Report of Foreign Issuer Pursuant to Rule 13a-16 or 15d-16 (6-k)

February 17 2022 - 6:59AM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE

COMMISSION

Washington, D.C. 20549

FORM 6-K

Report of Foreign Private

Issuer

Pursuant to Rule 13a-16 or 15d-16 of the

Securities Exchange Act of

1934

For the month of February

2022

Commission File Number

1-14732

COMPANHIA SIDERÚRGICA

NACIONAL

(Exact name of registrant

as specified in its charter)

National Steel Company

(Translation of registrant’s

name into English)

Av. Brigadeiro Faria Lima

3400, 20th Floor

São Paulo, SP, Brazil

04538-132

(Address of principal executive

office)

Indicate by check mark whether

the registrant files or will file annual reports

under cover Form 20-F or Form 40-F.

Form 20-F ___X___ Form 40-F

_______

Indicate by

check mark whether the registrant by furnishing the information contained in this Form is also thereby furnishing the information to the

Commission pursuant to Rule 12g3-2(b) under the Securities Exchange Act of 1934.

Yes _______ No ___X____

CSN Announces Early Results and Settlement of Cash Tender Offer by CSN

Resources S.A.

São Paulo, February 17, 2022 – Companhia Siderúrgica

Nacional (“CSN”) (NYSE: SID) informs today the early results of the previously announced cash tender offer (the

“Tender Offer”) by its Luxembourg finance subsidiary, CSN Resources S.A. (“CSN Resources”), for

up to US$300.0 million in aggregate principal amount (the “Maximum Tender Amount”) of its outstanding 7.625% Senior

Unsecured Guaranteed Notes due 2026 (the “Notes”). The Notes are fully, unconditionally and irrevocably guaranteed

by CSN. The Tender Offer is being made on the terms and is subject to the conditions set forth in the offer to purchase dated February

3, 2022.

As of 5:00 p.m., New York City time, on February 16, 2022 (the “Early

Tender Date”) tenders received (and not validly withdrawn) exceeded the Maximum Tender Amount. Consequently, CSN Resources will

not accept for purchase any Notes tendered after the Early Tender Date.

As the aggregate principal amount of the Notes validly tendered (and

not validly withdrawn) as of the Early Tender Date exceeded the Maximum Tender Amount, the Notes that will be accepted for purchase by

CSN Resources will be prorated so as to accept the maximum principal amount of the Notes that will not result in the Maximum Tender Amount

being exceeded. CSN Resources will pay for such early tendered Notes on February 17, 2022.

Disclaimer

This press release is for informational purposes only and does not constitute

an offer to purchase or the solicitation of an offer to sell any securities. The tender offer was not made in any jurisdiction in which

the making or acceptance thereof would not be in compliance with the securities, blue sky or other laws of such jurisdiction. In any jurisdiction

where the laws required the tender offer to be made by a licensed broker or dealer, the tender offer was made by the dealer managers on

behalf of CSN Resources. None of CSN Resources, the tender and information agent, the dealer managers or the trustee with respect to the

Notes, nor any of their affiliates, made any recommendation as to whether holders should tender or refrain from tendering all or any portion

of their Notes in response to the tender offer. None of CSN Resources, the tender and information agent, the dealer managers or the trustee

with respect to the Notes, nor any of their affiliates, have authorized any person to give any information or to make any representation

in connection with the tender offer other than the information and representations contained in the offer to purchase relating to the

tender offer.

This press release may contain forward-looking statements within the meaning

of Section 27A of the U.S. Securities Act of 1933 and Section 21E of the U.S. Securities Exchange Act of 1934, as amended, including those

related to the tender offer. Forward-looking information involves important risks and uncertainties that could significantly affect anticipated

results in the future, and, accordingly, such results may differ from those expressed in any forward-looking statements.

COMPANHIA SIDERÚRGICA

NACIONAL

Marcelo Cunha Ribeiro

Chief Financial and Investor

Relations Officer

- 2 -

SIGNATURES

Pursuant to the requirements

of the U.S. Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned,

thereunto duly authorized.

| |

|

|

| February 17, 2022 |

Companhia Siderúrgica Nacional |

| |

By:

|

/s/ Benjamin Steinbruch

Benjamin Steinbruch |

| |

|

Title: |

Chief Executive Officer |

| |

| |

By:

|

/s/ Marcelo Cunha Ribeiro

Marcelo Cunha Ribeiro |

| |

|

Title: |

Chief Financial and Investor Relations Officer |

| |

|

|

|

- 3 -

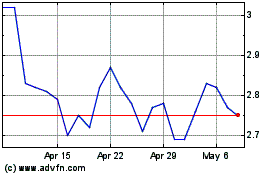

Companhia Siderurgica Na... (NYSE:SID)

Historical Stock Chart

From Nov 2024 to Dec 2024

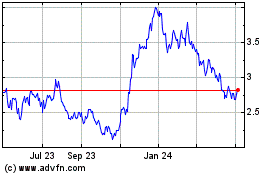

Companhia Siderurgica Na... (NYSE:SID)

Historical Stock Chart

From Dec 2023 to Dec 2024