UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

REPORT OF FOREIGN PRIVATE ISSUER PURSUANT TO

RULE 13A-16 OR 15D-16 UNDER THE SECURITIES

EXCHANGE ACT OF 1934

For the month of March 2025

Commission File Number: 001-16601

FRONTLINE PLC

(Translation of registrant's name into English)

8, Kennedy Street, Iris House, Off. 740B, 3106 Limmasol, Cyprus

(Address of principal executive offices)

Indicate by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F.

Form 20-F [ X ] Form 40-F [ ]

INFORMATION CONTAINED IN THIS FORM 6-K REPORT

Attached hereto as

Exhibit 1 is a copy of the

press release issued by Frontline plc (the “Company”), dated February 28, 2025, reporting the Company’s results for the fourth quarter and twelve months ended December 31, 2024.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

|

|

|

FRONTLINE PLC

(registrant)

|

|

|

|

|

|

Dated: March 3, 2025

|

|

By:

|

/s/ Inger M. Klemp

|

|

|

|

|

Name: Inger M. Klemp

|

|

|

|

|

Title: Principal Financial Officer

|

|

|

|

|

|

|

|

|

Exhibit 1

INTERIM FINANCIAL INFORMATION

FRONTLINE PLC

FOURTH QUARTER 2024

28 February 2025

FRONTLINE PLC REPORTS RESULTS FOR THE FOURTH QUARTER ENDED DECEMBER 31, 2024

Frontline plc (the “Company”, “Frontline,” “we,” “us,” or “our”), today reported unaudited results for the three and twelve months ended December 31, 2024:

|

•

|

Profit of $66.7 million, or $0.30 per share for the fourth quarter of 2024.

|

|

•

|

Adjusted profit of $45.1 million, or $0.20 per share for the fourth quarter of 2024.

|

|

•

|

Declared a cash dividend of $0.20 per share for the fourth quarter of 2024.

|

|

•

|

Reported revenues of $425.6 million for the fourth quarter of 2024.

|

|

•

|

Achieved average daily spot time charter equivalent earnings ("TCEs")1 for VLCCs, Suezmax tankers and LR2/Aframax

tankers in the fourth quarter of $35,900, $33,300 and $26,100 per day, respectively.

|

|

•

|

Fully drew down a sale-and-leaseback agreement in an amount of $512.1 million to refinance 10 Suezmax tankers, which generated net cash proceeds of $101.0 million in the fourth

quarter of 2024.

|

|

•

|

Sold its oldest Suezmax tanker, built in 2010, for a net sales price of $48.5 million and delivered the vessel to its new owner in October 2024. The transaction generated net

cash proceeds of $36.5 million after repayment of existing debt and a gain of $17.9 million in the fourth quarter of 2024.

|

|

•

|

Repaid the remaining $75.0 million outstanding under the $275.0 million senior unsecured revolving credit facility with an affiliate of Hemen Holding Limited, the Company's

largest shareholder (“Hemen”) in the fourth quarter of 2024.

|

|

•

|

Entered into three senior secured credit facilities for a total amount of up to $239.0 million to refinance outstanding debt on three VLCCs and one Suezmax tanker and, in

addition, to provide revolving credit capacity in a total amount of up to $91.9 million.

|

Lars H. Barstad, Chief Executive Officer of Frontline Management AS, commented:

“The fourth quarter of 2024 came in unusually soft compared to previous years. Global oil demand was up marginally as the year came to an end, but global seaborne exports slowed in the

fourth quarter. During the quarter we saw positive developments in the enforcement of sanctions against Iran and Russia in particular, but we could not escape the fact that these two countries represent a material part of the supply to Asia, at cost to

demand for the vessels Frontline operates. For 2025 we have already seen broader sanctions with a wider scope, at the same time as key importers of exposed crude are diversifying away from the mentioned suppliers. Compliant fleet growth for the asset

classes we deploy peaked a few years back, making the outlook very constructive as Frontline sail into the new year with our cost-efficient operations and modern fleet.”

1 This press release describes Time Charter Equivalent earnings and related per day amounts and spot TCE currently contracted, which are not

measures prepared in accordance with IFRS (“non-GAAP”). See Appendix 1 for a full description of the measures and reconciliation to the nearest IFRS measure.

Inger M. Klemp, Chief Financial Officer of Frontline Management AS, added:

”In February 2025 we entered into three senior secured credit facilities for a total amount of up to $239.0 million to refinance three existing term loan facilities, with total balloon

payments of $142.0 million maturing during 2025, leaving the Company with no debt maturities until the end of 2026 and, in addition, to provide revolving credit capacity in a total amount of up to $91.9 million.

Through these new financings we further strengthen our strong liquidity and reduce our borrowing costs and cash break even rates. We continue to focus on maintaining our competitive cost structure, breakeven levels and solid balance sheet to ensure

that we are well positioned to generate significant cash flow and create value for our shareholders.”

Average daily TCEs and estimated cash breakeven rates

|

($ per day)

|

Spot TCE

|

Spot TCE currently contracted

|

% Covered

|

Estimated average daily cash breakeven rates for 2025

|

| |

2024

|

Q4 2024

|

Q3 2024

|

Q2 2024

|

Q1 2024

|

2023

|

Q1 2025

|

2025

|

|

VLCC

|

43,400

|

35,900

|

39,600

|

49,600

|

48,100

|

50,300

|

43,700

|

80%

|

29,200

|

|

Suezmax

|

41,400

|

33,300

|

39,900

|

45,600

|

45,800

|

52,600

|

35,400

|

77%

|

24,000

|

|

LR2 / Aframax

|

42,300

|

26,100

|

36,000

|

53,100

|

54,300

|

46,800

|

29,700

|

64%

|

22,200

|

We expect the spot TCEs for the full first quarter of 2025 to be lower than the spot TCEs currently contracted, due to the impact of ballast days during the first quarter of 2025. See

Appendix 1 for further details.

