SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

REPORT OF FOREIGN PRIVATE ISSUER

PURSUANT TO RULE 13a-16 OR 15d-16 UNDER THE

SECURITIES EXCHANGE ACT OF 1934

November 27, 2024

Commission File Number: 001-32827

MACRO BANK INC.

(Translation of registrant’s name into

English)

Avenida Eduardo Madero 1182

Ciudad Autónoma de Buenos Aires C1106 ACY

Tel: 54 11 5222 6500

(Address of registrant’s principal executive

offices)

Indicate by check mark whether the registrant

files or will file annual reports under cover of Form 20-F or Form 40-F.

Indicate by check mark if the registrant

is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1):

Indicate by check mark if the registrant

is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7):

| BANCO MACRO | |

3Q24 EARNINGS RELEASE |

Index

| 01 |

Summary |

|

| |

|

|

| 02 |

Disclaimer |

|

| |

|

|

| 03 |

Results |

|

| |

|

|

| 04 |

Financial Assets |

|

| |

|

|

| 05 |

Public Sector Assets |

|

| |

|

|

| 06 |

Funding |

|

| |

|

|

| 07 |

Liquid Assets |

|

| |

|

|

| 08 |

Solvency |

|

| |

|

|

| 09 |

Asset Quality |

|

| |

|

|

| 10 |

3Q24 Snapshot |

|

| |

|

|

| 11 |

Relevant and Recent Events |

|

| |

|

|

| 12 |

Regulatory Changes |

|

| |

|

|

| 13 |

CER Exposure and Foreign Currency

Position |

|

| BANCO MACRO | |

3Q24 EARNINGS RELEASE |

| BANCO MACRO | |

3Q24 EARNINGS RELEASE |

| BANCO MACRO | |

3Q24 EARNINGS RELEASE |

·

THE BANK’S NET INCOME totaled Ps.91.3 billion in 3Q24. This result was 293% or Ps.68.1 billion higher than

in 3Q23. In 3Q24, the accumulated annualized return on average equity (“ROAE”) and the accumulated annualized return

on average assets (“ROAA”) were 6.8% and 2.1%, respectively.

·

In 3Q24, OPERATING INCOME (before G&A and personnel expenses) totaled Ps.829.2 billion, 61% or Ps.313 billion higher

than in 2Q24 and 25% or Ps.272.3 lower than 3Q24.

·

In 3Q24, OPERATING INCOME (after G&A and personnel expenses) totaled Ps.403.7 billion, 263% or Ps.292.6 billion higher

than in 2Q24 and 44% or Ps.322.5 billion lower than the same period of last year.

·

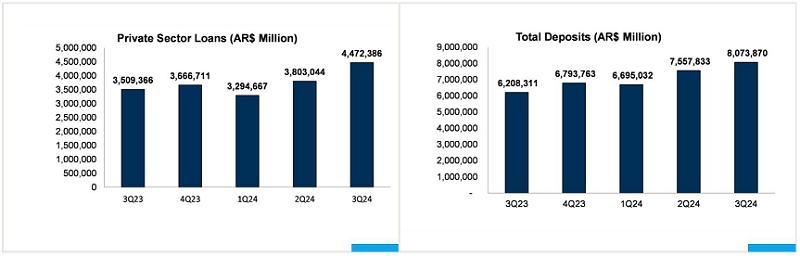

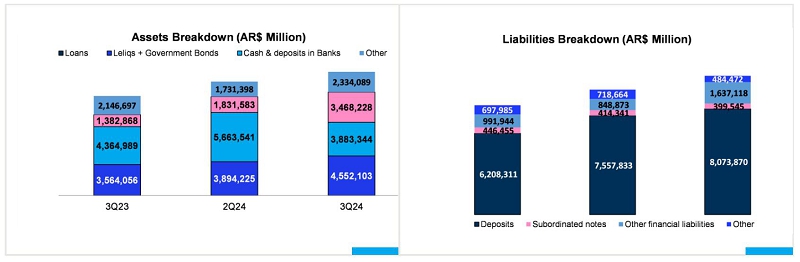

In 3Q24, BANCO MACRO’S TOTAL FINANCING increased 17% or Ps.657.9 billion quarter over quarter (“QoQ”)

totaling Ps.4.55 trillion and increased 28% or Ps.988 billion year over year (“YoY”). In 3Q24 peso financing increased 19%

while USD financing decreased 1%.

·

In 3Q24, BANCO MACRO’S TOTAL DEPOSITS increased 7% or Ps.516 billion QoQ and increased 30% or Ps.1.9 trillion YoY,

totaling Ps.8.1 trillion and representing 76% of the Bank’s total liabilities. Private sector deposits increased 6% or Ps.401.8

billion QoQ. In 3Q24, Peso deposits decreased 15% while USD deposits increased 87%.

·

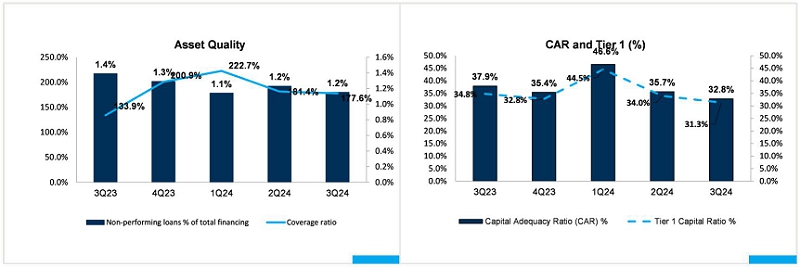

Banco Macro continued showing a strong solvency ratio, with an EXCESS CAPITAL of Ps.2.5 trillion, 32.8% Capital Adequacy

Ratio – Basel III and 32.8 % Tier 1 Ratio. In addition, the Bank’s LIQUID ASSETS remained at an adequate level, reaching

91% of its total deposits in 3Q24.

·

In 3Q24, the Bank’s NON-PERFORMING TO TOTAL FINANCING RATIO was 1.15% and the COVERAGE RATIO reached

177.6%.

·

As of 3Q24, through its 515 branches and 9.109 employees Banco Macro serves 5.24 million retail customers

(2.21 million digital customers) across 23 of the 24 Provinces in Argentina and over 161,180 corporate customers.

| BANCO MACRO | |

3Q24 EARNINGS RELEASE |

This press release includes forward-looking statements.

We have based these forward-looking statements largely on our current beliefs, expectations and projections about future events and financial

trends affecting our business. Many important factors could cause our actual results to differ substantially from those anticipated in

our forward-looking statements, including, among other things: inflation; changes in interest rates and the cost of deposits; government

regulation; adverse legal or regulatory disputes or proceedings; credit and other risks of lending, such as increases in defaults by

borrowers; fluctuations and declines in the value of Argentine public debt; competition in banking and financial services; deterioration

in regional and national business and economic conditions in Argentina; and fluctuations in the exchange rate of the peso.

The words “believe,” “may,”

“will,” “aim,” “estimate,” “continue,” “anticipate,” “intend,”

“expect” and similar words are intended to identify forward-looking statements. Forward-looking statements include information

concerning our possible or assumed future results of operations, business strategies, financing plans, competitive position, industry

environment, potential growth opportunities, the effects of future regulation and the effects of competition. Forward-looking statements

speak only as of the date they were made, and we undertake no obligation to update publicly or to revise any forward-looking statements

after we distribute this press release because of new information, future events or other factors. In light of the risks and uncertainties

described above, the forward-looking events and circumstances discussed in this press release might not occur and are not guarantees

of future performance.

This report is a summary analysis of Banco

Macro's financial condition and results of operations as of and for the period indicated. For a correct interpretation, this report

must be read in conjunction with all other material periodically filed with the Comisión Nacional de Valores (www.cnv.gob.ar),

the Securities and Exchange Commission (www.sec.gov), Bolsas y mercados Argentinos (www.byma.com.ar) and the New York Stock Exchange

(www.nyse.com). In addition, the Central Bank (www.bcra.gov.ar) may publish information related to Banco Macro as of a date subsequent

to the last date for which the Bank has published information.

Readers of this report must note that this is

a translation made from an original version written and expressed in Spanish. Consequently, any matters of interpretation should be referred

to the original version in Spanish.

This Earnings Release

has been prepared in accordance with the accounting framework established by the Central Bank of Argentina (“BCRA”), based

on International Financial Reporting Standards (“I.F.R.S.”) and the resolutions adopted by the International Accouting Standards

Board (“I.A.S.B”) and by the Federación Argentina de Consejos Profesionales de Ciencias Económicas (“F.A.C.P.E.”).

