- Net sales up 12% on solid Mineral Fiber AUV growth and

Architectural Specialties' acquisitions

- Operating income increased 9% and diluted net earnings per

share increased 12%

- Adjusted EBITDA up 13% and adjusted diluted net earnings per

share up 17%

- Raising full-year 2024 guidance

(All comparisons versus the prior year period unless otherwise

stated)

Armstrong World Industries, Inc. (NYSE:AWI), a leader in the

design, innovation and manufacture of ceiling and wall solutions in

the Americas, today reported record second-quarter 2024 financial

results highlighted by strong sales and earnings growth.

“With double digit net sales growth and record earnings, our

second-quarter results further demonstrate the resilience of our

business model and the strength of our growth initiatives,” said

Vic Grizzle, President and CEO of Armstrong World Industries. “As

market demand stabilizes, we also are continuing to see the

benefits from our balanced set of end-markets and the consistent

operational execution of our teams. With our team’s relentless

focus on Mineral Fiber Average Unit Value improvement,

market-driven innovation, operational excellence and Architectural

Specialties expansion, we expect to continue delivering consistent

top-line growth with robust EBITDA margins.”

Second-Quarter Results

(Dollar amounts in millions except

per-share data)

For the Three Months Ended June

30,

2024

2023

Change

Net sales

$

365.1

$

325.4

12.2%

Operating income

$

95.0

$

87.0

9.2%

Operating income margin (Operating income

as a % of net sales)

26.0

%

26.7

%

(70)bps

Net earnings

$

65.9

$

60.2

9.5%

Diluted net earnings per share

$

1.50

$

1.34

11.9%

Additional Non-GAAP* Measures

Adjusted EBITDA

$

125

$

111

12.5%

Adjusted EBITDA margin (Adjusted EBITDA as

a % of net sales)

34.3

%

34.2

%

10bps

Adjusted net earnings

$

71

$

62

14.7%

Adjusted diluted net earnings per

share

$

1.62

$

1.38

17.4%

* The Company uses non-GAAP adjusted

measures in managing the business and believes the adjustments

provide meaningful comparisons of operating performance between

periods and are useful alternative measures of performance.

Reconciliations of the most comparable generally accepted

accounting principles in the United States ("GAAP") measure are

found in the tables at the end of this press release. Excluding per

share data, non-GAAP figures are rounded to the nearest million and

corresponding percentages are rounded to the nearest decimal.

Second-quarter 2024 consolidated net sales increased 12.2% from

prior-year results, driven by higher volumes of $27 million and

favorable Average Unit Value (dollars per unit sold, or "AUV") of

$13 million. Architectural Specialties net sales increased $24

million and Mineral Fiber net sales increased $16 million.

Architectural Specialties segment net sales improved primarily from

a $20 million contribution from our April 2024 acquisition of

3form, LLC ("3form") and our October 2023 acquisition of BOK

Modern, LLC ("BOK"). The increase in Mineral Fiber net sales was

primarily driven by favorable AUV and, to a lesser extent, higher

sales volumes.

Consolidated operating income increased 9.2% in the second

quarter of 2024 primarily due a $17 million margin benefit from

higher sales volumes and a $9 million benefit from favorable AUV.

These benefits were partially offset by an $18 million increase in

selling, general and administrative (“SG&A”) expenses due to

the impact of acquisitions and an increase in Mineral Fiber

SG&A expenses.

Second-Quarter Segment Results Mineral Fiber

(Dollar amounts in millions)

For the Three Months Ended June

30,

2024

2023

Change

Net sales

$

250.2

$

234.0

6.9%

Operating income

$

81.7

$

75.5

8.2%

Adjusted EBITDA*

$

104

$

95

10.4%

Operating income margin

32.7

%

32.3

%

40bps

Adjusted EBITDA margin*

41.7

%

40.4

%

130bps

Mineral Fiber net sales increased 6.9% in the second quarter of

2024 due to $13 million of favorable AUV and $3 million of higher

sales volumes. The improvement in AUV was driven primarily by

favorable like-for-like price, with a modest contribution from

favorable mix. The second quarter increase in volumes was primarily

driven by stabilizing demand and the benefit from growth

initiatives compared to the prior-year period.

