Filed Pursuant to Rule 424(b)(5)

Registration No. 333-252441

PROSPECTUS SUPPLEMENT

(To Prospectus Dated March 3, 2022)

Up

to US$50,000,000

Common

Shares

We have entered into an At

Market Issuance Sales Agreement, dated September 1, 2023, which we refer to as the Sales Agreement, with B. Riley Securities, Inc. (“Agent”

or “B. Riley”), relating to the issuance and sale of our common shares offered by this prospectus supplement. In accordance

with the terms of the Sales Agreement, we may offer and sell our common shares under this prospectus supplement having an aggregate offering

price of up to $50,000,000 from time to time through or to B. Riley, as sales agent or principal.

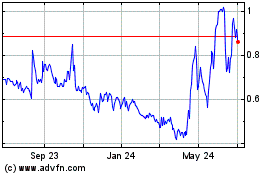

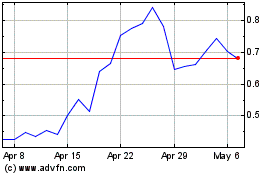

Our common shares are listed

on The Nasdaq Capital Market under the symbol “TLSA.” On August 31, 2023, the last reported price of the common shares on

The Nasdaq Capital Market was $0.73 per share.

Sales of common shares under

this prospectus supplement, if any, may be made in sales deemed to be “at the market offerings” as defined in Rule 415 promulgated

under the Securities Act of 1933, as amended, or the Securities Act. B. Riley will act as sales agent or principal on a best efforts basis

using commercially reasonable efforts consistent with its normal trading and sales practices. There is no arrangement for funds to be

received in any escrow, trust or similar arrangement.

The Agent will be entitled

to compensation at a commission rate equal to up to 3.0% of the gross sales price per common share sold. In connection with the sale of

common shares on our behalf, the Agent will be deemed to be an “underwriter” within the meaning of the Securities Act, and

the compensation of the Agent will be deemed to be underwriting commissions or discounts. We have agreed to provide indemnification to

the Agent against certain liabilities, including liabilities under the Securities Act.

See the “Plan of Distribution”

section beginning on page S-28 of this prospectus supplement for a description of the compensation payable to B. Riley as Agent.

Investing in the common

shares involves a high degree of risk. Before buying any securities, you should carefully consider the risk factors described in “Risk

Factors” beginning on page S-5 of this prospectus supplement, page 7 of the accompanying prospectus and in the documents

incorporated by reference into this prospectus supplement.

Neither the Securities

and Exchange Commission nor any state securities commission has approved or disapproved of these securities or determined if this prospectus

supplement or the accompanying prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

B.

Riley Securities

The date of this prospectus supplement is September

1, 2023

TABLE OF CONTENTS

PROSPECTUS SUPPLEMENT

PROSPECTUS

ABOUT

THIS PROSPECTUS SUPPLEMENT

This prospectus supplement

and the accompanying prospectus are part of a shelf registration statement that we filed with the Securities and Exchange Commission (the

“Commission”) using a “shelf” registration process. This prospectus supplement amends and supplements the information

contained in the prospectus filed as a part of our registration statement on Form F-3 (File No. 333-252441), which was declared effective

as of March 3, 2022 (the “Registration Statement”). This document is in two parts. The first part is the prospectus supplement,

including the documents incorporated by reference, which describes the specific terms of this offering. The second part, the accompanying

prospectus, including the documents incorporated by reference, provides more general information. Generally, when we refer to this prospectus

supplement, we are referring to both parts of this document combined. We urge you to carefully read this prospectus supplement and the

accompanying prospectus, and the documents incorporated by reference herein and therein, before buying any of the securities being offered

under this prospectus supplement. This prospectus supplement may add, update or change information contained in the accompanying prospectus.

To the extent that any statement that we make in this prospectus supplement is inconsistent with statements made in the accompanying prospectus

or any documents incorporated by reference therein filed prior to the date of this prospectus supplement, the statements made in this

prospectus supplement will be deemed to modify or supersede those made in the accompanying prospectus and such documents incorporated

by reference therein.

Before buying any of the common

shares offered hereby, we urge you to carefully read this prospectus supplement and the accompanying prospectus, together with the information

incorporated by reference as described under the heading “Where You Can Find More Information” and “Incorporation of

Documents by Reference.” These documents contain important information that you should consider when making your investment decision.

To the extent there is a conflict between the information contained in this prospectus supplement, on the one hand, and the information

contained in any document incorporated by reference in this prospectus that was filed with the SEC before the date of this prospectus

supplement, on the other hand, you should rely on the information in this prospectus supplement, provided that if any statement in one

of these documents is inconsistent with a statement in another document having a later date—for example, a document incorporated

by reference in this prospectus supplement—the statement in the document having the later date modifies or supersedes the earlier

statement.

“Tiziana,” the

Tiziana logo and other trademarks or service marks of Tiziana Life Sciences Ltd. appearing in this prospectus supplement are the property

of Tiziana or its subsidiaries. This prospectus supplement contains additional trade names, trademarks and service marks of others, which

are the property of their respective owners. Solely for convenience, trademarks and trade names referred to in this prospectus supplement

may appear without the ® or TM symbols.

In this prospectus supplement,

except where the context otherwise requires and for purposes of this prospectus supplement only:

| |

● |

“we,” “us,” “our company,” “the Company,” “the registrant,” “our,” “Tiziana” and “Tiziana Life Sciences Ltd.” refer to Tiziana Life Sciences plc and its wholly-owned subsidiaries, Tiziana Therapeutics, Inc., Tiziana Pharma Limited. and Longevia Genomics S.r.l.; |

| |

● |

“shares” refer to our ordinary shares; |

| |

● |

discrepancies in any table between the amounts identified as total amounts and the sum of the amounts listed therein are due to rounding. |

No action is being taken in

any jurisdiction outside the United States to permit a public offering of the common shares or possession or distribution of this prospectus

supplement in that jurisdiction. Persons who come into possession of this prospectus supplement in a jurisdiction outside of the United

States are required to inform themselves about and to observe any restrictions that are applicable to that jurisdiction, as to this offering

and the distribution of this prospectus supplement.

CAUTIONARY STATEMENT REGARDING FORWARD-LOOKING

STATEMENTS

This prospectus supplement,

including the documents that we incorporate by reference, contain forward-looking statements within the meaning of Section 27A of the

Securities Act and Section 21E of the Securities Exchange Act of 1934, as amended, or the Exchange Act. All statements, other than statements

of historical facts, contained in this prospectus supplement, including statements regarding our future results of operations and financial

position, business strategy, prospective products, product approvals, research and development costs, timing and likelihood of success,

plans and objectives of management for future operations, and future results of current and anticipated products, are forward-looking

statements. These statements relate to future events or to our future financial performance and involve known and unknown risks, uncertainties

and other factors which may cause our actual results, performance or achievements to be materially different from any future results,

performance or achievements expressed or implied by the forward-looking statements. The words “anticipate,” “assume,”

“believe,” “contemplate,” “continue,” “could,” “estimate,” “expect,”

“goal,” “intend,” “may,” “might,” “objective,” “plan,” “potential,”

“predict,” “project,” “positioned,” “seek,” “should,” “target,”

“will,” “would,” or the negative of these terms or other similar expressions are intended to identify forward-looking

statements, although not all forward-looking statements contain these identifying words. These forward-looking statements are based on

current expectations, estimates, forecasts and projections about our business and the industry in which we operate and management’s

beliefs and assumptions, are not guarantees of future performance or development and involve known and unknown risks, uncertainties and

other factors.

