S&P Global Ratings Upgrades Securitizations Sponsored by Carvana Due to Continued Strength in Loan Performance

June 01 2023 - 9:00AM

Business Wire

Reductions of Loss Assumptions on Certain

Outstanding Securitization Bonds Reflect Outperformance vs. Initial

S&P Expectations

Carvana Co. (NYSE: CVNA), the leading e-commerce platform for

buying and selling used cars, receives notable S&P Global

Ratings upgrades and revisions of securitization loss assumptions

due to capital structure de-leveraging and outperformance of

S&P initial assumptions:

This press release features multimedia. View

the full release here:

https://www.businesswire.com/news/home/20230601005499/en/

Carvana Co. (NYSE: CVNA), the leading

e-commerce platform for buying and selling used cars, receives

notable S&P Global Ratings upgrades and revisions of

securitization loss assumptions due to capital structure

de-leveraging and outperformance of S&P initial assumptions.

(Photo: Business Wire)

- S&P Global Ratings raised its ratings on 21 classes from

seven Carvana-sponsored securitizations backed by prime auto loans

and it affirmed its ratings on 19 classes from the same

transactions. S&P Global Ratings also lowered its loss

assumptions on the same seven transactions.

- S&P Global Ratings raised its ratings on 15 classes from

five Carvana-sponsored securitizations backed by non-prime auto

loans and it affirmed its ratings on nine classes from the same

transactions. S&P Global Ratings also lowered or affirmed its

loss assumptions on the same five transactions.

“We believe the ratings actions taken by S&P demonstrate our

ability to originate high quality assets in our lending business as

a result of disciplined underwriting practices that are

complemented by our third party servicer’s experience and

expertise,” said Meg Kehan, Carvana’s Senior Director of Capital

Markets.

S&P’s ratings actions demonstrate that the classes have

adequate credit enhancement at the upgraded or affirmed rating

levels. Reports can be viewed with S&P Global RatingsDirect

account access.

Carvana has issued 21 auto loan securitizations since 2019 and

more recently three securitizations year-to-date in 2023,

consisting of two prime and one non-prime securitizations totaling

~$1.3B of loan principal.

About Carvana

Carvana (NYSE: CVNA) is an industry pioneer for buying and

selling used vehicles online. As the fastest growing used

automotive retailer in U.S. history, its proven, customer-first

ecommerce model has positively impacted millions of people's lives

through more convenient, accessible and transparent experiences.

Carvana.com allows someone to purchase a vehicle from the comfort

of their home, completing the entire process online, benefiting

from a 7-day money back guarantee, home delivery, nationwide

inventory selection and more. Customers also have the option to

sell or trade-in their vehicle across all Carvana locations,

including its patented Car Vending Machines, in more than 300 U.S.

markets. Carvana brings a continued focus on people-first values,

industry-leading customer care, technology and innovation, and is

the No. 2 automotive brand in the U.S., only behind Ford, on the

Forbes 2022 Most Customer-Centric Companies List. Carvana is one of

the four fastest companies to make the Fortune 500 and for more

information, please visit www.carvana.com and follow us

@Carvana.

Carvana also encourages investors to visit its Investor

Relations website as financial and other company information is

posted.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20230601005499/en/

Investor Relations: Carvana Mike Mckeever

investors@carvana.com

Media Relations: Carvana Kristin Thwaites

press@carvana.com

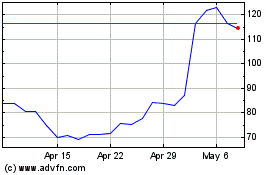

Carvana (NYSE:CVNA)

Historical Stock Chart

From Apr 2024 to May 2024

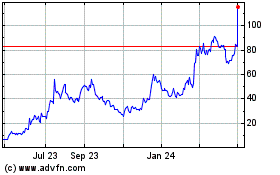

Carvana (NYSE:CVNA)

Historical Stock Chart

From May 2023 to May 2024