Mineral Fiber operating income increased in the second quarter

of 2024 primarily due to a $9 million benefit from favorable AUV, a

$3 million decrease in manufacturing and input costs, a $2 million

increase from higher sales volumes and a $2 million increase in

WAVE equity earnings. These benefits were partially offset by a $9

million increase in SG&A expenses, driven primarily by $3

million of higher incentive compensation, an increase in employee

costs due to inflationary pressures, accruals for environmental

remediation matters and higher depreciation and amortization.

Architectural Specialties

(Dollar amounts in millions)

For the Three Months Ended June

30,

2024

2023

Change

Net sales

$

114.9

$

91.4

25.7%

Operating income

$

14.2

$

12.2

16.4%

Adjusted EBITDA*

$

21

$

17

25.1%

Operating income margin

12.4

%

13.3

%

(90)bps

Adjusted EBITDA margin*

18.4

%

18.5

%

(10)bps

Second-quarter 2024 Architectural Specialties net sales

increased 25.7% from prior-year results, driven primarily by a $20

million contribution 3form and BOK, and to a lesser extent,

increased custom project net sales.

Architectural Specialties operating income increased in the

second quarter of 2024 primarily due to a $14 million margin

benefit from increased sales, driven primarily by the acquisitions

of 3form and BOK, and partially due to improved project margins.

This increase was partially offset by an $9 million increase in

SG&A expenses, primarily due to the acquisitions of 3form and

BOK as well as a $3 million increase in manufacturing costs. The

decline in segment operating income margin was solely driven by the

acquisitions of 3form and BOK.

Unallocated Corporate

Unallocated Corporate operating loss was $1 million in the

second quarter of 2024 and 2023.

Cash Flow

Year to date cash flows from operating activities in 2024

decreased $10 million in comparison to the prior-year period, while

cash flows from investing activities decreased $75 million versus

the prior-year period. The change in operating cash flows was

driven by higher cash earnings offset by unfavorable working

capital changes, most notably timing-related changes in

receivables, and an increase in cash paid for income taxes. The

decrease in investing cash flows was primarily due to the

acquisition of 3form, partially offset by lower purchases of

property, plant and equipment.

Share Repurchase Program

During the second quarter of 2024, we repurchased 0.1 million

shares of common stock for a total cost of $10 million, excluding

the cost of commissions and taxes. As of June 30, 2024, there was

$692 million remaining under the Board of Directors' current

authorized share repurchase program**.

** In July 2016, our Board of Directors

approved a share repurchase program authorizing us to repurchase up

to $150 million of our outstanding common stock through July 2018

(the “Program”). Pursuant to additional authorization and

extensions of the Program approved by our Board of Directors,

including $500 million authorized on July 18, 2023, we are

authorized to purchase up to $1,700 million of our outstanding

shares of common stock through December 2026. Since inception and

through June 30, 2024, we have repurchased 14.4 million shares

under the Program for a total cost of $1,008 million, excluding

commissions and taxes.

Updating 2024 Outlook

“Given our solid second quarter performance and improved line of

sight for the full year, we are increasing our guidance for all key

metrics,” said Chris Calzaretta, AWI Senior Vice President and CFO.

“We now expect operating conditions in the second half of the year

to be similar to the first half. With this backdrop, we expect to

expand Adjusted EBITDA margin at the total company level and we

will continue our disciplined deployment of capital to create value

for shareholders.”

For the Year Ended December 31,

2024

(Dollar amounts in millions except

per-share data)

2023 Actual

Current Guidance

VPY Growth %

Net sales

$

1,295

$

1,415

to

$

1,440

9%

to

11%

Adjusted EBITDA*

$

430

$

474

to

$

486

10%

to

13%

Adjusted diluted net earnings per

share*

$

5.32

$

6.00

to

$

6.15

13%

to

16%

Adjusted free cash flow*

$

263

$

288

to

$

300

10%

to

14%

Earnings Webcast

Management will host a live webcast conference call at 10:00

a.m. ET today, to discuss second-quarter 2024 results. This event

will be available on the Company's website. The call and

accompanying slide presentation can be found on the investor

relations section of the Company's website at

www.armstrongworldindustries.com. The replay of this event will be

available on the website for up to one year after the date of the

call.