Actual results or events could

differ materially from the plans, intentions and expectations disclosed in the forward-looking statements we make. As a result, any or

all of our forward-looking statements in this prospectus supplement may turn out to be inaccurate. We have included important factors

in the cautionary statements included in this prospectus supplement and the documents that we incorporate by reference, particularly in

the sections of this prospectus titled “Risk Factors,” that we believe could cause actual results or events to differ materially

from the forward-looking statements that we make. We may not actually achieve the plans, intentions or expectations disclosed in our forward-looking

statements, and you should not place undue reliance on our forward-looking statements. Moreover, we operate in a highly competitive and

rapidly changing environment in which new risks often emerge. It is not possible for our management to predict all risks, nor can we assess

the impact of all factors on our business or the extent to which any factor, or combination of factors, may cause actual results to differ

materially from those contained in any forward-looking statements we may make. Our forward-looking statements do not reflect the potential

impact of any future acquisitions, mergers, dispositions, joint ventures or investments we may make.

You should read this prospectus

supplement, the accompanying prospectus and the documents that we incorporate by reference in this prospectus supplement and have filed

as exhibits to the registration statement of which this prospectus supplement is a part completely and with the understanding that our

actual future results may be materially different from what we expect. The forward-looking statements contained in this prospectus supplement

are made as of the date on the front cover of this prospectus supplement, and we do not assume any obligation to update any forward-looking

statements except as required by applicable law and regulation.

PROSPECTUS SUPPLEMENT SUMMARY

This summary highlights

information contained elsewhere or incorporated by reference into this prospectus supplement. This summary does not contain all of the

information that you should consider before deciding to invest in our securities. You should read this entire prospectus supplement and

the accompanying prospectus carefully, including the “Risk Factors” section contained in this prospectus supplement, the accompanying

prospectus and our consolidated financial statements and the related notes and the other documents incorporated by reference into this

prospectus supplement and the accompanying prospectus.

Overview

We

are a clinical-stage biopharmaceutical company developing breakthrough therapies using transformational drug delivery technologies to

enable alternative routes of immunotherapy. Our innovative nasal approach has the potential to provide an improvement in efficacy as well

as safety and tolerability compared to intravenous (IV) delivery. Our lead candidate, intranasal foralumab, the only fully human anti-CD3

mAb, has demonstrated a favorable safety profile and clinical response in patients in studies to date. Our technology for alternative

routes of immunotherapy has been patented with several applications pending and is expected to allow for broad pipeline applications.

Intranasal foralumab is slated to start Phase 2b in non-active secondary progressive multiple sclerosis (na-SPMS) in Q4 2023 and has been

cleared to study in patients with mild to moderate Alzheimer’s disease. Addition indications under consideration include ALS, Long

COVID, Early Onset Type 1 DM and Intracerebral hemorrhage. We are led by a team of highly qualified executives with extensive drug development

and commercialization experience.

We

employ a lean and virtual research and development, or R&D, model using highly experienced teams of experts for each business function

to maximize value accretion by focusing resources on the drug discovery and development processes.

On

May 25, 2021 we announced that the first expanded access (EA) patient with na-SPMS was dosed with nasally administered foralumab

at the Brigham and Women’s Hospital (BWH), Harvard Medical School, Boston, MA. Nasal foralumab 50 mcg (25

mcg/nostril) was administered in 3-week cycles, with 3 times/week dosing for the first 2 weeks followed by 1 week of rest period. This

first-ever clinical study in SPMS patients, under an Individual Patient Expanded Access IND to evaluate routine safety, tolerability,

and neurological behaviors as well as examining microglial activation, by positron emission tomography (PET), immunological and neurodegenerative

markers to assess clinical responses following the dosing regimen.

On

January 20, 2022, FDA approved enrollment of a second EA SPMS patient for treatment with intranasal foralumab. Based on the safety data

from the first two EA patients, the FDA granted permission to enroll up to eight additional na-SPMS patients. As part of the original

treatment plan, the foralumab dose will remain 50 mcg three times a week (MWF), which is the same dose administered previously to the

first two SPMS patients. The dosing regimen in this IND also has a provision for dose escalation up to 100 mcg three times a week (MWF)

as an option to improve clinical benefit, if needed.

On

March 10, 2022, we reported positive clinical data in the EA1 (expanded access patient #1) following completion of six months of treatment

with intranasally administered foralumab. In addition to being well-tolerated, both biological and clinical improvements were seen. Importantly,

the PET imaging data indicated inhibition of microglial cell activation observed at 3 months following treatment initiation and was sustained

at 6 months after treatment start.

On

June 8, 2022, we announced positive 3-month clinical results for EA2. These results confirm the previously reported data, from the EA1

that after three months of treatment, intranasal foralumab. was well-tolerated and improved clinical and PET imaging analyses.

On November

10, 2022, we announced our corporate focus on developing intranasal foralumab for inflammatory diseases of the Central Nervous System

(CNS) such as non-active SPMS, Alzheimer’s disease and amyotrophic lateral sclerosis (ALS). This was based on the marked improved

of EA2. In 2022, upon beginning the EA program, EA2 required a cane for walking. By the end of 2022, we reported he no longer needed a

cane to walk 200 feet.

On

June 5, 2023 we announced that 3 out of 4 of our new EA patients (EA3 through 6) had improved 3-month PET scans compared to baseline.

When adding the improved 3-month PET scans of EA1 and EA2 83% (5 of 6) EA patients with na-SPMS showed 3-month PET scan improvements.

This data informed us to choose 3-month PET scans of the brain to be the primary endpoint in its phase 2a protocol submitted to the FDA

in the beginning of July. We anticipate having an investigator’s meeting in September 2023 and plan to enroll our first patient

in the study in Q4-2023.

In

August 2023, we announced the intranasal foralumab Alzheimer’s disease IND received a “may proceed” clearance e-mail

from the FDA. Intranasal foralumab represents a novel approach to the potential treatment of mild to moderate Alzheimer’s disease

by treating neuroinflammation either as concomitant therapy or standalone. The first patient is anticipated to be enrolled Q4-2023/Q1-2024.

