- Midnight’s Flight Test Campaign Accelerates – Closing In On

Transition Milestone. In Q1, Archer flew 100+ flights, keeping

us on track to exceed our goal of 400 flights this year. Midnight

is closing in on its transition milestone, meaning it would take

off vertically, accelerate until it transitions from thrust-born to

wing-borne flight and then land again vertically. From there, we

intend to fly the aircraft as much as 10-15 times per day getting

closer to our commercial mission tempo.

- Midnight’s Key Systems Pass Rigorous Testing Ahead of “For

Credit” Testing. This is a part of Midnight’s safety of flight

readiness for its upcoming piloted flight tests later this year and

in support of our ongoing FAA certification program.

- Final Assembly of First Conforming Midnight Aircraft Rapidly

Progressing. We have made significant progress on final

assembly and integration of the aircraft’s components and systems

and are on track to begin piloted flight tests of this aircraft

later this year. Yesterday we announced the completion of our new

battery pack manufacturing line, here is a behind-the-scenes first

look tour of our Integrated Test Lab and Manufacturing Facility

where these aircraft are being built.

- Multi-Hundred Million Dollar Framework Agreement To Build

the Future Of Air Travel in the UAE. We recently announced that

we signed a framework agreement with the Abu Dhabi Investment

Office for multi-hundred-million dollars to accelerate commercial

air taxi operations across the UAE.

- Continuing To Maintain Our Strong Liquidity Position. We

have maintained greater than $520 million of liquidity at the end

of each of our past four quarters while continuing to make

investments across the aircraft development program in support of

our planned commercial launch.

Archer Aviation Inc. (“Archer” or the “Company”) (NYSE: ACHR)

today announced operating and financial results for the first

quarter ended March 31, 2024. The Company issued a shareholder

letter discussing those results, as well as its second quarter 2024

estimates. The shareholder letter may be accessed on the Company’s

investor relations website here.

This press release features multimedia. View

the full release here:

https://www.businesswire.com/news/home/20240509910318/en/

Archer's Midnight aircraft in flight.

(Photo: Business Wire)

Commenting on first quarter 2024 results, Adam Goldstein,

Archer’s CEO said:

“The electrification of aviation continues to increasingly

emerge into the mainstream every day. From the outset, we’ve been

clear that our strategy is to keep the design of our first electric

aircraft, Midnight, as simple as possible while delivering

industry-leading performance balanced with safety. We are

accomplishing this by partnering with what we believe to be the

best suppliers in the aerospace industry, rather than take on the

cost and risk of vertically integrating every aspect of a novel

aircraft program. This capital-light strategy continues to pay

dividends that are more clear today than ever, as we continue to

make rapid progress towards commercializing electric aviation.”

Here is a behind-the-scenes first look tour of our Integrated

Test Lab and Manufacturing Facility where these aircraft are being

built.

Archer will be conducting its earnings conference call at 2:00

p.m. Pacific Time (5:00 p.m. Eastern Time) today. You can access a

live webcast on our investor relations website at

investors.archer.com or the conference call by dialing 404-975-4839

(domestic) or +1 833-470-1428 (international) and entering the

access code 781391.

A replay of the webcast will be available on our investor

relations website. In addition, a telephonic replay of the

conference call will be accessible for one week following the call

by dialing 866-813-9403 (domestic) or +44 204-525-0658

(international), and entering the access code 792154.

First Quarter 2024 Financial Results

Q1 2024 (GAAP)

Q1 20241 (Non-GAAP)

Total Operating Expenses

$

142.2M

$

89.1M

Net Loss

$

(116.5M)

NA

Adjusted EBITDA

NA

$

(86.8M)

Cash and Cash Equivalents

$

405.8M

NA

1. A reconciliation of non-GAAP financial measures to the most

comparable GAAP measures is provided below in the section titled

“Reconciliation of Selected GAAP To Non-GAAP Results for Q1 2024.”

