Form DEFA14A - Additional definitive proxy soliciting materials and Rule 14(a)(12) material

May 21 2024 - 4:45PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

|

|

|

| Filed by the Registrant ☒ |

|

|

|

| Filed by a Party other than the Registrant ☐ |

|

|

| Check the appropriate box: |

|

|

|

|

| ☐ Preliminary Proxy Statement

☐ Definitive

Proxy Statement |

|

☐ Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

|

| ☒ Definitive Additional Materials |

|

| ☐ Soliciting Material Pursuant to § 240.14a-12 |

BLACKROCK CALIFORNIA MUNICIPAL INCOME TRUST

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy

Statement, if Other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

|

|

|

| ☒ |

|

No fee required. |

|

|

| ☐ |

|

Fee paid previously with preliminary materials. |

|

|

| ☐ |

|

Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11. |

Defend Your Fund (by BlackRock) 1 follower Promoted Despite volatile markets, BlackRock’s commitment to investors never wavers.

Several of our CEFs have announced higher shareholder distributions, starting in June 2024. Vote FOR BlackRock’s CEF board nominees and AGAINST Saba’s proposal using ONLY THE WHITE CARD. #DefendYourFund BlackRock BlackRock Closed-End Fund Investors: Markets may be volatile. Our commitment to you isn’t. Vote FOR BlackRock board nominees today Higher Distribution Rate Declared on Several CEFS BlackRock blackrock.com

Defend Your Fund (by BlackRock) 1 follower Promoted Fact: There’s no magic button that BlackRock can push to create $1.4B in value.

Saba’s proposals would essentially change the closed-end funds you rely on for income. Vote FOR BlackRock’s CEF board nominees and AGAINST Saba’s proposal using ONLY THE WHITE CARD.

#DefendYourFund BlackRock BlackRock Closed-End Fund Investors: Fact vs. Fiction with Saba There’s no magical $1.4B CEF payday. Vote FOR BlackRock board nominees today Hey Saba: There’s No Magic

Button for a $1.4B CEF Payday BlackRock blackrock.com

Defend Your Fund (by BlackRock) 1 follower Promoted Saba has made many unfounded claims about BlackRock and your fund’s Board. As a

fiduciary, BlackRock wants to set the record straight: [add URL]. Vote FOR BlackRock’s CEF board nominees and AGAINST Saba’s proposal using ONLY THE WHITE CARD. #DefendYourFund BlackRock BlackRock

Closed-End Fund Investors: Let’s set the record straight. Vote FOR BlackRock board nominees today We’re Setting the Record Straight on Saba’s CEF Claims BlackRock blackrock.com

BLACKROCK CLOSED-END FUNDS

The future of your

long-term

investment depends on you The future of your long-term investment depends on you

Closed-end funds have been at the heart of BlackRock since our founding in 1988. At this year’s Annual Meetings in June, we are asking all shareholders to make their voices

heard in decisions that impact their investment. An activist hedge fund, Saba Capital Management L.P. (“Saba”), is attempting to take over or influence the board of one or more closed-end funds in which you are invested in through the

election of its own candidates who may potentially seek to change your Fund’s strategy.

› Cast your vote

What’s at stake How to vote Board nominees Portfolio Managers

BlackRock brings expertise

as investment advisor

BlackRock and the Funds’ Boards act in accordance with their fiduciary obligations.

Our Funds’ Boards are experienced stewards who have demonstrated their ability to deliver sustainable long-term value.

By fighting for products we believe in, BlackRock is supporting a vibrant marketplace of well-managed options for long-term financial planning.

The stakes could not be higher

This proxy season, a well-known shareholder activist has

launched proxy campaigns targeting BlackRock closed-end funds, purporting to act in the best interests of shareholders but in reality

seeking to benefit itself.

Here are the two types of proposals Saba is submitting for the shareholder meetings:

Director nominations

Saba is seeking to take the director seats, including, in some instances,

a majority of the Board.

