Enviva Inc. (NYSE: EVA) (“Enviva,” the “Company,” “we,” “us,” or

“our”) today released financial and operating results for

first-quarter 2023, discussed changes to its capital allocation

priorities in addition to providing a 2023 financial guidance

update, and announced a large, long-term take-or-pay off-take

contract with an existing Japanese customer.

“As we will describe today, the plans and initiatives underway

to improve productivity and costs across Enviva’s current asset

platform continue to fall behind expectations. While the board of

directors remains convinced of management’s ability to deliver the

originally forecasted operational and financial performance over

time, it is clearly taking longer than expected,” said John

Keppler, Executive Chairman of the board. “To more conservatively

underwrite that plan and ensure the ability of the Company to

capture the value of the fully contracted growth ahead, after

careful consideration with management, the board of directors

evaluated the most accretive uses of the Company’s capital and

decided to revise Enviva’s capital allocation framework,

eliminating the Company’s quarterly dividend in order to preserve

liquidity and a conservative leverage profile, maintain our current

growth trajectory, potentially accelerate future investments in new

fully contracted plant and port assets, and implement a limited

share repurchase program.”

With the elimination of the dividend, management expects to

retain approximately $1 billion in incremental cash flow during the

period 2023 to 2026, providing incremental liquidity and investment

into the productivity and operational improvements in its current

assets and further reduce the need to access the capital markets to

fund its current growth plans, which include the construction of

the Company’s fully contracted wood pellet production facilities in

Epes, Alabama (“Epes”) and near Bond, Mississippi (“Bond”).

Under the share repurchase program authorized by the board of

directors (“Board”), the Company can repurchase up to $100 million

in shares of the Company’s common stock opportunistically from time

to time in the open market, or in privately negotiated transactions

at prevailing market prices, or by such other means as will comply

with applicable state and federal securities laws. This is the

Company’s first authorization for share repurchases since its

founding.

President and Chief Executive Officer Thomas Meth commented, “We

recognize this is an important departure from the plan we laid out

at our Investor Day a month ago, but a lot has changed since then.

Compared to our expectations, while our cost position has trended

in the right direction, it has done so at a much slower pace than

we had anticipated, in part due to slower volume growth, and in

part due to a higher spend profile for the volume growth we did

achieve.”

Meth continued, “We know what the specific issues are: contract

labor is too high, discipline around repairs and maintenance spend

is insufficient, wood input costs need to come down further and

stay there, and utilization rates at specific plants need to

improve and stabilize at those improved levels. Because of where we

are in our journey to bend our cost curve down while bending our

production curve up, we feel it is prudent to take a much more

conservative view of what our business can realistically achieve

over the next eight months.”

Meth concluded, “Against this backdrop of operational

challenges, we are undergoing an extensive review of where we are

allocating our capital. We believe we have more accretive capital

allocation alternatives, which start with improving returns from

our existing fleet of assets, growing our fully contracted asset

base, managing liquidity and leverage, and also include the

potential to opportunistically repurchase our shares in the open

market, which we believe have traded below their intrinsic value

for some time.”

The timing of any repurchases under the share repurchase program

will depend on market conditions, capital allocation priorities,

liquidity and leverage positions, and other considerations. The

program may be extended, modified, suspended or discontinued at any

time, and does not obligate the Company to repurchase any dollar

amount or number of shares.

Key Takeaways:

- Delivered volumes of approximately 1.3 million metric tons

(“MT”) during first-quarter 2023; volumes delivered were 20% higher

for first-quarter 2023 compared to first-quarter 2022, but short of

management’s expectations of approximately 1.5 million MT;

delivered at port cost per MT declined by $9 throughout

first-quarter 2023, but remain higher than management’s

expectations

- Reported a net loss of $116.9 million for first-quarter 2023,

as compared to a net loss of $45.3 million for first-quarter 2022,

and reported adjusted EBITDA for first-quarter 2023 of $3.4 million

as compared to $36.6 million for first-quarter 2022

- Updated 2023 financial guidance in light of

weaker-than-expected first-quarter 2023 results and accelerated

improvements related to operating position and production rates.

Enviva updated certain full-year 2023 guidance metrics, including

revising net loss to a range of $186 million to $136 million, and

adjusted EBITDA to a range of $200 million to $250 million

- Changed capital allocation priorities to direct cash flows from

the business to highest-returning opportunities. In order of

management priority: (1) effectively managing liquidity and

leverage, (2) improving operating cost and productivity of current

asset platform, (3) returning capital to stockholders through share

repurchases, and (4) accelerating, when appropriate, investments in

new fully contracted wood pellet production assets

- Announced 10-year take-or-pay off-take contract with existing

Japanese counterparty for deliveries of approximately 300,000

metric tons per year (“MTPY”); contract reflects favorable

long-term pricing environment for wood pellets, and deliveries are

expected to commence in tandem with new capacity coming on

line

“Although the future continues to be incredibly bright for

Enviva’s business, we have had a difficult and disappointing start

to 2023,” said Meth. “Operating cost overages and production

challenges were key drivers behind the first quarter’s poor

performance. While plant production is increasing and we are

reducing our operating cost position, neither improvement is

materializing at the rate we forecasted a few months ago. Based on

results from the first four months of the year, we believe it is

prudent to take a more conservative view on the timing of our

ability to deliver these improvements.”

