,971

$

72,340

$

64,842

Interest and dividends on investment

securities

14,964

15,587

14,637

Total interest and dividend income

87,935

87,927

79,479

Interest expense

Interest on deposit liabilities

17,432

17,961

6,837

Interest on other borrowings

8,154

8,721

7,721

Total interest expense

25,586

26,682

14,558

Net interest income

62,349

61,245

64,921

Provision for credit losses

(2,159

)

304

1,175

Net interest income after provision for

credit losses

64,508

60,941

63,746

Noninterest income

Fees from other financial services

4,874

4,643

4,679

Fee income on deposit liabilities

4,898

5,104

4,599

Fee income on other financial products

2,743

2,664

2,744

Bank-owned life insurance

3,584

1,707

1,425

Mortgage banking income

424

209

130

Loss on sale of investment securities

—

(14,965

)

—

Other income, net

686

693

801

Total noninterest income

17,209

55

14,378

Noninterest expense

Compensation and employee benefits

32,459

28,797

30,204

Occupancy

5,063

5,422

5,588

Data processing

4,846

5,305

5,012

Services

4,151

5,032

2,595

Equipment

2,649

3,114

2,646

Office supplies, printing and postage

1,018

1,019

1,165

Marketing

776

1,167

1,016

Other expense

4,942

9,250

6,191

Total noninterest expense

55,904

59,106

54,417

Income before income taxes

25,813

1,890

23,707

Income taxes

4,879

(1,341

)

5,145

Net income

$

20,934

$

3,231

$

18,562

Comprehensive income (loss)

$

11,166

$

70,585

$

36,992

OTHER BANK INFORMATION (annualized %,

except as of period end)

Return on average assets

0.88

0.13

0.78

Return on average equity

15.64

2.74

15.51

Return on average tangible common

equity

18.48

3.32

18.73

Net interest margin

2.75

2.63

2.85

Efficiency ratio

70.27

96.42

68.62

Net charge-offs to average loans

outstanding

0.14

0.15

0.14

As of period end

Nonaccrual loans to loans receivable held

for investment

0.53

0.46

0.24

Allowance for credit losses to loans

outstanding

1.16

1.20

1.18

Tangible common equity to tangible

assets

5.0

4.7

4.3

Tier-1 leverage ratio

8.0

7.7

7.7

Dividend paid to HEI (via ASB Hawaii,

Inc.) ($ in millions)

$

—

$

—

$

14.0

This information should be read in conjunction with the

consolidated financial statements and the notes thereto in HEI

filings with the SEC. Results of operations for interim periods are

not necessarily indicative of results to be expected for future

interim periods or the full year.

Explanation of HEI’s Use of Certain Unaudited Non-GAAP

Measures

HEI, Hawaiian Electric and ASB management use certain non-GAAP

measures to evaluate the performance of HEI, the utility and bank.

Management believes these non-GAAP measures provide useful

information regarding the companies’ core operating activities.

Core earnings and other financial measures as presented here may

not be comparable to similarly titled measures used by other

companies. The accompanying tables provide a reconciliation of

reported GAAP1 earnings to non-GAAP core earnings for adjusted

diluted EPS (for HEI consolidated); return on average common equity

(for HEI consolidated and Hawaiian Electric); and returns on

average equity, average tangible equity and average assets, and

efficiency ratio (for ASB).

The reconciling adjustments from GAAP earnings to core earnings

are limited to the costs related to the Maui wildfires. Management

does not consider these items to be representative of the company’s

fundamental core earnings.

Reconciliation of GAAP to non-GAAP

Measures

Hawaiian Electric Industries, Inc. (HEI)

and Subsidiaries

Unaudited

(in thousands)

Three months ended March 31,

2024

Maui

wildfire-related costs

Pretax expenses:

Legal expenses

$

15,027

Outside services expenses

2,747

Provision for credit losses

(1,500

)

Other expenses

9,019

Interest expenses

4,825

Pretax expenses

30,118

Insurance recoveries

(12,577

)

Deferral of cost

(7,898

)

Wildfire-related expenses, excluding

insurance recovery and deferral

9,643

Income tax benefits2

(2,482

)

After-tax adjustments

$

7,161

HEI consolidated

net income

GAAP net income (as reported)

$

42,122

Excluding special items related to the

Maui wildfire (after tax):

Legal expenses

11,157

Outside services expenses

2,022

Provision for credit losses

(1,098

)

Other expenses

6,700

Interest expenses

3,582

After tax expenses

22,363

Insurance recoveries

(9,338

)

Deferral of cost

(5,864

)

Maui wildfire-related expenses, net of

insurance recoveries and approved deferral treatment (after

tax)

7,161

Non-GAAP (core) net income

$

49,283

GAAP Diluted earnings per share (as

reported)

$

0.38

Non-GAAP (core) Diluted earnings per

share

$

0.45

Three months ended March 31,

2024

Ratios

(%)

Based on GAAP1

Return on average equity

8.1

Based on Non-GAAP (core)

Return on average equity

9.5

1

Accounting principles generally accepted

in the United States of America.

