FICO Survey: Rising Acceptance of 'Liar Loans' Among Malaysian Consumers

September 25 2024 - 9:00PM

Business Wire

More than a third of Malaysians think it’s OK

to deliberately mislead on personal loans, mortgages, auto and

other applications.

(NYSE: FICO):

This press release features multimedia. View

the full release here:

https://www.businesswire.com/news/home/20240925312996/en/

37% of Malaysians believe it is ok for

people to exaggerate income on a loan application, while 18% think

it is normal for people to do this. (Photo: Business Wire)

Highlights

- More than half of Malaysians (55%) think it’s OK or normal for

people to exaggerate their income on loan applications,

significantly more than the global average of 39%

- More than one in six (18%) of Malaysians believe it’s normal

for people to deliberately misrepresent their income on mortgage

applications

- Falsifying insurance claims is viewed as the most taboo form of

fraud, with close to half (49%) of Malaysian respondents believing

it is not acceptable

Global analytics software leader FICO today shared its latest

global consumer fraud research, revealing alarming attitudes toward

first-party financial fraud both globally and in the Malaysian

market.

Three in five Malaysians think it is normal or acceptable in

some cases to misrepresent their income on applications for a bank

account (66%), automotive financing (64%), or mortgage (59%).

Similarly, many Malaysians are comfortable with exaggerating income

on personal loan applications, further complicating financial

integrity.

About a third (36%) of Malaysian consumers believe it’s never

acceptable to exaggerate income on a personal loan application,

while another third (37%) find it acceptable under specific

conditions. Approximately one in six views exaggerating income on

personal loan, mortgage and auto loan applications as common and

acceptable behaviour.

Globally, attitudes differ notably. The survey reveals that the

majority of consumers (56%) firmly reject the idea of exaggerating

income on loan applications, viewing it as never acceptable. One in

four (24%) consider it permissible in certain circumstances, while

one in seven (15%) view it as a normal practice.

“Malaysian banks are facing the threat of ‘liar loans’ with over

half of Malaysian consumers viewing income falsification as either

acceptable or justified,” said Aashish Sharma,

APAC segment leader for risk lifecycle and decision management

at FICO. “It is crucial for Malaysian consumers to understand

that misrepresenting income, even unintentionally, can lead to

serious consequences.”

More information:

https://www.fico.com/en/latest-thinking/ebook/consumer-survey-2023-digital-banking-customer-preferences-and-fraud-controls

Growing Mortgage Sector at Risk of Application Fraud

The FICO survey reveals that more than two in five (41%)

Malaysian consumers believe it is acceptable under certain

circumstances to lie on mortgage applications, and close to one in

five (18%) view it as normal. With residential mortgages accounting

for 64% of consumer loans in Malaysia (TA Securities), the findings

highlight significant risk assessment challenges and potential bad

loan rates that financial institutions face.

Even when a mortgage application from an existing customer

appears legitimate on paper, the established banking relationship

can be exploited to commit fraud. By exaggerating income, such as

inflating self-employment earnings or overstating bonuses, as well

as omitting debts or misrepresenting personal circumstances,

applicants can manipulate the loan process, making it difficult for

lenders to detect these discrepancies without thorough and

proactive verification measures.

“Financial institutions can overcome the unique challenges

presented by application fraud by leveraging cutting-edge data

analytics for risk assessments,” said Sharma. “This will

provide holistic views of each customer, enabling early detection

of anomalies and signs of sleeper fraud.”

Falsifying Insurance Claims Is Most Taboo

Falsifying insurance claims is viewed as the most taboo form of

fraud, according to FICO’s research, with around two-thirds of

consumers globally believing it is never acceptable to exaggerate

the value of stolen property or add false items to a claim. This

sentiment is echoed by close to half of Malaysian respondents

(49%).

Matching global trends, attitudes shift regarding other

financial products. Half of consumers globally, including more than

a quarter of Malaysians (29%), feel it is unacceptable to

exaggerate income on a mobile phone contract or an application for

automotive financing.

“The FICO survey reveals that cost-of-living pressures on

consumers are potentially shaping views about application fraud,”

noted Sharma. “This is a strong signal to financial

institutions to implement effective fraud prevention strategies to

safeguard their business and customers.”

The survey was conducted in November 2023 by an independent

research company adhering to research industry standards. 1,001

Malaysian adults were surveyed, along with approximately 12,000

other consumers in Canada, U.S., Brazil, Colombia, Mexico, The

Philippines, Indonesia, India, Singapore, Thailand, U.K. and

Spain.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240925312996/en/

Lizzy Li RICE for FICO +65 9034 7768 lizzy.li@ricecomms.com

Saxon Shirley FICO +65 9171 0965 saxonshirley@fico.com

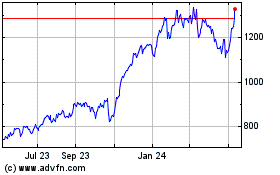

Fair Isaac (NYSE:FICO)

Historical Stock Chart

From Oct 2024 to Nov 2024

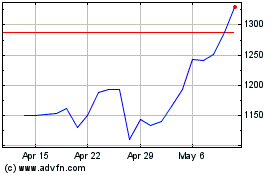

Fair Isaac (NYSE:FICO)

Historical Stock Chart

From Nov 2023 to Nov 2024