SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

Report of Foreign Private Issuer

Pursuant to Rule 13a-16 or 15d-16 of the

Securities Exchange Act of 1934

For the month of November, 2024

Commission File Number 1565025

AMBEV S.A.

(Exact name of registrant as specified in its

charter)

AMBEV S.A.

(Translation of Registrant's name into English)

Rua Dr. Renato Paes de Barros, 1017 - 3rd

Floor

04530-000 São Paulo, SP

Federative Republic of Brazil

(Address of principal executive office)

Indicate by check mark whether the

registrant files or will file annual reports under cover Form 20-F or Form 40-F.

Form 20-F ___X___ Form 40-F _______

Indicate

by check mark whether the registrant by furnishing the information contained in this Form is also thereby furnishing the information

to the Commission pursuant to Rule 12g3-2(b) under the Securities Exchange Act of 1934.

Yes _______ No ___X____

Ambev S.A.

Interim consolidated

financial statements at

September 30, 2024

and report on review

Report on review of interim

consolidated financial statements

To the Board of Directors and Shareholders

Ambev S.A.

Introduction

We have reviewed the accompanying interim consolidated balance sheet of Ambev S.A. and

its subsidiaries ("Company") as at September 30, 2024, the related interim consolidated income statement and comprehensive income

for the quarter and nine-month period then ended and the related interim consolidated statement of changes in equity and cash flows for

the nine-month period then ended and notes, comprising a summary of material accounting policies and other explanatory information.

Management is responsible for the preparation and fair presentation of these interim consolidated

financial statements in accordance with the accounting standard International Accounting Standard (IAS) 34 - Interim Financial

Reporting, of the International Accounting Standards Board (IASB). Our responsibility is to express a conclusion on these interim

consolidated financial statements based on our review.

Scope of review

We conducted our review in accordance with International Standards on Reviews of Interim

Financial Information (ISRE 2410 - Review of Interim Financial Information Performed by the Independent Auditor of the Entity, respectively).

A review of interim information consists of making inquiries, primarily of persons responsible for financial and accounting matters, and

applying analytical and other review procedures. A review is substantially less in scope than an audit conducted in accordance with Brazilian

and International Standards on Auditing and consequently does not enable us to obtain assurance that we would become aware of all significant

matters that might be identified in an audit. Accordingly, we do not express an audit opinion.

Conclusion

Based on our review, nothing has come to our attention that causes us to believe that the

accompanying interim consolidated financial statements referred to above is not prepared, in all material respects, in accordance with

IAS 34.

São Paulo, November 7, 2024

| PricewaterhouseCoopers |

|

Sérgio Eduardo Zamora |

| Auditores Independentes Ltda. |

|

Contador CRC 1SP168728/O-4 |

| CRC 2SP000160/O-5 |

|

|

PricewaterhouseCoopers Auditores Independentes Ltda., Avenida Brigadeiro Faria Lima,

3732, Edifício B32, 16o

São Paulo, SP, Brasil, 04538-132

T: +55 (11) 4004-8000, www.pwc.com.br

Contents

INTERIM CONSOLIDATED BALANCE SHEET

All amounts in thousands of Brazilian Reais

| Assets |

Note |

09/30/2024 |

12/31/2023 |

| |

|

|

|

| Cash and cash equivalents |

5.1 |

19,784,362 |

16,059,003 |

| Investment securities |

5.2 |

1,154,677 |

277,164 |

| Trade receivables |

|

6,087,501 |

5,741,457 |

| Derivative financial instruments |

21 |

533,652 |

378,049 |

| Inventories |

6 |

11,093,344 |

9,619,022 |

| Recoverable taxes |

7 |

2,471,625 |

3,435,688 |

| Other assets |

|

1,547,769 |

1,052,667 |

| Current assets |

|

42,672,930 |

36,563,050 |

| |

|

|

|

| |

|

|

|

| Investment securities |

5.2 |

248,018 |

242,168 |

| Derivative financial instruments |

21 |

2,394 |

1,673 |

| Recoverable taxes |

7 |

11,264,799 |

11,325,096 |

| Deferred tax assets |

8.1 |

9,138,239 |

7,969,592 |

| Other assets |

|

1,353,088 |

1,520,701 |

| Employee benefits |

|

65,588 |

57,261 |

| Long term assets |

|

22,072,126 |

21,116,491 |

| |

|

|

|

| Investments in associates and joint ventures |

|

328,000 |

289,063 |

| Property, plant and equipment |

9 |

28,767,577 |

26,630,156 |

| Intangible assets |

|

11,552,331 |

10,041,733 |

| Goodwill |

10 |

41,893,397 |

38,003,640 |

| |

|

|

|

| Non-current assets |

|

104,613,431 |

96,081,083 |

| |

|

|

|

| Total assets |

|

147,286,361 |

132,644,133 |

The accompanying notes are an integral part of these interim consolidated

financial statements.

INTERIM CONSOLIDATED BALANCE SHEET (CONTINUED)

All amounts in thousands of Brazilian Reais

| Equity and liabilities |

Note |

09/30/2024 |

12/31/2023 |

| |

|

|

|

| Trade payables |

11 |

21,071,847 |

23,195,101 |

| Derivative financial instruments |

21 |

185,193 |

751,362 |

| Interest-bearing loans and borrowings |

12 |

1,211,089 |

1,298,091 |

| Payroll and social security payables |

|

2,531,598 |

2,128,547 |

| Dividends and interest on shareholders’ equity payable |

|

1,666,361 |

1,526,151 |

| Income tax and social contribution payable |

|

1,604,295 |

1,340,492 |

| Taxes and contributions payable |

|

4,086,606 |

6,236,626 |

| Other liabilities, including put option granted on subsidiaries |

|

2,815,795 |

4,110,138 |

| Provisions |

13 |

500,330 |

418,389 |

| Current liabilities |

|

35,673,114 |

41,004,897 |

| |

|

|

|

| Trade payables |

11 |

343,425 |

307,300 |

| Derivative financial instruments |

21 |

- |

11,643 |

| Interest-bearing loans and borrowings |

12 |

2,169,184 |

2,202,975 |

| Deferred tax liabilities |

8.1 |

4,567,515 |

3,318,448 |

| Income tax and social contribution payable |

|

1,339,757 |

1,487,125 |

| Taxes and contributions payable |

|

572,973 |

513,315 |

| Other liabilities, including put option granted on subsidiaries |

|

944,668 |

1,083,221 |

| Provisions |

13 |

620,990 |

559,614 |

| Employee benefits |

|

2,170,658 |

2,011,793 |

| Non-current liabilities |

|

12,729,170 |

11,495,434 |

| |

|

|

|

| Total liabilities |

|

48,402,284 |

52,500,331 |

| |

|

|

|

| Equity |

14 |

|

|

| Issued capital |

|

58,226,036 |

58,177,929 |

| Reserves |

|

98,560,814 |

98,669,404 |

| Carrying value adjustments |

|

(73,481,018) |

(77,878,043) |

| Retained earnings/(losses) |

|

14,834,556 |

- |

| Equity attributable to Ambev’s shareholders |

|

98,140,388 |

78,969,290 |

| Non-controlling interests |

|

743,689 |

1,174,512 |

| Total equity |

|

98,884,077 |

80,143,802 |

| |

|

|

|

| Total equity and liabilities |

|

147,286,361 |

132,644,133 |

The accompanying notes are an integral part of these interim consolidated

financial statements.

