– Successful closing of exclusive worldwide

licensing agreement with Sanofi for three potential best-in-class

clinical-stage dual-masked T-cell engagers with initial clinical

data anticipated in Q1 2025 –

– Key Phase 2 SOLSTICE data in chronic

hepatitis delta to be presented at AASLD 2024 –

– The Company will host a Hepatitis Investor

Event following AASLD on November 19, 2024 –

– Jason O’Byrne appointed as Chief Financial

Officer –

– Conference call scheduled for October 31,

2024 at 1:30 p.m. PT / 4:30 p.m. ET –

Vir Biotechnology, Inc. (Nasdaq: VIR) today provided a corporate

update and reported financial results for the third quarter ended

September 30, 2024.

“This quarter was transformational for Vir. We have bolstered

our clinical pipeline with three potential best-in-class

dual-masked T-cell engagers in oncology, and have sharpened our

focus within infectious diseases to the areas where we believe we

can make the most significant impact for patients. We are also

thrilled to welcome Jason O’Byrne as our new CFO. Jason brings a

wealth of financial leadership experience, further strengthening

our ability to bring these potentially transformative therapies to

patients as quickly as possible,” said Marianne De Backer, M.Sc.,

Ph.D., MBA, Chief Executive Officer, Vir Biotechnology. “Looking

ahead, this is an exciting time for the Company. We eagerly

anticipate critical data in our hepatitis programs in the fourth

quarter and look forward to sharing initial clinical data from our

dual-masked T-cell engagers in the first quarter of 2025.”

Pipeline Programs

Chronic Hepatitis Delta (CHD)

- Preliminary data from the Phase 2 chronic hepatitis delta

SOLSTICE study was presented at the European Study of the Liver

(EASL) Meeting in June 2024. This data demonstrated the potential

for transformative treatment for people living with chronic

hepatitis delta, with both tobevibart as a monotherapy, and in

combination with elebsiran, achieving high rates of virologic

response and ALT normalization after 12 and 24 weeks of treatment.

No treatment-related serious adverse events were observed.

- The combination of tobevibart and elebsiran has been granted

Fast Track Designation by the U.S. FDA. Given the robust rates of

virologic suppression observed with the combination, the Company is

diligently working to advance this regimen into a pivotal

development program as quickly as possible to address the urgent

needs of these patients.

- At the upcoming American Association for the Study of Liver

Diseases (AASLD) “The Liver Meeting” in November 2024, the Company

will present additional data from the Phase 2 chronic hepatitis

delta SOLSTICE trial, including: 24-week clinical data for both

study cohorts in approximately 60 patients and further data for

those patients who were on study beyond 24 weeks at the time of

data cut-off.

- One cohort assesses the combination of tobevibart and elebsiran

administered every four weeks, while a second cohort evaluates

tobevibart monotherapy administered every two weeks.

- The SOLSTICE trial is evaluating the safety, tolerability and

efficacy of tobevibart and elebsiran for the treatment of chronic

hepatitis delta.

Chronic Hepatitis B (CHB)

- The Company plans to share end-of-treatment data from the Phase

2 MARCH Part B trial as a Late Breaking presentation at the AASLD

meeting in November 2024.

- The MARCH-B trial is evaluating the safety, tolerability and

antiviral activity of the triplet combination of tobevibart and

elebsiran plus peginterferon alfa-2a in approximately 30

participants, and approximately 50 participants treated with the

doublet combination of tobevibart and elebsiran.

- The Company plans to share further data assessing a potential

functional cure in the second quarter of 2025.

Solid Tumors

- VIR-5818 is a dual-masked HER2-targeted T-cell engager in

clinical development designed to minimize off-tumor toxicity,

potentially allowing for higher doses and increased efficacy to

address the significant unmet needs of patients with HER2

expressing cancers.

- A Phase 1 basket study of VIR-5818 as a monotherapy, and in

combination with pembrolizumab, is on-going in multiple tumor

types, including metastatic breast cancer and metastatic colorectal

cancer.

- The Company plans to share initial clinical data for VIR-5818

in the first quarter of 2025.

- VIR-5500 is a dual-masked PSMA directed T-cell engager in

clinical development designed to minimize off-tumor toxicity and

potentially improve efficacy relative to the existing approved

PSMA-targeted therapies.

