Ashland Inc. (NYSE: ASH) today announced financial results1 for the

first quarter of fiscal year 2025, which ended December 31, 2024,

and issued its full-year fiscal 2025 outlook. Ashland, a global

additives and specialty ingredients company, holds leadership

positions in high-quality, consumer-focused markets including

pharmaceuticals, personal care and architectural coatings.

"Since announcing the sale agreement for our

Avoca business, we are nearing the final stages of our portfolio

optimization activities. The last stage will be to fully implement

our $30 million cost reduction plan to offset the stranded costs

and gross profit loss from the sale of the nutraceutical business,”

said Guillermo Novo, chair and chief executive officer of Ashland.

“Ashland continues to demonstrate strategic progress and operating

discipline amid softer market conditions, generally consistent with

the first-quarter update shared at our strategy day event in

December. Organic sales volumes declined by one percent, primarily

due to lower demand in Europe and inventory control actions by our

pharmaceutical customers. This decline was mostly offset by

improved sales volumes in Personal Care, Specialty Additives, and

Intermediates. Pricing impacts moderated in the quarter,

reflecting our team’s disciplined approach to a stable raw material

environment."

“Given the significant uncertainty surrounding

trade policy under the incoming U.S. administration, we moved major

annual maintenance turnarounds to the first quarter. This builds

greater resilience to respond to potential trade and economic

changes. While this action shifted planned expenses forward, it

significantly enhanced our operational flexibility to navigate

uncertain markets. With our Portfolio Optimization behind us, our

top priority is to advance our strategy through execution

discipline, globalizing four high-quality business lines and

advancing the commercialization of our new technology platforms. In

the near term, our focus remains on delivering and accelerating

cost savings and enhancing productivity initiatives.”

Sales in the first quarter were $405 million,

versus $473 million in the prior-year quarter. Portfolio

Optimization reduced overall sales by approximately $50 million or

11 percent during the first quarter as certain lower margin

products were curtailed or divested. Excluding Portfolio

Optimization, sales declined three percent versus prior-year

quarter. Lower sales volumes within Life Sciences were mostly

offset by organic sales volume improvement within the Personal

Care, Specialty Additives and Intermediates segments. Overall

pricing was down two percent versus the prior year, primarily

within the Intermediates and Life Science segments. Foreign

currency unfavorably impacted sales by $1 million.

Net loss was $165 million, down from net income

of $26 million in the prior-year quarter. Loss from continuing

operations was $166 million, down from income of $28 million in the

prior-year quarter, or a loss of $3.51 per diluted share, down from

income of $0.54. Adjusted income from continuing operations

excluding intangibles amortization expense was $14 million, down

from $23 million in the prior-year quarter, or $0.28 per diluted

share, down from $0.45. Adjusted EBITDA was $61 million, down 13

percent from $70 million in the prior-year quarter, primarily

driven by Portfolio Optimization, reduced pricing, and increased

selling, administrative, research and development (SARD) expenses,

primarily related to the reset of variable compensation expenses.

This was partially offset with a production volume recovery versus

inventory corrective actions in the prior year. Excluding Portfolio

Optimization, Adjusted EBITDA declined two percent versus

prior-year quarter.

Average diluted shares outstanding totaled 48

million in the first quarter, down from 51 million in the

prior-year quarter following the company’s share repurchase

activities over the past 12 months.

Cash flows used by operating activities totaled

$30 million, compared to cash flows provided by operating

activities of $201 million in the prior-year quarter. Ongoing free

cash flow2 totaled negative $26 million compared to $66 million in

the prior-year quarter as inventory corrective actions and lower

variable compensation payouts favorably impacted the prior

year.

Reportable Segment

PerformanceTo aid in the understanding of Ashland’s

ongoing business performance, the results of Ashland’s reportable

segments are described below on an adjusted basis. In addition,

EBITDA and Adjusted EBITDA are reconciled to operating income in

Table 4. Free cash flow, ongoing free cash flow and Adjusted

operating income are reconciled in Table 6 and Adjusted income from

continuing operations, Adjusted diluted earnings per share and

Adjusted diluted earnings per share excluding intangible

amortization expense are reconciled in Table 7 of this news

release. These adjusted results are considered non-GAAP financial

measures. For a full description of the non-GAAP financial

measures used, see the “Use of Non-GAAP Measures” section that

further describes these adjustments below.

