Good business resilience in a waning

market

Regulatory News:

- Main financial indicators of the

group

- Total revenues: €1,026 million (-0.4%

vs. 2012)

- Housing revenues: €968 million (-3.3%

vs. 2012)

- Gross margin: €197 million vs. €202

million in 2012 (-2.5%)

- Housing gross margin: €189 million vs.

€195 million in 2012 (-3.0%)

- Attributable net income: €41 million

vs. €48 million in 2012 (-14.2%)

- Housing property portfolio: 15,200 lots

(3 years of business)

- Commercial property portfolio: 53,600

sq. m.

- Limited drop in commercial

activities over the entire fiscal year

- Housing orders: -2.0% in volume, -9.6%

in value

- Housing backlog in value: -11.5% (12

months of business)

- Stronger financial flexibility

- Net financial debt: €50 million, a €31

million improvement

- Borrowing power: €241 million (+16.7%

vs. at end 2012)

The Kaufman & Broad S.A. (Paris:KOF) Board of

Directors reviewed the results, which have not yet been audited,

for fiscal year 2013 (December 1, 2012 to November 30, 2013).

It also noted the mutually agreed resignation of Guy Nafilyan

from the office of Chairman of the Board of Directors, which was

announced last June. The Board of Directors expressed its thanks to

Guy Nafilyan for his commitment to serving the company and for

having transformed Kaufman & Broad into a brand that

sets a benchmark in the real estate market in France. It then

appointed Nordine Hachemi, previously General Manager and Deputy

Chairman of the Board of Directors of Kaufman & Broad

S.A., as Chairman.

Commenting on these results, Nordine Hachemi stated: “In fiscal

year 2013, Kaufman & Broad was able to stabilize its

revenues, and its gross margin fell by only 2.5% in a waning

market. At the same time, it continued to make significant progress

in reducing its debt.

Fiscal year 2014 is expected to be a mixed year. The historic

low levels of orders recorded in the market for the past two years

will have an impact on 2014, while the launch of new commercial

programs will be delayed because of municipal elections in

France.

Over the entire fiscal year 2014, Housing revenue is expected to

be substantially comparable to 2013 levels, while the housing gross

margin is expected to drop slightly.

However, in the second half of the year, sales activities could

experience a gradual upturn in orders in volume, reflecting the

imbalance between a continuously sustained demand driven by

demographic growth and a historic shortage of housing production,

which has amplified in recent years. In this context,

Kaufman & Broad is planning to increase its

commercial offer by approximately 15% in 2014.

In support of this policy, Kaufman & Broad will

intensify its growth efforts in two major directions: developing

its property portfolio in all of its business activities and

strengthening its marketing policy with institutional investors and

specifiers.”

- Sales activities

- Housing segment

During all of 2013, housing orders in volume fell 2.0%

(5,379 housing units ordered versus 5,487 in 2012). In value,

orders totaled €990.3 million (including VAT), down 9.6% compared

to 2012. Orders in Île-de-France accounted for 46.1% in volume and

50.6% in value of total housing orders, compared to 45.5% and 46.2%

for all of 2012.

In the fourth quarter of 2013, 1,436 housing units were ordered,

for a 1.6% drop compared to the fourth quarter of 2012. In value,

orders totaled €246.1 million (including VAT) compared to

€317.6 million (including VAT) in the same quarter of 2012, for a

decline of 22.5%, which can be partially attributed to the relative

weighting of the managed accommodation lots.

Apartments

In fiscal year 2013, 5,031 apartments were ordered versus 5,243

in 2012 (a 4.0% drop), which was more noticeable in the Regions

than in Île-de-France. In value, orders amounted to €884.7 million

(including VAT), versus €1,040.3 million (including VAT) in 2012,

for a 15.0% decrease.

