false

0001083301

0001083301

2024-10-23

2024-10-23

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant

to Section 13 or 15(d)

of the Securities

Exchange Act of 1934

Date of Report (Date of earliest event reported):

October 23, 2024

TERAWULF INC.

(Exact name of registrant as specified in its

charter)

| Delaware |

001-41163 |

87-1909475 |

|

(State or other jurisdiction

of incorporation) |

(Commission File Number) |

(IRS Employer

Identification No.) |

9 Federal Street

Easton, Maryland 21601

(Address of principal executive offices and zip code)

(410) 770-9500

(Registrant’s telephone number, including

area code)

Not Applicable

(Former Name or Former Address, if Changed Since Last

Report)

Check the appropriate box below if the Form 8-K filing is intended

to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| ☐ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered

pursuant to Section 12(b) of the Act:

| Title of each class |

|

Trading

Symbol(s) |

|

Name of each exchange

on which registered |

| Common stock, $0.001 par value per share |

|

WULF |

|

The Nasdaq Capital Market |

Indicate by check mark whether the registrant

is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the

Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by

check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting

standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 8.01. Other Events.

Share Repurchase

Program

On October 23, 2024,

TeraWulf Inc. (the “Company”) issued a press release announcing that the Company’s board of directors approved a share

repurchase program authorizing the Company to repurchase up to $200.0 million of the Company’s outstanding shares of common stock

through December 31, 2025. The Company intends to repurchase shares using excess cash, prioritizing this initiative after disciplined

capital expenditures aimed at supporting organic growth in high-performance computing and evaluating strategic opportunities, such as

potential site acquisitions. A copy of the press release announcing the share repurchase program is filed as Exhibit 99.1 to this Current

Report on Form 8-K and is incorporated herein by reference.

Convertible Notes

Offering

On October 23, 2024,

the Company issued a press release announcing its intention to offer, subject to market conditions and other factors, $350.0 million aggregate

principal amount of convertible senior notes due 2030 in a private offering to persons reasonably believed to be qualified institutional

buyers in reliance on Rule 144A under the Securities Act of 1933, as amended, and to grant to the initial purchasers of the notes an option

to purchase, within a 13-day period beginning on, and including, the date on which the notes are first issued, up to an additional $75.0

million aggregate principal amount of the notes. A copy of the press release announcing the offering is filed as Exhibit 99.2 to this

Current Report on Form 8-K and is incorporated herein by reference.

The information included

in this Current Report on Form 8-K is neither an offer to sell nor a solicitation of an offer to buy any securities.

Cautionary Note Regarding Forward-Looking

Statements

Statements in this Current

Report on Form 8-K about future expectations, plans, and prospects, as well as any other statements regarding matters that are not historical

facts, may constitute “forward-looking statements” within the meaning of The Private Securities Litigation Reform Act of 1995.

These statements include, but are not limited to, statements relating to the completion, size and timing of the offering, the anticipated

use of any proceeds from the offering, and the terms of the notes. The words “anticipate,” “believe,” “continue,”

“could,” “estimate,” “expect,” “intend,” “may,” “plan,” “potential,”

“predict,” “project,” “should,” “target,” “will,” “would,” and

similar expressions are intended to identify forward-looking statements, although not all forward-looking statements contain these identifying

words. Actual results may differ materially from those indicated by such forward-looking statements as a result of various important factors,

including uncertainties related to market conditions and the completion of the offering on the anticipated terms or at all, the other

factors discussed in the “Risk Factors” section of TeraWulf’s Annual Report on Form 10-K filed with the U.S. Securities

and Exchange Commission (the “SEC”) on March 20, 2024, the “Risk Factors” section of TeraWulf’s Quarterly

Reports on Form 10-Q and the risks described in other filings that TeraWulf may make from time to time with the SEC. Any forward-looking

statements contained in this Current Report on Form 8-K speak only as of the date hereof, and TeraWulf specifically disclaims any obligation

to update any forward-looking statement, whether as a result of new information, future events, or otherwise, except to the extent required

by applicable law.

