0001828536FALSE00018285362024-08-062024-08-06

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the

Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): August 6, 2024

Energy Vault Holdings, Inc.

(Exact name of registrant as specified in its charter)

| | | | | | | | | | | | | | |

| | | | |

| Delaware | | 001-39982 | | 85-3230987 |

(State or other jurisdiction

of incorporation) | | (Commission

File Number) | | (IRS Employer

Identification No.) |

| | | | | | | | |

4360 Park Terrace Drive, Suite 100 Westlake Village, California | | 91361 |

| (Address of principal executive offices) | | (Zip Code) |

Registrant’s telephone number, including area code: (805) 852-0000

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | | | | | | | |

| | | | |

| Title of each class | | Trading symbol | | Name of each exchange

on which registered |

| Common Stock, par value $0.0001 per share | | NRGV | | New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (17 CFR §230.405) or Rule 12b-2 of the Securities Exchange Act of 1934 (17 CFR §240.12b-2).

Emerging growth company ☒

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 2.02 Results of Operations and Financial Condition.

On August 6, 2024, Energy Vault Holdings, Inc. (the “Company”) issued a press release announcing its financial results for the quarter ended June 30, 2024. A copy of the press release is furnished herewith as Exhibit 99.1 and is incorporated herein by reference. The press release contains forward-looking statements regarding the Company, and includes cautionary statements identifying important factors that could cause actual results to differ materially from those anticipated.

The information in this Current Report on Form 8-K and Exhibit 99.1 is being furnished pursuant to Item 2.02 of Form 8-K and shall not be deemed to be “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liabilities of that section, nor shall it be deemed incorporated by reference in any filing made by the Company under the Securities Act of 1933, as amended, or the Exchange Act, except as shall be expressly set forth by specific reference in such a filing.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits

| | | | | | | | | | | |

Exhibit

No. | | Description | |

99.1 | | | |

104 | | Cover Page Interactive Data File (embedded within the inline XBRL document) | |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | | | | |

| ENERGY VAULT HOLDINGS, INC. | |

| | | |

Date: August 6, 2024 | By: | /s/ Michael Beer | |

| | Michael Beer | |

| | Chief Financial Officer | |

Exhibit 99.1

Energy Vault Reports Second Quarter 2024 Financial Results

Announced new 400MWh battery storage project in Australia with ACEN, hired new Head of Global Sales and entered partnership with structural engineering firm Skidmore Owings & Merrill (SOM) to integrate gravity energy storage within superstructure building design

Q2 GAAP Gross margin of 27.8% driven by strong management and execution on U.S. battery projects

Q2 GAAP Net Loss of $(26.2) million; Q2 Adjusted EBITDA improved $2.3 million or 12% year-over-year to $(15.8) million

Q2 GAAP Operating Expenses of $28.1 million; Q2 Adjusted Operating Expenses of $16.9 million, improved 23% year-over-year

Q2 results include a $1.7 million charge associated with previously announced organizational realignment and cost savings measures, expected to result in realized cost savings of $6–8 million annually, including $3-4 million in second half of 2024

Cash and Cash Equivalents of $113.0 million with no debt as of June 30, 2024

Reaffirming full-year 2024 guidance

WESTLAKE VILLAGE, Calif., August 6th, 2024 – Energy Vault Holdings, Inc. (NYSE: NRGV) (“Energy Vault” or “the Company”), a leader in sustainable, grid-scale energy storage solutions, announced financial results for the second quarter ended June 30, 2024.

“We recently outlined a vision for the next two years during our inaugural Investor & Analyst Day to deliver $500–700 million of revenue addressing the largest energy storage markets, while prioritizing our product mix and business model to deliver larger and more predictable cash flow streams,” said Robert Piconi, Chairman and CEO of Energy Vault. “We are executing on that plan with new announcements this past quarter of a 400MWh battery project in Australia as the first of many to come on the continent, continued traction across the portfolio of gravity-related technologies in Europe and the U.S., and progress on our own portfolio of standalone storage projects in California and Texas that we will own and operate. We remain poised to capture this growth given our energy solutions approach in solving customer problems with the best ‘fit for purpose’ technology, while meeting new energy storage requirements being driven by the massive upticks in power demand from generative AI and data center build-outs.”