Uncertainties Affecting Forward-Looking Statements

Disclosures in this release contain forward-looking statements

within the meaning of the Private Securities Litigation Reform Act

of 1995, including without limitation, those relating to future

financial and operational results, expected savings from cost

management initiatives, the performance of our WAVE joint venture,

market and broader economic conditions and guidance. Those

statements provide our future expectations or forecasts and can be

identified by our use of words such as “anticipate,” “estimate,”

“expect,” “project,” “intend,” “plan,” “believe,” “outlook,”

“target,” “predict,” “may,” “will,” “would,” “could,” “should,”

“seek,” and other words or phrases of similar meaning in connection

with any discussion of future operating or financial performance.

This includes annual guidance. Forward-looking statements, by their

nature, address matters that are uncertain and involve risks

because they relate to events and depend on circumstances that may

or may not occur in the future. As a result, our actual results may

differ materially from our expected results and from those

expressed in our forward-looking statements. A more detailed

discussion of the risks and uncertainties that could cause our

actual results to differ materially from those projected,

anticipated or implied is included in the “Risk Factors” and

“Management’s Discussion and Analysis” sections of our reports on

Form 10-K and Form 10-Q filed with the U.S. Securities and Exchange

Commission (“SEC”), including our quarterly report for the quarter

ended June 30, 2024, that the Company expects to file today.

Forward-looking statements speak only as of the date they are made.

We undertake no obligation to update any forward-looking statements

beyond what is required under applicable securities law.

About Armstrong and Additional Information

Armstrong World Industries, Inc. is a leader in the design,

innovation and manufacture of innovative ceiling and wall system

solutions in the Americas. With $1.3 billion in revenue in 2023,

AWI has approximately 3,500 employees and a manufacturing network

of 19 facilities, plus seven facilities dedicated to its WAVE joint

venture. For over 160 years, Armstrong has delivered products and

services to our customers that can transform how people design,

build and experience spaces with aesthetics, acoustics, wellbeing

and sustainability in mind.

More details on the Company’s performance can be found in its

report on Form 10-Q for the quarter ended June 30, 2024, that the

Company expects to file with the SEC today.

Reported Financial Results

(Amounts in millions, except per share data)

SELECTED FINANCIAL RESULTS Armstrong World

Industries, Inc. and Subsidiaries (Unaudited)

For the Three Months Ended June

30,

For the Six Months Ended June

30,

2024

2023

2024

2023

Net sales

$

365.1

$

325.4

$

691.4

$

635.6

Cost of goods sold

215.8

201.4

417.8

399.5

Gross profit

149.3

124.0

273.6

236.1

Selling, general and administrative

expenses

79.9

61.9

145.6

124.6

Loss related to change in fair value of

contingent consideration

0.7

-

0.4

-

Equity (earnings) from unconsolidated

affiliates, net

(26.3

)

(24.9

)

(53.5

)

(45.7

)

Operating income

95.0

87.0

181.1

157.2

Interest expense

11.1

9.2

20.1

17.9

Other non-operating (income), net

(3.2

)

(2.2

)

(6.3

)

(4.6

)

Earnings before income taxes

87.1

80.0

167.3

143.9

Income tax expense

21.2

19.8

41.5

36.4

Net earnings

$

65.9

60.2

$

125.8

$

107.5

Diluted net earnings per share of common

stock

$

1.50

$

1.34

$

2.86

$

2.38

Average number of diluted common shares

outstanding

44.0

45.0

44.0

45.2

SEGMENT RESULTS Armstrong World Industries,

Inc. and Subsidiaries (Unaudited)

For the Three Months Ended June

30,

For the Six Months Ended June

30,

2024

2023

2024

2023

Net Sales

Mineral Fiber

$

250.2

$

234.0

$

489.8

$

462.4

Architectural Specialties

114.9

91.4

201.6

173.2

Total net sales

$

365.1

$

325.4

$

691.4

$

635.6

For the Three Months Ended June

30,

For the Six Months Ended June

30,

2024

2023

2024

2023

Segment operating

income (loss)

