0000008947false00000089472025-01-162025-01-16

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

January 16, 2025

Date of Report (Date of earliest event reported)

AZZ Inc.

(Exact name of Registrant as specified in its charter)

| | | | | | | | | | | | | | |

| Texas | | 1-12777 | | 75-0948250 |

(State or other jurisdiction of incorporation) | | (Commission File Number) | | (I.R.S. Employer Identification No.) |

One Museum Place, Suite 500

3100 West 7th Street

Fort Worth, Texas 76107

(Address of principal executive offices) (Zip Code)

(817) 810-0095

(Registrant’s telephone number, including area code)

Not applicable

(Former name or former address, if changed since last report.)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| | | | | |

| ☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | | | | | | | |

| Title of each class | | Trading Symbol | | Name of each exchange on which registered |

| Common Stock | | AZZ | | New York Stock Exchange |

Indicate by check mark whether the Registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter). Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

| | | | | |

Item 5.02 | Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers. |

On January 16, 2025, the Board of Directors (the “Board”) of AZZ Inc. (the “Company”) appointed Jeff Vellines, 50, as President and Chief Operating Officer of the Company's Precoat Metals business segment to be effective as of March 1, 2025 (the “Effective Date”). Mr. Vellines has served as President — Precoat Metals of the Company since March 2024 and previously served as Senior Vice President, Commercial Operations — Precoat Metals from November 2021 to March 2024. Prior to joining the Company, Mr. Vellines served as Vice President, Sales — Precoat Metals, formerly a division of Sequa Corporation. He holds a B.A. in Communications from the University of Illinois, and a M.B.A. from Northwestern's Kellogg School of Management.

In his position as President and Chief Operating Officer of Precoat Metals, beginning on the Effective Date the Company will pay Mr. Vellines an annual base salary of $435,000 for fiscal year 2026. For fiscal year 2026, he will have the opportunity to earn an annual cash incentive award under the Company’s Senior Management Bonus Plan (the “STI Plan”), with a target amount of 70% of his annual base salary upon the achievement of certain individual and Company performance metrics. Mr. Vellines will also receive fiscal year 2026 annual equity target awards based upon 100% of his annual base salary, consisting of: (i) 50% performance share units ("PSUs") that vest and are settled at the end of a three-year performance cycle based upon the achievement of pre-determined performance metrics relative to the Company's industry peer performance, and (ii) 50% restricted stock units ("RSUs") that vest one-third each year, subject to continued employment, both of which will be issued under the Company's 2023 Long-Term Incentive Plan (the "2023 LTI Plan").

| | | | | | | | | | | | | | |

Name | Position | FY2026 Base Salary | FY2026 STI Plan Target Value | FY2026 2023 LTI Plan Target Value |

| | | | |

Jeff Vellines | President and Chief Operating Officer – Precoat Metals | $435,000 | $304,500 | $435,000 |

Mr. Vellines will continue to participate in the Company's health and welfare benefit plans that are applicable to other employees. In addition, he is eligible to participate in the AZZ Inc. Executive Officer Severance Plan (the “Executive Severance Plan”) and receive benefits in the event his employment is terminated by the Company without Cause, by him for Good Reason or in the event of a Change in Control (each term as defined in the Executive Severance Plan). The Executive Severance Plan provides for severance payments which may include a maximum payment of: (i) 200% of the total of his annual base salary and target cash bonus, (ii) accrued paid time off through the date of termination, (iii) a pro-rated annual cash bonus at target for the number of days of employment in the fiscal year of termination, (iv) full vesting of all outstanding time-based equity awards, and (v) COBRA continuation coverage for 24 months, based upon the reason for termination. In the event of a termination, the receipt of severance payments is conditioned upon the execution of a general release in a form approved by the Company.

There are no arrangements or understandings between Mr. Vellines and any other person pursuant to which he was appointed as an officer. He does not have any family relationship with any director or other executive officer of the Company, and there are no transactions directly or indirectly in which Mr. Vellines has an interest requiring disclosure under Item 404(a) of Regulation S-K under the Securities Exchange Act of 1934.

Consistent with the Company’s succession planning and executing on its strategic growth plan, and in conjunction with Mr. Vellines appointment to his new role, Kurt Russell, who currently serves as the Company’s Chief Operating Officer of the Precoat Metals business segment, will as of the same Effective Date, transition to the role of Senior Vice President and Chief Strategic Officer, where he will focus on several of the Company’s strategic growth initiatives.

| | | | | |

| Item 7.01 | Regulation FD Disclosure. |

On January 23, 2025, the Company issued a press release announcing these changes in executive leadership, a copy of which is furnished as Exhibit 99.1 hereto. Such press release shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended, or otherwise subject to liability of that Section unless the Company specifically incorporates it by reference in a document filed under the Securities Act of 1933, as amended, or the Securities Exchange Act of 1934, as amended.

| | | | | |

| Item 9.01 | Financial Statements and Exhibits. |

(d) Exhibits.