Second Quarter 2024 Financial Highlights

•Exited second quarter 2024 with a developed pipeline of $2.8 billion and revenue backlog of $264 million, reflecting an increase of approximately 4% and 17%, respectively, compared to May 2024, reflecting new project wins and long-term service agreements

•Revenue of $3.8 million for second quarter 2024, driven by storage projects with U.S. utilities and IPP’s; initial contribution from the recently announced Australian project expected to increase in the second half of 2024 and into 2025

•GAAP gross margin of 27.8% and gross profit of $1.0 million for second quarter 2024, driven by strong commissioning and construction project management, and a favorable mix of higher margin software and service revenue

•Adjusted operating expense of $16.9 million, improved 23% year-over-year, excluding a $1.7 million charge associated with previously announced organizational realignment and cost savings measures,

expected to result in realized cost savings of $6–8 million annually, including $3-4 million in second half of 2024

•GAAP net loss of $(26.2) million during the quarter was flat year-over-year despite the significantly lower revenue recognition due to strong gross margins, cost controls and reduction in operating expenses

•Adjusted EBITDA improved $2.3 million year-over-year, or 12%, to $(15.8) million from $(18.0) million due to lower cash operating expenses

•Total cash and cash equivalents of $113.0 million and no debt on the balance sheet as of June 30, 2024; Restricted cash of $6.1 million as of June 30, 2024 increased modestly from $1.0 million as of March 31, 2024, but remains well below the $35.6 million figure as of December 31, 2023

•The Company reaffirms full-year 2024 guidance for revenue, gross margin, adjusted EBITDA and year-end cash balance along with expectations for quarterly adjusted operating expense of approximately $15 million in the second half of 2024, following cost-side measures implemented in Q4 2023 and the first half of 2024

Operating and Other Highlights

•EPC and O&M contract executed with ACEN Australia for 200MW / 400MWh battery energy storage project in New South Wales

•Commenced commercial operations of 100MW / 200MWh Jupiter Power battery energy storage system in St. Gall, Texas

•Announced 100MW hybrid gravity energy storage project with Carbosulcis S.p.A. to accelerate carbon free Technology Hub at Italy’s largest coal mining site in Sardinia; this unique solution leverages Energy Vault EV0TM gravity technology through a “modular pumped hydro” application

•Exclusive global gravity energy storage partnership formalized with renown architecture firm, Skidmore, Owings & Merrill (SOM) to integrate energy storage into building design

•Implemented strategic decision to own and operate select energy storage projects with high IRR’s to improve margin profile and earnings visibility, leveraging existing capabilities and project expertise; initial projects to include the largest green hydrogen ultra-long duration energy storage system (293MWh) in the U.S. with PG&E in Calistoga, California and the Cross Trails battery storage project (114MWh) in Snyder, Texas

•Hired new Head of Global Sales, Wes Fuller, most recently of Powin, where he delivered on large growth initiatives in North America, building upon prior roles at Sunfolding, Schneider Electric and Siemens; announced organizational realignment initiatives to accelerate growth and market adoption of its diversified portfolio of energy storage solutions across all durations, enhancing and streamlining go-to-market strategy while rapidly expanding regional operations in Australia

Conference Call Information

Energy Vault will host a conference call today, August 6, 2024 at 4:30 PM ET to discuss the results, followed by a Q&A session. A live webcast of the call can be accessed at https://investors.energyvault.com/events-and-presentations/events. To access the call, participants may dial 1-844-826-3033, international callers may use 1-412-317-5185 and request to join the Energy Vault earnings call. A telephonic replay will be available shortly after the conclusion of the call and until August 20, 2024. Participants may access the replay at 1-844-512-2921; international callers may use 1-412-317-6671 and enter access code 10190406. The call will also be available for replay via webcast link on the Investors portion of the Energy Vault website at https://www.energyvault.com/.