Item 9.01. Financial Statements and

Exhibits.

(d) Exhibits

SIGNATURES

Pursuant to the requirements

of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto

duly authorized.

| Date: October 23, 2024 |

TERAWULF, INC. |

|

| |

|

|

|

|

| |

By: |

/s/ Patrick A. Fleury |

|

| |

Name: |

Patrick A. Fleury |

|

| |

Title: |

Chief Financial Officer |

|

EXHIBIT 99.1

TeraWulf Inc.’s Board

of Directors Authorizes $200 Million Share Repurchase Program

EASTON, Md. – October 23, 2024 – TeraWulf Inc.

(Nasdaq: WULF) (“TeraWulf” or the “Company”), a leading owner and operator of vertically integrated, next-generation

digital infrastructure powered by predominantly zero-carbon energy, today announced that its Board of Directors approved a share repurchase

program authorizing the Company to repurchase up to $200 million of the Company’s outstanding shares of common stock through December

31, 2025.

The share repurchase program reflects the Company’s confidence

in its business strategy and financial health. TeraWulf intends to repurchase shares using excess cash, prioritizing this initiative after

disciplined capital expenditures aimed at supporting organic growth in HPC/AI and evaluating strategic opportunities, such as potential

site acquisitions.

“We have taken decisive steps to strengthen our balance sheet,

including fully retiring our debt earlier this year, while making substantial progress in executing our business strategy,” said

Paul Prager, Chief Executive Officer of TeraWulf. “These achievements reinforce our confidence in TeraWulf’s long-term vision.

With a stronger financial foundation, we are well-positioned to optimize our capital allocation. The Board’s approval of a $200

million share repurchase program over the next year highlights our commitment to creating value for stockholders and driving profitable

growth, all while delivering strong returns.”

When determining the amount of capital to be allocated to share

repurchases, TeraWulf will consider various factors, including historical and projected business performance, cash flow, liquidity, and

prevailing global economic and market conditions. The Company will also assess the market price of its common stock.

The timing, method, price, and volume of any share repurchases

will be at the Company’s discretion. Purchases may be made through open market transactions, privately negotiated transactions,

or through investment banking structures, among other avenues, subject to applicable laws. The Company is not obligated to repurchase

a specific number of shares and retains the right to modify, suspend, or discontinue the program at any time.

About TeraWulf

TeraWulf develops, owns, and operates environmentally sustainable,

next-generation data center infrastructure in the United States, specifically designed for Bitcoin mining and high-performance computing.

Led by a team of seasoned energy entrepreneurs, the Company owns and operates the Lake Mariner facility situated on the expansive site

of a now retired coal plant in Western New York. Currently, TeraWulf generates revenue primarily through Bitcoin mining, leveraging predominantly

zero-carbon energy sources, including nuclear and hydroelectric power. Committed to environmental, social, and governance (ESG) principles

that align with its business objectives, TeraWulf aims to deliver industry-leading economics in mining and data center operations at

an industrial scale.

Forward-Looking Statements

This press release contains forward-looking statements within the

meaning of the “safe harbor” provisions of the Private Securities Litigation Reform Act of 1995, as amended. Such forward-looking

statements include statements concerning anticipated future events and expectations that are not historical facts. All statements, other

than statements of historical fact, are statements that could be deemed forward-looking statements. In addition, forward-looking statements

are typically identified by words such as “plan,” “believe,” “goal,” “target,” “aim,”

“expect,” “anticipate,” “intend,” “outlook,” “estimate,” “forecast,”

“project,” “continue,” “could,” “may,” “might,” “possible,” “potential,”