As of January 2020 the Bank started reporting with the application of (i) Expected losses of IFRS 9 “Financial

Instruments” and (ii) IAS 29 “Financial Reporting in Hyperinflationary Economies”. Data and figures

shown in this Earnings Release may differ from the ones shown in the 20-F annual report. As of fiscal year 2021, the monetary result

accrued by items of a monetary nature measured at fair value with changes in Other Comprehensive Income (OCI), is recorded in the Result

form the Net Monetary Position integrating the Net Result of the period in accordance with Communication “A” 7211 of the

Central Bank of Argentina. Previous quarters of 20223 have been restated in accordance with said Communication in order to make a comparison

possible

| BANCO MACRO | |

3Q24 EARNINGS RELEASE |

3Q24 Earnings Release Conference Call

Monday, December 2, 2024

Time:

11:00 a.m. Eastern Time

01:00 p.m. Buenos Aires Time

To participate, please dial:

Argentina Toll Free:

(011) 3984 5677

Participants Dial In (Toll

Free):

+1 (844) 450 3847

Participants International

Dial In:

+1 (412) 317 6370

Conference ID: Banco Macro

Webcast: click here

Webcast Replay: click

here

Available from 12/2/2024 through

12/16/2024

IR Contacts in Buenos Aires:

Jorge Scarinci

Chief Financial Officer

Nicolás A. Torres

Investor Relations

Phone: (54 11) 5222

6682

E-mail: investorelations@macro.com.ar

Visit our website at:

www.macro.com.ar/relaciones-inversores

| BANCO MACRO |

3Q24 EARNINGS RELEASE |

Earnings per outstanding share were Ps.142.1

in 3Q24, 293% higher than in 3Q23.

| EARNINGS PER SHARE | |

MACRO Consolidated | | |

Change | |

| In MILLION $ (Measuring Unit Current at EOP) | |

3Q23 | | |

4Q23 | | |

1Q24 | | |

2Q24 | | |

3Q24 | | |

QoQ | | |

YoY | |

| Net income -Parent Company- (M $) | |

| 23,210 | | |

| 927,000 | | |

| 365,924 | | |

| -261,537 | | |

| 91,321 | | |

| - | | |

| 293 | % |

| Average # of shares outstanding (M) | |

| 639 | | |

| 639 | | |

| 639 | | |

| 639 | | |

| 639 | | |

| 0 | % | |

| 0 | % |

| Book value per avg. Outstanding share ($) | |

| 4,873 | | |

| 6,450 | | |

| 6,992 | | |

| 5,604 | | |

| 5,701 | | |

| 2 | % | |

| 17 | % |

| Shares Outstanding (M) | |

| 639 | | |

| 639 | | |

| 639 | | |

| 639 | | |

| 639 | | |

| 0 | % | |

| 0 | % |

| Earnings per avg. outstanding share ($) | |

| 36.17 | | |

| 1,450.70 | | |

| 572.65 | | |

| -409.29 | | |

| 142.12 | | |

| - | | |

| 293 | % |

| EOP FX (Pesos per USD) | |

| 350.0083 | | |

| 808.4833 | | |

| 857.4167 | | |

| 911.7500 | | |

| 970.9167 | | |

| 6 | % | |

| 177 | % |

| Book value per avg. issued ADS (USD) | |

| 139.23 | | |

| 79.78 | | |

| 81.55 | | |

| 61.46 | | |

| 58.72 | | |

| -4 | % | |

| -58 | % |

| Earnings per avg. outstanding ADS (USD) | |

| 1.03 | | |

| 17.94 | | |

| 6.68 | | |

| -4.49 | | |

| 1.46 | | |

| - | | |

| 42 | % |

Banco Macro’s 3Q24 net income totaled

a Ps.91.3 billion gain, 293% or Ps.68.1 billion higher than in 3Q23. This result is mainly due to higher net interest income and a lower

loss related to result from the net monetary position (lower inflation registered in the quarter).

As of 3Q24 the accumulated result represented

an annualized ROAE and ROAA of 6.8% and 2.1% respectively.

Net operating income (before G&A and

personnel expenses) was Ps.829.2 billion in 3Q24, 61% or Ps.313 billion higher compared to 2Q24. On a yearly basis, Net Operating Income

(before G&A and personnel expenses) decreased 25% or Ps.272.3billion.

In 3Q24, Provision for loan losses totaled

Ps.23 billion, 24% or Ps.4.5 billion higher than in 2Q24. On a yearly basis provision for loan losses increased 53% or Ps.7.9 billion.

Operating income (after G&A and personnel

expenses) was Ps.403.7 billion in 3Q24, 263% or Ps.292.6 billion higher than in 2Q24 and 44% or Ps.322.5 billion lower than a year ago.

| BANCO MACRO |

3Q24 EARNINGS RELEASE |

| INCOME STATEMENT | |

MACRO Consolidated | | |

Change | |

| In MILLION $ (Measuring Unit Current at EOP) | |

3Q23 | | |

4Q23 | | |

1Q24 | | |

2Q24 | | |

3Q24 | | |

QoQ | | |

YoY | |

| Net Interest Income | |

| 348,220 | | |

| 370,287 | | |

| 222,710 | | |

| 213,035 | | |

| 569,131 | | |

| 167 | % | |

| 63 | % |

| Net fee income | |

| 109,667 | | |

| 112,019 | | |

| 98,464 | | |

| 108,657 | | |

| 117,808 | | |

| 8 | % | |

| 7 | % |

| Net Interest Income + Net Fee Income | |

| 457,887 | | |

| 482,306 | | |

| 321,174 | | |

| 321,692 | | |

| 686,939 | | |

| 114 | % | |

| 50 | % |

| Net Income from financial instruments at fair value

through P&L | |

| -112,346 | | |

| 1,804,611 | | |

| 1,691,704 | | |

| 135,902 | | |

| 103,585 | | |

| -24 | % | |

| - | |

| Income from assets at amortized cost | |

| 424 | | |

| 266 | | |

| 28 | | |

| -4 | | |

| 326 | | |

| - | | |

| -23 | % |

| Differences in quoted prices of gold and foreign

currency | |

| 735,665 | | |

| 368,386 | | |

| 107,146 | | |

| 28,766 | | |

| 16,263 | | |

| -43 | % | |

| -98 | % |

| Other operating income | |

| 34,864 | | |

| 50,720 | | |

| 58,964 | | |

| 48,265 | | |

| 45,008 | | |

| -7 | % | |

| 29 | % |

| Provision for loan losses | |

| 15,030 | | |

| 36,652 | | |

| 25,071 | | |

| 18,476 | | |

| 22,966 | | |

| 24 | % | |

| 53 | % |

| Net Operating Income | |

| 1,101,464 | | |

| 2,669,637 | | |

| 2,153,945 | | |

| 516,145 | | |

| 829,155 | | |

| 61 | % | |

| -25 | % |

| Employee benefits | |

| 133,241 | | |

| 179,320 | | |

| 177,344 | | |

| 152,986 | | |

| 161,679 | | |

| 6 | % | |

| 21 | % |

| Administrative expenses | |

| 71,308 | | |

| 128,039 | | |

| 91,615 | | |

| 74,088 | | |

| 90,253 | | |

| 22 | % | |

| 27 | % |

| Depreciation and impairment of assets | |

| 25,507 | | |

| 40,629 | | |

| 32,286 | | |

| 30,274 | | |

| 30,605 | | |

| 1 | % | |

| 20 | % |

| Other operating expenses | |

| 145,215 | | |

| 225,486 | | |

| 185,577 | | |

| 147,708 | | |

| 142,889 | | |

| -3 | % | |

| -2 | % |

| Operating Income | |

| 726,193 | | |

| 2,096,163 | | |

| 1,667,123 | | |

| 111,089 | | |

| 403,729 | | |

| 263 | % | |

| -44 | % |

| Result from associates & joint ventures | |

| -220 | | |

| 315,407 | | |

| -284 | | |

| -6,333 | | |

| 1,011 | | |

| - | | |

| - | |

| Result from net monetary postion | |

| -667,194 | | |

| -1,059,942 | | |

| -1,181,915 | | |

| -518,731 | | |

| -283,895 | | |

| -45 | % | |

| -57 | % |

| Result before taxes from continuing operations | |

| 58,779 | | |

| 1,351,628 | | |

| 484,924 | | |

| -413,975 | | |

| 120,845 | | |

| -129 | % | |

| 106 | % |

| Income tax | |

| 35,569 | | |

| 424,628 | | |

| 119,000 | | |

| -152,438 | | |

| 29,524 | | |

| -119 | % | |

| -17 | % |

| Net income from continuing operations | |

| 23,210 | | |

| 927,000 | | |

| 365,924 | | |

| -261,537 | | |

| 91,321 | | |

| -135 | % | |

| 293 | % |

| | |

| | | |

| - | | |

| - | | |

| | | |

| | | |

| | | |

| | |

| Net Income of the period | |

| 23,210 | | |

| 927,000 | | |

| 365,924 | | |

| -261,537 | | |

| 91,321 | | |

| -135 | % | |

| 293 | % |

| Net income of the period attributable to parent company | |

| 23,127 | | |

| 926,572 | | |

| 366,169 | | |

| -262,062 | | |

| 90,873 | | |

| - | | |

| 293 | % |

| Net income of the period attributable to minority interest | |

| 83 | | |

| 428 | | |

| -245 | | |

| 525 | | |

| 448 | | |

| -15 | % | |

| 440 | % |

| Other Comprehensive Income | |

| -4,378 | | |

| 80,670 | | |

| -19,552 | | |

| -53,772 | | |

| -29,118 | | |

| - | | |

| - | |

| Foreign currency translation differences in financial

statements conversion | |

| 396 | | |

| 20,624 | | |

| -18,697 | | |

| -4,731 | | |

| -2,158 | | |

| - | | |

| - | |

| Profits or losses from financial assets measured at fair

value through other comprehensive income (FVOCI) (IFRS 9(4.1.2)(a) | |

| -4,774 | | |

| 60,046 | | |

| -855 | | |

| -49,041 | | |

| -26,960 | | |

| - | | |

| - | |

| TOTAL COMPREHENSIVE INCOME FOR THE PERIOD | |

| 18,832 | | |

| 1,007,670 | | |

| 346,372 | | |

| -315,309 | | |

| 62,203 | | |

| -120 | % | |

| 230 | % |

| Total Comprehensive Income attributable to parent

Company | |

| 18,749 | | |

| 1,007,242 | | |

| 346,617 | | |

| -315,834 | | |

| 61,755 | | |

| 0 | % | |

| 229 | % |

| Total Comprehensive Income attributable to non-controlling

interests | |

| 83 | | |

| 428 | | |

| -245 | | |

| 525 | | |

| 448 | | |

| -15 | % | |

| 440 | % |

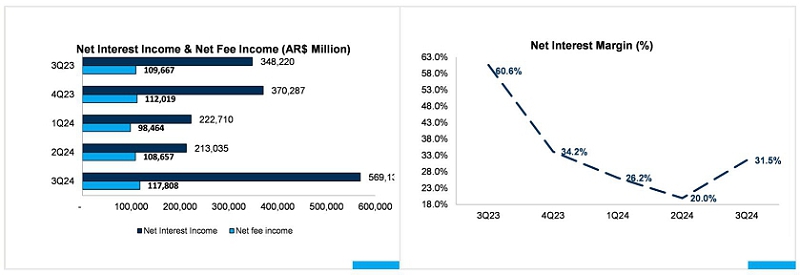

The Bank’s 3Q24 net interest income

totaled Ps.569.1 billion, 167% or Ps.356.1 billion higher than in 2Q24 and 63% or Ps.220.9 billion higher YoY. Interest income increased

23% while interest expenses decreased 40%.