About Energy Vault

Energy Vault develops and deploys utility-scale energy storage solutions designed to transform the world's approach to sustainable energy storage. The Company's comprehensive offerings include proprietary gravity-based storage,

battery storage, and green hydrogen energy storage technologies. Each storage solution is supported by the Company’s hardware technology-agnostic energy management system software and integration platform. Unique to the industry, Energy Vault’s innovative technology portfolio delivers customized short-and-long-duration energy storage solutions to help utilities, independent power producers, and large industrial energy users significantly reduce levelized energy costs while maintaining power reliability. Utilizing eco-friendly materials with the ability to integrate waste materials for beneficial reuse, Energy Vault’s gravity-based energy storage technology is facilitating the shift to a circular economy while accelerating the global clean energy transition for its customers. Please visit www.energyvault.com for more information.

Non-GAAP measures

Energy Vault has provided a reconciliation of net loss to adjusted EBITDA, with net loss being the most directly comparable GAAP measure, for the historical periods in this press release. Energy Vault has also provided a reconciliation of reported S&M, R&D and G&A expenses to adjusted S&M expenses, adjusted R&D expenses, and adjusted G&A expenses, respectively, and a reconciliation of reported operating expenses to adjusted operating expenses for the historical periods in this press release. A reconciliation of projected non-GAAP measures for the full-year 2024 has not been provided because certain information necessary to calculate such measures on a GAAP basis is unavailable or dependent on the timing of future events outside of our control. Therefore, because of the uncertainty and variability of the nature of the amount of future adjustments, which could be significant, the Company is unable to provide a reconciliation for these forward-looking non-GAAP measures without unreasonable effort.

Developed pipeline reflects uncontracted, potential revenue, from projects in which potential prospective customers have either awarded a project to the Company, or have put the Company on a shortlist to be awarded a project.

Backlog reflects contracted but unrecognized revenue from projects and services yet to be completed, unrecognized revenue or other income from intellectual property licensing agreements, and unrecognized revenue from tolling arrangements

Forward-Looking Statements

This press release includes forward-looking statements that reflect the Company’s current views with respect to, among other things, the Company’s operations and financial performance. Forward-looking statements include information concerning possible or assumed future results of operations, including descriptions of our business plan and strategies. These statements often include words such as “anticipate,” “expect,” “suggest,” “plan,” “believe,” “intend,” “project,” “forecast,” “estimates,” “targets,” “projections,” “should,” “could,” “would,” “may,” “might,” “will” and other similar expressions. We base these forward-looking statements or projections on our current expectations, plans, and assumptions, which we have made in light of our experience in our industry, as well as our perceptions of historical trends, current conditions, expected future developments and other factors we believe are appropriate under the circumstances at the time. These forward-looking statements are based on our beliefs, assumptions, and expectations of future performance, taking into account the information currently available to us. These forward-looking statements are only predictions based upon our current expectations and projections about future events. These forward-looking statements involve significant risks and uncertainties that could cause our actual results, level of activity, performance or achievements to differ materially from the results, level of activity, performance or achievements expressed or implied by the forward-looking statements, including changes in our strategy, expansion plans, customer opportunities, future operations, future financial position, estimated revenues and losses, projected costs, prospects and plans; the uncertainly of our awards, bookings, backlog and developed pipeline equating to future revenue; the lack of assurance that non-binding letters of intent and other indication of interest can result in binding orders or sales; the possibility of our products to be or alleged to be defective or experience other failures; the implementation, market acceptance and success of our business model and growth strategy; our ability to develop and maintain our brand and reputation; developments and projections relating to our business, our competitors, and industry; the ability of our suppliers to deliver necessary components or raw materials for construction of our energy storage systems in a timely manner; the impact of health epidemics, on our business and the actions we may take in response thereto; our expectations regarding our ability to obtain and maintain intellectual property protection and not infringe on the rights of others; expectations regarding the time during which we will be an emerging growth company under the JOBS Act; our future capital requirements and sources and uses of cash; the international nature of our operations and the impact of war or other hostilities on our business and

