Current Report Filing (8-k)

January 24 2018 - 2:15PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d)

OF THE SECURITIES EXCHANGE ACT OF 1934

Date of Report

(Date of Earliest Event Reported):

January 18, 2018

CAMPBELL SOUP COMPANY

|

|

|

|

|

|

|

|

|

New Jersey

|

|

1-3822

|

|

21-0419870

|

|

State of Incorporation

|

|

Commission File Number

|

|

I.R.S. Employer

Identification No.

|

One Campbell Place

Camden, New Jersey 08103-1799

Principal Executive Offices

Telephone Number: (856) 342-4800

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

¨

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

¨

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

¨

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

¨

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-(c))

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (17 CFR §230.405) or Rule 12b-2 of the Securities Exchange Act of 1934 (17 CFR §240.12b-2).

Emerging growth company

¨

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act.

¨

Item 2.05 — Costs Associated with Exit or Disposal Activities

In January 2015, Campbell Soup Company (the "Company") announced cost savings initiatives to implement a new enterprise design, to reduce costs and to streamline its organizational structure.

In February 2017, the Company announced that it was expanding these cost savings initiatives by further optimizing its supply chain network, primarily in North America, continuing to evolve its operating model to drive efficiencies, and more fully integrating its recent acquisitions. The Company extended the time horizon for the initiatives from fiscal 2018 to fiscal 2020. The Company indicated the cost estimates for these expanded initiatives, as well as timing for certain activities, are being developed.

On January 18, 2018, the Company authorized additional pre-tax costs for these expanded initiatives totaling approximately $125 million to $140 million associated with the following activities:

|

|

|

|

•

|

The Company will close its manufacturing facility in Toronto, Ontario, to improve the operational efficiency of its thermal supply chain network in North America and will move its Canadian headquarters and commercial operations to a new location in the Greater Toronto Area. The Company plans to operate the Toronto facility for up to 18 months and will close it in phases, transitioning substantially all its production to three U.S. thermal plants in Maxton, North Carolina; Napoleon, Ohio; and Paris, Texas. Approximately 380 positions will be impacted as a result of the closure; and

|

|

|

|

|

•

|

The Company will optimize its information technology infrastructure by migrating certain applications to the latest cloud technology platform, which will enhance integration of applications and network service.

|

The Company currently expects the additional costs to consist primarily of:

|

|

|

|

•

|

approximately $30 million in severance pay and benefits;

|

|

|

|

|

•

|

approximately $65 million in accelerated depreciation of property, plant and equipment; and

|

|

|

|

|

•

|

approximately $30 million to $45 million in implementation costs and other related costs.

|

Approximately $55 million to $70 million of the additional pre-tax costs are expected to be cash expenditures. In addition, the Company expects to invest approximately $65 million in capital expenditures in connection with these activities.

With these additional activities, the total estimated pre-tax costs for actions that have been identified to date are expected to be approximately $515 million to $560 million, and consist of the following:

|

|

|

|

•

|

approximately $170 million to in severance pay and benefits;

|

|

|

|

|

•

|

approximately $85 million in accelerated depreciation and asset impairment; and

|

|

|

|

|

•

|

approximately $260 million to $305 million in implementation costs and other related costs.

|

Of the aggregate $515 million to $560 million of pre-tax costs, the Company expects approximately $415 million to $460 million will be cash expenditures. In addition, the Company expects to invest approximately $250 million in capital expenditures in connection with the actions that have been identified to date. The Company expects to incur substantially all of the costs through fiscal 2019.

Cost estimates for these expanded initiatives, as well as timing for certain activities, are continuing to be developed.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, as amended, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

|

|

|

CAMPBELL SOUP COMPANY

|

|

|

|

|

(Registrant)

|

|

|

|

|

|

|

|

|

|

|

|

|

Date: January 24, 2018

|

By:

|

/s/ Anthony P. DiSilvestro

|

|

|

|

|

Anthony P. DiSilvestro

|

|

|

|

|

Senior Vice President and Chief Financial Officer

|

|

|

|

|

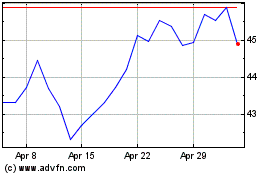

Campbell Soup (NYSE:CPB)

Historical Stock Chart

From Oct 2024 to Nov 2024

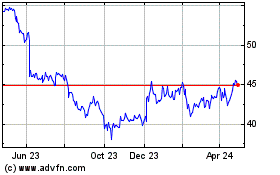

Campbell Soup (NYSE:CPB)

Historical Stock Chart

From Nov 2023 to Nov 2024