- Second quarter 2024 recorded and adjusted earnings were both

$0.85 per share compared to second quarter 2023 recorded earnings

of $1.04 per share and adjusted earnings of $0.86 per share

- Adjusted earnings for the second quarter 2023 exclude $0.18

per share related to the reversal of previously recorded revenues

subject to refund following the receipt of a final decision in the

cost of capital proceeding in June 2023

- AWR’s water utility reached a settlement agreement in

connection with the general rate case that will determine new water

rates for 2025 – 2027

- Settlement agreement, if approved, authorizes $573.1 million

in capital investment

- Quarterly dividend increased 8.3%, with first payment on

September 3

- This marks the 70th consecutive year that AWR has increased

annual dividends to shareholders

- AWR’s contracted services subsidiary commenced operations of

the water and wastewater utility systems at two new military bases

in April 2024, contributing earnings in the second quarter and YTD

June

American States Water Company (NYSE:AWR) today reported basic

and fully diluted earnings per share of $0.85 for the quarter ended

June 30, 2024, as compared to basic and fully diluted earnings per

share of $1.04 for the quarter ended June 30, 2023, a decrease of

$0.19 per share, which includes the impact of approximately $0.18

per share resulting from the reversal in June 2023 of previously

recorded estimated revenues subject to refund as a result of the

final cost of capital decision. Excluding this item from the three

months ended June 30, 2023 results, adjusted consolidated diluted

earnings were $0.86 per share compared to recorded consolidated

diluted earnings of $0.85 per share for the three months ended June

30, 2024.

Second Quarter 2024 Results

The table below sets forth a comparison of the second quarter

2024 diluted earnings per share contribution recorded by business

segment and for the parent company with amounts recorded during the

same period in 2023.

Diluted Earnings per

Share

Three Months Ended

6/30/2024

6/30/2023

CHANGE

Water

$

0.67

$

0.91

$

(0.24

)

Electric

0.01

0.03

(0.02

)

Contracted services

0.19

0.12

0.07

AWR (parent)

(0.02

)

(0.02

)

—

Consolidated diluted earnings per share,

as recorded (GAAP)

0.85

1.04

(0.19

)

Adjustment to GAAP

measure:

Impact related to the final cost of

capital decision*

—

(0.18

)

0.18

Consolidated diluted earnings per share,

as adjusted (Non-GAAP)*

$

0.85

$

0.86

$

(0.01

)

Water diluted earnings per share, as

adjusted (Non-GAAP)*

$

0.67

$

0.73

$

(0.06

)

* The adjustment to 2023’s recorded diluted earnings per share

relates to the water segment. The water segment’s adjusted earnings

for 2023 exclude the impact from the final CPUC decision issued in

June 2023 on the cost of capital proceeding that made all

adjustments to rates prospective, and which is shown separately in

the table above. As a result of that final decision, GSWC reversed

its regulatory liability previously recorded during 2022 and

through the end of the first quarter of 2023 for estimated revenues

subject to refund at that time.

Water Segment:

For the three months ended June 30, 2024, recorded diluted

earnings from the water utility segment were $0.67 per share, as

compared to $0.91 per share for the same period in 2023, a decrease

of $0.24 per share. Excluding the revenue impact of $9.3 million,

or approximately $0.18 per share, resulting from the reversal of

previously recorded estimated revenues subject to refund discussed

above, adjusted diluted earnings for the second quarter of 2023 at

the water segment were $0.73 per share, as compared to adjusted and

recorded earnings of $0.67 per share for the second quarter of

2024, an adjusted decrease at the water segment of approximately

$0.06 per share. The discussion below includes the major items,

which impacted the comparability of the two periods as

adjusted.

- Excluding the impact from the reversal of revenues subject to

refund recorded during the three months ended June 30, 2023 due to

the final cost of capital decision as previously discussed, there

was a net increase in water operating revenues of approximately $3

million that was largely a result of the third-year rate increases

related to the three months ended June 30, 2024. Furthermore,

during the three months ended June 30, 2023, there was an increase

in revenues as a result of recording regulatory adjustments of

approximately $2 million that did not recur during the same period

in 2024. The increase in water revenues during the second quarter

of 2024 represents the difference from the third-year rate

increases compared to the estimated second-year rate increases

recorded during the three months ended June 30, 2023 as a result of

receiving a final decision in the water general rate case.