global markets; our ability to obtain funding for our operations and future growth; our business, expansion plans and opportunities and other important factors discussed under the caption “Risk Factors” in our Annual Report on Form 10-K for the year ended December 31, 2023 filed with the SEC on March 13, 2024, as such factors may be updated from time to time in its other filings with the SEC, accessible on the SEC’s website at www.sec.gov. New risks emerge from time to time, and it is not possible for our management to predict all risks, nor can we assess the impact of all factors on our business or the extent to which any factor, or combination of factors, may cause actual results to differ materially from those contained in any forward-looking statements we may make. Any forward-looking statement made by us in this press release speaks only as of the date of this press release and is expressly qualified in its entirety by the cautionary statements included in this press release. We undertake no obligation to publicly update or review any forward-looking statement, whether as a result of new information, future developments or otherwise, except as may be required by any applicable laws. You should not place undue reliance on our forward-looking statements.

ENERGY VAULT HOLDINGS, INC.

Condensed Consolidated Balance Sheets

(Unaudited)

(In thousands except par value)

| | | | | | | | | | | |

| June 30,

2024 | | December 31,

2023 |

| Assets | | | |

| Current Assets | | | |

| Cash and cash equivalents | $ | 106,835 | | | $ | 109,923 | |

| Restricted cash | 6,116 | | | 35,632 | |

| Accounts receivable, net | 3,465 | | | 27,189 | |

| Contract assets, net | 33,297 | | | 84,873 | |

| Inventory | 111 | | | 415 | |

| Customer financing receivable, current portion, net | 1,313 | | | 2,625 | |

| Advances to suppliers | 5,388 | | | 8,294 | |

| Prepaid expenses and other current assets | 5,334 | | | 4,520 | |

| Assets held for sale | — | | | 6,111 | |

| Total current assets | 161,859 | | | 279,582 | |

| Property and equipment, net | 62,642 | | | 31,043 | |

| Intangible assets, net | 3,181 | | | 1,786 | |

| Operating lease right-of-use assets | 1,259 | | | 1,700 | |

| Customer financing receivable, long-term portion, net | 7,102 | | | 6,698 | |

| Investments | 17,443 | | | 17,295 | |

| Other assets | 2,117 | | | 2,649 | |

| Total Assets | $ | 255,603 | | | $ | 340,753 | |

Liabilities and Stockholders’ Equity | | | |

| Current Liabilities | | | |

| Accounts payable | $ | 28,553 | | | $ | 21,165 | |

| Accrued expenses | 17,747 | | | 85,042 | |

| Contract liabilities, current portion | 9,880 | | | 4,923 | |

| Lease liabilities, current portion | 286 | | | 724 | |

| Total current liabilities | 56,466 | | | 111,854 | |

| Deferred pension obligation | 1,637 | | | 1,491 | |

| Contract liabilities, long-term portion | — | | | 1,500 | |

| Other long-term liabilities | 1,948 | | | 2,115 | |

| Total liabilities | 60,051 | | | 116,960 | |

| Stockholders’ Equity | | | |

Preferred stock, $0.0001 par value; 5,000 shares authorized, none issued | — | | | — | |

Common stock, $0.0001 par value; 500,000 shares authorized, 150,136 and 146,577 issued and outstanding at June 30, 2024 and December 31, 2023, respectively | 15 | | | 15 | |

| Additional paid-in capital | 492,459 | | | 473,271 | |

| Accumulated deficit | (295,399) | | | (248,072) | |

| Accumulated other comprehensive loss | (1,512) | | | (1,421) | |

| Non-controlling interest | (11) | | | — | |

| Total stockholders’ equity | 195,552 | | | 223,793 | |

| Total Liabilities and Stockholders’ Equity | $ | 255,603 | | | $ | 340,753 | |

ENERGY VAULT HOLDINGS, INC.

