Westport Fuel Systems Inc. (“

Westport") (TSX:WPRT

/ Nasdaq:WPRT), a leading supplier of advanced alternative fuel

systems and components for the global transportation industry,

reported financial results for the third quarter ended

September 30, 2024, and provided an update on operations. All

figures are in U.S. dollars unless otherwise stated.

“Westport delivered solid results in the third

quarter of 2024. Although revenue was down, this decrease was more

than outweighed by the revenue earned at Cespira and we delivered

significant improvement in Adjusted EBITDA. We continue to execute

against our three strategic pillars - harnessing the potential of

our HPDI joint venture, enhancing operational excellence, and

driving continuous innovation to shape the world’s alternative

fueled future. The third quarter represented the first full

quarter with Cespira, our HPDI joint venture with Volvo Group,

being operational. This, along with the steps we have taken with

respect to various cost cutting measures, has enabled Westport to

decrease our costs including research and development as well as

sales, general and administrative expenses by approximately 40

percent as compared to the same period last year.

We remain confident in the role that alternative

fuels will play in driving sustainability in the future of the

transportation and industrial application space. Regarding

hydrogen, we acknowledge the slowdown in infrastructure development

in the global market, which has tapered the adoption of automotive

and industrial applications powered by hydrogen. The success of

this market depends on the installation of infrastructure and the

production of clean hydrogen, both of which have been slow to

materialize. However, we are steadfast in our belief that

hydrogen as a fuel will prevail – although gradual as opposed to

immediate – and become a clean fuel source that is adopted

worldwide. In the meantime, Westport currently delivers a suite of

proven and innovative components and systems for a wide range of

affordable alternative low-carbon fuels such as natural gas,

renewable natural gas, propane, and hydrogen. We are driving

cleaner performance by addressing lower emissions regulations with

practical applications using innovation available today.

As we navigate the next quarter, and the next

year, Westport is strongly committed to driving operational

excellence, nurturing innovation, and supporting Cespira, all to

position the Company for sustainable growth in an evolving

landscape. We are focused and dedicated to the present and our

future."

Dan Sceli, Chief Executive Officer, Westport

Fuel Systems

Q3 2024 Highlights

- Revenues decreased by 14% to $66.2

million compared to $77.4 million in the same quarter last year,

primarily driven by the transition of the Heavy-Duty OEM revenues

now being reflected in the results of Cespira, of which Westport

accounts for as an equity investment.

- Net loss of $3.9 million for the

quarter, an improvement over the net loss of $11.9 million for the

same quarter last year. This was primarily the result of an

improvement in gross margin by $1.3 million compared to the

prior year quarter, a significant decrease in operating

expenditures and depreciation and amortization as costs previously

associated with our HPDI business are now accrued by Cespira, cost

reductions in Westport and a net foreign exchange gain of $1.1

million.

- Continued improvement in Adjusted

EBITDA[2] achieving negative $0.8 million compared to negative $3.0

million for the same period in 2023.

- Cash and cash equivalents were

$33.3 million at the end of the third quarter of 2024. Cash used in

operating activities was $9.9 million primarily from an increase in

working capital of $11.4 million. Cash provided by investing

activities included the sale of investments for $9.6 million

related to the collection of $8.4 million from the formation

of the HPDI JV and sale of our ownership interest in Westport

Weichai Inc. ("Weichai"), partially offset by the purchase of

capital assets of $2.1 million. Cash used in financing activities

represented debt repayments of $7.0 million in the quarter.

- In September 2024, HPDI Technology,

the joint venture between Volvo Group and Westport, launched as

Cespira.

|

CONSOLIDATED RESULTS |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

($ in millions, except per share amounts) |

3Q24 |

3Q23 |

Over / (Under)

% |

9M24 |

9M23 |

Over / (Under)