- A Phase 1 dose escalation study of VIR-5500 is ongoing to

assess its safety profile and optimal dose levels for future

development in metastatic-castration resistant prostate

cancer.

- The Company plans to share initial clinical data for VIR-5500

in the first quarter of 2025.

- VIR-5525 is a dual-masked EGFR targeted T-cell engager with a

cleared Investigational New Drug Application (IND) from the U.S.

FDA.

- The Company plans to initiate a Phase 1 basket study of

VIR-5525 in the first quarter of 2025 in patients across a number

of solid tumor indications of high unmet need, which may include

metastatic head and neck squamous cell carcinoma, metastatic

adenocarcinoma, squamous non-small cell lung cancer, and metastatic

colorectal cancer.

Preclinical Pipeline Candidates

- The Company continues to advance pre-clinical assets in

respiratory syncytial virus in partnership with GSK and pursue HIV

cure in collaboration with the Bill & Melinda Gates

Foundation.

Corporate Update

- On August 1, 2024 the Company announced an exclusive worldwide

license to three clinical-stage masked T-cell engagers (TCEs) with

potential applications in a range of cancers, as well as the

exclusive use of the proprietary PRO-XTEN™ masking platform for

oncology and infectious disease. The Company announced closing of

the agreement with Sanofi on September 9, 2024.

- Key employees from Sanofi, possessing extensive scientific and

development expertise in TCEs, and in-depth experience with the

PRO-XTEN™ platform, joined the Company following the closing of the

agreement.

- On August 1, 2024 the Company announced the phase-out of

clinical programs in influenza, COVID-19, and its T-cell based

viral vector platform. The Company is seeking partners to advance

these clinical programs through further development. Additionally,

the Company announced a workforce reduction of approximately 25%,

or approximately 140 employees, and expects to end 2024 with

approximately 435 employees – a decrease of approximately 200 from

its peak headcount in the second quarter of 2023.

- On September 10, 2024, the Company announced the appointment of

Jason O’Byrne as Executive Vice President and Chief Financial

Officer, effective October 2, 2024. Mr. O’Byrne is an accomplished

executive with more than 20 years of finance and operations

experience, and brings leadership in capital allocation and

formation, corporate strategy and operational excellence.

- The Company will host two virtual investor events instead of

the previously scheduled R&D Day in the fourth quarter of 2024.

The first event, focusing on our hepatitis programs, will be held

in November 2024, following the AASLD conference, and will provide

detailed updates on our hepatitis delta and hepatitis B programs.

In the first quarter of 2025, the Company will share initial

clinical data for our masked T-cell engager programs during a

second dedicated investor event.

Third Quarter 2024 Financial

Results

Cash, Cash Equivalents and Investments: As of September

30, 2024, the Company had approximately $1.19 billion in cash, cash

equivalents and investments, representing a decrease of

approximately $245.1 million during the third quarter of 2024. The

decrease includes a $103.7 million upfront payment made to Sanofi

upon the closing of the agreement and a $75.0 million escrowed

milestone payment reclassified to restricted cash. The escrowed

milestone is subject to VIR-5525 achieving "first in human dosing"

by 2026. Excluding the impact of the Sanofi agreement, the decrease

in cash, cash equivalents and investments in the third quarter was

approximately $66.4 million.

Revenues: Total revenues for the quarter ended September

30, 2024, were $2.4 million compared to $2.6 million for the same

period in 2023.

Cost of Revenue: Cost of revenue was nominal for the

third quarter of 2024 and 2023.

Research and Development Expenses (R&D): R&D

expenses for the third quarter of 2024 were $195.2 million, which

included $8.9 million of non-cash stock-based compensation expense,

compared to $145.0 million for the same period in 2023, which

included $15.8 million of non-cash stock-based compensation

expense. The increase was primarily driven by $102.8 million of the

Sanofi upfront payment being recognized as in-process research and

development expense, partially offset by lower clinical development

costs and manufacturing costs associated with the discontinued flu

asset, VIR-2482.