Risks Associated with Our Business

Our business is subject to

numerous risks. You should read these risks before you invest in our securities. In particular, our risks include, but are not limited

to, the following:

| |

● |

We may fail to demonstrate the safety and therapeutic utility of our product candidates to the satisfaction of applicable regulatory authorities, which would prevent or delay regulatory approval and commercialization. |

| |

● |

We depend on enrollment of patients in our clinical trials for our product candidates and may find it difficult to enroll patients in our clinical trials, which could delay or prevent us from proceeding with clinical trials of our product candidates and could materially adversely affect our research and development efforts and business, financial condition and results of operations. |

| |

● |

We have incurred net losses in every year since our inception. We anticipate that we will continue to incur losses for the foreseeable future and may never achieve or maintain profitability. |

| |

● |

We need substantial additional funding to complete the development of our product candidates, which may not be available on acceptable terms, if at all. Failure to obtain this necessary capital when needed may force us to delay, limit or terminate certain of our product development, research operations or future commercialization efforts, if any. |

| |

● |

We rely, and expect to continue to rely, on third parties to conduct our preclinical studies and clinical trials and for product manufacturing. If these third parties do not successfully carry out their contractual duties or meet expected deadlines, we may not be able to obtain regulatory approval for or commercialize our product candidates. |

| |

● |

Our rights to develop and commercialize our product candidates are subject to the terms and conditions of licenses granted to us by others. If we fail to comply with our obligations under our existing and any future intellectual property licenses with third parties, we could lose license rights that are important to the business. |

| |

● |

If our competitors are able to obtain orphan drug exclusivity for products that constitute the same drug and treat the same indications as our product candidates, we may not be able to have competing products approved by applicable regulatory authorities for a significant period of time. In addition, even if we obtain orphan drug exclusivity for any of our products, such exclusivity may not protect us from competition. |

| |

● |

Healthcare legislative reform measures may have a negative impact on our business and results of operations. |

| |

● |

Our common shares may be delisted from The Nasdaq Capital Market if we fail to comply with continued listing standards. |

| |

● |

Because we are a foreign corporation, you may not have the same rights as a shareholder in a U.S. corporation. |

| |

● |

Claims of U.S. civil liabilities may not be enforceable against us. |

| |

● |

If we are a passive foreign investment company, there could be adverse U.S. federal income tax consequences to U.S. holders. |

Corporate Information

We were originally incorporated

under the laws of England and Wales on February 11, 1998 with the goal of leveraging the expertise of our management team as well

as Dr. Napoleone Ferrara, Dr. Arun Sanyal, Dr. Howard Weiner and Dr. Kevan Herold, and to acquire and exploit certain intellectual property

in biotechnology. We subsequently changed our name to Tiziana Life Sciences plc in April 2014 as a result of the acquisition of Tiziana

Pharma Limited in April 2014. On August 20, 2021 we announced that we had formally commenced a strategic

plan to change our corporate structure by establishing Tiziana Life Sciences Ltd, a Bermuda-incorporated company, to become the ultimate

parent company of the Tiziana Group. The reorganization was performed under a scheme of arrangement under Part 26 of the UK Companies

Act 2006 and became effective on October 20, 2021, at which point all shareholders became shareholders in the new Bermuda company.

Our registered office is located

at Clarendon House, 2 Church Street, Hamilton HM 11, Bermuda and our telephone number is +44 (0) 20 7495 2379. Our website address is

www.tizianalifesciences.com. The reference to our website is an inactive textual reference only and the information contained in,

or that can be accessed through, our website is not a part of this registration statement. Our agent for service of process in the United

States is Tiziana Therapeutics, Inc.

“Tiziana,” the

Tiziana logo and other trademarks or service marks of Tiziana Life Sciences Limited appearing in this prospectus supplement are the property

of Tiziana or our subsidiaries. This prospectus supplement contains additional trade names, trademarks and service marks of others, which

are the property of their respective owners. Solely for convenience, trademarks and trade names referred to in this prospectus supplement

may appear without the ® or TM symbols.

The Offering

| Securities offered |

|

Common shares having an aggregate offering price of up to US$50,000,000. |

| |

|

|

| Manner of offering |

|

“At the market offering” that may be made from time to time through or to B. Riley Securities, Inc., as sales agent or principal. See “Plan of Distribution” on page S-28. |

| |

|

|

| Common shares to be outstanding immediately after this offering (1) |

|

170,765,765 common shares |

| |

|

|

| Use of proceeds |

|

We intend to use net proceeds from this offering (i) to complete our Phase

2a clinical trial for the intra-nasal delivery of Foralumab in patients with non-active secondary progressive multiple sclerosis, (ii)

to expedite the clinical development of Foralumab in Alzheimer’s, (iii) to develop Foralumab for other indications, and (iv) for

working capital and other general corporate purposes. See “Use of Proceeds” on page S-10. |

| |

|

|

| Nasdaq Capital Market Symbol |

|

Our common shares are listed on The Nasdaq Capital Market under the symbol “TLSA.” |

| |

|

|

| Risk Factors |

|

This investment involves a high degree of risk. See “Risk Factors” beginning on page S-5 of this prospectus supplement, page 7 of the accompanying prospectus as well as the other information included in or incorporated by reference in this prospectus supplement for a discussion of risks you should consider carefully before making an investment decision. |

| (1) | The number of shares of our common

shares that will be outstanding after this offering is based on 102,272,614 common shares outstanding as of August 31, 2023, and excludes

as of that date: |

| |

● |

2,127,138 common shares issuable upon the exercise of share options at exercise prices of between $0.57 and $2.06 per common share; |

| |

● |

591,749 common shares that may be issued upon the exercise of warrants to purchase common shares at exercise prices of between $2.52 and $6.30 per common share; and |

Unless otherwise indicated,

this prospectus supplement reflects and assumes no exercise of outstanding share options or warrants after August 31, 2023.

Unless otherwise stated, all

information contained in this prospectus supplement reflects the assumed public offering price of US$0.73 per common share, which was

the closing price of our common shares on The Nasdaq Capital Market on August 31, 2023.

RISK FACTORS

An investment in the common

shares involves a high degree of risk. Prior to making a decision about investing in these securities, you should carefully consider the

specific risks, uncertainties and assumptions discussed under the heading “Risk Factors” included in our most recent Annual

Report on Form 20-F for the fiscal year ended December 31, 2022, all of which are incorporated herein by reference, and may be amended,

supplemented or superseded from time to time by other reports we file with the SEC in the future. Our business, financial condition or

results of operations could be materially adversely affected by any of these risks which cause you to lose all or part of your investment

in the offered securities. Certain statements in this prospectus supplement, the accompanying prospectus and the documents incorporated

by reference into the prospectus supplement are forward-looking statements. Please also see the section entitled “Cautionary Statement

Regarding Forward-Looking Statements.”

Risks Related to the Offering

The actual number of common shares we will

issue under the Sales Agreement, at any one time or in total, if any, is uncertain.

Subject to certain limitations

in the sales agreement with B. Riley and compliance with applicable law, we have the discretion to deliver placement notices to B. Riley

at any time throughout the term of the Sales Agreement. The number of common shares that are sold by B. Riley after our delivering a placement

notice will fluctuate based on the market price of our common shares during the sales period and limits we set with B. Riley.

The common shares offered under this prospectus

supplement may be sold in “at the market offerings”, and investors who buy common shares at different times will likely pay

different prices.

Investors who purchase common

shares under this prospectus supplement at different times will likely pay different prices, and so may experience different outcomes

in their investment results. We will have discretion, subject to market demand, to vary the timing, prices, and numbers of common shares

sold, and there is no minimum or maximum sales price. Investors may experience declines in the value of their common shares as a result

of sales made at prices lower than the prices they paid.

We may lose our foreign private issuer status

in the future, which would result in significant additional costs and expenses.

In the future, we may lose

our foreign private issuer status if a majority of our shareholders and a majority of our directors or management are US citizens or residents.

If we lose our foreign private issuer status, we will have to mandatorily comply with US federal proxy requirements, and our officers,

directors and principal shareholders will become subject to the short-swing profit disclosure and recovery provisions of Section 16 of

the Exchange Act. We will be required to file periodic reports and registration statements on US domestic issuer forms containing financial

statements prepared in accordance with US generally accepted accounting principles with the SEC, which are more detailed and extensive

than the forms available to a foreign private issuer. In addition, if we lose our status as a foreign private issuer we will become subject

to the Nasdaq corporate governance requirements. As a result, the regulatory and compliance costs to us may be significantly higher if

we cease to qualify as a foreign private issuer.