Terminate investment management agreement

If

approved, BlackRock would no longer manage the following Funds - BCAT, BFZ, BIGZ, BMEZ, BSTZ, ECAT.

Defend YOUR Fund

Saba is trying to fire BlackRock as investment advisor for certain BlackRock closed end funds and install its own Board members, which may potentially change your Fund’s

strategy.

Make your voices heard and vote for your Directors on the below white proxy cards today.

BSTZ proxy update ECAT proxy update BIGZ proxy update MYN proxy update MPA proxy update BCAT proxy update BMEZ proxy update BFZ proxy update MHN proxy update BNY proxy update

Board nominees up for election

Your Board is under attack by a self-serving

activist hedge fund. View some of the BlackRock Board nominees that are up for election. Click below to view the full list.

Robert Fairbairn Vice Chairman and

member of the Global Executive Committee at BlackRock

Cynthia L. Egan Former President of Retirement Plan Services at T. Rowe Price Group. Board Chair for The

Hanover Insurance Group and Lead Independent Director for Huntsman Corporation

J. Phillip Holloman Former President and Chief Operating Officer of Cintas

Corporation and director of PulteGroup, Inc. and Rockwell Automation Inc.

Lead Portfolio Managers

BlackRock’s closed-end funds are managed by some of the industry’s most influential thought leaders. Click to view our team of Portfolio Managers that seek to deliver on

the Funds’ investment objectives with decades of experience and recognition.

Rick Rieder

CIO of Global Fixed Income, Head of Fundamental Fixed Income, and Head of the Global Allocation Investment Team Rick Rieder was named Morningstar’s Outstanding Portfolio

Manager of the Year* in 2023. Responsible for roughly $2.4 trillion in assets, Rick Rieder is a member of BlackRock’s Global Executive Committee (GEC) and its GEC Investment Sub-Committee. He also is Chairman of the firm-wide BlackRock

Investment Council.

View all Portfolio Managers

Source *The award process

recognizes portfolio managers who Morningstar believes demonstrate the industry’s very best attributes, including investment skill and an alignment of interests with the strategies’ investors.

How do I vote?

Vote online Using the website provided on your enclosed WHITE proxy card and

following the simple instructions.

Vote phone By calling the toll-free number on your enclosed WHITE proxy card and following the simple instructions.

Vote by mail By completing and returning your enclosed WHITE proxy card in the postage paid envelope provided.

We’re here to help

For more information on your investment, email

cef@blackrock.com. If you have any questions about the proposals to be voted, please contact Georgeson LLC (“Georgeson”), toll free at 1-866-920-4784.

Cast your vote

© 2024 BlackRock, Inc. All rights reserved.

FOR EXISTING SHAREHOLDER USE ONLY – NOT FOR FURTHER DISTRIBUTION.

Investing involves

risk, including possible loss of principal.

No part of this website may be duplicated in any form by any means or redistributed without BlackRock’s prior

written consent.

This information should not be relied upon as research, investment advice, or a recommendation regarding any products, strategies, or any security

in particular. This website is strictly for informational purposes and is subject to change.

The information and opinions contained in this website are derived

from proprietary and nonproprietary sources deemed by BlackRock to be reliable, are not necessarily all-inclusive and are not guaranteed as to accuracy. Reliance upon information in this website is at the sole discretion of the reader.Click here to

access BlackRock’s Terms & Conditions and Privacy Policy.

© 2024 BlackRock, Inc. or its affiliates. All Rights Reserved. BLACKROCK and ALADDIN are

trademarks of BlackRock, Inc. or its affiliates. All other trademarks are those of their respective owners.

BlackRock

Proposals

BlackRock Nominees

BlackRock Portfolio Managers

BlackRock Funds

Truth About Saba

BLACKROCK CLOSED-END FUNDS

Voting items

This proxy season, closed-end funds advised by BlackRock are among the many Funds that Saba has targeted in pursuit of its true objectives: liquidity and short-term profit.

