Executive Compensation

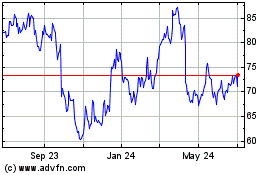

We are asking you to approve, on an advisory basis, the compensation of our named executive officers as disclosed in this proxy statement. At our last two annual shareholders meetings, a significant majority of our shareholders supported our executive compensation program, with approximately 96% of votes cast in both 2020 and 2021, voting in favor of our program. We design our compensation plans to tie pay to performance. The following chart illustrates the relationship over the last three fiscal years between our net earnings and the target total direct compensation (i.e., base salary, target annual incentive bonus, and long-term equity grants) paid to our Chief Executive Officer (“CEO”).

Net Earnings and CEO Target Total Direct Compensation

You will find additional information on our executive compensation program beginning on page 29.

Next Year’s Annual Shareholders Meeting

| | | | | |

Expected Date of 2023 Annual Shareholders Meeting

|

June 27, 2023

|

Deadline for Shareholder Proposals

|

January 10, 2023

|

| | |

| PROPOSAL ONE: ELECTION OF DIRECTORS |

We are asking you to vote for the election of the eleven director nominees listed on the following pages. Our Board has nominated these individuals at the recommendation of our independent Nominating and Governance Committee. The Committee based its recommendation on, among other things, the results of an annual Board and peer evaluation process, as well as the integrity, experience, and skills of each nominee. All of the nominees are current directors who were elected by shareholders at our 2021 annual meeting.

Robert J. Hombach, a director since 2018, has decided not to stand for re-election at this year’s annual meeting and resigned from the Audit Committee, effective March 31, 2022. The Board of Directors thanks Mr. Hombach for his many contributions over the years and his valuable insight to the Board and the Audit Committee.

Our Board is declassified and elected on an annual basis. Accordingly, each director nominee is standing for election to hold office until our 2023 annual meeting of shareholders. CarMax uses a majority vote standard for the election of directors. This means that to be elected in uncontested elections, each nominee must be approved by the affirmative vote of a majority of the votes cast.

Each nominee has consented to being named in this proxy statement and to serve if elected. If any nominee is not available to serve—for reasons such as death or disability—your proxy will be voted for a substitute nominee if the Board nominates one.

The table below summarizes the key experience, skills and backgrounds of our director nominees and it highlights the balanced mix of experience, skills and backgrounds of the Board as a whole. This high-level summary is not intended to be an exhaustive list of each director nominee’s skills or contributions to the Board.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Peter J. Bensen | Ronald E. Blaylock | Sona Chawla | Thomas J. Folliard | Shira Goodman | David W. McCreight | William D. Nash | Mark F. O’Neil | Pietro Satriano | Marcella Shinder | Mitchell D. Steenrod |

Leadership and Industry Experience | | | | | | | | | | | |

Other Public Company Board Experience | ü | ü | ü | ü | ü | ü | | ü | ü | | ü |

CEO/COO/ Division President | | ü | ü | ü | ü | ü | ü | ü | ü | | |

CFO | ü | | | | | | | | | | ü |

Relevant Industry Experience | | | ü | ü | ü | ü | ü | ü | | ü | ü |

Functional Expertise | | | | | | | | | | | |

Accounting & Finance | ü | ü | | | | | ü | | | | ü |

Innovation and Disruption | | | ü | ü | ü | ü | ü | ü | ü | ü | |

Data Analytics | | ü | ü | ü | | ü | ü | ü | ü | ü | ü |

E-commerce | | | ü | ü | ü | ü | ü | ü | ü | ü | ü |

Technology & Cyber | ü | | ü | | | | ü | ü | | ü | ü |

Product, Marketing & Media | | ü | ü | ü | ü | ü | ü | ü | ü | ü | |

Regulatory | | | | ü | | | ü | ü | | | ü |

Human Capital Management | | ü | | ü | ü | ü | ü | ü | ü | ü | ü |

Risk Oversight | ü | ü | | ü | | | ü | ü | ü | | ü |

Strategic Planning | ü | ü | ü | ü | ü | ü | ü | ü | ü | ü | ü |

Individual Characteristics | | | | | | | | | | | |

Age (Nominee Average is 58 years of age) | 59 | 62 | 54 | 57 | 61 | 59 | 53 | 63 | 59 | 55 | 55 |

Gender | M | M | F | M | F | M | M | M | M | F | M |

Race/Ethnicity | Caucasian | African American | Indian/South Asian | Caucasian | Caucasian | Caucasian | Caucasian | Caucasian | Caucasian | Caucasian | Caucasian |

The following pages include information about the nominees. This information includes a summary of the specific experience, qualifications, attributes or skills that led to the conclusion that each person should serve as a CarMax director. The Board recommends a vote FOR each of the nominees.

| | | | | |

| PETER J. BENSEN

Director since: 2018 Age: 59 Independent |

Mr. Bensen retired from McDonald’s Corporation, following a 20-year career, in 2016. He served as Chief Administrative Officer of McDonald’s from 2015 to 2016. Before that he served as Corporate Executive Vice President and Chief Financial Officer of McDonald’s from 2008 to 2014, when he was promoted to Corporate Senior Executive Vice President and Chief Financial Officer, a position he held until 2015. During his tenure as Chief Administrative Officer and Chief Financial Officer, Mr. Bensen also had oversight responsibility for information technology, supply chain, and other support departments. Before joining McDonald’s in 1996, Mr. Bensen was a senior manager at Ernst & Young LLP. |

Qualifications

Mr. Bensen’s long-standing service as the chief financial officer, and in other administrative, financial, and accounting roles, at a global, iconic company qualify him to serve on our Board. He brings to our Board extensive management experience and financial expertise, as well as his background as a key executive helping to shape McDonald’s strategic response to a changing market environment. |

Other Current Directorships Other Directorships within Past 5 Years

Lamb Weston Holdings, Inc. None. |

| | | | | |

| RONALD E. BLAYLOCK

Director since: 2007 Age: 62 Independent |

Mr. Blaylock is the founder and Managing Partner of GenNx360 Capital Partners, a private-equity buyout fund focused on industrial business-to-business companies. Prior to founding GenNx360 in 2006, Mr. Blaylock was Chief Executive Officer of Blaylock & Company, a full-service investment banking firm that he founded in 1993. Previously, Mr. Blaylock held senior management positions with PaineWebber and Citigroup. |

Qualifications

Mr. Blaylock’s experience managing two successful investment enterprises, as well as his considerable capital markets and finance experience, qualify him to serve on our Board. Mr. Blaylock’s years of relevant experience growing companies, serving as a strategic advisor and serving on other public company boards enable him to provide additional insight to our Board. |

Other Current Directorships Other Directorships within Past 5 Years

Pfizer Inc. Urban One, Inc. (2002-2019) W. R. Berkley Corporation Advantage Solutions Inc. |

| | | | | |

| SONA CHAWLA

Director since: 2017 Age: 54

Independent |

Ms. Chawla has served as the Chief Growth and Innovation Officer at CDW Corporation, a leading technology solutions provider to business, government, education and healthcare customers, since January 2020. She is responsible for strategy, digital and e-commerce, technology, operations, marketing, and product and partner management. Prior to joining CDW, she was President of Kohl’s Corporation from May 2018 to October 2019. Ms. Chawla joined Kohl’s in November 2015, serving as Chief Operating Officer until September 2017 and as President-Elect from September 2017 to May 2018. At Kohl’s her responsibilities encompassed omnichannel operations, including stores, e-commerce, technology, logistics & supply chain, and corporate strategy. Before joining Kohl’s, Ms. Chawla served at Walgreens as its President of Digital and Chief Marketing Officer from February 2014 to November 2015 and as its President, E-commerce from January 2011 to February 2014. Prior to joining Walgreens, Ms. Chawla was Vice President of Global Online Business at Dell, Inc. Before Dell, Ms. Chawla worked at Wells Fargo’s Internet Services Group, where she held several roles including Executive Vice President of Online Sales, Service and Marketing. |