As regards apartment orders, 46.1% in volume and 49.6% in value

were made in Île-de-France compared to, respectively, 45.2% and

45.7% in 2012. The apartments share remains the largest in

Kaufman & Broad orders since it reached 82.0% in

value and 93.2% in volume of its total orders compared to,

respectively, 93.7% and 95.6% in 2012.

More specifically, orders for managed accommodations grew 68.8%

in volume and 72.0% in value (851 orders for €74.7 million

(including VAT) in 2013 versus 504 orders for €43.4 million in

2012).

The group is developing a new offer of housing intended for

people seeking an environment in which everything is streamlined

with services and facilities and affordable charges.

Single-family homes in communities

During all of fiscal year 2013, orders for Single-family homes

in communities amounted to 348 units, versus 244 for all of 2012.

The increase of 104 units includes 28 orders in Île-de-France and

76 orders in the Regions.

In value, the orders amounted to €105.6 million (including VAT),

compared to €55.7 million (including VAT) in 2012, for an 89.7%

increase.

Customer base structure

In 2013, the structure of the group’s customer base remained

unchanged. Traditionally catering to homebuyers, almost half of

Kaufman & Broad orders were made by first-time

homebuyers (33%) and second-time homebuyers (14%), which clearly

indicate the reliability of the quality of its programs and

products.

The share of orders intended as investments in rental property

was 34% (including 23% under the “Scellier” and “Duflot”

incentives) versus 33% in 2012. Block orders remained unchanged at

20%.

- Commercial property segment

In the Commercial property segment,

Kaufman & Broad’s strategy is still based on a very

selective choice of projects and the 100% pre-sale principle.

During fiscal year 2013, the group recorded Commercial property

orders in the amount of €87.5 million (including VAT), versus €13.8

million (including VAT) in 2012. This includes the office building

program “YOU”, with a surface area of 9,300 sq. m., located in the

EcoQuartier - Île Seguin - Rives de Seine in Boulogne-Billancourt

(Hauts-de-Seine) and purchased before completion (VEFA) by

Boursorama for its future headquarters.

Moreover, Kaufman & Broad will apply for building

permits for two projects of significant size in Paris, representing

more than 46,000 sq. m. in office space.

- Advanced indicators of sales

activity

As of November 30, 2013, total backlog amounted to €1,018.6

million (excluding VAT), down 9.3% compared to the same period in

2012. The Housing backlog totaled €965.1 million (excluding

VAT), which is equal to 12 months of business.

As of the same date, Kaufman & Broad had 167

housing programs on the market, of which 44 were in Île-de-France

and 124 in the Regions, compared to 163 programs as of November 30,

2012.

The Housing property portfolio represented 15,213 lots, of which

5,401 were in Île-de-France and 9,812 in the Regions, for potential

revenues corresponding to close to three years of business.

The regeneration of the property portfolio is an important

aspect of Kaufman & Broad’s strategy. This

regeneration is done both with respect to quantity and types of

products. It relies on the ability of the group to develop building

complexes of significant size and mixed use (commercial, hotels,

housing, etc.).

Beyond Kaufman & Broad’s leadership in the sales

offices network, its enhanced marketing to private customers,

particularly through the development of the institutional investor

and specifier channels, should enable it to take full advantage of

the strength of the Kaufman & Broad brand.

Over the next 12 months, more than 90 program launches are

planned, representing 6,626 housing units (including 37

launches in Île-de-France representing 2,693 housing units and

54 launches in the Regions representing 3,933 housing

units).

- Financial results

- Business activities

Total revenues in fiscal year 2013 were €1,026.0 million

(excluding VAT) versus €1,030.0 million (excluding VAT) in 2012,

down 0.4%. In the fourth quarter alone, total revenues were €346.6

million (excluding VAT), down 2.2% compared to the fourth quarter

of 2012.

For the entire fiscal year, Housing revenues, which account for

94.3% of total revenues, recorded a drop of 3.3% compared to 2012

to €967.5 million (excluding VAT). Île-de-France’s share of those

revenues was 44.2%, compared to 45.5% in 2012.

