false000105275200010527522025-01-232025-01-23

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): January 23, 2025

GETTY REALTY CORP.

(Exact name of Registrant as Specified in Its Charter)

|

|

|

Maryland |

001-13777 |

11-3412575 |

(State or Other Jurisdiction of Incorporation) |

(Commission File Number) |

(IRS Employer Identification No.) |

|

|

292 Madison Avenue, 9th Floor, New York, New York |

10017-6318 |

(Address of Principal Executive Offices) |

(Zip Code) |

Registrant’s Telephone Number, Including Area Code: (646) 349-6000

Not Applicable

(Former Name or Former Address, if Changed Since Last Report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instructions A.2. below):

|

|

☐ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

☐ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

☐ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

☐ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

Title of each class |

|

Trading Symbol(s) |

|

Name of each exchange on which registered |

Common Stock |

|

GTY |

|

New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§ 230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§ 240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 1.01. Entry into a Material Definitive Agreement.

On January 23, 2025, Getty Realty Corp. (the “Company”) entered into a Third Amended and Restated Credit Agreement (the “Credit Agreement”) with Bank of America, N.A., as administrative agent (the “Agent”), and the lenders (the “Lenders”) and other agents party thereto, which amends and restates in its entirety the Second Amended and Restated Credit Agreement dated as of October 27, 2021 by and among the Company, the Agent, the Lenders and the other agents party thereto.

The Credit Agreement provides for a revolving credit facility (the “Credit Facility”) in an aggregate principal amount of $450.0 million and includes an accordion feature to increase the revolving commitments or add one or more tranches of term loans up to an additional aggregate amount not to exceed $300.0 million, subject to certain conditions, including one or more new or existing lenders agreeing to provide commitments for such increased amount and that no default or event of default shall have occurred and be continuing under the terms of the Credit Facility.

The Credit Facility matures January 23, 2029, subject to two six-month extensions (for a total of 12 months) exercisable at the Company's option. The Company's exercise of an extension option is subject to the absence of any default under the Credit Agreement and the Company's compliance with certain conditions, including the payment of extension fees to the Lenders under the Credit Facility and that no default or event of default shall have occurred and be continuing under the terms of the Credit Facility.

The Credit Agreement permits borrowings under the Credit Facility at an interest rate equal to (i) the sum of a SOFR rate plus a SOFR adjustment of 0.10% plus a margin of 1.30% to 1.90%, or (ii) the sum of a base rate plus a margin of 0.30% to 0.90%, based on the Company's consolidated total indebtedness to total asset value ratio at the end of each quarterly reporting period.

The per annum rate of the unused line fee on the undrawn funds under the Credit Facility is 0.15% to 0.25% based on the Company’s daily unused portion of the available Credit Facility.

The Credit Agreement contains customary financial covenants, including covenants with respect to total leverage, secured leverage and unsecured leverage ratios, fixed charge and interest coverage ratios, and minimum tangible net worth, as well as limitations on restricted payments, which may limit the Company’s ability to incur additional debt or pay dividends. The Credit Agreement contains customary events of default, including cross default provisions with respect to the Company’s existing senior unsecured note purchase agreements (the “Note Purchase Agreements”). Any event of default, if not cured or waived in a timely manner, could result in the acceleration of the Company’s indebtedness under the Credit Agreement and could also give rise to an event of default and the acceleration of the Company’s indebtedness under the Note Purchase Agreements.

As part of the transaction, the Company used borrowings under the Credit Facility to repay its $150 million senior unsecured term loan that was to mature in October 2025. This amount, which will remain drawn on the Credit Facility, will continue to be subject to interest rate swaps that fixed SOFR at 4.73% until the earlier of October 2026 or the amount is repaid.

Certain of the banks and other lenders under the Credit Agreement and their affiliates have in the past provided, and may from time to time in the future provide, commercial banking, financial advisory, investment banking and other services to the Company.

The foregoing description of the Credit Agreement does not purport to be complete and is subject to, and qualified in its entirety by, reference to the full text of the Credit Agreement, which which will be filed as an Exhibit to the Company’s Annual Report on Form 10-K for the year ending December 31, 2024.

Item 2.03. Creation of a Direct Financial Obligation or an Obligation under an Off-Balance Sheet Arrangement of a Registrant.