“predict,” “should,” “would” and other similar words and expressions, although the absence of these

words or expressions does not mean that a statement is not forward-looking. Forward-looking statements are based on the current expectations

and beliefs of TeraWulf’s management and are inherently subject to a number of factors, risks, uncertainties and assumptions and

their potential effects. There can be no assurance that future developments will be those that have been anticipated. Actual results may

vary materially from those expressed or implied by forward-looking statements based on a number of factors, risks, uncertainties and assumptions,

including, among others: (1) conditions in the cryptocurrency mining industry, including fluctuation in the market pricing of bitcoin

and other cryptocurrencies, and the economics of cryptocurrency mining, including as to variables or factors affecting the cost, efficiency

and profitability of cryptocurrency mining; (2) competition among the various providers of cryptocurrency mining services; (3) changes

in applicable laws, regulations and/or permits affecting TeraWulf’s operations or the industries in which it operates, including

regulation regarding power generation, cryptocurrency usage and/or cryptocurrency mining, and/or regulation regarding safety, health,

environmental and other matters, which could require significant expenditures; (4) the ability to implement certain business objectives

and to timely and cost-effectively execute integrated projects; (5) failure to obtain adequate financing on a timely basis and/or on acceptable

terms with regard to growth strategies or operations; (6) loss of public confidence in bitcoin or other cryptocurrencies and the

potential for cryptocurrency market manipulation; (7) adverse geopolitical or economic conditions, including a high inflationary

environment; (8) the potential of cybercrime, money-laundering, malware infections and phishing and/or loss and interference as a result

of equipment malfunction or break-down, physical disaster, data security breach, computer malfunction or sabotage (and the costs associated

with any of the foregoing); (9) the availability, delivery schedule and cost of equipment necessary to maintain and grow the business

and operations of TeraWulf, including mining equipment and infrastructure equipment meeting the technical or other specifications required

to achieve its growth strategy; (10) employment workforce factors, including the loss of key employees; (11) litigation relating to TeraWulf

and/or its business; and (12) other risks and uncertainties detailed from time to time in the Company’s filings with the Securities

and Exchange Commission (“SEC”). Potential investors, stockholders and other readers are cautioned not to place undue reliance

on these forward-looking statements, which speak only as of the date on which they were made. TeraWulf does not assume any obligation

to publicly update any forward-looking statement after it was made, whether as a result of new information, future events or otherwise,

except as required by law or regulation. Investors are referred to the full discussion of risks and uncertainties associated with forward-looking

statements and the discussion of risk factors contained in the Company’s filings with the SEC, which are available at www.sec.gov.

Investors:

Investors@terawulf.com

Media:

media@terawulf.com

EXHIBIT 99.2

TeraWulf

Inc. Announces Proposed Private Offering of $350 Million of Convertible Notes

EASTON, Md. – October 23, 2024 – TeraWulf

Inc. (Nasdaq: WULF) (“TeraWulf” or the “Company”), a leading owner and operator of vertically integrated, next-generation

digital infrastructure powered by predominantly zero-carbon energy, today announced that it intends to offer, subject to market conditions

and other factors, $350 million aggregate principal amount of convertible senior notes due 2030 (the “Convertible Notes”)

in a private offering to persons reasonably believed to be qualified institutional buyers in reliance on Rule 144A under the Securities

Act of 1933, as amended (the “Securities Act”).

TeraWulf also expects to grant the initial purchasers of the Convertible

Notes an option to purchase, within a 13-day period beginning on, and including the date on which the Convertible Notes are first issued,

up to an additional $75 million aggregate principal amount of the Convertible Notes. The offering is subject to market

and other conditions, and there can be no assurance as to whether, when or on what terms the offering may be completed.

The Company intends to use the net proceeds from the offering to

pay the cost of the capped call transactions (as described below), to repurchase shares of the Company’s common stock (the “common

stock”) and for general corporate purposes.

The Convertible Notes will be senior unsecured obligations of the

Company and will accrue interest at a rate payable semi-annually in arrears on May 1 and November 1 of each year,

beginning on May 1, 2025. The Convertible Notes will mature on February 1, 2030, unless earlier repurchased, redeemed or converted

in accordance with their terms. Prior to November 1, 2029, the Convertible Notes will be convertible only upon satisfaction of certain

conditions and during certain periods, and thereafter, the Convertible Notes will be convertible at any time until the close of business

on the second scheduled trading day immediately preceding the maturity date.