Fourth Quarter 2024 Results

The Company reported profit of $66.7 million for the fourth quarter ended December 31, 2024, compared with profit of $60.5 million in the previous quarter. The adjusted profit2 was $45.1 million for the fourth quarter of 2024 compared with adjusted profit of $75.4 million in the previous quarter. The adjustments in the fourth quarter of 2024 consist of a $17.9 million

gain on sale of a vessel, an $8.0 million synthetic option revaluation gain, $5.4 million of debt extinguishment losses, $1.7 million in dividends received, a $1.4 million loss on marketable securities, a $0.7 million unrealized gain on derivatives and

$0.3 million share of results of associated companies. The decrease in adjusted profit from the previous quarter was primarily due to a decrease in our TCE earnings from $292.2 million in the previous quarter to $249.4 million in the fourth quarter as

a result of lower TCE rates.

2 This press release describes adjusted profit and related per share amounts, which are not measures prepared in accordance with IFRS (“non-GAAP”).

See Appendix 1 for a reconciliation to the nearest IFRS measure.

According to the Energy Information Administration (“EIA”), global oil consumption averaged 103.4 million barrels per day ("mbpd") in the fourth quarter of 2024, an increase of 1.0 mbpd

compared to the same period last year. India was the largest contributor and is expected to be the leading source of growth in global oil consumption over the next year.

Global oil supply increased by 0.6 mbpd during the fourth quarter, averaging 103.4 mbpd. The growth was led by non-OPEC countries as the supply cut strategy of The Organization of the

Petroleum Exporting Countries' (“OPEC”) continues to be in effect. Global oil supply and consumption is now seemingly balanced according to the EIA, and global inventories remained flat during 2024. Global supply is expected to outpace demand in 2025,

and global oil inventories may increase if OPEC+ starts their planned unwinding of cuts in April.

The global tanker fleet continues to age as vessels continue to trade sanctioned crude despite the efforts of the U.S., E.U. and G7. A large part of overall trade employs questionable

actors, with an astonishing 11.3% of the global VLCC, Suezmax and Aframax/LR2 tanker fleets reported to be sanctioned by the U.S. Office of Foreign Asset Control (“OFAC”). The average age of the tanker fleet continues to rise with 17.4% of the

above-mentioned asset classes above 20 years of age, the age above which vessels are normally excluded from oil transportation by compliant actors.

Entering 2025, there has been a material increase in the scope and enforcement of sanctions, as well as the willingness to comply. Early in January this year the Shandong Port Authority

publicly stated that it would not accommodate vessels on the OFAC list; a substantial move of self-sanctioning in what is an important oil import hub to China. Soon thereafter, the OFAC expanded its focus adding more than 170 vessels and companies

suspected to be engaged in sanction-exposed trade to its list. India, another key actor in this respect, followed suit, and, according to industry sources, this has initiated a positive reversal in oil trading patterns as these major importers shift

their focus to compliant oil suppliers, increasing the demand for compliant tonnage. According to industry sources, there is also an increased demand for vessels that are not on the OFAC list, but willing to engage in the trade of Russian crude,

further pulling capacity out of the compliant tanker market. These recent events have the potential to turn the tide on compliant tanker demand, which has been under pressure ever since Russia invaded Ukraine and whilst Iran has had the opportunity to

increase their exports.

The current tanker orderbook for the asset classes owned by Frontline constitutes 18.4% of the existing global fleet, with orders amounting to 87 VLCCs, 97 Suezmax tankers, and 176 LR2

tankers. Most of the growth in the orderbooks is attributed to deliveries scheduled in 2026 and 2027, meaning the growth of the global fleet will remain modest in 2025. Due to the general age profile of the current fleet, the orderbook is not expected

to significantly impact the overall outlook of the tanker fleet in the near term.

As of December 31, 2024, the Company’s fleet consisted of 81 vessels owned by the Company (41 VLCCs, 22 Suezmax tankers, 18 LR2/Aframax tankers), with an aggregate capacity of

approximately 17.8 million DWT. As of December 31, 2024, all but one vessel in the Company's fleet were Eco vessels and 45 were scrubber-fitted vessels with a total average age of 6.6 years, making it one of the youngest and most energy-efficient

fleets in the industry.

As of December 31, 2024, six of the Company’s vessels (1 VLCC, 1 Suezmax tanker, 4 LR2/Aframax tankers) were on time charter-out contracts with initial periods in excess of 12 months.

In January 2024, the Company announced that it had entered into an agreement to sell its five oldest VLCCs, built in 2009 and 2010, for an aggregate net sale price of $290.0 million.

Three of the vessels were delivered to the new owner during the first quarter of 2024, and the two remaining vessels were delivered in the second quarter of 2024. After repayment of existing debt on the five vessels, the transaction generated net cash

proceeds of $208.0 million. The Company recorded a gain of $42.7 million in the first quarter of 2024 in relation to the three vessels delivered in the period and recorded a gain of $25.9 million in the second quarter of 2024 in relation to the

delivery of the remaining two vessels.

In January 2024, the Company entered into an agreement to sell one of its oldest Suezmax tankers, built in 2010, for a net sale price of $45.0 million. The vessel was delivered to the

new owner during the second quarter of 2024. After repayment of existing debt on the vessel, the transaction generated net cash proceeds of $32.0 million, and the Company recorded a gain of $11.8 million in the second quarter of 2024.

In March 2024, the Company entered into an agreement to sell another one of its oldest Suezmax tankers, built in 2010, for a net sale price of $46.9 million. The vessel was delivered to

the new owner during the second quarter of 2024. After repayment of existing debt on the vessel, the transaction generated net cash proceeds of $34.0 million, and the Company recorded a gain of $13.8 million in the second quarter of 2024.