The information set forth under Item 1.01 above is incorporated herein by reference.

Item 7.01. Regulation FD Disclosure.

On January 23, 2025, the Company issued a press release announcing its entry into the Credit Agreement. The Company’s press release is attached as Exhibit 99.1 hereto and is incorporated by reference in this Item 7.01.

Item 9.01. Financial Statements and Exhibits.

(d) Exhibits:

The information contained in Item 7.01 and Exhibit 99.1 to this Current Report on Form 8-K is being furnished and shall not be deemed “filed” for the purposes of Section 18 of the Securities Exchange Act of 1934, as amended, or otherwise subject to the liabilities of that Section. Such information in this Current Report on Form 8-K shall not be incorporated by reference into any registration statement or other document pursuant to the Securities Act of 1933, as amended, except as shall be expressly set forth by specific reference in any such filing.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned thereunto duly authorized.

|

|

|

|

|

|

GETTY REALTY CORP. |

|

|

|

|

Date: January 28, 2025 |

|

By: |

/s/ Brian R. Dickman |

|

|

|

Brian R. Dickman |

|

|

|

Executive Vice President |

|

|

|

Chief Financial Officer and Treasurer |

FOR IMMEDIATE RELEASE

GETTY REALTY CORP. ANNOUNCES EXPANDED

$450 MILLION CREDIT FACILITY

– Repays Outstanding Term Loan and Extends Maturity to 2029 –

– Company Has No Debt Maturities Until June 2028 –

NEW YORK, NY, January 23, 2025 — Getty Realty Corp. (NYSE: GTY) (“Getty” or the “Company”), a net lease REIT focused on convenience and automotive retail real estate, announced today that it has entered into a Third Amended and Restated Credit Agreement with a group of existing and new lenders that increases its senior unsecured revolving credit facility (the “Credit Facility”) to $450 million.

The Credit Facility will mature in January 2029, with Company options to extend the maturity date to January 2030, and includes an accordion option that allows the Company to request additional lender commitments not to exceed $300 million. All other material terms and conditions governing the Credit Facility remain the same.

As part of the transaction, the Company used the increased capacity provided by the Credit Facility to repay its $150 million senior unsecured term loan that was to mature in October 2025. This amount, which will remain drawn on the Credit Facility, will continue to be subject to interest rate swaps that fixed SOFR at 4.73% until the earlier of October 2026 or the amount is repaid.

"The expanded Credit Facility gives us increased capacity and enhanced flexibility as we continue to scale our platform and position our balance sheet to support our growth objectives,” said Brian Dickman, Getty’s Chief Financial Officer. “We appreciate the strong support of our bank group, including both new and existing lenders, and now have no debt maturities until June 2028.”

The Company entered into the Third Amended and Restated Credit Agreement with Bank of America, N.A., as administrative agent, and BofA Securities, Inc., J.P. Morgan Chase Bank, N.A., KeyBanc Capital Markets, and Wells Fargo Securities, LLC as joint lead arrangers. Other participants include Capital One, N.A., Citizens Bank, N.A., The Huntington National Bank, TD Bank, N.A., and Truist Bank.

About Getty Realty Corp.

Getty Realty Corp. is a publicly traded, net lease REIT specializing in the acquisition, financing and development of convenience, automotive and other single tenant retail real estate. As of December 31, 2024, the Company’s portfolio included 1,118 freestanding properties located in 42 states across the United States and Washington, D.C.

|

|

|

|

|

Contacts: |

|

Brian Dickman |

|

Investor Relations |

|

|

Chief Financial Officer |

|

(646) 349-0598 |

|

|

(646) 349-6000 |

|

ir@gettyrealty.com |

v3.24.4

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

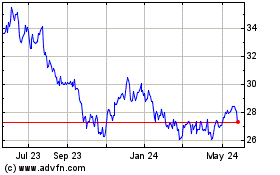

Getty Realty (NYSE:GTY)

Historical Stock Chart

From Jan 2025 to Feb 2025

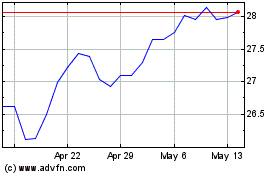

Getty Realty (NYSE:GTY)

Historical Stock Chart

From Feb 2024 to Feb 2025