Our senior management team may invest or

spend the net proceeds of this offering, if any, in ways with which you may not agree or in ways which may not yield a significant return.

Our senior management will

have broad discretion over, and we could spend, the net proceeds from this offering, if any, in ways with which the holders of common

shares may not agree or that do not yield a favorable return, if any. We expect to use our existing cash and cash equivalents and the

net proceeds from this offering, if any, (i) complete our Phase 2a clinical trial for the intra-nasal delivery of Foralumab in patients

with non-active secondary progressive multiple sclerosis, (ii) to expedite the clinical development of Foralumab in Alzheimer’s,

(iii) to develop Foralumab for other indications, and (iv) for working capital and other general corporate purposes. We may also use a

portion of the net proceeds from this offering to in-license, acquire or invest in complementary businesses, technologies, products or

assets, however, we have no current commitments or obligations to do so. Furthermore, our senior management will have considerable discretion

in the application of the net proceeds, and you will not have the opportunity, as part of your investment decision, to assess whether

the net proceeds are being used appropriately. The net proceeds may be used for corporate purposes that do not improve our operating results

or enhance the value of our common shares.

We

need substantial additional funding to complete the development of our product candidates, which may not be available on acceptable terms,

if at all. Failure to obtain this necessary capital when needed may force us to delay, limit or terminate certain of our product development,

research operations or future commercialization efforts, if any.

Our

operations have consumed substantial amounts of cash since inception, and we expect our expenses to increase in connection with our ongoing

activities, particularly as we continue the R&D of, initiate further clinical trials of and seek marketing approval for, our product

candidates. In addition, if we obtain marketing approval for our product candidates, we expect to incur significant expenses related to

product sales, marketing, manufacturing and distribution. Furthermore, we expect to incur additional costs associated with operating as

a public company listed on the Nasdaq in the United States. Our future capital requirements will depend on many factors, including:

| |

● |

the scope, progress, results and costs of laboratory testing, manufacturing, preclinical and clinical development for our current and future product candidates; |

| |

● |

the costs, timing and outcome of regulatory review of our product candidates; |

| |

● |

the extent to which we acquire or in-license and develop other product candidates and technologies; |

| |

● |

our ability to establish and maintain collaborations and license agreements on favorable terms, if at all; |

| |

● |

the costs, timing and outcome of potential future commercialization activities, including manufacturing, marketing, sales and distribution for our product candidates for which we receive marketing approval; |

| |

● |

the costs of developing, maintaining and enforcing our intellectual property rights and defending intellectual property-related claims; and |

| |

● |

the sales price and availability of adequate third-party coverage and reimbursement for our product candidates, if and when approved. |

Developing

product candidates and conducting preclinical studies and clinical trials is a time-consuming, expensive and uncertain process that takes

years to complete, and we may never generate the necessary data or results required to obtain marketing approval and achieve product sales.

In addition, our product candidates, if approved, may not achieve commercial success. Our product revenues, if any, will be derived from

or based on sales of product candidates that may not be commercially available for many years, if at all. Accordingly, we will need to

continue to rely on additional financing to achieve our business objectives. Adequate additional financing may not be available to us

on acceptable terms, if at all. To the extent that additional capital is raised through the issuance of equity or equity-linked securities,

the issuance of those securities could result in substantial dilution for our current shareholders and the terms of any future issuance

may include liquidation or other preferences that adversely affect the rights of our current shareholders. Debt financing, if available,

may involve covenants restricting our operations or our ability to incur additional debt. Any debt or additional equity financing that

we raise may contain terms that are not favorable to us or our shareholders. If we raise additional funds through collaboration and licensing

arrangements with third parties, it may be necessary to relinquish some rights to our technologies or our product candidates or grant

licenses on terms that are not favorable to us. Furthermore, the potential issuance of additional securities in the future, whether equity

or debt, by us, or the possibility of such issuance, may cause the market price of our common shares, to decline and existing shareholders

may not agree with our financing plans or the terms of such financings.

If

we are unable to obtain adequate funding on a timely basis, we may be required to significantly curtail, delay or discontinue our R&D

programs of our product candidates or any future commercialization efforts, be unable to expand our operations or be unable to otherwise

capitalize on our business opportunities, as desired, which could harm our business and potentially cause us to discontinue operations.

You will experience immediate and substantial

dilution in the net tangible book value per share of the common shares you purchase.

Since the offering price per

share of the common shares being offered is substantially higher than the net tangible book value per share of common shares, you will

suffer substantial dilution in the net tangible book value of the common shares you purchase in this offering. Assuming that an aggregate

of 68,493,151 common shares are sold at a price of $0.73 per common share, the last reported sale price of our common stock on The Nasdaq

Capital Market on August 31, 2023, for aggregate gross proceeds of approximately $50 million, and after deducting commissions and estimated

offering expenses payable by us, if you purchase common shares in this offering, you will suffer immediate and substantial dilution of

approximately $0.33 per share in the net tangible book value of the common shares. See the section entitled “Dilution” on

page S-10 of this prospectus supplement for a more detailed discussion of the dilution you will incur if you purchase common shares in

this offering.

Our common shares

may be delisted from The Nasdaq Capital Market if we fail to comply with continued listing standards.

If

we fail to meet any of the continued listing standards of The Nasdaq Capital Market, our common shares could be delisted from The Nasdaq

Capital Market. These continued listing standards include specifically enumerated criteria, such as:

|

|

● |

a $1.00 minimum closing bid price; |

| |

● |

stockholders’ equity of $2.5 million; |

| |

● |

500,000 shares of publicly-held common stock with a market value of at least $1 million; |

| |

● |

300 round-lot stockholders; and |

| |

● |

compliance with Nasdaq’s corporate

governance requirements, as well as additional or more stringent criteria that may be applied in the exercise of Nasdaq’s

discretionary authority. |

On June 14, 2022, we received

a written notice (the “Notice”) from the Nasdaq Stock Market LLC (“Nasdaq”) notifying us that were not in compliance

with Nasdaq Listing Rule 5550(a)(2) (the “Rule”), as the minimum bid price of the Company’s common shares has been below

$1.00 per share for 30 consecutive business days. On December 13, 2022, Nasdaq notified us that we were eligible for an additional 180

calendar day period, or until June 12, 2023, to regain compliance.

On April 21, 2023, we

received notice from Nasdaq that we had regained compliance with the minimum bid price requirement for continued listing on The Nasdaq

Capital Market.

On July 19, 2023, we received

Notice from Nasdaq notifying us that were not in compliance with the Rule, as the minimum bid price of the Company’s common shares

has been below $1.00 per share for 30 consecutive business days and that we have until January 16, 2024 to regain compliance.

If

we fail to comply with Nasdaq’s continued listing standards, we may be delisted and our common shares will trade, if at all, only

on the over-the-counter market, such as the OTC Bulletin Board or OTCQX market, and then only if one or more registered broker-dealer

market makers comply with quotation requirements. In addition, delisting of our common shares could depress our stock price, substantially

limit liquidity of our common shares and materially adversely affect our ability to raise capital on terms acceptable to us, or at all.