Saba has submitted various proposals for the shareholder meetings that may put your investments at risk: election of its own candidates on the Boards and

termination of the investment management agreement for certain Funds.

› Cast your vote

Director nominees

Mgmt. termination How to vote

> This proxy season counts. Vote the WHITE proxy card now! X

BlackRock brings expertise as

investment advisor BlackRock and the Funds’ Boards act in accordance with their fiduciary obligations.

Our Funds’ Boards are experienced stewards who

have demonstrated their ability to deliver sustainable long-term value.

By fighting for products we believe in, BlackRock is supporting a vibrant marketplace of

well-managed options for long-term financial planning.

Proposals

The

Funds’ current Board and Board Nominees have track records that demonstrate they operate in the best interest of shareholders. See what Saba proposes and the harmful implications.

Director nominations Board Nominees

• The Board Nominees have collectively extensive

experience with registered closed-end funds generally, with closed-end funds with strategies similar to those of each Fund, and specifically with each Fund, its investment objective(s) and strategies, and service providers.

• Each independent Board Nominee satisfied the standards contemplated by each Fund’s Statement of Policy that describes the experiences, qualifications, skills and

attributes that are necessary and desirable for potential independent Board member candidates.

• Each independent Board Nominee serves the interests of all

shareholders equally.

> View Board nominees

Saba’s proposal to elect

its handpicked nominees and its implications

• Saba’s nominees have little to no experience with closed-end funds.

• Saba’s nominees have no experience with respect to any of the Funds, their investment objective(s) and strategies, or established relationships with service providers.

• Saba’s nominees have been handpicked and nominated by Saba and may seek to advance the short-term goals reflected in its proposals, which would serve

the interests of Saba over the interests of the Fund or other shareholders.

Terminate the investment management agreement

This applies to the following Funds: BCAT, BFZ, BIGZ, BMEZ, BSTZ, ECAT

• Your Fund’s

existing BlackRock Board Members, as fiduciaries to the Fund, review the Investment Management Agreement annually and are well-positioned to evaluate BlackRock

• BlackRock is the world’s largest asset manager¹ and the largest manager of closed-end funds², with more than 35 years of advisory experience

• BlackRock believes that the Funds’ investment strategies strongly benefit from an investment adviser with the sophistication and extensive expertise of

BlackRock

• BlackRock’s scale and deep relationships have historically given it enhanced access to private investments and high-demand initial public

offerings

• BlackRock also leverages the Aladdin® Risk Management Platform and has significant risk management expertise

Saba’s proposal and its implications

• Could result in the firing of BlackRock as

each Fund’s investment adviser. Depriving each Fund of BlackRock’s experience and expertise may plunge each Fund into uncertainty about its investment adviser and its future, harming the Funds and their shareholders.

How do I vote?

Vote online

Using the website provided on your enclosed WHITE proxy card and following the simple instructions.

www.proxyvote.com

Vote by phone

By calling the toll-free number on your enclosed WHITE proxy card and following the simple instructions.

Vote by mail

By completing and returning your enclosed WHITE proxy card in the postage paid

envelope provided.

› Cast your vote

We’re here to help

For more information on your investment, email cef@blackrock.com. If you have any questions about the proposals to be voted, please contact Georgeson LLC (“Georgeson”),

toll free at 1-866-920-4784.

> Cast your vote

© 2024 BlackRock, Inc.

All rights reserved.

‘Based on $10.5T AUM as of March 31, 2024.

*Based

on $47B AUM in 51 funds as of March 31, 2024.

FOR EXISTING SHAREHOLDER USE ONLY - NOT FOR FURTHER DISTRIBUTION.

Investing involves risk, including possible loss of principal.

No part of this website may be

duplicated in any form by any means or redistributed without BlackRock’s prior written consent.

This information should not be relied upon as research,

investment advice, or a recommendation regarding any products, strategies, or any security in particular. This website is strictly for informational purposes and is subject to change.