Mineral Fiber

$

81.7

$

75.5

$

160.9

$

139.3

Architectural Specialties

14.2

12.2

21.9

19.4

Unallocated Corporate

(0.9

)

(0.7

)

(1.7

)

(1.5

)

Total consolidated operating income

$

95.0

$

87.0

$

181.1

$

157.2

SELECTED BALANCE SHEET INFORMATION Armstrong

World Industries, Inc. and Subsidiaries

Unaudited

June 30, 2024

December 31, 2023

Assets

Current assets

$

351.2

$

313.0

Property, plant and equipment, net

599.3

566.4

Other non-current assets

869.7

793.0

Total assets

$

1,820.2

$

1,672.4

Liabilities and

shareholders’ equity

Current liabilities

$

200.0

$

194.5

Non-current liabilities

951.2

886.1

Shareholders' equity

669.0

591.8

Total liabilities and shareholders’

equity

$

1,820.2

$

1,672.4

SELECTED CASH FLOW INFORMATION Armstrong World

Industries, Inc. and Subsidiaries (Unaudited)

For the Six Months Ended June

30,

2024

2023

Net earnings

$

125.8

$

107.5

Other adjustments to reconcile net

earnings to net cash provided by operating activities

3.6

(0.8

)

Changes in operating assets and

liabilities, net

(45.7

)

(12.8

)

Net cash provided by operating

activities

83.7

93.9

Net cash (used for) investing

activities

(81.4

)

(6.0

)

Net cash provided by (used for) financing

activities

1.1

(92.6

)

Effect of exchange rate changes on cash

and cash equivalents

(0.6

)

0.3

Net increase (decrease) in cash and cash

equivalents

2.8

(4.4

)

Cash and cash equivalents at beginning of

year

70.8

106.0

Cash and cash equivalents at end of

period

$

73.6

$

101.6

Supplemental Reconciliations of GAAP to

non-GAAP Results (unaudited) (Amounts in millions,

except per share data)

To supplement its consolidated financial statements presented in

accordance with accounting principles generally accepted in the

United States (“GAAP”), the Company provides additional measures of

performance adjusted to exclude the impact of certain discrete

expenses and income including adjusted Earnings Before Interest,

Taxes, Depreciation and Amortization ("EBITDA"), adjusted diluted

earnings per share ("EPS") and adjusted free cash flow. Investors

should not consider non-GAAP measures as a substitute for GAAP

measures. The Company excludes certain acquisition related expenses

(i.e. – impact of adjustments related to the fair value of

inventory, contingent third-party professional fees, changes in the

fair value of contingent consideration and deferred compensation

accruals for acquisitions). The deferred compensation accruals were

for cash and stock awards that are recorded over each award's

respective vesting period, as such payments were subject to the

sellers’ and employees’ continued employment with the Company. The

Company also excludes all acquisition-related intangible

amortization from adjusted net earnings and in calculations of

adjusted diluted EPS. Examples of other excluded items have

included plant closures, restructuring charges and related costs,

impairments, separation costs and other cost reduction initiatives,

environmental site expenses and environmental insurance recoveries,

endowment level charitable contributions, the impact of defined

benefit plan settlements, and certain other gains and losses. The

Company also excludes income/expense from its U.S. Retirement

Income Plan (“RIP”) in the non-GAAP results as it represents the

actuarial net periodic benefit credit/cost recorded. For all

periods presented, the Company was not required and did not make

cash contributions to the RIP based on guidelines established by

the Pension Benefit Guaranty Corporation, nor does the Company

expect to make cash contributions to the plan in 2024. Adjusted

free cash flow is defined as cash from operating and investing

activities, adjusted to remove the impact of cash used or proceeds

received for acquisitions and divestitures, environmental site

expenses and environmental insurance recoveries. Management's

adjusted free cash flow measure includes returns of investment from

WAVE and cash proceeds received from the settlement of

company-owned life insurance policies, which are presented within

investing activities on our condensed consolidated statement of

cash flows. The Company uses these adjusted performance measures in

managing the business, including communications with its Board of

Directors and employees, and believes that they provide users of

this financial information with meaningful comparisons of operating

performance between current results and results in prior periods.