Revenues for the Apartment segment were down 5.9%, to 919.3

million (excluding VAT). It represents 95.0% of total revenues for

the Housing business. Revenues for the Single-family homes in

communities segment was €48.2 million (excluding VAT), compared to

€23.9 million (excluding VAT) in 2012.

Revenues for the Commercial property business were €51.2 million

(excluding VAT) compared to €21.1 million (excluding VAT) in 2012.

The Showroom business generated revenues of €6.5 million (excluding

VAT).

- Elements of profitability

Gross margin was €196.8 million, compared to €202.1 million in

2012. As a percentage of revenues, it totaled 19.2%, versus 19.6%

in 2012. The Housing gross margin rate remained unchanged at

19.5%.

In the fourth quarter 2013, gross margin was €66.5 million

versus €71.6 million in the same quarter of 2012.

Current operating expenses amounted to €120.7 million, compared

with €116.9 million in 2012. They represent 11.8% of revenues

versus 11.3% in 2012.

Current operating income totaled €76.0 million for the year

2013, compared to €85.3 million in 2012. In the fourth quarter

alone, it totaled €30.7 million, down 16.6% compared to the same

period in 2012. The current operating margin rate was,

respectively, 7.4% in the entire fiscal year 2013 and 8.9% in the

fourth quarter alone.

The cost of net financial debt amounted to €2.8 million,

compared to €4.1 million in 2012. This improvement may be

explained for the most part by the reduction in average net

financial debt.

Attributable net income totaled €40.8 million, compared to €47.6

million in 2012. In the fourth quarter alone, it was down 13.7% to

€17.1 million.

- Financial structure and

liquidity

Balance sheet elements

Net financial debt was €50.0 million, down 38.4% compared to

November 30, 2012 when it was €81.2 million.

The gearing ratio (net debt to consolidated shareholders’

equity) was 26.6% as of November 30, 2013, compared to 54.5% as of

November 30, 2012, reflecting both the decline in net debt of €31.2

million and the increase in shareholders’ equity of €39.1

million.

Working capital requirements was down 12.2% compared to November

30, 2012 (€126.8 million vs. €144.4 million). It represents 12.4%

of revenues, versus 14.0% as of November 30, 2012.

As of November 30, 2013, active cash flow (available cash and

investment securities) totaled €188.3 million, compared to

€153.8 million as of November 30, 2012.

Borrowing power

As of November 30, 2013, the group had €290.6 million in

syndicated bank credit facilities (including the Senior B and C

lines drawn in the amount of €237.7 million). The unused

€52.9 million of the RCF line that was added to the €188.3

million in cash bring the group’s borrowing power as of

end-November 2013 to €241.2 million.

This press release is available from the

website www.ketb.com

- Next regular publication

dates:

April 9, 2014: First quarter 2014 results (after market

close)

April 11, 2014: Annual Shareholders’ Meeting

- About

Kaufman & Broad - For more than 40 years, Kaufman

& Broad has been designing, building and selling single-family

homes in communities, apartments and offices on behalf of third

parties. Kaufman & Broad is a leading French property builder

and developer in view of its size, earnings and power of its

brand.

Disclaimer - This document contains forward-looking

information. This information is liable to be affected by known or

unknown factors that KBSA cannot easily control or project, which

may make the results materially different from those stated,

implied or projected by the company. These risks specifically

include those listed under “Risk Factors” in the Registration

Document filed with the AMF under number D.13-0247 on April 2,

2013.

Orders: measured in volume (Units) and in value, orders

reflect the group’s commercial activity. Orders are recognized in

revenue based on the time needed for the “conversion” of an order

into a signed and notarized deed, which is the point at which

income is generated. In addition, in apartment programs that

include mixed-use buildings (apartments/business premises/retail

space/offices), all floor space is converted into housing

equivalents.

Units: are used to define the number of housing units or

equivalent housing units (for mixed programs) of any given program.