The information and opinions contained in this website are derived from proprietary and nonproprietary sources deemed by BlackRock to be reliable, are not necessarily all-inclusive

and are not guaranteed as to accuracy. Reliance upon information in this website is at the sole discretion of the reader.

Click here to access BlackRock’s

Terms & Conditions and Privacy Policy.

© 2024 BlackRock, Inc. or its affiliates. All Rights Reserved. BLACKROCK and ALADDIN are trademarks of BlackRock,

Inc. or its affiliates. All other trademarks are those of their respective owners.

BLACKROCK CLOSED-END FUNDS Proposals BlackRock Nominees BlackRock Portfolio Managers BlackRock Funds Truth About Saba BlackRock Board

nominees up for election View your BlackRock Board nominees that are up for election. Cast your vote This proxy season counts. Vote the WHITE proxy card now! Boards of Trustees Cynthia L. Egan Former President of Retirement Plan Services at T. Rowe

Price Group. Board Chair for The Hanover Insurance Group and Lead Independent Director for Huntsman Corporation Cynthia L. Egan is up for election on the following Funds’ Boards: ECAT, BIGZ and MPA. She has served on the Boards of BlackRock

Closed-End Funds for 8 years. Catherine A. Lynch, CFA Former Chief Executive Officer and Chief Investment Officer of the National Railroad Retirement Investment. Board Director for PennyMac Mortgage Investment Trust Catherine A. Lynch is up for

election on the following Funds’ Boards: ECAT, BIGZ, BFZ, MHN, MYN, BNY and MPA. She has served on the Boards of BlackRock Closed-End Funds for 8 years. Lt. Gen. Stayce D. Harris Former Lieutenant General, Inspector General, Office of the

Secretary of the U.S. Air Force. Board Director for The Boeing Company Lt. Gen. Stayce D. Harris is up for election on the following Funds’ Boards: ECAT, BIGZ, and MPA. She has served on the Boards of BlackRock Closed-End Funds for 3 years.

Lorenzo A. Flores Chief Financial Officer at Intel Foundry. Former Vice Chairman at Kioxia, Inc. Former Chief Financial Officer and Corporate Controller at Xilinx, Inc. Lorenzo A. Flores is up for election on the following Funds’ Boards: ECAT,

BIGZ, and MPA. He has served on the Boards of BlackRock Closed-End Funds for 3 years. R. Glenn Hubbard Former Chairman of the U.S. Council of Economic Advisers of the President of the United States. Dean Emeritus of Columbia Graduate Business

School. Professor of Finance and Economics R. Glenn Hubbard is up for election on the following Funds’ Boards: ECAT, BCAT, BSTZ, BIGZ, MPA and BMEZ. He has served on the Boards of BlackRock Closed-End Funds for 20 years. W. Carl Kester

Professor of Business Administration, Emeritus at Harvard Business School. Professor and author in finance, expert in corporate finance and corporate governance W. Carl Kester is up for election on the following Funds’ Boards: ECAT, BCAT, BSTZ,

BIGZ, MPA and BMEZ. He has served on the Boards of BlackRock Closed-End Funds for 29 years. J. Phillip Holloman Former President and Chief Operating Officer of Cintas Corporation and director of PulteGroup, Inc. and Rockwell Automation Inc. J.

Phillip Holloman is up for election on the following Funds’ Boards: BFZ, MHN, MYN, BNY, and MPA. He has served on the Boards of BlackRock Closed-End Funds for 3 years. Arthur P. Steinmetz Former Chairman, Chief Executive Officer and President

of the Oppenheimer Funds, Inc. Former Director of ScotiaBank (U.S.) Arthur P. Steinmetz is up for election on the following Funds’ Boards: BFZ, MHN, MYN, BNY, and MPA. He has served on the Boards of BlackRock Closed-End Funds for 1 year. John

M. Perlowski President and Chief Executive Officer of BlackRock’s US Retail Mutual Funds John M. Perlowski is up for election on the following Funds’ Boards: ECAT, BCAT, BSTZ, BIGZ, MPA and BMEZ. He has served on the Boards of BlackRock