The Company believes that these non-GAAP financial measures are

appropriate to enhance understanding of its past performance, as

well as prospects for its future performance. The Company also uses

adjusted EBITDA and adjusted free cash flow (with further

adjustments, when necessary) as factors in determining at-risk

compensation for senior management. These non-GAAP measures may not

be defined and calculated the same as similar measures used by

other companies. Non-GAAP financial measures utilized by the

Company may not be comparable to non-GAAP financial measures used

by other companies. A reconciliation of these adjustments to the

most directly comparable GAAP measures is included in this release

and on the Company’s website. These non-GAAP measures should not be

considered in isolation or as a substitute for the most comparable

GAAP measures.

In the following charts, numbers may not sum due to rounding.

Excluding adjusted diluted EPS, non-GAAP figures are rounded to the

nearest million and corresponding percentages are rounded to the

nearest percent based on unrounded figures.

Consolidated Results – Adjusted

EBITDA

For the Three Months Ended June

30,

For the Six Months Ended June

30,

2024

2023

2024

2023

Net sales

$

365

$

325

$

691

$

636

Net earnings

$

66

$

60

$

126

$

108

Add: Income tax expense

21

20

42

36

Earnings before income taxes

$

87

$

80

$

167

$

144

Add: Interest/other income and expense,

net

8

7

14

13

Operating income

$

95

$

87

$

181

$

157

Add: RIP expense (1)

1

1

1

1

Add: Acquisition-related impacts (2)

2

1

2

3

Add: Cost reduction initiatives

-

-

-

3

Add: WAVE pension settlement (3)

1

-

1

-

Add: Environmental expense

1

-

1

-

Adjusted operating income

$

100

$

89

$

186

$

164

Add: Depreciation and amortization

25

22

50

43

Adjusted EBITDA

$

125

$

111

$

236

$

207

Operating income margin

26.0

%

26.7

%

26.2

%

24.7

%

Adjusted EBITDA margin

34.3

%

34.2

%

34.1

%

32.6

%

(1)

RIP expense represents only the plan

service cost that is recorded within Operating income. For all

periods presented, we were not required to and did not make cash

contributions to our RIP.

(2)

Represents the impact of

acquisition-related adjustments for the fair value of inventory,

contingent third-party professional fees, changes in fair value of

contingent consideration, deferred compensation and restricted

stock expenses.

(3)

Represents the Company's 50% share of

WAVE's non-cash accounting loss upon settlement of their defined

benefit pension plan.

Mineral Fiber

For the Three Months Ended June

30,

For the Six Months Ended June

30,

2024

2023

2024

2023

Net sales

$

250

$

234

$

490

$

462

Operating income

$

82

$

76

$

161

$

139

Add: Acquisition-related impacts (1)

1

-

-

-

Add: Cost reduction initiatives

-

-

-

3

Add: WAVE pension settlement (2)

1

-

1

-

Add: Environmental expense

1

-

1

-

Adjusted operating income

$

85

$

76

$

164

$

142

Add: Depreciation and amortization

20

19

40

37

Adjusted EBITDA

$

104

$

95

$

203

$

179

Operating income margin

32.7

%

32.3

%

32.9

%

30.1

%

Adjusted EBITDA margin

41.7

%

40.4

%

41.5

%

38.6

%

(1)

Represents the impact of

acquisition-related adjustments for changes in fair value of

contingent consideration.

(2)

Represents the Company's 50% share of

WAVE's non-cash accounting loss upon settlement of their defined

benefit pension plan.

Architectural

Specialties

For the Three Months Ended June

30,

For the Six Months Ended June

30,

2024

2023

2024

2023

Net sales

$

115

$

91

$

202

$

173

Operating income

$

14

$

12

$

22

$

19

Add: Acquisition-related impacts (1)

1

1

1

3

Adjusted operating income

$

15

$

14

$

23

$

22

Add: Depreciation and amortization

6

3

10

6

Adjusted EBITDA

$

21

$

17

$

33

$

29

Operating income margin

12.4

%

13.3

%

10.9

%

11.2

%

Adjusted EBITDA margin

18.4

%

18.5

%

16.5

%

16.5

%

(1)

Represents the impact of

acquisition-related adjustments for the fair value of inventory,

contingent third-party professional fees, changes in fair value of

contingent consideration, deferred compensation and restricted

stock expenses.

