Atmos Energy Corporation (NYSE: ATO) today reported consolidated

results for its 2013 fiscal year and fourth quarter ended

September 30, 2013.

- Fiscal 2013 consolidated net income,

excluding net unrealized margins and a gain on sale, was $232.6

million, or $2.53 per diluted share, compared with consolidated net

income of $211.4 million, or $2.31 per diluted share in the prior

year, excluding net unrealized margins and the net positive impact

of several one-time items, including a gain on sale.

- Fiscal 2013 net income includes a net

gain on the sale of the Georgia assets of $5.3 million, or $0.06

per diluted share. Fiscal 2012 net income included a net gain on

the sale of the Missouri, Illinois and Iowa assets of $6.3 million,

or $0.07 per diluted share and the net positive impact of several

one-time items totaling $4.0 million, or $0.04 per diluted

share.

- Fiscal 2013 net income was $243.2

million, or $2.64 per diluted share, after including noncash,

unrealized net gains of $5.3 million, or $0.05 per diluted share

and the gain on sale. Net income was $216.7 million, or $2.37 per

diluted share in the prior year, after including unrealized net

losses of $5.0 million or $(0.05) per diluted share and the net

positive impact of several one-time items, including the gain on

sale.

- Atmos Energy expects fiscal 2014

earnings to be in the range of $2.66 to $2.76 per diluted share,

excluding net unrealized margins.

- The company’s Board of Directors has

declared a quarterly dividend of 37 cents per common share. The

indicated annual dividend for fiscal 2014 is $1.48, which

represents a 5.7 percent increase.

For the quarter ended September 30, 2013, consolidated net

income was $7.5 million, or $0.08 per diluted share, compared with

net income of $8.0 million, or $0.09 per diluted share for the same

quarter last year. Results from nonregulated operations include

noncash, unrealized net losses of $4.1 million, or $(0.05) per

diluted share for the three months ended September 30, 2013,

compared with net losses of $12.4 million, or $(0.14) per diluted

share for the prior-year quarter. The prior year fourth quarter net

income includes the aforementioned gain on the sale of Missouri,

Illinois and Iowa assets totaling $6.3 million, or $0.07 per

diluted share and the net positive impact of several one-time items

totaling $4.0 million or $0.04 per diluted share.

"Our fiscal 2013 financial performance reflects the significant

capital invested in our infrastructure, coupled with rate design

outcomes that further stabilized margins," said Kim Cocklin,

president and chief executive officer of Atmos Energy Corporation.

"The financial strength of the company allows us to continue to

invest in improving the safety and reliability of our system, while

providing a return to stakeholders. Looking forward, we are

positioned to continue delivering annual earnings per share growth

in the six to eight percent range," Cocklin concluded.

Results for the Fiscal Year Ended

September 30, 2013

Natural gas distribution gross profit, excluding discontinued

operations, increased $58.5 million to $1,081.2 million for the

year ended September 30, 2013, compared with $1,022.7 million

in the prior-year period. This increase is due largely to a $41.8

million net increase in rates from regulatory outcomes across all

jurisdictions. Additionally, gross profit increased $7.5 million

due to colder weather in the Mississippi, Kentucky/Mid-States and

Colorado-Kansas Divisions.

Regulated transmission and storage gross profit increased $21.5

million to $268.9 million for the year ended September 30,

2013, compared with $247.4 million in the prior fiscal year. This

increase is primarily a result of increased revenue from the Gas

Reliability Infrastructure Program (GRIP) filings that became

effective in May 2013 and April 2012.

Nonregulated gross profit increased $8.2 million to $63.3

million for the year ended September 30, 2013, compared with

$55.1 million for the prior-year period. Realized margins decreased

$8.8 million primarily from a decrease in gas delivery and other

services margins, largely due to a two percent decrease in

consolidated sales volumes attributable to reduced industrial and

power generation volumes, combined with a $0.02/Mcf decrease in

per-unit margins. Additionally, unrealized margins increased $17.0

million.

Consolidated operation and maintenance expense, excluding

discontinued operations, for the year ended September 30,

2013, was $488.0 million, compared with $453.6 million for the

prior year. The $34.4 million increase resulted primarily from

higher line locate and pipeline right of way activities of $19.1

million and a $13.3 million increase in employee-related costs.

