Initial Statement of Beneficial Ownership (3)

March 18 2022 - 4:41PM

Edgar (US Regulatory)

FORM 3

|

UNITED STATES SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

INITIAL STATEMENT OF BENEFICIAL OWNERSHIP OF SECURITIES

|

OMB APPROVAL

OMB Number:

3235-0104

Estimated average burden

hours per response...

0.5

|

|

Filed pursuant to Section 16(a) of the Securities Exchange Act of 1934 or Section 30(h) of the Investment Company Act of 1940

|

|

|

1. Name and Address of Reporting Person

*

Charleston Samantha L |

2. Date of Event Requiring Statement (MM/DD/YYYY)

3/9/2022

|

3. Issuer Name and Ticker or Trading Symbol

AMERICOLD REALTY TRUST [COLD]

|

|

(Last)

(First)

(Middle)

10 GLENLAKE PARKWAY, SOUTH TOWER, SUITE 600 |

4. Relationship of Reporting Person(s) to Issuer (Check all applicable)

_____ Director _____ 10% Owner

___X___ Officer (give title below) _____ Other (specify below)

EVP & Chief Human Resources Of / |

|

(Street)

ATLANTA, GA 30328

(City)

(State)

(Zip)

| 5. If Amendment, Date Original Filed(MM/DD/YYYY)

| 6. Individual or Joint/Group Filing(Check Applicable Line)

_X_ Form filed by One Reporting Person

___ Form filed by More than One Reporting Person

|

Table I - Non-Derivative Securities Beneficially Owned

|

1.Title of Security

(Instr. 4) | 2. Amount of Securities Beneficially Owned

(Instr. 4) | 3. Ownership Form: Direct (D) or Indirect (I)

(Instr. 5) | 4. Nature of Indirect Beneficial Ownership

(Instr. 5) |

Table II - Derivative Securities Beneficially Owned (e.g., puts, calls, warrants, options, convertible securities)

|

1. Title of Derivate Security

(Instr. 4) | 2. Date Exercisable and Expiration Date

(MM/DD/YYYY) | 3. Title and Amount of Securities Underlying Derivative Security

(Instr. 4) | 4. Conversion or Exercise Price of Derivative Security | 5. Ownership Form of Derivative Security: Direct (D) or Indirect (I)

(Instr. 5) | 6. Nature of Indirect Beneficial Ownership

(Instr. 5) |

| Date Exercisable | Expiration Date | Title | Amount or Number of Shares |

| Operating Partnership Profits Units (1) | (1)(2) | (1)(2) | Common Shares of Beneficial Interest | 3979.0 | $0.0 | D | |

| Performance OP Profits Units (3) | (4)(5) | (4)(5) | Common Shares of Beneficial Interest | 11936.0 | $0.0 | D | |

| Operating Partnership Profits Units (6) | (2)(6) | (2)(6) | Common Shares of Beneficial Interest | 15352.0 | $0.0 | D | |

| Explanation of Responses: |

| (1) | Represents OP Profits Units ("OP Profits Units") of Americold Realty Operating Partnership, L.P. ("Operating Partnership"), which will vest ratably on March 8, 2023, 2024 and 2025. The OP Profits Units were issued to the reporting person pursuant to the Americold Realty Trust 2017 Equity Plan. |

| (2) | Conditioned upon minimum allocations to the capital accounts of the OP Profits Units for federal income tax purposes, each vested OP Profits Unit may be converted, at the election of the holder, into a common unit of limited partnership interest in the Operating Partnership (a "Common Unit"). Each Common Unit acquired upon conversion of a vested OP Profits Unit may be presented for redemption, at the election of the holder, for cash equal to the then fair market value of a common share of Americold Realty Trust (the "Company") (the "Common Shares"), except that the Company may, at its election, acquire each Common Unit so presented for one Common Share. The rights to convert vested OP Profits Units into Common Units and redeem Common Units have no expiration dates. |

| (3) | Represents performance-based OP Profits Units ("Performance OP Profits Units") of the Operating Partnership. Payout of the Performance OP Profits Units will be determined based upon a comparison of the Company's total shareholder return ("TSR") on a relative basis to the MSCI U.S. REIT Index at the end of the applicable performance period (Jan 1, 2022 - Dec 31, 2024). The Performance OP Profits Units will vest, if at all, at the end of the 3-year period contingent upon the achievement of the pre-established TSR goal. |

| (4) | Represents performance-based OP Profits Units ("Performance OP Profits Units") of the Operating Partnership. Payout of the Performance OP Profits Units will be determined based upon a comparison of the Company's total shareholder return ("TSR") on a relative basis to the MSCI U.S. REIT Index at the end of the applicable performance period (Jan 1, 2020 - Dec 31, 2022). The Performance OP Profits Units will vest, if at all, at the end of the 3-year period contingent upon the achievement of the pre-established TSR goal. |

| (5) | Conditioned upon minimum allocations to the capital accounts of the Performance OP Profits Units for federal income tax purposes, each vested Performance OP Profits Unit may be converted, at the election of the holder, into a common unit of limited partnership interest in the Operating Partnership (a "Common Unit"). Each Common Unit acquired upon conversion of a vested Performance OP Profits Unit may be presented for redemption, at the election of the holder, for cash equal to the then fair market value of a common share of Americold Realty Trust (the "Company") (the "Common Shares"), except that the Company may, at its election, acquire each Common Unit so presented for one Common Share. The rights to convert vested Performance OP Profits Units into Common Units and redeem Common Units have no expiration dates. |

| (6) | Represents OP Profits Units ("OP Profits Units")of Americold Realty Operating Partnership, L.P. ("Operating Partnership"), which will vest ratably on January 3, 2023 and 2024. The OP Profits Units were issued to the reporting person pursuant to the Americold Realty Trust 2017 Equity Plan. |

Reporting Owners

|

| Reporting Owner Name / Address | Relationships |

| Director | 10% Owner | Officer | Other |

Charleston Samantha L

10 GLENLAKE PARKWAY, SOUTH TOWER

SUITE 600

ATLANTA, GA 30328 |

|

| EVP & Chief Human Resources Of |

|

Signatures

|

| /s/ Samantha L. Charleston | | 3/18/2022 |

| **Signature of Reporting Person | Date |

| Reminder: Report on a separate line for each class of securities beneficially owned directly or indirectly. |

| * | If the form is filed by more than one reporting person, see Instruction 5(b)(v). |

| ** | Intentional misstatements or omissions of facts constitute Federal Criminal Violations. See 18 U.S.C. 1001 and 15 U.S.C. 78ff(a). |

| Note: | File three copies of this Form, one of which must be manually signed. If space is insufficient, see Instruction 6 for procedure. |

| Persons who respond to the collection of information contained in this form are not required to respond unless the form displays a currently valid OMB control number. |

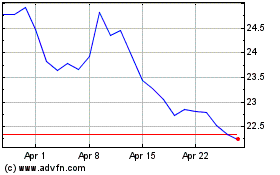

Americold Realty (NYSE:COLD)

Historical Stock Chart

From Aug 2024 to Sep 2024

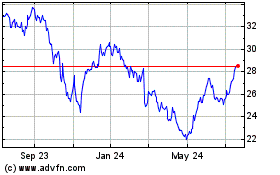

Americold Realty (NYSE:COLD)

Historical Stock Chart

From Sep 2023 to Sep 2024