Selling, General and Administrative Expenses (SG&A):

SG&A expenses for the third quarter of 2024 were $25.7 million,

which included $7.8 million of non-cash stock-based compensation

expense, compared to $40.9 million for the same period in 2023,

which included $11.1 million of non-cash stock-based compensation

expense. The decrease was largely related to cost savings

initiatives implemented during the second half of 2023.

Restructuring, long-lived assets impairment and related

charges: Restructuring, long-lived assets impairment and

related charges for the third quarter of 2024 were $12.7 million

compared to $3.4 million for the same period in 2023. The increase

was primarily driven by severance charges incurred related to our

strategic restructuring announcement in August 2024 and to a lesser

extent right-of-use asset impairment charges related to the closing

of our Portland, Oregon facility, which was previously announced on

December 13, 2023.

Other Income: Other income for the third quarter of 2024

was $17.8 million compared to $20.1 million for the same period in

2023. The decrease was primarily due to lower interest income.

(Provision for) Benefit from Income Taxes: Provision for

income taxes for the third quarter of 2024 was $0.2 million

compared to a benefit from income taxes of $3.2 million for the

same period in 2023.

Net Loss: Net loss attributable to Vir for the third

quarter of 2024 was $(213.7) million, or $(1.56) per share, basic

and diluted, compared to a net loss of $(163.4) million, or $(1.22)

per share, basic and diluted for the same period in 2023.

2024

Financial Guidance

The Company has updated its operating expense guidance for the

full-year 2024, which includes the upfront in-process research and

development expense associated with the clinical-stage T-cell

engagers licensed through its agreement with Sanofi:

(in $ millions)

GAAP operating expense range:

$

660

to

$

680

The following expenses are included in the

GAAP operating expense range:

Upfront payment to Sanofi recognized as

R&D expense in the third quarter of 2024

$103

Stock-based compensation expense

$

90

to

$

80

Restructuring charges*

$

40

to

$

30

* Restructuring charges include employee

severance cash payouts, as well as non-cash expense related to the

closing of two R&D sites previously announced on December 13,

2023.

The GAAP operating expense guidance does not include the effect

of GAAP adjustments caused by events that may occur subsequent to

the publication of this guidance, including, but not limited to,

business development activities, litigation, in-process R&D

impairments, and changes in the fair value of contingent

considerations.

Conference Call

Vir will host a conference call to discuss the third quarter

results at 1:30 p.m. PT / 4:30 p.m. ET today. A live webcast will

be available on https://investors.vir.bio/ and will be archived on

www.vir.bio for 30 days.

About Tobevibart (VIR-3434)

Tobevibart is an investigational broadly neutralizing monoclonal

antibody targeting the hepatitis B surface antigen. It is designed

to inhibit the entry of hepatitis B and hepatitis delta viruses

into hepatocytes, and to reduce the level of circulating viral and

subviral particles in the blood. Tobevibart, which incorporates

Xencor’s Xtend™ and other Fc technologies, has been engineered to

have an extended half-life and was identified using Vir’s

proprietary monoclonal antibody discovery platform. Tobevibart is

administered subcutaneously, and it is currently in clinical

development for treatment of patients with chronic hepatitis B and

patients with chronic hepatitis delta.

About Elebsiran (VIR-2218)

Elebsiran is an investigational hepatitis B virus-targeting

small interfering ribonucleic acid (siRNA) designed to degrade

hepatitis B virus RNA transcripts and limit the production of

hepatitis B surface antigen. Current data indicates that it has the

potential to have direct antiviral activity against hepatitis B

virus and hepatitis delta virus. Elebsiran is administered

subcutaneously, and it is currently in clinical development for

treatment of patients with chronic hepatitis B and patients with

chronic hepatitis delta. It is the first asset in Vir’s

collaboration with Alnylam Pharmaceuticals, Inc. to enter clinical

studies.

About VIR-5818, VIR-5500, VIR-5525

VIR-5818, VIR-5500, VIR-5525 are investigational, clinical

candidates currently being evaluated for the treatment of solid

tumors. These assets leverage the PRO-XTEN™ masking technology with

three different T-cell engagers (TCEs) targeting HER2, PSMA, and

EGFR, respectively.

