Uniti Group Inc. Announces Tax Reporting Information for 2021 Distributions

January 26 2022 - 4:15PM

Uniti Group Inc. (“Uniti”) (Nasdaq: UNIT) announced today the tax

treatment of its 2021 distributions. The following table summarizes

the federal income tax treatment of the distributions on its common

shares as it is expected to be reported on Form 1099 – DIV.

| Common Stock CUSIP

(91325V108) |

|

RecordDate |

|

PaymentDate |

|

TotalDistributionPer Share |

|

OrdinaryDividendPer Share |

|

Capital GainDistributionPer Share |

|

NondividendDistributionPer Share |

|

4/1/21 |

|

4/16/21 |

|

$0.15 |

|

$0.15 |

|

$0.00 |

|

$0.00 |

|

6/18/21 |

|

7/2/21 |

|

$0.15 |

|

$0.15 |

|

$0.00 |

|

$0.00 |

|

9/17/21 |

|

10/1/21 |

|

$0.15 |

|

$0.15 |

|

$0.00 |

|

$0.00 |

|

|

|

Total |

|

$0.45 |

|

$0.45 |

|

$0.00 |

|

$0.00 |

Ordinary dividend per share is non-qualified

dividend income. The Ordinary Dividend Per Share will also be

reported on Form 1099-DIV, Box 5, as Section 199A Dividends.

The quarterly cash dividend of $0.15 per share

of common stock, which was paid on January 3, 2022 to the

shareholders of record as of December 17, 2021, will be reported on

Form 1099-DIV for the 2022 taxable year for federal income tax

purposes.

ABOUT UNITI

Uniti, an internally managed real estate

investment trust, is engaged in the acquisition and construction of

mission critical communications infrastructure, and is a leading

provider of fiber and other wireless solutions for the

communications industry. As of September 30, 2021, Uniti owns

approximately 126,000 fiber route miles, 7.5 million fiber strand

miles, and other communications real estate throughout the United

States. Additional information about Uniti can be found on its

website at www.uniti.com.

INVESTOR AND MEDIA CONTACTS:

Paul Bullington, 251-662-1512Senior Vice President, Chief

Financial Officer & Treasurerpaul.bullington@uniti.com

Bill DiTullio, 501-850-0872Vice President, Finance and Investor

Relationsbill.ditullio@uniti.com

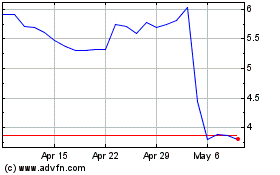

Uniti (NASDAQ:UNIT)

Historical Stock Chart

From Jun 2024 to Jul 2024

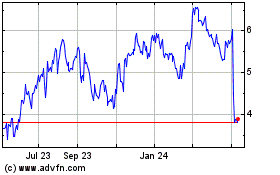

Uniti (NASDAQ:UNIT)

Historical Stock Chart

From Jul 2023 to Jul 2024