Qualifications

As Chief Growth and Innovation Officer at a leading business technology company that specializes in providing products, solutions and services, Ms. Chawla brings the perspective of an executive driving innovation for businesses accelerating their digital transformation and responding to the evolving technology landscape. Her background and operating executive experience in retail, including e-commerce, omnichannel strategy, store operations, logistics, and information and digital technology strengthen the business and strategic insight of our Board. |

Other Current Directorships Other Directorships within Past 5 Years

None. None. |

| | | | | |

| THOMAS J. FOLLIARD

Director since: 2006 Age: 57

Non-Executive Chair of the Board |

Mr. Folliard has been the Non-Executive Chair of the Board of CarMax since August 2016. He joined CarMax in 1993 as senior buyer and became Director of Purchasing in 1994. He was promoted to Vice President of Merchandising in 1996, Senior Vice President of Store Operations in 2000 and Executive Vice President of Store Operations in 2001. Mr. Folliard served as President and Chief Executive Officer of CarMax from 2006 to February 2016 and retired as Chief Executive Officer in August 2016. |

Qualifications

During his ten years as CEO, Mr. Folliard successfully led CarMax through the company’s establishment as a national brand and a time of significant growth, during which its store base and total revenues more than doubled and its net income quadrupled. With his long tenure at CarMax, Mr. Folliard brings to the board significant executive experience and in-depth knowledge of our company, the auto retail industry, and the continued deployment of technology within the industry. |

Other Current Directorships Other Directorships within Past 5 Years

PulteGroup, Inc. DAVIDsTEA, Inc. (2014-2017) |

| | | | | |

| SHIRA GOODMAN

Director since: 2007 Age: 61

Independent |

Ms. Goodman was the Chief Executive Officer of Staples, Inc. Ms. Goodman joined Staples in 1992 and held a variety of positions of increasing responsibility in general management, marketing and human resources, including serving as Executive Vice President, Marketing from 2001 to 2009, Executive Vice President, Human Resources from 2009 to 2012, Executive Vice President, Global Growth from 2012 to 2014, President, North American Commercial from 2014 to 2016, President, North American Operations from February to June 2016, Interim Chief Executive Officer from June to September 2016, and Chief Executive Officer from September 2016 to January 2018. From 1986 to 1992, Ms. Goodman worked at Bain & Company and helped develop the business plan for Staples’ initial delivery business. This business subsequently grew into a leading e-commerce site under Ms. Goodman’s leadership while at Staples. Ms. Goodman joined Charlesbank Capital Partners, a private equity firm, in 2019 as an Advisory Director. At Charlesbank, Ms. Goodman provides business development and strategic guidance to B2B and B2C companies and is responsible for leading Charlesbank’s ESG efforts across the firm and its portfolio companies. |

Qualifications

Ms. Goodman’s experience as the chief executive and senior executive in other leadership positions in operations, retail marketing, human resources and business growth at an internationally renowned retailer qualify her to serve on our Board. During her years at Staples, the company underwent a robust digital transformation and grew from a mid-sized US retailer into a global multi-channel distributor with a powerful presence in retail, e-commerce and B2B delivery. |

Other Current Directorships Other Directorships within Past 5 Years

CBRE Group, Inc. Henry Schein, Inc. (2018-2021) Staples (2016-2017) |

| | | | | |

| DAVID W. MCCREIGHT

Director since: 2018 Age: 59

Independent |

Mr. McCreight has served as the Chief Executive Officer of Lulu’s Fashion Lounge Holdings, Inc., an online retail platform for women’s apparel and accessories, since April 2021. Lulu’s is a customer-driven, digitally-native fashion brand serving millions of Millennial and Gen Z consumers. Mr. McCreight also served as President of Urban Outfitters, Inc., parent of Urban Outfitters, Anthropologie Group, and Free People consumer brands whose products are distributed internationally through their digital, retail, and wholesale channels, from 2016 to 2018 and Chief Executive Officer of Anthropologie from 2011 to 2018. During his tenure as CEO of Anthropologie, Mr. McCreight led the company’s transformation from a store-centric brand to a best-in-class omnichannel platform while enhancing its customers’ brand experience. Previously, Mr. McCreight served as President of Under Armour from 2008 until 2010; and he was President, from 2005 to 2008, and Senior Vice President, from 2003 to 2005, of Lands’ End. |

Qualifications

Mr. McCreight has executive experience leading high-profile retail brands in highly competitive and fast-evolving marketplaces. For over twenty years, Mr. McCreight led organizations in developing omnichannel strategies and digital competencies to expand the reach for new customers and strengthen relationships with existing customers. His deep experience as an omnichannel brand executive and successful track record qualify him to serve on our Board, particularly as CarMax continues to differentiate and grow its brand and enhance its omnichannel strategy. |

Other Current Directorships Other Directorships within Past 5 Years

Lulu’s Fashion Lounge Holdings, Inc. DAVIDsTEA, Inc. (2014-2018) Wolverine World Wide, Inc. |

| | | | | |

| WILLIAM D. NASH

Director since: 2016 Age: 53

President and Chief Executive Officer |

Mr. Nash has been the President and Chief Executive Officer of CarMax since September 2016. He was promoted to President in February 2016. In 2012, he assumed the role of Executive Vice President, Human Resources and Administrative Services, where he oversaw human resources, information technology, procurement, loss prevention, employee health & safety, and construction & facilities. In 2011, Mr. Nash was promoted to Senior Vice President, Human Resources and Administrative Services. Previously, he served as Vice President and Senior Vice President of Merchandising, after serving as Vice President of Auction Services. Mr. Nash joined CarMax in 1997 as auction manager. Before joining CarMax, Mr. Nash, a CPA, held a variety of accounting roles at Circuit City. |

Qualifications

As the chief executive officer of CarMax, Mr. Nash leads the Company’s day-to-day operations and is responsible for establishing and executing the Company’s strategic plans. His significant experience in the auto retail industry, his tenure with CarMax and his motivational leadership of more than 30,000 CarMax associates qualify him to serve on our Board. |

Other Current Directorships Other Directorships within Past 5 Years

None. None. |

| | | | | |

| MARK F. O’NEIL

Director since: 2019 Age: 63

Independent |

Mr. O’Neil retired as Chief Operating Officer of Cox Automotive, a global automotive services and software company, in March 2019 after being named to the position in 2016 following Cox’s acquisition of Dealertrack Technologies, Inc., a publicly traded provider of software, marketing and e-commerce services for automotive retailers. At Cox, Mr. O’Neil led the rebuild of the Autotrader website to make it more interactive for consumers. Mr. O’Neil was CEO of Dealertrack from 2001 until the sale to Cox in 2015 and also served as President from 2001 to 2014. He was a director of Dealertrack from 2001 to 2015 and Chairman of the Board from 2005 to 2015. As CEO of Dealertrack, Mr. O’Neil led the company’s growth in becoming the leading provider of web-based software solutions and services for all major segments of the automotive retail industry, including creating the largest online auto credit application network in the U.S. and Canada. Mr. O’Neil began his career at Intel Corporation and subsequently worked for McKinsey & Co. before moving to the automotive industry in the late 1980s. His experience in the automotive industry includes serving as President of Ertley MotorWorld, a dealer group based in Pennsylvania. From this traditional retail dealer group, Mr. O’Neil went on to work on the development and rollout of CarMax, serving in various roles at CarMax from 1992 until 2000, including as Vice President from 1997 to 2000. From 2000 through 2001, Mr. O’Neil was President and COO of Greenlight.com, an online automotive sales website. |

Qualifications

Mr. O’Neil’s extensive experience as a chief executive and a leader at the intersection of auto retail and technology uniquely qualifies him to serve on our Board. During his over 30-year career in auto retail, Mr. O’Neil led several companies through periods of significant retail innovation, using technology solutions to disrupt and transform financing, insurance, marketing and other activities within the automotive retail sales and service processes. |