Unallocated Corporate

For the Three Months Ended June

30,

For the Six Months Ended June

30,

2024

2023

2024

2023

Operating (loss)

$

(1

)

$

(1

)

$

(2

)

$

(2

)

Add: RIP expense (1)

1

1

1

1

Adjusted operating (loss)

$

-

$

-

$

(1

)

$

-

Add: Depreciation and amortization

-

-

-

-

Adjusted EBITDA

$

-

$

-

$

-

$

-

(1)

RIP expense represents only the plan

service cost that is recorded within Operating income. For all

periods presented, we were not required to and did not make cash

contributions to our RIP.

Consolidated Results – Adjusted Free

Cash Flow

For the Three Months Ended June

30,

For the Six Months Ended June

30,

2024

2023

2024

2023

Net cash provided by operating

activities

$

57

$

68

$

84

$

94

Net cash (used for) investing

activities

(87

)

(5

)

(81

)

(6

)

Net cash (used for) provided by

operating and investing activities

$

(30

)

$

63

$

2

$

88

Add: Cash paid for acquisitions, net of

cash acquired and investment in unconsolidated affiliate

94

10

99

10

Add: Arktura deferred compensation (1)

-

-

6

-

Add: Contingent consideration in excess of

acquisition-date fair value (1)

-

-

-

5

(Less): Proceeds from sale of facility

(2)

(2

)

-

(2

)

-

Adjusted Free Cash Flow

$

62

$

73

$

105

$

103

(1)

Deferred compensation and contingent

consideration payments related to 2020 acquisitions and were

recorded as components of net cash provided by operating

activities.

(2)

Proceeds related to the sale of

Architectural Specialties design center.

Consolidated Results – Adjusted Diluted

Earnings Per Share (EPS)

For the Three Months Ended June

30,

For the Six Months Ended June

30,

2024

2023

2024

2023

Total

Per Diluted Share

Total

Per Diluted Share

Total

Per Diluted Share

Total

Per Diluted Share

Net earnings

$

66

$

1.50

$

60

$

1.34

$

126

$

2.86

$

108

$

2.38

Add: Income tax expense

21

20

42

36

Earnings before income taxes

$

87

$

80

$

167

$

144

(Less): RIP (credit) (1)

-

-

-

(1

)

Add: Acquisition-related impacts (2)

2

1

2

3

Add: Acquisition-related amortization

(3)

3

1

5

3

Add: Cost reduction initiatives

-

-

-

3

Add: WAVE pension settlement (4)

1

-

1

-

Add: Environmental expense

1

-

1

-

Adjusted net earnings before income

taxes

$

94

$

83

$

176

$

151

(Less): Adjusted income tax expense

(5)

(23

)

(20

)

(44

)

(38

)

Adjusted net earnings

$

71

$

1.62

$

62

$

1.38

$

132

$

3.00

$

113

$

2.50

Adjusted diluted EPS change

versus prior year

17.4%

20.0%

Diluted shares outstanding

44.0

45.0

44.0

45.2

Effective tax rate

24%

25%

25%

25%

(1)

RIP (credit) represents the entire

actuarial net periodic pension (credit) recorded as a component of

net earnings. For all periods presented, we were not required to

and did not make cash contributions to our RIP.

(2)

Represents the impact of

acquisition-related adjustments for the fair value of inventory,

contingent third-party professional fees, changes in fair value of

contingent consideration, deferred compensation and restricted

stock expenses.

(3)

Represents acquisition-related intangible

amortization, including customer relationships, developed

technology, software, trademarks and brand names, non-compete

agreements and other intangibles.

(4)

Represents the Company's 50% share of

WAVE's non-cash accounting loss upon settlement of their defined

benefit pension plan.

(5)

Adjusted income tax expense is calculated

using the effective tax rate multiplied by the adjusted net

earnings before income taxes.