In 3Q24 interest income totaled Ps.857.6

billion, 23% or Ps.160.4 billion higher than in 2Q24 and 35% or Ps.468.4 billion lower than in 3Q23.

Income from interest on loans and other financing

totaled Ps.405.4 billion, 13% or Ps56.9 billion lower compared with the previous quarter mainly due to a 15.4 percentage points decrease

in the average lending rate which was partially offset by a 20% increase in the average volume of private sector loans. On a yearly basis

Income from interest on loans decreased 28% or Ps.161.1 billion.

In 3Q24, income from government and private

securities increased 143% or Ps.253 billion QoQ and decreased 33% or Ps.210.1 billion compared with the same period of last year.

This result is explained 80% by income from government and private securities valued at amortized cost and the remaining 20% is explained

by income from government and private securities through other comprehensive income (Other government securities)

| BANCO MACRO |

3Q24 EARNINGS RELEASE |

In 3Q24, income from Repos totaled Ps.18.6

billion, 66% or Ps.36 billion lower than the previous quarter and 84% or Ps.97.5 billion lower than a year ago.

In 3Q24 FX income totaled Ps.16.3 billion,

43% or Ps.12.5 billion lower than the previous quarter and 98% or Ps.719.4 billion lower than a year ago. FX income gain was due to the

6.5% argentine peso depreciation against the US dollar and the Bank’s long dollar position during the quarter.

| FX INCOME | |

MACRO Consolidated | | |

Variation | |

| In MILLION $ (Measuring Unit Current at EOP) | |

3Q23 | | |

2Q24 | | |

3Q24 | | |

QoQ | | |

YoY | |

| (1) Differences in quoted prices of

gold and foreign currency | |

| 735,665 | | |

| 28,766 | | |

| 16,263 | | |

| -43 | % | |

| -98 | % |

| Translation of FX assets and liabilities to Pesos | |

| 733,796 | | |

| 28,641 | | |

| 16,135 | | |

| -44 | % | |

| -98 | % |

| Income from foreign currency exchange | |

| 1,869 | | |

| 124 | | |

| 128 | | |

| 3 | % | |

| -93 | % |

| (2) Net Income from financial assets and

liabilities at fair value through P&L | |

| -1,341 | | |

| -4,136 | | |

| -23,833 | | |

| 476 | % | |

| 1677 | % |

| Income from investment in derivative

financing instruments | |

| -1,341 | | |

| -4,136 | | |

| -23,833 | | |

| 476 | % | |

| 1677 | % |

| (1) +(2) Total Result from Differences in

quoted prices of gold and foreign currency | |

| 734,324 | | |

| 24,630 | | |

| -7,570 | | |

| - | | |

| - | |

| BANCO MACRO |

3Q24 EARNINGS RELEASE |

| INTEREST INCOME | |

MACRO Consolidated | | |

Change | |

| In MILLION $ (Measuring Unit Current at EOP) | |

3Q23 | | |

4Q23 | | |

1Q24 | | |

2Q24 | | |

3Q24 | | |

QoQ | | |

YoY | |

| Interest on Cash and due from Banks | |

| 3,926 | | |

| 3,906 | | |

| 4,168 | | |

| 3,742 | | |

| 4,160 | | |

| 11 | % | |

| 6 | % |

| Interest from government securities | |

| 639,298 | | |

| 215,569 | | |

| 125,002 | | |

| 175,800 | | |

| 429,369 | | |

| 144 | % | |

| -33 | % |

| Interest from private securities | |

| 257 | | |

| 1,654 | | |

| 1,395 | | |

| 689 | | |

| 102 | | |

| -85 | % | |

| -60 | % |

| Interest on loans and other financing | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| To the financial sector | |

| 1,756 | | |

| 3,281 | | |

| 1,366 | | |

| 1,106 | | |

| 537 | | |

| -51 | % | |

| -69 | % |

| To the public non financial sector | |

| 12,390 | | |

| 10,721 | | |

| 2,215 | | |

| 923 | | |

| 4,725 | | |

| 412 | % | |

| -62 | % |

| Interest on overdrafts | |

| 84,485 | | |

| 153,050 | | |

| 94,880 | | |

| 69,081 | | |

| 61,032 | | |

| -12 | % | |

| -28 | % |

| Interest on documents | |

| 87,163 | | |

| 124,235 | | |

| 75,661 | | |

| 48,391 | | |

| 37,549 | | |

| -22 | % | |

| -57 | % |

| Interest on mortgages loans | |

| 67,378 | | |

| 98,610 | | |

| 144,584 | | |

| 92,866 | | |

| 48,572 | | |

| -48 | % | |

| -28 | % |

| Interest on pledged loans | |

| 5,270 | | |

| 5,895 | | |

| 4,178 | | |

| 3,323 | | |

| 3,724 | | |

| 12 | % | |

| -29 | % |

| Interest on personal loans | |

| 118,024 | | |

| 114,049 | | |

| 92,731 | | |

| 106,551 | | |

| 127,548 | | |

| 20 | % | |

| 8 | % |

| Interest on credit cards loans | |

| 99,019 | | |

| 111,001 | | |

| 86,306 | | |

| 66,917 | | |

| 54,109 | | |

| -19 | % | |

| -45 | % |

| Interest on financial leases | |

| 1,124 | | |

| 4,723 | | |

| 4,666 | | |

| 2,908 | | |

| 2,670 | | |

| -8 | % | |

| 138 | % |

| Interest on other loans | |

| 89,794 | | |

| 139,284 | | |

| 111,166 | | |

| 70,212 | | |

| 64,885 | | |

| -8 | % | |

| -28 | % |

| Interest on Repos | |

| 0 | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| From the BCRA | |

| 116,071 | | |

| 168,364 | | |

| 201,873 | | |

| 54,410 | | |

| 16,313 | | |

| -70 | % | |

| -86 | % |

| Other financial institutions | |

| 52 | | |

| 1,306 | | |

| 86 | | |

| 204 | | |

| 2,266 | | |

| - | | |

| - | |

| Total Interest income | |

| 1,326,007 | | |

| 1,155,648 | | |

| 950,277 | | |

| 697,123 | | |

| 857,561 | | |

| 23 | % | |

| -35 | % |

| Income from Interest on loans | |

| 552,257 | | |

| 750,847 | | |

| 614,172 | | |

| 460,249 | | |

| 400,089 | | |

| -13 | % | |

| -28 | % |

The Bank’s 3Q24 interest expense

totaled Ps.288.4 billion, decreasing 40% or Ps.195.7 billion compared to the previous quarter and 71% (Ps.689.4 billion) lower compared

to 3Q23.

In 3Q24, interest on deposits represented

96% of the Bank’s total interest expense, decreasing 41% or Ps.191.3 billion QoQ, due to a 12.4 percentage points decrease in the

average rate paid on deposits while the average volume of deposits from the private sector decreased 11%. On a yearly basis, interest

on deposits decreased 71% or Ps.682.4billion.

| INTEREST EXPENSE | |

MACRO Consolidated | | |

Change | |

| In MILLION $ (Measuring Unit Current at EOP) | |

3Q23 | | |

4Q23 | | |

1Q24 | | |

2Q24 | | |

3Q24 | | |

QoQ | | |

YoY | |

| Deposits | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Interest on checking accounts | |

| 65,571 | | |

| 72,205 | | |

| 85,233 | | |

| 40,053 | | |

| 15,952 | | |

| -60 | % | |

| -76 | % |

| Interest on saving accounts | |

| 8,464 | | |

| 12,536 | | |

| 17,400 | | |

| 10,999 | | |

| 5,747 | | |

| -48 | % | |

| -32 | % |

| Interest on time deposits | |

| 885,312 | | |

| 677,886 | | |

| 598,187 | | |

| 417,189 | | |

| 255,213 | | |

| -39 | % | |

| -71 | % |

| Interest on other financing from BCRA and financial

inst. | |

| 731 | | |

| 1,883 | | |

| 3,161 | | |

| -271 | | |

| 641 | | |

| -337 | % | |

| -12 | % |

| Repos | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Other financial institutions | |

| 6,664 | | |

| 5,466 | | |

| 5,463 | | |

| 2,124 | | |

| 29 | | |

| -99 | % | |

| -100 | % |

| Interest on corporate bonds | |

| 87 | | |

| 3,079 | | |

| 6,310 | | |

| 4,184 | | |

| 2,397 | | |

| -43 | % | |

| 2655 | % |

| Interest on subordinated bonds | |

| 7,294 | | |

| 7,612 | | |

| 8,023 | | |

| 6,668 | | |

| 6,378 | | |

| -4 | % | |

| -13 | % |

| Interest on other financial liabilities | |

| 3,664 | | |

| 4,694 | | |

| 3,790 | | |

| 3,142 | | |

| 2,073 | | |

| -34 | % | |

| -43 | % |

| Total financial expense | |

| 977,787 | | |

| 785,361 | | |

| 727,567 | | |

| 484,088 | | |

| 288,430 | | |

| -40 | % | |

| -71 | % |

| Expenses from interest on deposits | |

| 959,347 | | |

| 762,627 | | |

| 700,820 | | |

| 468,241 | | |

| 276,912 | | |

| -41 | % | |

| -71 | % |

| BANCO MACRO |

3Q24 EARNINGS RELEASE |

In 3Q24, the Bank’s net interest margin

(including FX) was 31.5%, higher than the 20% posted in 2Q24 and lower than the 60.6% posted in 3Q23.