Finally, delisting of our common shares could result in our common shares becoming a “penny stock” under the Exchange Act.

The prices of the common shares may be volatile

and fluctuate substantially, which could result in substantial losses for holders of the common shares.

The market prices of the

common shares on The Nasdaq Capital Market may be volatile and fluctuate substantially. The stock market in general and the market

for smaller pharmaceutical and biotechnology companies in particular have experienced extreme volatility that has often been

unrelated to the operating performance of particular companies. As a result of this volatility, holders of the common shares may not

be able to sell their common shares at or above the price at which they were purchased. The market price for the common shares may

be influenced by many factors, including:

| |

● |

the success of competitive products or technologies; |

| |

● |

results of clinical trials of Foralumab, anti-IL6R mAb (TZLS-501), Milciclib and any other future product candidate that we develop; |

| |

● |

results of clinical trials of product candidates of our competitors; |

| |

● |

changes or developments in laws or regulations applicable to Foralumab, anti-IL6R mAb (TZLS-501), Milciclib and any other future product candidates that we develop; |

| |

● |

our entry into, and the success of, any collaboration agreements with third parties; |

| |

● |

developments or disputes concerning patent applications, issued patents or other proprietary rights; |

| |

● |

the recruitment or departure of key personnel; |

| |

● |

the level of expenses related to any of our product candidates or clinical development programs; |

| |

● |

the results of our efforts to discover, develop, acquire or in-license additional product candidates, products or technologies; |

| |

● |

actual or anticipated changes in estimates as to financial results, development timelines or recommendations by securities analysts; |

| |

● |

variations in our financial results or those of companies that are perceived to be similar to us; |

| |

● |

market conditions in the biotechnology and pharmaceutical sectors; |

| |

● |

general economic, industry and market conditions; |

| |

● |

the trading volume of common shares on The Nasdaq Capital Market; and the other factors described in this “Risk Factors” section. |

If securities or industry analysts cease

to publish research reports about us or our industry, or if they adversely change their recommendations regarding our common shares, the

market price for the common shares and trading volume could decline.

The trading market for the

common shares is influenced by research reports that industry or securities analysts publish about us or our industry. If one or more

analysts who cover us downgrade the common shares, the market price for the common shares would likely decline. If one or more of these

analysts ceases coverage of us or fails to regularly publish reports on us, we could lose visibility in the financial markets, which,

in turn, could cause the market price or trading volume for the common shares to decline.

We have no present intention to pay dividends

on our common shares in the foreseeable future and, consequently, your only opportunity to achieve a return on your investment during

that time is if the price of the common shares appreciates.

We have never paid or declared

any cash dividends on our common shares, and we do not anticipate paying any cash dividends on our common shares in the foreseeable future.

We intend to retain all available funds and any future earnings to fund the development and expansion of our business. Under the Companies

Act 1981 of Bermuda, which we refer to in this prospectus as the “Companies Act” we may declare or pay a dividend only if

we have reasonable grounds for believing that we are, or would after the payment be, able to pay our liabilities as they become due and

if the realizable value of our assets would thereby be less than our liabilities. Any declaration of a dividend by our board of directors

will depend on many factors, including our financial condition, results of operations, legal requirements and other factors. Accordingly,

if the price of the common shares falls in the foreseeable future, you will incur a loss on your investment, without the likelihood that

this loss will be offset in part or at all by potential future cash dividends.

We are an “emerging

growth company,” and the reduced disclosure requirements applicable to emerging growth companies may make our common shares less

attractive to investors.

We

are an “emerging growth company” as defined in the SEC’s rules and regulations and we will remain an emerging growth

company until the earlier to occur of (a) the last day of the fiscal year (1) following the fifth anniversary of the completion of this

offering, (2) in which we have total annual gross revenues of at least $1.07 billion or (3) in which we are deemed to be a “large

accelerated filer” under the rules of the SEC, which means the market value of our common shares that are held by non-affiliates

exceeds $700.0 million as of the prior December 31, or (b) the date on which we have issued more than $1.0 billion in non-convertible

debt during the prior three-year period. For so long as we remain an emerging growth company, we are permitted and intend to rely on exemptions

from certain disclosure requirements that are applicable to other public companies that are not emerging growth companies. These exemptions

include:

| |

● |

not being required to comply with the auditor attestation requirements of Section 404 of the Sarbanes-Oxley Act, or Section 404; |

| |

● |

not being required to comply with any requirement that has or may be adopted by the Public Company Accounting Oversight Board regarding mandatory audit firm rotation or a supplement to the auditor’s report providing additional information about the audit and the financial statements; |

| |

● |

being permitted to provide only two years of audited financial statements in this prospectus, in addition to any required unaudited interim financial statements, with correspondingly reduced “Management’s discussion and analysis of financial condition and results of operations” disclosure; |

| |

● |

reduced disclosure obligations regarding executive compensation; and |

| |

● |

an exemption from the requirement to seek nonbinding advisory votes on executive compensation or golden parachute arrangements. |

We

may choose to take advantage of some, but not all, of the available exemptions. We have taken advantage of reduced reporting burdens in

this prospectus. In particular, we have not included all of the executive compensation information that would be required if we were not

an emerging growth company. We cannot predict whether investors will find our common shares less attractive if we rely on certain or all

of these exemptions. If some investors find our common shares less attractive as a result, there may be a less active trading market for

our common shares and our common share price may be more volatile.

In

addition, the JOBS Act provides that an emerging growth company may take advantage of an extended transition period for complying with

new or revised accounting standards. This allows an emerging growth company to delay the adoption of certain accounting standards until

those standards would otherwise apply to private companies. We have elected to take advantage of the extended transition period for complying

with new or revised accounting standards and, as a result, our financial statements may not be comparable to companies that comply with

new or revised accounting pronouncements as of public company effective dates.

Even

after we no longer qualify as an emerging growth company, we may still qualify as a “smaller reporting company” if the market

value of our common shares held by non-affiliates is below $250 million (or $700 million if our annual revenue is less than $100 million)

as of June 30 in any given year, which would allow us to take advantage of many of the same exemptions from disclosure requirements, including

reduced disclosure obligations regarding executive compensation in our periodic reports and, when required, our proxy statements.

USE OF PROCEEDS

We may issue and sell common

shares having aggregate sales proceeds of up to US$50,000,000 from time to time. Because there is no minimum offering amount required

as a condition to close this offering, the actual total public offering amount, commissions and proceeds to us, if any, are not determinable

at this time. Except as described in any free writing prospectus that we may authorize to be provided to you, we currently intend to use

the net proceeds from the sale of the securities offered hereby (i) complete our Phase 2a clinical trial for the intra-nasal delivery

of Foralumab in patients with non-active secondary progressive multiple sclerosis, (ii) to expedite the clinical development of Foralumab

in Alzheimer’s, (iii) to develop Foralumab for other indications, and (iv) for working capital and other general corporate purposes.

We may also use a portion of the net proceeds from this offering to in-license, acquire or invest in complementary businesses, technologies,

products or assets, however, we have no current commitments or obligations to do so.

Management’s plans for

the use of the proceeds of this offering are subject to change due to unforeseen events and opportunities, and the amounts and timing

of our actual expenditures depend on several factors, including our expansion plans and the amount of cash generated or used by our operations.