Adjusted EBITDA Guidance

For the Year Ending December 31,

2024

Low

High

Net earnings

$

254

to

$

257

Add: Income tax expense

85

87

Earnings before income taxes

$

339

to

$

344

Add: Interest expense

40

42

Add: Other non-operating (income), net

(12

)

(11

)

Operating income

$

367

to

$

375

Add: RIP expense (1)

2

2

Add: Acquisition-related impacts (2)

2

2

Add: Environmental expense

1

1

Add: WAVE pension settlement (3)

1

1

Adjusted operating income

$

374

to

$

380

Add: Depreciation and amortization

100

106

Adjusted EBITDA

$

474

to

$

486

(1)

RIP expense represents only the plan

service cost that is recorded within Operating income. We do not

expect to make cash contributions to our RIP.

(2)

Represents the impact of

acquisition-related adjustments for the fair value of inventory,

contingent third-party professional fees and changes in fair value

of contingent consideration.

(3)

Represents the Company's 50% share of

WAVE's non-cash accounting loss upon settlement of their defined

benefit pension plan.

Adjusted Diluted Net Earnings Per Share

Guidance

For the Year Ending December 31,

2024

Low

Per Diluted Share(1)

High

Per Diluted Share(1)

Net earnings

$

254

$

5.76

to

$

257

$

5.87

Add: Income tax expense

85

87

Earnings before income taxes

$

339

to

$

344

Add: RIP (credit) (2)

(2

)

(1

)

Add: Acquisition-related amortization

(3)

11

12

Add: Acquisition-related impacts (4)

2

2

Add: Environmental expense

1

1

Add: WAVE pension settlement (5)

1

1

Adjusted earnings before income

taxes

$

352

to

$

358

(Less): Adjusted income tax expense

(6)

(88

)

(89

)

Adjusted net earnings

$

264

$

6.00

to

$

269

$

6.15

(1)

Adjusted diluted EPS guidance for 2024 is

calculated based on approximately 44 million of diluted shares

outstanding.

(2)

RIP (credit) represents the entire

actuarial net periodic pension (credit) recorded as a component of

net earnings. We do not expect to make any cash contributions to

our RIP.

(3)

Represents acquisition-related intangible

amortization, including customer relationships, developed

technology, software, trademarks and brand names, non-compete

agreements and other intangibles.

(4)

Represents the impact of

acquisition-related adjustments for the fair value of inventory,

contingent third party professional fees and changes in fair value

of contingent consideration.

(5)

Represents the Company's 50% share of

WAVE's non-cash accounting loss upon settlement of their defined

benefit pension plan.

(6)

Income tax expense is based on an adjusted

effective tax rate of approximately 25%, multiplied by adjusted

earnings before income taxes.

Adjusted Free Cash Flow

Guidance

For the Year Ending December 31,

2024

Low

High

Net cash provided by operating

activities

$

171

to

$

183

Add: Return of investment from joint

venture

94

104

Add: Cash paid for acquisitions, net of

cash acquired and investment in unconsolidated affiliate

99

99

Add: Arktura deferred compensation (1)

6

6

(Less): Proceeds from sale of facility

(2)

(2

)

(2

)

Adjusted net cash provided by operating

activities

$

368

to

$

390

Less: Capital expenditures

(80

)

(90

)

Adjusted Free Cash Flow

$

288

to

$

300

(1)

Deferred compensation payments related to

2020 acquisition recorded as a component of net cash provided by

operating activities.

(2)

Proceeds related to the sale of

Architectural Specialties design center.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240730120396/en/

Investors & Media: Theresa Womble,

tlwomble@armstrongceilings.com or (717) 396-6354

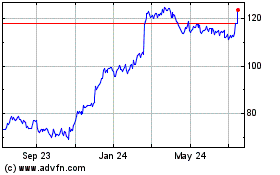

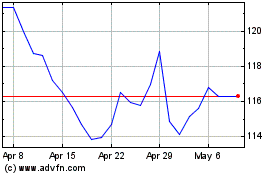

Armstrong World Industries (NYSE:AWI)

Historical Stock Chart

From Oct 2024 to Nov 2024

Armstrong World Industries (NYSE:AWI)

Historical Stock Chart

From Nov 2023 to Nov 2024