Life SciencesFirst quarter Life

Sciences sales declined 33 percent year-over-year to $134 million,

primarily due to the combined effects of Portfolio Optimization and

reduced pharma sales volumes. Portfolio Optimization primarily

includes divesting the Nutraceuticals segment and exiting

low-margin nutrition business, reducing year-over-year sales by

approximately $41 million or 21 percent. Excluding Portfolio

Optimization, sales were down 12 percent year-over-year driven

primarily by lower pharma sales. Reduced pharma sales primarily

represent the softening of market demand and customer inventory

control actions, particularly in Europe, the Middle East and Africa

(EMEA) and lower pricing from reductions implemented in fiscal year

2024. Despite a softer market, globalization business lines,

injectables and oral solid dosage film coatings, continued to

deliver double-digit sales growth. Foreign currency had a $1

million unfavorable impact on sales when compared to the prior-year

quarter.

Adjusted operating income was $14 million

compared to $32 million in the prior-year quarter. Adjusted EBITDA

was $28 million, down 42 percent from $48 million in the prior-year

quarter. Lower Adjusted EBITDA primarily reflects Portfolio

Optimization and lower pharma sales on reduced volumes and

carry-over pricing. Portfolio Optimization reduced Life Sciences

Adjusted EBITDA by approximately $8 million during the first

quarter. Foreign currency had a negligible impact on Adjusted

EBITDA when compared to the prior-year quarter.

Personal CarePersonal Care

delivered strong performance in the first quarter, with sales

increasing four percent year-over-year to $134 million. Portfolio

Optimization reduced personal care sales by approximately $2

million or two percent during the first quarter. Portfolio

Optimization primarily includes exiting low-margin oral-care

business. Excluding Portfolio Optimization, sales were up six

percent year-over-year. This growth was driven by higher sales

volumes across skin care, hair care, and biofunctionals

end-markets. Bolstered by strength in Asia, demand increased in

most regions, more than offsetting weakness in Europe. Foreign

currency had a negligible impact on sales when compared to the

prior-year quarter.

Adjusted operating income was $12 million

compared to $2 million in the prior-year quarter. Adjusted EBITDA

was $30 million, up 36 percent from $22 million in the prior-year

quarter. Adjusted EBITDA growth primarily reflects the impact of

higher sales and production volumes. Foreign currency had a

negligible impact on Adjusted EBITDA when compared to the

prior-year quarter.

Specialty AdditivesSales were

$115 million, down six percent from the prior-year quarter,

primarily reflecting Portfolio Optimization which reduced Specialty

Additives sales by approximately $7 million or six percent during

the first quarter. Portfolio Optimization primarily includes

exiting low-margin construction business. Excluding Portfolio

Optimization, sales were stable year-over-year. This stability was

achieved despite modestly lower pricing, which was offset by

increased sales volumes. Higher sales volumes in performance

specialties were partially offset by moderately lower coatings,

with notable weakness in China and EMEA. Foreign currency had a

negligible impact on sales when compared to the prior-year

quarter.

Adjusted operating loss was $3 million compared

to a loss of $11 million in the prior-year quarter. Adjusted EBITDA

was $13 million, up 117 percent from $6 million in the prior-year

quarter. Adjusted EBITDA growth primarily reflects the impact of

higher production volumes when compared to last year’s inventory

corrective actions. Foreign currency had a negligible impact on

Adjusted EBITDA when compared to the prior-year quarter.

IntermediatesSales were stable

versus the prior-year quarter at $33 million. This consistent

performance was delivered across both merchant and captive sales.

Merchant sales totaled $22 million, driven by higher sales volumes,

primarily n-methyl-2-pyrrolidone (NMP), which offset a decrease in

overall pricing. Captive internal butanediol (BDO) sales

remained consistent at $11 million and are recognized at

market-based pricing. Foreign currency had a negligible impact on

sales when compared to the prior-year quarter.