% |

|

Revenues |

$ |

66.2 |

|

$ |

77.4 |

|

|

(14 |

)% |

$ |

227.2 |

|

$ |

244.7 |

|

|

(7 |

)% |

|

Gross Margin(2) |

14.5 |

|

13.2 |

|

|

10 |

% |

43.3 |

|

40.9 |

|

|

6 |

% |

|

Gross Margin %(2) |

22 |

% |

17 |

% |

|

|

|

19 |

% |

17 |

% |

|

|

|

|

Income (loss) from Investments Accounted for by the Equity

Method(1) |

(2.8 |

) |

0.4 |

|

|

(800 |

)% |

(3.4 |

) |

0.6 |

|

|

(670 |

)% |

|

Net Loss |

$ |

(3.9 |

) |

$ |

(11.9 |

) |

|

68 |

% |

$ |

(11.7 |

) |

$ |

(35.8 |

) |

|

67 |

% |

|

Net Loss per Share - Basic |

$ |

(0.22 |

) |

$ |

(0.70 |

) |

|

69 |

% |

$ |

(0.68 |

) |

$ |

(2.08 |

) |

|

67 |

% |

|

Net Loss per Share - Diluted |

$ |

(0.22 |

) |

$ |

(0.70 |

) |

|

69 |

% |

$ |

(0.68 |

) |

$ |

(2.08 |

) |

|

67 |

% |

|

EBITDA(2) |

$ |

(0.3 |

) |

$ |

(8.6 |

) |

|

97 |

% |

$ |

(0.5 |

) |

$ |

(25.0 |

) |

|

98 |

% |

|

Adjusted EBITDA(2) |

$ |

(0.8 |

) |

$ |

(3.0 |

) |

|

73 |

% |

$ |

(9.4 |

) |

$ |

(11.5 |

) |

|

18 |

% |

(1) This includes income (loss) from Minda

Westport Technologies Limited and Cespira.

(2) Gross margin, EBITDA and Adjusted EBITDA are

non-GAAP measures. Please refer to GAAP and NON-GAAP FINANCIAL

MEASURES for the reconciliation to equivalent GAAP measures and

limitations on the use of such measures.

Segment Information

Light-Duty Segment

Revenue for the three and nine months ended

September 30, 2024 was $61.5 million and $194.2 million,

respectively, compared with $60.2 million and $200.4 million for

the three and nine months ended September 30, 2023.

Light-Duty revenue increased by $1.3 million for

the three months ended September 30, 2024 compared to the prior

year quarter, primarily a result of an increase in sales in our

light-duty OEM and IAM businesses and partially offset by decreased

sales in our fuel storage, DOEM, and electronics businesses. For

the nine months ended September 30, 2024, Light-Duty revenue

decreased by $6.2 million compared to the prior year period,

primarily driven by a decrease in sales in our DOEM, and fuel

storage businesses and partially offset by an increase in sales in

our light-duty OEM, electronics, and IAM businesses.

Gross margin increased by $1.9 million to $13.9

million, or 23% of revenue, for the three months ended September

30, 2024 compared to $12.0 million, or 20% of revenue, for the

three months ended September 30, 2023. This was primarily driven by

a slight increase in sales volumes, a change in sales mix with

increases in sales to European customers and reduction in sales to

developing regions.

Gross margin increased by $4.3 million to $41.4

million, or 21% of revenue, for the nine months ended September 30,

2024 compared to $37.1 million, or 19% of revenue, for the nine

months ended September 30, 2023. This was primarily driven by a

change in sales mix with an increase in sales to European customers

and a reduction in sales to developing regions.

Westport began supplying its Euro 6 LPG fuel

system to its global OEM customer in early 2024. Despite a slower

start to production than anticipated, Westport expects to exceed

planned Euro 6 LPG fuel system deliveries in 2024. This production

supply agreement has been instrumental in improving revenue and

delivering higher margins, which more than offset the decline in

revenue as a result of a key delayed OEM customer continuing to

work through their inventory. Production for the Euro 7 LPG fuel

system for the same global OEM customer is anticipated to begin

mid-to-late 2025.

The Light-Duty segment continues to evolve our

LPG fuel system solution, providing more customers with a

cost-competitive alternative fuel solution. Recently, two new

product platforms were announced utilizing our systems. Westport

was excited to be part of the first-ever OEM hybrid vehicle powered

by HEV and LPG technologies - the Kia Niro Tri-Fuel in Italy. This

revolutionary product, born from Westport's historic partnership

with Kia Italia, offers three fuel sources—petrol, electric, and

LPG—delivering over 1,600 km on full tanks with reduced emissions

and uncompromised performance. Westport also announced the global

availability of a LPG fuel system for the RAM 1500 Hurricane 3.0 DI

Twin Turbo engine, enabling customers to benefit from lower

emissions and lower fuel costs.

High-Pressure Controls & Systems

Segment

Revenue for the three and nine months ended

September 30, 2024, was $1.6 million and $7.4 million,

respectively, compared with $3.7 million and $9.4 million for the

three and nine months ended September 30, 2023. The decrease in

revenue for the three months ended September 30, 2024 compared to

the prior year quarter was primarily driven by the general slowdown

in the hydrogen infrastructure development leading to a slower

adoption of automotive and industrial applications powered by

hydrogen.

Gross margin decreased by $0.6 million to $0.4

million, or 25% of revenue, for the three months ended September

30, 2024 compared to $1.0 million or 27% of revenue, for the three

months ended September 30, 2023. Gross margin decreased by $0.9

million to $1.5 million, or 20% of revenue, for the nine months

ended September 30, 2024 compared to $2.4 million, or 26% of

revenue, for the nine months ended September 30, 2023. This was

primarily driven by lower sales volume in the quarter.

Heavy-Duty OEM Segment

Revenue for the three and nine months ended

September 30, 2024 includes revenue from the HPDI business from

January 1 to June 3, the closing date of the transaction to form

Cespira plus revenue earned under a transitional services

agreement. Revenue for the three and nine months ended September

30, 2024 was $3.1 million and $25.6 million, respectively, compared

with $13.5 million and $34.9 million for the three and nine months

ended September 30, 2023.