Condensed Consolidated Statements of Operations and Comprehensive Loss

(Unaudited)

(In thousands except per share data)

| | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended June 30, | | Six Months Ended June 30, |

| 2024 | | 2023 | | 2024 | | 2023 |

| Revenue | $ | 3,770 | | | $ | 39,680 | | | $ | 11,529 | | | $ | 51,102 | |

| Cost of revenue | 2,721 | | | 35,733 | | | 8,412 | | | 44,736 | |

| Gross profit | 1,049 | | | 3,947 | | | 3,117 | | | 6,366 | |

| Operating expenses: | | | | | | | |

| Sales and marketing | 4,861 | | | 4,852 | | | 9,031 | | | 9,426 | |

| Research and development | 6,951 | | | 10,218 | | | 13,917 | | | 21,396 | |

| General and administrative | 16,278 | | | 17,012 | | | 31,542 | | | 36,412 | |

| Depreciation and amortization | 279 | | | 226 | | | 574 | | | 435 | |

| Asset impairment and loss on sale of assets | 565 | | | — | | | 565 | | | — | |

| Loss from operations | (27,885) | | | (28,361) | | | (52,512) | | | (61,303) | |

| Other income (expense): | | | | | | | |

| | | | | | | |

| Interest expense | (38) | | | — | | | (46) | | | (1) | |

| Interest income | 1,746 | | | 2,295 | | | 3,572 | | | 4,230 | |

| | | | | | | |

| | | | | | | |

| Other income (expense), net | (22) | | | (92) | | | 1,648 | | | (251) | |

| Loss before income taxes | (26,199) | | | (26,158) | | | (47,338) | | | (57,325) | |

| Provision for income taxes | — | | | 4 | | | — | | | 4 | |

| Net loss | (26,199) | | | (26,162) | | | (47,338) | | | (57,329) | |

| Net loss attributable to non-controlling interest | (11) | | | — | | | (11) | | | — | |

| Net loss attributable to Energy Vault Holdings, Inc. | $ | (26,188) | | | $ | (26,162) | | | $ | (47,327) | | | $ | (57,329) | |

| | | | | | | |

| Net loss per share attributable to Energy Vault Holdings, Inc. — basic and diluted | $ | (0.18) | | | $ | (0.18) | | | $ | (0.32) | | | $ | (0.41) | |

| Weighted average shares outstanding — basic and diluted | 149,143 | | | 142,756 | | | 148,081 | | | 141,129 | |

| | | | | | | |

| Other comprehensive income (loss) — net of tax | | | | | | | |

| Actuarial gain (loss) on pension | $ | 3 | | | $ | (218) | | | $ | (228) | | | $ | (54) | |

| Foreign currency translation (loss) gain | (15) | | | 45 | | | 137 | | | 166 | |

| Total other comprehensive (loss) income attributable to Energy Vault Holdings, Inc. | (12) | | | (173) | | | (91) | | | 112 | |

| Total comprehensive loss attributable to Energy Vault Holdings, Inc. | $ | (26,200) | | | $ | (26,335) | | | $ | (47,418) | | | $ | (57,217) | |

ENERGY VAULT HOLDINGS, INC.

Condensed Consolidated Statements of Cash Flows

(Unaudited)