TCEs are powerful anti-tumor agents that direct the immune

system, specifically T-cells, to destroy cancer cells. The

PRO-XTEN™ masking technology is designed to keep the TCEs inactive

(or masked) until they reach the tumor microenvironment, where

tumor-specific proteases cleave off the mask and activate the TCEs

leading to killing of cancer cells. By driving the activity

exclusively to the tumor microenvironment, we aim to circumvent the

traditionally high toxicity associated with TCEs and increase their

efficacy and tolerability. Additionally, the mask also helps drug

candidates stay in the bloodstream longer in their inactive form,

allowing them to better reach the site of action and potentially

allowing more convenient dosing regimens for patients and

clinicians.

About Vir Biotechnology, Inc.

Vir Biotechnology, Inc. is a clinical-stage biopharmaceutical

company focused on powering the immune system to transform lives by

discovering and developing medicines for serious infectious

diseases and cancer. Vir’s clinical-stage portfolio includes

infectious disease programs for chronic hepatitis delta and chronic

hepatitis B infections, in addition to programs across several

clinically validated targets in solid tumor indications. Vir also

has a preclinical portfolio of programs across a range of other

infectious diseases and oncologic malignancies. Vir routinely posts

information that may be important to investors on its website.

Forward-Looking Statements

This press release contains forward-looking statements within

the meaning of the Private Securities Litigation Reform Act of

1995. Words such as “should,” “could,” “may,” “might,” “will,”

“plan,” “potential,” “aim,” “expect,” “anticipate,” “promising” and

similar expressions (as well as other words or expressions

referencing future events, conditions or circumstances) are

intended to identify forward-looking statements. These

forward-looking statements are based on Vir’s expectations and

assumptions as of the date of this press release. Forward-looking

statements contained in this press release include, but are not

limited to, statements regarding; Vir’s cash balance; Vir’s future

financial and operating results and its expectations related

thereto including Vir’s financial guidance; Vir’s ability to

realize the anticipated benefits from the exclusive worldwide

license agreement with Sanofi; potential of, and expectations for,

Vir’s pipeline; Vir’s clinical and preclinical development

programs; clinical studies, including the enrollment of clinical

studies, and the expected timing of data readouts and

presentations; the potential benefits, safety, and efficacy of

Vir’s investigational therapies; Vir’s strategy and plans; and

risks and uncertainties associated with drug development and

commercialization. Many factors may cause differences between

current expectations and actual results, including whether or when

anticipated cost reductions will be achieved; unexpected safety or

efficacy data or results observed during clinical studies or in

data readouts; the occurrence of adverse safety events; risks of

unexpected costs, delays or other unexpected hurdles; difficulties

in collaborating with other companies; successful development

and/or commercialization of alternative product candidates by Vir’s

competitors; changes in expected or existing competition; delays in

or disruptions to Vir’s business or clinical studies due to

geopolitical changes or other external factors; failure to achieve

any necessary regulatory approvals; the timing and amount of actual

expenses, including, without limitation, Vir’s anticipated combined

GAAP R&D and SG&A expenses; and unexpected litigation or

other disputes. Drug development and commercialization involve a

high degree of risk, and only a small number of research and

development programs result in commercialization of a product.

Results in early-stage clinical studies may not be indicative of

full results or results from later stage or larger scale clinical

studies and do not ensure regulatory approval. You should not place

undue reliance on these statements, or the scientific data

presented. Other factors that may cause actual results to differ

from those expressed or implied in the forward-looking statements

in this press release are discussed in Vir’s filings with the U.S.

Securities and Exchange Commission, including the section titled

“Risk Factors” contained therein. Except as required by law, Vir

assumes no obligation to update any forward-looking statements

contained herein to reflect any change in expectations, even as new

information becomes available.

PRO-XTEN™ is a trademark of Amunix Pharmaceuticals, Inc., a

Sanofi company.

VIR BIOTECHNOLOGY,

INC.

