Legg Mason Partners Fund Advisor, LLC Announces Distributions for the Month of August 2021

August 02 2021 - 8:00AM

Business Wire

Legg Mason Partners Fund Advisor, LLC announced today that

certain closed end funds have declared their distributions for the

month of August 2021.

The following dates apply to the distribution schedule

below:

Month

Record Date

Ex-Dividend Date

Payable Date

August

8/24/2021

8/23/2021

8/31/2021

Ticker

Fund Name

Amount

Change from Previous

Distribution

CEM

ClearBridge MLP and Midstream Fund

Inc.

$0.4800

_

EMO

ClearBridge Energy Midstream Opportunity

Fund Inc.

$0.3800

_

CTR

ClearBridge MLP and Midstream Total Return

Fund Inc.

$0.4200

_

The distributions may be treated as dividend income, return of

capital or a combination thereof for tax purposes. This press

release is not for tax reporting purposes. In early 2022, after

definitive information is available, the Funds will send

stockholders a Form 1099-DIV, if applicable, specifying how the

distributions paid by the Funds during the prior calendar year

should be characterized for purposes of reporting the distributions

on a stockholder’s tax return (e.g., dividend income or return of

capital).

Legg Mason Partners Fund Advisor, LLC is an indirect,

wholly-owned subsidiary of Franklin Resources, Inc. (“Franklin

Resources”).

For more information about the Funds, please call 1-888-777-0102

or consult the Funds’ website at www.lmcef.com. Hard copies of the

Funds’ complete audited financial statements are available free of

charge upon request.

Data and commentary provided in this press release are for

informational purposes only. Franklin Resources and its affiliates

do not engage in selling shares of the Funds.

Category: Distribution Related

Source: Franklin Resources, Inc.

Source: Legg Mason Closed End Funds

View source

version on businesswire.com: https://www.businesswire.com/news/home/20210802005319/en/

Investor Contact: Fund Investor Services

1-888-777-0102

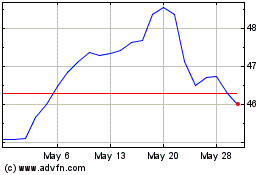

ClearBridge MLP and Mids... (NYSE:CEM)

Historical Stock Chart

From Oct 2024 to Nov 2024

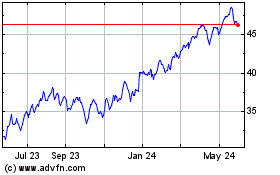

ClearBridge MLP and Mids... (NYSE:CEM)

Historical Stock Chart

From Nov 2023 to Nov 2024