(In thousands)

| | | | | | | | | | | |

| Six Months Ended June 30, |

| 2024 | | 2023 |

| Cash Flows From Operating Activities | | | |

| Net loss | $ | (47,338) | | | $ | (57,329) | |

Adjustments to reconcile net loss to net cash used in operating activities: | | | |

| Depreciation and amortization | 574 | | | 435 | |

| Non-cash interest income | (760) | | | (681) | |

| Stock based compensation | 19,188 | | | 23,809 | |

| Asset impairment and loss on sale of assets | 565 | | | — | |

| | | |

| | | |

| | | |

| Provision for credit losses | 353 | | | 240 | |

| Foreign exchange losses | 107 | | | 258 | |

| Change in operating assets | 75,161 | | | (50,857) | |

| Change in operating liabilities | (59,696) | | | (7,699) | |

| Net cash used in operating activities | (11,846) | | | (91,824) | |

| Cash Flows From Investing Activities | | | |

| Proceeds from sale of property and equipment | 219 | | | — | |

| Purchase of property and equipment | (21,051) | | | (18,817) | |

| | | |

| Purchase of equity securities | — | | | (6,000) | |

| Net cash used in investing activities | (20,832) | | | (24,817) | |

| Cash Flows From Financing Activities | | | |

| Proceeds from exercise of stock options | — | | | 113 | |

| Proceeds from insurance premium financings | 1,670 | | | — | |

| Repayment of insurance premium financings | (819) | | | — | |

| Payment of taxes related to net settlement of equity awards | (297) | | | (4,562) | |

| | | |

| | | |

| Payment of finance lease obligations | (194) | | | (21) | |

| | | |

| | | |

| | | |

| Net cash provided by (used in) financing activities | 360 | | | (4,470) | |

| Effect of exchange rate changes on cash, cash equivalents, and restricted cash | (286) | | | (34) | |

| Net decrease in cash, cash equivalents, and restricted cash | (32,604) | | | (121,145) | |

Cash, cash equivalents, and restricted cash – beginning of the period | 145,555 | | | 286,182 | |

Cash, cash equivalents, and restricted cash – end of the period | 112,951 | | | 165,037 | |

| Less: Restricted cash at end of period | 6,116 | | | 57,988 | |

| Cash and cash equivalents - end of period | $ | 106,835 | | | $ | 107,049 | |

| | | |

| Supplemental Disclosures of Cash Flow Information: | | | |

| Income taxes paid | 51 | | | 46 | |

| Cash paid for interest | 46 | | | 1 | |

| Supplemental Disclosures of Non-Cash Investing and Financing Information: | | | |

| Actuarial loss on pension | (228) | | | (54) | |

| Property, plant and equipment financed through accounts payable | 2,569 | | | 6,108 | |

| Assets acquired on finance lease | 120 | | | — | |

| | | |

Non-GAAP Financial Measures

To complement our condensed consolidated statements of operations, we use non-GAAP financial measures of adjusted selling and marketing (“S&M”) expenses, adjusted research and development (“R&D”) expenses, adjusted general and administrative (“G&A”) expenses, adjusted operating expenses, and adjusted EBITDA. Management believes that these non-GAAP financial measures complement our GAAP amounts and such measures are useful to securities analysts and investors to evaluate our ongoing results of operations when considered alongside our GAAP measures. The presentation of these non-GAAP measures is not meant to be considered in isolation or as an alternative to other measures of financial performance calculated in accordance with GAAP. These non-GAAP measures and their reconciliation to GAAP financial measures are shown below.

The following table provides a reconciliation from GAAP S&M expenses to non-GAAP adjusted S&M expenses (amounts in thousands):

| | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended June 30, | | Six Months Ended June 30, |

| 2024 | | 2023 | | 2024 | | 2023 |

| S&M expenses (GAAP) | $ | 4,861 | | | $ | 4,852 | | | $ | 9,031 | | | $ | 9,426 | |

| Non-GAAP adjustment: | | | | | | | |

| Stock-based compensation expense | 1,782 | | | 1,727 | | | 3,497 | | | 3,676 | |

| Reorganization expenses | 288 | | | — | | | 288 | | | — | |

| Adjusted S&M expenses (non-GAAP) | $ | 2,791 | | | $ | 3,125 | | | $ | 5,246 | | | $ | 5,750 | |

