B&G Foods Issues Notice of Full Redemption of Remaining 5.25% Senior Notes due 2025

September 09 2024 - 8:50AM

Business Wire

B&G Foods, Inc. (NYSE: BGS), announced today that it has

issued a notice of redemption for all $265,392,000 remaining

aggregate principal amount of its outstanding 5.25% senior notes

due 2025 at a cash redemption price of 100.0% of the principal

amount of the notes being redeemed, plus accrued and unpaid

interest on such amount, to, but excluding, the redemption date of

October 9, 2024. B&G Foods plans to fund the redemption with

revolving loans under its existing credit facility together with

cash on hand.

Interest on the redeemed notes will cease to accrue on and after

October 9, 2024. The only remaining right of the holders of the

redeemed notes will be to receive payment of the redemption price

(together with the accrued and unpaid interest on such amount).

A notice of redemption will be sent by The Bank of New York

Mellon Trust Company, N.A., the trustee for the notes, to the

registered holders of the notes. Copies of the notice of redemption

and additional information relating to the procedure for redemption

may be obtained from The Bank of New York Mellon Trust Company at

1.800.254.2826.

About B&G Foods, Inc.

Based in Parsippany, New Jersey, B&G Foods and its

subsidiaries manufacture, sell and distribute high-quality, branded

shelf-stable and frozen foods across the United States, Canada and

Puerto Rico. With B&G Foods’ diverse portfolio of more than 50

brands you know and love, including B&G, B&M, Bear Creek,

Cream of Wheat, Crisco, Dash, Green Giant, Las Palmas, Le Sueur,

Mama Mary’s, Maple Grove Farms, New York Style, Ortega, Polaner,

Spice Islands and Victoria, there’s a little something for

everyone. For more information about B&G Foods and its brands,

please visit www.bgfoods.com.

Forward-Looking Statements

Statements in this press release that are not statements of

historical or current fact, including, without limitation,

statements about the planned funding and completion of the

redemption, constitute “forward-looking statements.” Such

forward-looking statements involve known and unknown risks,

uncertainties and other unknown factors that could cause the actual

results of B&G Foods to be materially different from the

historical results or from any future results expressed or implied

by such forward-looking statements. In addition to statements that

explicitly describe such risks and uncertainties, readers are urged

to consider statements labeled with the terms “believes,” “belief,”

“expects,” “projects,” “intends,” “anticipates,” “assumes,”

“could,” “should,” “estimates,” “potential,” “seek,” “predict,”

“may,” “will” or “plans” and similar references to future periods

to be uncertain and forward-looking. Factors that may affect actual

results include, without limitation: B&G Foods’ substantial

leverage; the effects of rising costs for and/or decreases in the

supply of commodities, ingredients, packaging, other raw materials,

distribution and labor; crude oil prices and their impact on

distribution, packaging and energy costs; B&G Foods’ ability to

successfully implement sales price increases and cost saving

measures to offset any cost increases; intense competition, changes

in consumer preferences, demand for B&G Foods’ products and

local economic and market conditions; B&G Foods’ continued

ability to promote brand equity successfully, to anticipate and

respond to new consumer trends, to develop new products and

markets, to broaden brand portfolios in order to compete

effectively with lower priced products and in markets that are

consolidating at the retail and manufacturing levels and to improve

productivity; the ability of B&G Foods and its supply chain

partners to continue to operate manufacturing facilities,

distribution centers and other work locations without material

disruption, and to procure ingredients, packaging and other raw

materials when needed despite disruptions in the supply chain or

labor shortages; the impact pandemics or disease outbreaks, such as

the COVID-19 pandemic, may have on B&G Foods’ business,

including among other things, B&G Foods’ supply chain,

manufacturing operations or workforce and customer and consumer

demand for B&G Foods’ products; B&G Foods’ ability to

recruit and retain senior management and a highly skilled and

diverse workforce at B&G Foods’ corporate offices,

manufacturing facilities and other locations despite a very tight

labor market and changing employee expectations as to fair

compensation, an inclusive and diverse workplace, flexible working

and other matters; the risks associated with the expansion of

B&G Foods’ business; B&G Foods’ possible inability to

identify new acquisitions or to integrate recent or future

acquisitions or B&G Foods’ failure to realize anticipated

revenue enhancements, cost savings or other synergies from recent

or future acquisitions; B&G Foods’ ability to successfully

complete the integration of recent or future acquisitions into

B&G Foods’ enterprise resource planning (ERP) system; tax

reform and legislation, including the effects of the Infrastructure

Investment and Jobs Act, U.S. Tax Cuts and Jobs Act; and the U.S.

CARES Act, the Inflation Reduction Act, and future tax reform or

legislation; B&G Foods’ ability to access the credit markets

and B&G Foods’ borrowing costs and credit ratings, which may be

influenced by credit markets generally and the credit ratings of

B&G Foods’ competitors; unanticipated expenses, including,

without limitation, litigation or legal settlement expenses; the

effects of currency movements of the Canadian dollar and the

Mexican peso as compared to the U.S. dollar; the effects of

international trade disputes, tariffs, quotas, and other import or

export restrictions on B&G Foods’ international procurement,

sales and operations; future impairments of B&G Foods’ goodwill

and intangible assets; B&G Foods’ ability to protect

information systems against, or effectively respond to, a

cybersecurity incident, other disruption or data leak; B&G

Foods’ ability to successfully implement B&G Foods’

sustainability initiatives and achieve B&G Foods’

sustainability goals, and changes to environmental laws and

regulations; and other factors that affect the food industry

generally, including recalls if products become adulterated or

misbranded, liability if product consumption causes injury,

ingredient disclosure and labeling laws and regulations and the

possibility that consumers could lose confidence in the safety and

quality of certain food products; competitors’ pricing practices

and promotional spending levels; fluctuations in the level of

B&G Foods’ customers’ inventories and credit and other business

risks related to B&G Foods’ customers operating in a

challenging economic and competitive environment; and the risks

associated with third-party suppliers and co-packers, including the

risk that any failure by one or more of B&G Foods’ third-party

suppliers or co-packers to comply with food safety or other laws

and regulations may disrupt B&G Foods’ supply of raw materials

or certain finished goods products or injure B&G Foods’

reputation. The forward-looking statements contained herein are

also subject generally to other risks and uncertainties that are

described from time to time in B&G Foods’ filings with the

Securities and Exchange Commission, including under Item 1A, “Risk

Factors” in B&G Foods’ most recent Annual Report on Form 10-K

and in its subsequent reports on Forms 10-Q and 8-K. Investors are

cautioned not to place undue reliance on any such forward-looking

statements, which speak only as of the date they are made. B&G

Foods undertakes no obligation to publicly update or revise any

forward-looking statement, whether as a result of new information,

future events or otherwise.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240908770680/en/

Investor Relations: ICR, Inc. Anna Kate Heller

bgfoodsIR@icrinc.com

Media Relations: ICR, Inc. Matt Lindberg 203.682.8214

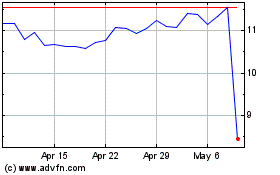

B and G Foods (NYSE:BGS)

Historical Stock Chart

From Oct 2024 to Nov 2024

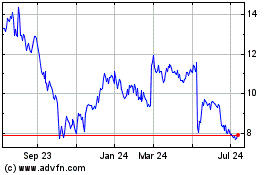

B and G Foods (NYSE:BGS)

Historical Stock Chart

From Nov 2023 to Nov 2024