INTERIM CONSOLIDATED INCOME STATEMENT

For the three and nine-month periods ended September 30

All amounts in thousands of Brazilian Reais unless otherwise stated

| |

|

Nine-month period ended: |

|

Three-month period ended: |

| |

Note |

2024 |

2023 |

|

2024 |

2023 |

| |

|

|

|

|

|

|

| Net sales |

16 |

62,417,251 |

59,747,622 |

|

22,096,739 |

20,317,765 |

| Cost of sales |

|

(31,091,577) |

(29,990,311) |

|

(10,972,603) |

(10,223,018) |

| Gross profit |

|

31,325,674 |

29,757,311 |

|

11,124,136 |

10,094,747 |

| |

|

|

|

|

|

|

| Distribution expenses |

|

(8,269,753) |

(8,206,220) |

|

(2,828,265) |

(2,607,819) |

| Commercial expenses |

|

(6,123,679) |

(5,608,527) |

|

(2,028,008) |

(1,776,858) |

| Administrative expenses |

|

(4,313,400) |

(3,893,180) |

|

(1,530,002) |

(1,272,024) |

| Other operating income/(expenses) |

17 |

1,707,934 |

1,352,248 |

|

595,321 |

474,735 |

| Exceptional items |

18 |

(48,178) |

(167,948) |

|

(18,882) |

(16,643) |

| Income from operations |

|

14,278,598 |

13,233,684 |

|

5,314,300 |

4,896,138 |

| |

|

|

|

|

|

|

| Finance income |

19 |

1,646,048 |

1,547,633 |

|

515,567 |

488,284 |

| Finance expenses |

19 |

(2,853,655) |

(4,225,851) |

|

(936,110) |

(1,299,888) |

| Other net financial results |

19 |

(496,085) |

(231,024) |

|

(260,982) |

(26,292) |

| Net financial results (i) |

|

(1,703,692) |

(2,909,242) |

|

(681,525) |

(837,896) |

| |

|

|

|

|

|

|

| Share of results of associates and joint ventures |

|

1,822 |

(15,163) |

|

36,844 |

1,440 |

| Income before income tax |

|

12,576,728 |

10,309,279 |

|

4,669,619 |

4,059,682 |

| |

|

|

|

|

|

|

| Income tax expense |

8.1 |

(2,754,357) |

122,734 |

|

(1,103,318) |

(44,678) |

| Net income |

|

9,822,371 |

10,432,013 |

|

3,566,301 |

4,015,004 |

| |

|

|

|

|

|

|

| Attributable to: |

|

|

|

|

|

|

| Equity holders of Ambev |

|

9,556,858 |

10,114,289 |

|

3,460,273 |

3,911,740 |

| Non-controlling interest |

|

265,513 |

317,724 |

|

106,028 |

103,264 |

| |

|

|

|

|

|

|

| Basic earnings per share – common – R$ |

|

0.6073 |

0.6424 |

|

0.2200 |

0.2484 |

| Diluted earnings per share – common – R$ |

|

0.6040 |

0.6384 |

|

0.2188 |

0.2469 |

(i) As detailed in note 19 – Net financial results, as of

the first quarter of 2024 the Company improved the split between financial result lines, including for comparative purposes.

The accompanying notes are an integral part of these interim consolidated

financial statements.

INTERIM CONSOLIDATED STATEMENT OF COMPREHENSIVE INCOME

For the three and nine-month periods ended September 30

All amounts in thousands of Brazilian Reais

| |

Nine-month period ended: |

|

Three-month period ended: |

| |

2024 |

2023 |

|

2024 |

2023 |

| |

|

|

|

|

|

| Net income |

9,822,371 |

10,432,013 |

|

3,566,301 |

4,015,004 |

| |

|

|

|

|

|

| Items that may be subsequently reclassified to profit or loss: |

|

|

|

|

|

| Exchange differences on the translation of foreign operations (gains/(losses)) |

|

|

|

|

|

| Investment hedge – put option granted on subsidiaries |

(74,043) |

135,744 |

|

22,643 |

(61,976) |

| Gains/losses on translation of other foreign operations |

4,133,385 |

(5,845,467) |

|

(1,174,030) |

(532,452) |

| Gains/losses on translation of foreign operations |

4,059,342 |

(5,709,723) |

|

(1,151,387) |

(594,428) |

| |

|

|

|

|

|

| Cash flow hedge – gains/(losses) |

|

|

|

|

|

| Recognized in equity (Hedge reserve) |

152,046 |

(32,851) |

|

(134,157) |

635,991 |

| Reclassified from equity (Hedge reserve) and included in profit or loss |

(256,138) |

(5,949) |

|

(217,778) |

111,221 |

| Total cash flow hedge |

(104,092) |

(38,800) |

|

(351,935) |

747,212 |

| |

|

|

|

|

|

| Items that will not be reclassified to profit or loss: |

|

|

|

|

|

| Re-measurements of post-employment benefits |

496 |

3,961 |

|

(365) |

(269) |

| |

|

|

|

|

|

| Other comprehensive (loss)/income |

3,955,746 |

(5,744,562) |

|

(1,503,687) |

152,515 |

| |

|

|

|

|

|

| Total comprehensive (loss)/income |

13,778,117 |

4,687,451 |

|

2,062,614 |

4,167,519 |

| |

|

|

|

|

|

| Attributable to: |

|

|

|

|

|

| Equity holders of Ambev |

13,453,868 |

4,433,195 |

|

1,999,486 |

4,027,481 |

| Non-controlling interest |

324,249 |

254,256 |

|

63,128 |

140,038 |

The consolidated statement of comprehensive income is presented net of income

tax. The income tax effects of these items are disclosed in note 8 –Income tax and social contribution.

The accompanying notes are an integral part of these interim consolidated financial statements.

INTERIM CONSOLIDATED STATEMENT OF CHANGES IN EQUITY

For the nine-month period ended September 30

All amounts in thousands of Brazilian Reais

| |

Equity attributable to Ambev’s holders |

|

|

|

| |

Issued capital |

Capital reserves |

Profit reserves |

Retained earnings |

Carrying value adjustments |

Total |

|

Non-controlling interests |

Total equity |

| At January 1, 2023 |

58,130,517 |

55,339,694 |

36,906,900 |

- |

(68,421,478) |

81,955,633 |

|

1,372,194 |

83,327,827 |

| |

|

|

|

|

|

|

|

|

|

| Net Income |

- |

- |

- |

10,114,289 |

- |

10,114,289 |

|

317,724 |

10,432,013 |

| |

|

|

|

|

|

|

|

|

|

| Comprehensive income: |

|

|

|

|

|

|

|

|

|

| Gains/(losses) on cumulative translation adjustment [CTA] |

- |

|

- |

- |

(5,647,643) |

(5,647,643) |

|

(62,080) |

(5,709,723) |

| Cash flow hedges |

- |

|

- |

- |

(37,590) |

(37,590) |

|

(1,210) |

(38,800) |

| Actuarial gains/(losses) |

- |

|

- |

- |

4,139 |

4,139 |

|

(178) |

3,961 |

| Total comprehensive income |

- |

- |

- |

10,114,289 |

(5,681,094) |

4,433,195 |

|

254,256 |

4,687,451 |

| Capital increase (note 14) |

47,412 |

(32,869) |

- |

- |

- |

14,543 |

|

- |

14,543 |

| Effect of application of IAS 29 (hyperinflation) |

- |

- |

- |

3,656,397 |

- |

3,656,397 |

|

9,556 |

3,665,953 |

| Options granted on subsidiaries |

- |

- |

- |

- |

6,666 |

6,666 |

|

- |

6,666 |

| Gains/(losses) of controlling interest |

- |

- |

- |

- |

811 |

811 |

|

- |

811 |

| Tax on deemed dividends |

- |

- |

- |

- |

(12,467) |

(12,467) |

|

- |

(12,467) |

| Dividends paid |

- |

- |

- |

- |

- |

- |

|

(331,215) |

(331,215) |

| Share buyback, results from treasury shares and share-based payments |

- |

200,122 |

- |

- |

- |

200,122 |

|

1,487 |

201,609 |

| At September 30, 2023 |

58,177,929 |

55,506,947 |

36,906,900 |

13,770,686 |

(74,107,562) |

90,254,900 |

|

1,306,278 |

91,561,178 |

The accompanying notes are an integral part of these interim consolidated

financial statements.