- An increase in water supply costs of $0.7 million, which

consist of purchased water, purchased power for pumping,

groundwater production assessments and changes in the water supply

cost balancing accounts. The increase in water supply costs is

primarily related to an increase in customer water usage and an

increase in overall actual supply costs in 2024. Actual water

supply costs are tracked against adopted costs in the revenue

requirement, and passed through to customers on a dollar-for-dollar

basis by way of the CPUC-approved water supply cost balancing

accounts. The increase in water supply costs results in a

corresponding increase in water operating revenues and has no net

impact on the water segment’s profitability.

- An overall increase in operating expenses of $2.8 million

(excluding supply costs) due primarily to increases in (i) overall

labor costs, (ii) administrative and general expenses resulting

largely from higher outside services costs related to the pending

general rate case application and other regulatory filings, (iii)

depreciation and amortization expenses resulting from additions to

utility plant, and (iv) property taxes; partially offset by a

decrease in maintenance expenses due to timing.

- An increase in interest expenses (net of interest income) of

$1.6 million resulting primarily from an overall increase in

interest rates, as well as an overall increase in total borrowing

levels to support, among other things, the capital expenditure

programs at GSWC, partially offset by higher interest income earned

on regulatory assets bearing interest at the current 90-day

commercial-paper rate, which increased compared to 2023’s rates, as

well as an increase in the level of regulatory assets

recorded.

- An overall decrease in other income (net of other expenses) of

$0.2 million due primarily to a decrease of $0.5 million in gains

generated on investments held to fund one of the company’s

retirement plans for the three months ended June 30, 2024 compared

to the same period in 2023, due to financial market conditions,

partially offset by the change in the non-service cost components

related to GSWC’s benefit plans resulting from changes in actuarial

assumptions including expected returns on plan assets. However, as

a result of GSWC’s two-way pension balancing accounts authorized by

the CPUC, changes in total net periodic benefits costs related to

the pension plan have no material impact to earnings.

- A decrease in earnings of approximately $0.01 per share due to

the dilutive effects from the issuance of equity under AWR’s

at-the-market (“ATM”) offering program. Under the ATM offering

program, AWR may offer and sell its Common Shares, with an

aggregate gross offering price of up to $200 million, from time to

time at its sole discretion. Through June 30, 2024, AWR has sold

455,648 Common Shares through this ATM offering program.

Electric Segment:

Diluted earnings from the electric utility segment decreased

$0.02 per share for the three months ended June 30, 2024 as

compared to the same period in 2023, largely resulting from not

having new rates while awaiting the processing of the pending

electric general rate case that will set new rates for 2023 – 2026,

while also experiencing continued increases in overall operating

expenses and interest costs. When a decision is issued in the

electric general rate case, new rates are expected to be

retroactive to January 1, 2023 and cumulative adjustments will be

recorded at that time.

Contracted Services

Segment:

Diluted earnings from the contracted services segment increased

$0.07 per share for the three months ended June 30, 2024 when

compared to the same period in 2023, due to an increase in

management fee revenue resulting from the resolution of various

economic price adjustments and operation of the water and

wastewater systems at the new bases (Naval Air Station Patuxent

River and Joint Base Cape Cod) and an increase in construction

activity largely resulting from timing differences of when

construction work was performed in 2024 as compared to the same

period in 2023, partially offset by an overall increase in

operating expenses. The contracted services segment is expected to

contribute $0.50 to $0.54 per share for the full 2024 year.

Year-to-Date (“YTD”) 2024 Results

- $0.50 per share decrease in recorded YTD 2024 consolidated

diluted EPS compared to YTD 2023, or $0.01 per share increase as

adjusted

- YTD 2023 recorded results reflect the impact of retroactive

rates of $0.38 per share related to the full year of 2022 due to

receiving a final decision in the water utility general rate

case.

- YTD 2023 recorded results also reflect a favorable variance

of $0.13 per share resulting from the reversal of revenues subject

to refund previously recorded in 2022 following the receipt of a

final decision in the cost of capital proceeding in June

2023.

The table below sets forth a comparison of the diluted earnings

per share contribution by business segment and for the parent

company as recorded during the year-to-date June 30, 2024 and

2023.