| ASSETS &

LIABILITIES PERFORMANCE (AR$) | |

MACRO

Consolidated | |

| In MILLION

$ | |

3Q23 | | |

2Q24 | | |

3Q24 | |

| (Measuring Unit Current at EOP) | |

AVERAGE | | |

REAL INT | | |

NOMINAL | | |

AVERAGE | | |

REAL INT | | |

NOMINAL | | |

AVERAGE | | |

REAL INT | | |

NOMINAL | |

| Yields & rates in annualized nominal

% | |

BALANCE | | |

RATE | | |

INT RATE | | |

BALANCE | | |

RATE | | |

INT RATE | | |

BALANCE | | |

RATE | | |

INT RATE | |

| Interest-earning assets | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Loans & Other Financing | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Public

Sector | |

| 53,281 | | |

| -19.3 | % | |

| 92.3 | % | |

| 10,331 | | |

| -22.2 | % | |

| 35.9 | % | |

| 46,461 | | |

| -5.2 | % | |

| 40.5 | % |

| Financial

Sector | |

| 9,808 | | |

| -28.4 | % | |

| 70.5 | % | |

| 28,945 | | |

| -34.3 | % | |

| 14.8 | % | |

| 31,230 | | |

| -27.7 | % | |

| 7.2 | % |

| Private

Sector | |

| 3,154,774 | | |

| -30.3 | % | |

| 66.0 | % | |

| 2,627,430 | | |

| -4.0 | % | |

| 67.6 | % | |

| 3,298,999 | | |

| -1.3 | % | |

| 46.4 | % |

| Other debt securities | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Central Bank Securities (Leliqs) | |

| 2,182,080 | | |

| -16.3 | % | |

| 99.4 | % | |

| 0 | | |

| 0.0 | % | |

| 0.0 | % | |

| 0 | | |

| 0.0 | % | |

| 0.0 | % |

| Government & Private

Securities | |

| 465,170 | | |

| -28.9 | % | |

| 69.3 | % | |

| 574,663 | | |

| 27.0 | % | |

| 121.9 | % | |

| 2,625,717 | | |

| 11.2 | % | |

| 64.9 | % |

| Repos | |

| 451,304 | | |

| -15.1 | % | |

| 102.1 | % | |

| 391,669 | | |

| -10.6 | % | |

| 56.1 | % | |

| 179,301 | | |

| -4.8 | % | |

| 41.2 | % |

| Total interest-earning assets | |

| 6,316,417 | | |

| -24.2 | % | |

| 80.6 | % | |

| 3,633,038 | | |

| -0.2 | % | |

| 74.4 | % | |

| 6,181,708 | | |

| 3.8 | % | |

| 53.9 | % |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Fin. Assets through P&L and

equity inv. | |

| 35,393 | | |

| 303.5 | % | |

| 688.4 | % | |

| 5,145,984 | | |

| 5.3 | % | |

| 224.0 | % | |

| 936,576 | | |

| -37.3 | % | |

| 9.6 | % |

| Other Non interest-earning

assets | |

| 1,482,453 | | |

| | | |

| | | |

| 1,852,964 | | |

| | | |

| | | |

| 2,322,551 | | |

| | | |

| | |

| Total Non interest-earning

assets | |

| 1,517,846 | | |

| | | |

| | | |

| 6,998,948 | | |

| | | |

| | | |

| 3,259,127 | | |

| | | |

| | |

| Total Average Assets | |

| 7,834,263 | | |

| | | |

| | | |

| 10,631,986 | | |

| | | |

| | | |

| 9,440,835 | | |

| | | |

| | |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Interest-bearing liabilities | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Deposits | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Public Sector | |

| 359,421 | | |

| -21.1 | % | |

| 88.0 | % | |

| 348,435 | | |

| -13.3 | % | |

| 51.5 | % | |

| 382,528 | | |

| -8.7 | % | |

| 35.3 | % |

| Private

Sector | |

| 4,773,777 | | |

| -27.3 | % | |

| 73.1 | % | |

| 4,009,305 | | |

| -18.4 | % | |

| 42.5 | % | |

| 3,441,606 | | |

| -13.7 | % | |

| 28.0 | % |

| BCRA and other financial institutions | |

| 934 | | |

| 72.7 | % | |

| 311.4 | % | |

| 955 | | |

| -55.7 | % | |

| -22.7 | % | |

| 3,146 | | |

| 25.6 | % | |

| 86.2 | % |

| Corporate bonds | |

| 0 | | |

| 0.0 | % | |

| 0.0 | % | |

| 12,335 | | |

| 20.6 | % | |

| 110.7 | % | |

| 12,801 | | |

| 2.2 | % | |

| 51.5 | % |

| Repos | |

| 31,383 | | |

| -22.7 | % | |

| 84.2 | % | |

| 16,309 | | |

| -12.8 | % | |

| 52.4 | % | |

| 431 | | |

| -14.5 | % | |

| 26.8 | % |

| Other financial liabilities | |

| 4907 | | |

| 0.578 | | |

| 2.759 | | |

| 26413 | | |

| -0.204 | | |

| 0.391 | | |

| 13943 | | |

| 0.03 | | |

| 0.527 | |

| Total int.-bearing liabilities | |

| 5,170,422 | | |

| -26.8 | % | |

| 74.4 | % | |

| 4,413,752 | | |

| -17.9 | % | |

| 43.4 | % | |

| 3,854,455 | | |

| -13.0 | % | |

| 29.0 | % |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Total non int.-bearing liabilities | |

| 2,292,142 | | |

| | | |

| | | |

| 2,463,852 | | |

| | | |

| | | |

| 2,193,877 | | |

| | | |

| | |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Total Average Liabilities | |

| 7,462,564 | | |

| | | |

| | | |

| 6,877,604 | | |

| | | |

| | | |

| 6,048,332 | | |

| | | |

| | |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Assets Performance | |

| | | |

| 1,283,231 | | |

| | | |

| | | |

| 672,439 | | |

| | | |

| | | |

| 837,150 | | |

| | |

| Liabilities Performance | |

| | | |

| 970,095 | | |

| | | |

| | | |

| 476,048 | | |

| | | |

| | | |

| 280,533 | | |

| | |

| Net Interest Income | |

| | | |

| 313,136 | | |

| | | |

| | | |

| 196,391 | | |

| | | |

| | | |

| 556,617 | | |

| | |

| Total interest-earning assets | |

| | | |

| 6,316,417 | | |

| | | |

| | | |

| 3,633,038 | | |

| | | |

| | | |

| 6,181,708 | | |

| | |

| Net Interest Margin (NIM) | |

| | | |

| 19.7 | % | |

| | | |

| | | |

| 21.7 | % | |

| | | |

| | | |

| 35.8 | % | |

| | |

| BANCO MACRO | |

3Q24 EARNINGS RELEASE |

| ASSETS &

LIABILITIES PERFORMANCE USD | |

MACRO

Consolidated | |

| In MILLION $ | |

3Q23 | | |

2Q24 | | |

3Q24 | |

| (Measuring

Unit Current at EOP) | |

AVERAGE | | |

REAL

INT | | |

NOMINAL | | |

AVERAGE | | |

REAL

INT | | |

NOMINAL | | |

AVERAGE | | |

REAL

INT | | |

NOMINAL | |

| Yields &

rates in annualized nominal % | |

| BALANCE | | |

| RATE | | |

| INT

RATE | | |

| BALANCE | | |

| RATE | | |

| INT

RATE | | |

| BALANCE | | |

| RATE | | |

| INT

RATE | |

| Interest-earning

assets | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Cash

and Deposits in Banks | |

| 476,278 | | |

| -56.6 | % | |

| 3.3 | % | |

| 454,139 | | |

| -40.9 | % | |

| 3.3 | % | |

| 409,123 | | |

| -29.9 | % | |

| 4.0 | % |

| Loans &

Other Financing | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Financial

Sector | |

| 820 | | |

| -55.2 | % | |

| 6.8 | % | |

| 1,134 | | |

| -33.8 | % | |

| 15.6 | % | |

| 303 | | |

| -60.9 | % | |

| -42.0 | % |

| Private

Sector | |

| 254,045 | | |

| -40.2 | % | |

| 42.4 | % | |

| 704,358 | | |

| -36.7 | % | |

| 10.6 | % | |

| 712,893 | | |

| -26.9 | % | |

| 8.4 | % |

| Other

debt securities | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Government &

Private Securities | |

| 50,254 | | |

| -19.2 | % | |

| 92.4 | % | |

| 66,026 | | |

| -34.9 | % | |

| 13.7 | % | |

| 58,850 | | |

| -27.0 | % | |

| 8.3 | % |

| Total

interest-earning assets | |

| 781,397 | | |

| -48.9 | % | |

| 21.7 | % | |

| 1,225,657 | | |

| -38.1 | % | |

| 8.1 | % | |

| 1,181,169 | | |

| -27.9 | % | |

| 6.9 | % |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Fin. Assets

through P&L and equity inv. | |

| 2,429,141 | | |

| -69.7 | % | |

| -27.9 | % | |

| 151,471 | | |

| -16.7 | % | |

| 45.5 | % | |

| 140,282 | | |

| -27.6 | % | |

| 7.4 | % |

| Other

Non interest-earning assets | |

| 878,121 | | |

| | | |

| | | |

| 890,399 | | |

| | | |

| | | |

| 1,107,609 | | |

| | | |

| | |

| Total

Non interest earning assets | |

| 3,307,262 | | |

| | | |

| | | |

| 1,041,870 | | |

| | | |

| | | |

| 1,247,891 | | |

| | | |

| | |

| Total Average Assets | |

| 4,088,659 | | |

| | | |

| | | |

| 2,267,527 | | |

| | | |

| | | |

| 2,429,060 | | |

| | | |

| | |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Interest-bearing

liabilities | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Deposits | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Public