INTERIM CONSOLIDATED STATEMENT OF CHANGES IN EQUITY (CONTINUED)

For the nine-month period ended September 30

All amounts in thousands of Brazilian Reais

| |

Equity attributable to Ambev’s holders |

|

|

|

| |

Issued capital |

Capital reserves |

Profit reserves |

Retained earnings |

Carrying value adjustments |

Total |

|

Non-controlling interests |

Total equity |

| At January 1, 2024 |

58,177,929 |

55,479,564 |

43,189,840 |

- |

(77,878,043) |

78,969,290 |

|

1,174,512 |

80,143,802 |

| |

|

|

|

|

|

|

|

|

|

| Net Income |

- |

- |

- |

9,556,858 |

- |

9,556,858 |

|

265,513 |

9,822,371 |

| |

|

|

|

|

|

|

|

|

|

| Comprehensive income: |

|

|

|

|

|

|

|

|

|

| Gains/(losses) on cumulative translation adjustment [CTA] |

- |

|

- |

- |

3,998,332 |

3,998,332 |

|

61,010 |

4,059,342 |

| Cash flow hedges |

- |

|

- |

- |

(101,858) |

(101,858) |

|

(2,234) |

(104,092) |

| Actuarial gains/(losses) |

- |

|

- |

- |

536 |

536 |

|

(40) |

496 |

| Total comprehensive income |

- |

- |

- |

9,556,858 |

3,897,010 |

13,453,868 |

|

324,249 |

13,778,117 |

| Capital increase (note 14) |

48,107 |

- |

- |

- |

- |

48,107 |

|

- |

48,107 |

| Effect of application of IAS 29 (hyperinflation) |

- |

- |

- |

5,256,878 |

- |

5,256,878 |

|

10,589 |

5,267,467 |

| Gains/(losses) of controlling interest |

- |

1,958 |

- |

- |

517,291 |

519,249 |

|

(518,385) |

864 |

| Tax on deemed dividends |

- |

- |

- |

- |

(17,276) |

(17,276) |

|

- |

(17,276) |

| Dividends paid |

- |

- |

- |

- |

- |

- |

|

(248,391) |

(248,391) |

| Share buyback, results from treasury shares and share-based payments |

- |

(110,548) |

- |

- |

- |

(110,548) |

|

1,115 |

(109,433) |

| Prescribed/(complementary) dividends |

- |

- |

- |

20,820 |

- |

20,820 |

|

- |

20,820 |

| At September 30, 2024 |

58,226,036 |

55,370,974 |

43,189,840 |

14,834,556 |

(73,481,018) |

98,140,388 |

|

743,689 |

98,884,077 |

The accompanying notes are an integral part of these interim consolidated

financial statements.

INTERIM CONSOLIDATED STATEMENT OF CASH FLOWS

For the three and nine-month periods ended September 30

All amounts in thousands of Brazilian Reais

| |

|

Nine-month period ended: |

|

Three-month period ended: |

| |

Note |

2024 |

2023 |

|

2024 |

2023 |

| |

|

|

|

|

|

|

| Net income |

|

9,822,371 |

10,432,013 |

|

3,566,301 |

4,015,004 |

| Adjustments by: |

|

|

|

|

|

|

| Depreciation, amortization and impairment |

|

5,082,448 |

4,902,238 |

|

1,730,270 |

1,671,482 |

| Impairment losses on receivables and inventory |

|

245,746 |

272,126 |

|

68,443 |

87,934 |

| Additions/(reversals) in provisions and employee benefits |

|

210,409 |

107,301 |

|

79,366 |

35,216 |

| Net financial results |

19 |

1,703,692 |

2,909,242 |

|

681,525 |

837,896 |

| Losses/(gains) on sale of property, plant and equipment and intangible assets |

|

(74,887) |

(54,551) |

|

(32,998) |

(11,978) |

| Share-based payment expenses |

20 |

287,241 |

269,671 |

|

102,759 |

87,761 |

| Income tax expense |

8 |

2,754,357 |

(122,734) |

|

1,103,318 |

44,678 |

| Share of results of associates and joint ventures |

|

(1,822) |

15,163 |

|

(36,844) |

(1,440) |

| Hedge operations |

21.2 |

(374,885) |

(239,937) |

|

(345,416) |

1,367 |

| Other non-cash items included in profit |

|

- |

(9,031) |

|

- |

- |

| Cash flow from operating activities before changes in working capital |

|

19,654,670 |

18,481,501 |

|

6,916,724 |

6,767,920 |

| |

|

|

|

|

|

|

| (Increase)/decrease in trade and other receivables |

|

(264,803) |

(581,478) |

|

19,185 |

(373,086) |

| (Increase)/decrease in inventories |

|

(1,270,465) |

833,952 |

|

78,927 |

996,543 |

| Increase/(decrease) in trade and other payables |

|

(3,426,717) |

(5,612,067) |

|

946,601 |

273,352 |

| Cash generated from operations |

|

14,692,685 |

13,121,908 |

|

7,961,437 |

7,664,729 |

| |

|

|

|

|

|

|

| Interest paid |

|

(404,664) |

(552,361) |

|

(133,940) |

(264,494) |

| Interest received |

|

1,098,880 |

629,430 |

|

346,209 |

256,985 |

| Dividends received |

|

21,411 |

11,213 |

|

10,032 |

5,935 |

| Income tax paid |

|

(3,223,555) |

(2,447,773) |

|

(75,306) |

259,824 |

| Cash flow from operating activities |

|

12,184,757 |

10,762,417 |

|

8,108,432 |

7,922,979 |

| |

|

|

|

|

|

|

| Proceeds from sales of property, plant and equipment and intangible assets |

|

117,484 |

83,769 |

|

26,521 |

25,493 |

| Acquisitions of property, plant and equipment and intangible assets |

|

(3,229,988) |

(3,731,380) |

|

(1,186,002) |

(1,282,685) |

| Proceeds/(acquisitions) of subsidiaries, net of cash acquired |

|

3,373 |

(46,507) |

|

(186) |

(46,507) |

| Capital increase in associates and subsidiaries |

|

- |

(6,334) |

|

- |

2,087 |

| Investments in short-term debt securities and net proceeds/(acquisitions) of debt securities |

|

(877,164) |

191,231 |

|

32,060 |

91,488 |

| Net proceeds/(acquisitions) of other assets |

|

(6,424) |

- |

|

(6,424) |

- |

| Cash flow from/(used in) investing activities |

|

(3,992,719) |

(3,509,221) |

|

(1,134,031) |

(1,210,124) |

| |

|

|

|

|

|

|

| Capital increase |

|

17,486 |

14,543 |

|

- |

- |

| Capital increase/(decrease) of non-controlling interest |

|

(1,343) |

- |

|

(46) |

- |

| Proceeds/(buyback) treasury shares |

|

(367,555) |

(79,149) |

|

(228) |

(54,067) |

| Acquisitions of non-controlling interest |

|

(1,716,959) |

- |

|

- |

- |

| Proceeds from borrowings |

|

460,300 |

39,482 |

|

27,057 |

1,120 |

| Repayment of borrowings |

|

(557,375) |

(180,036) |

|

(49,534) |

(48,045) |

| Cash net of finance costs other than interests |

|

(1,741,399) |

(2,800,028) |

|

(647,635) |

(861,426) |

| Payment of lease liabilities |

|

(994,874) |

(827,594) |

|

(327,556) |

(314,250) |

| Dividends and interest on shareholders’ equity paid |

|

(187,504) |

(292,170) |

|

(89,948) |

(125,381) |

| Cash flow from/(used in) financing activities |

|

(5,089,223) |

(4,124,952) |

|

(1,087,890) |

(1,402,049) |

| |

|

|

|

|

|

|

| Net increase/(decrease) in cash and cash equivalents |

|

3,102,815 |

3,128,244 |

|

5,886,511 |

5,310,806 |

| Cash and cash equivalents less bank overdrafts at the beginning of the year |

|

16,059,003 |

14,852,092 |

|

14,154,434 |

12,013,065 |

| Effect of exchange rate fluctuations on cash and cash equivalents |

|

622,544 |

(567,860) |

|

(256,583) |

88,605 |

| Cash and cash equivalents less bank overdrafts at the end of the year |

|

19,784,362 |

17,412,476 |

|

19,784,362 |

17,412,476 |

The accompanying notes are an integral part of these interim consolidated financial statements.

1.1 Description of business

Ambev S.A. (referred to as the “Company” or “Ambev”)

together with its subsidiaries (the “Group” or “Consolidated”), headquartered in São Paulo - SP, Brazil,

has as its social purpose, either directly or through participation in other companies, the production and sale of beer, draft beer, soft

drinks, other non-alcoholic beverages, malt and food in general, as well as the advertising of its own and of third party products, the

sale of promotional and advertising materials and the direct or indirect exploitation of bars, restaurants, snack bars and similar establishments,

among others.

The Group portfolio includes several own brands, like Brahma®, Skol®,

Antarctica®, Original®, Colorado®, Bohemia®, Serramalte®, Quilmes®, Patagonia®, Guaraná Antarctica®,

Beats® among others, and licensed brands, like Budweiser®, Corona®, Stella Artois®, Spaten® Beck’s® and

Mike’s®.