First-Quarter 2023 Financial Results

Enviva reported certain accretive sales transactions in

first-quarter 2023 to a large European customer with whom we also

have a third-party pellet purchase agreement which resulted in a

deferral of gross margin (the “Deferred Gross Margin Transactions”

or “DGMT”). The cash has been collected in full for the sales, and

the accounting treatment is similar to the DGMT we reported in our

fourth-quarter 2022 financial results. The DGMT transactions in

first-quarter 2023 are with the same customer that gave rise to the

DGMT in fourth-quarter 2022.

The DGMT resulted in a decrease of $29.7 million in net revenue

for first-quarter 2023, with a decrease to both gross margin and

adjusted EBITDA of $4.6 million. Enviva expects the DGMT related to

these sales to have the opposite effect on gross margin and

adjusted EBITDA in 2024 and 2025, increasing gross margin and

adjusted EBITDA over those years.

Reported metric tons sold for first-quarter 2023 were reduced by

0.1 million MT for the tons sold pursuant to the DGMT.

The table below outlines reported first-quarter 2023 results as

well as the DGMT impact:

$ millions, unless noted

1Q23 As Reported

DGMT

1Q23 Excluding DGMT

Impact**

1Q22

Net Revenue

269.1

29.7

298.8

233.0

Net Income (Loss)

(116.9)

45.0

(71.9)

(45.3)

Gross Margin

(20.7)

4.6

(16.1)

(0.3)

Adjusted Gross Margin*

21.3

4.6

25.9

50.7

Adjusted EBITDA*

3.4

4.6

8.0

36.6

Adjusted Gross Margin $/metric ton*

17.93

37.70

19.77

46.27

*Adjusted gross margin, adjusted EBITDA,

and adjusted gross margin per metric ton are non-GAAP financial

measures. For a reconciliation of non-GAAP measures to their most

directly comparable GAAP measure please see the Non-GAAP Financial

Measures section below

**All financial measures presented

excluding the DGMT impact are non-GAAP financial measures; please

see the Non-GAAP Financial Measures section below

Net revenue for first-quarter 2023 was $269.1 million as

compared to $233.0 million for first-quarter 2022. The increase of

approximately 15% year-over-year was primarily driven by

incremental volumes produced and sold, in large part due to

production contributions from Enviva’s newest plant in Lucedale,

Mississippi being fully ramped during first-quarter 2023. Enviva

delivered approximately 20% more volume to customers during

first-quarter 2023 compared to first-quarter 2022. The increase in

net revenue was also bolstered by an uptick in average sales price

per ton as a result of annual price escalators in our contracts as

well as new contracts typically having higher pricing than our

legacy contracts.

Net loss for first-quarter 2023 was $116.9 million as compared

to $45.3 million for first-quarter 2022. Net loss for the first

quarter 2023 included $40.4 million of non-cash interest expense

associated with the DGMT.

Gross margin was $(20.7) million for first-quarter 2023 as

compared to $(0.3) million for first-quarter 2022.

Adjusted gross margin for first-quarter 2023 was $21.3 million

as compared to $50.7 million for first-quarter 2022. The decrease

in adjusted gross margin year-over-year was primarily attributable

to the following factors:

- Customer mix: Approximately $16 million of gross margin was

shifted to the second half of 2023 from first-quarter 2023 as a

result of customer delivery adjustments, whereby more tons were

sold and shipped in the quarter to Japanese customers as a result

of requests from a few of our European customers that were managing

supply chain challenges to delay such shipments to the second half

of 2023. Generally, Japanese contracts currently have slightly

lower sales prices per MT and higher shipping costs than our

European customers to whom these deliveries are scheduled to be

made in the second half of the year

- Repairs and Maintenance and Contract Labor: Approximately $10

million of unplanned repairs and maintenance expenses were incurred

during the quarter, including overages in contract labor

expenses

- Isolated costs: Approximately $5 million of expenses were

incurred during first-quarter 2023 related to third-party

consulting fees associated with plant optimization initiatives and

professional fees

- DGMT: Approximately $4.6 million of gross margin is deferred to

future years due to the accounting for sales related to shipments

delivered to a large European customer with whom we also have a

third-party pellet purchase agreement (associated with the same

customer as in our fourth-quarter 2022 results)

Adjusted gross margin per metric ton (“AGM/MT”) for

first-quarter 2023 was $17.93, as compared to $46.27 for

first-quarter 2022. The year-over-year decrease was driven by the

same factors that impacted adjusted gross margin.

Adjusted EBITDA for first-quarter 2023 was $3.4 million as

compared to $36.6 million for first-quarter 2022. The

year-over-year decrease was driven by the same factors that

impacted adjusted gross margin and from incremental sales, general

and administrative expenses.

Enviva’s liquidity was $634.4 million as of March 31, 2023,

which included cash on hand, including cash generally restricted to

funding a portion of the costs of the acquisition, construction,

equipping, and financing of our Epes and Bond facilities, as well

as availability under our $570.0 million senior secured revolving

credit facility.

2023 Guidance

Enviva continues to advance productivity and cost-reduction

initiatives designed to improve the operating and financial

performance of its fully contracted assets. Notwithstanding a

difficult start to the year, produced tons in first-quarter 2023

increased by 7.7% over first-quarter 2022.