We cannot specify with certainty the particular uses for the net proceeds to be received upon completion of this offering. Accordingly,

our management will have broad discretion in using the net proceeds of this offering. Pending the use of the net proceeds, we intend to

invest the net proceeds in short-term, investment-grade, interest-bearing instruments.

DILUTION

If you purchase common shares

in this offering, your ownership interest in us will be diluted to the extent of the difference between the public offering price per

common share you will pay in this offering and the pro forma net tangible book value per common share after this offering.

Our historical net tangible

book value as of December 31, 2022, was approximately $19.6 million, corresponding to a net tangible book value of $0.19 per common

share, as of such date. We calculate our historical net tangible book value per share or per common share by taking the amount of our

total tangible assets, subtracting the amount of our total liabilities, and then dividing the difference by the actual total number of

common shares outstanding.

After giving effect to the

sale of common shares in the aggregate amount of US$50 million at an assumed offering price of US$0.73 per common share, which was

the closing price of common shares on The Nasdaq Capital Market on August 31, 2023, and after deducting estimated offering commissions

and expenses payable by us, our as adjusted net tangible book value as of December 31, 2022 would have been would have been

$0.40 per common share. This represents an immediate increase in net tangible book value of $0.21 per common share to existing shareholders

and an immediate dilution of $0.33 per common share to new investors purchasing common shares in this offering. Dilution per common share

to new investors is determined by subtracting the as adjusted net tangible book value per common share after this offering from the public

offering price per common share paid by new investors.

The following table illustrates

this dilution:

| Assumed public offering price per common share | |

| | | |

$ | 0.73 | |

| Net tangible book value per common share as at December 31, 2022 | |

$ | 0.19 | | |

| | |

| Increase in net tangible book value per common share attributable to purchasers purchasing common shares in this offering | |

$ | 0.21 | | |

| | |

| As adjusted net tangible book value per common share | |

| | | |

$ | 0.40 | |

| Dilution per common share to purchasers in this offering | |

| | | |

$ | 0.33 | |

The number of shares

of our common shares that will be outstanding after this offering is based on 102,272,614 common shares outstanding as of December 31,

2022 , and excludes as of that date:

| |

● |

3,807,763 common shares issuable upon the exercise of share options at exercise prices of between $0.97 and $4.35 per common share; |

| |

● |

591,749 common shares that may be issued upon the exercise of warrants to purchase common shares at exercise prices of between $2.76 and $6.90 per common share; and |

DESCRIPTION

OF SHARE CAPITAL AND MEMORANDUM OF ASSOCIATION

Introduction

Set forth below is a summary

of certain information concerning our share capital as well as a description of certain provisions of our memorandum of association, or

Memorandum, and relevant provisions of the Bermuda Companies Act. The summary below contains only material information concerning our

share capital and corporate status and does not purport to be complete and is qualified in its entirety by reference to our memorandum

of association and applicable Bermuda law.

We were originally incorporated

under the laws of England and Wales on February 11, 1998 under the name of Bigboom plc, with the goal of leveraging the expertise of our

management team as well as Dr. Napoleone Ferrara, Dr. Arun Sanyal, Dr. Howard Weiner and Dr. Kevan Herold, and to acquire and exploit

certain intellectual property in biotechnology. We subsequently changed our name to Tiziana Life Sciences plc in April 2014 as a result

of the acquisition of Tiziana Pharma Limited in April 2014. On October 19, 2021, pursuant to a UK scheme of arrangement, a Bermuda-incorporated

company that is tax resident in England acquired the business of Tiziana Life Sciences plc, in succession to us, and the holders of ordinary

shares of Tiziana Life Sciences plc received new common shares of the Bermuda company in exchange for their ordinary shares of Tiziana

Life Sciences plc. Our new name, operating as a Bermuda company. is Tiziana Life Sciences Ltd.

Our registered office is located

at Clarendon House, 2 Church Street, Hamilton HM 11, Bermuda and our telephone number is +44 (0) 20 7495 2379. Our website address is

www.tizianalifesciences.com. The reference to our website is an inactive textual reference only and the information contained in,

or that can be accessed through, our website is not a part of this registration statement.

General

Our share capital comprises

common shares of par value $0.0005 each and preference shares of par value $0.001 each. Subject to a resolution of shareholders to the

contrary and any special rights previously conferred on the holders of any existing shares or class of shares, the Board is authorized

to issue any unissued shares on such terms and conditions as it may determine.

Common Shares

Holders of common shares have

no pre-emptive, redemption, conversion or sinking fund rights. Holders of common shares are entitled to one vote per share on all matters

submitted to a vote of holders of common shares. Unless a different majority is required by law or by our bye-laws, resolutions to be

approved by holders of common shares require approval by a simple majority of votes cast at a meeting at which a quorum is present.

In the event of our liquidation,

dissolution or winding up, the holders of common shares are entitled to share equally and ratably in our assets, if any, remaining after

the payment of all of our debts and liabilities, subject to any liquidation preference on any issued and outstanding preference shares.

Preference Shares

Pursuant to Bermuda law and

our bye-laws, our board of directors may, by resolution, establish one or more series of preference shares having such number of shares,

designations, dividend rates, relative voting rights, conversion or exchange rights, redemption rights, liquidation rights and other relative

participation, optional or other special rights, qualifications, limitations or restrictions as may be fixed by the board of directors

without any further shareholder approval. Such rights, preferences, powers and limitations, as may be established, could have the effect

of discouraging an attempt to obtain control of our company.

Dividend Rights

Under Bermuda law, a company

may not declare or pay dividends if there are reasonable grounds for believing that (1) the company is, or would after the payment

be, unable to pay its liabilities as they become due; or (2) that the realizable value of its assets would thereby be less than its

liabilities. Under our bye-laws, each common share is entitled to dividends if, as and when dividends are declared by our board of directors,

subject to any preferred dividend right of the holders of any preference shares. We do not anticipate paying cash dividends in the foreseeable

future.

Variation of Rights

If at any time we have more

than one class of shares, the rights attaching to any class, unless otherwise provided for by the terms of issue of the relevant class,

may be varied either: (1) with the consent in writing of the holders of 75% of the issued shares of that class; or (2) with

the sanction of a resolution passed by a majority of the votes cast at a general meeting of the relevant class of shareholders at which

a quorum consisting of at least two persons holding or representing one-third of the issued shares of the relevant class is present. Our

bye-laws specify that the creation or issue of shares ranking equally with existing shares will not, unless expressly provided by the

terms of issue of existing shares, vary the rights attached to existing shares. In addition, the creation or issue of preference shares

ranking prior to common shares will not be deemed to vary the rights attached to common shares or, subject to the terms of any other class

or series of preference shares, to vary the rights attached to any other class or series of preference shares.

Transfer of Shares

Our board of directors may,

in its absolute discretion and without assigning any reason, refuse to register the transfer of a share on the basis that it is not fully

paid. Our board of directors may also refuse to recognize an instrument of transfer of a share unless it is accompanied by the relevant

share certificate and such other evidence of the transferor’s right to make the transfer as our board of directors shall reasonably

require or unless all applicable consents, authorizations and permissions of any governmental agency or body in Bermuda have been obtained.

