Turkey, with Data Stuffing - Earnings Preview

November 17 2011 - 7:00PM

Zacks

Earnings Preview 11/18/11

There will only be a handful of firms reporting next week as the

third quarter reporting season is almost over. A total of 70 firms

are scheduled to report, including 8 of the S&P 500.

The firms reporting next week include:

Analog

Devices (ADI),

Campbell Soup (CPB),

Deere (DE),

Hewlett-Packard

(HPQ),

Medtronic (MDT) and

Tyson

Foods (TSN).

It will be effectively a short week, so all the data is jammed into

the first three days. There is enough to keep the markets busy

until everyone stops for turkey and football on Thursday.

The key reports start with existing home sales. On Tuesday we get

the second look at GDP growth in the third quarter. We will also

get the Fed minutes for the November 2 meeting. Things get very

busy on Wednesday as initial claims get pushed forward a day and we

get data on Personal Income and Spending, as well as new orders for

Durable Goods.

While the market will be open on Friday, there will be little

buying and selling going on at the corner of Broad and Wall -- the

focus will be on all the buying in the malls with Black Friday.

Europe does not share this holiday, so we will probably get more

drama from that side of the pond as well.

Monday

- In September, existing home sales ran at a 4.91 million annual

pace, down 3.0% from August. In October they are expected to slip

slightly further to a 4.85 million rate. Of at least equal concern

is the level of inventories available for sale relative to the

sales pace. In September there were 8.5 months of supply on the

market, well above the normal level of about 6 months. That

suggests continued downward pressure on existing home prices. As

sales of used homes are just the transfer of an existing asset,

they do not represent that much in the way of economic activity.

However, as the major store of wealth for the middle class,

existing home prices are vital. Also, the more prices fall, the

greater the number of people who are underwater on their mortgages,

and thus vulnerable to foreclosure.

Tuesday

- In the first look at GDP it was estimated that the economy grew

at a 2.5% pace, well above the 1.3% growth rate of the second

quarter and the nearly non-existent growth of just 0.4% in the

first quarter. The quality of the growth was also quite high as

that growth included a 1.08% drag from the change in inventories.

The overall growth rate is not expected to change, however the

quality of the growth probably improved even further, with a higher

contribution from net exports and consumer spending, but a bigger

drag from inventory investment.

- The Fed decided to do nothing at its 11/2/11 meeting. That

satisfied the three members who had objected in the previous two

meetings but spurred a new dissent from Charles Evans of Chicago.

The minutes to the meeting should provide clues as to why the Fed

decided to sit on its hands in the face of 9.0% unemployment when

it has a legal mandate to keep unemployment low.

Wednesday

- Weekly Initial Claims for Unemployment Insurance come out a day

early. Recently they broke below the psychologically important

400,000 level. Last week they fell by 5,000 to 388,000, but only

after the previous week had been revised upward by 3,000, so it was

really more like a 2,000 decline. The consensus is looking for

391,000. The 400,000 level is important in that it has historically

been the inflection point below which we tend to create enough jobs

to bring down the unemployment rate. The week-to-week numbers can

be very volatile, so the four-week average is the thing to focus

on. Keep an eye on the prior week’s revision as well, as the change

from the revised number.

- Continuing Jobless Claims have been in a downtrend of late, but

the road down has been bumpy. Last week they fell by 57,000 to

3.608 million. That is down 662,000 from a year ago. I would expect

a small decline this week. The consensus is looking for a bounce to

3.620 million, a small increase. Federally paid extended claims

fell by 70,000 to 3.459 million last week and are down 1.468

million over the last year. Looking at just the regular continuing

claims numbers is a serious mistake. They only include a little

over half of the unemployed now, given the unprecedentedly high

duration of unemployment figures. A better measure is the total

number of people getting unemployment benefits -- currently at

6.773 million -- which is down 62,000 from last week (there are

some timing issues, so the change in continuing and existing claims

does not match the change in the total). The total number of people

getting benefits is now 2.076 million below year-ago levels. What

is not known is how many people have left the extended claims via

the road to prosperity -- finding a new job -- and how many have

left on the road to poverty, having simply exhausted even the

extended benefits. Unless the program is renewed, all extended

benefits will end in January. Make sure to look at both sets of

numbers! Many of the press reports will not, but we will here at

Zacks.

- New Orders for Durable Goods are expected to fall 1.0% in

October after falling 0.6% in September. Previous months are often

revised significantly for this data, and those revisions can be

just as important as the current month’s data. The weakness last

month came from the highly volatile transportation equipment

segment. Since they are so high priced, a few orders for jetliners

can really push around the total number, but the orders tend to be

lumpy. Excluding transportation equipment, new orders are expected

to be unchanged after being up 1.8% in September. Given the tone of

the other data. I will take the over on both headline and

ex-transportation.