Sector | |

| 26,656 | | |

| -58.0 | % | |

| 0.1 | % | |

| 10,203 | | |

| -42.4 | % | |

| 0.6 | % | |

| 26,470 | | |

| -31.5 | % | |

| 1.5 | % |

| Private

Sector | |

| 540,414 | | |

| -58.0 | % | |

| 0.0 | % | |

| 863,534 | | |

| -42.7 | % | |

| 0.1 | % | |

| 902,965 | | |

| -32.4 | % | |

| 0.2 | % |

| BCRA and

other financial institutions | |

| 15,176 | | |

| -55.3 | % | |

| 6.5 | % | |

| 25,580 | | |

| -39.5 | % | |

| 5.6 | % | |

| 21,964 | | |

| -30.3 | % | |

| 3.4 | % |

| Issued corporate

bonds | |

| 15,563 | | |

| -57.1 | % | |

| 2.2 | % | |

| 60,069 | | |

| -39.7 | % | |

| 5.3 | % | |

| 52,320 | | |

| -28.8 | % | |

| 5.6 | % |

| Subordinated

bonds | |

| 441,819 | | |

| -55.3 | % | |

| 6.5 | % | |

| 421,744 | | |

| -39.1 | % | |

| 6.4 | % | |

| 398,298 | | |

| -28.2 | % | |

| 6.4 | % |

| Total

int.-bearing liabilities | |

| 1,039,628 | | |

| -56.8 | % | |

| 2.9 | % | |

| 1,381,130 | | |

| -41.4 | % | |

| 2.3 | % | |

| 1,402,017 | | |

| -31.1 | % | |

| 2.2 | % |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Total

non int.-bearing liabilities | |

| 567,478 | | |

| | | |

| | | |

| 750,397 | | |

| | | |

| | | |

| 742,878 | | |

| | | |

| | |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Total Average liabilities | |

| 1,607,106 | | |

| | | |

| | | |

| 2,131,527 | | |

| | | |

| | | |

| 2,144,895 | | |

| | | |

| | |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Assets Performance | |

| | | |

| 42,776 | | |

| | | |

| | | |

| 24,684 | | |

| | | |

| | | |

| 20,411 | | |

| | |

| Liabilities

Performance | |

| | | |

| 7,692 | | |

| | | |

| | | |

| 8,042 | | |

| | | |

| | | |

| 7,898 | | |

| | |

| Net

Interest Income | |

| | | |

| 35,084 | | |

| | | |

| | | |

| 16,642 | | |

| | | |

| | | |

| 12,513 | | |

| | |

| Total

interest-earning assets | |

| | | |

| 781,397 | | |

| | | |

| | | |

| 1,225,657 | | |

| | | |

| | | |

| 1,181,169 | | |

| | |

| Net

Interest Margin (NIM) | |

| | | |

| 17.8 | % | |

| | | |

| | | |

| 5.5 | % | |

| | | |

| | | |

| 4.2 | % | |

| | |

In 3Q24 Banco

Macro’s net fee income totaled Ps.117.8 billion, 8% or Ps.9.2 billion higher than in 2Q24 and was 7% or Ps.8.1 billion higher

than the same period of last year.

In the quarter,

fee income totaled Ps.138.6 billion, 9% or Ps.11.6 billion higher than in 2Q24. In the quarter insurance fees increased 37% or

Ps.2.3 billion, corporate services fees increased 18% or Ps.3 billion while credit card fees increased 18% or Ps.3.8 billion. On a yearly

basis, fee income increased 14% or Ps.16.8 billion.

In the quarter,

total fee expense increased 13% or Ps2.5 billion, mainly due to higher ATM networks fees. On a yearly basis, fee expenses increased

71% or Ps.8.6 billion.

| BANCO MACRO | |

3Q24 EARNINGS RELEASE |

| NET FEE INCOME | |

MACRO

Consolidated | | |

Change | |

| In MILLION $ (Measuring Unit Current at EOP) | |

3Q23 | | |

4Q23 | | |

1Q24 | | |

2Q24 | | |

3Q24 | | |

QoQ | | |

YoY | |

| Fees charged on

deposit accounts | |

| 43,861 | | |

| 44,116 | | |

| 38,481 | | |

| 46,484 | | |

| 46,504 | | |

| 0 | % | |

| 6 | % |

| Credit card fees | |

| 24,451 | | |

| 26,338 | | |

| 22,660 | | |

| 21,005 | | |

| 24,838 | | |

| 18 | % | |

| 2 | % |

| Corporate services fees | |

| 18,634 | | |

| 18,425 | | |

| 18,234 | | |

| 16,934 | | |

| 19,898 | | |

| 18 | % | |

| 7 | % |

| Debit card fees | |

| 7,835 | | |

| 8,819 | | |

| 7,431 | | |

| 8,575 | | |

| 8,585 | | |

| 0 | % | |

| 10 | % |

| ATM transaction fees | |

| 7,149 | | |

| 6,793 | | |

| 6,800 | | |

| 9,148 | | |

| 10,908 | | |

| 19 | % | |

| 53 | % |

| Insurance fees | |

| 5,876 | | |

| 5,675 | | |

| 4,825 | | |

| 6,338 | | |

| 8,665 | | |

| 37 | % | |

| 47 | % |

| Credit related fees | |

| 2,960 | | |

| 4,455 | | |

| 4,792 | | |

| 8,139 | | |

| 7,983 | | |

| -2 | % | |

| 170 | % |

| Financial agent fees (provinces) | |

| 6,618 | | |

| 6,057 | | |

| 4,619 | | |

| 5,760 | | |

| 5,447 | | |

| -5 | % | |

| -18 | % |

| Mutual funds & securities

fees | |

| 4,161 | | |

| 5,648 | | |

| 3,903 | | |

| 4,408 | | |

| 5,572 | | |

| 26 | % | |

| 34 | % |

| AFIP & Collection services | |

| 234 | | |

| 208 | | |

| 166 | | |

| 186 | | |

| 199 | | |

| 7 | % | |

| -15 | % |

| ANSES fees | |

| 63 | | |

| 43 | | |

| 20 | | |

| 17 | | |

| 16 | | |

| -6 | % | |

| -75 | % |

| Total fee income | |

| 121,842 | | |

| 126,577 | | |

| 111,931 | | |

| 126,994 | | |

| 138,615 | | |

| 9 | % | |

| 14 | % |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Total fee expense | |

| 12,175 | | |

| 14,558 | | |

| 13,467 | | |

| 18,337 | | |

| 20,807 | | |

| 13 | % | |

| 71 | % |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Net fee income | |

| 109,667 | | |

| 112,019 | | |

| 98,464 | | |

| 108,657 | | |

| 117,808 | | |

| 8 | % | |

| 7 | % |

In 3Q24 Net

Income from financial assets and liabilities at fair value through profit or loss totaled a Ps.103.6 billion gain, decreasing 24%

or Ps.32.3 billion in the quarter. This result was mainly due to a 4% decrease in income from government securities and 58% decrease

in income from private securities.

| In 3Q24 Net Income from financial

assets and liabilities at fair value through profit or loss decreased 24%QoQ. |

|

| NET INCOME

FROM FINANCIAL ASSETS AND LIABILITIES AT FAIR VALUE THROUGH PROFIT OR LOSS | |

MACRO

Consolidated | | |

Change | |

| In MILLION $ (Measuring

Unit Current at EOP) | |

3Q23 | | |

4Q23 | | |

1Q24 | | |

2Q24 | | |

3Q24 | | |

QoQ | | |

YoY | |

| Profit or loss from

government securities | |

| -187,771 | | |

| 1,683,591 | | |

| 1,700,701 | | |

| 119,851 | | |

| 114,476 | | |

| -4 | % | |

| -161 | % |

| Profit or loss from private securities | |

| 49,513 | | |

| 72,832 | | |

| 8,747 | | |

| 9,833 | | |

| 4,154 | | |

| -58 | % | |

| -92 | % |

| Profit or loss from investment

in derivative financing instruments | |

| 2,554 | | |

| 31,061 | | |

| 6,867 | | |

| 4,858 | | |

| 3,190 | | |

| -34 | % | |

| 25 | % |

| Profit or loss from other financial

assets | |

| -3,235 | | |

| 4,930 | | |

| 4,208 | | |

| 1,788 | | |

| 1,026 | | |

| -43 | % | |

| -132 | % |

| Profit or loss from investment

in equity instruments | |

| 5,535 | | |

| 1,391 | | |

| 578 | | |

| 2,372 | | |

| 465 | | |

| -80 | % | |

| -92 | % |

| Profit or loss from the sale

of financial assets at fair value | |

| 22,399 | | |

| 12,941 | | |

| -19,282 | | |

| 1,336 | | |

| 4,107 | | |

| - | | |

| - | |

| Income from financial assets

at fair value through profit or loss | |

| -111,005 | | |

| 1,806,746 | | |

| 1,701,819 | | |

| 140,038 | | |

| 127,418 | | |

| -9 | % | |

| - | |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Profit or loss from derivative

financing instruments | |

| -1,341 | | |

| -2,135 | | |

| -10,115 | | |

| -4,136 | | |

| -23,833 | | |

| - | | |

| - | |

| Income from financial liabilities

at fair value through profit or loss | |

| -1,341 | | |

| -2,135 | | |

| -10,115 | | |

| -4,136 | | |

| -23,833 | | |

| - | | |

| - | |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| NET INCOME FROM FINANCIAL

ASSETS AT FAIR VALUE THROUGH PROFIT OR LOSS | |

| -112,346 | | |

| 1,804,611 | | |

| 1,691,704 | | |

| 135,902 | | |

| 103,585 | | |

| -24 | % | |

| - | |

| BANCO MACRO | |

3Q24 EARNINGS RELEASE |

In

the quarter, Other Operating Income totaled Ps.45 billion, 7% or Ps.3.3 billion lower than in 2Q24. Others decreased 49% or Ps.6.7

billion while income from initial recognition of financial assets and liabilities decreased 141% or Ps.2.8 billion. Other service related

fees increased 31% or Ps.5.6 billion. On a yearly basis, Other Operating Income increased 29% or Ps.10.1 billion.