The following table provides a reconciliation from GAAP R&D expenses to non-GAAP adjusted R&D expenses (amounts in thousands):

| | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended June 30, | | Six Months Ended June 30, |

| 2024 | | 2023 | | 2024 | | 2023 |

| R&D expenses (GAAP) | $ | 6,951 | | | $ | 10,218 | | | $ | 13,917 | | | $ | 21,396 | |

| Non-GAAP adjustment: | | | | | | | |

| Stock-based compensation expense | 2,059 | | | 2,785 | | | 4,286 | | | 5,934 | |

| Reorganization expenses | 503 | | | — | | | 503 | | | — | |

| Adjusted R&D expenses (non-GAAP) | $ | 4,389 | | | $ | 7,433 | | | $ | 9,128 | | | $ | 15,462 | |

The following table provides a reconciliation from GAAP G&A expenses to non-GAAP adjusted G&A expenses (amounts in thousands):

| | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended June 30, | | Six Months Ended June 30, |

| 2024 | | 2023 | | 2024 | | 2023 |

| G&A expenses (GAAP) | $ | 16,278 | | | $ | 17,012 | | | $ | 31,542 | | | $ | 36,412 | |

| Non-GAAP adjustment: | | | | | | | |

| Stock-based compensation expense | 5,663 | | | 5,581 | | | 11,405 | | | 14,199 | |

| Reorganization expenses | 918 | | | — | | | 918 | | | — | |

| Adjusted G&A expenses (non-GAAP) | $ | 9,697 | | | $ | 11,431 | | | $ | 19,219 | | | $ | 22,213 | |

The following table provides a reconciliation from GAAP operating expenses to non-GAAP operating expenses (amounts in thousands):

| | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended June 30, | | Six Months Ended June 30, |

| 2024 | | 2023 | | 2024 | | 2023 |

| S&M expenses (GAAP) | $ | 4,861 | | | $ | 4,852 | | | $ | 9,031 | | | $ | 9,426 | |

| R&D expenses (GAAP) | 6,951 | | | 10,218 | | | 13,917 | | | 21,396 | |

| G&A expenses (GAAP) | 16,278 | | | 17,012 | | | 31,542 | | | 36,412 | |

| Operating expenses (GAAP) | 28,090 | | | 32,082 | | | 54,490 | | | 67,234 | |

| Non-GAAP adjustment: | | | | | | | |

| Stock-based compensation expense | 9,504 | | | 10,093 | | | 19,188 | | | 23,809 | |

| Reorganization expenses | 1,709 | | | — | | | 1,709 | | | — | |

| Adjusted operating expenses (non-GAAP) | $ | 16,877 | | | $ | 21,989 | | | $ | 33,593 | | | $ | 43,425 | |

The following table provides a reconciliation from net loss to non-GAAP adjusted EBITDA, with net loss being the most directly comparable GAAP measure (amounts in thousands): | | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended June 30, | | Six Months Ended June 30, |

| 2024 | | 2023 | | 2024 | | 2023 |

| Net loss attributable to Energy Vault Holdings, Inc. (GAAP) | $ | (26,188) | | | $ | (26,162) | | | $ | (47,327) | | | $ | (57,329) | |

| Non-GAAP Adjustments: | | | — | | | — | | | |

| Interest income, net | (1,708) | | | (2,295) | | | (3,526) | | | (4,229) | |

| Provision for income taxes | — | | | 4 | | | — | | | 4 | |

| Depreciation and amortization | 279 | | | 226 | | | 574 | | | 435 | |

| Stock-based compensation expense | 9,504 | | | 10,093 | | | 19,188 | | | 23,809 | |

| Reorganization expenses | 1,709 | | | — | | | 1,709 | | | — | |

| Gain on derecognition of contract liability | — | | | — | | | (1,500) | | | — | |

| | | | | | | |

| | | | | | | |

| Asset impairment and loss on sale of assets | 565 | | | — | | | 565 | | | — | |

| Foreign exchange losses | 47 | | | 88 | | | 107 | | | 258 | |

| | | | | | | |

| Adjusted EBITDA (non-GAAP) | $ | (15,792) | | | $ | (18,046) | | | $ | (30,210) | | | $ | (37,052) | |

We present adjusted EBITDA, which is net loss excluding adjustments that are outlined in the quantitative reconciliation provided above, as a supplemental measure of our performance and because we believe this measure is frequently used by securities analysts, investors, and other interested parties in the evaluation of companies in our industry. The adjusted EBITDA measure excludes the financial impact of items management does not consider in assessing our ongoing operating performance, and thereby facilitates review of our operating performance on a period-to-period basis.