Other Current Directorships Other Directorships within Past 5 Years

None. None. |

| | | | | |

| PIETRO SATRIANO

Director since: 2018 Age: 59

Independent |

Mr. Satriano has been the Chief Executive Officer and a director of US Foods Holding Corp., a publicly held foodservice distributor, since July 2015 and Chairman of the US Foods board from December 2017 through February 2022. Prior to that, Mr. Satriano served as Chief Merchandising Officer of US Foods from February 2011 until July 2015. Before joining US Foods, Mr. Satriano was President of LoyaltyOne Canada from 2009 to 2011 and served in a number of leadership positions at Loblaw Companies Limited, including Executive Vice President, Loblaw Brands, and Executive Vice President, Food Segment, from 2002 to 2008. Mr. Satriano began his career in strategy consulting, first in Toronto, Canada with what is now The Boston Consulting Group, and then in Milan, Italy with the Monitor Company. |

Qualifications

Mr. Satriano’s chief executive experience at US Foods, as well as his extensive executive experience at consumer-facing companies, qualify him to serve on our Board. In his role as CEO, Mr. Satriano is leading US Foods’ strategy of using technology and e-commerce solutions to fuel future growth in the highly-competitive and rapidly-evolving foodservice distribution industry. |

Other Current Directorships Other Directorships within Past 5 Years

US Foods Holding Corp. None. |

| | | | | |

| MARCELLA SHINDER

Director since: 2015 Age: 55

Independent |

Ms. Shinder served as Global Head of Partnerships at WeWork Companies, Inc. a technologically driven global provider of shared working spaces, from April 2019 to November 2019. Ms. Shinder joined WeWork in March 2018, serving as Global Head of Marketing until April 2019. At WeWork, Ms. Shinder was responsible for leading a global, integrated, omnichannel marketing agenda. Prior to WeWork, Ms. Shinder was Chief Marketing Officer at WorkMarket, a venture-backed enterprise software-as-a-service company acquired by ADP, from 2016 until 2018. Before that, Ms. Shinder was Chief Marketing Officer of Nielsen Holdings plc, a global measurement and data analytics company from 2011 to 2016 where she transformed the company’s digital properties and positioned it for success as a leader in digital measurement. Prior to joining Nielsen, Ms. Shinder held various executive roles during her 17 years with American Express, including Head of Marketing and General Manager of divisions including OPEN Small Business and Global Business Travel where her work and leadership earned numerous industry accolades for digital leadership and marketing innovation. Ms. Shinder joined Charlesbank Capital Partners, a private equity firm, in 2020 as an Advisory Director. Ms. Shinder is also a founding member of Brilliant Friends Investing, a venture capital fund for women-founded businesses. |

Qualifications

Ms. Shinder’s experiences as the lead marketing officer of innovative technology companies, as a senior executive at a leading global measurement and data analytics company, and at a large consumer financial services organization focused on consumer lending, qualify her to serve on our Board. Further, Ms. Shinder’s deep experience with omnichannel media and marketing, digital transformation, big data and analytics, AI and advanced technologies, cybersecurity, marketing and product innovation, and social media and branding enable her to provide additional insight to our Board and its committees. |

Other Current Directorships Other Directorships within Past 5 Years

None. None. |

| | | | | |

| MITCHELL D. STEENROD

Director since: 2011 Age: 55

Lead Independent Director |

Mr. Steenrod is the retired Senior Vice President and Chief Financial Officer of Pilot Travel Centers LLC, the nation’s largest operator of travel centers and truck stops. Mr. Steenrod joined Pilot Travel Centers in 2001 as controller and treasurer. In 2004, he was promoted to Senior Vice President and Chief Financial Officer and held this position until his retirement in 2018. During his tenure as CFO, Mr. Steenrod also had oversight responsibility for the technology, business development, supply chain and legal departments. Previously, he spent 12 years with Marathon Oil Company and Marathon Ashland Petroleum LLC in a variety of positions of increasing responsibility in accounting, general management and marketing. |

Qualifications

Mr. Steenrod’s extensive retail industry and operational experience as well as his experience implementing successful growth strategies, including participating in several large acquisitions and business combinations at Marathon Ashland Petroleum LLC and Pilot, qualify him to serve on our Board. Additionally, Mr. Steenrod’s extensive financial and accounting experience, including his years of experience as a chief financial officer, strengthens our Board through his understanding of accounting principles, financial reporting rules and regulations, internal controls, and technology oversight. |

Other Current Directorships Other Directorships within Past 5 Years

Recharge Acquisition Corp. None. |

CarMax is committed to good corporate governance. In this section of the proxy statement we describe our governance policies and practices and the role our Board plays in shaping them.

Overview

Our business and affairs are managed under the direction of the Board in accordance with the Virginia Stock Corporation Act, our articles of incorporation and our bylaws. The standing committees of the Board are the Audit Committee, the Compensation and Personnel Committee, the Nominating and Governance Committee, and the Technology and Innovation Committee.

The Board and its committees direct our governance practices. The Board has made significant changes to those practices in recent years in response to shareholder feedback and based on evolving practices and the Board’s independent judgment. Demonstrating its continued interest in adopting meaningful shareholder focused changes, since 2011 the Board has:

•added a standing Technology and Innovation Committee;

•approved a majority vote standard for the election of directors;

•established annual elections for all directors;

•adopted a mandatory director retirement policy providing that directors, with limited exceptions, may not stand for reelection after reaching age 76;

•adopted a proxy access right for eligible CarMax shareholders; and

•allowed CarMax’s shareholder rights plan to expire without renewal.

These changes supplement longstanding good governance practices, such as maintaining a largely independent Board (9 of 11 director nominees) and appointing a lead independent director to lead meetings of the independent directors and work alongside the chair.

As part of its commitment to board refreshment and seeking diverse perspectives and skills in new directors, in recent years the Board has added six independent directors (Ms. Chawla in 2017, Mr. Bensen, Mr. Hombach (who is not standing for re-election), Mr. McCreight, and Mr. Satriano in 2018, and Mr. O’Neil in 2019).

In addition to improvements to our governance practices, we have implemented several initiatives and programs to support our commitment to having a positive impact on our people, communities, and the environment. We discuss these initiatives and programs as well as reporting our progress in environmental, social, and governance (ESG) matters in our annual Responsibility Report, which we first published in December 2019. The preparation of the report is overseen by a management-level ESG Leadership Team, which reports directly to Bill Nash, our Chief Executive Officer and President. In addition, the Nominating and Governance Committee has oversight for corporate and social responsibility, environmental, and sustainability matters, including the Responsibility Report. We expect to publish the 2022 Responsibility Report on our website in May 2022.

The Board has approved documents that memorialize our governance standards and practices. These documents include our bylaws, our corporate governance guidelines and a code of business conduct. These documents, each of which is described below, are available under the “Governance” link at investors.carmax.com. We will send you a printed copy of any of these documents without charge, upon written request to our Corporate Secretary at CarMax, Inc., 12800 Tuckahoe Creek Parkway, Richmond, Virginia 23238.

| | | | | |

| Bylaws | Our bylaws regulate the corporate affairs of CarMax. They include provisions relating to shareholder meetings, voting, the nomination of directors and the proxy access right. |

| Corporate Governance Guidelines | Our corporate governance guidelines set forth the Board’s practices with respect to its responsibilities, qualifications, performance, direct access to associates and independent advisors, compensation, continuing education, and management evaluation and succession. The guidelines also include director stock ownership requirements. |

| Code of Business Conduct | Our code of business conduct is the cornerstone of our compliance and ethics program. It applies to all CarMax associates and Board members. It includes provisions relating to honest and ethical conduct, compliance with laws, the handling of confidential information and diversity. It explains how to use our associate help line and related website, both of which allow associates to report misconduct anonymously. It also describes our zero-tolerance policy on retaliation for making such reports. Any amendment to, or waiver from, a provision of this code for our directors or executive officers will be promptly disclosed under the “Governance” link at investors.carmax.com. |

Corporate Responsibility and Sustainability

For over 25 years, CarMax has transformed the way people buy and sell cars. When CarMax first opened its doors in 1993, we made a commitment to conduct business in an ethical, honest, and transparent way. As we have grown from that first store to over 200 locations and approximately 33,000 associates, so too has grown our ability to positively impact and support our associates, our customers, our communities, and our environment.