| OTHER OPERATING INCOME | |

MACRO Consolidated | | |

Change | |

| In MILLION $ (Measuring Unit Current at EOP) | |

3Q23 | | |

4Q23 | | |

1Q24 | | |

2Q24 | | |

3Q24 | | |

QoQ | | |

YoY | |

| Credit and debit cards | |

| 4,851 | | |

| 6,154 | | |

| 5,047 | | |

| 6,115 | | |

| 8,429 | | |

| 38 | % | |

| 74 | % |

| Lease of safe deposit boxes | |

| 3,241 | | |

| 3,729 | | |

| 3,464 | | |

| 4,006 | | |

| 4,357 | | |

| 9 | % | |

| 34 | % |

| Other service related fees | |

| 12,838 | | |

| 15,082 | | |

| 17,072 | | |

| 17,708 | | |

| 23,265 | | |

| 31 | % | |

| 81 | % |

| Other adjustments and interest from other receivables | |

| 9,133 | | |

| 12,359 | | |

| 19,039 | | |

| 8,629 | | |

| 6,799 | | |

| -21 | % | |

| -26 | % |

| Initial recognition of loans | |

| - | | |

| - | | |

| 6,863 | | |

| -2,013 | | |

| -4,850 | | |

| - | | |

| - | |

| Sale of property, plant and equipment | |

| -7 | | |

| 70 | | |

| 2 | | |

| 51 | | |

| -31 | | |

| -161 | % | |

| 343 | % |

| Others | |

| 4,808 | | |

| 13,326 | | |

| 7,477 | | |

| 13,769 | | |

| 7,039 | | |

| -49 | % | |

| 46 | % |

| Other Operating Income | |

| 34,864 | | |

| 50,720 | | |

| 58,964 | | |

| 48,265 | | |

| 45,008 | | |

| -7 | % | |

| 29 | % |

In 3Q24 Banco

Macro’s administrative expenses plus employee benefits totaled Ps.251.9 billion, 11% or Ps.24.9 billion higher than the previous

quarter, due to higher employee benefits (+6%) and higher (+22%) administrative expenses. On a yearly basis, administrative expenses

plus employee benefits increased 23% or Ps.47.4 billion.

Employee benefits

increased 6% or Ps.8.7 billion QoQ, remunerations increased 8% or Ps.8.3 billion while Employee services increased 35% or Ps.1.6

billion. On a yearly basis, Employee benefits increased 21% or Ps.22.4 billion.

In 3Q24, administrative

expenses increased 22% or Ps.16.2 billion, due to higher Directors and auditors fees and higher Other administrative expenses. On

a yearly basis administrative expenses increased 27% or Ps.18.9 billion.

In 3Q24, the

efficiency ratio reached 36.3%, improving significantly from the 55.6% posted in 2Q24 and deteriorating from the 22.4% posted a year

ago. In 3Q24 expenses (employee benefits + G&A expenses + depreciation and impairment of assets) increased 10%, while income (net

interest income + net fee income + differences in quoted prices of gold and foreign currency + other operating income + net income from

financial assets at fair value through profit or loss – (Turnover Tax + Insurance on deposits)) increased 68% compared to 2Q24.

| BANCO MACRO | |

3Q24 EARNINGS RELEASE |

| PERSONNEL& ADMINISTRATIVE EXPENSES | |

MACRO Consolidated | | |

Change | |

| In MILLION $ (Measuring Unit Current at EOP) | |

3Q23 | | |

4Q23 | | |

1Q24 | | |

2Q24 | | |

3Q24 | | |

QoQ | | |

YoY | |

| Employee benefits | |

| 133,241 | | |

| 179,320 | | |

| 177,344 | | |

| 152,986 | | |

| 161,679 | | |

| 6 | % | |

| 21 | % |

| Remunerations | |

| 92,189 | | |

| 119,318 | | |

| 121,516 | | |

| 104,648 | | |

| 112,982 | | |

| 8 | % | |

| 23 | % |

| Social Security Contributions | |

| 22,870 | | |

| 31,249 | | |

| 29,134 | | |

| 26,139 | | |

| 27,204 | | |

| 4 | % | |

| 19 | % |

| Compensation and bonuses | |

| 13,799 | | |

| 24,021 | | |

| 22,362 | | |

| 17,773 | | |

| 15,500 | | |

| -13 | % | |

| 12 | % |

| Employee services | |

| 4,383 | | |

| 4,732 | | |

| 4,332 | | |

| 4,426 | | |

| 5,993 | | |

| 35 | % | |

| 37 | % |

| Administrative Expenses | |

| 71,308 | | |

| 128,039 | | |

| 91,615 | | |

| 74,088 | | |

| 90,253 | | |

| 22 | % | |

| 27 | % |

| Taxes | |

| 14,883 | | |

| 18,134 | | |

| 15,672 | | |

| 20,951 | | |

| 16,618 | | |

| -21 | % | |

| 12 | % |

| Maintenance, conservation fees | |

| 9,982 | | |

| 13,956 | | |

| 12,861 | | |

| 12,556 | | |

| 13,274 | | |

| 6 | % | |

| 33 | % |

| Directors& statutory auditors fees | |

| 4,089 | | |

| 39,653 | | |

| 16,001 | | |

| -10,004 | | |

| 4,232 | | |

| - | | |

| - | |

| Security services | |

| 6,041 | | |

| 6,464 | | |

| 5,335 | | |

| 6,753 | | |

| 8,102 | | |

| 20 | % | |

| 34 | % |

| Electricity& Communications | |

| 5,215 | | |

| 4,935 | | |

| 6,789 | | |

| 7,175 | | |

| 6,752 | | |

| -6 | % | |

| 29 | % |

| Other professional fees | |

| 7,777 | | |

| 11,944 | | |

| 7,533 | | |

| 8,672 | | |

| 9,535 | | |

| 10 | % | |

| 23 | % |

| Rental agreements | |

| 213 | | |

| 197 | | |

| 576 | | |

| 254 | | |

| 266 | | |

| 5 | % | |

| 25 | % |

| Advertising& publicity | |

| 5,729 | | |

| 6,540 | | |

| 3,700 | | |

| 4,752 | | |

| 5,663 | | |

| 19 | % | |

| -1 | % |

| Personnel allowances | |

| 1,405 | | |

| 1,747 | | |

| 1,004 | | |

| 1,477 | | |

| 1,361 | | |

| -8 | % | |

| -3 | % |

| Stationary& Office Supplies | |

| 494 | | |

| 653 | | |

| 481 | | |

| 484 | | |

| 445 | | |

| -8 | % | |

| -10 | % |

| Insurance | |

| 626 | | |

| 634 | | |

| 448 | | |

| 1,021 | | |

| 1,175 | | |

| 15 | % | |

| 88 | % |

| Hired administrative services | |

| 1,229 | | |

| 2,581 | | |

| 3,818 | | |

| 9,423 | | |

| 6,285 | | |

| -33 | % | |

| 411 | % |

| Other | |

| 13,625 | | |

| 20,601 | | |

| 17,397 | | |

| 10,574 | | |

| 16,545 | | |

| 56 | % | |

| 21 | % |

| Total Administrative Expenses | |

| 204,549 | | |

| 307,359 | | |

| 268,959 | | |

| 227,074 | | |

| 251,932 | | |

| 11 | % | |

| 23 | % |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Total Employees | |

| 7,765 | | |

| 9,192 | | |

| 9,166 | | |

| 9,175 | | |

| 9,109 | | |

| | | |

| | |

| Branches | |

| 461 | | |

| 519 | | |

| 517 | | |

| 515 | | |

| 515 | | |

| | | |

| | |

| Efficiency ratio | |

| 22.4 | % | |

| 13.6 | % | |

| 14.7 | % | |

| 55.6 | % | |

| 36.3 | % | |

| | | |

| | |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Accumulated efficiency ratio | |

| 23.0 | % | |

| 18.6 | % | |

| 14.7 | % | |

| 22.2 | % | |

| 25.5 | % | |

| | | |

| | |

In 2Q24, Other

Operating Expenses totaled Ps.142.9 billion, decreasing 3% or Ps.4.8 billion QoQ, due to lower Other operating expenses (25% or Ps.17.5billion),

while Initial recognition charges on financial assets and liabilities increased Ps.10.2 billion. On a yearly basis, Other Operating Expenses

decreased 2% or Ps.2.3 billion.

| OTHER OPERATING EXPENSES | |

MACRO Consolidated | | |

Change | |

| In MILLION $ (Measuring Unit Current at EOP) | |

3Q23 | | |

4Q23 | | |

1Q24 | | |

2Q24 | | |

3Q24 | | |

QoQ | | |

YoY | |

| Turnover Tax | |

| 85,011 | | |

| 141,323 | | |

| 123,377 | | |

| 69,125 | | |

| 71,233 | | |

| 3 | % | |

| -16 | % |

| Other provision charges | |

| 2,721 | | |

| 7,628 | | |

| 4,946.00 | | |

| 3,590 | | |

| 4,264 | | |

| 19 | % | |

| 57 | % |

| Deposit Guarantee Fund Contributions | |

| 2,974 | | |

| 2,498 | | |

| 2,243 | | |

| 2,633 | | |

| 2,872 | | |

| 9 | % | |

| -3 | % |

| Donations | |

| 283 | | |

| 374 | | |

| 704 | | |

| 605 | | |

| 222 | | |

| -63 | % | |

| -22 | % |

| Insurance claims | |

| 1,197 | | |

| 1,613 | | |

| 1,500 | | |

| 1,782 | | |

| 1,644 | | |

| -8 | % | |

| 37 | % |

| Initial loan recognition | |

| 1,714 | | |

| 12,002 | | |

| 0 | | |

| 0 | | |

| 10,192 | | |

| -100 | % | |

| 100 | % |

| Late charges and charges payable to the Central Bank | |

| 1 | | |

| 21 | | |

| 4 | | |

| 10 | | |

| 6 | | |

| -40 | % | |

| 500 | % |

| Others | |

| 51,314 | | |

| 60,027 | | |

| 52,803 | | |

| 69,963 | | |

| 52,456 | | |

| -25 | % | |

| 2 | % |

| Other Operating Expenses | |

| 145,215 | | |

| 225,486 | | |

| 185,577 | | |

| 147,708 | | |

| 142,889 | | |

| -3 | % | |

| -2 | % |

| BANCO MACRO | |

3Q24 EARNINGS RELEASE |

In 2Q24, the

result from the net monetary position totaled a Ps.283.9 billion loss, 45% or Ps.234.8 billion lower than the loss posted in 2Q24 and