The decrease in revenue for the three months

ended September 30, 2024 is a result of the transition of this

business to Cespira and the resulting change in accounting

treatment. We continue to earn service revenue from Cespira under

the transitional services agreement for the quarter, which is

represented in this segment.

Gross margin was $0.2 million, or 6% of revenue,

for the three months ended September 30, 2024 compared to $0.2

million or 1% of revenue, for the three months ended September 30,

2023. Gross margin decreased by $1.0 million to $0.4 million, or 2%

of revenue, for the nine months ended September 30, 2024 compared

to $1.4 million, or 4% of revenue, for the nine months ended

September 30, 2023.

Selected Cespira Statements of

Operations Data

We account for Cespira using the equity method

of accounting for investments.

The following table sets forth a summary of the

financial results of Cespira for the three months ended September

30, 2024 and the period between June 3, 2024 to September 30,

2024:

|

|

|

|

|

|

|

|

|

|

|

Three months ended September 30, |

|

Change |

|

Period ended September 30, |

|

Change |

|

(in millions of U.S. dollars) |

2024 |

|

2023 |

|

$ |

|

% |

|

2024 |

|

2023 |

|

$ |

|

% |

|

Revenue |

$ |

16.2 |

|

|

$ |

— |

|

|

$ |

16.2 |

|

|

|

— |

% |

|

$ |

20.3 |

|

|

$ |

— |

|

|

$ |

20.3 |

|

|

|

— |

% |

|

Gross margin1 |

$ |

(1.1 |

) |

|

$ |

— |

|

|

$ |

(1.1 |

) |

|

|

— |

% |

|

$ |

(0.9 |

) |

|

$ |

— |

|

|

$ |

(0.9 |

) |

|

|

— |

% |

|

Gross margin %1 |

|

(7 |

)% |

|

|

— |

% |

|

|

|

|

|

|

|

|

|

|

(4 |

)% |

|

|

— |

% |

|

|

|

|

|

|

|

|

|

Operating loss |

$ |

(5.3 |

) |

|

$ |

— |

|

|

$ |

(5.3 |

) |

|

|

— |

% |

|

$ |

(7.3 |

) |

|

$ |

— |

|

|

$ |

(7.3 |

) |

|

|

— |

% |

|

Net loss attributable to the Company |

$ |

(3.0 |

) |

|

$ |

— |

|

|

$ |

(3.0 |

) |

|

|

— |

% |

|

$ |

(4.1 |

) |

|

$ |

— |

|

|

$ |

(4.1 |

) |

|

|

— |

% |

(1) Gross margin is a non-GAAP measure. Please

refer to GAAP and NON-GAAP FINANCIAL MEASURES for the

reconciliation to equivalent GAAP measures and limitations on the

use of such measures.

Cespira earned revenue of $16.2 million for

three months ended September 30, 2024. For the prior year quarter,

the Heavy-Duty OEM segment included our HPDI business which earned

$13.5 million. The revenue increase is largely driven by an

increase in HPDI systems sold.

Cespira lost $1.1 million on gross margin for

three months ended September 30, 2024. For the prior year quarter,

the Heavy-Duty OEM segment earned $0.2 million.

Cespira had operating losses of $5.3 million for

the three months ended September 30, 2024. For the prior year

quarter, Heavy-Duty OEM had incurred operating losses of $3.7

million.

As previously announced, Westport and Weichai

are parties to a technology development and supply agreement which

contains an obligation for Weichai to order, and Westport to

supply, certain volumes of HPDI fuel system components prior to

December 31, 2024. Significant orders for HPDI fuel system

components against this agreement have not been received to date

and we do not currently anticipate that orders for any significant

additional volumes will be received prior to year end. Westport and

Cespira continue to collaborate with Weichai Power Co. Ltd

(“Weichai Power”) on an HPDI fuel system equipped version of the

Weichai Power engine platforms. The parties are currently

discussing the next stages of this work and the obligations of each

party going forward.

|

SEGMENT RESULTS |

Three months ended September 30, 2024 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