During first-quarter 2023, management was able to reduce the

delivered at port (“DAP”) cost per MT by approximately $9, which

was well below management’s expectations. Management’s execution

plan is now targeting a further $20 reduction in DAP costs by

year-end 2023. Despite the improvements underway, the rate of

productivity increases and cost reduction is slower than

management’s prior expectations for full-year 2023. As a result,

management is reducing its estimates for full-year produced volumes

in 2023 to be approximately 5 million to 5.5 million MT, as

compared to our prior forecast of 5.5 million to 6.0 million MT.

For third-party procured volumes, we now are forecasting these to

be within a range of 500,000 to 1 million MT, as compared to our

prior estimate of 1.0 million to 1.5 million MT, which, net of

contracted tons that have been deferred by customers due to planned

and unplanned outages in power generation facilities, creates a

balance between our wood pellet deliveries and customer demand for

the remainder of the year.

Management continues to expect net revenue per ton to be

approximately $234 per MT for full-year 2023.

Given the impact of the challenging performance of first-quarter

2023, which was approximately $50 million below management’s

expectations for adjusted EBITDA, as well as the impact of the

updated production and cost estimates, Enviva is revising its

full-year 2023 guidance expectations for net loss and adjusted

EBITDA.

$ millions, unless noted

Previous 2023 Guidance

Revised 2023 Guidance

Net Loss

(48) - (18)

(186) - (136)

Adjusted EBITDA*

305 - 335

200 - 250

Dividend per Common Share ($/Share)

3.62

—

Total Capital Expenditures

365 - 415

365 - 415

*For a reconciliation of forward-looking

non-GAAP measures to their most directly comparable GAAP measure,

please see the Non-GAAP Financial Measures section below

Net loss guidance for 2023 is now projected to be a range of

$186 million to $136 million, changed from the prior estimate of a

net loss range of $48 million to $18 million.

Adjusted EBITDA for 2023 is projected to be within a range of

$200 million to $250 million, which is reduced from previously

provided guidance of $305 million to $335 million. Approximately

$30 million of the delta between the previous guidance midpoint of

$320 million and the revised midpoint of $225 million is related to

the weakness in first-quarter 2023 and the remaining $65 million

related to a shift in timing expectations to when productivity and

cost improvements are more fully realized.

Enviva’s quarterly income and cash flow are subject to

seasonality and the mix of customer shipments made, which varies

from period to period. Our business usually experiences higher

seasonality during the first quarter of the year as compared to

subsequent quarters, as colder and wetter winter weather increases

costs of procurement and production at our plants, and we have

experienced this in 2023.

In effort to give more visibility into our 2023 guidance

expectations, we are providing quarterly estimates for net income

(loss) and adjusted EBITDA. The table below outlines quarterly

expectations for net loss and adjusted EBITDA throughout the

remainder of 2023. Adjusted EBITDA is heavily weighted towards the

second half of the year, which is driven by the following

factors:

- Seasonality benefits and productivity improvements related to

production

- Cost reduction programs underway being more fully realized

- Increase in revenue per ton as a result of the majority of

deliveries being related to higher-priced contracts; key drivers

include regular seasonality, annual price escalators being fully

represented, and new higher-priced contracts accounting for an

increasingly larger percentage of shipments

$ millions, unless noted

2Q23 Guidance Ranges

3Q23 Guidance Ranges

4Q23 Guidance Ranges

Net Income ( Loss)

(60) - (50)

(25) - (5)

20 - 40

Adjusted EBITDA*

20 - 30

70 - 90

110 - 130

*For a reconciliation of forward-looking

non-GAAP measures to their most directly comparable GAAP measure,

please see the Non-GAAP Financial Measures section below

Enviva continues to forecast that total capital expenditures

(inclusive of capitalized interest) will range from $365 million to

$415 million for 2023, with investments in the following

projects:

- Greenfield site development and construction projects, ranging

from $295 million to $325 million

- Expansion and optimization of our plants, ranging from $50

million to $70 million

- Maintenance capital for existing asset footprint of

approximately $20 million

Total capital expenditures are expected to be back-end weighted

for 2023.

“Although we are very disappointed in our start to 2023, we are

committed to returning to much better levels of operating cost

control, asset utilization, and productivity,” said Meth. “We

believe in the cost position we have delivered historically and

that the production levels we have demonstrated are achievable on a

reliable, go-forward basis, and look forward to consistently

reporting on our progress.”

“I am also pleased to note that given the strong future

contracted growth we have in hand, the pace of our investment

continues to be on track, and with the changes we have announced

today, we have the opportunity to continue to deliver this growth

with lower risk and limited needs to access the capital markets,”

Meth concluded.

Capital Allocation Framework

The Board has decided to revise Enviva’s capital allocation

framework, eliminating Enviva’s quarterly dividend in order to

maintain conservative leverage, improve the operating cost and

productivity of its current asset platform, implement a share

repurchase program, and where appropriate, to accelerate investment

in new fully contracted plant and port assets.

With the elimination of the dividend, management expects to

retain approximately $1 billion in incremental cash flow during the

period 2023 to 2026. This is expected to provide incremental

liquidity and investment into the productivity and operational

improvements in Enviva’s current assets as well as further reduce

future needs to access the capital markets to fund its current

growth plans, which include the construction of the Company’s fully

contracted wood pellet production facilities, Epes and Bond.

Under the share repurchase program authorized by the Board, the

Company can repurchase up to $100 million in shares of the

Company’s common stock opportunistically from time to time in the

open market, in privately negotiated transactions at prevailing

market prices, or by such other means as will comply with

applicable state and federal securities laws. This is the Company’s

first authorization for share repurchases since its founding, and

is of a lower capital allocation priority compared to maintaining

conservative leverage metrics.