57% or Ps.383.3 billion lower than the loss posted one year ago. This result is a consequence of lower inflation during the quarter

(inflation decreased to 12.1% in 3Q24 from 18.6% in 2Q24)

| OPERATING RESULT | |

MACRO consolidated | | |

Change | |

| In MILLION $ (Measuring Unit Current at EOP) | |

3Q23 | | |

4Q23 | | |

1Q24 | | |

2Q24 | | |

3Q24 | | |

QoQ | | |

YoY | |

| Operating Result (exc. Loss from net monetary position) | |

| 726,193 | | |

| 2,096,163 | | |

| 1,667,123 | | |

| 111,089 | | |

| 403,729 | | |

| 263 | % | |

| -44 | % |

| Result from net monetary position (i.e. inflation adjustment) | |

| -667,194 | | |

| -1,059,942 | | |

| -1,181,915 | | |

| -518,731 | | |

| -283,895 | | |

| -45 | % | |

| -57 | % |

| Operating Result (Inc. Loss from net monetary position) | |

| 58,999 | | |

| 1,036,221 | | |

| 485,208 | | |

| -407,642 | | |

| 119,834 | | |

| - | | |

| 103 | % |

In 3Q24, Banco

Macro's effective tax rate was 24.4%, lower than the 60.5% registered in 3Q23.

| For more information, please see note 21 “Income Tax” of our Financial Statements. |

|

| BANCO MACRO | |

3Q24 EARNINGS RELEASE |

Loans and other financing

The volume of financing (including loans,

financial trust and leasing portfolio) totaled Ps.4.55 triillion, increasing 17% or Ps.657.9 billion QoQ and 28% or Ps.988 billion YoY.

In 3Q24 Private sector loans increased 18% or Ps.669.3 billion. On a yearly basis Private sector loans increased 27% or Ps.963 billion.

Within commercial loans, Overdrafts stand

out with a 46% or Ps.212.5 billion increase, while Documents decreased 12% or Ps.83.5 billion.

Within consumer lending, personal loans

increased 43% or Ps.235.5 billion while credit card loans increased 25% or Ps.227.1 billion.

Within private sector financing, peso

financing increased 19% or Ps.616.7 billion, while US dollar financing decreased 1% or USD 6 million.

As of 3Q24, Banco Macro’s market share

over private sector loans was 9.2%.

| LOANS AND OTHER FINANCING | |

MACRO Consilidated | | |

Change | |

| In MILLION $ (Measuring Unit Current at EOP) | |

3Q23 | | |

4Q23 | | |

1Q24 | | |

2Q24 | | |

3Q24 | | |

QoQ | | |

YoY | |

| Public Sector | |

| 9,767 | | |

| 9,508 | | |

| 3,746 | | |

| 50,535 | | |

| 44,439 | | |

| -12 | % | |

| 355 | % |

| Finacial Sector | |

| 44,923 | | |

| 20,088 | | |

| 26,108 | | |

| 40,646 | | |

| 35,278 | | |

| -13 | % | |

| -21 | % |

| Financial Sector | |

| 44,995 | | |

| 20,135 | | |

| 26,137 | | |

| 40,663 | | |

| 35,381 | | |

| -13 | % | |

| -21 | % |

| Less: Expected Credit Losses | |

| -72 | | |

| -47 | | |

| -29 | | |

| -17 | | |

| -103 | | |

| 506 | % | |

| 43 | % |

| Private Sector | |

| 3,509,366 | | |

| 3,666,711 | | |

| 3,294,667 | | |

| 3,803,044 | | |

| 4,472,386 | | |

| 18 | % | |

| 27 | % |

| Overdrafts | |

| 348,799 | | |

| 580,350 | | |

| 457,272 | | |

| 466,678 | | |

| 679,141 | | |

| 46 | % | |

| 95 | % |

| Discounted documents | |

| 668,185 | | |

| 681,987 | | |

| 668,684 | | |

| 717,561 | | |

| 634,079 | | |

| -12 | % | |

| -5 | % |

| Mortgage loans | |

| 336,395 | | |

| 337,161 | | |

| 326,978 | | |

| 352,570 | | |

| 386,541 | | |

| 10 | % | |

| 15 | % |

| Pledged loans | |

| 57,901 | | |

| 56,699 | | |

| 43,777 | | |

| 74,590 | | |

| 98,927 | | |

| 33 | % | |

| 71 | % |

| Personal loans | |

| 612,985 | | |

| 480,233 | | |

| 420,641 | | |

| 550,738 | | |

| 786,241 | | |

| 43 | % | |

| 28 | % |

| Credit Card loans | |

| 1,054,697 | | |

| 977,203 | | |

| 801,529 | | |

| 891,931 | | |

| 1,119,035 | | |

| 25 | % | |

| 6 | % |

| Leasing | |

| 4,485 | | |

| 19,127 | | |

| 13,370 | | |

| 12,817 | | |

| 14,726 | | |

| 15 | % | |

| 228 | % |

| Others | |

| 492,941 | | |

| 642,048 | | |

| 654,392 | | |

| 826,189 | | |

| 848,910 | | |

| 3 | % | |

| 72 | % |

| Less: Expected Credit Losses | |

| -67,022 | | |

| -108,097 | | |

| -91,976 | | |

| -90,030 | | |

| -95,214 | | |

| 6 | % | |

| 42 | % |

| Total loans and other financing | |

| 3,564,056 | | |

| 3,696,307 | | |

| 3,324,521 | | |

| 3,894,225 | | |

| 4,552,103 | | |

| 17 | % | |

| 28 | % |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Total loans in Pesos | |

| 3,325,812 | | |

| 3,333,499 | | |

| 2,650,253 | | |

| 3,175,753 | | |

| 3,792,442 | | |

| 19 | % | |

| 14 | % |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Total loans in foreign currency | |

| 238,244 | | |

| 362,808 | | |

| 674,268 | | |

| 718,472 | | |

| 759,661 | | |

| 6 | % | |

| 219 | % |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| EOP FX (Pesos per USD) | |

| 350.0083 | | |

| 808.4833 | | |

| 857.4167 | | |

| 911.7500 | | |

| 970.9167 | | |

| 6 | % | |

| 177 | % |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Total loans in foreign currency (USD) | |

| 681 | | |

| 449 | | |

| 786 | | |

| 788 | | |

| 782 | | |

| -1 | % | |

| 15 | % |

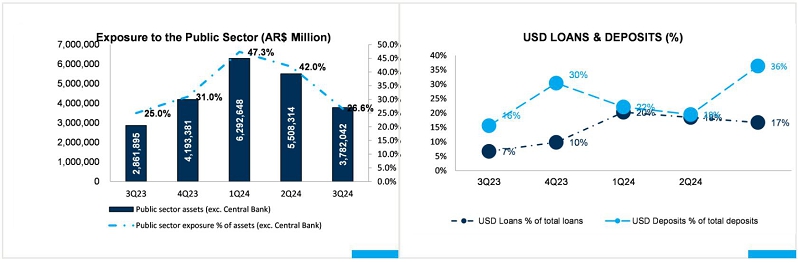

| USD financing / Financing to the private sector | |

| 7 | % | |

| 10 | % | |

| 20 | % | |

| 18 | % | |

| 17 | % | |

| | | |

| | |

| BANCO MACRO | |

3Q24 EARNINGS RELEASE |

In 3Q24, the

Bank’s public sector assets to total assets ratio was 27%, lower than the 42.8% registered in the previous quarter, and

higher than the 25.1% posted in 3Q23. Other government securities decreased 32% or Ps.1.72 trillion (namely CER inflation adjusted Bonds).