The number of equivalent housing units is calculated as a ratio of

the surface area by type (business premises/retail space/offices)

to the average surface area of the housing units previously

obtained.

EHU: EHUs (Equivalent Housing Units delivered) directly

reflect sales. The number of EHUs is a function of multiplying (i)

the number of housing units of a given program for which the

notarized sales deeds have been signed by (ii) the ratio between

the group’s property expenses and construction expenses incurred on

this program and the total expense budget for this program.

Take-up rate: the number of orders in relation to the

average commercial offer for the period.

Commercial offer: the total inventory of properties

available for sale as of the date in question, i.e., all unordered

housing units as of this date (less the programs that have not

entered the marketing phase).

Gross margin: corresponds to revenues less cost of sales.

Cost of sales consists of the price of land parcels, the related

property costs and construction costs.

Backlog: a summary at any given moment that enables a

projection of future revenues for the coming months.

Property portfolio: all real estate for which a deed or

commitment to sell has been signed.

APPENDICES

Key consolidated data

In € millions

Q4 Year Q4

Year 2013 2013

2012 2012

Revenues

346.6 1,026.0

354.4 1,030.0 -- of which Housing

307.3

967.5

345.3

1,000.7

-- of which Showroom

1.6

6.5

2.0

6.7

-- of which Commercial property

37.7

51.2

6.4

21.1

-- of which Other

-

0.8

0.6

1.6

-- of which Île-de France housing

43.6%

44.2%

43.5%

45.5%

-- Of which Regions housing

56.4%

55.8%

56.5%

54.5%

Gross margin

66.5 196.8 71.6 202.1 Gross margin rate

(%)

19.2%

19.2%

20.2%

19.6%

Current operating profit

30.7

76.0

36.8 85.3 Current operating margin (%)

8.9%

7.4%

10.4%

8.3%

Attributable net income

17.1

40.8

19.8 47.6

Attributable net income per share

(€/share) *

€0.79

€1.89

€0.92 €2.21

* Based on the number of shares composing the capital of

Kaufman & Broad .SA, i.e., 21,584,658 shares

Consolidated income statement*

In € thousands

Q4 Year Q4

Year 2013 2013

2012 2012

Revenues 346,641

1,025,954 354,374 1,030,046 Cost of sales

(280,131) (829,185) (282,738) (827,912)

Gross margin

66,510 196,769 71,636 202,134 Selling

expenses (9,092) (30,619) (7,896) (29,242) General and

administrative expenses (18,222) (65,058) (18,190) (62,935)

Technical and customer service expenses (4,696) (18,052) (4,710)

(16,301) Other income and expenses (3,760) (7,011) (3,996) (8,375)

Current operating profit 30,740 76,030

36,844 85,281 Other non-recurring income and expenses

6 (1) 1,545 1,528

Operating income 30,746

76,029 38,389 86,809 Cost of net financial

debt (2,027) (2,807) (1,342) (4,121) Other income and expenses

(959) (109) Income tax (expenses)/income (8,868) (21,961) (13,702)

(25,814) Share of income (loss) of equity affiliates and joint

ventures 288 642 (257) (61)