At CarMax, we believe that acting responsibly not only serves our core values but also drives the long-term, sustainable value of CarMax for all of our stakeholders, including our associates, customers, communities, and shareholders.

We continue to develop the governance structure that serves as the foundation of our Environmental, Social, and Governance (“ESG”) efforts. In fiscal 2021, we established a leadership team (which we refer to as our ESGLT) to manage and drive support of our social responsibility initiatives. During fiscal 2022, we more clearly defined the roles of the leaders within this team. Our Vice President of Corporate Social Responsibility (“VP-CSR”) leads our ESGLT and the related Social work tracks. She routinely partners with our Vice President of Store Delivery and Support Services, who oversees our Environmental work tracks, and our Vice President, Deputy General Counsel and Corporate Secretary, who oversees the Governance work tracks. These three associates guide our medium- to long-term ESG strategies and prioritization and ensure alignment of ESG initiatives with senior management and the Board. The ESGLT receives frequent guidance from our President and CEO, who sponsors and oversees the strategy and execution of our ESG work.

Our ESG governance framework is formalized at the Board level through our Nominating and Governance Committee. The Nominating and Governance Committee Charter outlines the responsibility of its members to consider corporate and social responsibility, environmental and sustainability matters as necessary, as well as to make recommendations to the Board, or take action with respect to appropriate ESG matters.

Our ESG oversight structure is specifically designed to ensure deep alignment of our company values and our business strategy, and, in fiscal 2022, with the guidance of a third-party advisor, we identified the key ESG issues most relevant and impactful to our business. We recognize the value of open communication with all of our stakeholders, and we will continue to work relentlessly to ensure we are focused on the issues that matter most.

We organize our approach to responsibility and sustainability around four main pillars: Putting People First, Protecting the Environment, Caring for Our Communities, and Ensuring Responsible Governance and Ethics.

PUTTING PEOPLE FIRST

A FORTUNE “100 Best Companies to Work For®” for eighteen consecutive years, we are proud to provide an award-winning workplace where we help our associates progress on their career journey and achieve their career goals. Our people are our priority and central to our success at CarMax. In fiscal 2022, we amplified the voice of our associates by revamping our

employee engagement practices. We increased the frequency of our associate surveys and incorporated questions on inclusion and belonging, to better assess the health and well-being of our associates and our workplace culture.

Building on our long-standing commitment to diversity and inclusion (“D&I”), we further invested in fostering our culture of belonging in 2021. We expanded our D&I team with new members focused on advancing our vision, and fully integrated our diversity and inclusion leaders into our broader CSR team. Additionally, more than 95% of CarMax employees and all of our Board members completed quarterly D&I educational lessons exploring important topics such as unconscious bias, empathy, and allyship in the workplace.

We are also committed to approaching compensation through the lens of equity, with a focus on ensuring that associate compensation is fair, competitive, and that it fully reflects our value of Putting People First. We made good on this commitment in fiscal 2022 and increased the hourly rate for a significant portion of our field associates following a comprehensive review of our Company-wide pay structure. As of February 28, 2022, all of our associates were paid above the applicable minimum wage.

PROTECTING THE ENVIRONMENT

In 2021, CarMax established greenhouse gas (GHG) emission reduction targets to demonstrate our commitment to reducing our carbon footprint: we intend to reduce Scope 1 and Scope 2 GHG emissions by 50% by 2025 against our 2018 baseline and achieve net-zero carbon emissions by 2050 in alignment with the Paris Agreement. We plan to report our Scope 1 and Scope 2 GHG emissions in our 2022 Responsibility Report. We have continued to focus on decreasing overall energy use and increasing use of renewable energy, while also taking important steps to ensure CarMax has the foundational pieces in place to meet our ambitious emissions goals. All CarMax stores now operate with energy-efficient exterior LED lighting, and we have begun retrofitting interior lighting as well.

CARING FOR OUR COMMUNITIES

We view the success of our business as fundamentally linked to the health and well-being of our local communities. Last year was no exception, and we paired our return to in-person volunteering with new efforts to continue our focus on supporting the communities in which we live and work.

In 2020, we took a strong stand against racial injustice, pledging $1 million to organizations that promote fairness and inclusion. This marked an important step in our journey to create lasting change in our communities. Guided by our values, we were inspired by a desire to affect people’s lives in real, tangible ways and fulfilled our initial commitment by investing in nonprofits making an impact on individuals. We believe that everyone should have the same opportunities to reach their full potential, and we are continuing to focus our efforts on promoting equitable access to economic opportunity in communities nationwide. We are focused on four pathways to achieve economic opportunity for underrepresented communities: education, careers, access to credit and financial education, and entrepreneurship.

In fiscal 2022 we invested more than $9.5 million through The CarMax Foundation and our corporate philanthropy efforts. We also equipped our associates to connect in meaningful ways with their local communities as we continued our work with nonprofits providing individuals with access to economic opportunities, built playgrounds, wrote letters to veterans, packaged care kits for our most vulnerable community members, and volunteered our time to support our communities’ most pressing needs. We also expanded our Care Card program in conjunction with Giving Tuesday, with more than 22,000 associates participating by donating $50 to a nonprofit of their choice, which resulted in donations of over $1.1 million to more than 8,000 nonprofits. These are just a few of the many ways CarMax and our associates supported our local communities over the past year.

ENSURING RESPONSIBLE GOVERNANCE AND ETHICS

Sound Corporate Governance

Our Board and management have adopted governance standards and practices that seek to further our commitment to integrity while ensuring effective enterprise risk management. Our compliance and ethics program works to ensure full legal and regulatory compliance across all aspects of our business.

Ethics

Our fundamental principle of integrity is reflected in the way we serve our customers, treat each other, and deliver our products. We rely on our fair and responsible business practices, our code of business conduct training, and benchmarking and improvements to our compliance and ethics program to maintain our culture of integrity. This culture is a distinct competitive advantage and allows us to attract and maintain a high-performing workforce.

Data Security and Consumer Privacy

Our comprehensive, risk-based approach to safeguarding information reflects our commitment to do the right thing and protect the sensitive data of those who trust in us.

As an auto retailer and financial institution, we are required to collect a significant amount of sensitive information to protect our business and our customers from fraudulent activity and to comply with regulatory requirements. As such, we take the responsibly to collect and protect sensitive data seriously and maintain a comprehensive program of technical solutions, procedural requirements and policies, staffed by well-trained and experienced cybersecurity and privacy professionals. Although the risks of cybersecurity breaches are dynamic, and potentially only growing as our reliance on digital operations increases, in the last three fiscal years, to our knowledge no information security breach has resulted in material expenses or the material compromise of our customers’ or employees’ sensitive information. Given the potential impact and dynamic nature of cybersecurity threats, our management team briefs either the full Board or a committee of the Board on a quarterly basis on topics related to technology and cybersecurity risk.

RESPONSIBILITY REPORTING

We publish our Responsibility Report annually, which is available at socialresponsibility.carmax.com. We expect to post the 2022 Responsibility Report in May 2022. The Responsibility Report includes a comprehensive discussion of the initiatives and programs we have implemented to support our commitment to having a positive impact on our people, communities, and the environment. In preparing the Responsibility Report we considered various standards, frameworks, ratings, and rankings for responsibility and sustainability reporting. Several of the metrics and narrative disclosures in the report align with the guidance provided by the Sustainability Accounting Standards Board (“SASB”) for the Consumer Goods Sector.

The Responsibility Report is reviewed by our Nominating and Governance Committee and our Board.