In June 2024, the Company entered into an agreement to sell its oldest Suezmax tanker, built in 2010, for a net sale price of $48.5 million. The vessel was delivered to the new owner in

October 2024. After repayment of existing debt on the vessel, the transaction generated net cash proceeds of $36.5 million, and the Company recorded a gain of $17.9 million in the fourth quarter of 2024.

In March 2024, the Company entered into a fixed rate time charter-out contract for one VLCC to a third party on a

three-year time charter at a daily base rate of $51,500. The charter commenced in the third quarter of 2024.

In April 2024, the Company entered into a time charter-out contract for one Suezmax tanker to a third party on a three-year time charter at a daily base rate of $32,950 plus 50% profit

share.

In June 2024, the Company attended an introductory hearing before the Enterprise Court in Antwerp, Belgium, in response to a summons received from certain funds managed by FourWorld

Capital Management LLC (“FourWorld”) in connection with their claims pertaining to the integrated solution for the strategic and structural deadlock within Euronav NV ("Euronav") announced on October 9, 2023, and Euronav’s acquisition of CMB.TECH NV.

FourWorld claims that the transactions should be rescinded and in addition has requested the court to order Compagnie Maritime Belge NV and Frontline to pay damages in an amount to be determined during the course of the proceedings. A procedural

calendar has been agreed and the case is scheduled for oral court pleadings in May 2026, after which a judgment will be rendered. The Company finds the claims to be without merit and intends to vigorously defend against them.

The Board of Directors declared a dividend of $0.20 per share for the fourth quarter of 2024. The record date for the dividend will be March 14, 2025, the ex-dividend date is expected

to be March 14, 2025, for shares listed on the New York Stock Exchange and March 13, 2025, for shares listed on the Oslo Stock Exchange, and the dividend is scheduled to be paid on or about March 31, 2025.

The Company had 222,622,889 ordinary shares outstanding as of December 31, 2024. The weighted average number of shares outstanding for the purpose of calculating basic and diluted

earnings per share for the fourth quarter of 2024 was 222,622,889.

In October 2024, the Company entered into a sale-and-leaseback agreement in an amount of up to $512.1 million with CMB Financial Leasing Co., Ltd to refinance an existing

sale-and-leaseback agreement for 10 Suezmax tankers. The lease financing has a tenor of 10 years, carries an interest rate of SOFR plus a margin of 180 basis points and has an amortization profile of 20.6 years commencing on the delivery date from the

yard and includes purchase options for Frontline throughout the term of the agreement. In the fourth quarter of 2024, the Company fully drew down the $512.1 million under the facility. The refinancing generated net cash proceeds of $101.0 million in

the fourth quarter of 2024.

In October 2024, the Company repaid the remaining $75.0 million outstanding under the $275.0 million senior unsecured revolving credit facility with an affiliate of Hemen. Up to $275.0

million remains available to be drawn following the repayment.

In February 2025, the Company entered into a senior secured credit facility in an amount of up to $119.7 million with ING and First Citizens to refinance outstanding debt on two VLCCs

and, in addition, to provide revolving credit capacity in an amount of up to $51.6 million. The new facility has a tenor of five years, carries an interest rate of SOFR plus a margin of 165 basis points and has an amortization profile of 18 years

commencing on the delivery date from the yard.

In February 2025, the Company entered into a senior secured credit facility in an amount of up to $72.3 million with Crédit Agricole to refinance outstanding debt on a VLCC and, in

addition, to provide revolving credit capacity in an amount of up to $25.4 million. The new facility has a tenor of five years, carries an interest rate of SOFR plus a margin of 170 basis points and has an amortization profile of 18 years commencing on

the delivery date from the yard.

In February 2025, the Company entered into a senior secured credit facility in an amount of up to $47.0 million with SEB to refinance outstanding debt on one Suezmax tanker and, in

addition, to provide revolving credit capacity in an amount of up to $14.9 million. The new facility has a tenor of five years, carries an interest rate of SOFR plus a margin of 170 basis points and has an amortization profile of 20 years commencing on

the delivery date from the yard.

Conference Call and Webcast

On February 28, 2025, at 9:00 A.M. ET (3:00 P.M. CET), the Company's management will host a conference call to discuss the results.

Presentation materials and a webcast of the conference call may be accessed on the Company’s website, www.frontlineplc.cy, under the ‘Webcast’ link. The link can also be accessed here.

Telephone conference:

Participants are required to register in advance of the conference using the link provided below. Upon registering, each participant will be provided with Participant Dial In Numbers,

and a unique Personal PIN.

In the 10 minutes prior to call start time, participants will need to use the conference access information provided in the e-mail received at the point of registering. Participants may

also use the call me feature instead of dialing the nearest dial in number.

Online Registration to the call may be accessed via the following link:

Online registration

A replay of the conference call will be available following the live call. Please use below link to access the webcast:

Replay of conference call

None of the information contained in or that forms a part of the Company’s conference calls, website or audio webcasts is incorporated into or forms part of this release.

Forward-Looking Statements

Matters discussed in this report may constitute forward-looking statements. The Private Securities Litigation Reform Act of 1995 provides safe harbor protections for forward-looking

statements, which include statements concerning plans, objectives, goals, strategies, future events or performance, and underlying assumptions and other statements, which are other than statements of historical facts.

Frontline plc and its subsidiaries, or the Company, desires to take advantage of the safe harbor provisions of the Private Securities Litigation Reform Act of 1995 and is including this

cautionary statement in connection with this safe harbor legislation. This report and any other written or oral statements made by us or on our behalf may include forward-looking statements, which reflect our current views with respect to future events

and financial performance and are not intended to give any assurance as to future results. When used in this document, the words "believe," "anticipate," "intend," "estimate," "forecast," "project," "plan," "potential," "will," "may," "should,"

"expect" and similar expressions, terms or phrases may identify forward-looking statements.