Diluted Earnings per

Share

Six Months Ended

6/30/2024

6/30/2023

CHANGE

Water

$

1.15

$

1.65

$

(0.50

)

Electric

0.06

0.09

(0.03

)

Contracted services

0.32

0.27

0.05

AWR (parent)

(0.06

)

(0.04

)

(0.02

)

Consolidated diluted earnings per share,

as recorded (GAAP)

$

1.47

$

1.97

$

(0.50

)

Adjustments to GAAP

measure:

Impact of retroactive rates related to the

full year of 2022 from the final decision in the water general rate

case*

—

(0.38

)

0.38

Impact related to the final cost of

capital decision*

—

(0.13

)

0.13

Consolidated diluted earnings per share,

as adjusted (Non-GAAP)*

$

1.47

$

1.46

$

0.01

Water diluted earnings per share, as

adjusted (Non-GAAP)*

$

1.15

$

1.14

$

0.01

* All adjustments to 2023’s recorded diluted earnings per share

relate to the water segment. The water segment’s adjusted earnings

for 2023 exclude both the impact of the final decision on the water

general rate case that included retroactive rates related to the

full year of 2022, and the impact of reversing previously recorded

estimated 2022 revenues subject to refund as a result of the final

cost of capital decision issued in June 2023 that made all

adjustments to rates prospective. Both adjustments are shown

separately in the table above.

As noted in the table above, consolidated diluted earnings for

the six months ended June 30, 2024 were $1.47 per share, as

compared to $1.97 per share recorded for the same period in 2023, a

decrease of $0.50 per share. Included in the results for the six

months ended June 30, 2023 were (i) the impact from the final

decision in the water general rate case recorded in 2023 that

included retroactive new rates related to the full 2022 year of

$0.38 per share, and (ii) the impact of the final cost of capital

decision that resulted in the reversal of estimated water revenues

subject to refund previously recorded in 2022 of $6.4 million, or

$0.13 per share. Excluding these items from the first half of 2023,

adjusted consolidated diluted earnings were $1.46 per share,

compared to recorded consolidated earnings of $1.47 per share

during the same period in 2024, an adjusted increase of $0.01 per

share. There was a decrease in earnings in the YTD 2024 results of

approximately $0.01 per share due to the dilutive effects from the

issuance of equity under AWR’s ATM offering program as previously

discussed in the quarterly results.

The decrease in diluted earnings per share at the electric

utility segment was largely due to not having new rates while

awaiting the processing of the pending electric general rate case

that will set new rates for 2023 – 2026. The increase in diluted

earnings per share at the contracted services segment was largely

due to an increase in management fee revenue resulting from the

favorable resolution of various economic price adjustments and the

commencement of operations of the water and wastewater systems at

the new bases.

For more details on the YTD results, please refer to the

company’s Form 10-Q filed with the Securities and Exchange

Commission.

Dividends

On July 30, 2024, AWR’s Board of Directors approved an 8.3%

increase in the third quarter dividend to $0.4655 per share from

$0.4300 per share on AWR’s Common Shares. Dividends on the Common

Shares will be paid on September 3, 2024 to shareholders of record

at the close of business on August 16, 2024. AWR has paid common

dividends every year since 1931, and has increased the dividends

received by shareholders each calendar year for 70 consecutive

years, which places it in an exclusive group of companies on the

New York Stock Exchange that have achieved that result. The company

has grown its quarterly dividend rate at a compound annual growth

rate (CAGR) of 8.8% over the last five years since the third

quarter of 2019 and is on pace to achieve an 8.0% CAGR in its

calendar year dividend payments from 2014 – 2024. AWR's current

policy is to achieve a CAGR in the dividend of more than 7% over

the long-term.

Non-GAAP Financial Measures

This press release includes a discussion on AWR’s operations in

terms of diluted earnings per share by business segment, which is

each business segment’s earnings divided by the company’s weighted

average number of diluted common shares. The impact of retroactive

rates related to the full year 2022 recorded during the six months

ended June 30, 2023 resulting from the final decision on the water

general rate case approved in June 2023, and the impact from the

reversal of revenues subject to refund due to a change in estimates

recorded during the three and six months ended June 30, 2023

following the receipt of a final cost of capital decision in June

2023 have been excluded in this analysis when communicating AWR’s

consolidated and water segment results for the three and six months

ended June 30, 2024 and 2023 to help facilitate comparisons of

AWR’s performance from period to period. All of these measures are

derived from consolidated financial information but are not

presented in our financial statements that are prepared in

accordance with Generally Accepted Accounting Principles (“GAAP”)

in the United States. These items constitute “non-GAAP financial

measures” under Securities and Exchange Commission rules, which

supplement our GAAP disclosures but should not be considered as an

alternative to the respective GAAP measures. Furthermore, the

non-GAAP financial measures may not be comparable to similarly

titled non-GAAP financial measures of other registrants.