Second Quarter 2024 Financial Estimates

Archer’s financial estimates for second quarter of 2024 are as

follows:

- Non-GAAP total operating expenses of $80M to $95M

We have not reconciled our non-GAAP total operating expense

estimates because certain items that impact non-GAAP total

operating expense are uncertain or out of our control and cannot be

reasonably predicted. In particular, stock-based compensation

expense is impacted by the future fair market value of our common

stock and other factors, all of which are difficult to predict,

subject to frequent change, or not within our control. The actual

amount of these expenses during 2024 will have a significant impact

on our future GAAP financials. Accordingly, a reconciliation of

non-GAAP total operating expenses is not available without

unreasonable effort.

About Archer

Archer is designing and developing electric vertical takeoff and

landing aircraft for use in urban air mobility networks. Archer’s

mission is to unlock the skies, freeing everyone to reimagine how

they move and spend time. Archer's team is based in Santa Clara,

CA.

To learn more, visit www.archer.com.

Source: Archer Text: ArcherIR

Forward-Looking Statements

This press release contains forward-looking statements regarding

Archer’s future business plans and expectations, including

statements regarding our expected financial results for the second

quarter of 2024, our business strategy and plans, aircraft

performance, the pace at which we intend to design, develop,

certify, conduct test flights, manufacture and commercialize our

planned eVTOL aircraft, business opportunities, government

incentives and expansion of Archer’s business internationally. In

addition, this press release refers to a framework agreement that

is conditioned on the future execution by the parties of additional

binding definitive agreements incorporating the terms outlined in

the framework agreement, which definitive agreements may not be

completed or may contain different terms than those set forth in

the framework agreement. These forward-looking statements are only

predictions and may differ materially from actual results due to a

variety of factors. The risks and uncertainties that could cause

actual results to differ from the results predicted are more fully

detailed in our filings with the Securities and Exchange Commission

(SEC), including our most recent Annual Report on Form 10-K and

most recent Quarterly Report on Form 10-Q, which are or will be

available on our investor relations website at investors.archer.com

and on the SEC website at www.sec.gov. In addition, please note

that any forward-looking statements contained herein are based on

assumptions that we believe to be reasonable as of the date of this

press release. We undertake no obligation to update these

statements as a result of new information or future events.

Reconciliation of Selected GAAP To Non-GAAP Results for Q1

2024

Reconciliation of Total Operating Expenses (in millions;

unaudited): A reconciliation of total operating expenses to

non-GAAP total operating expenses for the three months ended March

31, 2024 is set forth below.

Three Months Ended

March 31, 2024

Total operating expenses

$

142.2

Adjusted to exclude the following:

Stellantis warrant expense (1)

(2.1)

Stock-based compensation (2)

(40.7)

Technology and dispute resolution

agreements (3)

(10.3)

Non-GAAP total operating expenses

$

89.1

(1)

Amount includes non-cash warrant costs, classified as research and

development expenses, for the warrants issued to Stellantis in

connection with certain services they are providing to the Company.

(2)

Amounts include stock-based compensation for options and restricted

stock units issued to both employees and non-employees, including

the grants issued to our founders in connection with the closing of

the business combination.

(3)

Amounts reflect charges relating to the Boeing Wisk Agreements (as

defined in our shareholder letter).

Reconciliation of Adjusted EBITDA (in millions; unaudited): A

reconciliation of net loss to Adjusted EBITDA for the three months

ended March 31, 2024 is set forth below.

Three Months Ended

March 31, 2024

Net loss

$

(116.5)

Adjusted to exclude the following:

Other (income) expense, net (1)

(20.6)

Interest income, net

(5.3)

Income tax expense

0.2

Depreciation and amortization expense

2.3

Stellantis warrant expense (2)

2.1

Stock-based compensation (3)

40.7

Technology and dispute resolution

agreements (4)

10.3

Adjusted EBITDA

$

(86.8)

(1)

Amount includes changes in fair value of the public and private

warrants, which are classified as warrant liabilities.

(2)

Amount includes non-cash warrant costs, classified as research and

development expenses, for the warrants issued to Stellantis in

connection with certain services they are providing to the Company.

(3)

Amount includes stock-based compensation for options and restricted

stock units issued to both employees and non-employees, including

the grants issued to our founders in connection with the closing of

the business combination.