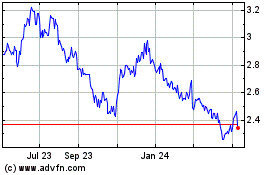

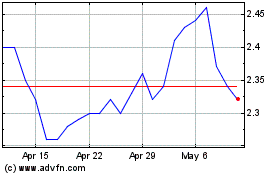

The Company’s shares and American Depositary Receipts (“ADRs”)

are listed on the Brasil, Bolsa, Balcão S.A. (“B3”), under the ticker “ABEV3” and on the New York Stock

Exchange (“NYSE”) under the ticker “ABEV”, respectively.

The Company’s direct controlling shareholders are Interbrew International

B.V. (“ITW International”), AmBrew S.à.r.l (“Ambrew”), both of which are subsidiaries of Anheuser-Busch

InBev N.V. (“AB InBev”).

| 2. | BASIS OF PREPARATION AND PRESENTATION OF THE INTERIM CONSOLIDATED

FINANCIAL STATEMENTS |

The interim consolidated financial statements on September 30, 2024 have

been prepared using the going-concern accounting basis and are being presented in accordance with IAS 34 – Interim Financial

Reporting as issued by the International Accounting Standards Board (“IASB®”).

The information does not meet all disclosure requirements for the presentation

of full annual consolidated financial statements and are disclosed with relevant information and changes in the period, without the level

of detail in certain accompanying notes previously disclosed, avoiding repetition which, in Management's opinion, provides an understanding

of the Company's equity position and performance during the interim period. Therefore, the consolidated interim financial statements should

be read in conjunction with the consolidated financial statements for the year ended December 31, 2023, prepared in accordance with International

Financial Reporting Standards (“IFRS®”) issued by the IASB®.

The following notes are not disclosed in the interim consolidated financial

statements:

| |

Name of accompanying note in annual financial statements |

Accompanying note |

| (a) |

Payroll and related benefits |

9 |

| (b) |

Additional information on cost of sales and operating expenses by nature |

10 |

| (c) |

Earnings per share |

12 |

| (d) |

Impairment of non-financial assets |

16 |

| (e) |

Intangibles |

17 |

| (f) |

Trade receivables |

20 |

| (g) |

Employee benefits |

24 |

In addition, the material accounting policies presented in the respective

accompanying notes are not disclosed in these interim consolidated financial statements. The following notes are not in the same level

of detail presented in the annual consolidated financial statements, for the year ended December 31, 2023:

| |

Name of accompanying note in annual financial statements |

Accompanying note |

| (a) |

Summary of material accounting policies |

3 |

| (b) |

Use of estimates and judgments |

4 |

| (c) |

Income tax and social contribution |

13 |

| (d) |

Goodwill |

15 |

| (e) |

Changes in equity |

22 |

| (f) |

Interest-bearing loans and borrowing |

23 |

| (g) |

Share-based payments |

25 |

| (h) |

Provisions, contingent liabilities and contingent asset |

27 |

| (i) |

Financial instruments and risks |

28 |

| (j) |

Related parties |

30 |

In preparing the interim consolidated financial statements, management uses

judgments, estimates and assumptions that affect the application of accounting practices and the reported amounts of assets, liabilities,

income and expenses. The relevant estimates and judgments are disclosed in note 4 - Use of estimates and judgments.

The interim consolidated financial statements were approved, in their

final form, by the Board of Directors on October 30, 2024.

2.1 Functional and presentation currency

The functional and presentation currency of the Company interim consolidated

financial statements is the Brazilian Real, which is the currency of its main economic operating environment. For presentation purposes,

the interim consolidated financial statements are presented in thousands of Brazilian Reais (“R$”), unless otherwise indicated,

rounded to the nearest thousand.

Foreign currency transactions are registered using the exchange rates prevailing

on the transaction dates. Monetary assets and liabilities denominated in foreign currencies are translated using the balance sheet date

rate. Non-monetary assets and liabilities denominated in foreign currencies are translated using the foreign exchange rate prevailing

as at the date of the transaction. Non-monetary assets and liabilities denominated in foreign currencies stated at fair value are translated

using the exchange rate in force as at the date on which the fair value was determined. Gains and losses arising from the settlement of

transactions in foreign currencies and resulting from the conversion of assets and liabilities denominated in foreign currencies are recognized

in the income statement.

Assets and liabilities of subsidiaries located abroad are translated using

the foreign exchange rates prevailing at the balance sheet date, while amounts from the income statement and cash flow are translated

utilizing the average exchange rate for the year, and changes in equity are translated at the historical exchange rate of each transaction.

Translation adjustments arising from the difference between the average exchange rates and the historical rates are recorded directly

in Carrying value adjustments.

In the consolidation process, exchange differences arising from the translation

of equity in foreign operations and borrowing and other currency instruments designated as net investment hedges are recognized in Carrying

value adjustments, an equity reserve, and included in Other comprehensive income.

Even when recorded in the acquiring entity, the goodwill and fair value adjustments

arising from the acquisition of a foreign entity are treated as assets and liabilities of the foreign entity and are translated at the

foreign exchange rate at the balance sheet date.

2.1.1 Exchange rates

The most significant exchange rates used for the preparation of the Company’s

interim consolidated financial statements are as follow:

| |

|

|

Closing rate |

|

Average rate |

| |

|

|

|

|

Nine-month period ended: |

|

Three-month period ended: |

| Currency |

Name |

Country |

09/30/2024 |

12/31/2023 |

|

09/30/2024 |

09/30/2023 |

|

06/30/2024 |

06/30/2023 |

| |

|

|

|

|

|

|

|

|

|

|

| ARS |

Argentinian Peso |

Argentina |

0.0056 |

0.0060 |

|

0.0058 |

0.0203 |

|

0.0058 |

0.0240 |

| BBD |

Barbadian Dollar |

Barbados |

2.6857 |

2.3866 |

|

2.5722 |

2.4717 |

|

2.4767 |

2.5225 |

| BOB |

Bolivian Peso |

Bolivia |

0.7828 |

0.6956 |

|

0.7497 |

0.7204 |

|

0.7218 |

0.7352 |

| CAD |

Canadian Dollar |

Canada |

4.0307 |

3.6536 |

|

3.8361 |

3.7174 |

|

3.7058 |

3.7682 |

| CLP |

Chilean Peso |

Chile |

0.0061 |

0.0055 |

|

0.0056 |

0.0061 |

|

0.0054 |

0.0063 |

| GTQ |

Quetzal |

Guatemala |

0.7089 |

0.6189 |

|

0.6718 |

0.6401 |

|

0.6455 |

0.6542 |

| USD |

US Dollar |

Panamá and Cuba |

5.4481 |

4.8413 |

|

5.2179 |

5.0140 |

|

5.0241 |

5.1171 |

| PYG |

Guarani |

Paraguay |

0.0007 |

0.0007 |

|

0.0007 |

0.0007 |

|

0.0007 |

0.0007 |

| DOP |

Dominican Peso |

Dominican Republic |

0.0904 |

0.0831 |

|

0.0883 |

0.0899 |

|

0.0853 |

0.0921 |

| UYU |

Uruguayan Peso |

Uruguay |

0.1308 |

0.1241 |

|

0.1330 |

0.1303 |

|

0.1297 |

0.1311 |

| 3. | SUMMARY OF MATERIAL ACCOUNTING POLICIES |

The accounting practices adopted by the Company are consistent in the both

years presented. There were no changes in the accounting policies and calculation methods used for the interim

consolidated financial statements as at September 30, 2024 compared to those presented in the consolidated financial statements for the

years ended December 31, 2023.

3.1 Recently issued IFRS

The changes in standards and new standards,

which became effective in 2024 are not applicable or did not have any material impact in

these consolidated financial statements. The main changes in accounting standards which, in management's assessment, could possibly

generate an impact on subsequent disclosures follows:

| (i) | In December 2021, the Organisation for Economic Cooperation and Development

("OECD"), as part of the Inclusive Framework on Base Erosion and Profit Shifting ("BEPS") project, released the Global

Model Rules Against Base Erosion (or Global Anti-Base Erosion Model Rules - GloBE), part of “Pilar Two” project, aiming at

a common approach to international corporate taxation, in order to ensure that multinational economic groups within the scope of these

rules calculate income taxes at a minimum effective rate of 15% in each country where it operates. These rules will have to be approved

locally in each country that adheres to the proposal, via applicable legislation. A few countries in which the company operates have already

promulgated new laws or are in the process of discussing and approving them. |

In May 2023, the IASB® issued scope changes to IAS 12 –

Income Taxes that allows a temporary exemption in accounting for deferred income taxes arising from promulgated or substantially

promulgated legislation implementing OECD Pillar Two, an exemption which has been adopted by the Group.

