Average U.S. FICO Score Holds at 717 Despite Economic Uncertainty

October 09 2024 - 8:00AM

Business Wire

New analysis from global analytics software leader, FICO (NYSE:

FICO), shows that the national average U.S. FICO® Score currently

sits at 717. This is one point lower than a year ago and the same

as when FICO last reported on it earlier this year.

FICO® Scores are used by 90% of the top U.S. lenders and serve

as the trusted, independent benchmark for assessing consumer credit

risk. FICO Scores are dynamic and evolve as shifts in borrower

behavior are reflected in the data maintained by the three primary

U.S. consumer reporting agencies. FICO consistently releases the

average U.S. FICO Score, which serves as an indicator of credit

health for consumers nationwide.

Key factors impacting the average U.S. FICO® Score in

2024:

- Missed payments continue to rise: As of April 2024, just

over 18% of the population had a past-due payment on one or more

credit accounts in the last year. This is up by 5% in relative

terms compared to April 2023.

- Consumer debt continues to trend higher than pre-pandemic

levels: As of April 2024, the average credit card utilization

grew to 35%. This is up by 3% in relative terms compared to April

2023, and by 6% in relative terms compared to April 2020.

- New credit activity continues to slow down: As of April

2024, 44% of the population had opened at least one new credit

account in the prior 12 months. This is down from 45.5% as of April

2023.

“Understanding the average FICO Score is essential for gaining a

comprehensive view of consumer credit health,” said Can Arkali,

senior director of Scores and Predictive Analytics at FICO. “We

remain focused on tracking developing credit risk patterns to

understand how consumers are adjusting to the current economic

landscape. Our latest analysis shows that factors such as high

interest rates and consumer prices are adding pressure to household

finances as evidenced by continued increases in missed borrower

payments and consumer debt levels.”

Full analysis on the average U.S. FICO® Score is available here:

Average U.S. FICO® Score stays at 717 even as consumers are

faced with economic uncertainty.

About FICO

FICO (NYSE: FICO) powers decisions that help people and

businesses around the world prosper. Founded in 1956, the company

is a pioneer in the use of predictive analytics and data science to

improve operational decisions. FICO holds more than 200 US and

foreign patents on technologies that increase profitability,

customer satisfaction and growth for businesses in financial

services, insurance, telecommunications, health care, retail and

many other industries. Using FICO solutions, businesses in more

than 100 countries do everything from protecting 4 billion payment

cards from fraud, to improving financial inclusion, to increasing

supply chain resiliency. The FICO® Score, used by 90% of top US

lenders, is the standard measure of consumer credit risk in the US

and has been made available in over 40 other countries, improving

risk management, credit access and transparency.

Learn more at https://www.fico.com/en.

Join the conversation at https://x.com/FICO_corp &

https://www.fico.com/blogs/

For FICO news and media resources, visit

https://www.fico.com/en/newsroom.

FICO is a registered trademark of Fair Isaac Corporation in the

U.S. and other countries.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20241009477979/en/

Julie Huang press@fico.com

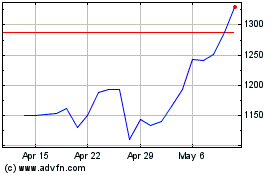

Fair Isaac (NYSE:FICO)

Historical Stock Chart

From Oct 2024 to Nov 2024

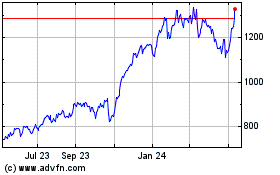

Fair Isaac (NYSE:FICO)

Historical Stock Chart

From Nov 2023 to Nov 2024