In evaluating adjusted EBITDA, one should be aware that in the future we may incur expenses similar to the adjustments noted above. Our presentation of adjusted EBITDA should not be construed as an inference that our future results will be unaffected by these types of adjustments. Adjusted EBITDA is not a measurement of our financial performance under GAAP and should not be considered as an alternative to net loss, operating loss, or any other performance measures derived in accordance with GAAP or as an alternative to cash flow from operating activities as a measure of our liquidity.

Our adjusted EBITDA measure has limitations as an analytical tool, and should not be considered in isolation or as a substitute for analysis of our results as reported under GAAP. Some of these limitations are:

•it does not reflect our cash expenditures, future requirements for capital expenditures, or contractual commitments;

•it does not reflect changes in, or cash requirements for, our working capital needs;

•it does not reflect stock-based compensation, which is an ongoing expense;

•although depreciation and amortization are non-cash charges, the assets being depreciated and amortized will often have to be replaced in the future, and our adjusted EBITDA measure does not reflect any cash requirements for such replacements;

•it is not adjusted for all non-cash income or expense items that are reflected in our condensed consolidated statements of cash flows;

•it does not reflect the impact of earnings or charges resulting from matters we consider not to be indicative of our ongoing operations;

•it does not reflect limitations on or costs related to transferring earnings from our subsidiaries to us; and

•other companies in our industry may calculate this measure differently than we do, limiting its usefulness as a comparative measure.

Because of these limitations, adjusted EBITDA should not be considered as a measure of discretionary cash available to us to invest in the growth of our business or as a measure of cash that will be available to use to meet our obligations. You should compensate for these limitations by relying primarily on our GAAP results and using adjusted EBITDA only supplementally.

Contacts

Investors:

energyvaultIR@icrinc.com

Media:

media@energyvault.com

v3.24.2.u1

Cover

|

Aug. 06, 2024 |

| Cover [Abstract] |

|

| Document Type |

8-K

|

| Document Period End Date |

Aug. 06, 2024

|

| Entity Registrant Name |

Energy Vault Holdings, Inc.

|

| Entity Incorporation, State or Country Code |

DE

|

| Entity File Number |

001-39982

|

| Entity Tax Identification Number |

85-3230987

|

| Entity Address, Address Line One |

4360 Park Terrace Drive

|

| Entity Address, Address Line Two |

Suite 100

|

| Entity Address, City or Town |

Westlake Village

|

| Entity Address, State or Province |

CA

|

| Entity Address, Postal Zip Code |

91361

|

| City Area Code |

805

|

| Local Phone Number |

852-0000

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Common Stock, par value $0.0001 per share

|

| Trading Symbol |

NRGV

|

| Security Exchange Name |

NYSE

|

| Entity Emerging Growth Company |

true

|

| Entity Ex Transition Period |

false

|

| Entity Central Index Key |

0001828536

|

| Amendment Flag |

false

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

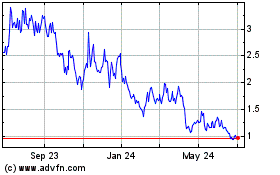

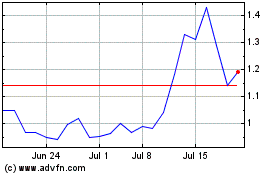

Energy Vault (NYSE:NRGV)

Historical Stock Chart

From Oct 2024 to Nov 2024

Energy Vault (NYSE:NRGV)

Historical Stock Chart

From Nov 2023 to Nov 2024