In the Group's case, the Pillar Two

Rules are effective in 2024 in some jurisdictions without material impacts in the interim financial statements as of September

30, 2024. In Brazil, on October 3, 2024, after the period ended, were published the Provisional Measure

No. 1.262/24 and RFB Normative Instruction No. 2.228/24, effective as of January 1, 2025, with has the purpose of adapting Brazilian tax

legislation to the Global Anti-Base Erosion Model Rules (GloBE rules) and implementing the additional Social Contribution on Net Income

(CSLL), to establish a minimum effective tax rate of 15%. The Company's analysis of the potential impacts of this new legislation on its

financial statements is in progress.

| (ii) | In August 2023, IASB®

issued amendments to IAS 21 – The Effects of Changes in Foreign Exchange Rates. The modifications implemented provides the

application of a consistent approach when assessing whether a currency is exchangeable for another currency as well as new guidelines

on measurement and disclosure in contexts where the currency is not considered exchangeable. The Company is evaluating potential impacts

from these amendments, which is required to be adopted for annual reporting periods beginning on or after 1 January 2025. |

| (iii) | In April 2024, IASB® issued the IFRS 18 - Presentation

and Disclosure in Financial Statements. This standard will replace IAS 1 - Presentation of Financial Statements, for the preparation

of financial statements beginning on or after January 1, 2027. The standard intends to address investor demands for more relevant and

comparable information disclosed in entities' financial statements. IFRS 18 introduces changes to the income statement with three new

categories of income and expenses - operating, investing, and financing - two mandatory subtotals, and changes in the grouping of balances.

Additionally, it introduces mandatory disclosures in the notes on management-defined performance measures, changes to the statement of

cash flows, and new requirements for presenting expenses by nature or function. The Group is currently assessing the impacts of adopting

this standard on its consolidated financial statements. |

Regarding the amendments to IAS 7 – Statement of Cash Flows

and IFRS 7 – Financial Instruments: Disclosures, which establish new disclosure requirements for financing transactions with

suppliers, the so-called "Supplier Finance Arrangements". The Group has evaluated the changes and has not identified the necessity

for additional disclosures in its consolidated financial statements.

In addition, there are no other standards, standard changes or IFRIC interpretations

that still haven’t been in force and that may have a material impact in entity’s consolidated financial statements. The company

also has not adopted any standards in advance.

| 4. | USE OF ESTIMATES AND JUDGMENTS |

The preparation of interim consolidated financial statements in compliance

with IFRS requires Management to make use of judgments, estimates and assumptions that affect the application of accounting practices

and the reported amounts of assets and liabilities, income and expenses. The estimates and assumptions are based on past experience and

several other factors that are believed to be reasonable under the circumstances, the results of which form the basis for decision-making

regarding judgments relating to the carrying amounts of assets and liabilities that are not readily evident from other sources. The actual

results may differ from these estimates.

The estimates and assumptions are reviewed on a regular basis. Changes in

accounting estimates may affect the period during which they are realized, or future periods.

The accounting policy which reflects significant estimates and judgments

used in the preparation of these interim consolidated financial statements for the nine-month period ended September 30, 2024 have not

changed from those valid on December 31, 2023.

| 5. | CASH AND CASH EQUIVALENTS AND INVESTMENT SECURITIES |

5.1 Cash and equivalents

| |

09/30/2024 |

12/31/2023 |

| |

|

|

| Cash |

137,928 |

267,077 |

| Current bank accounts |

8,578,606 |

6,818,336 |

| Short-term bank deposits (i) |

11,067,828 |

8,973,590 |

| Cash and cash equivalents |

19,784,362 |

16,059,003 |

(i) The balance refers mostly to Bank Deposit Certificates (“CDBs”),

high liquidity bonds, which are readily convertible into known amounts of cash, and which are subject to an insignificant risk of change

in value.

The cash and cash equivalents balance includes the amount of R$3,664 million

as at September 30, 2024 (R$3,768 million in December 31, 2023), which is not freely transferable to the parent company due to remittance

restrictions in Cuba and Argentina, although available for use in the local operations of the subsidiaries in question.

5.2 Investment securities

| |

09/30/2024 |

12/31/2023 |

| |

|

|

| Financial assets at fair value through profit or loss |

1,154,677 |

277,164 |

| Current assets |

1,154,677 |

277,164 |

| |

|

|

| Investment on debt securities (i) |

248,018 |

242,168 |

| Non-current assets |

248,018 |

242,168 |

| |

|

|

| Total |

1,402,695 |

519,332 |

(i) The balance refers substantially to financial investments linked to tax

incentives that are not readily convertible into a known amount of cash.

| |

09/30/2024 |

12/31/2023 |

| |

|

|

| Finished goods |

4,188,336 |

2,990,337 |

| Work in progress |

766,846 |

826,520 |

| Raw materials and consumables |

4,661,081 |

4,599,874 |

| Spare parts and others |

974,041 |

806,867 |

| Prepayments |

629,180 |

537,871 |

| Impairment losses |

(126,140) |

(142,447) |

| |

11,093,344 |

9,619,022 |

The changes in impairment losses on inventory are as follows:

| |

09/30/2024 |

12/31/2023 |

| Balance at the end of the previous year |

(142,447) |

(160,173) |

| Effects of cumulative translation adjustment (CTA) |

(9,665) |

12,932 |

| Provisions |

(176,132) |

(262,884) |

| Write-offs |

202,104 |

267,678 |

| Balance at the end of the period |

(126,140) |

(142,447) |

| |

09/30/2024 |

12/31/2023 |

| PIS/COFINS exclusion of ICMS (i) |

287,179 |

219,010 |

| PIS/COFINS |

69,585 |

170,426 |

| ICMS |

357,021 |

426,936 |

| IPI |

120,676 |

112,541 |

| Income tax and social contributions |

1,536,252 |

2,436,614 |

| Other |

100,912 |

70,161 |

| Current |

2,471,625 |

3,435,688 |

| |

|

|

| PIS/COFINS exclusion of ICMS (i) |

6,695,512 |

6,490,398 |

| ICMS |

378,209 |

436,508 |

| Income tax and social contributions |

3,870,133 |

4,087,032 |

| Other |

320,945 |

311,158 |

| Non-current |

11,264,799 |

11,325,096 |

| |

|

|

| Total |

13,736,424 |

14,760,784 |

(i)

Over the last few years, as disclosed in the respective annual consolidated financial statements, the Company recognized at the income

statement PIS and COFINS credits arising from the exclusion of ICMS, including

in the form of tax substitution, from the calculation basis. The effect of that entry impacts the balance sheet, in the item Recoverable

PIS/COFINS – exclusion of ICMS, according to the table above.