- Personal Income is expected to rise 0.3% from September, after

it rose just 0.1% last month. Just as important as the total amount

of personal income is the source of that income. Recently, growth

in income from wages and salaries has been very weak, with most of

the growth we have seen coming from with rental income and higher

dividends. That suggests that most of the meager total income

growth is going to the top of the income distribution. Personal

Spending is expected to rise 0.3% after rising 0.6% in September.

Of course, if spending rises by more than income, the savings rate

will fall. In September, the savings rate fell to just 3.6% from an

already low 4.1% in August. Over the long term, the economy needs a

higher savings rate. Short-term, though, a falling savings rate

tends to boost the economy.

- The deadline for the “Super Committee” to come up with at least

$1.2 Trillion in deficit reduction is hit. I expect total failure

and deadlock. That means that we will get $1.2 Trillion in spending

cuts in a meat-cleaver fashion starting in 2013. Those cuts fall

roughly equally on Defense and non-defense discretionary spending.

While there is plenty of fat to cut, doing so in this way could

have adverse National Security implications. Nor are meat-cleaver

cuts to non-defense discretionary spending wise, particularly when

the economy is still soft. However, those are what we will probably

get. Look for Congress to spend much of 2012 figuring out how to

defuse the “trigger." Given the wide philosophical differences in

Washington these days, I also suspect that the efforts to defuse

the trigger will fail. The efforts will raise the political heat

level.

- The University of Michigan Consumer Sentiment index for

November is expected to match its initial read of 64.2. That is up

off the lows of the summer, but still very depressed by any

historical standard. Personally, I think this is one of the most

overrated economic statistics around, since what consumers say in

the survey is often very different that what they actually do.

Still, better seeing it go up than down.

Thursday

- Everyone eats lots of turkey, stuffing, mashed potatoes, etc.

then sits down and watches football and perhaps a parade. Happy

Thanksgiving to all, and I hope you have a tasty turkey.

Friday

- The stock market will be open, but traditionally it is the

lightest volume trading day of the year. Instead of buying and

selling on Wall Street the focus will be on the buying at the malls

on Black Friday, the traditional start of the Holiday shopping

season.

Given the very small number of firms reporting next week, there are

few good cadidates to make good predicitions of potential positive

or negative surprises and thus I omit this section this week.

In the Earnings Calendar below, $999.00 should be read as N.A.