Revenue |

|

Operating income (loss) |

|

Depreciation & amortization |

|

Equity income (loss) |

|

Light-Duty |

$ |

61.5 |

|

|

$ |

2.4 |

|

|

$ |

1.6 |

|

|

$ |

0.2 |

|

|

High-Pressure Controls & Systems |

|

1.6 |

|

|

|

(1.2 |

) |

|

|

0.1 |

|

|

|

— |

|

|

Heavy-Duty OEM |

|

3.1 |

|

|

|

0.9 |

|

|

|

— |

|

|

|

— |

|

|

Corporate |

|

— |

|

|

|

(1.0 |

) |

|

|

0.1 |

|

|

|

(3.0 |

) |

|

Cespira |

|

16.2 |

|

|

|

(5.3 |

) |

|

|

0.9 |

|

|

|

— |

|

|

Total segment |

|

82.4 |

|

|

|

(4.2 |

) |

|

|

2.7 |

|

|

|

(2.8 |

) |

|

Less: Cespira |

|

16.2 |

|

|

|

(5.3 |

) |

|

|

0.9 |

|

|

|

— |

|

|

Total consolidated |

$ |

66.2 |

|

|

$ |

1.1 |

|

|

$ |

1.8 |

|

|

$ |

(2.8 |

) |

|

SEGMENT RESULTS |

Three months ended September 30, 2023 |

|

|

Revenue |

|

Operating loss |

|

Depreciation & amortization |

|

Equity income |

|

Light-Duty |

$ |

60.2 |

|

|

$ |

(3.0 |

) |

|

$ |

1.7 |

|

|

$ |

0.4 |

|

|

High-Pressure Controls & Systems |

|

3.7 |

|

|

|

(0.4 |

) |

|

|

0.1 |

|

|

|

— |

|

|

Heavy-Duty OEM |

|

13.5 |

|

|

|

(3.7 |

) |

|

|

1.3 |

|

|

|

— |

|

|

Corporate |

|

— |

|

|

|

(5.0 |

) |

|

|

0.1 |

|

|

|

— |

|

|

Total Consolidated |

$ |

77.4 |

|

|

$ |

(12.1 |

) |

|

$ |

3.2 |

|

|

$ |

0.4 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Q3 2024 Conference Call Westport

has scheduled a conference call on November 13, 2024, at 7:00 am

Pacific Time (10:00 am Eastern Time) to discuss these results. To

access the conference call please register at

https://register.vevent.com/register/BI0e453d34cd1c4f7da856b4eec14f0d4c.

The live webcast of the conference call can be accessed through the

Westport website at https://investors.wfsinc.com/.

The webcast will be archived on Westport’s

website at https://investors.wfsinc.com.

Financial Statements and Management's

Discussion and Analysis To view Westport financials for

the second quarter ended September 30th, 2024, please visit

https://investors.wfsinc.com/financials/

About Westport Fuel Systems

At Westport Fuel Systems, we are driving

innovation to power a cleaner tomorrow. We are a leading supplier

of advanced fuel delivery components and systems for clean,

low-carbon fuels such as natural gas, renewable natural gas,

propane, and hydrogen to the global transportation industry. Our

technology delivers the performance and fuel efficiency required by

transportation applications and the environmental benefits that

address climate change and urban air quality challenges.

Headquartered in Vancouver, Canada, with operations in Europe,

Asia, North America, and South America, we serve our customers in

more than 70 countries with leading global transportation brands.

At Westport Fuel Systems, we think ahead. For more information,

visit www.wfsinc.com.

Cautionary Note Regarding Forward

Looking Statements This press release contains

forward-looking statements, including statements regarding revenue

and cash usage expectations, future strategic initiatives and

future growth, future of our development programs (including those

relating to HPDI and hydrogen), the demand for our products, the

future success of our business and technology strategies,

intentions of partners and potential customers, the performance and

competitiveness of Westport’s products and expansion of product

coverage, future market opportunities, speed of adoption of natural

gas and hydrogen for transportation and terms and timing of current

and future agreements as well as Westport's management’s response

to any of the aforementioned factors. These statements are neither

promises nor guarantees, but involve known and unknown risks and

uncertainties and are based on both the views of management and

assumptions that may cause our actual results, levels of activity,

performance or achievements to be materially different from any

future results, levels of activities, performance or achievements

expressed in or implied by these forward looking statements. These

risks, uncertainties and assumptions include those related to our

revenue growth, operating results, industry and products, the

general economy, conditions of and access to the capital and debt

markets, solvency, governmental policies and regulation, technology

innovations, fluctuations in foreign exchange rates, operating

expenses, continued reduction in expenses, ability to successfully

commercialize new products, the performance of our joint ventures,

the availability and price of natural gas and hydrogen, global

government stimulus packages and new environmental regulations, the

acceptance of and shift to natural gas and hydrogen vehicles, the

relaxation or waiver of fuel emission standards, the inability of

fleets to access capital or government funding to purchase natural

gas and hydrogen vehicles, the development of competing

technologies, our ability to adequately develop and deploy our

technology, the actions and determinations of our joint venture and

development partners, ongoing supply chain challenges as well as

other risk factors and assumptions that may affect our actual

results, performance or achievements or financial position

discussed in our most recent Annual Information Form and other

filings with securities regulators. Readers should not place undue

reliance on any such forward-looking statements, which speak only

as of the date they were made. We disclaim any obligation to

publicly update or revise such statements to reflect any change in

our expectations or in events, conditions or circumstances on which

any such statements may be based, or that may affect the likelihood

that actual results will differ from those set forth in these

forward looking statements except as required by National

Instrument 51-102. The contents of any website, RSS feed or twitter

account referenced in this press release are not incorporated by

reference herein.