Condensed Consolidated Balance

Sheets

(in thousands, except share

and per share data)

(unaudited)

September 30,

2024

December 31,

2023

ASSETS

CURRENT ASSETS:

Cash and cash equivalents

$

168,350

$

241,576

Short-term investments

740,607

1,270,980

Restricted cash and cash equivalents,

current

89,598

13,268

Equity investments

5,517

9,853

Prepaid expenses and other current

assets

43,085

52,549

Total current assets

1,047,157

1,588,226

Intangible assets, net

19,258

22,565

Goodwill

16,938

16,937

Property and equipment, net

64,791

96,018

Operating lease right-of-use assets

60,779

71,182

Restricted cash and cash equivalents,

noncurrent

6,382

6,448

Long-term investments

271,495

105,275

Other assets

11,556

12,409

TOTAL ASSETS

$

1,498,356

$

1,919,060

LIABILITIES AND STOCKHOLDERS’

EQUITY

CURRENT LIABILITIES:

Accounts payable

$

7,305

$

6,334

Accrued and other liabilities

94,658

104,220

Deferred revenue, current

15,198

64,853

Total current liabilities

117,161

175,407

Operating lease liabilities,

noncurrent

93,405

111,673

Contingent consideration, noncurrent

33,170

25,960

Other long-term liabilities

13,893

15,784

TOTAL LIABILITIES

257,629

328,824

Commitments and contingencies (Note 8)

STOCKHOLDERS’ EQUITY:

Preferred stock, $0.0001 par value;

10,000,000 shares authorized as of September 30, 2024 and December

31, 2023; no shares issued and outstanding as of September 30, 2024

and December 31, 2023

—

—

Common stock, $0.0001 par value;

300,000,000 shares authorized as of September 30, 2024 and December

31, 2023; 136,706,350 and 134,781,286 shares issued and outstanding

as of September 30, 2024 and December 31, 2023, respectively

14

13

Additional paid-in capital

1,894,781

1,828,862

Accumulated other comprehensive gain

(loss)

1,127

(815

)

Accumulated deficit

(655,195

)

(237,824

)

TOTAL STOCKHOLDERS’ EQUITY

1,240,727

1,590,236

TOTAL LIABILITIES AND STOCKHOLDERS’

EQUITY

$

1,498,356

$

1,919,060

VIR BIOTECHNOLOGY,

INC.

Condensed Consolidated

Statements of Operations

(in thousands, except share

and per share data)

(unaudited)

Three Months Ended

September 30,

2024

2023

Revenues:

Collaboration revenue

$

(1,102

)

$

(4,387

)

Contract revenue

1,391

289

Grant revenue

2,091

6,737

Total revenues

2,380

2,639

Operating expenses:

Cost of revenue

50

38

Research and development

195,178

145,028

Selling, general and administrative

25,744

40,933

Restructuring, long-lived assets

impairment and related charges

12,712

3,372

Total operating expenses

233,684

189,371

Loss from operations

(231,304

)

(186,732

)

Other income:

Change in fair value of equity

investments

1,130

(2,707

)

Interest income

17,527

21,931

Other (expense) income, net

(893

)

882

Total other income

17,764

20,106

Loss before (provision for) benefit from

income taxes

(213,540

)

(166,626

)

(Provision for) benefit from income

taxes

(177

)

3,213

Net loss

(213,717

)

(163,413

)

Net loss attributable to noncontrolling

interest

—

—

Net loss attributable to Vir

$

(213,717

)

$

(163,413

)

Net loss per share attributable to Vir,

basic and diluted

$

(1.56

)

$

(1.22

)

Weighted-average shares outstanding, basic

and diluted

136,653,753

134,289,620

View source

version on businesswire.com: https://www.businesswire.com/news/home/20241031806056/en/

Media Arran Attridge Senior Vice President, Corporate

Communications aattridge@vir.bio

Investors Richard Lepke Senior Director, Investor

Relations rlepke@vir.bio

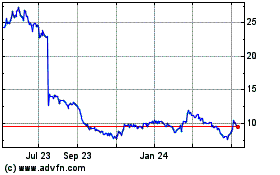

Vir Biotechnology (NASDAQ:VIR)

Historical Stock Chart

From Nov 2024 to Dec 2024

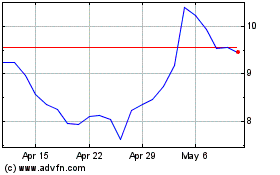

Vir Biotechnology (NASDAQ:VIR)

Historical Stock Chart

From Dec 2023 to Dec 2024