Contracting and Market Update

Enviva’s customers are renewing existing contracts and signing

new contracts in large part due to the urgent need to reduce

lifecycle greenhouse gas emissions from their supply chains and

products while securing reliable, affordable, renewable feedstocks

over the long term. There are limited large-scale alternatives

available for renewable baseload and dispatchable power and heat

generation, and even fewer sustainably sourced feedstocks to

substitute in hard-to-abate carbon-intensive industries.

Additionally, the carbon price environment in the European Union

continues to strengthen, which reinforces the cost-competitiveness

of biomass. Wood pellets are currently the cheapest form of thermal

energy generation in Europe. Enviva’s long-term contracted wood

pellets at $220 to $260 per MT makes biomass generation in the EU

more profitable than conventional generation, especially compared

to delivered liquified natural gas prices. Biomass continues to be

very price competitive, with biomass currently forecasted to be

cheaper than natural gas and coal at all points along forward

curves.

Today, Enviva announced a new 10-year, take-or-pay off-take

contract with an existing investment-grade Japanese customer that

is utilizing biomass in its power generating facilities. Deliveries

of approximately 300,000 MTPY are expected to commence in line with

our new capacity additions. The contract is subject to conditions

precedent.

On average, new long-term off-take contract pricing over the

last 12 months is approximately 20% higher than Enviva’s existing

long-term off-take contracts scheduled to expire over the next 3

years.

Pricing of Enviva’s long-term, take-or-pay off-take contracts is

not generally exposed to, nor predominantly driven by, current

commodity prices, but rather our customers’ longer-term view of

securing a long-term, cost-competitive, and renewable, sustainable

feedstock over timeframes spanning from 5 to more than 20 years,

which may relate to goals of achieving net-zero targets.

As of April 1, 2023, Enviva’s total weighted-average remaining

term of take-or-pay off-take contracts is approximately 14 years,

with a total contracted revenue backlog of approximately $23

billion. This contracted revenue backlog is complemented by a

customer sales pipeline exceeding $50 billion, which includes

contracts in various stages of negotiation. Given the quality and

size of this backlog and of our current customer sales pipeline, we

believe we will be able to support the addition of at least four

new fully contracted wood pellet production plants and several

highly accretive capital-light projects over the next four years.

We expect to construct our new fully-contracted wood pellet

production plants at an approximately 5 times, or better, adjusted

EBITDA project investment multiple.

European Union – Renewable Energy Directive Update

On March 30, 2023, EU negotiators reached an agreement on the

Renewable Energy Directive III (“RED III” or the “Agreement”). We

are pleased to hear that woody biomass will continue to be

recognized as a renewable energy source in the EU.

Although the final language has not yet been released, Enviva

understands that the Agreement does not impose restrictions on

“primary woody biomass,” which will continue to be counted as 100

percent renewable and zero-rated in the EU Emissions Trading System

(EU ETS), provided sustainability criteria are fulfilled. As the

world’s leading producer of sustainably sourced woody biomass,

Enviva is confident it will be able to meet all updated

sustainability criteria, enabling its customers to continue to make

an important contribution to achieving global climate goals.

Importantly, the final Agreement is expected to include:

assurances that electricity-only plants already receiving subsidies

will continue to do so, meaning Enviva’s existing off-take

contracts are not expected to be impacted; continuing availability

of financial support to electricity-only installations where

Bioenergy with Carbon Capture and Storage (BECCS) is used (this is

a pivotal technology for reaching net zero and a key focus for many

of Europe’s power generators); and the availability of financial

support for all other end uses of woody biomass, which should

provide further tailwinds to Enviva’s growth in combined heat and

power, hard-to-abate sectors, and advanced biofuels.

The final language of the Agreement is expected to be released

publicly by the end of May 2023, with the final vote, and formal

endorsement, by the EU Council of Ministers and EU Parliament

expected to be held in the following months, after which RED III

will enter into law and national implementation will begin.

Sustainability Update

Recently, the Enviva Forest Conservation Fund (the “Fund”)

announced the recipients of its 2023 grants. The projects funded

this year aim to conserve an estimated 6,165 acres and protect

ecologically sensitive bottomland hardwood forests in the

Virginia-North Carolina coastal plains.

The Fund has awarded 31 projects totaling more than $3.8 million

in grants over the past eight years, and expects to meet its target

protected acreage approximately two years earlier than planned. An

estimated 36,736 acres will be protected when these projects reach

completion. The forests conserved as a part of the Fund help clean

drinking water, purify the air, buffer structures from storms, and

provide habitat for many species of wildlife, while at the same

time, providing jobs and economic opportunity for rural families

and private landowners.

Asset Update

Construction of Epes is progressing well, and we continue to

expect that the facility will be operational in mid-2024.

We are moving forward with our process to enter into

construction agreements with one or more EPC firms to complete the

engineering, procurement, and construction of Bond and future

similar plants. We have all the necessary permits in hand for our

Bond development, and expect to have a signed EPC agreement in the

second half of 2023.

Given our updated capital allocation framework, we may have the

opportunity to accelerate the build timing of Bond, and move the

in-service date up by approximately six months, thus allowing a

potential in-service date as early as the fourth quarter of

2024.