Independence

Our Board, in consultation with the Nominating and Governance Committee, evaluates the independence of our directors and director nominees at least annually. The most recent evaluation took place in April 2022. During this evaluation, the Board considered transactions between the directors (and their immediate family members) and the Company and its affiliates. The Board determined that the following directors are independent under the listing standards of the New York Stock Exchange (“NYSE”):

| | | | | | | | | | | | | | |

| Peter J. Bensen | David W. McCreight | | | |

| Ronald E. Blaylock | Mark F. O’Neil | | | |

| Sona Chawla | Pietro Satriano | | | |

| Shira Goodman | Marcella Shinder | | | |

| Robert J. Hombach | Mitchell D. Steenrod | | | |

Mr. Folliard is not independent because he was an executive officer of CarMax until 2016, and Mr. Nash is not independent because he is currently an executive officer of CarMax. In assessing independence, the Board considered transactions not just between CarMax and the individual directors themselves (and their immediate family members), but also between CarMax and entities associated with the directors or their immediate family members. The Board’s review included the following:

▪Ms. Chawla joined CDW Corporation as an executive officer in January 2020. CarMax purchased technology solutions from CDW in the ordinary course of business in fiscal 2020, fiscal 2021 and fiscal 2022. In addition, CDW acts as a value-added reseller of Microsoft products to CarMax. While CarMax does not make payments to CDW for this service, CDW does receive compensation from Microsoft in connection with products purchased under this arrangement. The payments from CarMax or in connection with sales to CarMax in each of the last three fiscal years did not exceed the greater of $1 million or 2% of the total net sales of CDW in each year.

The Board determined that this relationship did not impair the independence of Ms. Chawla.

Board Leadership Structure

CarMax has historically split the roles of CEO and Board chair. Mr. Folliard was our CEO from 2006 until his retirement in 2016, at which time the Board appointed Mr. Nash as CEO and Mr. Folliard as non-executive chair. The Board determined that Mr. Folliard’s long history of leading the Company uniquely positions him to serve as non-executive chair.

As non-executive chair of our Board, Mr. Folliard is responsible for chairing Board and shareholder meetings, attending meetings of the Board’s committees with the approval of the respective committee, and assisting management in representing CarMax to external groups as needed and as determined by the Board. The Board elects its chair annually.

Mr. Nash oversees the day-to-day affairs of CarMax and directs the formulation and implementation of our strategic plans. We believe that this leadership structure is currently the most appropriate for CarMax because it allows our CEO to focus primarily on our business strategy and operations while leveraging the experience of our chair to direct the business of the Board.

Mr. Steenrod, a director since 2011, was appointed as the Board’s lead independent director in 2019. As lead independent director, Mr. Steenrod serves as the principal liaison between the independent, non-management directors and the CEO, and is responsible for setting the agendas for Board meetings, presiding over executive sessions of the independent directors, coordinating feedback from directors in connection with the evaluations of the CEO and each director, and acting as chair of any Board meeting when the non-executive chair is not present. The Board elects its lead independent director annually.

Our Board periodically reviews this structure and recognizes that, depending on the circumstances, a different leadership model might be appropriate. The Board has no fixed policy on whether the roles of chair and CEO should be separate or combined, which maintains flexibility based on CarMax’s needs and the Board’s assessment of the Company’s leadership. Our corporate governance guidelines do provide that the Board appoint a lead independent director in the event the CEO is elected chair or the chair otherwise does not qualify as independent.

Board Committees

During fiscal 2022, the Board had four standing committees: Audit, Compensation and Personnel, Nominating and Governance and Technology and Innovation. Each committee is composed solely of independent directors as that term is defined in applicable rules of the U.S. Securities and Exchange Commission (“SEC”) and the NYSE.

| | | | | |

Each committee is composed solely of independent directors.

| In addition, all members of the Compensation and Personnel Committee qualify as “outside directors” within the meaning of Section 162(m) of the Internal Revenue Code and “non-employee directors” as defined by Rule 16b-3 under the Securities Exchange Act of 1934. Each committee has a charter that describes the committee’s responsibilities. These charters are available under the “Governance” link at investors.carmax.com or upon written request to our Corporate Secretary at CarMax, Inc., 12800 Tuckahoe Creek Parkway, Richmond, Virginia 23238. |

The table below lists the members and summarizes the responsibilities of the four committees.

| | | | | | | | |

| Committee | Members | Responsibilities |

| Audit | Peter J. Bensen

(Chair)

Robert J. Hombach*

David W. McCreight

Mark F. O’Neil

| The Audit Committee assists in the Board’s oversight of: •the integrity of our financial statements; •our compliance with legal and regulatory requirements; •the independent auditors’ qualifications, performance and independence; and •the performance of our internal audit function. The Audit Committee retains and approves all fees paid to the independent auditors, who report directly to the Committee. Each member of the Audit Committee is financially literate, with Mr. Bensen considered an audit committee financial expert under the standards of the NYSE and the SEC. The Audit Committee’s report to shareholders can be found on page 26.

* Mr. Hombach resigned from the Audit Committee effective March 31, 2022.

|

Compensation

and Personnel | Ronald E. Blaylock (Chair)

Sona Chawla Mitchell D. Steenrod | The Compensation and Personnel Committee assists in the Board’s oversight of: •our executive compensation philosophy; •our executive and director compensation programs, including related risks; •salaries, short- and long-term incentives and other benefits and perquisites for our CEO and other executive officers, including any severance agreements; •the administration of our incentive compensation plans and all equity-based plans; •management succession planning, including for our CEO; and •our strategy, policies and practices related to human capital management, including talent management, associate engagement and diversity and inclusion. The Compensation and Personnel Committee has sole authority to retain and terminate its independent compensation consultant, as well as to approve the consultant’s fees. The Compensation and Personnel Committee’s report to shareholders can be found on page 46. |

Nominating

and Governance | Shira Goodman

(Chair)

Pietro Satriano

Marcella Shinder | The Nominating and Governance Committee assists in the Board’s oversight of: •Board organization and membership, including by identifying individuals qualified to become members of the Board, considering director nominees submitted by shareholders, and recommending director nominees to the Board; •corporate and social responsibility, environmental and sustainability matters; and •our corporate governance guidelines. |

| Technology and Innovation | Sona Chawla (Chair)

Mark F. O’Neil Marcella Shinder | The Technology and Innovation Committee assists in the Board’s oversight of: •our technology, omni-channel, digital, e-commerce, and innovation strategies; •significant emerging technology, omni-channel, e-commerce, digital, and innovation trends; •major technology related project progress, budgets, and effectiveness; •our development and commercial use of data assets, data science, and machine learning; •CarMax’s intellectual property portfolio; and •risks and exposures related to cybersecurity, data privacy, and business continuity matters. |

Board and Committee Meetings

During fiscal 2022, our Board met four times and our Board committees met a combined 23 times. Each incumbent director attended 93% or more of the total number of meetings of the Board and the committees on which he or she served. The average attendance of all of our incumbent directors in fiscal 2022 was 98%. We expect our directors to attend the annual meeting of shareholders and all of our incumbent directors did so in 2021.

Our independent directors meet in executive session, without management present, at least once during each regularly scheduled Board meeting. Our lead independent director presides over these executive sessions. In addition, our non-management directors meet in executive session, also without management present, at least once during each regularly scheduled Board meeting. As chair, Mr. Folliard presides over these executive sessions. The table below lists the number of Board and committee meetings in fiscal 2022 and discloses each director’s attendance.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Director | Board | | Audit | | Compensation

and Personnel | | Nominating

and Governance | | Technology

and Innovation |

| Peter J. Bensen | 4 | | 10* | | — | | — | | — |

| Ronald E. Blaylock | 4 | | — | | 5* | | — | | — |

| Sona Chawla | 4 | | — | | 5 | | — | | 4* |

| Thomas J. Folliard | 4* | | — | | — | | — | | — |

| Shira Goodman | 4 | | — | | — | | 4* | | — |

| Robert J. Hombach*** | 4 | | 10 | | — | | — | | — |

| David W. McCreight | 4 | | 9 | | — | | — | | — |

| William D. Nash | 4 | | — | | — | | — | | — |

| Mark F. O’Neil | 4 | | 9 | | — | | — | | 4 |

| Pietro Satriano | 4 | | — | | — | | 4 | | — |

| Marcella Shinder | 4 | | — | | — | | 4 | | 4 |

| Mitchell D. Steenrod | 4** | | — | | 5 | | — | | — |

| TOTAL MEETINGS | 4 | | 10 | | 5 | | 4 | | 4 |

* Chair

** Lead independent director

*** Mr. Hombach is not standing for reelection at this year’s annual meeting and resigned from the Audit Committee, effective March 31, 2022.