The following exhibit is filed as part of this report.

| | | | | |

| Exhibit | Description |

| 99.1 | |

104 | Cover Page Interactive Date File (embedded with the Inline XBRL document). |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | |

| AZZ Inc. |

| Date: January 23, 2025 |

By: /s/ Tara D. Mackey |

| Tara D. Mackey

Chief Legal Officer and Secretary |

AZZ Inc. Appoints Jeff Vellines as President and Chief Operating Officer and Kurt Russell as

Senior Vice President and Chief Strategic Officer

January 23, 2025 - FORT WORTH, TX - AZZ Inc. (NYSE: AZZ), the leading independent provider of hot-dip galvanizing and coil coating solutions in North America, announced today that effective March 1, 2025, Mr. Jeff Vellines will serve as President and Chief Operating Officer of the Precoat Metals business segment. Mr. Kurt Russell, AZZ’s former President and Chief Operating Officer of the Precoat Metals business segment will transition into Senior Vice President and Chief Strategic Officer, where he will focus on several growth initiatives for the Company.

Mr. Vellines joined Precoat Metals in 2011 as Director of Strategic Planning where his primary focus was the integration of Roll Coater which had been acquired by Precoat. He was later promoted to the position of Vice President of Sales in 2013, and again in 2021, when he assumed responsibility for all Commercial Operations at Precoat as Senior Vice President. Most recently Jeff was appointed as President of AZZ Precoat Metals in the first quarter of 2024. Prior to joining Precoat, Jeff held a number of leadership roles at both Roll Coater and Material Sciences Corporation. He has a B.A. in Communications from the University of Illinois, and a M.B.A. from Northwestern’s Kellogg School of Management.

Tom Ferguson, Chief Executive Officer of AZZ, said “We are excited to have Kurt Russell, with his tremendous experience in the metal coatings industry and successful track record leading AZZ Precoat Metals, move into the newly created Chief Strategic Officer role to support our stated objective to grow more aggressively in the coatings space. Jeff Vellines role is being expanded to include Kurt’s current duties as Chief Operating Officer of AZZ Precoat Metals. Both promotions are a testament to our leadership bench strength, commitment to developing great talent, and emphasis on executing our strategic plans.”

About AZZ Inc.

Certain statements herein about our expectations of future events or results constitute forward-looking statements for purposes of the safe harbor provisions of The Private Securities Litigation Reform Act of 1995. You can identify forward-looking statements by terminology such as "may," "could," "should," "expects," "plans," "will," "might," "would," "projects," "currently," "intends," "outlook," "forecasts," "targets," "anticipates," "believes," "estimates," "predicts," "potential," "continue," or the negative of these terms or other comparable terminology. Such forward-looking statements are based on currently available competitive, financial, and economic data and management’s views and assumptions regarding future events. Such forward-looking statements are inherently uncertain, and investors must recognize that actual results may differ from those expressed or implied in the forward-looking statements. Forward-looking statements speak only as of the date they are made and are subject to risks that could

cause them to differ materially from actual results. Certain factors could affect the outcome of the matters described herein. This press release may contain forward-looking statements that involve risks and uncertainties including, but not limited to, changes in customer demand for our products and services, including demand by the construction markets, the industrial markets, and the metal coatings markets. We could also experience additional increases in labor costs, components and raw materials including zinc and natural gas, which are used in our hot-dip galvanizing process; supply-chain vendor delays; customer requested delays of our products or services; delays in additional acquisition opportunities; an increase in our debt leverage and/or interest rates on our debt, of which a significant portion is tied to variable interest rates; availability of experienced management and employees to implement AZZ’s growth strategy; a downturn in market conditions in any industry relating to the products we inventory or sell or the services that we provide; economic volatility, including a prolonged economic downturn or macroeconomic conditions such as inflation or changes in the political stability in the United States and other foreign markets in which we operate; acts of war or terrorism inside the United States or abroad; and other changes in economic and financial conditions. AZZ has provided additional information regarding risks associated with the business, including in Part I, Item 1A. Risk Factors, in AZZ's Annual Report on Form 10-K for the fiscal year ended February 29, 2024, and other filings with the SEC, available for viewing on AZZ's website at www.azz.com and on the SEC's website at www.sec.gov. You are urged to consider these factors carefully when evaluating the forward-looking statements herein and are cautioned not to place undue reliance on such forward-looking statements, which are qualified in their entirety by this cautionary statement. These statements are based on information as of the date hereof and AZZ assumes no obligation to update any forward-looking statements, whether as a result of new information, future events, or otherwise.

Investor Relations and Company Contact:

David Nark, Senior Vice President of Marketing, Communications, and Investor Relations

AZZ Inc.

(817) 810-0095

www.azz.com

Investor Contact:

Sandy Martin / Phillip Kupper

Three Part Advisors

(214) 616-2207

www.threepa.com

v3.24.4

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

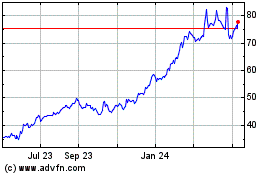

AZZ (NYSE:AZZ)

Historical Stock Chart

From Dec 2024 to Jan 2025

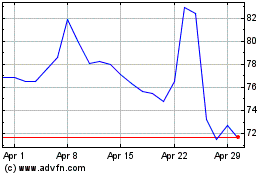

AZZ (NYSE:AZZ)

Historical Stock Chart

From Jan 2024 to Jan 2025