Our business model of fully contracting plants and expansions

before commencing construction remains unchanged and, given the

strong pace of contracting, we potentially have the option to

accelerate the timing of our next two greenfield developments after

Bond, with potential in-service dates now in late 2025 and late

2026, respectively.

We continue to project that average cost per plant for the next

four greenfield projects (including Epes and Bond) will be

approximately $375 million, and we also expect a five times, or

better, project-level adjusted EBITDA investment multiple, which

implies annual plant-level adjusted EBITDA of $75 million to $90

million, when the production ramp is complete. Our expectation is

that Epes will generate a five times return, with subsequent plants

achieving an even better return, given the higher off-take contract

pricing environment relative to most of our historical long-term

off-take contracts.

First-Quarter and Full-Year 2022 Earnings Call

Details

Enviva will host a webcast and conference call on Thursday, May

4, 2023 at 10:00 a.m. Eastern Time to discuss first-quarter results

and the Company’s outlook. The conference call number for North

American participation is +1 (877) 883-0383, and for international

callers is +1 (412) 902-6506. The passcode is 9953103.

Alternatively, the call can be accessed online through a webcast

link provided on Enviva’s Events & Presentations website page,

located at ir.envivabiomass.com.

About Enviva

Enviva Inc. (NYSE: EVA) is the world’s largest producer of

industrial wood pellets, a renewable and sustainable energy source

produced by aggregating a natural resource, wood fiber, and

processing it into a transportable form, wood pellets. Enviva owns

and operates ten plants with a combined production capacity of

approximately 6.2 million metric tons per year in Virginia, North

Carolina, South Carolina, Georgia, Florida, and Mississippi, and is

constructing its 11th plant in Epes, Alabama. Enviva is planning to

commence construction of its 12th plant, near Bond, Mississippi, in

2023. Enviva sells most of its wood pellets through long-term,

take-or-pay off-take contracts with primarily creditworthy

customers in the United Kingdom, the European Union, and Japan,

helping to accelerate the energy transition and to defossilize

hard-to-abate sectors like steel, cement, lime, chemicals, and

aviation. Enviva exports its wood pellets to global markets through

its deep-water marine terminals at the Port of Chesapeake,

Virginia, the Port of Wilmington, North Carolina, and the Port of

Pascagoula, Mississippi, and from third-party deep-water marine

terminals in Savannah, Georgia, Mobile, Alabama, and Panama City,

Florida.

To learn more about Enviva, please visit our website at

www.envivabiomass.com. Follow Enviva on social media @Enviva.

Financial Statements

ENVIVA INC. AND

SUBSIDIARIES

Condensed Consolidated Balance

Sheets

(In thousands, except par

value and number of shares)

March 31, 2023

December 31, 2022

(Unaudited)

Assets

Current assets:

Cash and cash equivalents

$

5,275

$

3,417

Accounts receivable

128,737

169,847

Other accounts receivable

14,255

8,950

Inventories

185,746

158,884

Short-term customer assets

23,987

21,546

Prepaid expenses and other current

assets

8,499

7,695

Total current assets

366,499

370,339

Property, plant, and equipment, net

1,598,543

1,584,875

Operating lease right-of-use assets

100,764

102,623

Goodwill

103,928

103,928

Long-term restricted cash

216,099

247,660

Long-term customer assets

117,656

118,496

Other long-term assets

41,242

23,519

Total assets

$

2,544,731

$

2,551,440

Liabilities, Mezzanine Equity, and

Shareholders’ Equity

Current liabilities:

Accounts payable

$

24,646

$

37,456

Accrued and other current liabilities

133,395

146,497

Customer liabilities

36,828

75,230

Current portion of interest payable

16,908

32,754

Current portion of long-term debt and

finance lease obligations

15,313

20,993

Deferred revenue

48,972

32,840

Financial liability pursuant to repurchase

accounting

180,954

111,913

Total current liabilities

457,016

457,683

Long-term debt and finance lease

obligations

1,393,076

1,571,766

Long-term operating lease liabilities

113,159

115,294

Deferred tax liabilities, net

2,104

2,107

Long-term deferred revenue

129,689

41,728

Other long-term liabilities

72,177

76,106

Total liabilities

2,167,221

2,264,684

Commitments and contingencies

Mezzanine equity:

Series A convertible preferred stock,

$0.001 par value, 100,000,000 shares authorized, 6,605,671 and none

issued and outstanding as of March 31, 2023 and December 31, 2022,

respectively

248,589

—

Shareholders’ equity:

Common stock, $0.001 par value,

600,000,000 shares authorized, 67,727,662 and 66,966,092 issued and

outstanding as of March 31, 2023 and December 31, 2022,

respectively

68

67

Additional paid-in capital

461,576

502,554

Accumulated deficit

(285,206

)

(168,307

)

Accumulated other comprehensive income

198

197

Total Enviva Inc. shareholders’ equity

176,636

334,511

Noncontrolling interests

(47,715

)

(47,755

)

Total shareholders’ equity

128,921

286,756

Total liabilities, Mezzanine equity, and

shareholders’ equity

$

2,544,731

$

2,551,440

ENVIVA INC. AND

SUBSIDIARIES

Condensed Consolidated

Statements of Operations

(In thousands)

(Unaudited)

Three Months Ended March

31,

2023

2022

Product sales

$

260,248

$

230,912

Other revenue

8,834

2,070

Net revenue

269,082

232,982

Operating costs and expenses:

Cost of goods sold, excluding items

below

253,215

211,036

Loss on disposal of assets

3,629

901

Selling, general, administrative, and

development expenses

30,954

33,691

Depreciation and amortization

34,674

22,559

Total operating costs and expenses

322,472

268,187

Loss from operations

(53,390

)

(35,205

)

Other (expense) income:

Interest expense

(23,393

)

(9,970

)

Interest expense on repurchase

accounting

(40,373

)

—

Total interest expense

(63,766

)

(9,970

)

Other income (expense), net

309

(116

)

Total other expense, net

(63,457

)

(10,086

)

Net loss before income taxes

(116,847

)

(45,291

)

Income tax expense

12

16

Net loss

$

(116,859

)

$

(45,307

)

ENVIVA INC. AND

SUBSIDIARIES

Condensed Consolidated

Statements of Cash Flows

(In thousands)

(Unaudited)

Three Months Ended March

31,

2023

2022

Cash flows from operating activities:

Net loss

$

(116,859

)

$

(45,307

)

Adjustments to reconcile net loss to net

cash provided by (used in) operating activities:

Depreciation and amortization

34,674

22,559

Interest expense pursuant to repurchase

accounting

40,373

—

Amortization of debt issuance costs, debt

premium, and original issue discounts

654

647

Loss on disposal of assets

3,629

901

Non-cash equity-based compensation and

other expense

16,708

10,260

Fair value changes in derivatives

(439

)

(1,485

)

Unrealized loss on foreign currency

transactions, net

113

98

Change in operating assets and

liabilities:

Accounts and other receivables

39,045

26,328

Prepaid expenses and other current and

long-term assets

14,387

(426

)

Inventories

(15,027

)

(7,733

)

Finished goods subject to repurchase

accounting

(27,242

)

—

Derivatives

438

(125

)

Accounts payable, accrued liabilities, and

other current liabilities

(42,012

)

(28,939

)

Deferred revenue

104,094

—

Accrued interest

(15,846

)

(12,451

)

Other long-term liabilities

(4,818

)

(7,250

)

Net cash provided by (used in) operating

activities

31,872

(42,923

)

Cash flows from investing activities:

Purchases of property, plant, and

equipment

(72,194

)

(53,051

)

Payment for acquisition of a business

—

(5,000

)

Net cash used in investing activities

(72,194

)

(58,051

)

Cash flows from financing activities:

Principal payments on senior secured

revolving credit facility, net

(280,000

)

(172,000

)

Proceeds from debt issuance

102,900

—

Principal payments on other long-term debt

and finance lease obligations

(12,089

)

(4,839

)

Cash paid related to debt issuance costs

and deferred offering costs

(1,662

)

(591

)

Support payments received

9,821

—

Proceeds from sale of finished goods

subject to repurchase accounting

14,887

—

Proceeds from issuance of Series A

convertible preferred shares, net

248,583

—

Proceeds from issuance of Enviva Inc.

common shares, net

—

333,615

Cash dividends

(56,556

)

(52,037

)

Payment for withholding tax associated

with Long-Term Incentive Plan vesting

(15,265

)

(16,364

)

Net cash provided by financing

activities

10,619

87,784

Net decrease in cash, cash equivalents,

and restricted cash

(29,703

)

(13,190

)

Cash, cash equivalents, and restricted

cash, beginning of period

251,077

18,518

Cash, cash equivalents, and restricted

cash, end of period

$

221,374

$

5,328

ENVIVA INC. AND

SUBSIDIARIES

Condensed Consolidated

Statements of Cash Flows (continued)

(In thousands)

(Unaudited)

Three Months Ended March

31,

2023

2022

Non-cash investing and financing

activities:

Property, plant, and equipment acquired

included in accounts payable and accrued liabilities

$

(108

)

$

9,534

Supplemental information:

Interest paid, net of capitalized

interest

$

38,899

$

21,612

Non-GAAP Financial Measures

In addition to presenting our financial results in accordance

with accounting principles generally accepted in the United States

(“GAAP”), adjusted net income (loss), adjusted gross margin,

adjusted gross margin per metric ton, and adjusted EBITDA to

measure our financial performance.

Adjusted Net Income (Loss)

We define adjusted net income (loss) as net income (loss)

excluding acquisition and integration costs and other, effects of

COVID-19 and the war in Ukraine, Support Payments, Executive

separation, and early retirement of debt obligation. We believe

that adjusted net income (loss) enhances investors’ ability to

compare the past financial performance of our underlying operations

with our current performance separate from certain items of gain or

loss that we characterize as unrepresentative of our ongoing

operations.

Adjusted Gross Margin and Adjusted Gross Margin per Metric

Ton

We define adjusted gross margin as gross margin excluding loss

on disposal of assets and impairment of assets, non-cash

equity-based compensation and other expense, depreciation and

amortization, changes in unrealized derivative instruments related

to hedged items, acquisition and integration costs and other,

effects of COVID-19 and the war in Ukraine, and Support Payments.

We define adjusted gross margin per metric ton as adjusted gross

margin per metric ton of wood pellets sold. We believe adjusted

gross margin and adjusted gross margin per metric ton are

meaningful measures because they compare our revenue-generating

activities to our cost of goods sold for a view of profitability

and performance on a total-dollar and a per-metric ton basis.

Adjusted gross margin and adjusted gross margin per metric ton

primarily will be affected by our ability to meet targeted

production volumes and to control direct and indirect costs

associated with procurement and delivery of wood fiber to our wood

pellet production plants and our production and distribution of

wood pellets.