Selection of Directors

CRITERIA

The Board and the Nominating and Governance Committee believe that the Board should include directors with diverse backgrounds and that directors should have, at a minimum, high integrity, sound judgment and significant experience or skills that will benefit the Company. In addition, the Board amended our corporate governance guidelines in 2019 to include an affirmative statement that the Nominating and Governance Committee will consider candidates with diversity of experience and background, including ethnic and gender diversity, when searching for new directors.

| | | | | |

We believe our Board should include directors with diverse backgrounds, including ethnic and gender diversity.

| The Committee takes into account a number of additional factors in assessing director nominees, including the current size of the Board, the particular challenges facing CarMax, the Board’s need for specific skills or perspectives, and the nominee’s character, reputation, experience, independence from management and ability to devote the requisite time.

We believe that the diverse backgrounds and experiences of our current directors demonstrate the Committee’s success. |

PROCESS

The Nominating and Governance Committee screens and recommends candidates for nomination by the Board. The Committee may consider input from several sources, including Board members, shareholders, outside search firms, and management. The Committee evaluates candidates in the same manner regardless of the source of the recommendation, using the criteria summarized above. Shareholders may send their recommendations for director candidates to the attention of our Corporate Secretary at CarMax, Inc., 12800 Tuckahoe Creek Parkway, Richmond, Virginia 23238.

Our bylaws include proxy access provisions, which enable eligible CarMax shareholders to have their own director nominee included in the Company’s proxy materials along with candidates nominated by our Board. Our proxy access right permits an eligible shareholder, or a group of up to 20 shareholders, to nominate and include in CarMax’s proxy materials directors constituting up to 20% of the Board of Directors. To be eligible, the shareholder or shareholder group must have owned 3% or more of our outstanding capital stock continuously for at least three years and satisfy certain notice and other requirements set forth in our bylaws. Shareholders who wish to include director nominations in our proxy statement or nominate directors directly at an annual shareholders meeting must follow the instructions under “Shareholder Proposal Information” on page 74.

EVALUATION AND REFRESHMENT

In connection with the annual election of directors and at other times throughout the year, the Nominating and Governance Committee considers whether our Board has the right mix of skills and experience to meet the challenges facing CarMax. In addition, as reflected in the 2019 amendments to our corporate governance guidelines, the Nominating and Governance Committee strives to ensure that the Board reflects a diversity of experience and background, including ethnic and gender diversity.

One of the processes that assists the Committee in its consideration is our Board’s annual evaluation process. The Board and each of its committees conducts a self-evaluation. In addition, the chair, lead independent director and Committee preside over a thorough peer evaluation process in which every year each individual director completes an individual evaluation for each of the other directors. The collective comments of the directors are compiled and presented by the chair, or by the lead independent director, with respect to the chair’s evaluation, to the full Board for discussion. The results of these evaluations assist the Committee in determining both whether to nominate incumbent directors for reelection and whether to search for additional directors.

As part of its consideration, the Committee reviews both the age and tenure of incumbent directors. Our Board has adopted a mandatory director retirement policy providing that directors may not stand for re-election after reaching age 76. The Board may waive this limitation in appropriate circumstances.

Our Board has undergone significant refreshment in the past several years, with five of our nine independent director nominees having joined the Board since 2017. The fresh perspectives and diversity of skills of the directors recently added to the Board, coupled with the institutional knowledge of the tenured independent directors, provides the Board with ample experience and leadership.

The average tenure of our director nominees is 8 years, and the average age of our director nominees is 58 years.

Key Board Responsibilities

BOARD’S ROLE IN SUCCESSION PLANNING

The Board oversees the recruitment, development and retention of executive talent. As part of its oversight, the Board regularly reviews short- and long-term succession plans for the Chief Executive Officer and other executive officer positions. In assessing possible CEO candidates, the independent directors identify the skills, experience and other attributes they believe are required to be an effective CEO in light of CarMax’s business strategies, opportunities and challenges.

The Board also considers its own succession. In doing so, the Nominating and Governance Committee and the Board take into account, among other things, the needs of the Board and the Company in light of the overall composition of the Board with a view to achieving a balance of skills, experience and attributes that would be beneficial to the Board’s oversight role.

BOARD’S ROLE IN STRATEGIC PLANNING

The Board has oversight responsibility for our business strategy and strategic planning. While the formulation and implementation of CarMax’s strategic plan is primarily the responsibility of management, the Board plays an active role. This includes not only monitoring progress made in executing the strategic plan, but also regularly evaluating the strategy in light of evolving operating and economic conditions, shifts in market fundamentals, technology and consumer preferences. The Board carries out its role primarily through regular reviews of the Company’s strategic plan and discussions with management, which include both broad-based presentations and more in-depth analyses and discussions of specific areas of focus. In addition, regular Board meetings throughout the year include presentations and discussions with management on significant initiatives implementing the strategic plan; developments affecting an area of the Company’s business; and on trends, competition, and emerging challenges and opportunities. The Board also reviews the strategic plan, including actions taken and planned to implement the strategy, as part of its review and approval of the annual budget.

The Board’s oversight of risk management enhances the directors’ understanding of the risks associated with the Company’s strategic plan and its ability to provide guidance to and oversight of senior management in executing the Company’s strategy.

BOARD’S ROLE IN RISK OVERSIGHT

Taking reasonable and responsible risks is an inherent part of our strategy and is critical to achieving our strategic objectives. Our Board undertakes its responsibility to oversee risks to CarMax through a risk governance framework designed to:

•identify critical risks;

•allocate responsibilities for overseeing those risks to the Board and its committees; and

•evaluate the Company’s risk management processes.

The Board does not view risk in isolation. Rather, it considers risks in its business decisions and as part of CarMax’s business strategy. This consideration occurs in the ordinary course of the Board’s business and is not tied to any of the formal processes described below, although it is enhanced by those processes.

The following table describes the components of CarMax’s risk governance framework.

| | | | | | | | |

Assignment of Risk Categories

to Board and its Committees | The Board has assigned oversight of certain key risk categories to either the full Board or one of its committees. For each category, management reports regularly to the Board or the assigned committee, as appropriate, describing CarMax’s strategies for monitoring, managing and mitigating risks that fall within that category.

Examples of the risk categories assigned to each committee and the full Board are described below. This list is not comprehensive and is subject to change: |

| | § | Audit Committee: oversees risks related to financial reporting, compliance and ethics, and legal and regulatory issues. |

| | § | Compensation and Personnel Committee: oversees risks related to human resources and compensation practices. |

| | § | Nominating and Governance Committee: oversees risks related to government affairs, CarMax’s reputation, social responsibility, and environmental and sustainability matters. |

| § | Technology and Innovation Committee: oversees risks related to information technology, cybersecurity, and business continuity. |

| | § | Board: oversees risks related to the economy, competition, shareholder relations, finance and strategy. |

| Enterprise Risk Management | Risk Committee: We have a management-level Risk Committee, which is chaired by Enrique Mayor-Mora, our Senior Vice President and Chief Financial Officer (“CFO”), and includes as members other leaders from across CarMax. The Risk Committee meets periodically to identify and discuss the risks facing CarMax. |

| Board Reporting: The Risk Committee delivers biannual reports to the Board identifying the most significant risks facing the Company. |

| Board Oversight: On an annual basis, Mr. Mayor-Mora, on behalf of the Risk Committee, discusses our procedures for identifying significant risks with the Audit Committee. |

Other Processes that Support

Risk Oversight and Management | The Board oversees other processes that are not intended primarily to support enterprise risk management, but that assist the Company in identifying and controlling risk. These processes include our compliance and ethics program, our internal audit function, pre-filing review of SEC filings by our management-level disclosure committee, and the work of our independent auditors. |

We believe that our Board leadership structure, discussed in detail beginning on page 18, supports the Board’s risk oversight function. Our chair, lead independent director and committee chairs set agendas and lead meetings to ensure strong risk oversight, while our CEO and his management team are charged with managing risk.

