Current Report Filing (8-k)

June 29 2018 - 7:11AM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d) OF THE

SECURITIES EXCHANGE ACT OF 1934

Date of Report (Date of earliest event reported): June 29, 2018

CNX Resources Corporation

(Exact name of registrant as specified in its charter)

|

|

|

|

|

|

|

|

|

Delaware

|

|

001-14901

|

|

51-0337383

|

|

(State or other jurisdiction

of incorporation)

|

|

(Commission File Number)

|

|

(IRS Employer

Identification No.)

|

|

|

|

|

|

CNX Center

1000 CONSOL Energy Drive Suite 400

Canonsburg, Pennsylvania 15317

(Address of principal executive offices)

(Zip code)

|

Registrant's telephone number, including area code:

(724) 485-4000

Not applicable

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (

see

General Instruction A.2. below):

o

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

o

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

o

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

o

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company

o

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act

.

Item 1.01 Entry into a Material Definitive Agreement

On June 28, 2018, CNX Gas Company LLC (“Seller”), a subsidiary of CNX Resources Corporation (“CNX”), entered into a Purchase and Sale Agreement (the “Purchase and Sale Agreement”) with Ascent Resources - Utica, LLC (“Buyer” and, together with Seller, the “parties” and each a “party”) pursuant to which Buyer will acquire certain assets and assume certain liabilities relating to certain of Seller’s operations located in the State of Ohio (the “Assets”) for a cash purchase price of approximately $400 million, subject to purchase price adjustments, including, among others, adjustments for certain title defects and environmental defects asserted prior to August 17, 2018 (the “Transaction”).

The closing of the Transaction (the “Closing”) is expected to occur on or about August 30, 2018. The Closing is subject to certain closing conditions, including, among others, (a) the absence of certain legal impediments to the consummation of the Transaction; (b) the parties’ performance, in all material respects, of their respective obligations under the Purchase and Sale Agreement; (c) the material accuracy of the parties’ representations and warranties as of the Closing; and (d) the simultaneous closing of a separate transaction between Buyer and a third-party with respect to certain other assets located in the State of Ohio. Buyer’s obligation to close the Transaction is not subject to any financing condition.

The Agreement contains customary representations, warranties and covenants. From and after the Closing, Seller and Buyer have agreed to indemnify each other against certain losses resulting from any breach of their representations, warranties or covenants contained in the Purchase and Sale Agreement, subject to certain customary limitations and survival periods. Additionally, from and after the Closing, Seller has agreed to indemnify Buyer for certain identified retained liabilities related to the Assets, subject to certain survival periods, and Buyer has agreed to indemnify Seller for certain assumed obligations related to the Assets.

The Purchase and Sale Agreement may be terminated, subject to certain exceptions, (i) upon mutual written consent of Buyer and Seller, (ii) if the Closing has not occurred by August 31, 2018, (iii) for certain material breaches of representations and warranties or covenants that remain uncured or (iv) upon the occurrence of certain other events specified in the Purchase and Sale Agreement

Item 7.01

Regulation FD.

On June 29, 2018, CNX issued a press release announcing the Purchase and Sale Agreement and the Transaction. A copy of the press release is furnished as Exhibit 99.1 hereto.

Item 9.01

Financial Statements and Exhibits.

(d) Exhibits.

|

|

|

|

|

|

|

|

|

Press release of CNX Resources Corporation dated June 29, 2018

|

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

CNX RESOURCES CORPORATION

By:

/s/ Stephanie L . Gill

Stephanie L. Gill

Vice President and General Counsel

Dated: June 29, 2018

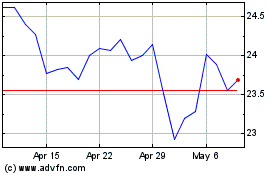

CNX Resources (NYSE:CNX)

Historical Stock Chart

From Oct 2024 to Nov 2024

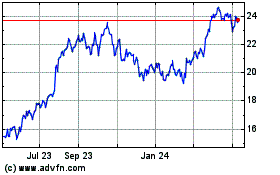

CNX Resources (NYSE:CNX)

Historical Stock Chart

From Nov 2023 to Nov 2024