The Convertible Notes will be convertible into cash in respect

of the aggregate principal amount of the Convertible Notes to be converted and cash, shares of the common stock or a combination of cash

and shares of the common stock, at the Company’s election, in respect of the remainder, if any, of the Company’s conversion

obligation in excess of the aggregate principal amount of the Convertible Notes being converted. The initial conversion rate, interest

rate and other terms of the Convertible Notes will be determined at the time of pricing in negotiations with the initial purchasers of

the Convertible Notes.

In connection with the pricing of the Convertible Notes, the Company

expects to enter into privately negotiated capped call transactions with one or more of the initial purchasers of the Convertible Notes

and/or other financial institutions (the “option counterparties”). If the initial purchasers of the Convertible Notes exercise

their option to purchase additional Convertible Notes, the Company expects to use a portion of the net proceeds from the sale of the additional

Convertible Notes to enter into additional capped call transactions with the option counterparties.

The capped call transactions are expected generally to reduce potential

dilution to the common stock upon conversion of any Convertible Notes and/or offset any cash payments the Company is required to make

in excess of the principal amount of converted Convertible Notes, as the case may be, with such reduction and/or offset subject to a cap.

In connection with establishing their initial hedges of the capped

call transactions, the Company expects the option counterparties or their respective affiliates to purchase shares of the common stock

and/or enter into various derivative transactions with respect to the common stock concurrently with or shortly after the pricing of the

Convertible Notes. This activity could increase (or reduce the size of any decrease in) the market price of the common stock or the Convertible

Notes at that time. In addition, the option counterparties or their respective affiliates may modify their hedge positions by entering

into or unwinding various derivatives with respect to the common stock and/or purchasing or selling shares of the common stock or other

securities of the Company in secondary market transactions following the pricing of the Convertible Notes and prior to the maturity of

the Convertible Notes (and are likely to do so on each exercise date for the capped call transactions or following any termination of

any portion of the capped call transactions in connection with any repurchase, redemption or early conversion of the Convertible Notes).

This activity could also cause or avoid an increase or decrease in the market price of the common stock or the Convertible Notes, which

could affect holders of the Convertible Notes’ ability to convert the Convertible Notes and, to the extent the activity occurs following

conversion of the Convertible Notes or during any observation period related to a conversion of the Convertible Notes, it could affect

the amount and value of the consideration that holders of the Convertible Notes will receive upon conversion of such Convertible Notes.

The Company expects to repurchase the shares of common stock from

purchasers of the Convertible Notes in privately negotiated transactions effected concurrently with the pricing of the Convertible Notes,

and the Company expects the purchase price per share of the common stock repurchased in such transactions to equal the closing price

per share of the common stock on the date the offering of the Convertible Notes is priced.

The Convertible Notes and any shares of common stock issuable upon

conversion of the Convertible Notes, if any, have not been registered under the Securities Act, securities laws of any other jurisdiction,

and the Convertibles Notes and such shares of common stock may not be offered or sold in the United States absent registration

or an applicable exemption from registration under the Securities Act and any applicable state securities laws. The Convertible Notes

will be offered only to persons reasonably believed to be qualified institutional buyers under Rule 144A under the Securities Act.

This press release shall not constitute an offer to sell, or a

solicitation of an offer to buy the Convertible Notes, nor shall there be any sale of the Convertible Notes or common stock in any state

or jurisdiction in which such an offer, solicitation or sale would be unlawful prior to registration or qualification under the securities

laws of any such state or jurisdiction.

About TeraWulf

TeraWulf develops, owns, and operates environmentally sustainable,

next-generation data center infrastructure in the United States, specifically designed for Bitcoin mining and high-performance computing.

Led by a team of seasoned energy entrepreneurs, the Company owns and operates the Lake Mariner facility situated on the expansive site

of a now retired coal plant in Western New York. Currently, TeraWulf generates revenue primarily through Bitcoin mining, leveraging predominantly

zero-carbon energy sources, including nuclear and hydroelectric power. Committed to environmental, social, and governance (ESG) principles

that align with its business objectives, TeraWulf aims to deliver industry-leading economics in mining and data center operations at an

industrial scale.