Contact Information Investor Relations Westport

Fuel Systems T: +1 604-718-2046

GAAP and NON-GAAP FINANCIAL MEASURES

Management reviews the operational progress of

its business units and investment programs over successive periods

through the analysis of gross margin, gross margin as a percentage

of revenue, net income, EBITDA and Adjusted EBITDA. The Company

defines gross margin as revenue less cost of revenue. The Company

defines EBITDA as net income or loss from continuing operations

before income taxes adjusted for interest expense (net),

depreciation and amortization. Westport Fuel Systems defines

Adjusted EBITDA as EBITDA from continuing operations excluding

expenses for stock-based compensation, unrealized foreign exchange

gain or loss, and non-cash and other adjustments. Management uses

Adjusted EBITDA as a long-term indicator of operational performance

since it ties closely to the business units’ ability to generate

sustained cash flow and such information may not be appropriate for

other purposes. Adjusted EBITDA includes the company's share

of income from joint ventures.

The terms gross margin, gross margin as a

percentage of revenue, EBITDA and Adjusted EBITDA are not defined

under U.S. generally accepted accounting principles ("U.S.

GAAP") and are not a measure of operating income,

operating performance or liquidity presented in accordance with

U.S. GAAP. EBITDA and Adjusted EBITDA have limitations as an

analytical tool, and when assessing the company's operating

performance, investors should not consider EBITDA and Adjusted

EBITDA in isolation, or as a substitute for net loss or other

consolidated statement of operations data prepared in accordance

with U.S. GAAP. Among other things, EBITDA and Adjusted EBITDA do

not reflect the company's actual cash expenditures. Other companies

may calculate similar measures differently than Westport Fuel

Systems, limiting their usefulness as comparative tools. The

company compensates for these limitations by relying primarily on

its U.S. GAAP results and using EBITDA and Adjusted EBITDA as

supplemental information.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Gross margin and Gross margin as percentage of