If you want to follow me on Twitter, I am @DirkHvanDijk

| Company |

Ticker |

Qtr End |

EPS Est |

Year Ago

EPS |

Last EPS

Surprise % |

Next EPS Report Date |

Time |

Daily Price |

| ANALOG DEVICES |

ADI |

201110 |

0.63 |

0.73 |

-2.74 |

20111121 |

AMC |

$35.50 |

| BROCADE COMM SY |

BRCD |

201110 |

0.06 |

0.08 |

0 |

20111121 |

AMC |

$4.70 |

| BROWN SHOE CO |

BWS |

201110 |

0.51 |

0.45 |

-200 |

20111121 |

AMC |

$8.80 |

| CHIMERA INVEST |

CIM |

201109 |

0.14 |

0.16 |

N/A |

20111121 |

AMC |

$2.68 |

| CHINACACHE INTL |

CCIH |

201109 |

0.04 |

-0.69 |

-233.33 |

20111121 |

AMC |

$5.10 |

| CHINAEDU CP-ADR |

CEDU |

201109 |

0.08 |

0.11 |

100 |

20111121 |

AMC |

$5.60 |

| CNINSURE IN-ADR |

CISG |

201109 |

0.18 |

0.32 |

3.45 |

20111121 |

AMC |

$7.45 |

| COLLECTIVE BRND |

PSS |

201110 |

0.51 |

0.75 |

45.45 |

20111121 |

AMC |

$13.53 |

| DYCOM INDS |

DY |

201110 |

0.3 |

0.18 |

58.33 |

20111121 |

AMC |

$20.14 |

| GALAXY GAMING |

GLXZ |

201109 |

0 |

999 |

N/A |

20111121 |

|

$0.21 |

| GLOBUS MARITIME |

GLBS |

201109 |

0.15 |

999 |

166.67 |

20111121 |

BTO |

$4.14 |

| GOLAR LNG PARTN |

GMLP |

201109 |

0.4 |

999 |

2.63 |

20111121 |

AMC |

$27.85 |

| HASTING ENTMT |

HAST |

201110 |

-0.56 |

-0.35 |

-1466.67 |

20111121 |

BTO |

$1.90 |

| HEWLETT PACKARD |

HPQ |

201110 |

1.13 |

1.33 |

0 |

20111121 |

AMC |

$27.29 |

| JACK IN THE BOX |

JACK |

201109 |

0.41 |

0.4 |

-5 |

20111121 |

AMC |

$20.29 |

| JINKOSOLAR HLDG |

JKS |

201109 |

0.44 |

1.75 |

30.94 |

20111121 |

AMC |

$6.19 |

| MOBILE TELE-ADR |

MBT |

201109 |

0.29 |

0.5 |

-18.18 |

20111121 |

|

$13.85 |

| NORTHWEST PIPE |

NWPX |

201109 |

0.44 |

0.07 |

147.83 |

20111121 |

AMC |

$23.47 |

| PAC SUNWEAR CAL |

PSUN |

201110 |

-0.14 |

-0.07 |

25 |

20111121 |

AMC |

$1.29 |

| PERFECT WORLD |

PWRD |

201109 |

0.63 |

0.6 |

61.4 |

20111121 |

AMC |

$12.30 |

| PHOENIX NEW MED |

FENG |

201109 |

0.05 |

999 |

-2350 |

20111121 |

AMC |

$5.34 |

| SHANGPHARMA-ADR |

SHP |

201109 |

0.18 |

0.22 |

-14.29 |

20111121 |

BTO |

$8.25 |

| SHIP FIN INTL |

SFL |

201109 |

0.4 |

0.46 |

4.44 |

20111121 |

|

$14.45 |

| TECH DATA CORP |

TECD |

201110 |

1.27 |

1.07 |

15.79 |

20111121 |

BTO |

$48.66 |

| TRINA SOLAR LTD |

TSL |

201109 |

0.06 |

1.08 |

-63.04 |

20111121 |

AMC |

$6.54 |

| TYSON FOODS A |

TSN |

201109 |

0.31 |

0.64 |

15 |

20111121 |

BTO |

$19.34 |

| VALSPAR CORP |

VAL |

201110 |

0.7 |

0.56 |

0 |

20111121 |

|

$34.61 |

| ZALE CORP NEW |

ZLC |

201110 |

-1.42 |

-1.59 |

8.93 |

20111121 |

AMC |

$3.47 |

| AMER WOODMARK |

AMWD |

201110 |

-0.22 |

-0.52 |

-11.76 |

20111122 |

BTO |

$12.93 |

| CAMPBELL SOUP |

CPB |

201110 |

0.8 |

0.82 |

16.22 |

20111122 |

BTO |

$33.41 |

| CANADIAN SOLAR |

CSIQ |

201109 |

-0.51 |

0.47 |

-17.24 |

20111122 |

BTO |

$2.29 |

| CHICOS FAS INC |

CHS |

201110 |

0.2 |

0.16 |

4.17 |

20111122 |

BTO |

$11.56 |

| CHINA DIG TV |

STV |

201109 |

0.18 |

0.17 |

26.67 |

20111122 |

AMC |

$3.69 |

| CHINA RE IN-ADR |

CRIC |

201109 |

0.1 |

0.07 |

-14.29 |

20111122 |

BTO |

$5.11 |

| CHINA XINIYA FS |

XNY |

201109 |

0.21 |

999 |

25 |

20111122 |

BTO |

$1.58 |

| CITI TRENDS INC |

CTRN |

201110 |

-0.37 |

-0.03 |

3.13 |

20111122 |

BTO |

$10.41 |

| CRACKER BARREL |

CBRL |

201110 |

0.97 |

1.01 |