Closed-End Funds for 9 years. Sir Robert Fairbairn Vice Chairman and member of the Global Executive Committee at BlackRock Sir Robert Fairbairn is up for election on the following Fund’s Board: MPA. He has served on the Boards of BlackRock

Closed-End Funds for 6 years. How do I vote? Cast your vote We’re here to help For more information on your investment, email cef@blackrock.com. If you have any questions about the proposals to be voted, please contact Georgeson LLC

(“Georgeson”), toll free at 1-866-920-4784. Cast your vote © 2024 BlackRock, Inc. All rights reserved. FOR EXISTING SHAREHOLDER USE ONLY – NOT FOR FURTHER DISTRIBUTION. Investing involves risk, including possible loss of

principal. No part of this website may be duplicated in any form by any means or redistributed without BlackRock’s prior written consent. This information should not be relied upon as research, investment advice, or a recommendation regarding

any products, strategies, or any security in particular. This website is strictly for informational purposes and is subject to change. The information and opinions contained in this website are derived from proprietary and nonproprietary sources

deemed by BlackRock to be reliable, are not necessarily all-inclusive and are not guaranteed as to accuracy. Reliance upon information in this website is at the sole discretion of the reader. Click here to access BlackRock’s Terms &

Conditions and Privacy Policy. © 2024 BlackRock, Inc. or its affiliates. All Rights Reserved. BLACKROCK and ALADDIN are trademarks of BlackRock, Inc. or its affiliates. All other trademarks are those of their respective owners. Vote online

Using the website provided on your enclosed WHITE proxy card and following the simple instructions. www.proxyvote.com Vote by phone By calling the toll-free number on your enclosed WHITE proxy card and following the simple instructions. Vote by mail

By completing and returning your enclosed WHITE proxy card in the postage paid envelope provided.

BLACKROCK CLOSED-END FUNDS Proposals BlackRock Nominees BlackRock Portfolio Managers BlackRock Funds Truth About Saba Lead Portfolio

Managers Get to know our team of lead Portfolio Managers. Cast your vote This proxy season counts. Vote the WHITE proxy card now! Lead Portfolio Managers Rick Rieder CIO of Global Fixed Income, Head of Fundamental Fixed Income, and Head of the

Global Allocation Investment Team Rick Rieder was named Morningstar’s Outstanding Portfolio Manager of the Year* in 2023. Responsible for roughly $2.4 trillion in assets, Rick is a member of BlackRock’s Global Executive Committee (GEC),

its GEC Investment Sub- Committee, and is Chairman of the BlackRock Investment Council. He is the lead Portfolio Manager for ECAT and BCAT. Source *The award process recognizes portfolio managers who Morningstar believes demonstrate the

industry’s very best attributes, including investment skill and an alignment of interests with the strategies’ investors. Erin Xie Head of the Fundamental Equities Health Sciences team, Managing Director and Portfolio Manager Erin

Xie’s service with BlackRock dates back to 2001, including her years with State Street Research & Management (SSRM), which merged with BlackRock in 2005. At SSRM, she was a Senior Vice President and Portfolio Manager responsible for

managing the State Street Health Sciences Fund. She is the lead Portfolio Manager for BMEZ. Sean Carney Chief Investment Officer (CIO) of Municipal Bond Funds and Head of the Municipal Strategy team, Managing Director and Portfolio Manager Sean

Carney has 20+ years of experience in the industry. He has been instrumental in building out the Municipal Strategy platform and the Primary Markets Group at BlackRock. For 7 years, he was recognized as the industry’s top buy-side Municipal

Strategist by Smith’s Research & Gradings. He is the lead Portfolio Manager for MPA, BNY, MHN, MYN, BFZ. Phil Ruvinsky Lead portfolio manager of the BlackRock Large Cap Growth , BlackRock Mid-Cap Growth Equity and BlackRock SMID-Cap Growth