Adjusted operating income was $3 million

compared to $7 million in the prior-year quarter. Adjusted EBITDA

was $6 million, down 40 percent from $10 million in the prior-year

quarter, primarily reflecting lower pricing, unfavorable product

mix, partially offset by higher production volumes. Foreign

currency had a negligible impact on Adjusted EBITDA when compared

to the prior-year quarter.

Unallocated &

OtherUnallocated and other expense was $202 million

compared to $27 million in the prior-year quarter, primarily

reflecting a non-cash impairment on the Avoca business. Adjusted

unallocated and other expense EBITDA was $16 million, in-line with

the prior-year quarter.

Financial Outlook

Ashland continues to proactively drive

performance by leveraging growth catalysts, such as expanding

high-performing business lines into new markets and commercializing

new technology platforms, while simultaneously accelerating cost

savings and optimizing its portfolio through the planned sale of

Avoca. This diversified strategy aims to drive growth and

improve business mix while improving cost structure to ultimately

support the company's full-year outlook.

As expected, the first quarter was seasonally

slow. Aside from weaker demand in Europe and the effects of

extended plant shutdowns, Ashland’s performance is generally

aligned with planning assumptions. The company is monitoring a

potential European recovery and trade policy shifts, but has not

observed any market dynamics that would necessitate a revision of

its outlook. Despite uncertainty surrounding potential trade policy

changes, Ashland is well-prepared following the completion of its

annual maintenance turnarounds.

Overall, Ashland continues to expect full fiscal

year sales in the range of $1.90 billion to $2.05 billion and

Adjusted EBITDA in the range of $430 million to $470

million.

"Ashland is taking decisive action to deliver on

our commitments," said Novo. "Our strong financial foundation

allows us to invest strategically in our future while proactively

addressing challenges. By focusing on commercial and operational

excellence, accelerating cost savings, and advancing key growth

initiatives, we are confident in our ability to drive sustainable

growth and create long-term value. We are well-positioned to

deliver on our goals with high-impact, self-help efforts underway.

I look forward to sharing more insight into our plans as well as

our outlook during our earnings call tomorrow morning," Novo

concluded.

Conference Call WebcastThe

company’s live webcast with securities analysts will include an

executive summary and detailed remarks. The live webcast will take

place at 9 a.m. ET on Wednesday, January 29, 2025. Simultaneously,

the company will post a slide presentation in the Investor

Relations section of its website at

http://investor.ashland.com.

To access the call by phone, please go to this

registration link and you will be provided with dial in details. To

avoid delays, we encourage participants to dial into the conference

call fifteen minutes ahead of the scheduled start time.

Following the live event, an archived version of

the webcast and supporting materials will be available for 12

months on http://investor.ashland.com.

Use of Non-GAAP MeasuresAshland

believes that by removing the impact of depreciation and

amortization and excluding certain non-cash charges, amounts spent

on interest and taxes and certain other charges that are highly

variable from year to year, EBITDA, Adjusted EBITDA, EBITDA margin

and Adjusted EBITDA margin provide Ashland’s investors with

performance measures that reflect the impact to operations from

trends in changes in sales, margin and operating expenses,

providing a perspective not immediately apparent from net income,

operating income, net income margin and operating income margin.

The adjustments Ashland makes to derive the non-GAAP measures of

EBITDA, Adjusted EBITDA, EBITDA margin and Adjusted EBITDA margin

exclude items which may cause short-term fluctuations in net income

and operating income and which Ashland does not consider to be the

fundamental attributes or primary drivers of its business. EBITDA,

Adjusted EBITDA, EBITDA margin and Adjusted EBITDA margin provide

disclosure on the same basis as that used by Ashland’s management

to evaluate financial performance on a consolidated and reportable

segment basis and provide consistency in our financial reporting,

facilitate internal and external comparisons of Ashland’s

historical operating performance and its business units, and

provide continuity to investors for comparability purposes. EBITDA

margin and Adjusted EBITDA margin are defined as EBITDA and

Adjusted EBITDA divided by sales for the corresponding period.