| In 3Q24, a 32% or Ps.1.77 trillion decrease in Government Securities stands out. |

|

| PUBLIC SECTOR ASSETS | |

MACRO Consolidated | | |

Change | |

| In MILLION $ (Measuring Unit Current at EOP) | |

3Q23 | | |

4Q23 | | |

1Q24 | | |

2Q24 | | |

3Q24 | | |

QoQ | | |

YoY | |

| SECURITIES AT FAIR VALUE THROUGH PROFIT OR LOSS | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Government Securities in Pesos | |

| 15,639 | | |

| 10,938 | | |

| 9,802 | | |

| 23,876 | | |

| 439,914 | | |

| 1743 | % | |

| 2713 | % |

| CER adjusted Governement Securities | |

| 19,434 | | |

| 27,346 | | |

| 5,595,116 | | |

| 4,829,790 | | |

| 445,524 | | |

| -91 | % | |

| 2193 | % |

| Government Securities in USD | |

| 306,549 | | |

| 427,666 | | |

| 61,084 | | |

| 83,468 | | |

| 79,246 | | |

| -5 | % | |

| -74 | % |

| DUAL Bonds | |

| 2,064,050 | | |

| 2,999,876 | | |

| 19,975 | | |

| 16,261 | | |

| - | | |

| -100 | % | |

| - | |

| Total Government Securities at fair value through profit or loss | |

| 2,405,672 | | |

| 3,465,826 | | |

| 5,685,977 | | |

| 4,953,395 | | |

| 964,684 | | |

| -81 | % | |

| -60 | % |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| SECURITIES AT AMORTIZED COST | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Government Securities in Pesos | |

| 253,963 | | |

| 193,646 | | |

| 194,145 | | |

| 213,503 | | |

| 269,503 | | |

| 26 | % | |

| 6 | % |

| CER adjusted Governement Securities | |

| - | | |

| - | | |

| - | | |

| - | | |

| 2,191,457 | | |

| - | | |

| - | |

| Leliqs | |

| 1,291,668 | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | |

| Lediv | |

| 108,207 | | |

| 66,657 | | |

| 12,311 | | |

| 5,623 | | |

| 5,340 | | |

| -5 | % | |

| -95 | % |

| Total Government Securities at amortized cost | |

| 1,653,838 | | |

| 260,303 | | |

| 206,456 | | |

| 219,126 | | |

| 2,466,300 | | |

| 1026 | % | |

| 49 | % |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| SECURITIES AT FAIR VALUE THROUGH O.C.I | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Government Securities in Pesos | |

| - | | |

| 24,228 | | |

| 21,076 | | |

| 16,272 | | |

| - | | |

| -100 | % | |

| - | |

| CER adjusted Governement Securities | |

| 163,960 | | |

| 467,780 | | |

| 344,104 | | |

| 329,448 | | |

| 328,332 | | |

| 0 | % | |

| 100 | % |

| Government Securities in USD | |

| 38,829 | | |

| 95,982 | | |

| 61,195 | | |

| 55,428 | | |

| 48,150 | | |

| -13 | % | |

| 24 | % |

| Total Government Securities at fair value through O.C.I | |

| 202,789 | | |

| 587,990 | | |

| 426,375 | | |

| 401,148 | | |

| 376,482 | | |

| -6 | % | |

| 86 | % |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| TOTAL GOVERNMENT SECURITIES | |

| 4,262,299 | | |

| 4,314,119 | | |

| 6,318,808 | | |

| 5,573,669 | | |

| 3,807,466 | | |

| -32 | % | |

| -11 | % |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Provincial Loans | |

| 6,684 | | |

| 6,491 | | |

| 1,265 | | |

| 47,144 | | |

| 41,349 | | |

| -12 | % | |

| 519 | % |

| Government securities loans | |

| 5,031 | | |

| 5,209 | | |

| 27,553 | | |

| 934 | | |

| - | | |

| -100 | % | |

| - | |

| TOTAL LOANS | |

| 11,715 | | |

| 11,700 | | |

| 28,818 | | |

| 48,078 | | |

| 41,349 | | |

| -14 | % | |

| 253 | % |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| TOTAL PUBLIC SECTOR ASSETS | |

| 4,274,014 | | |

| 4,325,819 | | |

| 6,347,626 | | |

| 5,621,747 | | |

| 3,848,815 | | |

| -32 | % | |

| -10 | % |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| TOTAL PUBLIC SECTOR ASSETS (net of Leliq/Lediv) | |

| 2,874,139 | | |

| 4,259,162 | | |

| 6,335,315 | | |

| 5,616,124 | | |

| 3,843,475 | | |

| -32 | % | |

| 34 | % |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| TOTAL PUBLIC SECTOR ASSETS (net of Leliq/Lediv) / TOTAL ASSETS | |

| 25.1 | % | |

| 31.4 | % | |

| 47.7 | % | |

| 42.8 | % | |

| 27.0 | % | |

| | | |

| | |

| BANCO MACRO |

3Q24 EARNINGS RELEASE |

Deposits

Banco Macro’s deposit base totaled

Ps.8.1 trillion in 3Q24, increasing 7% or Ps.516 billion QoQ and 30% or Ps.1.87 trillion YoY, representing 76% of the Bank’s total

liabilities.

On a quarterly basis private sector deposits

increased 6% or Ps.401.7 billion while public sector deposits increased 12% or Ps.104.6 billion.

The increase in private sector deposits was led

by demand deposits, which increased 28% or Ps.999.7 billion (including Special Saving Accounts related to the Tax Amnesty), while

time deposits decreased 32% or Ps.829.5 billion QoQ.

Within private sector deposits, peso deposits

decreased 15% or Ps.941.7 billion, while US dollar deposits increased 87% or USD 1.4 billion.

As of 3Q24, Banco Macro´s market share

over private sector deposits was 7.4%.

| DEPOSITS | |

MACRO Consolidated | | |

Change | |

| In MILLION $ (Measuring Unit Current at EOP) | |

3Q23 | | |

4Q23 | | |

1Q24 | | |

2Q24 | | |

3Q24 | | |

QoQ | | |

YoY | |

| Public sector | |

| 549,118 | | |

| 377,159 | | |

| 688,475 | | |

| 892,400 | | |

| 997,003 | | |

| 12 | % | |

| 82 | % |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Financial sector | |

| 10,668 | | |

| 40,690 | | |

| 17,777 | | |

| 13,435 | | |

| 23,121 | | |

| 72 | % | |

| 117 | % |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Private sector | |

| 5,648,525 | | |

| 6,375,914 | | |

| 5,988,780 | | |

| 6,651,998 | | |

| 7,053,746 | | |

| 6 | % | |

| 25 | % |

| Checking accounts | |

| 777,323 | | |

| 1,027,300 | | |

| 719,626 | | |

| 916,573 | | |

| 880,093 | | |

| -4 | % | |

| 13 | % |

| Savings accounts | |

| 1,998,587 | | |

| 2,882,665 | | |

| 2,156,893 | | |

| 2,611,954 | | |

| 3,648,131 | | |

| 40 | % | |

| 83 | % |

| Time deposits | |

| 2,744,208 | | |

| 2,113,046 | | |

| 2,674,646 | | |

| 2,613,550 | | |

| 1,784,049 | | |

| -32 | % | |

| -35 | % |

| Investment accounts | |

| 20,162 | | |

| 252,410 | | |

| 348,691 | | |

| 421,998 | | |

| 647,331 | | |

| 53 | % | |

| 3111 | % |

| Other | |

| 108,245 | | |

| 100,493 | | |

| 88,924 | | |

| 87,923 | | |

| 94,142 | | |

| | | |

| | |

| Total | |

| 6,208,311 | | |

| 6,793,763 | | |

| 6,695,032 | | |

| 7,557,833 | | |

| 8,073,870 | | |

| 7 | % | |

| 30 | % |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Pesos | |

| 5,239,861 | | |

| 4,730,651 | | |

| 5,216,162 | | |

| 6,084,717 | | |

| 5,143,065 | | |

| -15 | % | |

| -2 | % |

| Foreign Currency (in Pesos) | |

| 968,450 | | |

| 2,063,112 | | |

| 1,478,870 | | |

| 1,473,116 | | |

| 2,930,805 | | |

| 99 | % | |

| 203 | % |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| EOP FX (Pesos per USD) | |

| 350.0083 | | |

| 808.4833 | | |

| 857.4167 | | |

| 911.7500 | | |

| 970.9167 | | |

| 6 | % | |

| 177 | % |

| Foreign Currency (USD) | |

| 2,767 | | |

| 2,552 | | |

| 1,725 | | |

| 1,616 | | |

| 3,019 | | |

| 87 | % | |

| 9 | % |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| USD Deposits / Total Deposits | |

| 16 | % | |

| 30 | % | |

| 22 | % | |

| 19 | % | |

| 36 | % | |

| | | |

| | |

Banco Macro’s transactional deposits

represent approximately 62% of its total deposit base as of 3Q24. These accounts are low cost and are not sensitive to interest rate

increases.

| BANCO MACRO |

3Q24 EARNINGS RELEASE |

Other sources of funds

In 3Q24, the total amount of other sources

of funds increased 1% or Ps.45.5 billion compared to 2Q24 mainly due to a 2% or Ps.61.8 billion increase in Shareholders’ equity

generated by the positive net income registered during the period. Subordinated corporate bonds decreased 4% or Ps.14.8 billion.

On a yearly basis, other sources of funds increased 15% or Ps.537.5 billion.

| OTHER SOURCES OF FUNDS | |

MACRO Consolidated | | |

Change | |

| In MILLION $ (Measuring Unit Current at EOP) | |

3Q23 | | |

4Q23 | | |

1Q24 | | |

2Q24 | | |

3Q24 | | |

QoQ | | |

YoY | |

| Central Bank of Argentina | |

| 167 | | |

| 174 | | |

| 82 | | |

| 88 | | |

| 85 | | |

| -3 | % | |

| -49 | % |

| Banks and international institutions | |

| 16,035 | | |

| 30,684 | | |

| 24,664 | | |

| 22,517 | | |

| 23,748 | | |

| 5 | % | |

| 48 | % |

| Financing received from Argentine financial institutions | |

| 814 | | |

| 9,054 | | |

| 1,503 | | |

| 1,399 | | |

| 680 | | |

| -51 | % | |

| -16 | % |

| Subordinated corporate bonds | |

| 446,455 | | |

| 661,645 | | |

| 470,061 | | |

| 414,341 | | |

| 399,545 | | |

| -4 | % | |

| -11 | % |

| Corporate bonds | |

| 16,851 | | |

| 118,659 | | |

| 89,314 | | |

| 67,194 | | |

| 65,198 | | |

| -3 | % | |

| 287 | % |

| Shareholders' equity | |

| 3,113,404 | | |

| 4,120,645 | | |

| 4,467,263 | | |

| 3,580,163 | | |

| 3,641,918 | | |

| 2 | % | |

| 17 | % |

| Total other source of funds | |

| 3,593,726 | | |

| 4,940,861 | | |

| 5,052,887 | | |

| 4,085,702 | | |