Revenue |

|

(expressed in millions of U.S. dollars) |

|

Three months ended |

3Q23 |

|

4Q23 |

|

1Q24 |

|

2Q24 |

|

3Q24 |

|

Revenue |

$ |

77.4 |

|

|

$ |

87.2 |

|

|

$ |

77.6 |

|

|

$ |

83.4 |

|

|

$ |

66.2 |

|

|

Less: Cost of revenue |

|

64.2 |

|

|

|

79.2 |

|

|

|

65.9 |

|

|

|

66.3 |

|

|

|

51.7 |

|

|

Gross margin |

|

13.2 |

|

|

|

8.0 |

|

|

|

11.7 |

|

|

|

17.1 |

|

|

|

14.5 |

|

|

Gross margin % |

|

17.1 |

% |

|

|

9.2 |

% |

|

|

15.1 |

% |

|

|

20.5 |

% |

|

|

21.9 |

% |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

EBITDA and Adjusted EBITDA |

|

(expressed in millions of U.S. dollars) |

|

Three months ended |

3Q23 |

|

4Q23 |

|

1Q24 |

|

2Q24 |

|

3Q24 |

|

Income (Loss) before income taxes |

$ |

(12.0 |

) |

|

$ |

(14.0 |

) |

|

$ |

(12.9 |

) |

|

$ |

6.8 |

|

|

$ |

(2.5 |

) |

|

Interest expense (income), net |

|

0.2 |

|

|

|

(0.2 |

) |

|

|

0.5 |

|

|

|

0.5 |

|

|

|

0.4 |

|

|

Depreciation and amortization |

|

3.2 |

|

|

|

3.3 |

|

|

|

3.2 |

|

|

|

1.7 |

|

|

|

1.8 |

|

|

EBITDA |

|

(8.6 |

) |

|

|

(10.9 |

) |

|

|

(9.2 |

) |

|

|

9.0 |

|

|

|

(0.3 |

) |

|

Stock based compensation (recovery) |

|

(0.3 |

) |

|

|

1.4 |

|

|

|

0.3 |

|

|

|

1.2 |

|

|

|

(0.1 |

) |

|

Unrealized foreign exchange (gain) loss |

|

1.4 |

|

|

|

(0.9 |

) |

|

|

1.8 |

|

|

|

0.1 |

|

|

|

(1.1 |

) |

|

Severance costs |

|

4.5 |

|

|

|

— |

|

|

|

0.5 |

|

|

|

0.2 |

|

|

|

0.1 |

|

|

Gain on deconsolidation |

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

(13.3 |

) |

|

|

— |

|

|

Loss on sale of investment |

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

0.4 |

|

|

Restructuring costs |

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

0.8 |

|

|

|

0.2 |

|

|

Impairment of long-term investments |

|

— |

|

|

|

0.4 |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

Adjusted EBITDA |

$ |

(3.0 |

) |

|

$ |

(10.0 |

) |

|

$ |

(6.6 |

) |

|

$ |

(2.0 |

) |

|

$ |

(0.8 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

WESTPORT FUEL SYSTEMS INC.Condensed Consolidated

Interim Balance Sheets (unaudited)(Expressed in thousands of United

States dollars, except share amounts)September 30, 2024 and

December 31, 2023 |

|

|

|

|

|

|

|

September 30, 2024 |

|

December 31, 2023 |

|

Assets |

|

|

|

|

Current assets: |

|

|

|

|

Cash and cash equivalents (including restricted cash) |

$ |

33,257 |

|

|

$ |

54,853 |

|

|

Accounts receivable |

|

70,344 |

|

|

|

88,077 |

|

|

Inventories |

|

66,322 |

|

|

|

67,530 |

|

|

Prepaid expenses |

|

7,165 |

|

|

|

6,323 |

|

|

Total current assets |

|

177,088 |

|

|

|

216,783 |

|

|

Long-term investments |

|

41,322 |

|

|

|

4,792 |

|

|

Property, plant and equipment |

|

42,665 |

|

|

|

69,489 |

|

|

Operating lease right-of-use assets |

|

20,433 |

|

|

|

22,877 |

|

|

Intangible assets |

|

5,953 |

|

|

|

6,822 |

|

|

Deferred income tax assets |

|

11,696 |

|

|

|

11,554 |

|

|

Goodwill |

|

3,088 |

|

|

|

3,066 |

|

|

Other long-term assets |

|

9,389 |

|

|

|

20,365 |

|

|

Total assets |

$ |

311,634 |

|

|

$ |

355,748 |

|

|

Liabilities and shareholders’ equity |

|

|

|

|

Current liabilities: |

|

|

|

|

Accounts payable and accrued liabilities |

$ |

88,760 |

|

|

$ |

95,374 |

|

|

Current portion of operating lease liabilities |

|

2,656 |

|

|

|

3,307 |

|

|

Short-term debt |

|

— |

|

|

|

15,156 |

|

|

Current portion of long-term debt |

|

15,260 |

|

|

|

14,108 |

|

|

Current portion of warranty liability |

|

4,045 |

|

|

|

6,892 |

|

|

Total current liabilities |

|

110,721 |

|

|

|

134,837 |

|

|

Long-term operating lease liabilities |

|

17,781 |

|

|

|

19,300 |

|

|

Long-term debt |

|

23,483 |

|

|

|

30,957 |

|

|

Warranty liability |

|

1,350 |

|

|

|

1,614 |

|

|

Deferred income tax liabilities |

|

4,138 |

|

|

|

3,477 |

|

|

Other long-term liabilities |

|

4,869 |

|

|

|

5,115 |

|

|

Total liabilities |

|

162,342 |

|

|

|

195,300 |

|

|

Shareholders’ equity: |

|

|

|

|

Share capital: |

|

|

|

|

Unlimited common and preferred shares, no par value |

|

|

|

|

17,264,864 (2023 - 17,174,502) common shares issued and

outstanding |

|

1,245,712 |

|

|

|

1,244,539 |

|

|

Other equity instruments |

|

9,399 |

|

|

|

9,672 |

|