The company uses earnings per share by business segment as an

important measure in evaluating its operating results and believes

this measure is a useful internal benchmark in evaluating the

performance of its operating segments. The company reviews this

measurement regularly and compares it to historical periods and to

the operating budget. The company has provided the computations and

reconciliations of diluted earnings per share from the measure of

operating income by business segment to AWR’s consolidated fully

diluted earnings per share in this press release.

Forward-Looking Statements

Certain matters discussed in this press release with regard to

the company’s expectations may be forward-looking statements that

involve risks and uncertainties. The assumptions and risk factors

that could cause actual results to differ materially include those

described in the company’s most recent Form 10-Q and Form 10-K

filed with the Securities and Exchange Commission.

Conference Call

Robert Sprowls, president and chief executive officer, and Eva

Tang, senior vice president and chief financial officer, will host

a conference call to discuss these results at 2:00 p.m. Eastern

Time (11:00 a.m. Pacific Time) on Wednesday, August 7. There will

be a question and answer session as part of the call. Interested

parties can listen to the live conference call and view

accompanying slides on the internet at www.aswater.com. The call

will be archived on the website and available for replay beginning

August 7, 2024 at 5:00 p.m. Eastern Time (2:00 p.m. Pacific Time)

through August 14, 2024.

About American States Water Company

American States Water Company is the parent of Golden State

Water Company, Bear Valley Electric Service, Inc. and American

States Utility Services, Inc., serving over one million people in

ten states. Through its water utility subsidiary, Golden State

Water Company, the company provides water service to approximately

264,400 customer connections located within more than 80

communities in Northern, Coastal and Southern California. Through

its electric utility subsidiary, Bear Valley Electric Service,

Inc., the company distributes electricity to approximately 24,800

customer connections in the City of Big Bear Lake and surrounding

areas in San Bernardino County, California. Through its contracted

services subsidiary, American States Utility Services, Inc., the

company provides operations, maintenance and construction

management services for water distribution, wastewater collection,

and treatment facilities located on twelve military bases

throughout the country under 50-year privatization contracts with

the U.S. government and one military base under a 15-year

contract.

American States Water

Company

Consolidated

Comparative Condensed Balance

Sheets (Unaudited)

(in thousands)

June 30, 2024

December 31, 2023

Assets

Net Property, Plant and Equipment

$

1,981,636

$

1,892,280

Goodwill

1,116

1,116

Other Property and Investments

45,923

42,932

Current Assets

209,523

205,978

Other Assets

110,122

103,816

Total Assets

$

2,348,320

$

2,246,122

Capitalization and Liabilities

Capitalization

$

1,473,505

$

1,351,664

Current Liabilities

299,118

166,623

Other Credits

575,697

727,835

Total Capitalization and

Liabilities

$

2,348,320

$

2,246,122

Condensed Statements of Income

(Unaudited)

Three Months Ended

June 30,

Six Months Ended

June 30,

(in thousands,

except per share amounts)

2024

2023

2024

2023

Operating Revenues

Water

$

110,424

$

116,908

$

200,689

$

229,620

Electric

8,703

8,828

20,908

21,732

Contracted services

36,201

31,664

68,982

67,471

Total operating revenues

155,328

157,400

290,579

318,823

Operating Expenses

Water purchased

17,968

18,070

31,729

32,374

Power purchased for pumping

3,521

2,869

6,353

5,223

Groundwater production assessment

5,818

5,365

10,672

9,198

Power purchased for resale

1,503

2,469

5,835

7,455

Supply cost balancing accounts

3,436

2,837

2,828

14,403

Other operation

10,733

9,716

20,356

19,832

Administrative and general

23,487

21,503

48,834

45,050

Depreciation and amortization

10,770

10,258

21,492

21,461

Maintenance

3,535

3,779

6,760

6,929

Property and other taxes

6,612

5,555

13,099

11,850

ASUS construction

16,197

16,034

31,899

34,938

Total operating expenses

103,580

98,455

199,857

208,713

Operating income

51,748

58,945

90,722

110,110

Other Income and Expenses

Interest expense

(13,137

)

(10,728

)

(25,992

)