| 8. | INCOME TAX AND SOCIAL CONTRIBUTION |

8.1 Deferred income tax and social contribution

The details of the amount of deferred income tax and social contribution

by type of temporary difference are as follows:

| |

09/30/2024 |

|

12/31/2023 |

| |

Assets |

Liabilities |

Net |

|

Assets |

Liabilities |

Net |

| Investment securities |

8,147 |

- |

8,147 |

|

8,231 |

- |

8,231 |

| Intangible |

- |

(1,904,063) |

(1,904,063) |

|

- |

(1,369,738) |

(1,369,738) |

| Employee benefits |

915,866 |

- |

915,866 |

|

856,512 |

- |

856,512 |

| Trade payables |

3,401,435 |

- |

3,401,435 |

|

2,843,806 |

(3,281) |

2,840,525 |

| Trade receivables |

32,671 |

(5,186) |

27,485 |

|

43,807 |

(7,002) |

36,805 |

| Derivative financial instruments |

31,040 |

(115,513) |

(84,473) |

|

31,091 |

(77,210) |

(46,119) |

| Interest-bearing loans and borrowings |

8,411 |

- |

8,411 |

|

7,518 |

- |

7,518 |

| Inventories |

61,521 |

(112,288) |

(50,767) |

|

268,589 |

(59,561) |

209,028 |

| Property, plant and equipment |

1,053,481 |

(2,333,388) |

(1,279,907) |

|

714,218 |

(1,837,179) |

(1,122,961) |

| Withholding tax on undistributed profits and royalties |

- |

(1,849,673) |

(1,849,673) |

|

- |

(1,385,500) |

(1,385,500) |

| Investments in associates and joint ventures |

- |

(383,678) |

(383,678) |

|

- |

(383,678) |

(383,678) |

| Interest on shareholders’ equity |

881,777 |

- |

881,777 |

|

- |

- |

- |

| Tax losses carryforward |

4,064,849 |

- |

4,064,849 |

|

4,383,261 |

- |

4,383,261 |

| Provisions |

1,352,230 |

(14,408) |

1,337,822 |

|

1,026,343 |

(4,637) |

1,021,706 |

| Complement of income tax of foreign subsidiaries due in Brazil |

- |

(136,628) |

(136,628) |

|

- |

- |

- |

| Impact of the adoption of IFRS 16 (Leases) |

- |

(40,065) |

(40,065) |

|

14,484 |

(19,679) |

(5,195) |

| Exclusion of ICMS from PIS/COFINS calculation basis |

- |

(75,842) |

(75,842) |

|

- |

(228,510) |

(228,510) |

| Other items |

257,780 |

(527,752) |

(269,972) |

|

266,340 |

(437,081) |

(170,741) |

| Gross deferred tax assets/(liabilities) |

12,069,208 |

(7,498,484) |

4,570,724 |

|

10,464,200 |

(5,813,056) |

4,651,144 |

| Netting by taxable entity |

(2,930,969) |

2,930,969 |

- |

|

(2,494,608) |

2,494,608 |

- |

| Net deferred tax assets/(liabilities) |

9,138,239 |

(4,567,515) |

4,570,724 |

|

7,969,592 |

(3,318,448) |

4,651,144 |

Among the deferred tax assets on tax losses carryforward, the tax authorities

unilaterally offset in tax proceedings the total amount of R$268,602 (R$268,602 in December 31, 2023), which is equivalent to R$790,005

(R$790,005 in December 31, 2023) in tax losses basis. Such proceedings are classified as having a possible likelihood of loss.

8.1.1 Realization of deferred taxes

As at September 30, 2024 the deferred tax assets and liabilities are expected

to be utilized/settled, as follows:

| |

09/30/2024 |

| Deferred taxes not related to tax losses |

to be realized until 12 months |

to be realized after 12 months |

Total |

| |

|

|

|

| Investment securities |

- |

8,147 |

8,147 |

| Intangible |

- |

(1,904,063) |

(1,904,063) |

| Employee benefits |

223,967 |

691,899 |

915,866 |

| Trade payables |

(55,958) |

3,457,393 |

3,401,435 |

| Trade receivables |

23,393 |

4,092 |

27,485 |

| Derivative financial instruments |

(86,560) |

2,087 |

(84,473) |

| Interest-bearing loans and borrowings |

- |

8,411 |

8,411 |

| Inventories |

(49,429) |

(1,338) |

(50,767) |

| Property, plant and equipment |

16,166 |

(1,296,073) |

(1,279,907) |

| Withholding tax on undistributed profits and royalties |

- |

(1,849,673) |

(1,849,673) |

| Investments in associates and joint ventures |

- |

(383,678) |

(383,678) |

| Interest on shareholders’ equity |

881,777 |

- |

881,777 |

| Provisions |

597,922 |

739,900 |

1,337,822 |

| Complement of income tax of foreign subsidiaries due in Brazil |

(136,628) |

- |

(136,628) |

| Impact of the adoption of IFRS 16 (Leases) |

- |

(40,065) |

(40,065) |

| Exclusion of ICMS from PIS/COFINS calculation basis |

- |

(75,842) |

(75,842) |

| Other items |

(124,549) |

(145,423) |

(269,972) |

| Total |

1,290,101 |

(784,226) |

505,875 |

| Deferred tax related to tax losses carryforward |

09/30/2024 |

| 2025 |

373,730 |

| 2026 |

1,509,387 |

| 2027 |

787,200 |

| 2028 to 2030 |

1,049,307 |

| 2031 onward (i) |

345,225 |

| Total |

4,064,849 |

(i) The Company has no tax losses expected to be realized in more than 10

years.

8.1.2 Changes in deferred taxes

The net change in deferred income tax and social contribution is detailed

as follows:

| At December 31, 2023 |

4,651,144 |

| Recognition of actuarial gains/(losses) |

(92) |

| Cash flow hedge – gains/(losses) |

(206,991) |

| Gains/(losses) on cumulative translation adjustment [CTA] |

622,819 |

| Recognized in other comprehensive income |

415,736 |

| Recognized in the income statement |

636,039 |

| Changes directly in the balance sheet |

(1,132,195) |

| Recognized in deferred tax |

(726,753) |

| Effect of application of IAS 29 (hyperinflation) |

(726,753) |

| Recognized in other balance sheet group |

(405,442) |

| At September 30, 2024 |

4,570,724 |

8.1.3 Deferred tax asset related to tax losses

As of September 30, 2024, besides the tax credits related to tax losses carryforward

effectively recognized in the amounts disclosed above, other tax credits related to tax losses carryforward were not recorded, since their

realization is not probable in currently Management evaluation. The accumulated amount represents R$834,599 (R$669,024 in December 31,

2023) - which is equivalent, in value basis, to R$3,183,482 at September 30, 2024 (R$2,521,047 in December 31, 2023).

8.2 Income tax and social contribution

Income taxes reported in the income statement are analyzed as follows:

| |

Nine-month period ended: |

|

Three-month period ended: |

| |

09/30/2024 |

09/30/2023 |

|

09/30/2024 |

09/30/2023 |

| Income tax expense – current |

(3,390,396) |

(2,790,108) |

|

(1,277,530) |

(1,269,706) |

| |

|

|

|

|

|

| Deferred tax expense on temporary differences |

954,451 |

2,732,018 |

|

27,978 |

1,323,060 |

| Deferred tax on tax loss carryforward movements in the current period |

(318,412) |

180,824 |

|

146,234 |

(98,032) |

| Total deferred tax (expense)/income |

636,039 |

2,912,842 |

|

174,212 |

1,225,028 |

| |

|

|

|

|

|

| Total income tax expenses |

(2,754,357) |

122,734 |

|

(1,103,318) |

(44,678) |

The reconciliation between the weighted nominal tax rate and the effective

tax rate is summarized as follows:

| |

Nine-month period ended: |

|

Three-month period ended: |

| |

09/30/2024 |

09/30/2023 |

|

09/30/2024 |

09/30/2023 |

| Profit before income tax |

12,576,728 |

10,309,279 |

|

4,669,619 |

4,059,682 |

| Adjustment on a taxable basis |

|

|

|

|

|

| Others non-taxable income |

(376,439) |

(622,435) |

|

(122,530) |

(131,521) |

| Government grants related to excise duties |

(27,819) |

(2,173,355) |

|

(27,819) |

(769,185) |

| Share of results of associates and joint ventures |

(1,822) |

15,163 |

|

(36,844) |

(1,440) |

| Non-deductible expenses |

49,925 |

31,518 |

|

15,125 |

11,924 |

| Foreign profit calculation |

(30,084) |

422,581 |

|

36,013 |

161,926 |

| |

12,190,489 |

7,982,751 |

|

4,533,564 |

3,331,386 |

| Aggregated weighted nominal tax rate |

28.57% |

28.97% |

|

27.22% |

29.65% |

| Taxes payable – nominal rate |

(3,483,053) |

(2,312,373) |

|

(1,233,924) |

(987,677) |

| Adjustment on tax expense |

|

|

|

|

|

| Income tax incentives |

399,534 |

77,282 |

|

75,263 |

29,604 |

| Deductible interest on shareholders’ equity |

874,698 |

2,758,884 |

|

363,660 |

1,082,183 |

| Tax savings from goodwill amortization |

2,689 |

12,868 |

|

896 |

4,289 |

| Withholding income tax |

(564,870) |

(222,846) |

|

(154,958) |

(122,082) |

| Recognition/(write-off) of deferred charges on tax losses |

(105,234) |

29,102 |

|

(73,809) |

123,485 |

| Effect of application of IAS 29 (hyperinflation) |

57,222 |

(409,960) |

|

(294) |

(152,379) |

| Others with reduced taxation |

64,657 |

189,777 |

|

(80,152) |

(22,101) |

| Income tax and social contribution expense |

(2,754,357) |

122,734 |

|

(1,103,318) |

(44,678) |

| Effective tax rate |

21.90% |

-1.19% |

|

23.63% |

1.10% |

The main events that impacted the effective tax rate for the period were:

| · | Government grants for excise duties: Related to regional

incentives and economic development policies, these are related primarily to local production, contributing to economic and social

impact, and, when reinvested, were not subject to income tax and social contribution, before the advent of Federal Law 14.789/2023,

which explains the relevant impact on the effective tax rate in the comparative period. In this regard, since August 2024, the

group's companies have been obtaining favorable preliminary injunctions in their operations

in Brazil that exempt them from paying IRPJ/CSLL on the amounts calculated as government grants for investment related to tax benefits

known as presumed ICMS credits. The amounts described in this line are usually impacted by fluctuations in the volume, price and any eventual

increases in state VAT (“ICMS”), reflected in other operating income or net sales depending on its nature. At the end of 2023,

the amounts related to tax incentives were allocated to the profit reserve, according to note 14 –

Changes in equity. |

| · | Foreign profit calculation: shows complement of income tax on foreign

subsidiaries due in Brazil according to the regulations of Law No. 12,973/14 and taxable adjustments of the foreign companies consolidated

in the group. |

| · | Income tax incentive: refers mainly to income tax incentives granted

by the Federal Government to promote regional development in some areas of the North and Northeast of the country. These incentives are

recorded in the income statement on an accrual basis and allocated to the tax incentive reserves account, in accordance with item (14.3.1)

"Tax incentives" of note 14 – Changes in equity. |

| · | Withholding income tax: The amount is mainly related to dividends already

distributed or to be distributed by subsidiaries located outside of Brazil, applicable according to local tax legislation. The recorded

values in 2024 are mainly related to withholding tax on dividends distributed in 2024 and the exchange rate variation of the deferred

income tax related to subsidiary profits undistributed. |

| · | Deductible interest on shareholders’ equity (or

Interest on Capital – “IOC”): under Brazilian law, companies have an option to remunerate their shareholders

through the payment of Interest on shareholders’ equity, which amount is impacted by the taxable result, profit reserves of the

Company and by the long-term interest rate (“TJLP”). These remunerations are deductible for income tax purposes. On December

29, 2023, the Federal Law No. 14,789/23 was enacted, effective as of January 1, 2024, which limited, as from that date, the equity accounts

that could be used in the interest on shareholders’ equity calculation basis. |

| · | Effect of application of IAS 29 (hyperinflation): our subsidiary in

Argentina, which operates in a hyperinflationary economy, is subject to monetary correction of non-financial assets and liabilities, equity

and income statement, which, at times, reflects in the consolidated effective tax rate and implies variation between periods. |

| 9. | PROPERTY, PLANT AND EQUIPMENT |

| |

09/30/2024 |

12/31/2023 |

| Property, plant and equipment |

25,803,212 |

23,662,728 |

| Right of use assets |

2,964,365 |

2,967,428 |

| |

28,767,577 |

26,630,156 |

9.1 Changes in the carrying amount of

property, plant, and equipment

| |

|

|

|

|

|

|

|

|

|

Carrying amount |

| |

At December 31, 2022 |

Cumulative translation adjustment (CTA) |

Effects of application of IAS 29 (hyperinflation) |

Acquisitions |

Depreciation |

Disposals and write-offs |

Transfers |

At December 31, 2023 |

|

Acquisition cost |

Depreciation |

| Land and buildings |

9,698,425 |

(1,485,238) |

663,123 |

44,741 |

(481,587) |

(3,738) |

800,535 |

9,236,261 |

|

14,287,840 |

(5,051,579) |

| Plant and equipment |

11,589,556 |

(1,726,730) |

779,390 |

1,230,174 |

(3,533,364) |

(39,135) |

2,488,955 |

10,788,846 |

|

39,509,056 |

(28,720,210) |

| Fixtures and accessories |

1,323,571 |

(193,404) |

86,460 |

56,419 |

(541,605) |

(13,471) |

373,702 |

1,091,672 |

|

7,074,126 |

(5,982,454) |

| Under construction |

4,349,748 |

(311,718) |

120,197 |

3,283,918 |

- |

(3,391) |

(4,892,805) |

2,545,949 |

|

2,545,949 |

- |

| |

26,961,300 |

(3,717,090) |

1,649,170 |

4,615,252 |

(4,556,556) |

(59,735) |

(1,229,613) |

23,662,728 |

|

63,416,971 |

(39,754,243) |

| |

|

|

|

|

|

|

|

|

|

Carrying amount |

| |

At December 31, 2023 |

Cumulative translation adjustment (CTA) |

Effects of application of IAS 29 (hyperinflation) |

Acquisitions |

Depreciation |

Disposals and write-offs |

Transfers |

At September 30, 2024 |

|

Acquisition cost |

Depreciation |

| Land and buildings |

9,236,261 |

247,632 |

955,867 |

16,427 |

(369,658) |

(21,888) |

444,331 |

10,508,972 |

|

16,251,037 |

(5,742,065) |

| Plant and equipment |

10,788,846 |

282,418 |

1,018,426 |

489,051 |

(2,804,903) |

(5,037) |

1,701,416 |

11,470,217 |

|

45,507,098 |

(34,036,881) |

| Fixtures and accessories |

1,091,672 |

27,458 |

78,408 |

29,209 |

(391,203) |

(20,714) |

81,093 |

895,923 |

|

7,913,660 |

(7,017,737) |

| Under construction |

2,545,949 |

68,167 |

141,502 |

2,402,967 |

- |

- |

(2,230,485) |

2,928,100 |

|

2,928,100 |

- |

| |

23,662,728 |

625,675 |

2,194,203 |

2,937,654 |

(3,565,764) |

(47,639) |

(3,645) |

25,803,212 |

|

72,599,895 |

(46,796,683) |

9.2 Changes in the carrying amount

of right-of-use assets

| |

|

|

|

|

|

|

|

|

|

Carrying amount |

| |

At December 31, 2022 |

Cumulative translation adjustment (CTA) |

Effects of application of IAS 29 (hyperinflation) |

Additions |

Depreciation |

Disposals and write-offs |

Transfers |

At December 31, 2023 |

|

Acquisition cost |

Depreciation |

| Buildings |

1,350,836 |

(49,482) |

11,951 |

343,028 |

(451,693) |

(30,532) |

(1,842) |

1,172,266 |

|

2,925,946 |

(1,753,680) |

| Machinery, vehicles and others |

1,743,554 |

(32,731) |

15,496 |

1,313,799 |

(773,939) |

(475,532) |

4,515 |

1,795,162 |

|

3,534,476 |

(1,739,314) |

| Total |

3,094,390 |

(82,213) |

27,447 |

1,656,827 |

(1,225,632) |

(506,064) |

2,673 |

2,967,428 |

|

6,460,422 |

(3,492,994) |

| |

|

|

|

|

|

|

|

|

|

Carrying amount |

| |

At December 31, 2023 |

Cumulative translation adjustment (CTA) |

Effects of application of IAS 29 (hyperinflation) |

Additions |

Depreciation |

Disposals and write-offs |

Transfers |

At September 30, 2024 |

|

Acquisition cost |

Depreciation |

| Buildings |

1,172,266 |

50,393 |

5,778 |

296,597 |

(314,788) |

(22,338) |

(3,023) |

1,184,885 |

|

3,216,733 |

(2,031,848) |

| Machinery, vehicles and others |

1,795,162 |

22,780 |

20,715 |

609,709 |

(659,456) |

(8,359) |

(1,071) |

1,779,480 |

|

4,186,706 |

(2,407,226) |

| Total |

2,967,428 |

73,173 |

26,493 |

906,306 |

(974,244) |

(30,697) |

(4,094) |

2,964,365 |

|

7,403,439 |

(4,439,074) |

| |

09/30/2024 |

12/31/2023 |

| |

|

|

| Balance at the end of the previous year |

38,003,640 |

40,594,038 |

| Effects of cumulative translation adjustment (CTA) |

1,706,064 |

(4,067,916) |

| Effect of application of IAS 29 (hyperinflation) |

2,148,278 |

1,481,136 |

| Acquisitions, (write-offs) and disposal through business combinations |

35,415 |

(3,618) |

| Balance at end of the period |

41,893,397 |

38,003,640 |

Impairment testing

The impairment test is performed annually considering the most accurate estimates

calculated by Management. The Company’s Management has not identified any relevant indications of impairment in the nine-month period

ended September 30, 2024.

| |

09/30/2024 |

12/31/2023 |

| |

|

|

| Trade payables |

19,077,242 |

21,278,615 |

| Related parties (note 23) |

1,994,605 |

1,916,486 |

| Current |

21,071,847 |

23,195,101 |

| |

|

|

| Trade payables |

113,281 |

107,386 |

| Related parties (note 23) |

230,144 |

199,914 |

| Non-current |

343,425 |

307,300 |

| |

|

|

| Total |

21,415,272 |

23,502,401 |

The present value adjustment recorded for trade payables, at September 30,

2024 is R$201 million (R$308 million at December 31, 2023).