Adjusted EBITDA

We define adjusted EBITDA as net income (loss) excluding

depreciation and amortization, total interest expense, income tax

expense (benefit), early retirement of debt obligation, non-cash

equity-based compensation and other expense, loss on disposal of

assets and impairment of assets, changes in unrealized derivative

instruments related to hedged items, acquisition and integration

costs and other, effects of COVID-19 and the war in Ukraine,

Support Payments, and Executive separation. Adjusted EBITDA is a

supplemental measure used by our management and other users of our

financial statements, such as investors, commercial banks, and

research analysts, to assess the financial performance of our

assets without regard to financing methods or capital

structure.

Limitations of Non-GAAP Financial Measures

Adjusted net income (loss), adjusted gross margin, adjusted

gross margin per metric ton, and adjusted EBITDA are not financial

measures presented in accordance with GAAP. We believe that the

presentation of these non-GAAP financial measures provides useful

information to investors in assessing our financial condition and

results of operations. Our non-GAAP financial measures should not

be considered as alternatives to the most directly comparable GAAP

financial measures. Each of these non-GAAP financial measures has

important limitations as an analytical tool because they exclude

some, but not all, items that affect the most directly comparable

GAAP financial measures. You should not consider adjusted net

income (loss), adjusted gross margin, adjusted gross margin per

metric ton, or adjusted EBITDA in isolation or as substitutes for

analysis of our results as reported in accordance with GAAP.

Our definitions of these non-GAAP financial measures may not be

comparable to similarly titled measures of other companies, thereby

diminishing their utility.

The following tables present a reconciliation of adjusted net

loss, adjusted gross margin, adjusted gross margin per metric ton,

and adjusted EBITDA to the most directly comparable GAAP financial

measures, as applicable, for each of the periods indicated.

Three Months Ended March

31,

2023

2022

(in thousands)

Reconciliation of net loss to adjusted net

loss:

Net loss

$

(116,859

)

$

(45,307

)

Acquisition and integration costs and

other

—

10,778

Effects of COVID-19

—

15,189

Effects of the war in Ukraine

—

5,051

Support Payments

2,050

7,849

Adjusted net loss

$

(114,809

)

$

(6,440

)

Three Months Ended March

31,

2023

2022

(in thousands, except per

metric ton)

Reconciliation of gross margin to adjusted

gross margin and adjusted gross margin per metric ton:

Gross margin(1)

$

(20,735

)

$

(261

)

Loss on disposal of assets and impairment

of assets

3,797

901

Non-cash equity-based compensation and

other expense

3,255

734

Depreciation and amortization

32,973

21,306

Changes in unrealized derivative

instruments

(2

)

(1,610

)

Acquisition and integration costs and

other

—

2,801

Effects of COVID-19

—

13,942

Effects of the war in Ukraine

—

5,051

Support Payments

2,050

7,849

Adjusted gross margin

$

21,338

$

50,713

Metric tons sold

1,190

1,096

Adjusted gross margin per metric ton

$

17.93

$

46.27

(1)Gross margin is defined as net revenue

less cost of goods sold (including related depreciation and

amortization and loss on disposal of assets).

Three Months Ended March

31,

2023

2022

(in thousands)

Reconciliation of net loss to adjusted

EBITDA:

Net loss

$

(116,859

)

$

(45,307

)

Add:

Depreciation and amortization

34,674

22,559

Total interest expense

63,766

9,970

Income tax expense

12

16

Non-cash equity-based compensation and

other expense

16,006

11,154

Loss on disposal of assets and impairment

of assets

3,797

901

Changes in unrealized derivative

instruments

(2

)

(1,610

)

Acquisition and integration costs and

other

—

10,778

Effects of COVID-19

—

15,189

Effects of the war in Ukraine

—

5,051

Support Payments

2,050

7,849

Adjusted EBITDA

$

3,444

$

36,550

The following table provides a reconciliation of the estimated

range of adjusted EBITDA to the estimated range of net income

(loss) for Enviva for the quarters ending June 30, 2023, September

30, 2023, and December 31, 2023 (in millions):

Three Months Ending June 30,

2023

Three Months Ending September

30, 2023

Three Months Ending December

31, 2023

Estimated net income (loss)

(60) - (50)

(25) - (5)

20 - 40

Add:

Depreciation and amortization

35

35

35

Interest expense

20

20

20

Interest expense on repurchase

accounting

15

30

25

Income tax expense

—

—

—

Non-cash equity-based compensation

expense

10

10

10

Loss on disposal of assets

—

—

—

Changes in unrealized derivative

instruments

—

—

—

Support Payments

—

—

—

Estimated adjusted EBITDA

20 - 30

70 - 90

110 - 130

The following table provides a reconciliation of the estimated

range of adjusted EBITDA to the estimated range of net income

(loss) for Enviva for the twelve months ending December 31, 2023

(in millions):

Twelve Months Ending December

31, 2023

Estimated net income (loss)

(186) - (136)

Add:

Depreciation and amortization

140

Interest expense

84

Interest expense on repurchase

accounting

110

Income tax expense

0

Non-cash equity-based compensation

expense

46

Loss on disposal of assets

4

Changes in unrealized derivative

instruments

0

Support Payments

2

Estimated adjusted EBITDA

$ 200 - 250

Cautionary Note Concerning Forward-Looking Statements

The information included herein and in any oral statements made

in connection herewith include “forward-looking statements” within

the meaning of Section 27A of the Securities Act of 1933, as

amended, and Section 21E of the Securities Exchange Act of 1934, as

amended. All statements, other than statements of present or

historical fact included herein, regarding Enviva’s strategy,

future operations, financial position, estimated revenues and

losses, projected costs, prospects, plans, and objectives of

management are forward-looking statements. When used herein,

including any oral statements made in connection herewith, the

words “could,” “should,” “will,” “may,” “believe,” “anticipate,”

“intend,” “estimate,” “expect,” “project,” the negative of such

terms, and other similar expressions are intended to identify

forward-looking statements, although not all forward-looking

statements contain such identifying words. These forward-looking

statements are based on management’s current expectations and

assumptions about future events and are based on currently

available information as to the outcome and timing of future

events. Except as otherwise required by applicable law, Enviva

disclaims any duty to revise or update any forward-looking

statements, all of which are expressly qualified by the statements

in this section, to reflect events or circumstances after the date

hereof. Enviva cautions you that these forward-looking statements

are subject to risks and uncertainties, most of which are difficult

to predict and many of which are beyond the control of Enviva.

These risks include, but are not limited to: (i) the volume and

quality of products that we are able to produce or source and sell,

which could be adversely affected by, among other things, operating

or technical difficulties at our wood pellet production plants or

deep-water marine terminals; (ii) the prices at which we are able

to sell or source our products; (iii) our ability to capitalize on

higher spot prices and contract flexibility in the future, which is

subject to fluctuations in pricing and demand; (iv) the possibility

that current market prices may not continue and therefore, in the

future, we may not be able to make spot sales and may need to make

spot purchases at higher prices; (v) our ability to successfully

negotiate, complete, and integrate acquisitions, including the

associated contracts, or to realize the anticipated benefits of

such acquisitions; (vi) failure of our customers, vendors, and

shipping partners to pay or perform their contractual obligations

to us; (vii) our inability to successfully execute our project

development, capacity, expansion, and new facility construction

activities on time and within budget; (viii) the creditworthiness

of our contract counterparties; (ix) the amount of low-cost wood

fiber that we are able to procure and process, which could be

adversely affected by, among other things, disruptions in supply or

operating or financial difficulties suffered by our suppliers; (x)

changes in the price and availability of natural gas, coal, or

other sources of energy; (xi) changes in prevailing economic and

market conditions; (xii) inclement or hazardous environmental

conditions, including extreme precipitation, temperatures, and

flooding; (xiii) fires, explosions, or other accidents; (xiv)

changes in domestic and foreign laws and regulations (or the

interpretation thereof) related to renewable or low-carbon energy,

the forestry products industry, the international shipping

industry, or power, heat, or combined heat and power generators;

(xv) changes in domestic and foreign tax laws and regulations

affecting the taxation of our business and investors; (xvi) changes

in the regulatory treatment of biomass in core and emerging

markets; (xvii) our inability to acquire or maintain necessary

permits or rights for our production, transportation, or

terminaling operations; (xviii) changes in the price and

availability of transportation; (xix) changes in foreign currency

exchange or interest rates, and the failure of our hedging

arrangements to effectively reduce our exposure to related risks;

(xx) risks related to our indebtedness, including the levels and

maturity date of such indebtedness; (xxi) our failure to maintain

effective quality control systems at our wood pellet production

plants and deep-water marine terminals, which could lead to the

rejection of our products by our customers; (xxii) changes in the

quality specifications for our products that are required by our

customers; (xxiii) labor disputes, unionization, or similar

collective actions; (xxiv) our inability to hire, train, or retain

qualified personnel to manage and operate our business and newly

acquired assets; (xxv) the possibility of cyber and malware

attacks; (xxvi) our inability to borrow funds and access capital

markets; (xxvii) viral contagions or pandemic diseases; (xxviii)

changes to our leadership and management team; (xxix) overall

domestic and global political and economic conditions, including

the imposition of tariffs or trade or other economic sanctions,

political instability or armed conflict, including the ongoing

conflict in Ukraine, rising inflation levels and government efforts

to reduce inflation, or a prolonged recession; and (xxx) risks

related to our capital allocation plans and share repurchase

program, including the risk that the share repurchase program could

increase volatility and fail to enhance stockholder value and the

possibility that the share repurchase program may be suspended or

discontinued.

Should one or more of the risks or uncertainties described

herein and in any oral statements made in connection therewith

occur, or should underlying assumptions prove incorrect, actual

results and plans could different materially from those expressed

in any forward-looking statements. Additional information

concerning these and other factors that may impact Enviva’s

expectations and projections can be found in Enviva’s periodic

filings with the SEC. Enviva’s SEC filings are available publicly

on the SEC’s website at www.sec.gov.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20230503006028/en/

Kate Walsh Vice President, Investor Relations

Investor.Relations@envivabiomass.com

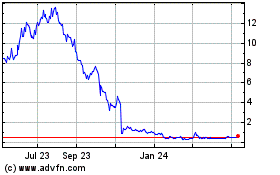

Enviva (NYSE:EVA)

Historical Stock Chart

From Jan 2025 to Feb 2025

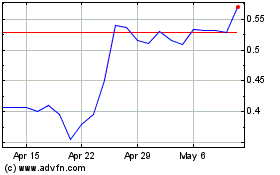

Enviva (NYSE:EVA)

Historical Stock Chart

From Feb 2024 to Feb 2025