Equity Portfolios Phil Ruvinsky is the lead Portfolio Manager of the BlackRock Large Cap Growth, BlackRock Mid-Cap Growth Equity, and BlackRock SMID-Cap Growth Equity Portfolios. Prior to joining BlackRock, Phil was a Sector Head and Research

Analyst at Sureview Capital LLC. He is the lead Portfolio Manager for BIGZ. Tony Kim Head of the Fundamental Equities Global Technology team, Managing Director and Portfolio Manager Tony Kim has 24+ years of experience in technology investments at

firms including Artisan Partners, Credit Suisse Asset Management, Neuberger Berman, and Merrill Lynch. In 2013, he became a member of the Fundamental Equity division of BlackRock’s Portfolio Management Group and the Technology Sector Head. He

is the lead Portfolio Manager for BSTZ. How do I vote? Vote online Using the website provided on your enclosed WHITE proxy card and following the simple instructions. www.proxyvote.com Vote by phone By calling the toll-free number on your enclosed

WHITE proxy card and following the simple instructions. Vote by mail By completing and returning

your enclosed WHITE proxy card in the postage paid envelope

provided. Cast your vote We’re here to help For more information on your investment, email cef@blackrock.com. If you have any questions about the proposals to be voted, please contact Georgeson LLC (“Georgeson”), toll free at

1-866-920-4784. Cast your vote © 2024 BlackRock, Inc. All rights reserved. FOR EXISTING SHAREHOLDER USE ONLY – NOT FOR FURTHER DISTRIBUTION. Investing involves risk, including possible loss of principal. No part of this website may be

duplicated in any form by any means or redistributed without BlackRock’s prior written consent. This information should not be relied upon as research, investment advice, or a recommendation regarding any products, strategies, or any security

in particular. This website is strictly for informational purposes and is subject to change. The information and opinions contained in this website are derived from proprietary and nonproprietary sources deemed by BlackRock to be reliable, are not

necessarily all-inclusive and are not guaranteed as to accuracy. Reliance upon information in this website is at the sole discretion of the reader. Click here to access BlackRock’s Terms & Conditions and Privacy Policy. © 2024

BlackRock, Inc. or its affiliates. All Rights Reserved. BLACKROCK and ALADDIN are trademarks of BlackRock, Inc. or its affiliates. All other trademarks are those of their respective owners. www.proxyvote.com

BLACKROCK CLOSED-END FUNDS Proposals BlackRock Nominees BlackRock Portfolio Managers BlackRock Funds Truth About Saba Funds and

resources Explore more about the closed-end funds impacted, their underlying strategies, holdings, characteristics, fees and portfolio managers. Cast your vote This proxy season counts. Vote the WHITE proxy card now! BCAT BlackRock Capital

Allocation Term Trust View BCAT’s latest performance, key facts, and holdings data. See fact sheet BIGZ BlackRock Innovation and Growth Term Trust View BIGZ’s latest performance, key facts, and holdings data. See fact sheet BMEZ BlackRock

Health Sciences Term Trust View BMEZ’s latest performance, key facts, and holdings data. See fact sheet BSTZ BlackRock Science and Technology Term Trust View BSTZ’s latest performance, key facts, and holdings data. See fact sheet ECAT

BlackRock ESG Capital Allocation Term Trust View ECAT’s latest performance, key facts, and holdings data. See fact sheet BFZ BlackRock California Municipal Income Trust View BFZ’s latest performance, key facts, and holdings data. See fact

sheet BNY BlackRock New York Municipal Income Trust View BNY’s latest performance, key facts, and holdings data. See fact sheet MHN BlackRock MuniHoldings New York Quality Fund, Inc. View MHN’s latest performance, key facts, and holdings

data. See fact sheet MPA BlackRock MuniYield Pennsylvania Quality Fund View MPA’s latest performance, key facts, and holdings data. See fact sheet MYN BlackRock MuniYield New York Quality Fund, Inc. View MYN’s latest performance, key

facts, and holdings data. See fact sheet Fund Materials BCAT commentary BCAT proxy update Fund Materials BIGZ commentary BIGZ proxy update Fund Materials BMEZ commentary BMEZ proxy update Fund Materials BSTZ commentary BSTZ proxy update Fund