Results for fiscal 2012 included a $5.3 million noncash charge

to impair the remaining investment in the Kentucky natural gas

gathering assets recorded in the fourth quarter.

Miscellaneous expense was $0.2 million for the year ended

September 30, 2013, compared to miscellaneous expense of $14.6

million for the prior year. The $14.4 million year-over-year change

resulted primarily from the absence in the current year of a $10.0

million one-time cash donation made to a donor-advised fund in the

prior-year fourth quarter. Additionally, the current year reflects

a $3.9 million increase in performance based rates earned primarily

in the Tennessee and Mississippi service areas.

Interest charges for the year ended September 30, 2013 were

$128.4 million, compared with $141.2 million in the prior year. The

$12.8 million year-over-year decrease resulted primarily from

interest deferrals related to Texas infrastructure spending during

the current year.

Results for fiscal 2012 included a tax benefit of $13.6 million.

During the fiscal 2012 fourth quarter, the company reduced the tax

rate at which deferred taxes were expected to be settled in future

periods as a result of the sale of the Missouri, Illinois and Iowa

assets.

The debt capitalization ratio at September 30, 2013 was

52.2 percent, compared with 51.7 percent at September 30,

2012. At September 30, 2013, there was $368.0 million of

short-term debt outstanding, compared with $570.9 million at

September 30, 2012. The decrease in short-term debt in fiscal

2013 was due to the early redemption of the company's 5.125% $250

million senior notes with short-term debt in the fourth quarter of

fiscal 2012.

For the year ended September 30, 2013, the company

generated operating cash flow of $613.1 million, a $26.2 million

increase compared with the year ended September 30, 2012. The

year-over-year increase reflects changes in working capital, offset

by a $10.5 million decrease in contributions made to the pension

and postretirement plans in the current year.

Capital expenditures increased to $845.0 million for the year

ended September 30, 2013, compared with $732.9 million in the

prior year. The $112.1 million increase primarily reflects

increased infrastructure spending across all divisions, Line W and

Line WX pipeline expansion projects and increased cathodic

protection spending in the regulated transmission and storage

segment.

Results for the 2013 Fiscal Fourth Quarter

Ended September 30, 2013

Natural gas distribution gross profit, excluding discontinued

operations, increased $43.3 million to $215.1 million for the

fiscal 2013 fourth quarter, compared with $171.8 million in the

prior-year quarter. As expected, this increase primarily reflects

an increase in margins due to rate design changes implemented in

the recent Mid-Tex and West Texas Divisions’ rate cases, which

resulted in an increase to the customer’s base charge and decrease

to the consumption charge. These rate design changes shifted

margins from the first and second fiscal quarters into the third

and fourth fiscal quarters.

Regulated transmission and storage gross profit increased $6.8

million to $72.3 million for the quarter ended September 30,

2013, compared with $65.5 million for the same quarter last year.

This increase is primarily the result of a $6.8 million increase

related to GRIP filings that became effective in May 2013.

Nonregulated gross profit increased $0.8 million to $13.3

million for the fourth quarter of fiscal 2013, compared with $12.5

million for the prior-year quarter. Realized margins from gas

delivery and other services decreased $3.0 million, primarily due

to a four percent decrease in consolidated sales volumes combined

with a $0.03/Mcf decrease in per-unit margins. Gross profit also

decreased $9.1 million quarter-over-quarter primarily due to the

timing and magnitude of gains realized on the settlement of

financial positions in the prior-year quarter. Finally, unrealized

margins increased $12.9 million quarter over quarter.

Consolidated operation and maintenance expense, excluding

discontinued operations for the three months ended

September 30, 2013, was $149.1 million, compared with $123.6

million for the prior-year quarter. The $25.5 million

quarter-over-quarter increase resulted primarily from a $12.0

million increase in employee-related costs and higher line locate

and pipeline right of way activities of $9.4 million.

Results for the quarter ended September 30, 2012, included the

one-time items previously discussed which resulted in a total net

of tax gain of $10.3 million.

Outlook

The leadership of Atmos Energy remains focused on enhancing

system safety and reliability through infrastructure investment

while delivering shareholder value and consistent earnings growth.

Atmos Energy expects fiscal 2014 earnings to be in the range of

$2.66 to $2.76 per diluted share, excluding unrealized margins. Net

income from regulated operations is expected to be in the range of

$237 million to $247 million, while net income from nonregulated

operations is expected to be in the range of $9 million to $11

million. Capital expenditures for fiscal 2014 are expected to range

between $830 million to $850 million.