10 |

20111122 |

BTO |

$45.37 |

| DAKTRONICS INC |

DAKT |

201110 |

0.13 |

0.17 |

-27.27 |

20111122 |

BTO |

$9.79 |

| DELIAS INC |

DLIA |

201110 |

-0.1 |

-0.07 |

-7.69 |

20111122 |

BTO |

$1.37 |

| DIANA CONTAINER |

DCIX |

201109 |

0.12 |

-0.01 |

-200 |

20111122 |

BTO |

$4.83 |

| DSW INC CL-A |

DSW |

201110 |

0.8 |

0.79 |

25.81 |

20111122 |

BTO |

$44.71 |

| EATON VANCE |

EV |

201110 |

0.43 |

0.41 |

4 |

20111122 |

BTO |

$23.54 |

| E-HOUSE CHINA |

EJ |

201109 |

0.04 |

0.1 |

-25 |

20111122 |

BTO |

$6.81 |

| FREDS INC |

FRED |

201110 |

0.22 |

0.2 |

-7.14 |

20111122 |

BTO |

$12.32 |

| GENESCO INC |

GCO |

201110 |

0.95 |

0.77 |

120 |

20111122 |

BTO |

$57.78 |

| GUESS INC |

GES |

201110 |

0.74 |

0.75 |

3.7 |

20111122 |

AMC |

$27.95 |

| HANWHA SOLARONE |

HSOL |

201109 |

-0.05 |

0.69 |

-192.31 |

20111122 |

BTO |

$1.35 |

| HORMEL FOODS CP |

HRL |

201110 |

0.42 |

0.45 |

2.86 |

20111122 |

BTO |

$29.28 |

| JA SOLAR HOLDGS |

JASO |

201109 |

-0.02 |

0.5 |

-633.33 |

20111122 |

BTO |

$1.63 |

| LA-Z-BOY INC |

LZB |

201110 |

0.14 |

0.07 |

-33.33 |

20111122 |

AMC |

$10.17 |

| LDK SOLAR CO |

LDK |

201109 |

-0.36 |

0.72 |

-20 |

20111122 |

BTO |

$3.01 |

| LE GAGA HLD-ADR |

GAGA |

201109 |

0.11 |

13.91 |

-7.69 |

20111122 |

BTO |

$4.39 |

| LTX-CREDENCE CP |

LTXC |

201110 |

-0.07 |

0.43 |

-3.57 |

20111122 |

BTO |

$6.03 |

| MEDTRONIC |

MDT |

201110 |

0.82 |

0.82 |

0 |

20111122 |

BTO |

$33.86 |

| NUANCE COMM INC |

NUAN |

201109 |

0.3 |

0.24 |

4.35 |

20111122 |

AMC |

$24.61 |

| PANDORA MEDIA |

P |

201110 |

0 |

999 |

0 |

20111122 |

AMC |

$12.26 |

| PATTERSON COS |

PDCO |

201110 |

0.47 |

0.45 |

-6.67 |

20111122 |

BTO |

$29.39 |

| QAD INC |

QADB |

201110 |

0.13 |

0.5 |

137.5 |

20111122 |

AMC |

$12.09 |

| RAVEN INDS INC |

RAVN |

201110 |

0.63 |

0.63 |

33.33 |

20111122 |

BTO |

$61.28 |

| SIGNET GRP PLC |

SIG |

201110 |

0.2 |

0.07 |

28.81 |

20111122 |

BTO |

$43.33 |

| SOC QUIMICA MIN |

SQM |

201109 |

0.56 |

0.36 |

4.17 |

20111122 |

AMC |

$56.09 |

| SUNTECH PWR HLD |

STP |

201109 |

-0.21 |

0.18 |

-218.75 |

20111122 |

BTO |

$2.40 |

| TIVO INC |

TIVO |

201110 |

-0.23 |

-0.18 |

15 |

20111122 |

AMC |

$10.12 |

| DEERE & CO |

DE |

201110 |

1.44 |

1.07 |

0.6 |

20111123 |

BTO |

$75.02 |

| DIANA SHIPPING |

DSX |

201109 |

0.31 |

0.42 |

-2.86 |

20111123 |

BTO |

$7.94 |

| HILLENBRAND INC |

HI |

201109 |

0.37 |

0.4 |

-2.56 |

20111123 |

AMC |

$21.00 |

| NJ RESOURCES |

NJR |

201109 |

0.04 |

-0.03 |

4.55 |

20111123 |

BTO |

$47.27 |

| PARTNER COMM |

PTNR |

201109 |

0.44 |

0.54 |

-35.59 |

20111123 |

BTO |

$10.07 |

| RENESOLA LT-ADR |

SOL |

201109 |

-0.16 |

0.7 |

-66.67 |

20111123 |

BTO |

$1.77 |

| YINGLI GREEN EN |

YGE |

201109 |

0.03 |

0.49 |

13.79 |

20111123 |

BTO |

$3.42 |

ANALOG DEVICES (ADI): Free Stock Analysis Report

CAMPBELL SOUP (CPB): Free Stock Analysis Report

DEERE & CO (DE): Free Stock Analysis Report

HEWLETT PACKARD (HPQ): Free Stock Analysis Report

MEDTRONIC (MDT): Free Stock Analysis Report

Zacks Investment Research

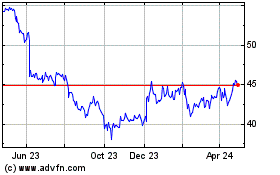

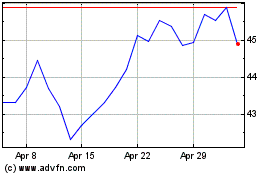

Campbell Soup (NYSE:CPB)

Historical Stock Chart

From Jun 2024 to Jul 2024

Campbell Soup (NYSE:CPB)

Historical Stock Chart

From Jul 2023 to Jul 2024