Key items, which are set forth on Table 7

of this release, are defined as financial effects from significant

transactions that, either by their nature or amount, have caused

short-term fluctuations in net income and/or operating income which

Ashland does not consider to reflect Ashland’s underlying business

performance and trends most accurately. Further, Ashland believes

that providing supplemental information that excludes the financial

effects of these items in the financial results will enhance the

investor’s ability to compare financial performance between

reporting periods.

Tax-specific key items, which are set forth on

Table 7 of this release, are defined as financial transactions, tax

law changes or other matters that fall within the definition of key

items as described above. These items relate solely to tax matters

and would only be recorded within the income tax caption of the

Statement of Consolidated Income. As with all key items, due to

their nature, Ashland does not consider the financial effects of

these tax-specific key items on net income to be the most accurate

reflection of Ashland’s underlying business performance and

trends.

The free cash flow metrics enable Ashland to

provide a better indication of the ongoing cash being generated

that is ultimately available for both debt and equity holders as

well as other investment opportunities. Unlike cash flow provided

by operating activities, free cash flow and ongoing free cash flow

include the impact of capital expenditures from continuing

operations and other significant items impacting free cash flow,

providing a more complete picture of current and future cash

generation. Free cash flow, ongoing free cash flow, and free cash

flow conversion are non-GAAP liquidity measures that Ashland

believes provide useful information to management and investors

about Ashland’s ability to convert Adjusted EBITDA to ongoing free

cash flow. These liquidity measures are used regularly by Ashland’s

stakeholders and industry peers to measure the efficiency at

providing cash from regular business activity. Free cash flow,

ongoing free cash flow, and free cash flow conversion have certain

limitations, including that they do not reflect adjustments for

certain non-discretionary cash flows such as mandatory debt

repayments. The amount of mandatory versus discretionary

expenditures can vary significantly between periods.

Adjusted diluted earnings per share is a

performance measure used by Ashland and is defined by Ashland as

earnings (loss) from continuing operations, adjusted for identified

key items and divided by the number of outstanding diluted shares

of common stock. Ashland believes this measure provides investors

additional insights into operational performance by providing

earnings and diluted earnings per share metrics that exclude the

effect of the identified key items and tax specific key items.

The Adjusted diluted earnings per share,

excluding intangibles amortization expense metric enables Ashland

to demonstrate the impact of non-cash intangibles amortization

expense on earnings per share, in addition to key items previously

mentioned. Ashland’s management believes this presentation is

helpful to illustrate how previous acquisitions impact applicable

period results.

Ashland does not quantitatively reconcile our

guidance ranges for our non-GAAP measures to their most comparable

GAAP measures in the Financial Outlook section of this press

release. The guidance ranges for GAAP and non-GAAP financial

measures reflect Ashland’s assessment of potential sources of

variability in financial results and are informed by evaluation of

multiple scenarios, many of which have interactive effects across

several financial statement line items. Providing guidance for

individual reconciling items between our non-GAAP financial

measures and the comparable GAAP measures would imply a degree of

precision and certainty in those reconciling items that is not a

consistent reflection of our scenario-based process to prepare our

guidance ranges. To the extent that a material change affecting the

individual reconciling items between the Company’s forward-looking

non-GAAP and comparable GAAP financial measures is anticipated, the

Company has provided qualitative commentary in the Financial

Outlook section of this press release for your consideration.

However, as the impact of such factors cannot be predicted with a

reasonable degree of certainty or precision, a quantitative

reconciliation is not available without unreasonable effort.

About Ashland Ashland Inc.

(NYSE: ASH) is a global additives and specialty ingredients company

with a conscious and proactive mindset for environmental, social

and governance (ESG). The company serves customers in a wide range

of consumer and industrial markets, including architectural

coatings, construction, energy, food and beverage, personal care

and pharmaceutical. Approximately 3,200 passionate, tenacious

solvers – from renowned scientists and research chemists to

talented engineers and plant operators – thrive on developing

practical, innovative and elegant solutions to complex problems for

customers in more than 100 countries. Visit ashland.com

and ashland.com/ESG to learn more.