The forward-looking statements in this report are based upon various assumptions, including without limitation, management's examination of historical operating trends, data contained

in our records and data available from third parties. Although we believe that these assumptions were reasonable when made, because these assumptions are inherently subject to significant uncertainties and contingencies which are difficult or

impossible to predict and are beyond our control, we cannot assure you that we will achieve or accomplish these expectations, beliefs or projections. We undertake no obligation to update any forward-looking statements, whether as a result of new

information, future events or otherwise.

In addition to these important factors and matters discussed elsewhere herein, important factors that, in our view, could cause actual results to differ materially from those discussed

in the forward-looking statements include:

|

•

|

the strength of world economies;

|

|

•

|

fluctuations in currencies and interest rates, including inflationary pressures and central bank policies intended to combat overall inflation and rising interest rates and

foreign exchange rates;

|

|

•

|

the impact that any discontinuance, modification or other reform or the establishment of alternative reference rates have on the Company’s floating interest rate debt

instruments;

|

|

•

|

general market conditions, including fluctuations in charter hire rates and vessel values;

|

|

•

|

changes in the supply and demand for vessels comparable to ours and the number of newbuildings under construction;

|

|

•

|

the highly cyclical nature of the industry that we operate in;

|

|

•

|

the loss of a large customer or significant business relationship;

|

|

•

|

changes in worldwide oil production and consumption and storage;

|

|

•

|

changes in the Company's operating expenses, including bunker prices, dry docking, crew costs and insurance costs;

|

|

•

|

planned, pending or recent acquisitions, business strategy and expected capital spending or operating expenses, including dry docking, surveys and upgrades;

|

|

•

|

risks associated with any future vessel construction;

|

|

•

|

our expectations regarding the availability of vessel acquisitions and our ability to complete vessel acquisition transactions as planned;

|

|

•

|

our ability to successfully compete for and enter into new time charters or other employment arrangements for our existing vessels after our current time charters expire and our

ability to earn income in the spot market;

|

|

•

|

availability of financing and refinancing, our ability to obtain financing and comply with the restrictions and other covenants in our financing arrangements;

|

|

•

|

availability of skilled crew members and other employees and the related labor costs;

|

|

•

|

work stoppages or other labor disruptions by our employees or the employees of other companies in related industries;

|

|

•

|

compliance with governmental, tax, environmental and safety regulation, any non-compliance with U.S. or European Union regulations;

|

|

•

|

the impact of increasing scrutiny and changing expectations from investors, lenders and other market participants with respect to our ESG policies;

|

|

•

|

Foreign Corrupt Practices Act of 1977 or other applicable regulations relating to bribery;

|

|

•

|

general economic conditions and conditions in the oil industry;

|

|

•

|

effects of new products and new technology in our industry, including the potential for technological innovation to reduce the value of our vessels and charter income derived

therefrom;

|

|

•

|

new environmental regulations and restrictions, whether at a global level stipulated by the International Maritime Organization, and/or imposed by regional or national

authorities such as the European Union or individual countries;

|

|

•

|

vessel breakdowns and instances of off-hire;

|

|

•

|

the impact of an interruption in or failure of our information technology and communications systems, including the impact of cyber-attacks upon our ability to operate;

|

|

•

|

potential conflicts of interest involving members of our Board of Directors and senior management;

|

|

•

|

the failure of counter parties to fully perform their contracts with us;

|

|

•

|

changes in credit risk with respect to our counterparties on contracts;

|

|

•

|

our dependence on key personnel and our ability to attract, retain and motivate key employees;

|

|

•

|

adequacy of insurance coverage;

|

|

•

|

our ability to obtain indemnities from customers;

|

|

•

|

changes in laws, treaties or regulations;

|

|

•

|

the volatility of the price of our ordinary shares;

|

|

•

|

our incorporation under the laws of Cyprus and the different rights to relief that may be available compared to other countries, including the United States;

|

|

•

|

changes in governmental rules and regulations or actions taken by regulatory authorities;

|

|

•

|

government requisition of our vessels during a period of war or emergency;

|

|

•

|

potential liability from pending or future litigation and potential costs due to environmental damage and vessel collisions;

|

|

•

|

the arrest of our vessels by maritime claimants;

|

|

•

|

general domestic and international political conditions or events, including “trade wars”;

|

|

•

|

any further changes in U.S. trade policy that could trigger retaliatory actions by the affected countries;

|

|

•

|

potential disruption of shipping routes due to accidents, environmental factors, political events, public health threats, international hostilities including the ongoing

conflict between Russia and Ukraine, the conflict between Israel and Hamas and related conflicts in the Middle East, the Houthi attacks in the Red Sea and the Gulf of Aden, acts by terrorists or acts of piracy on ocean-going vessels;

|

|

•

|

the impact of the U.S. presidential and congressional election results affecting the economy, future government laws and regulations, trade policy matters, such as the

imposition of tariffs, the amendment, termination or any other material change to a relationship governed by a treaty and other import restrictions;

|

|

•

|

the length and severity of epidemics and pandemics and their impacts on the demand for seaborne transportation of crude oil and refined products;

|

|

•

|

the impact of port or canal congestion;

|

|

•

|

business disruptions due to adverse weather, natural disasters or other disasters outside our control; and

|

|

•

|

other important factors described from time to time in the reports filed by the Company with the Securities and Exchange Commission.

|

We caution readers of this report not to place undue reliance on these forward-looking statements, which speak only as of their dates. These forward-looking statements are no guarantee

of our future performance, and actual results and future developments may vary materially from those projected in the forward-looking statements.