Subject to these restrictions, a holder of common shares may transfer the title to all or any of his common shares by completing a form

of transfer in the form set out in our bye-laws (or as near thereto as circumstances admit) or in such other common form as our board

of directors may accept. The instrument of transfer must be signed by the transferor and transferee, although in the case of a fully paid

share our board of directors may accept the instrument signed only by the transferor. Shares that are listed or admitted to trading on

an ‘appointed stock exchange’ (as defined pursuant to the Companies Act, which includes Nasdaq) may be transferred in accordance

with the rules and regulations of the exchange, without the requirement of using a form of transfer in the form set out in the bye-laws.

Meetings of Shareholders

Under Bermuda law, a

company is required to convene at least one general meeting of shareholders each calendar year, which we refer to as the annual

general meeting. However, the shareholders may by resolution waive this requirement, either for a specific year or period of time,

or indefinitely. When the requirement has been so waived, any shareholder may, on notice to the company, terminate the waiver, in

which case an annual general meeting must be called. We have chosen not to waive the convening of an annual general meeting.

Bermuda law provides that

a special general meeting of shareholders may be called by the board of directors of a company and must be called upon the request of

shareholders holding not less than 10% of the paid-up capital of the company carrying the right to vote at general meetings. Bermuda law

also requires that shareholders be given at least five days’ advance notice of a general meeting, but the accidental omission to

give notice to any person does not invalidate the proceedings at a meeting. Our bye-laws provide that our board of directors may convene

an annual general meeting and the chairman or a majority of our directors then in office may convene a special general meeting. Under

our bye-laws, at least 21 days’ notice of an annual general meeting or 5 days’ notice of a special general meeting must be

given to each shareholder entitled to vote at such meeting. This notice requirement is subject to the ability to hold such meetings on

shorter notice if such notice is agreed: (1) in the case of an annual general meeting by all of the shareholders entitled to attend and

vote at such meeting; or (2) in the case of a special general meeting by a majority in number of the shareholders entitled to attend and

vote at the meeting holding not less than 95% in nominal value of the shares entitled to vote at such meeting. Subject to the rules of

Nasdaq, the quorum required for a general meeting of shareholders is two or more persons present in person at the start of the meeting

and representing in person or by proxy in excess of 33 1/3% of total voting rights of all issued and outstanding shares.

Access to Books and Records and Dissemination of Information

Members of the general public

have a right to inspect the public documents of a company available at the office of the Registrar of Companies in Bermuda. These documents

include a company’s memorandum of association, including its objects and powers, and certain alterations to the memorandum of association.

The shareholders have the additional right to inspect the bye-laws of the company, minutes of general meetings and the company’s

audited financial statements, which must be presented in the annual general meeting. The register of members of a company is also open

to inspection by shareholders and by members of the general public without charge. The register of members is required to be open for

inspection for not less than two hours in any business day (subject to the ability of a company to close the register of members for not

more than thirty days in a year). A company is required to maintain its share register in Bermuda but may, subject to the provisions of

the Companies Act establish a branch register outside of Bermuda. A company is required to keep at its registered office a register of

directors and officers that is open for inspection for not less than two hours in any business day by members of the public without charge.

Bermuda law does not, however, provide a general right for shareholders to inspect or obtain copies of any other corporate records.

Election and Removal of Directors

Our bye-laws provide that

our board of directors shall consist of such number of directors as the board of directors may determine. Our board of directors consists

of four directors. Our board of directors is divided into three classes that are, as nearly as possible, of equal size. Each class of

directors is elected for a three-year term of office, but the terms will be staggered so that the term of only one class of directors

expires at each annual general meeting. The initial terms of the Class I, Class II and Class III directors will expire in 2022, 2023 and

2024, respectively. At each succeeding annual general meeting, successors to the class of directors whose term expires at the annual general

meeting will be elected for a three-year term.

A shareholder holding any

percentage of the common shares in issue may propose for election as a director someone who is not an existing director or is not proposed

by our board of directors. Where a director is to be elected at an annual general meeting, notice of any such proposal for election must

be given not less than 90 days nor more than 120 days before the anniversary of the last annual general meeting prior to the giving of

the notice or, in the event the annual general meeting is called for a date that is not less than 30 days before or after such anniversary

the notice must be given not later than ten days following the earlier of the date on which notice of the annual general meeting was posted

to shareholders or the date on which public disclosure of the date of the annual general meeting was made. Where a director is to be elected

at a special general meeting, that notice must be given not later than seven days following the earlier of the date on which notice of

the special general meeting was posted to shareholders or the date on which public disclosure of the date of the special general meeting

was made.

A director may be removed,

only with cause, by the shareholders, provided notice of the shareholders meeting convened to remove the director is given to the director.

The notice must contain a statement of the intention to remove the director and a summary of the facts justifying the removal and must

be served on the director not less than 14 days before the meeting. The director is entitled to attend the meeting and be heard on the

motion for his removal.

Proceedings of Board of Directors

Our bye-laws provide that

our business is to be managed and conducted by our board of directors. Bermuda law permits individual and corporate directors and there

is no requirement in our bye-laws or Bermuda law that directors hold any of our shares. There is also no requirement in our bye-laws or

Bermuda law that our directors must retire at a certain age.

The compensation of our directors

will be determined by the board of directors, and there is no requirement that a specified number or percentage of “independent”

directors must approve any such determination. Our directors may also be paid all travel, hotel and other reasonable out-of-pocket expenses

properly incurred by them in connection with our business or their duties as directors.

A director who discloses a

direct or indirect interest in any contract or arrangement with us as required by Bermuda law may vote in respect of the contract or arrangement

and be counted in quorum.

Indemnification of Directors and Officers

Section 98 of the Companies

Act provides generally that a Bermuda company may indemnify its directors, officers and auditors against any liability which by virtue

of any rule of law would otherwise be imposed on them in respect of any negligence, default, breach of duty or breach of trust, except

in cases where such liability arises from fraud or dishonesty of which such director, officer or auditor may be guilty in relation to

the company. Section 98 further provides that a Bermuda company may indemnify its directors, officers and auditors against any liability

incurred by them in defending any proceedings, whether civil or criminal, in which judgment is awarded in their favor or in which they

are acquitted or granted relief by the Supreme Court of Bermuda pursuant to Section 281 of the Companies Act.

Our bye-laws provide that

we shall indemnify our officers and directors in respect of their actions and omissions, except in respect of their fraud or dishonesty,

and that we shall advance funds to our officers and directors for expenses incurred in their defense upon receipt of an undertaking to

repay the funds if any allegation of fraud or dishonesty is proved. Our bye-laws provide that the shareholders waive all claims or rights

of action that they might have, individually or in right of the company, against any of the company’s directors or officers for

any act or failure to act in the performance of such director’s or officer’s duties, except in respect of any fraud or dishonesty

of such director or officer. Section 98A of the Companies Act permits us to purchase and maintain insurance for the benefit of any officer

or director in respect of any loss or liability attaching to him in respect of any negligence, default, breach of duty or breach of trust,

whether or not we may otherwise indemnify such officer or director. We have purchased and maintain a directors’ and officers’

liability policy for such purpose.