Conference Call to be Webcast November 7,

2013

Atmos Energy will host a conference call with financial analysts

to discuss the fiscal 2013 financial results and outline the

assumptions supporting the fiscal 2014 guidance on Thursday,

November 7, 2013, at 10 a.m. Eastern Time. The telephone number is

877-485-3107. The conference call will be webcast live on the Atmos

Energy website at www.atmosenergy.com.

A playback of the call will be available on the website later that

day. Kim Cocklin, president and chief executive officer, and Bret

Eckert, senior vice president and chief financial officer, will

participate in the conference call.

Highlights and Recent Developments

Standard & Poor's Upgrade

On October 8, 2013, Standard & Poor's Corporation raised

Atmos Energy's senior unsecured debt rating to A- from BBB+, with a

ratings outlook of stable, citing an improved business risk profile

from an increasing contribution of earnings from regulated

operations and focusing nonregulated operations on its core

delivered gas business.

This news release should be read in conjunction with the

attached unaudited financial information.

Forward-Looking Statements

The matters discussed in this news release may contain

“forward-looking statements” within the meaning of Section 27A of

the Securities Act of 1933 and Section 21E of the Securities

Exchange Act of 1934. All statements other than statements of

historical fact included in this news release are forward-looking

statements made in good faith by the company and are intended to

qualify for the safe harbor from liability established by the

Private Securities Litigation Reform Act of 1995. When used in this

news release or in any of the company's other documents or oral

presentations, the words “anticipate,” “believe,” “estimate,”

“expect,” “forecast,” “goal,” “intend,” “objective,” “plan,”

“projection,” “seek,” “strategy” or similar words are intended to

identify forward-looking statements. Such forward-looking

statements are subject to risks and uncertainties that could cause

actual results to differ materially from those discussed in this

news release, including the risks and uncertainties relating to

regulatory trends and decisions, the company's ability to continue

to access the capital markets and the other factors discussed in

the company's reports filed with the Securities and Exchange

Commission. These factors include the risks and uncertainties

discussed in the company's Annual Report on Form 10-K for the

fiscal year ended September 30, 2012 and in the company's

Quarterly Report on Form 10-Q for the three and nine months ended

June 30, 2013. Although the company believes these forward-looking

statements to be reasonable, there can be no assurance that they

will approximate actual experience or that the expectations derived

from them will be realized. The company undertakes no obligation to

update or revise forward-looking statements, whether as a result of

new information, future events or otherwise.

About Atmos Energy

Atmos Energy Corporation, headquartered in Dallas, is one of the

country's largest natural-gas-only distributors, serving over three

million natural gas distribution customers in over 1,400

communities in eight states from the Blue Ridge Mountains in the

East to the Rocky Mountains in the West. Atmos Energy also manages

company-owned natural gas pipeline and storage assets, including

once of the largest intrastate natural gas pipeline systems in

Texas and provides natural gas marketing and procurement services

to industrial, commercial and municipal customers primarily in the

Midwest and Southeast. For more information, visit www.atmosenergy.com.

Atmos Energy Corporation

Financial Highlights

(Unaudited)

Statements of

Income

Year EndedSeptember 30

Percentage (000s except per share) 2013

2012 Change Gross Profit: Natural gas

distribution segment $ 1,081,236 $ 1,022,743 6 % Regulated

transmission and storage segment 268,900 247,351 9 % Nonregulated

segment 63,331 55,124 15 % Intersegment eliminations (1,417

) (1,479 ) 4 % Gross profit 1,412,050 1,323,739 7 %

Operation and maintenance expense 488,020 453,613 8 % Depreciation

and amortization 235,079 237,525 (1 )% Taxes, other than income

187,072 181,073 3 % Asset impairment — 5,288

(100 )% Total operating expenses 910,171 877,499 4 %

Operating income 501,879 446,240 12 % Miscellaneous expense (197 )