The Board of Directors

Frontline plc

Limassol, Cyprus

February 27, 2025

Ola Lorentzon - Chairman and Director

John Fredriksen - Director

James O'Shaughnessy - Director

Steen Jakobsen - Director

Cato Stonex - Director

Ørjan Svanevik - Director

Dr. Maria Papakokkinou - Director

Questions should be directed to:

Lars H. Barstad: Chief Executive Officer, Frontline Management AS

+47 23 11 40 00

Inger M. Klemp: Chief Financial Officer, Frontline Management AS

+47 23 11 40 00

INTERIM FINANCIAL INFORMATION

FOURTH QUARTER 2024

Index

CONDENSED CONSOLIDATED STATEMENTS OF PROFIT OR LOSS (UNAUDITED)

CONDENSED CONSOLIDATED STATEMENTS OF COMPREHENSIVE INCOME (UNAUDITED)

CONDENSED CONSOLIDATED STATEMENTS OF FINANCIAL POSITION (UNAUDITED)

CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS (UNAUDITED)

CONDENSED CONSOLIDATED STATEMENTS OF CHANGES IN EQUITY (UNAUDITED)

FRONTLINE PLC CONDENSED CONSOLIDATED FINANCIAL STATEMENTS (UNAUDITED)

|

2023

Oct-Dec

|

2024

Oct-Dec

|

CONDENSED CONSOLIDATED STATEMENTS OF PROFIT OR LOSS

(in thousands of $, except per share data)

|

2024

Jan-Dec

|

2023

Jan-Dec

|

|

415,004

|

425,644

|

Revenues

|

2,050,385

|

1,802,184

|

|

—

|

17,847

|

Other operating income

|

112,121

|

24,080

|

|

415,004

|

443,491

|

Total revenues and other operating income

|

2,162,506

|

1,826,264

|

| |

|

|

|

|

|

158,107

|

173,466

|

Voyage expenses and commission

|

773,434

|

618,595

|

|

44,941

|

55,452

|

Ship operating expenses

|

232,243

|

176,533

|

|

13,891

|

1,709

|

Administrative expenses

|

36,086

|

53,528

|

|

60,018

|

83,148

|

Depreciation

|

339,030

|

230,942

|

|

276,957

|

313,775

|

Total operating expenses

|

1,380,793

|

1,079,598

|

|

138,047

|

129,716

|

Net operating income

|

781,713

|

746,666

|

| |

|

|

|

|

|

6,537

|

4,170

|

Finance income

|

17,098

|

18,065

|

|

(55,419)

|

(67,893)

|

Finance expense

|

(295,088)

|

(171,336)

|

|

29,074

|

(1,403)

|

Gain (loss) on marketable securities

|

(3,405)

|

22,989

|

|

118

|

279

|

Share of results of associated companies

|

(599)

|

3,383

|

|

240

|

1,650

|

Dividends received

|

3,535

|

36,852

|

|

118,597

|

66,519

|

Profit before income taxes

|

503,254

|

656,619

|

|

(226)

|

214

|

Income tax benefit (expense)

|

(7,671)

|

(205)

|

|

118,371

|

66,733

|

Profit for the period

|

495,583

|

656,414

|

|

$0.53

|

$0.30

|

Basic and diluted earnings per share

|

$2.23

|

$2.95

|

|

|

|

|

|

|

|

2023

Oct-Dec

|

2024

Oct-Dec

|

CONDENSED CONSOLIDATED STATEMENTS OF COMPREHENSIVE INCOME

(in thousands of $)

|

2024

Jan-Dec

|

2023

Jan-Dec

|

| |

|

|

|

|

|

118,371

|

66,733

|

Profit for the period

|

495,583

|

656,414

|

| |

|

|

|

|

| |

|

Items that may be reclassified to profit or loss:

|

|

|

|

(117)

|

1,172

|

Foreign currency exchange gain (loss)

|

1,367

|

(39)

|

|

(117)

|

1,172

|

Other comprehensive income (loss)

|

1,367

|

(39)

|

|

118,254

|

67,905

|

Comprehensive income

|

496,950

|

656,375

|

FRONTLINE PLC CONDENSED CONSOLIDATED FINANCIAL STATEMENTS (UNAUDITED)

|

CONDENSED CONSOLIDATED STATEMENTS OF FINANCIAL POSITION

(in thousands of $)

|

Dec 31

2024

|

Dec 31

2023

|

|

ASSETS

|

|

|

|

Current assets

|

|

|

|

Cash and cash equivalents

|

413,532

|

308,322

|

|

Marketable securities

|

4,027

|

7,432

|

|

Other current assets

|

408,454

|

412,172

|

|

Total current assets

|

826,013

|

727,926

|

| |

|

|

|

Non-current assets

|

|

|

|

Vessels and equipment

|

5,246,697

|

4,633,169

|

|

Right-of-use assets

|

1,435

|

2,236

|

|

Goodwill

|

112,452

|

112,452

|

|

Investment in associated company

|

11,788

|

12,386

|

|

Prepaid consideration

|

—

|

349,151

|

|

Other non-current assets

|

22,422

|

45,446

|

|

Total non-current assets

|

5,394,794

|

5,154,840

|

|

Total assets

|

6,220,807

|

5,882,766

|

| |

|

|

|

LIABILITIES AND EQUITY

|

|

|

|

Current liabilities

|

|

|

|

Short-term debt and current portion of long-term debt

|

460,318

|

261,999

|

|

Current portion of obligations under leases

|

1,153

|

1,104

|

|

Other current payables

|

134,182

|

145,951

|

|

Total current liabilities

|

595,653

|

409,054

|

| |

|

|

|

Non-current liabilities

|

|

|

|

Long-term debt

|

3,284,070

|

3,194,464

|

|

Obligations under leases

|

451

|

1,430

|

|

Other non-current payables

|

452

|

472

|

|

Total non-current liabilities

|

3,284,973

|

3,196,366

|

| |

|

|

|

Equity

|

|

|

|

Frontline plc equity

|

2,340,653

|

2,277,818

|

|

Non-controlling interest

|

(472)

