Atmos Energy Announces Sale of Atmos Energy Marketing

October 31 2016 - 5:01PM

Business Wire

- Atmos Energy to sell its nonregulated

gas marketing business to a subsidiary of CenterPoint Energy

- Transaction expected to close in the

first calendar quarter of 2017, subject to customary approvals

- No impact on earnings per share growth

of six to eight percent through fiscal 2020

Atmos Energy Corporation (NYSE: ATO) today announced that Atmos

Energy Holdings, Inc., a wholly-owned subsidiary has executed a

definitive agreement to sell all of the equity interest in Atmos

Energy Marketing, LLC (AEM) to CenterPoint Energy Services, Inc.,

an indirect wholly-owned subsidiary of CenterPoint Energy, Inc.

(NYSE: CNP). The transaction will include the transfer of

approximately 800 delivered gas customers and AEM’s related asset

optimization business at an all cash price of $40.0 million plus

working capital at the date of closing. No material gain or loss is

currently anticipated in connection with the closing of this

transaction.

“We are pleased to have found a strategic buyer for our

nonregulated delivered gas business, Atmos Energy Marketing, in

CenterPoint Energy,” said Kim Cocklin, Chief Executive Officer of

Atmos Energy Corporation. “CenterPoint brings substantial scale and

diversity, with a sharp focus on superior customer service and

excellent employee relations.”

“Given our company’s long-term vision to become the nation’s

safest regulated natural gas utility and to further our strategy to

grow organically by investing in our regulated infrastructure, now

is the perfect time to move forward with this sale,” said Mike

Haefner, President and Chief Operating Officer of Atmos Energy

Corporation. “This transaction results in Atmos Energy becoming a

fully regulated pure-play natural gas company. Finally, it is

important to note that the sale of this business will not reduce

our ability and commitment to deliver earnings per diluted share

growth in the six to eight percent range through fiscal 2020.”

The sale is expected to close in the first calendar quarter of

2017. The proceeds from this transaction will be redeployed to fund

infrastructure investment in the regulated business. Once the sale

is complete, Atmos Energy will have fully exited the nonregulated

gas marketing business. Atmos Energy will release fiscal 2016

results and give fiscal 2017 earnings guidance after the market

close on November 9, 2016.

Forward-Looking Statements

The matters discussed in this news release may contain

“forward-looking statements” within the meaning of Section 27A of

the Securities Act of 1933 and Section 21E of the Securities

Exchange Act of 1934. All statements other than statements of

historical fact included in this news release are forward-looking

statements made in good faith by the company and are intended to

qualify for the safe harbor from liability established by the

Private Securities Litigation Reform Act of 1995. When used in this

news release or in any of the company's other documents or oral

presentations, the words “anticipate,” “believe,” “estimate,”

“expect,” “forecast,” “goal,” “intend,” “objective,” “plan,”

“projection,” “seek,” “strategy” or similar words are intended to

identify forward-looking statements. Such forward-looking

statements are subject to risks and uncertainties that could cause

actual results to differ materially from those discussed in this

news release, including the risks and uncertainties relating to

regulatory trends and decisions, the company's ability to continue

to access the capital markets and the other factors discussed in

the company's reports filed with the Securities and Exchange

Commission. These factors include the risks and uncertainties

discussed in the company's Annual Report on Form 10-K for the

fiscal year ended September 30, 2015 and in the company's

Quarterly Report on Form 10-Q for the three and nine months ended

June 30, 2016. Although the company believes these

forward-looking statements to be reasonable, there can be no

assurance that they will approximate actual experience or that the

expectations derived from them will be realized. The company

undertakes no obligation to update or revise forward-looking

statements, whether as a result of new information, future events

or otherwise.

About Atmos Energy

Atmos Energy Corporation, headquartered in Dallas, is the

country's largest natural-gas-only distributor, serving over three

million natural gas distribution customers in over 1,400

communities in eight states from the Blue Ridge Mountains in the

East to the Rocky Mountains in the West. Atmos Energy also manages

company-owned natural gas pipeline and storage assets, including

one of the largest intrastate natural gas pipeline systems in Texas

and currently provides natural gas marketing and procurement

services to industrial, commercial and municipal customers

primarily in the Midwest and Southeast. For more information, visit

www.atmosenergy.com.

View source

version on businesswire.com: http://www.businesswire.com/news/home/20161031006083/en/

Atmos Energy CorporationSusan Giles,

972-855-3729

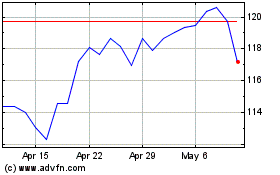

Atmos Energy (NYSE:ATO)

Historical Stock Chart

From Oct 2024 to Nov 2024

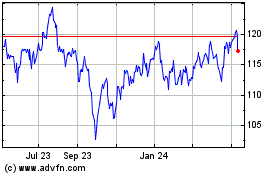

Atmos Energy (NYSE:ATO)

Historical Stock Chart

From Nov 2023 to Nov 2024