(14,644 ) 99 % Interest charges 128,385

141,174 (9 )% Income from continuing operations before

income taxes 373,297 290,422 29 % Income tax expense 142,599

98,226 45 % Income from continuing operations

230,698 192,196 20 % Income from discontinued operations, net of

tax 7,202 18,172 (60 )% Gain on sale of discontinued operations,

net of tax 5,294 6,349 (17 )% Net

income $ 243,194 $ 216,717 12 % Basic earnings per

share Income per share from continuing operations $ 2.54 $ 2.12

Income per share from discontinued operations 0.14

0.27 Net income per share — basic $ 2.68 $

2.39 Diluted earnings per share Income per share from

continuing operations $ 2.50 $ 2.10 Income per share from

discontinued operations 0.14 0.27 Net

income per share — diluted $ 2.64 $ 2.37 Cash

dividends per share $ 1.40 $ 1.38 Weighted average shares

outstanding: Basic 90,533 90,150 Diluted 91,711 91,172

Year EndedSeptember 30

Percentage

Summary Net Income

(Loss) by Segment (000s)

2013 2012 Change Natural gas

distribution – continuing operations $ 150,856 $ 123,848 22 %

Natural gas distribution – discontinued operations 12,851 24,521

(48 )% Regulated transmission and storage 68,260 63,059 8 %

Nonregulated – continuing operations 6,252 10,276 (39 )%

Nonregulated – discontinued operations (355 ) — (100 )% Unrealized

margins, net of tax 5,330 (4,987 ) 207 %

Consolidated net income $ 243,194 $ 216,717 12 %

Atmos Energy Corporation

Financial Highlights, continued

(Unaudited)

Statements of

Income

Three Months EndedSeptember 30

Percentage (000s except per share) 2013

2012 Change Gross Profit: Natural gas

distribution segment $ 215,104 $ 171,761 25 % Regulated

transmission and storage segment 72,330 65,482 10 % Nonregulated

segment 13,305 12,527 6 % Intersegment eliminations (299 )

(381 ) 22 % Gross profit 300,440 249,389 20 % Operation and

maintenance expense 149,149 123,624 21 % Depreciation and

amortization 60,191 60,783 (1 )% Taxes, other than income 40,717

36,903 10 % Asset impairment — 5,288

(100 )% Total operating expenses 250,057 226,598 10 % Operating

income 50,383 22,791 121 % Miscellaneous expense (2,140 ) (11,059 )

81 % Interest charges 31,791 33,896 (6

)% Income (loss) from continuing operations before income taxes

16,452 (22,164 ) 174 % Income tax expense (benefit) 8,916

(21,878 ) 141 % Income (loss) from continuing

operations 7,536 (286 ) 2,735 % Income from discontinued

operations, net of tax — 1,904 (100 )% Gain on sale of discontinued

operations, net of tax — 6,349 (100 )%

Net income $ 7,536 $ 7,967 (5 )% Basic earnings per

share Income (loss) per share from continuing operations $ 0.08 $ —

Income per share from discontinued operations —

0.09 Net income per share — basic $ 0.08 $

0.09 Diluted earnings per share Income (loss) per share from

continuing operations $ 0.08 $ — Income per share from discontinued

operations — 0.09 Net income per share

— diluted $ 0.08 $ 0.09 Cash dividends per share $

0.350 $ 0.345 Weighted average shares outstanding: Basic 90,640

90,207 Diluted 91,818 91,224

Three Months EndedSeptember 30

Percentage

Summary Net Income

(Loss) by Segment (000s)

2013 2012 Change Natural gas

distribution – continuing operations $ (4,244 ) $ (10,221 ) 58 %

Natural gas distribution – discontinued operations — 8,253 (100 )%

Regulated transmission and storage 12,528 14,881 (16 )%

Nonregulated 3,401 7,419 (54 )% Unrealized margins, net of tax

(4,149 ) (12,365 ) 66 % Consolidated net income $

7,536 $ 7,967 (5 )%

Atmos Energy

Corporation

Financial Highlights, continued

(Unaudited)

Discontinued

Operations

Three Months EndedSeptember 30

Year EndedSeptember 30

(000s) 2013 2012 2013 2012 Operating revenues $ — $

11,596 $ 37,962 $ 114,703 Purchased gas cost — 4,966

21,464 62,902 Gross profit — 6,630 16,498 51,801

Operating expenses — 4,105 5,858 24,174

Operating income — 2,525 10,640 27,627 Other nonoperating income

— 106 548 611 Income from discontinued

operations before income taxes — 2,631 11,188 28,238 Income tax

expense — 727 3,986 10,066 Income from

discontinued operations — 1,904 7,202 18,172 Gain on sale of

discontinued operations, net of tax — 6,349

5,294 6,349 Net income from discontinued operations $ — $

8,253 $ 12,496 $ 24,521

Atmos Energy

Corporation

Financial Highlights, continued

(Unaudited)

