Carvana Fully Satisfies Public Issuance Requirements of Previously Announced Exchange Offer Transaction Support Agreement, Raising $225 Million Through At-the-Market Equity Offering Program

July 27 2023 - 4:10PM

Business Wire

Carvana Co. (“Carvana” or the “Company”), the fastest growing

used car dealer in U.S. history, today announced that it has raised

$225 million through the issuance of approximately 4.9 million

shares through its at-the-market equity offering program (“ATM”),

fully satisfying the public equity requirement of its exchange

offer transaction support agreement (“TSA”). The TSA, which was

announced last week, provides significant financial flexibility to

Carvana including reducing required cash interest expense by more

than $430 million for the next two years, extending maturities, and

lowering total debt outstanding by over $1.2 billion.

“We are pleased to announce that we have successfully raised

$225 million through our at-the-market offering program, fulfilling

the public issuance commitment of our exchange offer transaction

support agreement,” said Mark Jenkins, Carvana’s Chief Financial

Officer. “Our liquidity position is strong, and any further

issuance under the program would be purely opportunistic. We have

no plans for an underwritten equity offering at this time.”

Pursuant to the TSA, the Garcia party investors have agreed to

purchase $126 million of equity securities from Carvana prior to

twenty business days after the upcoming launch of the notes

exchange offer, unless certain other conditions are met.

Citigroup Global Markets Inc. and Moelis & Company LLC

served as joint sales agents under the ATM program.

About Carvana (NYSE: CVNA)

Carvana (NYSE: CVNA) is the industry pioneer for buying and

selling used vehicles online. As the fastest growing used

automotive retailer in U.S. history, its proven, customer-first

ecommerce model has positively impacted millions of people’s lives

through more convenient, accessible and transparent experiences.

Carvana.com allows someone to purchase a vehicle from the comfort

of their home, completing the entire process online, benefiting

from a 7-day money back guarantee, home delivery, nationwide

inventory selection and more. Customers also have the option to

sell or trade-in their vehicle across all Carvana locations,

including its patented Car Vending Machines, in more than 300 U.S.

markets. Carvana brings a continued focus on people-first values,

industry-leading customer care, technology and innovation, and is

the No. 2 automotive brand in the U.S., only behind Ford, on the

Forbes 2022 Most Customer-Centric Companies List. Carvana is one of

the four fastest companies to make the Fortune 500 and for more

information, please visit www.carvana.com and follow us

@Carvana.

Carvana also encourages investors to visit its Investor

Relations website as financial and other company information is

posted.

No Offer

This communication is not intended to and does not constitute an

offer to sell, buy or subscribe for any securities or otherwise,

nor shall there be any sale, issuance or transfer of securities in

any jurisdiction in contravention of applicable law. In particular,

this communication is not an offer of securities for sale into the

United States. No offer of securities shall be made in the United

States absent registration under the Securities Act of 1933, as

amended, or pursuant to an exemption from, or in a transaction not

subject to, such registration requirements.

Note Regarding Forward-Looking Statements

These forward-looking statements reflect Carvana’s current

intentions, expectations or beliefs regarding the proposed

transactions. These statements may be preceded by, followed by or

include the words “aim,” “anticipate,” “believe,” “estimate,”

“expect,” “forecast,” “intend,” “likely,” “outlook,” “plan,”

“potential,” “project,” “projection,” “seek,” “can,” “could,”

“may,” “should,” “would,” “will,” the negatives thereof and other

words and terms of similar meaning. Forward-looking statements

include all statements that are not historical facts, including,

among others, statements we make regarding the transactions

contemplated by the Support Agreement with holders of our senior

notes; short-term and long-term liquidity; potential sales of our

Class A common stock using the at-the-market program; expectations

regarding our operational and efficiency initiatives, our strategy,

expected gross profit per unit, forecasted results, and

expectations regarding the effect of Carvana’s actions to improve

performance. Such forward-looking statements are subject to various

risks and uncertainties. Accordingly, there are or will be

important factors that could cause actual outcomes or results to

differ materially from those indicated in these statements. Among

these factors are risks related to: our inability to consummate the

transactions contemplated by the Support Agreement as scheduled or

at all; the volatility of the trading price of our Class A common

stock, which can increase as a result of the issuance of equity

pursuant to the Support Agreement and the use of the at-the-market

program; the impact on our business from the larger automotive

ecosystem and macroeconomic conditions, including consumer demand,

global supply chain challenges, heightened inflation and rising

interest rates; our ability to raise additional capital, the

quality of the financial markets, and our substantial indebtedness;

our history of losses and ability to achieve or maintain

profitability in the future; our ability to sell loans into the

market; the seasonal and other fluctuations in our quarterly

operating results; our ability to compete in the highly competitive

industry in which we participate; the changes in prices of new and

used vehicles; our ability to sell our inventory expeditiously; and

the other risks identified under the “Risk Factors” section in our

Annual Report on Form 10-K for the fiscal year ended December 31,

2022, Quarterly Report on Form 10-Q for the second quarter of 2023

and documentation relating to the transactions (such as the

Exchange Offer Memorandum and Consent Solicitation Statement).

There is no assurance that any forward-looking statements will

materialize. You are cautioned not to place undue reliance on

forward-looking statements, which reflect expectations only as of

this date. Carvana does not undertake any obligation to publicly

update or review any forward-looking statement, whether as a result

of new information, future developments, or otherwise, except as

required by law.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20230727059441/en/

Investor Relations: Carvana Mike Mckeever

investors@carvana.com

Media Contact: Carvana Kristin Thwaites

press@carvana.com

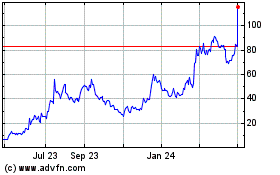

Carvana (NYSE:CVNA)

Historical Stock Chart

From Oct 2024 to Nov 2024

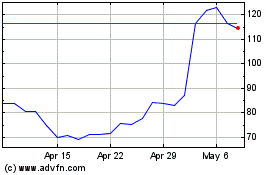

Carvana (NYSE:CVNA)

Historical Stock Chart

From Nov 2023 to Nov 2024