Materials ECAT commentary ECAT proxy update Fund Materials BFZ proxy update Fund Materials BNY proxy update Fund Materials MHN proxy update Fund Materials MPA proxy update Fund Materials MYN proxy update How do I vote? Vote online Using the website

provided on your enclosed WHITE proxy card and following the simple instructions. www.proxyvote.com Vote by phone By calling the toll-free number on your enclosed WHITE proxy card and following the simple instructions. Vote by mail By completing and

returning your enclosed WHITE proxy card in the postage paid envelope provided. www.proxyvote.com Cast your vote We’re here to help For more information on your investment, email cef@blackrock.com. If you have any questions about the proposals

to be voted, please contact Georgeson LLC (“Georgeson”), toll free at 1-866-920-4784. Cast your vote © 2024 BlackRock, Inc. All rights reserved. FOR EXISTING SHAREHOLDER USE ONLY – NOT FOR FURTHER DISTRIBUTION. Investing involves

risk, including possible loss of principal. No part of this website may be duplicated in any form by any means or redistributed without BlackRock’s prior written consent. This information should not be relied upon as research, investment

advice, or a recommendation regarding any products, strategies, or any security in particular. This website is strictly for informational purposes and is subject to change. The information and opinions contained in this website are derived from

proprietary and nonproprietary sources deemed by BlackRock to be reliable, are not necessarily all-inclusive and are not guaranteed as to accuracy. Reliance upon information in this website is at the sole discretion of the reader. Click here to

access BlackRock’s Terms & Conditions and Privacy Policy. © 2024 BlackRock, Inc. or its affiliates. All Rights Reserved. BLACKROCK and ALADDIN are trademarks of BlackRock, Inc. or its affiliates. All other trademarks are those of their

respective owners.

BLACKROCK CLOSED-END FUNDS

Setting the record

straight

As a fiduciary to the Funds, we strive for transparency. Boaz Weinstein, Founder and Chief Investment Officer of Saba Capital Management L.P.

(“Saba”), has made several unfounded claims about BlackRock, your Funds and their Boards.

Cast your vote

This proxy season counts. Vote the WHITE proxy card now!

Many invest in CEFS for the stable,

consistent income they may offer

Saba claims that closed-end fund (CEF) investors would prefer one-time payouts over stable income and the other benefits CEFS

provide. The truth

• Closed-end funds offer access to asset classes otherwise unavailable to retail investors and performance over multiple market cycles.

• CEF investors are often retirees or individuals planning for retirement, and they choose CEFS for the long-term, consistent income they are designed to

provide.

• On the contrary, arbitrage investors like Saba are trying to take advantage of CEF market dynamics for a quick profit without concern for other

shareholders. Saba’s interests are not aligned with shareholders Saba claims they act in the best interests of closed-end fund retail shareholders. The truth

• Saba is a well-funded hedge fund beholden to their own sophisticated investor base. We believe Saba is not interested in helping CEF shareholders reach

their long-term financial goals, as consistently demonstrated by their self-serving actions.

• Saba has chosen to use their vast resources to buy controlling

stakes in CEFs, engage in costly proxy fights, and force actions that provide them with a quick profit at the expense of retail shareholders looking for stable income over multiple market cycles.

There is no $1.4B “magic button”

Saba claims that with a “press of a

button” BlackRock can magically create $1.4 billion in immediate value and that open-ending these funds would benefit shareholders in the long term.’ The truth

• There is no magic button and statements to the contrary are misleading at best. One of the key advantages of CEFs is their ability to hold greater concentrations of illiquid

assets and certain asset classes, like private investments, that are generally not otherwise available to retail investors.