|

Additional paid in capital |

|

11,516 |

|

|

|

11,516 |

|

|

Accumulated deficit |

|

(1,086,133 |

) |

|

|

(1,074,434 |

) |

|

Accumulated other comprehensive loss |

|

(31,202 |

) |

|

|

(30,845 |

) |

|

Total shareholders' equity |

|

149,292 |

|

|

|

160,448 |

|

|

Total liabilities and shareholders' equity |

$ |

311,634 |

|

|

$ |

355,748 |

|

| |

|

|

|

|

|

|

|

|

WESTPORT FUEL SYSTEMS INC.Condensed Consolidated

Interim Statements of Operations and Comprehensive Loss

(unaudited)(Expressed in thousands of United States dollars, except

share and per share amounts) Three and nine months ended September

30, 2024 and 2023 |

|

|

|

|

|

|

|

Three months ended September 30, |

|

Nine months ended September 30, |

|

|

2024 |

|

2023 |

|

2024 |

|

2023 |

|

Revenue |

$ |

66,251 |

|

|

$ |

77,391 |

|

|

$ |

227,211 |

|

|

$ |

244,653 |

|

|

Cost of revenue and expenses: |

|

|

|

|

|

|

|

|

Cost of revenue |

|

51,785 |

|

|

|

64,163 |

|

|

|

183,900 |

|

|

|

203,695 |

|

|

Research and development |

|

3,266 |

|

|

|

5,748 |

|

|

|

17,519 |

|

|

|

18,796 |

|

|

General and administrative |

|

7,706 |

|

|

|

12,993 |

|

|

|

29,662 |

|

|

|

33,307 |

|

|

Sales and marketing |

|

2,770 |

|

|

|

4,088 |

|

|

|

9,497 |

|

|

|

12,557 |

|

|

Foreign exchange (gain) loss |

|

(1,069 |

) |

|

|

1,430 |

|

|

|

808 |

|

|

|

4,926 |

|

|

Depreciation and amortization |

|

751 |

|

|

|

1,100 |

|

|

|

2,514 |

|

|

|

3,158 |

|

|

|

|

65,209 |

|

|

|

89,522 |

|

|

|

243,900 |

|

|

|

276,439 |

|

|

Income (loss) from operations |

|

1,042 |

|

|

|

(12,131 |

) |

|

|

(16,689 |

) |

|

|

(31,786 |

) |

|

|

|

|

|

|

|

|

|

|

Income (loss) from investments accounted for by the equity

method |

|

(2,781 |

) |

|

|

448 |

|

|

|

(3,438 |

) |

|

|

633 |

|

|

Gain on deconsolidation |

|

— |

|

|

|

— |

|

|

|

13,266 |

|

|

|

— |

|

|

Loss on sale of investment |

|

(352 |

) |

|

|

— |

|

|

|

(352 |

) |

|

|

— |

|

|

Interest on long-term debt and accretion on royalty payable |

|

(919 |

) |

|

|

(568 |

) |

|

|

(2,125 |

) |

|

|

(2,058 |

) |

|

Loss on extinguishment of royalty payable |

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

(2,909 |

) |

|

Interest and other income, net of bank charges |

|

569 |

|

|

|

238 |

|

|

|

761 |

|

|

|

1,437 |

|

|

Loss before income taxes |

|

(2,441 |

) |

|

|

(12,013 |

) |

|

|

(8,577 |

) |

|

|

(34,683 |

) |

|

Income tax expense (recovery) |

|

1,427 |

|

|

|

(76 |

) |

|

|

3,122 |

|

|

|

1,089 |

|

|

Net loss for the period |

|

(3,868 |

) |

|

|

(11,937 |

) |

|

|

(11,699 |

) |

|

|

(35,772 |

) |

|

|

|

|

|

|

|

|

|

|

Changes in foreign currency translation adjustment |

|

2,177 |

|

|

|

(3,427 |

) |

|

|

535 |

|

|

|

1,925 |

|

|

Ownership share of equity method investments' other comprehensive

loss |

|

(809 |

) |

|

|

— |

|

|

|

(892 |

) |

|

|

— |

|

|

Other comprehensive income (loss) |

|

1,368 |

|

|

|

(3,427 |

) |

|

|

(357 |

) |

|

|

1,925 |

|

|

Comprehensive loss |

$ |

(2,500 |

) |

|

$ |

(15,364 |

) |

|

$ |

(12,056 |

) |

|

$ |

(33,847 |

) |

|

|

|

|

|

|

|

|

|

|

Net loss per share: |

|

|

|

|

|

|

|

|

Net loss per share - basic |

$ |

(0.22 |

) |

|

$ |

(0.70 |

) |

|

$ |

(0.68 |

) |

|

$ |

(2.08 |

) |

|

Net loss per share - diluted |

$ |

(0.22 |

) |

|

$ |

(0.70 |

) |

|

$ |

(0.68 |

) |

|

$ |

(2.08 |

) |

|

Weighted average common shares outstanding: |

|

|

|

|

|

|

|

|

Basic |

|

17,264,157 |

|

|

|

17,174,972 |

|

|

|

17,241,469 |

|

|

|

17,172,429 |

|

|

Diluted |

|

17,264,157 |

|

|

|

17,174,972 |

|

|

|

17,241,469 |

|

|

|

17,172,429 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

WESTPORT FUEL SYSTEMS INC.Condensed Consolidated

Interim Statements of Cash Flows (unaudited)(Expressed in thousands

of United States dollars) Three and nine months ended September 30,

2024 and 2023 |

|

|

|

|

|

|

|

Three months ended September 30, |

|

Nine months ended September 30, |

|

|

2024 |

|

2023 |

|

2024 |

|

2023 |

|

Operating activities: |

|

|

|

|

|

|

|

|

Net loss for the period |

$ |

(3,868 |

) |

|

$ |

(11,937 |

) |

|

$ |

(11,699 |

) |

|

$ |

(35,772 |

) |

|

Adjustments to reconcile net loss to net cash provided by (used in)