Income (loss) attributable to

shareholders 20,140 51,903 22,130

56,704 Minority interest 3,079 11,055

2,349 9,080

Attributable net income

17,061 40,848 19,780

47,624

*Unaudited and not approved by the Board of Directors

Consolidated balance sheet*

In € thousands

Nov. 30, Nov. 30,

2013 2012 ASSETS

Goodwill 68,511 68,511 Intangible assets 85,376 84,897

Property, plant and equipment 4,713 5,604 Equity affiliates and

joint ventures 8,181 4,373 Other non-current financial assets

20,139 1,262

Non-current assets 186,920

164,647 Inventories 324,963 284,469 Trade receivables

291,778 268,189 Other receivables 153,404 180,141 Cash and cash

equivalents 188,258 153,763 Prepaid expenses 867 1,008

Current

assets 959,270 887,570 TOTAL

ASSETS 1,146,190 1,052,217

EQUITY AND LIABILITIES

Capital stock 5,612 5,612 Additional paid-in

capital 130,932 135,910 Interim dividends - (48,455) Attributable

net income 40,847 47,624 Attributable shareholders’ equity 177,391

140,691 Minority interest 10,811 8,420

Shareholders’ equity

188,202 149,111 Non-current provisions 33,422 24,510

Borrowings and other non-current financial liabilities (> 1

year) 218,959 234,435 Deferred tax liabilities 40,365 55,586

Non-current liabilities 292,746 314,631

Current provisions 1,724 1,000 Other current financial liabilities

(< 1 year) 19,340 458 Accounts payable 550,233 473,624 Other

liabilities 92,729 111,777 Deferred income 1,217 1,616

Current

liabilities 665,242 588,475

TOTAL EQUITY AND LIABILITIES 1,146,190

1,052,217

*Unaudited and not approved by the Board of Directors

Housing Q4 Year

Q4 Year 2013 2013

2012 2012

Revenues (€ millions)

307.3 967.5 345.3 1,000.7

-- of which Apartments

288.4

919.3

321.3

976.8

-- of which Single-family homes in

communities

18.9 48.2

8.5

23.9

Delivered EHUs

1,937 5,839 2,072 5,669

-- of which Apartments

1,844

5,606

2,230

5,567

-- of which Single-family homes in

communities

93

233 42 102

Net orders (units)

1,436 5,379 1,460 5,487

-- of which Apartments

1,367

5,031

1,404

5,243

-- of which Single-family homes in

communities

69

348

56

244

Net orders (€M, including VAT)

246.1 990.3 317.6 1,096.0

-- of which Apartments

218.6

884.7

301.6

1,040.3

-- of which Single-family homes in

communities

27.5

105.6

16.1

55.7

-- of which first-time homebuyers

30%

33%

29%

32%

-- of which other homebuyers

10%

14%

18%

15%

-- of which investors / block

60%

53%

53%

53%

-- of which Île-de France

53.9%

50.6%

42.9%

46.2%

of which Regions

46.1%

49.4%

57.1%

53.8%

Commercial offer at period end (units) 3,550 3,222

Backlog end of period -- In value (€M, excluding VAT) 965.1 1,091.1

-- of which Apartments

870.4 1,037.6

-- of which Single-family homes in

communities

94.7 53.5 -- In months of business 12.0 13.1 Property portfolio end

of period -- Number of lots 15,213 16,049

-- of which Île-de France

5,401 6,188

-- of which Regions

9,812 9,861 -- In years of business 3 3

Commercial property

Q4 Year Q4

Year 2013 2013

2012 2012

Revenues (€ millions) 37.7 51.2

6.4

21.1 Net orders (€M, including VAT) 76.0 87.5 - 13.8 Backlog end of

period (€m, excluding VAT) 52.7 31.0

Chief Finance OfficerBruno Coche+33 (1) 41 43 44

73Infos-invest@ketb.comPress RelationsDelphine Peyrat - Wise

Conseil+33 (6) 38 81 40 00dpeyratstricker@wiseconseil.com

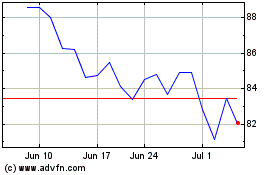

Coca Cola FEMSA SAB De CV (NYSE:KOF)

Historical Stock Chart

From Jun 2024 to Jul 2024

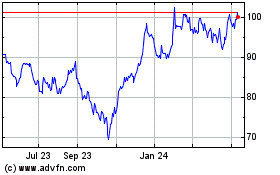

Coca Cola FEMSA SAB De CV (NYSE:KOF)

Historical Stock Chart

From Jul 2023 to Jul 2024