• Unwinding these types of

investments suddenly could cause a fund to sell assets at lower prices and potentially incur tax consequences. We believe that the short-term benefit of any such action is far out outweighed by the long-term consequences such actions could have for

a fund’s shareholders and their investment options going forward. “Open-ending” these funds would negatively impact those features and effectively limit shareholders’ options when choosing investment vehicles.

BlackRock is committed to delivering value for shareholders

Saba claims that BlackRock CEFs

are not performing as they were intended because they sometimes trade at a discount to net asset value.

The truth

• The CEF market, like other markets, are cyclical and funds may trade at a premium or discount to net asset value over time. We’ve seen such a discount cycle play out

during the past 18 months. What doesn’t change is the steady income CEFs are designed to provide.

• Additionally, BlackRock has taken steps to narrow the

discount of these funds through share repurchases, distribution increases and implementation of managed distribution plans.

• Our funds have also repurchased

$1.3 billion in shares, generating significant gains to shareholders through NAV accretion.² We are focused on helping shareholders reach their financial goals.

The grass at Saba may not be greener

Saba claims to be a better CEF manager

than BlackRock.

The truth

• Experience matters. BlackRock has a 35+ year

history managing CEFS and an established track record of delivering long-term value.

• In contrast, Saba has never launched a CEF-just taken them over-and has

exposed their Funds’ shareholders to riskier assets, like SPACs, or forced liquidity events, potentially leaving them with a fund that no longer serves their long-term financial goals.

• Additionally, both Funds Saba took over have traded at discounts and have underperformed under Saba’s management.

How do I vote?

Vote online Using the website provided on your enclosed WHITE proxy card and

following the simple instructions.

Vote phone By calling the toll-free number on your enclosed WHITE proxy card and following the simple instructions.

Vote by mail By completing and returning your enclosed WHITE proxy card in the postage paid envelope provided.

We’re here to help

For more information on your investment, email

cef@blackrock.com. If you have any questions about the proposals

to be voted, please contact

Georgeson LLC (“Georgeson”), toll free at 1-866-920-4784.

› Cast your vote

© 2024 BlackRock, Inc. All rights reserved.

‘Source: CNBC Squwak Box interview on

May 14, 2024

2Source: BlackRock. Since inception of the funds’ repurchase programs to 4/30/2024. Date of inception of the funds BCAT, ECAT, BIGZ, BMEZ and

BSTZ repurchase programs is 11/15/2018. Date of inception of the funds BFZ, BNY, MHN, MPA and MYN repurchase programs is 11/19/2021.

FOR EXISTING SHAREHOLDER USE

ONLY - NOT FOR FURTHER DISTRIBUTION.

Investing involves risk, including possible loss of principal.

No part of this website may be duplicated in any form by any means or redistributed without BlackRock’s prior written consent.

This information should not be relied upon as research, investment advice, or a recommendation regarding any products, strategies, or any security in particular. This website is

strictly for informational purposes and is subject to change.

The information and opinions contained in this website are derived from proprietary and

nonproprietary sources deemed by BlackRock to be reliable, are not necessarily all-inclusive and are not

guaranteed as to accuracy. Reliance upon information in

this website is at the sole discretion of the reader.

Click here to access BlackRock’s Terms & Conditions and Privacy Policy.

© 2024 BlackRock, Inc. or its affiliates. All Rights Reserved. BLACKROCK and ALADDIN are trademarks of BlackRock, Inc. or its affiliates. All other trademarks are those of

their respective owners.

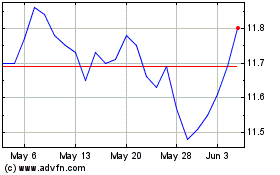

BlackRock California Mun... (NYSE:BFZ)

Historical Stock Chart

From May 2024 to Jun 2024

BlackRock California Mun... (NYSE:BFZ)

Historical Stock Chart

From Jun 2023 to Jun 2024