Amendment of Memorandum of Association and

Bye-laws

Bermuda law provides that

the memorandum of association of a company may be amended by a resolution passed at a general meeting of shareholders. Our bye-laws provide

that no bye-law shall be rescinded, altered or amended, and no new bye-law shall be made, unless it shall have been approved by a resolution

of our board of directors and by a resolution of our shareholders. Bye-laws 37, 38, 39, 40, 42, 76 and 78.2 may not be rescinded, altered

or amended and no new bye-law may be made which would have the effect of rescinding, altering or amending the provisions of such bye-laws,

until the same has been approved by a resolution of the board including the affirmative vote of not less than 66 and 2/3% of the directors

then in office and by a resolution of the shareholders including the affirmative vote of shares carrying not less than 66 and 2/3% of

the total voting rights of all issued and outstanding shares.

Under Bermuda law, the

holders of an aggregate of not less than 20% in par value of a company’s issued share capital or any class thereof have the

right to apply to the Supreme Court of Bermuda for an annulment of any amendment of the memorandum of association adopted by

shareholders at any general meeting, other than an amendment that alters or reduces a company’s share capital as provided in

the Companies Act. Where such an application is made, the amendment becomes effective only to the extent that it is confirmed by the

Supreme Court of Bermuda. An application for an annulment of an amendment of the memorandum of association must be made within 21

days after the date on which the resolution altering the company’s memorandum of association is passed and may be made on

behalf of persons entitled to make the application by one or more of their number as they may appoint in writing for the purpose. No

application may be made by shareholders voting in favor of the amendment.

Amalgamations and Mergers and Business Combinations

The amalgamation or merger

of a Bermuda company with another company or corporation (other than certain affiliated companies) requires the amalgamation or merger

agreement to be approved by the company’s board of directors and by its shareholders. Unless the company’s bye-laws provide

otherwise, the approval of 75% of the shareholders voting at such meeting is required to approve the amalgamation or merger agreement,

and the quorum for such meeting must be two or more persons holding or representing more than one-third of the issued shares of the company.

Our bye-laws provide that if the amalgamation or merger is a “business combination” (see below) the approval of 66 2/3 % of

the total voting rights of all our issued and outstanding shares (other than any “interested shareholder”) at a meeting of

shareholders to approve the amalgamation or merger agreement shall be sufficient, and the quorum for such meeting shall be two or more

persons present throughout the meeting and representing in person or by proxy in excess of 33 1/3% of the total voting rights of all our

issued and outstanding shares. Similarly, if the amalgamation or merger is not a “business combination”, but is not approved

by the board, the approval of 66 2/3 % of the total voting rights of all our issued and outstanding shares (other than any “interested

shareholder”) at a meeting of shareholders to approve the amalgamation or merger agreement shall be sufficient, and the quorum for

such meeting shall be two or more persons present throughout the meeting and representing in person or by proxy in excess of 33 1/3% of

the total voting rights of all our issued and outstanding shares. If the amalgamation is not a “business combination” and

is approved by the board the approval of a simple majority of votes cast at a meeting of shareholders shall be sufficient to approve the

amalgamation or merger agreement, and the quorum for such meeting shall be two or more persons present throughout the meeting and representing

in person or by proxy in excess of 33 1/3% of the total voting rights of all our issued and outstanding shares.

Under Bermuda law, in the

event of an amalgamation or merger of a Bermuda company with another company or corporation, a shareholder of the Bermuda company who

did not vote in favor of the amalgamation or merger and who is not satisfied that fair value has been offered for such shareholder’s

shares may, within one month of notice of the shareholders meeting, apply to the Supreme Court of Bermuda to appraise the fair value of

those shares.

Although the Companies Act

does not contain specific provisions regarding “business combinations” between companies organized under the laws of Bermuda

and “interested shareholders,” we have included these provisions in our bye-laws. Specifically, our bye-laws contain provisions

which prohibit us from engaging in a business combination with an interested shareholder for a period of three years after the date of

the transaction in which the person became an interested shareholder, unless, in addition to any other approval that may be required by

applicable law:

| |

● |

prior to the date of the transaction that resulted in the shareholder becoming an interested shareholder, our board of directors approved either the business combination or the transaction that resulted in the shareholder becoming an interested shareholder; |

| |

● |

upon consummation of the transaction that resulted in the shareholder becoming an interested shareholder, the interested shareholder owned at least 85% of our issued and voting shares outstanding at the time the transaction commenced; or |

| |

● |

after the date of the transaction that resulted in the shareholder becoming an interested shareholder, the business combination is approved by our board of directors and authorized at an annual or special meeting of shareholders by the affirmative vote of at least 662/3% of our issued and outstanding voting shares that are not owned by the interested shareholder. |

For purposes of these

provisions, a “business combination” includes recapitalizations, mergers, amalgamations, consolidations, exchanges,

asset sales, leases, certain issues or transfers of shares or other securities and other transactions resulting in a financial

benefit to the interested shareholder. An “interested shareholder” is any person or entity that beneficially owns 15% or

more of our issued and outstanding voting shares and any person or entity affiliated with or controlling or controlled by that

person or entity.

Shareholder Suits

Class actions and derivative

actions are generally not available to shareholders under Bermuda law. The Bermuda courts, however, would ordinarily be expected to permit

a shareholder to commence an action in the name of a company to remedy a wrong to the company where the act complained of is alleged to

be beyond the corporate power of the company or illegal, or would result in the violation of the company’s memorandum of association

or bye-laws. Furthermore, consideration would be given by a Bermuda court to acts that are alleged to constitute a fraud against the minority

shareholders or, for instance, where an act requires the approval of a greater percentage of the company’s shareholders than that

which actually approved it. When the affairs of a company are being conducted in a manner that is oppressive or prejudicial to the interests

of some part of the shareholders, one or more shareholders may apply to the Supreme Court of Bermuda, which may make such order as it

sees fit, including an order regulating the conduct of the company’s affairs in the future or ordering the purchase of the shares

of any shareholders by other shareholders or by the company.

Our bye-laws contain a provision

by virtue of which our shareholders waive any claim or right of action that they have, both individually and on our behalf, against any

director or officer in relation to any action or failure to take action by such director or officer, except in respect of any fraud or

dishonesty of such director or officer. We have been advised by the SEC that in the opinion of the SEC, the operation of this provision

as a waiver of the right to sue for violations of federal securities laws would likely be unenforceable in U.S. courts.

Capitalization of Profits and Reserves

Pursuant to our bye-laws,

our board of directors may (1) capitalize any part of the amount of our share premium or other reserve accounts or any amount credited

to our profit and loss account or otherwise available for distribution by applying such sum in paying up unissued shares to be allotted

as fully paid bonus shares pro rata (except in connection with the conversion of shares) to the shareholders; or (2) capitalize any sum

standing to the credit of a reserve account or sums otherwise available for dividend or distribution by paying up in full, partly paid

or nil paid shares of those shareholders who would have been entitled to such sums if they were distributed by way of dividend or distribution.

Untraced Shareholders

Our bye-laws provide that

our board of directors may forfeit any dividend or other monies payable in respect of any shares that remain unclaimed for six years from

the date when such monies became due for payment. In addition, we are entitled to cease sending dividend warrants and checks by post or

otherwise to a shareholder if such instruments have been returned undelivered to, or left uncashed by, such shareholder on at least two

consecutive occasions or, following one such occasion, reasonable enquires have failed to establish the shareholder’s new address.

This entitlement ceases if the shareholder claims a dividend or cashes a dividend check or a warrant.

Certain Provisions of Bermuda Law

We have been designated by