(4)

Amounts reflect charges relating to the Boeing Wisk Agreements.

Non-GAAP Financial Measures

To supplement our condensed consolidated financial results

prepared in accordance with GAAP, we use a number of non-GAAP

financial measures to help us in analyzing and assessing our

overall business performance, for making operating decisions and

for forecasting and planning future periods. We consider the use of

non-GAAP financial measures helpful in assessing our current

financial performance, ongoing operations and prospects for the

future as well as understanding financial and business trends

relating to our financial condition and results of operations.

While we use non-GAAP financial measures as a tool to enhance

our understanding of certain aspects of our financial performance

and to provide incremental insight into the underlying factors and

trends affecting our performance, we do not consider these measures

to be a substitute for, or superior to, the information provided by

GAAP financial measures. Consistent with this approach, we believe

that disclosing non-GAAP financial measures to the readers of our

financial statements provides useful supplemental data that, while

not a substitute for GAAP financial measures, can offer insight in

the review of our financial and operational performance and enables

investors to more fully understand trends in our current and future

performance.

In assessing our business during the quarter ended March 31,

2024, we excluded items in the following general categories from

one or more of our non-GAAP financial measures, certain of which

are described below:

Stock-Based Compensation Expense:

We believe that providing non-GAAP measures excluding stock-based

compensation expense, in addition to the GAAP measures, allows for

better comparability of our financial results from period to

period. We prepare and maintain our budgets and forecasts for

future periods on a basis consistent with this non-GAAP financial

measure. Further, companies use a variety of types of equity awards

as well as a variety of methodologies, assumptions and estimates to

determine stock-based compensation expense. We believe that

excluding stock-based compensation expenses enhances our ability

and the ability of investors to understand the impact of non-cash

stock-based compensation on our operating results and to compare

our results against the results of other companies.

Warrant Expense and Gains or Losses from

Revaluation of Warrants: Expense from our common stock

warrants issued to United Airlines and Stellantis, which is

recurring (but non-cash) and gains or losses from change in fair

value of public and private warrants from revaluation will be

reflected in our financial results for the foreseeable future. We

exclude warrant expense and gains or losses from change in fair

value for similar reasons to our stock-based compensation

expense.

Technology and Dispute Resolution

Agreements: Amounts reflect non-cash charges relating to the

Boeing Wisk Agreements.

Each of the non-GAAP financial measures presented in this

release should not be considered in isolation from, or as a

substitute for, a measure of financial performance prepared in

accordance with GAAP and are presented for supplemental

informational purposes only. Further, investors are cautioned that

there are inherent limitations associated with the use of each of

these non-GAAP financial measures as an analytical tool. In

particular, these non-GAAP financial measures have no standardized

meaning prescribed by GAAP and are not based on a comprehensive set

of accounting rules or principles and many of the adjustments to

the GAAP financial measures reflect the exclusion of items that are

recurring and may be reflected in our financial results for the

foreseeable future. In addition, the non-GAAP measures we use may

be different from non-GAAP measures used by other companies,

limiting their usefulness for comparison purposes. We compensate

for these limitations by providing specific information in the

reconciliation included in this release regarding the GAAP amounts

excluded from the non-GAAP financial measures. In addition, as

noted above, we evaluate the non-GAAP financial measures together

with the most directly comparable GAAP financial information.

Investors are encouraged to review the reconciliations of these

non-GAAP measures to their most directly comparable GAAP financial

measures included in this release.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240509910318/en/

For Investors investors@archer.com

For Media The Brand Amp Archer@TheBrandAmp.com

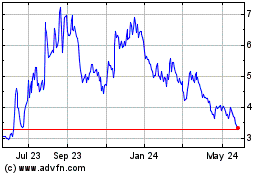

Archer Aviation (NYSE:ACHR)

Historical Stock Chart

From Oct 2024 to Nov 2024

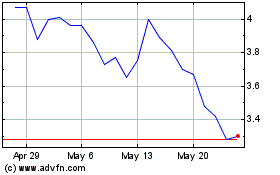

Archer Aviation (NYSE:ACHR)

Historical Stock Chart

From Nov 2023 to Nov 2024