2

Current year composite statutory tax rate

of 25.75% is used for Utility and corporate amounts and current

year composite statutory tax rate of 26.80% is used for ASB

amounts.

Note: Other segment (Holding and Other Companies)

wildfire-related expenses (legal, outside services and other) are

included in “Expenses-Other” and interest expense is included in

“Interest expense, net—other than on deposit liabilities and other

bank borrowings” on the HEI and subsidiaries’ Consolidated

Statements of Income Data. See Electric Utilities and Bank tables

below for more detail.

Reconciliation of GAAP to non-GAAP

Measures

Hawaiian Electric Company, Inc. and

Subsidiaries

Unaudited

(in thousands)

Three months ended March 31,

2024

Maui windstorm

and wildfire-related costs

Pretax expenses:

Legal expenses1

$

10,735

Outside services expenses1

784

Other expenses1

9,141

Interest expenses2

3,907

Pretax expenses

24,567

Insurance recoveries

(9,969

)

Deferral of cost

(7,898

)

Total Maui windstorm and

wildfire-related expenses, net of insurance recoveries and approved

deferral treatment

6,700

Income tax benefits3

(1,725

)

After-tax expenses

$

4,975

Hawaiian Electric

consolidated net income

GAAP net income (as reported)

$

39,221

Excluding special items related to the

Maui windstorm and wildfires (after tax):

Legal expenses

7,971

Outside services expenses

582

Other expenses

6,787

Interest expenses

2,901

Maui windstorm and wildfire-related cost

(after tax)

18,241

Insurance recovery (after tax)

(7,402

)

Deferral of cost (after tax)

(5,864

)

Total Maui windstorm and wildfire- related

expenses, net of insurance recoveries and approved deferral

treatment (after tax)

4,975

Non-GAAP (core) net income

$

44,196

Three months ended March 31,

2024

Ratios

(%)

Based on GAAP

Return on average equity

7.8

Based on Non-GAAP (core)

Return on average equity

8.0

1

Legal, outside services and other are

included in “Other operation and maintenance” on the Hawaiian

Electric and subsidiaries Consolidated Statements of Income

Data.

2

Interest expense is included in “Interest

expense and other charges, net” on the Hawaiian Electric and

subsidiaries Consolidated Statements of Income Data.

3

Current year composite statutory tax rate

of 25.75% is used for Utility amounts.

Reconciliation of GAAP to non-GAAP

Measures

American Savings Bank F.S.B.

Unaudited

(in thousands)

Three months ended March 31,

2024

Maui wildfire

related costs

Pretax expenses:

Provision for credit losses

$

(1,500

)

Professional services expense

1,708

Other expenses, net

(317

)

Pretax Maui wildfire related costs,

net

(109

)

Income tax1

29

After-tax expenses, net

$

(80

)

ASB net

income

GAAP (as reported)

$

20,934

Maui wildfire costs (after tax):

Provision for credit losses

(1,098

)

Professional services expense

1,250

Other expenses, net

(232

)

Maui wildfire related cost, net (after

tax)

(80

)

Non-GAAP (core) net income

$

20,854

Three months ended March 31,

2024

Ratios

(annualized %)

Based on GAAP

Return on average assets

0.88

Return on average equity

15.64

Return on average tangible common

equity

18.48

Efficiency ratio

70.27

Based on Non-GAAP (core)

Return on average assets

0.88

Return on average equity

15.58

Return on average tangible common

equity

18.41

Efficiency ratio

68.52

1

Current year composite statutory tax rate

of 26.8% is used for ASB amounts.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240510915101/en/

Mateo Garcia Director, Investor Relations Telephone: (808)

543-7300 E-mail: ir@hei.com

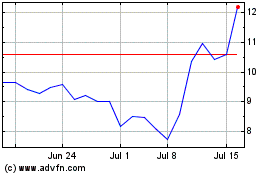

Hawaiian Electric Indust... (NYSE:HE)

Historical Stock Chart

From Nov 2024 to Dec 2024

Hawaiian Electric Indust... (NYSE:HE)

Historical Stock Chart

From Dec 2023 to Dec 2024