The subsidiaries in Argentina, Chile, Paraguay and Panama have discounted

trade payables with endorsement (trade payables securitization) with vendors in the amount of R$85 million at September 30, 2024 (R$159

million at December 31, 2023). In general, abovementioned discount transactions occur by legal impositions existing in these jurisdictions.

These transactions maintain their commercial characteristics since there are no change in previously established conditions (amount, terms,

and counterpart) and its vendor’s choice to carry out the anticipation of its receivables with the Company, therefore, these operations

do not result in any additional obligations for the Company.

| 12. | INTEREST-BEARING LOANS AND BORROWINGS |

| |

09/30/2024 |

12/31/2023 |

| |

|

|

| Secured bank loans |

20,507 |

14,938 |

| Other secured loans |

137,143 |

136,269 |

| Lease liabilities |

1,053,439 |

1,146,884 |

| Current liabilities |

1,211,089 |

1,298,091 |

| |

|

|

| Secured bank loans |

96,940 |

111,628 |

| Other secured loans |

231,824 |

279,401 |

| Lease liabilities |

1,840,420 |

1,811,946 |

| Non-current liabilities |

2,169,184 |

2,202,975 |

| |

|

|

| Total |

3,380,273 |

3,501,066 |

Additional information regarding the exposure of the Company to interest

rate, foreign currency risk and debt repayment schedule is disclosed in note 21 - Financial instruments and risks.

12.1 Contractual clauses (Covenants)

In the nine-month period ended September 30, 2024, as well as at December

31, 2023 and until the date of issue of these interim consolidated financial statements there were no events of default, breach of covenant

clauses or significant contractual changes that would result in changes to the payment terms of loan and financing contracts.

12.2 Terms and discount rates of leasing contracts

The Company estimates discount rates based on risk-free interest rates observed

in the Brazilian market, for the terms of its contracts, adjusted to their reality (credit spread). Spreads were obtained with financial

institutions. The following table shows the weighted average of rates applied considering the terms of the existing contracts:

| |

Rate % |

| Lease Term |

09/30/2024 |

| 2024 - 2027 |

11.08% |

| 2028 – 2035 |

11.26% |

| 13. | PROVISIONS, CONTINGENT LIABILITIES AND CONTINGENT ASSETS |

The Company and its subsidiaries are involved in administrative and judicial

proceedings and arbitrations arising from the normal course of business. The assessment of the probability of loss, carried out by the

Company with the support of its legal advisors, considers the probability of the Company position being accepted at the end of the process,

considering the applicable legislation, the case law on the subject and the existing evidence. Due to their nature, these legal proceedings

involve inherent uncertainties, including, but not limited to, courts rulings negotiations between affected parties and governmental actions

and, as a consequence, Ambev's Management cannot, at this stage, estimate the likely timing of resolution of these matters.

13.1 Provision

The Company and some of its subsidiaries are involved in lawsuits, mainly

of a tax, civil and labor nature, which are considered probable of loss, and which are fully provisioned, under the terms of IAS 37 -

Provisions, Contingent Liabilities and Contingent Assets. Legal proceedings are considered with a probable likelihood of loss when

there is consolidated or binding case law unfavorable to the thesis defended by the Company and its subsidiaries, or, in the case of a

factual or evidentiary discussion, when the Company and its subsidiaries do not have the necessary and sufficient evidence to prove the

right alleged.

13.1.1 Main legal proceedings with a probable likelihood

of loss:

Excise duties: in Brazil, the

Company and its subsidiaries are parties to various administrative and judicial proceedings related to ICMS, IPI, PIS and COFINS taxes,

considered as probable likelihood of loss. Such proceedings include, among others, tax offsetting, appropriation of tax credits and alleged

insufficient payment of the respective taxes.

Labor: the Company and its subsidiaries

are parties to labor proceedings with former employees, including former employees of service providers companies. The main issues involve

overtime and related effects and respective charges.

Civil: the Company and its subsidiaries

are involved in civil proceedings considered as representing a probable likelihood of loss. The most relevant portion of these lawsuits

refers to former distributors, mainly in Brazil, mostly claiming damages resulting from the termination of their contracts.

13.1.2 Provision changes

| |

Excise duties |

Labor |

Civil |

Other taxes (i) |

Restructuring |

Total |

| |

|

|

|

|

|

|

| Balance at December 31, 2022 |

246,948 |

132,101 |

335,934 |

192,929 |

11,797 |

919,709 |

| Effect of cumulative translation adjustment (CTA) |

- |

(2,774) |

(35,824) |

(6,283) |

(506) |

(45,387) |

| Additions |

135,768 |

247,769 |

234,556 |

75,635 |

3,190 |

696,918 |

| Provisions consumed |

(27,321) |

(181,662) |

(121,944) |

(40,777) |

(11,211) |

(382,915) |

| Provisions reversed |

(73,223) |

(45,497) |

(72,545) |

(19,057) |

- |

(210,322) |

| Balance at December 31, 2023 |

282,172 |

149,937 |

340,177 |

202,447 |

3,270 |

978,003 |

| Effect of cumulative translation adjustment (CTA) |

- |

288 |

(613) |

5,432 |

393 |

5,500 |

| Additions |

75,544 |

201,381 |

117,269 |

22,725 |

17,293 |

434,212 |

| Provisions consumed |

(2,430) |

(132,526) |

(22,638) |

(5,759) |

(16,388) |

(179,741) |

| Provisions reversed |

(48,245) |

(38,485) |

(23,079) |

(6,845) |

- |

(116,654) |

| Balance at September 30, 2024 |

307,041 |

180,595 |

411,116 |

218,000 |

4,568 |

1,121,320 |

(i) Other taxes refer to provisions for legal proceedings concerning taxes

other than excise duties and income taxes. The uncertain tax treatments related to income taxes with

a prognosis of probable loss have their value reported directly in the income tax and social contribution payable, as per IFRIC 23 - Uncertainty

on the Treatment of Income Taxes.

13.1.3 Expected settlement

| |

12/31/2023 |

| |

Excise duties |

Labor |

Civil |

Other taxes (i) |

Restructuring |

Total |

| Current |

113,652 |

67,248 |

226,736 |

7,483 |

3,270 |

418,389 |

| Non-current |

168,520 |

82,689 |

113,441 |

194,964 |

- |

559,614 |

| Total |

282,172 |

149,937 |

340,177 |

202,447 |

3,270 |

978,003 |

| |

09/30/2024 |

| |

Excise duties |

Labor |

Civil |

Other taxes (i) |

Restructuring |

Total |

| Current |

188,823 |

60,322 |

226,880 |

19,737 |

4,568 |

500,330 |

| Non-current |

118,218 |

120,273 |

184,236 |

198,263 |

- |

620,990 |

| Total |

307,041 |

180,595 |

411,116 |

218,000 |

4,568 |

1,121,320 |

(i) Other taxes refer to provisions for legal proceedings concerning taxes

other than excise duties and income taxes. The uncertain tax treatments related income taxes with a prognosis of probable loss have their

value reported directly in the income tax and social contribution payable, as per IFRIC 23 - Uncertainty on the Treatment of Income

Taxes.

The expected settlement of provisions was based on management’s best