Related Person Transactions

Our Board has adopted a written Related Person Transactions Policy that applies to any transaction in which:

•CarMax or one of its affiliates is a participant;

•the amount involved exceeds $120,000; and

•the related person involved in the transaction (whether a director, executive officer, owner of more than 5% of our common stock, or an immediate family member of any such person) has a direct or indirect material interest.

| | | | | |

We did not have any related person transactions in fiscal 2022.

| A copy of our policy is available under the “Governance” link at investors.carmax.com. The Audit Committee is responsible for overseeing the Company’s policy and reviewing any related person transaction that is required to be disclosed pursuant to SEC rules. |

In reviewing related person transactions, the Audit Committee considers, among other things:•the related person’s relationship to CarMax;

•the facts and circumstances of the proposed transaction;

•the aggregate dollar amount involved in the transaction;

•the related person’s interest in the transaction, including his or her position or relationship with, or ownership in, an entity that is a party to, or has an interest in, the transaction; and

•the benefits to CarMax of the proposed transaction and, if applicable, the terms and availability of comparable products and services from unrelated third parties.

The Audit Committee will approve or ratify a related person transaction only if it determines that: (i) the transaction serves the best interests of CarMax and its shareholders; or (ii) the transaction is on terms reasonably comparable to those that could be obtained in arm’s length dealings with an unrelated third party.

We did not have any related person transactions in fiscal 2022.

Shareholder Outreach and Engagement

We believe that strong corporate governance should include engagement with our shareholders to enable us to understand and respond to shareholder concerns. Our senior management team, including our CEO, CFO, and members of our Investor Relations team, maintain regular contact with a broad base of investors, including through quarterly earnings calls, individual meetings, and other channels for communication, to understand their concerns.

Additionally, in fiscal 2022, we led a proactive shareholder outreach program. Our shareholder outreach program is led by a cross-functional team that includes members of our senior management team, Investor Relations, ESG, and Legal functions. Members of our Board are also involved, as appropriate. In fiscal 2022, we held meetings with shareholders representing a significant percentage of our investor base and covered topics important to our shareholders, including environmental, social, and governance (ESG) matters; our unique CarMax culture; board refreshment, qualifications and diversity; and cybersecurity, among other topics.

In the past several years, several enhancements to our policies and practices have been informed by shareholder feedback. For example:

•Our Board of Directors established a Technology and Innovation Committee in 2021.

•We incorporated diversity training goals into our Annual Incentive Bonus Program for fiscal 2022.

•We announced our commitment to achieving net zero greenhouse gas (GHG) emissions by 2050 and a 50% reduction in GHG emissions by 2025, compared with a 2018 baseline.

•We expect to disclose EEO-1 data in our 2022 Responsibility Report.

•We committed to provide enhanced transparency regarding our corporate contributions for candidates for public office, as well as our membership in certain trade associations. We expect to publicize this information in our 2022 Responsibility Report.

Shareholder Communication with Directors

Shareholders or other interested parties wishing to contact the Board or any individual director may send correspondence to CarMax, Inc., c/o Corporate Secretary, 12800 Tuckahoe Creek Parkway, Richmond, Virginia 23238, or may send an e-mail to chair@carmax.com, which is monitored by John M. Stuckey, III, our Corporate Secretary. Mr. Stuckey will forward to the Board or appropriate Board member any correspondence that deals with the functions of the Board or its committees or any other matter that would be of interest to the Board. If the correspondence is unrelated to Board or shareholder matters, it will be forwarded to the appropriate department within the Company for further handling.

| | |

PROPOSAL TWO: RATIFICATION OF THE APPOINTMENT OF

THE INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM |

We are asking you to ratify the Audit Committee’s appointment of KPMG LLP (“KPMG”) as CarMax’s independent registered public accounting firm for fiscal 2023. KPMG has served as our independent registered public accounting firm continuously since our separation from Circuit City Stores, Inc. (“Circuit City”) in fiscal 2003, and also served as Circuit City’s independent registered public accounting firm from the incorporation of CarMax, Inc. in 1996 through the separation. KPMG has been appointed by the Audit Committee to continue as CarMax’s independent registered public accounting firm for fiscal 2023. The members of the Audit Committee and the Board believe that the continued retention of KPMG to serve as CarMax’s independent registered public accounting firm is in the best interests of CarMax and its shareholders.

The Audit Committee is directly responsible for the appointment, compensation, retention, evaluation, and oversight of the independent registered public accounting firm retained to audit CarMax’s financial statements. In accordance with the SEC-mandated rotation of the audit firm’s lead engagement partner, the Audit Committee and its chairperson are directly involved in the selection of KPMG’s lead engagement partner and were directly involved in the selection of KPMG’s current lead engagement partner, whose period of service began in fiscal 2023. Furthermore, in order to ensure continuing auditor independence, the Audit Committee periodically considers whether there should be a regular rotation of the independent registered public accounting firm.

Although we are not required to seek shareholder ratification, we are doing so as a matter of good corporate governance. If the shareholders do not ratify the appointment of KPMG, the Audit Committee will reconsider its decision. Even if the appointment is ratified, the Audit Committee, in its discretion, may change the appointment at any time during the year if it determines that a change would be in the best interests of CarMax and its shareholders.

We expect that representatives of KPMG will attend the annual shareholders meeting. They will be given the opportunity to make a statement if they desire to do so and to respond to appropriate questions.

The Board recommends a vote FOR Proposal Two.

The Audit Committee reports to and acts on behalf of CarMax’s Board of Directors by providing oversight of the integrity of the Company’s financial statements, the Company’s independent and internal auditors, and the Company’s compliance with legal and regulatory requirements. The Audit Committee operates under a written charter adopted by the Board, which is reviewed annually and is available under the “Governance” link at investors.carmax.com. The members of the Audit Committee meet the independence and financial literacy requirements of the NYSE and the SEC.

Management is responsible for the preparation, presentation and integrity of the Company’s financial statements and the establishment of effective internal control over financial reporting. KPMG, the Company’s independent registered public accounting firm, is responsible for auditing those financial statements in accordance with the standards of the Public Company Accounting Oversight Board (“PCAOB”) and expressing an opinion on the conformity of CarMax’s audited financial statements with generally accepted accounting principles and on the effectiveness of CarMax’s internal controls over financial reporting. In this context, the Audit Committee has met and held discussions with management, KPMG and the Company’s internal auditors, meeting 10 times in fiscal 2022.

Management represented to the Committee that the Company’s fiscal 2022 consolidated financial statements were prepared in accordance with generally accepted accounting principles, and the Committee reviewed and discussed the fiscal 2022 consolidated financial statements with management and KPMG.

The Committee has discussed with KPMG the matters required to be discussed by the applicable requirements of the PCAOB and the SEC, including significant accounting policies and the quality, not just the acceptability, of the accounting principles utilized. The Committee has also received from KPMG the written disclosures and the letter required by applicable requirements of the PCAOB regarding the independent auditor’s communications with the Audit Committee regarding independence, and the Audit Committee has discussed with KPMG the firm’s independence. The Audit Committee concluded that KPMG is independent from the Company and management.

In reliance on these reviews and discussions, the Committee recommended to the Board of Directors that the audited consolidated financial statements be included in the Company’s Annual Report on Form 10-K for the fiscal year ended February 28, 2022, for filing with the SEC.

AUDIT COMMITTEE

Peter J. Bensen, Chair

David W. McCreight

Mark F. O’Neil

| | |

AUDITOR FEES AND PRE-APPROVAL POLICY |

Auditor Fees and Services

The following table sets forth fees billed by KPMG for fiscal 2021 and 2022.

| | | | | | | | | | | |

| Years Ended February 28 |

| Type of Fee | 2022 | | 2021 |

Audit Fees(a) | $ | 2,768,058 | | | $ | 2,193,000 | |

Audit-Related Fees(b) | 570,000 | | | 570,000 | |

Tax Fees(c) | 110,000 | | | 1,462 | |

| TOTAL FEES | $ | 3,448,058 | | | $ | 2,764,462 | |

(a)This category includes fees associated with the annual audit of CarMax’s consolidated financial statements and the audit of CarMax’s internal control over financial reporting. It also includes fees associated with quarterly reviews of CarMax’s unaudited consolidated financial statements.