|

(472)

|

|

Total equity

|

2,340,181

|

2,277,346

|

|

Total liabilities and equity

|

6,220,807

|

5,882,766

|

FRONTLINE PLC CONDENSED CONSOLIDATED FINANCIAL STATEMENTS (UNAUDITED)

|

2023

Oct-Dec

|

2024

Oct-Dec

|

CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS

(in thousands of $)

|

2024

Jan-Dec

|

2023

Jan-Dec

|

| |

|

OPERATING ACTIVITIES

|

|

|

|

100,494

|

167,848

|

Net cash provided by operating activities

|

736,412

|

856,181

|

| |

|

|

|

|

| |

|

INVESTING ACTIVITIES

|

|

|

|

(1,477,907)

|

(4,321)

|

Additions to newbuildings, vessels and equipment

|

(915,248)

|

(1,631,423)

|

|

—

|

49,500

|

Proceeds from sale of vessels

|

431,850

|

142,740

|

|

—

|

—

|

Cash inflow on repayment of loan to associated company

|

—

|

1,388

|

|

251,839

|

—

|

Proceeds from sale of marketable securities

|

—

|

251,839

|

|

(1,226,068)

|

45,179

|

Net cash provided by (used in) investing activities

|

(483,398)

|

(1,235,456)

|

| |

|

|

|

|

| |

|

FINANCING ACTIVITIES

|

|

|

|

1,350,074

|

512,060

|

Proceeds from issuance of debt

|

2,167,296

|

1,609,449

|

|

(134,544)

|

(556,522)

|

Repayment of debt

|

(1,880,055)

|

(536,587)

|

|

(231)

|

(226)

|

Repayment of obligations under leases

|

(930)

|

(862)

|

|

(66,787)

|

(75,692)

|

Dividends paid

|

(434,115)

|

(638,928)

|

|

1,148,512

|

(120,380)

|

Net cash provided by (used in) financing activities

|

(147,804)

|

433,072

|

| |

|

|

|

|

|

22,938

|

92,647

|

Net change in cash and cash equivalents

|

105,210

|

53,797

|

|

285,384

|

320,885

|

Cash and cash equivalents at start of period

|

308,322

|

254,525

|

|

308,322

|

413,532

|

Cash and cash equivalents at end of period

|

413,532

|

308,322

|

FRONTLINE PLC CONDENSED CONSOLIDATED FINANCIAL STATEMENTS (UNAUDITED)

|

CONDENSED CONSOLIDATED STATEMENTS OF CHANGES IN EQUITY

(in thousands of $ except number of shares)

|

2024

Jan-Dec

|

2023

Jan-Dec

|

| |

|

|

|

NUMBER OF SHARES OUTSTANDING

|

|

|

|

Balance at beginning and end of period

|

222,622,889

|

222,622,889

|

| |

|

|

|

SHARE CAPITAL

|

|

|

|

Balance at beginning and end of period

|

222,623

|

222,623

|

| |

|

|

|

ADDITIONAL PAID IN CAPITAL

|

|

|

|

Balance at beginning and end of period

|

604,687

|

604,687

|

| |

|

|

|

CONTRIBUTED SURPLUS

|

|

|

|

Balance at beginning and end of period

|

1,004,094

|

1,004,094

|

| |

|

|

|

ACCUMULATED OTHER RESERVES

|

|

|

|

Balance at beginning of period

|

415

|

454

|

|

Other comprehensive income (loss)

|

1,367

|

(39)

|

|

Balance at end of period

|

1,782

|

415

|

| |

|

|

|

RETAINED EARNINGS

|

|

|

|

Balance at beginning of period

|

445,999

|

428,513

|

|

Profit for the period

|

495,583

|

656,414

|

|

Cash dividends

|

(434,115)

|

(638,928)

|

|

Balance at end of period

|

507,467

|

445,999

|

| |

|

|

|

EQUITY ATTRIBUTABLE TO THE COMPANY

|

2,340,653

|

2,277,818

|

| |

|

|

|

NON-CONTROLLING INTEREST

|

|

|

|

Balance at beginning and end of period

|

(472)

|

(472)

|

|

TOTAL EQUITY

|

2,340,181

|

2,277,346

|

APPENDIX I - Non-GAAP measures

Reconciliation of Adjusted profit

This press release describes adjusted profit and related per share amounts, which are not measures prepared in accordance with IFRS (“non-GAAP”). We believe the non-GAAP financial

measures provide investors with a means of analyzing and understanding the Company's ongoing operating performance. The non-GAAP financial measures should not be considered in isolation from, as substitutes for, or superior to financial measures

prepared in accordance with IFRS.

|

(in thousands of $)

|

FY 2024

|

Q4 2024

|

Q3 2024

|

Q2 2024

|

Q1 2024

|

FY 2023

|

Q4 2023

|

|

Adjusted profit

|

|

|

|

|

|

|

|

|

Profit

|

495,583

|

66,733

|

60,457

|

187,574

|

180,819

|

656,414

|

118,371

|

|

Add back:

|

|

|

|

|

|

|

|

|

Loss on marketable securities

|

5,493

|

1,403

|

2,817

|

—

|

1,273

|

23,968

|

—

|

|

Share of losses of associated companies

|

2,134

|

—

|

—

|

2,134

|

—

|

1,690

|

—

|

|

Unrealized loss on derivatives (1)

|

16,191

|

—

|

12,806

|

3,385

|

—

|

20,950

|

13,211

|

|

Debt extinguishment losses

|

6,307

|

5,371

|

—

|

—

|

936

|

—

|

—

|

| |

|

|

|

|

|

|

|

|

Less:

|

|

|

|

|

|

|

|

|

Unrealized gain on derivatives (1)

|

(1,493)

|

(678)

|

—

|

—

|

(815)

|

(6,075)

|

—

|

|

Gain on marketable securities

|

(2,088)

|

—

|

—

|

(2,088)

|

—

|

(46,957)

|

(29,074)

|

|

Share of results of associated companies

|

(1,535)

|

(279)

|

(42)

|

—

|

(1,214)

|

(5,073)

|

(118)

|

|

Gain on sale of vessels

|

(112,079)

|

(17,850)

|

—

|

(51,487)

|

(42,742)

|

(21,960)

|

—

|

|

Dividends received

|

(3,535)

|

(1,650)

|

(602)

|

(975)

|

(308)

|

(36,852)

|

(240)

|

|

Debt extinguishment gains

|

(354)

|

—

|

—

|

(354)

|

—

|

—

|

|

|

Synthetic option revaluation gain (2)

|

(7,982)

|

(7,982)

|

—

|

—

|

—

|

—

|

—

|

|

Gain on settlement of insurance and other claims

|

—

|

—

|

—

|

—

|

—

|

(397)

|

—

|

|

Adjusted profit

|

396,642

|

45,068

|

75,436

|

138,189

|

137,949

|

585,708

|

102,150

|

|

(in thousands)

|

|

|

|

|

|

|

|

|

Weighted average number of ordinary shares

|

222,623

|

222,623

|

222,623

|

222,623

|

222,623

|

222,623

|

222,623

|

| |

|

|

|

|

|

|

|

|

(in $)

|

|

|

|

|

|

|

|

|

Adjusted basic and diluted earnings per share

|

1.78

|

0.20

|

0.34

|

0.62

|

0.62

|

2.63

|

0.46

|

(1) Adjusted profit excludes the unrealized gain/loss on derivatives to give effect to the economic benefit/cost provided by our interest rate swap agreements. The components of the

gain/loss on derivatives are as follows:

|

(in thousands of $)

|

FY 2024

|

Q4 2024

|

Q3 2024

|

Q2 2024

|

Q1 2024

|

FY 2023

|

Q4 2023

|

|

Unrealized gain (loss) on derivatives

|

(14,698)

|

678

|

(12,806)

|

(3,385)

|

815

|

(14,875)

|

(13,211)

|

|

Interest income on derivatives

|

23,904

|

5,219

|

6,267

|

6,254

|

6,164

|

22,914

|

6,283

|

|

Gain (loss) on derivatives

|

9,206

|

5,897

|

(6,539)

|

2,869

|

6,979

|

8,039

|

(6,928)

|

(2) The vesting period for the synthetic options granted to employees and board members ended during the fourth quarter of 2024. As there are no ongoing service requirements, adjusted

profit for the fourth quarter of 2024 excludes the gain due to the revaluation of the synthetic option liability in the period. Adjusted profit will exclude any gains/losses due to the revaluation of the liability for the remaining exercisable options

until the expiration of the options in the fourth quarter of 2026.

Reconciliation of Total operating revenues to Time Charter Equivalent and Time Charter Equivalent per day

Consistent with general practice in the shipping industry, we use TCE as a measure to compare revenue generated from a voyage charter to revenue generated from a time charter. We define

TCE as operating revenues less voyage expenses and commission, administrative income, finance lease interest income and other non-vessel related income. Under time charter agreements, voyage costs, such as bunker fuel, canal and port charges and

commissions are borne and paid by the charterer whereas under voyage charter agreements, voyage costs are borne and paid by the owner. TCE is a common shipping industry performance measure used primarily to compare period-to-period changes in a

shipping company’s performance despite changes in the mix of charter types (i.e., spot charters and time charters) under which the vessels may be employed between the periods. Time charter equivalent, a non-GAAP measure, provides additional meaningful

information in conjunction with operating revenues, the most directly comparable IFRS measure, because it assists management in making decisions regarding the deployment and use of our vessels and in evaluating their financial performance, regardless

of whether a vessel has been employed on a time charter or a voyage charter.

|

(in thousands of $)

|

FY 2024

|

Q4 2024

|

Q3 2024

|

Q2 2024

|

Q1 2024

|

FY 2023

|

Q4 2023

|

|

Revenues

|

2,050,385

|

425,644

|

490,318

|

556,026

|

578,397

|

1,802,184

|

415,004

|

| |

|

|

|

|

|

|

|

|

Less

|

|

|

|

|

|

|

|

|

Voyage expenses and commission

|

(773,434)

|

(173,466)

|

(194,985)

|

(197,795)

|

(207,188)

|

(618,595)

|

(158,107)

|

|

Other non-vessel items

|

(7,920)

|

(2,741)

|

(3,113)

|

(575)

|

(1,491)

|

(13,524)

|

(5,625)

|

|

Total TCE

|

1,269,031

|

249,437

|

292,220

|

357,656

|

369,718

|

1,170,065

|

251,272

|

Time charter equivalent per day

The Company recognizes revenues over time, ratably from commencement of cargo loading until completion of discharge of cargo (the "load-to-discharge basis").

Time charter equivalent per day ("TCE rate" or "TCE per day") represents the weighted average daily TCE income of vessels of different sizes in our fleet.

