FICO and Richard Childress Racing Driver Kyle Busch to Promote Financial Literacy at Busch’s Alma Mater, Durango High School

October 03 2024 - 8:00AM

Business Wire

Busch joins FICO's credit education workshop to

raise awareness of the importance of financial literacy for

teens

Highlights:

- A recent FICO survey finds that more than one in four (28%)

members of Gen Z do not consider themselves financially literate;

significantly higher than Millennials (20%), Gen X (19%), and Baby

Boomers (10%).

- 90% of Gen Z young adults state that their current financial

situation would improve if they had access to more personal finance

resources and education, FICO survey reports.

- FICO offers a free credit education curriculum called Score A

Better Future™ (SABF) Fundamentals that educators can adopt to help

teach their students how to make more informed credit

decisions.

Global analytics software leader FICO will host a full day of

Score A Better Future™ (SABF) Fundamentals free credit education

workshops for students at Durango High School in Las Vegas, Nevada

on October 18. Richard Childress Racing’s No. 8 FICO Chevrolet

driver and two-time NASCAR Champion, Kyle Busch, will visit his

alma mater and participate in a SABF Fundamentals workshop, helping

to inspire students to learn more about finances, credit, and FICO®

Scores. The free educational information provided at the event will

help empower students with the knowledge, tools, and resources to

gain a deeper understanding of personal finance and how to work

toward financial independence.

SABF Fundamentals is designed to bridge the financial literacy

gap in the U.S. A recent Harris Poll survey commissioned by FICO

found that 3 in 5 Americans (60%), including 50% of Gen Z (ages

18-27), believe personal finance is one of the most useful subjects

in adulthood that can be taught in high school. A quarter (25%) of

Gen Z feel a lack of personal finance skills has prevented them

from achieving financial goals over the past 12 months. Many Gen Z

(43%) also believe that banks and financial institutions should be

most responsible for educating people on how to manage their

finances, such as using credit responsibly, managing debt, and

saving for retirement.

“Nearly four in five Americans (79%) think personal finance

skills should be part of the high school curriculum. At FICO, we

are working diligently to partner with schools across the nation to

help equip students with the important financial education tools

and resources they need for adulthood,” said Jenelle Dito,

senior director of Client Services at FICO.

WHO: FICO, Richard Childress Racing, and two-time NASCAR

Champion Kyle Busch

WHY: FICO, Richard Childress Racing, and Busch are

teaming up to raise awareness of the need for financial education

as the essential first step to achieve financial wellness. The

FICO® Score is used by 90% of top U.S. lenders who extend credit

for personal loans, mortgages, auto loans, credit cards and more,

which is why it is so important for people to know their personal

FICO Scores and what impacts them.

WHEN: October 18, 2024

WHERE: Durango High School - 7100 W Dewey Dr, Las Vegas,

NV 89113

MEDIA CONTACT: To cover the event or for questions in

advance: press@fico.com

Score A Better Future™ Fundamentals

Used by 90% of the top U.S. lenders, FICO® Scores help millions

of people gain access to the credit they need to do things like get

an education and make major purchases. SABF Fundamentals helps

empower students with free financial literacy and the knowledge to

achieve their financial goals.

Educators at all accredited middle and high schools can receive

the SABF Fundamentals curriculum and supporting materials through

the SABF Fundamentals website, which will also provide the

background knowledge and understanding for teachers to successfully

educate students while strengthening their own understanding of

credit.

To learn more about SABF Fundamentals visit

https://www.fico.com/sabf/fundamentals.

About FICO

FICO (NYSE: FICO) powers decisions that help people and

businesses around the world prosper. Founded in 1956, the company

is a pioneer in the use of predictive analytics and data science to

improve operational decisions. FICO holds more than 200 US and

foreign patents on technologies that increase profitability,

customer satisfaction and growth for businesses in financial

services, insurance, telecommunications, health care, retail and

many other industries. Using FICO solutions, businesses in more

than 100 countries do everything from protecting 4 billion payment

cards from fraud, to improving financial inclusion, to increasing

supply chain resiliency. The FICO® Score, used by 90% of top US

lenders, is the standard measure of consumer credit risk in the US

and has been made available in over 40 other countries, improving

risk management, credit access and transparency.

Learn more at https://www.fico.com/en. Join the conversation at

https://twitter.com/FICO_corp & https://www.fico.com/blogs/.

For FICO news and media resources, visit

https://www.fico.com/en/newsroom. FICO and Score A Better Future

are trademarks or registered trademarks of Fair Isaac Corporation

in the U.S. and other countries.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20241003141104/en/

Julie Huang press@fico.com

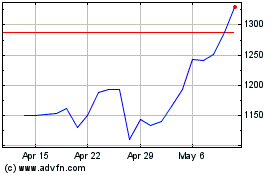

Fair Isaac (NYSE:FICO)

Historical Stock Chart

From Oct 2024 to Nov 2024

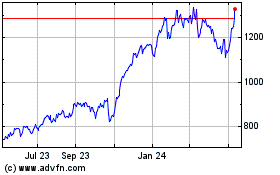

Fair Isaac (NYSE:FICO)

Historical Stock Chart

From Nov 2023 to Nov 2024