Forward-Looking Statements This

news release contains forward-looking statements within the meaning

of Section 27A of the Securities Act of 1933, as amended and

Section 21E of the Securities Exchange Act of 1934, as amended.

Ashland has identified some of these forward-looking statements

with words such as “anticipates,” “believes,” “expects,”

“estimates,” “is likely,” “predicts,” “projects,” “forecasts,”

“objectives,” “may,” “will,” “should,” “plans” and “intends” and

the negative of these words or other comparable terminology.

Ashland may from time to time make forward-looking statements in

its annual reports, quarterly reports and other filings with the

SEC, news releases and other written and oral communications. These

forward-looking statements are based on Ashland’s expectations and

assumptions, as of the date such statements are made, regarding

Ashland’s future operating performance, financial, operating cash

flow and liquidity, as well as the economy and other future events

or circumstances. These statements include but may not be limited

to statements with respect to Ashland’s anticipations and

expectations regarding raw materials and year-over-year absorption;

its ability to drive sustainable growth and create long-term value;

its portfolio optimization initiatives and accelerated cost savings

programs; and management’s expectations and beliefs regarding

Ashland’s fiscal-year 2025 results and outlook.

Ashland’s expectations and assumptions include,

without limitation, internal forecasts and analyses of current and

future market conditions and trends, management plans and

strategies, operating efficiencies and economic conditions (such as

prices, supply and demand, cost of raw materials, and the ability

to recover raw-material cost increases through price increases),

and risks and uncertainties associated with the following: the

impact of acquisitions and/or divestitures Ashland has made or may

make (including the possibility that Ashland may not realize the

anticipated benefits from such transactions); Ashland’s substantial

indebtedness (including the possibility that such indebtedness and

related restrictive covenants may adversely affect Ashland’s future

cash flows, results of operations, financial condition and its

ability to repay debt); severe weather, natural disasters, public

health crises, cyber events and legal proceedings and claims

(including product recalls, environmental and asbestos matters);

the effects of the ongoing Ukraine/Russia and Israel/Hamas

conflicts on the geographies in which we operate, the end markets

we serve and on our supply chain and customers, and without

limitation, risks and uncertainties affecting Ashland that are

described in Ashland’s most recent Form 10-K (including Item 1A

Risk Factors) filed with the SEC, which is available on Ashland’s

website at http://investor.ashland.com or on the SEC’s website at

http://www.sec.gov. Various risks and uncertainties may cause

actual results to differ materially from those stated, projected or

implied by any forward-looking statements. Ashland believes its

expectations and assumptions are reasonable, but there can be no

assurance that the expectations reflected herein will be achieved.

Unless legally required, Ashland undertakes no obligation to update

any forward-looking statements made in this news release whether as

a result of new information, future events or otherwise.

1Financial results are preliminary until

Ashland’s Form 10-Q is filed with the U.S. Securities and Exchange

Commission.

2The ongoing free cash flow metric excludes the

impact of inflows and outflows from U.S. and Foreign Accounts

Receivable Sales Program and payments related to restructuring and

environmental and litigation-related matters in both the

current-year and prior-year periods.

™ Trademark, Ashland or its subsidiaries,

registered in various countries.

FOR FURTHER INFORMATION:

|

Investor Relations: |

Media Relations: |

|

William C. Whitaker |

Carolmarie C. Brown |

|

+1 (614) 790-2095 |

+1 (302) 995-3158 |

|

wcwhitaker@ashland.com |

ccbrown@ashland.com |

- Ashland_Q1_ 2025_Earnings_ Release_FNL_20250128

- Earnings_Release_Tables_Q1_FY25_20250128

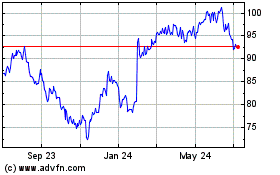

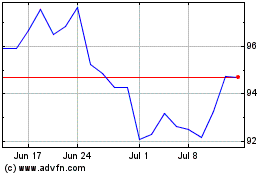

Ashland (NYSE:ASH)

Historical Stock Chart

From Feb 2025 to Mar 2025

Ashland (NYSE:ASH)

Historical Stock Chart

From Mar 2024 to Mar 2025