TCE per day is a measure of the average daily income performance. Our method of calculating TCE per day is determined by dividing TCE by on hire days during a reporting period. On hire

days are calculated on a vessel by vessel basis and represent the net of available days and off hire days for each vessel (owned or chartered in) in our possession during a reporting period. Available days for a vessel during a reporting period is the

number of days the vessel (owned or chartered in) is in our possession during the period. By definition, available days for an owned vessel equal the calendar days during a reporting period, unless the vessel is delivered by the yard during the

relevant period whereas available days for a chartered-in vessel equal the tenure in days of the underlying time charter agreement, pro-rated to the relevant reporting period if such tenure overlaps more than one reporting period. Off hire days for a

vessel during a reporting period is the number of days the vessel is in our possession during the period but is not operational as a result of unscheduled repairs, scheduled dry docking or special or intermediate surveys and lay-ups, if any.

| |

FY 2024

|

Q4 2024

|

Q3 2024

|

Q2 2024

|

Q1 2024

|

FY 2023

|

Q4 2023

|

|

Time charter TCE (in thousands of $)

|

|

|

|

|

|

|

|

|

VLCC

|

7,967

|

4,679

|

3,288

|

—

|

—

|

—

|

—

|

|

Suezmax

|

8,697

|

3,052

|

3,079

|

2,566

|

—

|

—

|

—

|

|

LR2

|

56,277

|

13,974

|

14,202

|

14,044

|

14,057

|

45,586

|

14,226

|

|

Total Time charter TCE

|

72,941

|

21,705

|

20,569

|

16,610

|

14,057

|

45,586

|

14,226

|

| |

|

|

|

|

|

|

|

|

Spot TCE (in thousands of $)

|

|

|

|

|

|

|

|

|

VLCCs ex. vessels acquired from Euronav

|

302,880

|

62,705

|

60,317

|

78,889

|

100,969

|

395,514

|

83,511

|

|

VLCCs acquired from Euronav

|

339,888

|

67,849

|

84,381

|

103,393

|

84,265

|

1,054

|

1,054

|

|

VLCCs total

|

642,768

|

130,554

|

144,698

|

182,282

|

185,234

|

396,568

|

84,565

|

|

Suezmax

|

337,496

|

63,655

|

80,805

|

91,493

|

101,543

|

480,346

|

97,382

|

|

LR2

|

215,826

|

33,523

|

46,148

|

67,271

|

68,884

|

247,565

|

55,099

|

|

Total Spot TCE

|

1,196,090

|

227,732

|

271,651

|

341,046

|

355,661

|

1,124,479

|

237,046

|

| |

|

|

|

|

|

|

|

|

Total TCE

|

1,269,031

|

249,437

|

292,220

|

357,656

|

369,718

|

1,170,065

|

251,272

|

| |

|

|

|

|

|

|

|

|

Spot days (available days less off hire days)

|

|

|

|

|

|

|

|

|

VLCCs ex. vessels acquired from Euronav

|

6,295

|

1,466

|

1,472

|

1,493

|

1,864

|

7,869

|

1,975

|

|

VLCCs acquired from Euronav

|

8,518

|

2,169

|

2,179

|

2,180

|

1,990

|

184

|

184

|

|

VLCCs total

|

14,813

|

3,635

|

3,651

|

3,673

|

3,854

|

8,053

|

2,159

|

|

Suezmax

|

8,158

|

1,912

|

2,023

|

2,005

|

2,218

|

9,140

|

2,130

|

|

LR2

|

5,102

|

1,285

|

1,282

|

1,267

|

1,268

|

5,294

|

1,285

|

| |

|

|

|

|

|

|

|

|

Spot TCE per day (in $ per day)

|

|

|

|

|

|

|

|

|

VLCCs ex. vessels acquired from Euronav

|

48,100

|

42,800

|

41,000

|

52,800

|

54,200

|

50,300

|

42,300

|

|

VLCCs acquired from Euronav

|

39,900

|

31,300

|

38,700

|

47,400

|

42,300

|

5,700

|

5,700

|

|

VLCCs total

|

43,400

|

35,900

|

39,600

|

49,600

|

48,100

|

49,200

|

39,200

|

|

Suezmax

|

41,400

|

33,300

|

39,900

|

45,600

|

45,800

|

52,600

|

45,700

|

|

LR2

|

42,300

|

26,100

|

36,000

|

53,100

|

54,300

|

46,800

|

42,900

|

Due to rounding, numbers presented throughout this document may not add up precisely to the totals provided and per day amounts may not precisely reflect the absolute figures.

Estimated average daily cash breakeven rates

The estimated average daily cash breakeven rates are the daily TCE rates our vessels must earn to cover operating expenses including dry docks, repayments of loans, interest on loans,

bareboat hire, time charter hire and net general and administrative expenses for the next 12 months.

Spot TCE currently contracted

Spot TCE currently contracted are provided on a load-to-discharge basis, whereby the Company recognizes revenues over time ratably from commencement of cargo loading until completion of

discharge of cargo. The rates reported are for all contracted days so far in the first quarter and therefore may not be reflective of rates to be earned for the full first quarter. The percentage of the period covered reflects the number of days each

vessel is currently contracted for the first quarter as compared to the total available days in the first quarter. The actual rates to be earned in the first quarter will depend on the number of additional contracted days the Company is able to achieve

and when each vessel commences loading of its cargo. On a load-to-discharge basis, the Company is unable to recognize revenues on ballast days, which are days when a vessel is sailing without cargo. The number of contracted ballast days at the end of

the fourth quarter of 2024 was 1,116 days for VLCCs, 238 days for Suezmax tankers and 174 days for LR2/Aframax tankers.

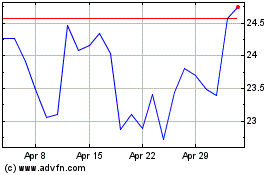

Frontline (NYSE:FRO)

Historical Stock Chart

From Feb 2025 to Mar 2025

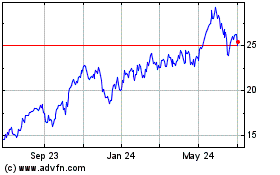

Frontline (NYSE:FRO)

Historical Stock Chart

From Mar 2024 to Mar 2025