(20,209

)

Interest income

2,093

1,803

4,163

3,667

Other, net

1,519

1,705

3,861

3,316

Total other income and (expenses),

net

(9,525

)

(7,220

)

(17,968

)

(13,226

)

Income Before Income Tax

Expense

42,223

51,725

72,754

96,884

Income tax expense

10,359

13,204

17,755

23,956

Net Income

$

31,864

$

38,521

$

54,999

$

72,928

Weighted average shares outstanding

37,309

36,976

37,169

36,972

Basic earnings per Common Share

$

0.85

$

1.04

$

1.48

$

1.97

Weighted average diluted shares

37,418

37,067

37,263

37,058

Fully diluted earnings per Common

Share

$

0.85

$

1.04

$

1.47

$

1.97

Dividends paid per Common Share

$

0.4300

$

0.3975

$

0.8600

$

0.7950

Computation and Reconciliation of Non-GAAP Financial Measure

(Unaudited)

Below are the computation and reconciliation of diluted earnings

per share from the measure of operating income by business segment

to AWR’s consolidated fully diluted earnings per share for the

three and six months ended June 30, 2024 and 2023.

Water

Electric

Contracted Services

AWR (Parent)

Consolidated (GAAP)

In 000's except per

share amounts

Q2 2024

Q2 2023

Q2 2024

Q2 2023

Q2 2024

Q2 2023

Q2 2024

Q2 2023

Q2 2024

Q2 2023

Operating income (loss)

$

40,565

$

50,524

$

1,233

$

2,103

$

9,952

$

6,354

$

(2

)

$

(36

)

$

51,748

$

58,945

Other (income) and expenses, net

6,883

5,057

930

645

379

357

1,333

1,161

9,525

7,220

Income tax expense (benefit)

8,487

11,934

(39

)

247

2,322

1,506

(411

)

(483

)

10,359

13,204

Net income (loss)

$

25,195

$

33,533

$

342

$

1,211

$

7,251

$

4,491

$

(924

)

$

(714

)

$

31,864

$

38,521

Weighted Average Number of Diluted

Shares

37,418

37,067

37,418

37,067

37,418

37,067

37,418

37,067

37,418

37,067

Diluted earnings (loss) per share

$

0.67

$

0.91

$

0.01

$

0.03

$

0.19

$

0.12

$

(0.02

)

$

(0.02

)

$

0.85

$

1.04

Water

Electric

Contracted Services

AWR (Parent)

Consolidated (GAAP)

In 000's except per

share amounts

YTD 2024

YTD 2023

YTD 2024

YTD 2023

YTD 2024

YTD 2023

YTD 2024

YTD 2023

YTD 2024

YTD 2023

Operating income (loss)

$

69,732

$

90,763

$

4,374

$

5,734

$

16,619

$

13,650

$

(3

)

$

(37

)

$

90,722

$

110,110

Other (income) and expenses, net

12,432

8,923

1,769

1,205

712

614

3,055

2,484

17,968

13,226

Income tax expense (benefit)

14,311

20,844

521

948

3,882

3,191

(959

)

(1,027

)

17,755

23,956

Net income (loss)

$

42,989

$

60,996

$

2,084

$

3,581

$

12,025

$

9,845

$

(2,099

)

$

(1,494

)

$

54,999

$

72,928

Weighted Average Number of Diluted

Shares

37,263

37,058

37,263

37,058

37,263

37,058

37,263

37,058

37,263

37,058

Diluted earnings (loss) per share

$

1.15

$

1.65

$

0.06

$

0.09

$

0.32

$

0.27

$

(0.06

)

$

(0.04

)

$

1.47

$

1.97

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240805810943/en/

Eva G. Tang Senior Vice President-Finance, Chief Financial

Officer, Corporate Secretary and Treasurer Telephone: (909)

394-3600, ext. 707

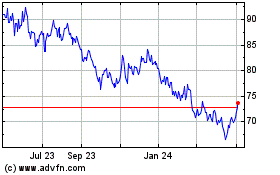

American States Water (NYSE:AWR)

Historical Stock Chart

From Oct 2024 to Nov 2024

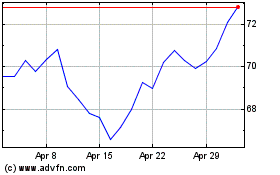

American States Water (NYSE:AWR)

Historical Stock Chart

From Nov 2023 to Nov 2024