operating activities: |

|

Depreciation and amortization |

|

1,790 |

|

|

|

3,250 |

|

|

|

6,753 |

|

|

|

9,270 |

|

|

Stock-based compensation expense |

|

267 |

|

|

|

(310 |

) |

|

|

900 |

|

|

|

1,065 |

|

|

Unrealized foreign exchange (gain) loss |

|

(1,069 |

) |

|

|

1,430 |

|

|

|

808 |

|

|

|

4,926 |

|

|

Deferred income tax expense (recovery) |

|

333 |

|

|

|

(324 |

) |

|

|

678 |

|

|

|

(347 |

) |

|

Loss (income) from investments accounted for by the equity

method |

|

2,781 |

|

|

|

(448 |

) |

|

|

3,438 |

|

|

|

(633 |

) |

|

Interest on long-term debt and accretion on royalty payable |

|

18 |

|

|

|

22 |

|

|

|

53 |

|

|

|

316 |

|

|

Change in inventory write-downs |

|

594 |

|

|

|

500 |

|

|

|

2,030 |

|

|

|

2,078 |

|

|

Loss on extinguishment of royalty payable |

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

2,909 |

|

|

Change in bad debt expense |

|

271 |

|

|

|

304 |

|

|

|

122 |

|

|

|

676 |

|

|

Gain on deconsolidation |

|

— |

|

|

|

— |

|

|

|

(13,266 |

) |

|

|

— |

|

|

Loss on sale of investments |

|

352 |

|

|

|

— |

|

|

|

352 |

|

|

|

— |

|

|

Other |

|

14 |

|

|

|

144 |

|

|

|

46 |

|

|

|

123 |

|

|

Changes in operating assets and liabilities: |

|

|

|

|

|

|

|

|

Accounts receivable |

|

13,977 |

|

|

|

2,877 |

|

|

|

23,760 |

|

|

|

2,305 |

|

|

Inventories |

|

(7,788 |

) |

|

|

3,359 |

|

|

|

(14,242 |

) |

|

|

2,231 |

|

|

Prepaid expenses |

|

(77 |

) |

|

|

1,889 |

|

|

|

(665 |

) |

|

|

3,296 |

|

|

Accounts payable and accrued liabilities |

|

(15,746 |

) |

|

|

844 |

|

|

|

(3,551 |

) |

|

|

1,894 |

|

|

Warranty liability |

|

(1,782 |

) |

|

|

(1,061 |

) |

|

|

(3,809 |

) |

|

|

(3,622 |

) |

|

Net cash provided by (used in) operating

activities |

|

(9,933 |

) |

|

|

539 |

|

|

|

(8,292 |

) |

|

|

(9,285 |

) |

|

Investing activities: |

|

|

|

|

|

|

|

|

Purchase of property, plant and equipment |

|

(2,140 |

) |

|

|

(4,081 |

) |

|

|

(12,470 |

) |

|

|

(11,993 |

) |

|

Proceeds from sale of investments |

|

9,564 |

|

|

|

— |

|

|

|

29,994 |

|

|

|

— |

|

|

Proceeds on sale of assets |

|

38 |

|

|

|

— |

|

|

|

607 |

|

|

|

133 |

|

|

Dividends received from investments accounted for by the equity

method |

|

— |

|

|

|

— |

|

|

|

297 |

|

|

|

— |

|

|

Capital contributions to investments accounted for by the equity

method |

|

— |

|

|

|

— |

|

|

|

(9,900 |

) |

|

|

— |

|

|

Net cash provided by (used in) investing

activities |

|

7,462 |

|

|

|

(4,081 |

) |

|

|

8,528 |

|

|

|

(11,860 |

) |

|

Financing activities: |

|

|

|

|

|

|

|

|

Repayments of operating lines of credit and long-term

facilities |

|

(6,965 |

) |

|

|

(11,397 |

) |

|

|

(41,042 |

) |

|

|

(33,077 |

) |

|

Drawings on operating lines of credit and long-term facilities |

|

— |

|

|

|

7,497 |

|

|

|

19,336 |

|

|

|

20,593 |

|

|

Payment of royalty payable |

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

(8,687 |

) |

|

Net cash used in financing activities |

|

(6,965 |

) |

|

|

(3,900 |

) |

|

|

(21,706 |

) |

|

|

(21,171 |

) |

|

Effect of foreign exchange on cash and cash equivalents |

|

1,171 |

|

|

|

(856 |

) |

|

|

(126 |

) |

|

|

99 |

|

|

Net decrease in cash and cash equivalents |

|

(8,265 |

) |

|

|

(8,298 |

) |

|

|

(21,596 |

) |

|

|

(42,217 |

) |

|

Cash and cash equivalents, beginning of period (including

restricted cash) |

|

41,522 |

|

|

|

52,265 |

|

|

|

54,853 |

|

|

|

86,184 |

|

|

Cash and cash equivalents, end of period (including

restricted cash) |

$ |

33,257 |

|

|

$ |

43,967 |

|

|

$ |

33,257 |

|

|

$ |

43,967 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

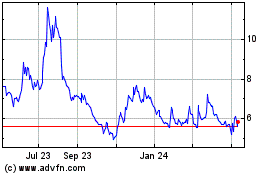

Westport Fuel Systems (NASDAQ:WPRT)

Historical Stock Chart

From Nov 2024 to Dec 2024

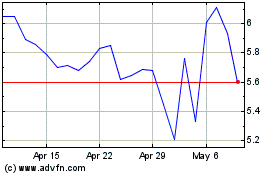

Westport Fuel Systems (NASDAQ:WPRT)

Historical Stock Chart

From Dec 2023 to Dec 2024