(b)This category includes fees associated with agreed-upon procedures and attestation services related to our financing and securitization program.

(c)This category includes fees associated with tax compliance, consultation and planning services.

Approval of Auditor Fees and Services

The Audit Committee’s charter provides for pre-approval of audit and non-audit services to be performed by the independent auditors. The Committee typically pre-approves specific types of audit, audit-related and tax services, together with related fee estimates, on an annual basis. The Committee pre-approves all other services on an individual basis throughout the year as the need arises. The Committee has delegated to its chair the authority to pre-approve independent auditor engagements in an amount not to exceed $50,000 per engagement. Any such pre-approvals are reported to and ratified by the entire Committee at its next regular meeting.

All audit, audit-related and tax services in fiscal 2022 were pre-approved by the Audit Committee or pre-approved by the chair pursuant to his delegated authority and subsequently ratified by the Audit Committee. In all cases, the Audit Committee concluded that the provision of such services by KPMG was compatible with the maintenance of KPMG’s independence.

| | |

PROPOSAL THREE: ADVISORY RESOLUTION TO

APPROVE EXECUTIVE COMPENSATION |

We are asking you to approve an advisory resolution approving the compensation of our named executive officers as disclosed in this proxy statement. This vote is commonly referred to as a “Say on Pay” vote and is required by Section 14A of the Securities Exchange Act of 1934. Although this resolution is not binding, we value your opinion and our Compensation and Personnel Committee will consider the outcome of this vote when making future decisions.

We believe our executive compensation program promotes the achievement of positive results for our shareholders, aligns pay and performance, and allows us to attract and retain the talented executives that drive our long-term financial success. We urge you to read the “Compensation Discussion and Analysis” section of this proxy statement beginning on page 29, which describes in more detail how our executive compensation program operates and how it is designed to achieve our compensation objectives. We also encourage you to review the “Summary Compensation Table” and other compensation tables and narratives, found on pages 47 through 63.

We have adopted a policy providing for an annual “Say on Pay” vote. Accordingly, the next advisory vote on the compensation of our named executive officers will occur in 2023.

Our Board recommends that, on an advisory basis, shareholders vote in favor of the following resolution:

RESOLVED, that the compensation of the named executive officers of CarMax, Inc. (the “Company”), as disclosed in the Company’s 2022 Proxy Statement pursuant to the compensation disclosure rules of the Securities and Exchange Commission, including the Compensation Discussion and Analysis, compensation tables and the narrative discussion that accompanies the compensation tables, is hereby APPROVED.

The Board recommends a vote FOR Proposal Three.

| | |

COMPENSATION DISCUSSION AND ANALYSIS |

Overview

The Compensation and Personnel Committee (the “Committee”) oversees an executive compensation program that is intended to drive the creation of long-term shareholder value. This section describes that program and details the compensation earned by our CEO, our CFO, and our three other most highly compensated executive officers, as well as two recently retired executive officers. We refer to these individuals, listed below, as our “named executive officers” or “NEOs.” Our NEOs as of February 28, 2022 are the following.

| | | | | |

| William D. Nash | President and Chief Executive Officer. Mr. Nash joined CarMax in 1997 and was promoted to his current position in 2016. Mr. Nash is also a member of our Board. |

| Enrique N. Mayor-Mora | Senior Vice President and Chief Financial Officer. Mr. Mayor-Mora joined CarMax in 2011 and was promoted to his current position in October 2019. |

| James Lyski | Executive Vice President and Chief Marketing Officer. Mr. Lyski joined CarMax in 2014 and was promoted to his current position in 2017. |

| Shamim Mohammad | Executive Vice President and Chief Information and Technology Officer. Mr. Mohammad joined CarMax in 2012 and was promoted to his current role in 2021. |

| Diane L. Cafritz | Senior Vice President, General Counsel, Chief Compliance Officer and Chief Human Resources Officer. Ms. Cafritz joined CarMax in 2003 and was appointed to her current role in 2021. |

| Edwin J. Hill | Former Executive Vice President and Chief Operating Officer. Mr. Hill retired on January 2, 2022. |

| Eric M. Margolin | Former Executive Vice President, General Counsel, Chief Compliance Officer and Corporate Secretary. Mr. Margolin retired on August 31, 2021. |

Executive Summary

SUMMARY OF FISCAL 2022 COMPENSATION CHANGES FOR OUR NAMED EXECUTIVE OFFICERS

Two long-standing CarMax executive officers retired in fiscal 2022, namely Mr. Hill, our Executive Vice President and Chief Operating Officer, and Mr. Margolin, our Executive Vice President, General Counsel, Chief Compliance Officer and Corporate Secretary. And, directly tied to our succession planning efforts, several executive officers took on additional responsibilities. Mr. Lyski, our Executive Vice President and Chief Marketing Officer, assumed management responsibilities for our Edmunds business, upon our Edmunds acquisition in June 2021, as well as management oversight of our business development and certain data analytics functions. Ms. Cafritz, who had previously been serving as our Senior Vice President and Chief Human Resources Officer, took on additional responsibilities following Mr. Margolin’s retirement; she now also serves as our General Counsel and Chief Compliance Officer. Mr. Mohammad, previously serving as Senior Vice President and Chief Information and Technology Officer, was recognized for his continued ability to drive innovation and technology-related solutions for our business; he was promoted to Executive Vice President in April 2021.

The following chart summarizes the key compensation elements for fiscal 2022:

| | | | | | | | |

| Compensation Element | Committee

Determinations | Why We Made These Determinations |

| Base Salary | Base salary increases ranging from 3% and 14% | Differentiated increases were awarded to our NEOs related to executive promotions, increasing responsibilities and benchmarking data used to inform pay decisions. See pages 33 and 34 for more detail. |

| Annual Incentive Bonus | 185.6% payout versus a 100% payout in fiscal 2021

Increased target percentage for each NEO | The Committee set bonus goals for fiscal 2022 during the first quarter of the fiscal year. The goals were intended to drive the Company’s financial performance, market share growth, operational execution (in the form of enhancing its online sales capabilities), and associate-wide diversity and inclusion (“D&I”) training. See pages 34 to 37 for more detail.

The Committee also reviewed target percentages for our executive officers and determined that the then-current percentages were on the lower end of the market range, and increased that percentage for each NEO between 10 and 17.5 percentage points. See page 34 for more detail. |

| Long-Term Equity Awards | Return to Performance Stock Units | In fiscal 2022, we granted our NEOs two forms of long-term equity awards: stock options and performance stock units (“PSUs”). Last year, and in light of the continued uncertainty related to the COVID-19 pandemic, we granted our named executive officers market stock units instead of PSUs. For fiscal 2022, the Committee returned to issuing PSUs, tied to our pre-tax EPS performance. |

LOOKING FORWARD TO FISCAL 2023

At its meeting in March 2022, the Committee approved the promotions of each of Mr. Mayor-Mora to Executive Vice President and Chief Financial Officer, and Ms. Cafritz to Executive Vice President, General Counsel, Chief Compliance Officer and Chief Human Resources Officer. Mr. Mayor-Mora’s leadership has been pivotal in helping to grow and fund our complex and diversified business, including the addition of Edmunds, our first acquisition, in 2021. Ms. Cafritz’s guidance and counsel has been critical throughout the past several years, as she has led the transformation of our benefits, recruiting and development programs, established our newly formed Corporate Social Responsibility team, and continued to drive our compliance-minded culture.

How We Make Compensation Decisions

The Committee oversees our executive and director compensation programs and determines all executive officer and director compensation.

COMPENSATION PHILOSOPHY AND OBJECTIVES