Condensed Balance

Sheets

September 30, September 30, (000s) 2013

2012 Net property, plant and equipment $ 6,030,655 $ 5,475,604 Cash

and cash equivalents 66,199 64,239 Accounts receivable, net 301,992

234,526 Gas stored underground 244,741 256,415 Other current assets

70,334 272,782 Total current assets 683,266 827,962

Goodwill and intangible assets 741,484 740,847 Deferred charges and

other assets 484,996 451,262 $ 7,940,401 $ 7,495,675

Shareholders' equity $ 2,580,409 $ 2,359,243 Long-term debt

2,455,671 1,956,305 Total capitalization 5,036,080

4,315,548 Accounts payable and accrued liabilities 241,611 215,229

Other current liabilities 368,891 489,665 Short-term debt 367,984

570,929 Current maturities of long-term debt — 131

Total current liabilities 978,486 1,275,954 Deferred income taxes

1,164,053 1,015,083 Deferred credits and other liabilities

761,782 889,090 $ 7,940,401 $ 7,495,675

Atmos Energy Corporation

Financial Highlights, continued

(Unaudited)

Condensed Statements

of Cash Flows

Year EndedSeptember 30

(000s) 2013 2012

Cash

flows from operating activities Net income $ 243,194 $ 216,717

Asset impairment — 5,288 Gain on sale of discontinued operations

(8,203 ) (9,868 ) Depreciation and amortization 237,607 246,577

Deferred income taxes 141,336 104,319 Other 23,407 26,876 Changes

in assets and liabilities (24,214 ) (2,992 ) Net cash

provided by operating activities 613,127 586,917

Cash flows from

investing activities Capital expenditures (845,033 ) (732,858 )

Proceeds from the sale of discontinued operations 153,023 128,223

Other, net (4,904 ) (4,625 ) Net cash used in

investing activities (696,914 ) (609,260 )

Cash flows from

financing activities Net increase (decrease) in short-term debt

(208,070 ) 354,141 Net proceeds from issuance of long-term debt

493,793 — Settlement of Treasury lock agreements (66,626 ) —

Repayment of long-term debt (131 ) (257,034 ) Cash dividends paid

(128,115 ) (125,796 ) Repurchase of common stock — (12,535 )

Repurchase of equity awards (5,150 ) (5,219 ) Issuance of common

stock 46 1,606 Net cash provided by

(used in) financing activities 85,747 (44,837

) Net increase (decrease) in cash and cash equivalents 1,960

(67,180 ) Cash and cash equivalents at beginning of period

64,239 131,419 Cash and cash equivalents at

end of period $ 66,199 $ 64,239

Three Months EndedSeptember 30

Year EndedSeptember 30

Statistics,

including discontinued operations

2013 2012 2013 2012 Consolidated

natural gas distribution throughput (MMcf as metered) 51,632 58,641

397,037 390,983 Consolidated regulated transmission and storage

transportation volumes (MMcf) 132,142 133,186 467,178 466,527

Consolidated nonregulated delivered gas sales volumes (MMcf) 77,878

81,256 343,669 351,628 Natural gas distribution meters in service

3,011,980 3,116,589 3,011,980 3,116,589 Natural gas distribution

average cost of gas $ 5.36 $ 4.13 $ 4.91 $ 4.64 Nonregulated net

physical position (Bcf) 12.0 18.8 12.0 18.8

Atmos Energy CorporationSusan Giles,

972-855-3729

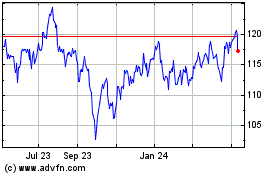

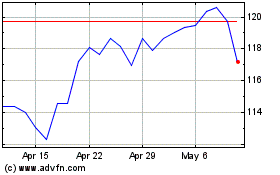

Atmos Energy (NYSE:ATO)

Historical Stock Chart

From Feb 2025 to Mar 2025

Atmos Energy (NYSE:ATO)

Historical Stock Chart

From Mar 2024 to Mar 2025