Forward-Looking Statements

This press release contains forward-looking statements within the

meaning of the “safe harbor” provisions of the Private Securities Litigation Reform Act of 1995, as amended. Such forward-looking

statements include statements concerning anticipated future events and expectations that are not historical facts, such as statements

concerning the proposed terms of the notes and the capped call transactions, the completion, timing and size of the proposed offering

of the notes and the capped call transactions, and the anticipated use of proceeds from the proposed offering (including the proposed

share repurchases). All statements, other than statements of historical fact, are statements that could be deemed forward-looking statements.

In addition, forward-looking statements are typically identified by words such as “plan,” “believe,” “goal,”

“target,” “aim,” “expect,” “anticipate,” “intend,” “outlook,”

“estimate,” “forecast,” “project,” “continue,” “could,” “may,”

“might,” “possible,” “potential,” “predict,” “should,” “would”

and other similar words and expressions, although the absence of these words or expressions does not mean that a statement is not forward-looking.

Forward-looking statements are based on the current expectations and beliefs of TeraWulf’s management and are inherently subject

to a number of factors, risks, uncertainties and assumptions and their potential effects. There can be no assurance that future developments

will be those that have been anticipated. Actual results may vary materially from those expressed or implied by forward-looking statements

based on a number of factors, risks, uncertainties and assumptions, including, among others: (1) conditions in the cryptocurrency mining

industry, including fluctuation in the market pricing of bitcoin and other cryptocurrencies, and the economics of cryptocurrency mining,

including as to variables or factors affecting the cost, efficiency and profitability of cryptocurrency mining; (2) competition among

the various providers of cryptocurrency mining services; (3) changes in applicable laws, regulations and/or permits affecting TeraWulf’s

operations or the industries in which it operates, including regulation regarding power generation, cryptocurrency usage and/or cryptocurrency

mining, and/or regulation regarding safety, health, environmental and other matters, which could require significant expenditures; (4)

the ability to implement certain business objectives and to timely and cost-effectively execute integrated projects; (5) failure to obtain

adequate financing on a timely basis and/or on acceptable terms with regard to growth strategies or operations; (6) loss of public

confidence in bitcoin or other cryptocurrencies and the potential for cryptocurrency market manipulation; (7) adverse geopolitical

or economic conditions, including a high inflationary environment; (8) the potential of cybercrime, money-laundering, malware infections

and phishing and/or loss and interference as a result of equipment malfunction or break-down, physical disaster, data security breach,

computer malfunction or sabotage (and the costs associated with any of the foregoing); (9) the availability, delivery schedule and

cost of equipment necessary to maintain and grow the business and operations of TeraWulf, including mining equipment and infrastructure

equipment meeting the technical or other specifications required to achieve its growth strategy; (10) employment workforce factors, including

the loss of key employees; (11) litigation relating to TeraWulf and/or its business; and (12) other risks and uncertainties detailed from

time to time in the Company’s filings with the Securities and Exchange Commission (“SEC”). Potential investors, stockholders

and other readers are cautioned not to place undue reliance on these forward-looking statements, which speak only as of the date on which

they were made. TeraWulf does not assume any obligation to publicly update any forward-looking statement after it was made, whether as

a result of new information, future events or otherwise, except as required by law or regulation. Investors are referred to the full discussion

of risks and uncertainties associated with forward-looking statements and the discussion of risk factors contained in the Company’s

filings with the SEC, which are available at www.sec.gov.

Investors:

Investors@terawulf.com

Media:

media@terawulf.com

v3.24.3

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

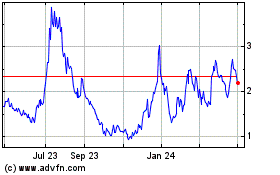

TeraWulf (NASDAQ:WULF)

Historical Stock Chart

From Oct 2024 to Nov 2024

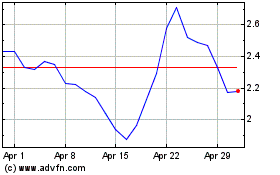

TeraWulf (NASDAQ:WULF)

Historical Stock Chart

From Nov 2023 to Nov 2024